Abstract

This paper reassesses the relationship between tax structure and long-run income, using as indicators of tax structure both a new series of implicit tax rates based on Mendoza et al. (J Public Econ 66:99–126, 1997) and tax ratios, adopting a dynamic panel estimation strategy, and explicitly accounting for cross-sectional dependence in the panel. When implicit tax rates are used, the paper shows that the link between tax structure and long-run income per capita is not robust to the adoption of different assumptions on observable and unobservable heterogeneity across countries. When tax ratios are used, there is some evidence of a negative impact of labour taxation on long-run income, but this result is shown to capture non-fiscal effects coming from the evolution of the labour share. Turning to the short run, the research presented here finds strong evidence of a positive effect on per capita income of a tax shift from labour and capital taxation towards consumption taxation, which provides support for fiscal devaluations.

Similar content being viewed by others

Notes

In both exogenous and endogenous growth models, taxes may affect the long-run GDP level through two different channels: by affecting productivity and by altering factors’ accumulation. As shown in Arnold et al. (2011a), the empirical specification in (1) is compatible with both exogenous and endogenous growth models. However, the presence of standard factors of production (labour, physical, and human capital) among the controls implies that the estimated coefficients of the fiscal variables would only capture the impact of the tax structure through the first channel (i.e. factor productivity). As a consequence, the analysis may over- or underestimate the effect of tax structure on the long-run GDP level. This limitation is shared by most of the existing literature. An analysis of the effect of changes in tax structure on long-run GDP via the investment in physical and human capital is beyond the scope of this paper and is left for future research.

The 15 countries are: Australia, Austria, Belgium, Canada, Finland, France, Greece, Italy, Japan, Netherlands, Norway, Spain, Sweden, the UK, and the USA.

The countries that do not allow social security contributions to be deducted are Australia, Canada, the UK, and the USA.

Results are available upon request.

We include this control variable to avoid the bias that could result from a correlation between the tax mix and the overall tax burden. However, the value of the coefficient of this variable cannot be interpreted as an estimate of the effect of the overall tax burden on GDP for a given tax structure. Since we always omit from the regressions at least one tax structure indicator, the coefficient of tax revenues over GDP represents the impact on long-run GDP of an increase in the overall tax burden achieved by a change in the omitted indicator(s). This implies that the sign and the significance of the estimated coefficient may vary across the different regressions we run to evaluate revenue-neutral tax changes. Furthermore, as highlighted by Arnold et al. (2011b), our regressions cannot provide an accurate estimate of this coefficient because we do not take into account how any additional tax revenue is spent.

When tax structure is measured by tax ratios, the increase in one tax ratio—given the share of total revenues in GDP—necessarily delivers a reduction in one or more of the others. When we measure tax structure by implicit tax rates, the increase in one of them—again, given the share of total revenues in GDP—causes a change in one or more of the others. The sign of the change is not known a priori as it depends on the elasticity of the tax base.

Given the error correction specification, it is important to check that the residuals from the long-run equation are stationary to avoid spurious correlations. The errors of the regression equation have been tested for non-stationarity using panel unit root tests based on Im et al. (2003) . Non-stationarity of the residuals was rejected at the 1 % level. Results are available upon request.

We use this more parsimonious specification to allow a straightforward comparison with the results of the Pesaran (2006) CCE estimator that will be presented in Table 5. Indeed, we cannot implement the Pesaran (2006) approach using all tax indicators because our time series are not sufficiently long. To check the robustness of our results in Table 2, we have replicated—using the MG estimator—the regressions in Table 1, maintaining all the tax structure indicators used in the PMG regression. We still find that no tax structure measure is statistically significant when implicit tax rates are used. When tax ratios are implemented, there is evidence that labour taxes are the most harmful for growth. The Hausman and Wald tests still cast doubts on the assumption of equal long-run coefficients. The results are available upon request.

The analysis based on tax ratios does not provide any clear evidence on the short-run effects. The PMG estimator delivers a negative sign for both an increase in consumption and in labour taxation. The former result is in contrast with the fiscal devaluation hypothesis. However, the short-run impacts are not statistically significant when we allow for heterogeneity in the long-run relationship and control for cross-sectional dependence.

References

Alworth, J., & Arachi, G. (2010). Taxation policy in EMU. In M. Buti, S. Deroose, V. Gaspar, & J. Nogueria Martins (Eds.), Euro: The first decade (pp. 557–596). Cambridge: Cambridge University Press.

Andrews, D. W. K. (2005). Cross-section regression with common shocks. Econometrica, 73(5), 1551–1585.

Arnold, J., Bassanini, A., & Scarpetta, S. (2011a). Solow or Lucas? Testing speed of convergence on a panel of OECD countries. Research in Economics, 65(2), 110–123.

Arnold, J., Brys, B., Heady, C., Johansson, A., Schwellnus, C., & Vartia, L. (2011b). Tax policy for economic recovery and growth. The Economic Journal, 121, F59–F80.

Bai, J. (2009). Panel data models with interactive fixed effects. Econometrica, 77(4), 1229–1279.

Bleaney, M., Gemmell, N., & Kneller, R. (2001). Testing the endogenous growth model: Public expenditure, taxation and growth over the long run. Canadian Journal of Economics, 34, 36–57.

Carey, D., & Tchilinguirian, H. (2000). Average effective tax rates on capital, labour and consumption. Economics Department Working Papers No. 258, OECD.

Chudik, A., & Pesaran, M. H. (2013). Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. Federal Reserve Bank of Dallas Globalization and Monetary Policy Institute Working Paper No. 146.

Chudik, A., Pesaran, M. H., & Tosetti, E. (2011). Weak and strong cross section dependence and estimation of large panels. Econometrics Journal, 14(1), C45–C90.

D’Antoni, M., & Zanardi, A. (2011). Shifting the tax burden from labour income to consumption. Rivista di Diritto Finanziario e Scienza delle Finanze, 4, 493–513.

De Mooij, R., & Keen, M. (2013). “Fiscal devaluation” and fiscal consolidation: The vat in troubled times. In A. Alesina & F. Giavazzi (Eds.), Fiscal policy after the financial crisis (pp. 443–485). Chicago: The University of Chicago Press.

Eberhardt, M., & Presbitero, A.F. (2013). This time they are different: Heterogeneity and nonlinearity in the relationship between debt and growth. IMF Working Paper No. 248.

European Commission (2012). Employment and social developments in Europe 2012. Publications Office of the European Union.

European Commission (2013). Taxation trends in the European Union. Publications Office of the European Union.

Farhi, E., Gopinath, G., & Itskhoki, O. (2014). Fiscal devaluation. Review of Economic Studies, 81(2), 725–760.

Gemmell, N., Kneller, R., Sanz, I. (2013). The growth effects of tax rates in the OECD. Working Papers in Public Finance No. 2, Victoria Business School.

Hausman, J. A. (1978). Specification tests in econometrics. Econometrica, 46(6), 1251–1271.

Im, K., Pesaran, M. H., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal of Econometrics, 115(1), 53–74.

Jaimovich, N., & Rebelo, S. (2012). Non-linear effects of taxation on growth. National Bureau of Economic Research Working Papers No. 18473.

Kapetanios, G., Pesaran, M. H., & Yamagata, T. (2011). Panels with nonstationary multifactor error structures. Journal of Econometrics, 160(2), 326–348.

Kneller, R., Bleaney, M. F., & Gemmell, N. (1999). Fiscal policy and growth: Evidence from OECD countries. Journal of Public Economics, 74, 171–190.

Martinez-Mongay, C. (2000). ECFIN’s effective tax rates. Properties and comparisons with other tax indicators. European Commission Economic Paper No: 146.

Mendoza, E., Milesi-Ferretti, G. M., & Asea, P. (1997). On the ineffectiveness of tax policy in altering long run growth: Harberger’s superneutrality conjecture. Journal of Public Economics, 66, 99–126.

Mendoza, E. G., Razin, A., & Tesar, L. L. (1994). Effective tax rates in macroeconomics: Cross-country estimates of tax rates on factor incomes and consumption. Journal of Monetary Economics, 34, 297–323.

Myles G.D. (2009) Economic growth and the role of taxation-theory. OECD Economics Department Working Papers 713, OECD Publishing.

OECD. (2008). Tax and economic growth. Economics Department Working Paper No. 620.

OECD. (2010). Going for growth 2010. Paris: OECD Publishing.

Pesaran, M. H. (2004). General diagnostic tests for cross section dependence in panels. Unpublished working paper.

Pesaran, M. H. (2006). Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica, 74(4), 967–1012.

Pesaran, M. H., Shin, Y., & Smith, R. P. (1999). Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American Statistical Association, 94(446), 621–634.

Pesaran, M. H., & Tosetti, E. (2011). Large panels with common factors and spatial correlations. Journal of Econometrics, 161(2), 182–202.

Phillips, P. C. B., & Sul, D. (2003). Dynamic panel estimation and homogeneity testing under cross section dependence. Econometrics Journal, 6(1), 217–259.

Sonedda, D. (2009). The output effects of labor income taxes in OECD countries. Public Finance Review, 37(6), 686–709.

Xing, J. (2012). Does tax structure affect economic growth? Empirical evidence from OECD countries. Economics Letters, 117(1), 379–382.

Acknowledgments

We thank Camilla Mastromarco and two anonymous referees for their comments and suggestions. All errors and omissions are ours.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Computation of implicit tax rates

The following list provides the tax revenue data used in order to compute implicit tax rates. Using the OECD codes, we have:

-

1100 Taxes on income, profits, and capital gains of individuals or households;

-

1200 Taxes on income, profits, and capital gains of corporations;

-

2100 Social security contributions paid by employees;

-

2200 Social security contributions paid by employers;

-

2300 Social security contributions paid by the self-employed and persons outside of the labour force;

-

2400 Social security contributions unallocated;

-

3000 Taxes on payroll and workforce;

-

4000 Taxes on property;

-

5110 General taxes on goods and services;

-

5121 Excise taxes;

-

5122 Profits of fiscal monopolies;

-

5123 Customs and import duties;

-

5126 Taxes on specific services;

-

5128 Other taxes (among taxes on specific goods and service);

-

5200 Taxes on use of goods and performances;

-

6000 Other taxes;

-

CP private final consumption expenditure;

-

EE dependent employment;

-

ES self-employment;

-

CG government final consumption expenditure;

-

OS net operating surplus of the overall economy;

-

OSPUE unincorporated business net income (including imputed rentals on owner-occupied housing);

-

PEI interest, dividends, and investment receipts;

-

W wages and salaries of dependent employment;

-

WSSS compensation of employees (including private employers’ contributions to social security and to pension funds).

The implicit tax rate on consumption \(\mathrm{ITR}_\mathrm{c}\) is computed as:

In order to compute implicit tax rates on labour and on capital, we first calculate the implicit tax rate on total household income (\(\mathrm{ITR}_{\mathrm{hh}} )\), the wage-bill for the self-employed (\(\mathrm{WSE})\), the share of labour income in household income (\(\alpha )\), and, correspondingly, the share of capital income in household income (\(1-\alpha \equiv \beta )\):

If social security contributions are not deductible, the implicit tax rates on capital and labour are computed as:

If social security contributions are deductible, they are equal to:

For France and Italy, we make some adjustments to account for peculiar taxes that the OECD classifies in the residual category “other taxes” and that generate large revenues (i.e. Tax professionelle and IRAP). Because their tax base includes both labour and capital, we split the revenues of these taxes between labour and capital according to the share \(\alpha \) we defined before and add them to the numerator of the corresponding implicit tax rate.

Appendix 2: Descriptive statistics

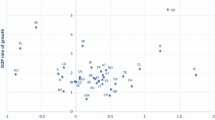

See Table 6 and Figs. 1 and 2.

Rights and permissions

About this article

Cite this article

Arachi, G., Bucci, V. & Casarico, A. Tax structure and macroeconomic performance. Int Tax Public Finance 22, 635–662 (2015). https://doi.org/10.1007/s10797-015-9364-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-015-9364-1