Abstract

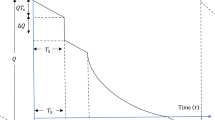

In today’s competitive market environment, providing different sorts of concessions are often observed from the suppliers/manufacturers to their customers for escalating the number of order quantity, as well as work mutually to control the rising level of carbon emission along with long-lasting financial benefits. So, it is challenging for researchers and industry to develop low carbon inventory models that can meet emission reduction targets while maintaining company’s profit. The credit function plays an important role within the organization. Furthermore, with the globalization of the marketing policy, the supplier may provide the retailer a discounted price if the quantity of purchase is large enough, and green inventory management reduces the environmental impact of a business without affecting its profitability. In this paper, we study a profit maximizing green economic order quantity (EOQ) model by considering capacity constraints under order-size dependent trade credit and all-units discount, along with minimizing carbon emissions for a cleaner environment. Shortages are allowed and partially backordered. The paper discusses all the potential cases, which may occur in green inventory models with carbon emission costs under different allowable delay-in-payments. We find that if retailers’ own warehouse capacity is relatively small, they always benefit from enlarging order quantities and renting an extra warehouse. Finally, some numerical examples are presented to illustrate the applicability of the proposed model. Sensitivity analysis of the major parameters is performed and some insights are obtained.

Similar content being viewed by others

References

Aggarwal SP, Jaggi CK (1995) Ordering policies of deteriorating items under permissible delay in payments. J Oper Res Soc 46(5):658–662

Agrawal S, Banerjee S, Papachristos S (2013) Inventory model with deteriorating items, ramp-type demand and partially backlogged shortages for a two warehouses system. Appl Math Model 37(20–21):8912–8929

Ahmed W, Sarkar M, Sarkar B, Kim SJ (2017) Effect of carbon tax and uncertainty in an economic policy for second generation biofuel supply chain. In: Proceedings of the Fall Conference of the Korean Institute of Industrial Engineers, pp 1700–1707

Ahmed W, Sarkar B (2018) Impact of carbon emissions in a sustainable supply chain management for a second generation biofuel. J Clean Prod 186:807–820

Alfares HK, Ghaithan AM (2016) Inventory and pricing model with price-dependent demand, time-varying holding cost, and quantity discounts. Comput Ind Eng 94:170–177

Arslan MC, Turkay M (2013) EOQ revisited with sustainability considerations. Found Comput Decis Sci 38(4):223–249

Battini D, Persona A, Sgarbossa F (2014) A sustainable EOQ model: Theoretical formulation and applications. Int J Prod Econ 149:145–153

Benjaafar S, Li Y, Daskin M (2013) Carbon footprint and the management of supply chains: Insights from simple models. IEEE Trans Autom Sci Eng 10(1):99–116

Bhunia AK, Jaggi CK, Sharma A, Sharma R (2014) A two-warehouse inventory model for deteriorating items under permissible delay in payment with partial backlogging. Appl Math Comput 232:1125–1137

Bonney M, Jaber MY (2011) Environmentally responsible inventory models: Non-classical models for a non-classical era. Int J Prod Econ 133(1):43–53

Chen X, Benjaafar S, Elomri A (2013) The carbon-constrained EOQ. Oper Res Lett 41(2):172–179

Chen SC, Teng JT (2015) Inventory and credit decisions for time-varying deteriorating items with up-stream and down-stream trade credit financing by discounted cash flow analysis. Eur J Oper Res 243(2):566–575

Chen SC, Cárdenas-Barrón LE, Teng JT (2014) Retailer’s economic order quantity when the supplier offers conditionally permissible delay in payments link to order quantity. Int J Prod Econ 155:284–291

Chang CT, Ouyang LY, Teng JT (2003) An EOQ model for deteriorating items under supplier credits linked to ordering quantity. Appl Math Model 27(12):983–996

Chung KJ, Liao JJ (2009) The optimal ordering policy of the EOQ model under trade credit depending on the ordering quantity from the DCF approach. Eur J Oper Res 196(2):563–568

Chung KJ, Lin SD, Srivastava HM (2013) The inventory models under conditional trade credit in a supply chain system. Appl Math Model 37(24):10036–10052

Chang CT, Cheng MC, Ouyang LY (2015) Optimal pricing and ordering policies for non-instantaneously deteriorating items under order-size-dependent delay in payments. Appl Math Model 39(2):747–763

Chakraborty D, Jana DK, Roy TK (2018) Two-warehouse partial backlogging inventory model with ramp type demand rate, three-parameter Weibull distribution deterioration under inflation and permissible delay in payments. Comput Ind Eng 123:157–179

Daryanto Y, Christata B (2021) Optimal order quantity considering carbon emission costs, defective items, and partial backorder. Uncertain Supply Chain Manag 9(2):307–316

Dye C-Y, Yang C-T (2015) Sustainable trade credit and replenishment decisions with credit-linked demand under carbon emission constraints. Eur J Oper Res 244(1):187–200

Feng L, Chan YL (2019) Joint pricing and production decisions for new products with learning curve effects under upstream and downstream trade credits. Eur J Oper Res 272(3):905–913

Goyal SK (1985) Economic order quantity under conditions of permissible delay in payments. J Oper Res Soc 36(4):335–338

Ghiami Y, Williams T, Wu Y (2013) A two-echelon inventory model for a deteriorating item with stock-dependent demand, partial backlogging and capacity constraints. Eur J Oper Res 231(3):587–597

Harris FW (1913) How many parts to make at once. The Magazine of Management 152(10):135–136

Huang YF (2003) Optimal retailer’s ordering policies in the EOQ model under trade credit financing. J Oper Res Soc 54(9):1011–1015

Huang YF (2007) Economic order quantity under conditionally permissible delay in payments. Eur J Oper Res 176(2):911–924

Huang YF (2006) An inventory model under two levels of trade credit and limited storage space derived without derivatives. Appl Math Model 30(5):418–436

Hua G, Cheng T, Wang S (2011) Managing carbon footprints in inventory management. Int J Prod Econ 132(2):178–185

Hua GW, Cheng TCE, Zhang Y, Zhang JL, Wang SY (2016) CARBON-CONSTRAINED PERISHABLE INVENTORY MANAGEMENT WITH FRESHNESS-DEPENDENT DEMAND.Int J Simul Modell 15(3)

Hartley RV (1976) Operations research: A managerial emphasis. Santa Monica, CA, pp 315–317

Jamal AMM, Sarker BR, Wang S (1997) An ordering policy for deteriorating items with allowable shortage and permissible delay in payment. Journal of the Operational Research Society 48(8):826–833

Jaggi CK, Pareek S, Khanna A, Sharma R (2014) Credit financing in a two-warehouse environment for deteriorating items with price-sensitive demand and fully backlogged shortages. Appl Math Model 38(21–22):5315–5333

Jaggi CK, Tiwari S, Goel SK (2017) Credit financing in economic ordering policies for non-instantaneous deteriorating items with price dependent demand and two storage facilities. Ann Oper Res 248(1–2):253–280

Jonas CP (2019) Optimizing a two-warehouse system under shortage backordering, trade credit, and decreasing rental conditions. Int J Prod Econ 209:147–155

Kazemi N, Abdul-Rashid SH, Ghazilla RAR, Shekarian E, Zanoni S (2016) Economic order quantity models for items with imperfect quality and emission considerations. Int J Syst Sci Oper Logist 1–17

Kazemi N, Abdul-Rashid SH, Ghazilla RAR, Shekarian E, Zanoni S (2018) Economic order quantity models for items with imperfect quality and emission considerations. Int J Syst Sci Oper Logist 5(2):99–115

Khan MAA, Shaikh AA, Panda GC, Konstantaras I (2019) Two-warehouse inventory model for deteriorating items with partial backlogging and advance payment scheme. RAIRO Oper Res 53(5):1691–1708

Khan MAA, Shaikh AA, Panda GC, Konstantaras I, Cárdenas-Barrón LE (2020) The effect of advance payment with discount facility on supply decisions of deteriorating products whose demand is both price and stock dependent. Int Trans Oper Res 27(3):1343–1367

Khan MAA, Shaikh AA, Panda GC, Konstantaras I, Taleizadeh AA (2019) Inventory system with expiration date: Pricing and replenishment decisions. Comput Ind Eng 132:232–247

Khouja M, Mehrez A (1996) Optimal inventory policy under different supplier credit policies. J Manuf Syst 15(5):334–339

Lashgari M, Taleizadeh AA, Sadjadi SJ (2018) Ordering policies for non-instantaneous deteriorating items under hybrid partial prepayment, partial trade credit and partial backordering. J Oper Res Soc 69(8):1167–1196

Lee SK, Yoo SH, Cheong T (2017) Sustainable EOQ under lead-time uncertainty and multi-modal transport. Sustainability 9(3):476

Li R, Liu Y, Teng JT, Tsao YC (2019) Optimal pricing, lot-sizing and backordering decisions when a seller demands an advance-cash-credit payment scheme. Eur J Oper Res 278(1):283–295

Li D, Zhao Y, Zhang L, Chen X, Cao C (2018) Impact of quality management on green innovation. J Clean Prod 170:462–470

Lin F, Jia T, Wu F, Yang Z (2019) Impacts of two-stage deterioration on an integrated inventory model under trade credit and variable capacity utilization. Eur J Oper Res 272(1):219–234

Lee CC, Hsu SL (2009) A two-warehouse production model for deteriorating inventory items with time-dependent demands. Eur J Oper Res 194(3):700–710

Liang Y, Zhou F (2011) A two-warehouse inventory model for deteriorating items under conditionally permissible delay in payment. Appl Math Model 35(5):2221–2231

Liao JJ, Huang KN, Chung KJ (2012) Lot-sizing decisions for deteriorating items with two warehouses under an order-size-dependent trade credit. Int J Prod Econ 137(1):102–115

Liao JJ, Chung KJ, Huang KN (2013) A deterministic inventory model for deteriorating items with two warehouses and trade credit in a supply chain system. Int J Prod Econ 146(2):557–565

Liao JJ, Huang KN, Ting PS (2014) Optimal strategy of deteriorating items with capacity constraints under two-levels of trade credit policy. Appl Math Comput 233:647–658

Mahata P, Mahata GC (2020) Production and payment policies for an imperfect manufacturing system with discount cash flows analysis in fuzzy random environments. Math Comput Model Dyn Syst 26(4):374–408

Mahata P, Mahata GC, Mukherjee A (2019) An ordering policy for deteriorating items with price dependent iso-elastic demand under permissible delay in payments and price inflation. Math Comput Model Dyn Syst 25(5):575–601

Mahata GC (2012) An EPQ-based inventory model for exponentially deteriorating items under retailer partial trade credit policy in supply chain. Expert Syst Appl 39:3537–3550

Mahata GC, Mahata P (2011) Analysis of a fuzzy economic order quantity model for deteriorating items under retailer partial trade credit financing in a supply chain. Math Comput Model 53:1621–1636

Ouyang LY, Teng JT, Goyal SK, Yang CT (2009) An economic order quantity model for deteriorating items with partially permissible delay in payments linked to order quantity. Eur J Oper Res 194(2):418–431

Ouyang LY, Ho CH, Su CH (2008) Optimal strategy for an integrated system with variable production rate when the freight rate and trade credit are both linked to the order quantity. Int J Prod Econ 115(1):151–162

Ouyang LY, Ho CH, Su CH (2009) An optimization approach for joint pricing and ordering problem in an integrated inventory system with order-size dependent trade credit. Comput Ind Eng 57(3):920–930

Ouyang LY, Ho CH, Su CH, Yang CT (2015) An integrated inventory model with capacity constraint and order-size dependent trade credit. Comput Ind Eng 84:133–143

Panda GC, Khan MAA, Shaikh AA (2019) A credit policy approach in a two-warehouse inventory model for deteriorating items with price-and stock-dependent demand under partial backlogging. J Ind Eng Int 15(1):147–170

Pentico DW, Drake MJ (2009) The deterministic EOQ with partial backordering: a new approach. Eur J Oper Res 194(1):102–113

Sarkar B, Ahmed W, Choi SB, Tayyab M (2018) Sustainable inventory management for environmental impact through partial backordering and multi-trade-credit-period. Sustainability 10(12):4761

Seifert D, Seifert RW, Protopappa-Sieke M (2013) A review of trade credit literature: Opportunities for research in operations. Eur J Oper Res 231(2):245–256

Seifert D, Seifert RW, Isaksson OH (2017) A test of inventory models with permissible delay in payment. Int J Prod Res 55(4):1117–1128

Shah NH, Cárdenas-Barrón LE (2015) Retailer’s decision for ordering and credit policies for deteriorating items when a supplier offers order-linked credit period or cash discount. Appl Math Comput 259:569–578

Sarma KVS (1987) A deterministic order level inventory model for deteriorating items with two storage facilities. Eur J Oper Res 29(1):70–73

Shaikh AA, Das SC, Bhunia AK, Panda GC, Khan MAA (2019) A two-warehouse EOQ model with interval-valued inventory cost and advance payment for deteriorating item under particle swarm optimization. Soft Comput 23(24):13531–13546

Shaikh AA, Khan MAA, Panda GC, Konstantaras I (2019) Price discount facility in an EOQ model for deteriorating items with stock-dependent demand and partial backlogging. Int Trans Oper Res 26(4):1365–1395

Soleymanfar VR, Taleizadeh AA, Zia NP (2015) A sustainable lot-sizing model with partial backordering. Int J Adv Oper Manag 7(2):157–172

Tayyab M, Sarkar B (2016) Optimal batch quantity in a cleaner multi-stage lean production system with random defective rate. J Clean Prod 139:922–934

Teng JT, Goyal SK (2007) Optimal ordering policies for a retailer in a supply chain with up-stream and down-stream trade credits. J Oper Res Soc 58(9):1252–1255

Teng JT, Min J, Pan Q (2012) Economic order quantity model with trade credit financing for non-decreasing demand. Omega 40(3):328–335

Taleizadeh AA, Pentico DW, Jabalameli MS, Aryanezhad M (2013) An EOQ model with partial delayed payment and partial backordering. Omega 41(2):354–368

Taleizadeh AA, Pourmohammad-Zia N, Konstantaras I (2019) Partial linked-to-order delayed payment and life time effects on decaying items ordering. Oper Res 1–23

Taleizadeh AA, Pentico DW (2014) An economic order quantity model with partial backordering and all-units discount. Int J Prod Econ 155:172–184

Taleizadeh AA, Hazarkhani B, Moon I (2020) Joint pricing and inventory decisions with carbon emission considerations, partial backordering and planned discounts. Ann Oper Res 290(1):95–113

Ting PS (2015) Comments on the EOQ model for deteriorating items with conditional trade credit linked to order quantity in the supply chain management. Eur J Oper Res 246(1):108–118

Tiwari S, Ahmed W, Sarkar B (2018) Multi-item sustainable green production system under trade-credit and partial backordering. J Clean Prod 204:82–95

Tiwari S, Cárdenas-Barrón LE, Shaikh AA, Goh M (2018b) Retailer’s optimal ordering policy for deteriorating items under order-size dependent trade credit and complete backlogging. Comput Ind Eng

Tiwari S, Jaggi CK, Gupta M, Cárdenas-Barrón LE (2018) Optimal pricing and lotsizing policy for supply chain system with deteriorating items under limited storage capacity. Int J Prod Econ 200:278–290

Tiwari S, Cárdenas-Barrón LE, Khanna A, Jaggi CK (2016) Impact of trade credit and inflation on retailer's ordering policies for non-instantaneous deteriorating items in a two-warehouse environment. Int J Prod Econ 176:154–169

Wee HM, Daryanto Y (2020) Imperfect quality item inventory models considering carbon emissions. Optimization and Inventory Management. Springer, Singapore, pp 137–159

Wu J, Teng JT, Skouri K (2018) Optimal inventory policies for deteriorating items with trapezoidal-type demand patterns and maximum lifetimes under upstream and downstream trade credits. Ann Oper Res 264(1–2):459–476

Xiang and Lawley (2019) The impact of British Columbia’s carbon tax on residential natural gas consumption. Energy Econ 80:206–218

Xu X, Bai Q, Chen M (2017) A comparison of different dispatching policies in two-warehouse inventory systems for deteriorating items over a finite time horizon. Appl Math Model 41:359–374

Yang HL, Chang CT (2013) A two-warehouse partial backlogging inventory model for deteriorating items with permissible delay in payment under inflation. Appl Math Model 37(5):2717–2726

Yao MJ, Lin JY, Lee C, Wang PH (2020) Optimal replenishment and inventory financing strategy in a three-echelon supply chain under the variable demand and default risk. J Oper Res Soc 1–15

Zia NP, Taleizadeh AA (2015) A lot-sizing model with backordering under hybrid linked-to-order multiple advance payments and delayed payment. Transp Res E Logist Transp Rev 82:19–37

Zhou YW, Yang SL (2005) A two-warehouse inventory model for items with stock-level dependent demand rate. Int J Prod Econ 95(2):215–228

Acknowledgements

The authors are grateful to the Associate editor and anonymous reviewers for their valuable comments and suggestions to improve the quality of this article.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1 Equivalent transformation of the objective function

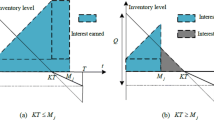

Case 1–1: \({M}_{j}\le KT\le {T}_{w}\)

Using \(K+\left(1-K\right)\beta =1-\left(1-K\right)\left(1-\beta \right)\) and \({\pi }_{j}=p+{c}_{g}-{c}_{j}\), Eq. (7) can be rewritten as below

From Eq. (51), \(AT{P}_{11}^{\left(j\right)}\left(K,T\right)\) is maximized by minimizing the expression which is

Further, making some algebraic manipulation, Eq. (52) can be rearranged to Eq. (53),

Case 1–2: \(KT\le {M}_{j}\le {T}_{w}\) or \(KT\le {T}_{w}\le {M}_{j}\)

Maximizing Eq. (54) is equivalent to minimizing the following function

Case 2–1: \({M}_{j}\le {T}_{w}\le KT\) or \({T}_{w}\le {M}_{j}\le KT\)

Maximizing Eq. (56) is equivalent to minimizing the following function

Case 2–2: \({T}_{w}\le KT\le {M}_{j}\)

Maximizing Eq. (58) is equivalent to minimizing the following function

Appendix 2 Find the optimal values when \({\varphi }_{115}\le 0\) and \({\varphi }_{215}\le 0\)

For Case 1–1, if \({\varphi }_{115}\le 0,\) we have \({\theta }_{11}\left(K\right)={\varphi }_{111}{K}^{2}-{\varphi }_{112}K+{\varphi }_{114}>0,\) which always holds for any \(K\in \left[0, 1\right]\). So if \({\varphi }_{115}\le 0,\) then

From Eq. (60), we can conclude that \(AT{C}_{11}^{\left(j\right)}\left(K,T\right)\) is a strictly increasing function of T. Therefore, \(AT{C}_{11}^{\left(j\right)}\left(K,T\right)\) reaches its minimum at \(T=\frac{{M}_{j}}{K}\). Then substituting \(T=\frac{{M}_{j}}{K}\) into Eq. (11) lead to

Taking the first and second derivatives of Eq. (70) with respect to K, we have

Clearly, \(AT{C}_{11}^{\left(j\right)}\left(K,T\right)\) is a strictly convex function of K. Setting \(AT{C}_{11}^{\left(j\right)}\left(K,\frac{{M}_{j}}{K}\right)=0\) yields

Therefore, from Eq. (64), if \({{K}^{^{\prime}}}_{11}\) is feasible, the optimal solution in this case is \(\left({T}_{11}, {K}_{11}\right)=\left(\frac{{M}_{j}}{{{K}^{^{\prime}}}_{11}}, {{K}^{^{\prime}}}_{11}\right).\) Otherwise the optimal solution is \(\left({T}_{11}, {K}_{11}\right)=({M}_{j},1)\).

Similarly, for Case 2–1, if \({\varphi }_{215}\le 0,\) following the same steps used in Case 1–1 to develop \({{K}^{^{\prime}}}_{21}\), we have

For Eq. (65), if \({{K}^{^{\prime}}}_{21}\) is feasible, the optimal solution in this case is \(\left({T}_{21}, {K}_{21}\right)=\left(\frac{max\left\{{T}_{w},{M}_{j}\right\}}{{K{^{\prime}}}_{21}}, {K{^{\prime}}}_{21}\right)\).

Otherwise the optimal solution is \(\left({T}_{21}, {K}_{21}\right)=(max\left\{{T}_{w},{M}_{j}\right\},1)\).

Appendix 3 Find the roots \(\left({K}_{11}, {T}_{11}\right)\), \(\left({K}_{12}, {T}_{12}\right)\), \(\left({K}_{21}, {T}_{21}\right)\), and \(\left({K}_{22}, {T}_{22}\right)\)

Case 1–1: \({M}_{j}\le KT\le {T}_{w}\)

From Eq. (11), differentiating \(AT{C}_{11}^{\left(j\right)}\left(K,T\right)\) with respect to \(K\mathrm{and}T\), we have

After some algebra

and

Similarly, for Case 1–2, Case 2–1 and Case 2–2, the roots \(\left({K}_{12}, {T}_{12}\right)\), \(\left({K}_{21}, {T}_{21}\right)\), and \(\left({K}_{22}, {T}_{22}\right)\) can be obtained easily.

Appendix 4 Find the optimal values of T # when K = 1

Case 1–1:\({M}_{j}\le KT\le {T}_{w}\)

Substituting \({K}_{11}=1\) into Eq. (10) leads to

Taking the first and second derivatives of Eq. (70) with respect to \(T\), we have

Obviously, if \({\varphi }_{115}>0,\) then \(AT{C}_{11}^{\left(j\right)}\left(1,T\right)\) is a strictly convex function of \(T\). Setting \(AT{C}_{11}^{{^{\prime}}\left(j\right)}\left(1,T\right)=0\) yields

Similarly, for the other cases, \({T}\) can be obtained when \({K}_{12}=1\), \({K}_{21}=1\), and \({K}_{22}=1\),

Appendix 5 Find the optimal values of T' and K'

For the solution of \({K}_{11}\) and \({T}_{11}\) derived for Case 1–1, if the relationship \({K}_{11}{T}_{11}<{M}_{j}\) is established, it shows that the optimal values will be obtained on the boundary point. Thus, we may set \(T=\frac{{M}_{j}}{{K}_{11}}\) and then substitute it into Eq. (11), which leads to

Taking the first and second derivatives of Eq. (77) with respect to \({K}_{11}\), we have

From Eq. (79), \(AT{C}_{11}^{\left(j\right)}\left({K}_{11},\frac{{M}_{j}}{{K}_{11}}\right)\) is a strictly convex function of \({K}_{11}\). Setting \(AT{C}_{11}^{{^{\prime}}\left(j\right)}\left({K}_{11},\frac{{M}_{j}}{{K}_{11}}\right)=0\) yields

Noticing that, if \({K{^{\prime}}}_{11}\) is feasible, the optimal solution in this case is \(\left({T}_{11}, {K}_{11}\right)=\left(\frac{{M}_{j}}{{K{^{\prime}}}_{11}}, {K{^{\prime}}}_{11}\right),\) Otherwise the optimal solution is \(\left({T}_{11}, {K}_{11}\right)=\left({M}_{j},1\right).\)

In addition, if the relationship \({K}_{11}{T}_{11}>{T}_{w}\) is established, use the same approach to develop\({K{^{\prime}}}_{11}\), \({K{^{\prime}}}_{11}=\sqrt{\frac{{\varphi }_{114}{{T}_{w}}^{2}}{{\varphi }_{111}{{T}_{w}}^{2}-{\varphi }_{113}{T}_{w}+{\varphi }_{115}}}\).

In the same way, we can analyze Case 1–2, Case 2–1, Case 2–2. The specific computational results are summarized in Table 2.

Appendix 6 Find the optimal values of T'' and K'' when optimal order quantity \({Q}_{j}\notin [{q}_{j},{q}_{j+1})\)

If \({Q}_{j}\notin [{q}_{j},{q}_{j+1})\), there are two situations:

-

1.

if \({Q}_{j}\ge {q}_{j+1},\) the optimal solution does not exist and then the retailer needs to adjust the order quantity;

-

2.

if \({Q}_{j}<{q}_{j}\), the optimal values will be obtained at point \(T=\frac{{q}_{j}}{D\left[\left(1-\beta \right)K+\beta \right]}\).

Based on the analysis above, we only need to discuss the case of \({Q}_{j}<{q}_{j}\).

First, for Case 1–1, substituting \(T=\frac{{q}_{j}}{D\left[\left(1-K\right)\beta +K\right]}=\frac{{q}_{j}}{D\left[\left(1-\beta \right)K+\beta \right]}\) into Eq. (52) leads to

Taking the first and second derivatives of Eq. (81) with respect to K, we have

From Eq. (83), we know that \(AT{C}_{11}^{\left(j\right)}\left(K\right)\) is convex. Setting \(dAT{C}_{11}^{\left(j\right)}\left(K\right)/dK=0\) yields

After some transformation, the Eq. (84) can be simplified to

where,

For the quadratic equation (F5), if it has roots \(\left(\mathrm{i}.\mathrm{e}., \Delta ={\mu }_{112}-4{\mu }_{111}{\mu }_{113}\ge 0\right)\), then we have

If \({{K}^{^{\prime}}}_{11}\) is feasible, then we obtain the retailer’s replenishment cycle

If \({{K}^{^{\prime}}}_{11}\) is not feasible or Eq. (85) has no root, we may set \({K{^{\prime}}{^{\prime}}}_{11}=0\) or \({K{^{\prime}}{^{\prime}}}_{11}=1\).

In summary, for the solution of \({K{^{\prime}}{^{\prime}}}_{11}\) and \({T{^{\prime}}{^{\prime}}}_{11}\) derived for Case 1–1, we also need to check whether the constraint \({M}_{j}\le {K{^{\prime}}{^{\prime}}}_{11}{T{^{\prime}}{^{\prime}}}_{11}\le {T}_{w}\) is satisfied. If the constraint is valid, the optimal solution is obtained. Otherwise, the optimal solution does not exist.

Following the same steps used in Case 1–1, we can analyze Case 1–2, Case 2–1 and Case 2–2 separately.

where,

where,

where,

Appendix 7

Algorithm A: Determine (\({K}_{11}^{**},{T}_{11}^{**}\)) and \({ATP}_{11}^{(j)}\left({K}_{11}^{**}, {T}_{11}^{**}\right)\)

-

A1.

Calculate \({\varphi }_{11i}\left(i=\mathrm{1,2},\dots ,6\right)\) from Eqs.(14)-(19). If \({\varphi }_{115}>0,\) go to step A2; if not, go to step A6.

-

A2.

Calculate \({\beta }_{11}\) from Eq. (28), if \({\beta \le \beta }_{11}\), go to step A4; else if \({\beta >\beta }_{11},\) calculate \({T}_{11}\) from Eq. (29). If \({T}_{11}\) is feasible, go to step A3; if not, go to step A4.

-

A3.

Compute \({K}_{11}\) from Eq. (30), if \({K}_{11}\le 1,\) go to step A5; if not, go to step A4.

-

A4.

Set \({K}_{11}=1,\) determine \({T}_{11}\) from Eq.(D4) in Appendix 4. If \({T}_{11}>{T}_{w}\), set \(\left({K}_{11}^{*},{T}_{11}^{*}\right)=(1,{T}_{w})\) and go to step A7; else if \({T}_{11}<{M}_{j}\), set \(\left({K}_{11}^{*},{T}_{11}^{*}\right)=(1,{M}_{j})\) and go to step A7; otherwise, set \(\left({K}_{11}^{*},{T}_{11}^{*}\right)=(1,{T}_{11})\) and go to step A7.

-

A5.

If \({M}_{j}\le {K}_{11}{T}_{11}\le {T}_{w}\), set \(\left({K}_{11}^{*},{T}_{11}^{*}\right)=({K}_{11},{T}_{11})\) and go to step A7; if not, go to step A6.

-

A6.

If \({K}_{11}{T}_{11}>{T}_{w},\) obtain \(\left({K}_{11}^{*},{T}_{11}^{*}\right)=\left({K}_{11}^{^{\prime}},{T}_{11}^{^{\prime}}\right)\) by employing Table 2. Then if \({T}_{11}^{*}\) and \({K}_{11}^{*}\) are feasible, go to step A7; if not, go to step A4. On the other hand, if \({K}_{11}{T}_{11}<{M}_{j},\) obtain \(\left({K}_{11}^{*},{T}_{11}^{*}\right)=\left({K}_{11}^{^{\prime}},{T}_{11}^{^{\prime}}\right)\) using Table 2. Now, if \({T}_{11}^{*}\) and \({K}_{11}^{*}\) are feasible, go to step A7; if not, go to step A4.

-

A7.

Calculate order quantity \({Q}_{j}=D{T}_{12}^{*}\left[\left(1-{K}_{12}^{*}\right)\beta +{K}_{12}^{*}\right]\) from Eq. (31), and go to step A8.

-

A8.

Determine the relationship between \({Q}_{j}\) and \(\left[{q}_{j},\left.{q}_{j+1}\right)\right.\) using the following sub-steps.

-

A8.1

If \({q}_{j}\le {Q}_{j}<{q}_{j+1},\) set \(\left({K}_{11}^{**},{T}_{11}^{**}\right)=\left({K}_{11}^{*},{T}_{11}^{*}\right).\) Calculate the retailer’s annual profit \({ATP}_{11}^{(j)}\left({K}_{11}^{**}, {T}_{11}^{**}\right)\) using Eq. (7) and go to step A9.

-

A8.2

If \({Q}_{j}\ge {q}_{j+1},\) then \({T}_{11}^{*}\) and \({K}_{11}^{*}\) are not feasible solutions, set \({ATP}_{11}^{(j)}\left(K,T\right)=-\mathrm{inf}.\)

-

A8.3

If \({Q}_{j}<{q}_{j},\) then \({T}_{11}^{*}\) and \({K}_{11}^{*}\) are not feasible solutions. However, \({ATP}_{11}^{(j)}\left(K,T\right)\) at point \(T=\frac{{q}_{j}}{D\left[\left(1-\beta \right)K+\beta \right]}\) has a maximum value. Thus, calculate \({K}_{11}^{{^{\prime}}{^{\prime}}}\) from Eq. (86) in Appendix 6. If \({K}_{11}^{{^{\prime}}{^{\prime}}}\) is feasible, go to step A8.3.1; if not, go to step A8.3.2.

-

A8.3.1

If \({M}_{j}\le {K{^{\prime}}{^{\prime}}}_{11}{T{^{\prime}}{^{\prime}}}_{11}\le {T}_{w}\), set \(\left({K}_{11}^{**},{T}_{11}^{**}\right)=\left({K}_{11}^{{^{\prime}}{^{\prime}}},{T}_{11}^{{^{\prime}}{^{\prime}}}\right),\) and calculate the retailer’s annual profit \({ATP}_{11}^{(j)}\left({K}_{11}^{**}, {T}_{11}^{**}\right)\) using Eq. (7), go to step A9. Otherwise,\({T}_{11}^{{^{\prime}}{^{\prime}}}\) and \({K}_{11}^{{^{\prime}}{^{\prime}}}\) are not feasible solutions, set \({ATP}_{11}^{(j)}\left(K,T\right)=-\mathrm{inf},\) go to step A9.

-

A8.3.2

Let \({K}_{11}^{\mathrm{^{\prime}}\mathrm{^{\prime}}}=1\) and \({T}_{11}^{\mathrm{^{\prime}}\mathrm{^{\prime}}}={q}_{j}/D.\) If \({M}_{j}\le {K\mathrm{^{\prime}}\mathrm{^{\prime}}}_{11}{T\mathrm{^{\prime}}\mathrm{^{\prime}}}_{11}\le {T}_{w},\) set \(\left({K}_{11}^{**},{T}_{11}^{**}\right)=(1,{q}_{j}/D),\) and calculate the retailer’s annual profit \({ATP}_{11}^{(j)}\left({K}_{11}^{**}, {T}_{11}^{**}\right)\) using Eq. (7) and go to step A9.

Otherwise, \({T}_{11}^{^{\prime}}\) and \({K}_{11}^{^{\prime}}\) are not feasible solutions, set \({ATP}_{11}^{(j)}\left(K,T\right)=-\mathrm{inf},\) go to step A9.

-

A9.

If \({ATP}_{11}^{(j)}\left({K}_{11}^{**}, {T}_{11}^{**}\right)\ge -{\pi }_{j}D,\) the optimal solutions \({K}_{11}^{**}\) and \({T}_{11}^{**}\) are found and stop. Otherwise, go to step A9.

-

A10.

Set \(\left({K}_{11}^{**},{T}_{11}^{**}\right)=\left(0,\infty \right),{ATP}_{11}^{(j)}\left({K}_{11}^{**}, {T}_{11}^{**}\right)=-{\uppi }_{j}D.\)

Appendix 8

Algorithm B: Determine (\({K}_{12}^{**},{T}_{12}^{**}\)) and \({ATP}_{12}^{(j)}\left({K}_{12}^{**}, {T}_{12}^{**}\right)\)

-

B1.

Calculate \({\varphi }_{12i} \left(i=\mathrm{1,2},\dots ,6\right)\) from Eqs. (35)-(40), go to step B2.

-

B2.

Calculate \({\beta }_{12}\) from Eq. (42), if \({\beta \le \beta }_{12}\), go to step B4; else if \({\beta >\beta }_{12}\), calculate \({T}_{12}\) from Eq. (43). If \({T}_{12}\) is feasible, go to step B3; if not, go to step B4.

-

B3.

Compute \({K}_{12}\) from Eq. (44), if \({K}_{12}\le 1,\) go to step B5; if not, go to step B4.

-

B4.

Set \({K}_{12}=1,\) determine \({T}_{12}\) from Eq.(D5) in Appendix 4. If \({T}_{12}>\mathrm{min}\{{T}_{w},{M}_{j}\}\), set \(\left({K}_{12}^{*},{T}_{12}^{*}\right)=(1,\mathrm{min}\{{T}_{w},{M}_{j}\})\) and go to step B7; otherwise, set \(\left({K}_{12}^{*},{T}_{12}^{*}\right)=(1,{T}_{12})\) and go to step B7.

-

B5.

If \({K}_{12}{T}_{12}\le \mathrm{min}\{{T}_{w},{M}_{j}\}\), set \(\left({K}_{12}^{*},{T}_{12}^{*}\right)=({K}_{12},{T}_{12})\) and go to step B7; if not, go to step B6.

-

B6.

If If \({K}_{12}{T}_{12}>\mathrm{min}\{{T}_{w},{M}_{j}\},\) obtain \(\left({K}_{12}^{*},{T}_{12}^{*}\right)=\left({K}_{12}^{^{\prime}},{T}_{12}^{^{\prime}}\right)\) by employing Table 2.Then if \({T}_{12}^{*}\) and \({K}_{12}^{*}\) are feasible, go to step B7; if not, go to step B4.

-

B7.

Calculate order quantity \({Q}_{j}=D{T}_{12}^{*}\left[\left(1-{K}_{12}^{*}\right)\beta +{K}_{12}^{*}\right]\), and go to step B8.

-

B8.

Determine the relationship between \({Q}_{j}\) and \(\left[{q}_{j},\left.{q}_{j+1}\right)\right.\) using the following sub-steps.

-

B8.1

If \({q}_{j}\le {Q}_{j}<{q}_{j+1},\) set \(\left({K}_{12}^{**},{T}_{12}^{**}\right)=\left({K}_{12}^{*},{T}_{12}^{*}\right).\) Calculate the retailer’s annual profit \({ATP}_{12}^{(j)}\left({K}_{12}^{**}, {T}_{12}^{**}\right)\) using Eq. (8) and go to step B9.

-

B8.2

If \({Q}_{j}\ge {q}_{j+1},\) then \({T}_{12}^{*}\) and \({K}_{12}^{*}\) are not feasible solutions, set \({ATP}_{12}^{(j)}\left({K}_{12}^{*},{T}_{12}^{*}\right)=-\mathrm{inf}.\)

-

B8.3

If \({Q}_{j}<{q}_{j},\) then \({T}_{12}^{*}\) and \({K}_{12}^{*}\) are not feasible solutions. However, \({ATP}_{12}^{(j)}\left(K,T\right)\) at point \(T=\frac{{q}_{j}}{D\left[\left(1-\beta \right)K+\beta \right]}\) has a maximum value. Thus, calculate \({K}_{12}^{{^{\prime}}{^{\prime}}}\) from Eq. (88) in Appendix 6. If \({K}_{12}^{{^{\prime}}{^{\prime}}}\) is feasible, go to step B8.3.1; if not, go to step B8.3.2.

-

B8.3.1

If \({{K}^{^{\prime}}}_{12}{{T}^{^{\prime}}}_{12}\le \mathrm{min}\{{T}_{w},{M}_{j}\}\), set \(\left({K}_{12}^{**},{T}_{12}^{**}\right)=\left({K}_{12}^{{^{\prime}}{^{\prime}}},{T}_{12}^{{^{\prime}}{^{\prime}}}\right),\) and calculate the retailer’s annual profit \({ATP}_{12}^{(j)}\left({K}_{12}^{**}, {T}_{12}^{**}\right)\) using Eq. (8), go to step B9. Otherwise,\({T}_{12}^{{^{\prime}}{^{\prime}}}\) and \({K}_{12}^{{^{\prime}}{^{\prime}}}\) are not feasible solutions, set \({ATP}_{12}^{(j)}\left({K}_{12}^{**},{T}_{12}^{**}\right)=-\mathrm{inf},\) go to step B9.

-

B8.3.2

Let \({K}_{12}^{\mathrm{^{\prime}}\mathrm{^{\prime}}}=1\) and \({T}_{12}^{\mathrm{^{\prime}}\mathrm{^{\prime}}}={q}_{j}/D.\) If \({{K}_{12}^{\mathrm{^{\prime}}\mathrm{^{\prime}}}T\mathrm{^{\prime}}\mathrm{^{\prime}}}_{12}\le \mathrm{min}\{{T}_{w},{M}_{j}\},\) set \(\left({K}_{12}^{**},{T}_{12}^{**}\right)=(1,{q}_{j}/D),\) and calculate the retailer’s annual profit \({ATP}_{12}^{(j)}\left({K}_{12}^{**}, {T}_{12}^{**}\right)\) using Eq. (8) and go to step B9.

Otherwise, \({T}_{11}^{{^{\prime}}{^{\prime}}}\) and \({K}_{11}^{{^{\prime}}{^{\prime}}}\) are not feasible solutions, set \({ATP}_{12}^{(j)}\left({K}_{12}^{**},{T}_{12}^{**}\right)=-\mathrm{inf},\) go to step B9.

-

B9.

If \({ATP}_{12}^{(j)}\left({K}_{12}^{**}, {T}_{12}^{**}\right)\ge -{\pi }_{j}D,\) the optimal solutions \({K}_{12}^{**}\) and \({T}_{12}^{**}\) are found and stop. Otherwise, go to step B10.

-

B10.

Set \(\left({K}_{12}^{**},{T}_{12}^{**}\right)=\left(0,\infty \right),{ATP}_{12}^{(j)}\left({K}_{12}^{**}, {T}_{12}^{**}\right)=-{\uppi }_{j}D.\)

Appendix 9

Algorithm C: Determine (\({K}_{21}^{**},{T}_{21}^{**}\)) and \({ATP}_{21}^{(j)}\left({K}_{21}^{**}, {T}_{21}^{**}\right)\)

-

C1.

Calculate \({\varphi }_{21i}\left(i=\mathrm{1,2},\dots ,6\right)\) from Eqs.(48)-(53). If \({\varphi }_{215}>0,\) go to step C2; if not, go to step C6.

-

C2.

Calculate \({\beta }_{21}\) from Eq. (55), if \({\beta \le \beta }_{21}\), go to step C4; else if \({\beta >\beta }_{21}\), calculate \({T}_{21}\) from Eq. (56). If \({T}_{21}\) is feasible, go to step C3; if not, go to step C4.

-

C3.

Compute \({K}_{21}\) from Eq. (57), if \({K}_{21}\le 1,\) go to step C5; if not, go to step C4.

-

C4.

Set \({K}_{21}=1,\) determine \({T}_{21}\) from Eq.(D6) in Appendix 4. If \({T}_{21}<\mathrm{max}\{{T}_{w},{M}_{j}\}\), set \(\left({K}_{21}^{*},{T}_{21}^{*}\right)=(1,\mathrm{max}\{{T}_{w},{M}_{j}\})\) and go to step C7. Otherwise, set \(\left({K}_{21}^{*},{T}_{21}^{*}\right)=(1,{T}_{21})\) and go to step C7.

-

C5.

If \(\mathrm{max}\{{T}_{w},{M}_{j}\}\le {K}_{21}{T}_{21}\), set \(\left({K}_{21}^{*},{T}_{21}^{*}\right)=({K}_{21},{T}_{21})\) and go to step C7; if not, go to step C6.

-

C6.

If \({K}_{21}{T}_{21}<\mathrm{max}\{{T}_{w},{M}_{j}\},\) obtain \(\left({K}_{21}^{*},{T}_{21}^{*}\right)=\left({K}_{21}^{^{\prime}},{T}_{21}^{^{\prime}}\right)\) by employing Table 2.Then if \({T}_{21}^{*}\) and \({K}_{21}^{*}\) are feasible, go to step C7; if not, go to step C4.

-

C7.

Calculate order quantity \({Q}_{j}=D{T}_{21}^{*}\left[\left(1-{K}_{21}^{*}\right)\beta +{K}_{21}^{*}\right]\), and go to step C8.

-

C8.

Determine the relationship between \({Q}_{j}\) and \(\left[{q}_{j},\left.{q}_{j+1}\right)\right.\) using the following sub-steps.

-

C8.1

If \({q}_{j}\le {Q}_{j}<{q}_{j+1},\) set \(\left({K}_{21}^{**},{T}_{21}^{**}\right)=\left({K}_{21}^{*},{T}_{21}^{*}\right).\) Calculate the retailer’s annual profit \({ATP}_{21}^{(j)}\left({K}_{21}^{**}, {T}_{21}^{**}\right)\) using Eq. (9) and go to step C9.

-

C8.2.

If \({Q}_{j}\ge {q}_{j+1},\) then \({T}_{21}^{*}\) and \({K}_{21}^{*}\) are not feasible solutions, set \({ATP}_{21}^{(j)}\left({K}_{21}^{*},{T}_{21}^{*}\right)=-\mathrm{inf}.\)

-

C8.3.

If \({Q}_{j}<{q}_{j},\) then \({T}_{21}^{*}\) and \({K}_{21}^{*}\) are not feasible solutions. However, \({ATP}_{21}^{(j)}\left(K,T\right)\) at point \(T=\frac{{q}_{j}}{D\left[\left(1-\beta \right)K+\beta \right]}\) has a maximum value. Thus, calculate \({K}_{21}^{{^{\prime}}{^{\prime}}}\) from Eq. (89) in Appendix 6. If \({K}_{21}^{{^{\prime}}{^{\prime}}}\) is feasible, go to step C8.3.1; if not, go to step C8.3.2.

-

C8.3.1

If \(\mathrm{max}\{{T}_{w},{M}_{j}\}\le {{K}^{^{\prime}}}_{21}{{T}^{^{\prime}}}_{21}\), set \(\left({K}_{21}^{**},{T}_{21}^{**}\right)=\left({K}_{21}^{{^{\prime}}{^{\prime}}},{T}_{21}^{{^{\prime}}{^{\prime}}}\right),\) and calculate the retailer’s annual profit \({ATP}_{21}^{(j)}\left({K}_{21}^{**}, {T}_{21}^{**}\right)\) using Eq. (9), go to step C9. Otherwise,\({T}_{21}^{{^{\prime}}{^{\prime}}}\) and \({K}_{21}^{{^{\prime}}{^{\prime}}}\) are not feasible solutions, set \({ATP}_{21}^{(j)}\left({K}_{21}^{**},{T}_{21}^{**}\right)=-\mathrm{inf},\) go to step C9.

-

C8.3.2

Let \({K}_{21}^{\mathrm{^{\prime}}\mathrm{^{\prime}}}=1\) and \({T}_{21}^{\mathrm{^{\prime}}\mathrm{^{\prime}}}={q}_{j}/D.\) If \(\mathrm{max}\{{T}_{w},{M}_{j}\}\le {K\mathrm{^{\prime}}\mathrm{^{\prime}}}_{21}{T\mathrm{^{\prime}}\mathrm{^{\prime}}}_{21},\) set \(\left({K}_{21}^{**},{T}_{21}^{**}\right)=(1,{q}_{j}/D),\) and calculate the retailer’s annual profit \({ATP}_{21}^{(j)}\left({K}_{21}^{**}, {T}_{21}^{**}\right)\) using Eq. (9) and go to step C9. Otherwise, \({T}_{21}^{\mathrm{^{\prime}}\mathrm{^{\prime}}}\) and \({K}_{21}^{\mathrm{^{\prime}}\mathrm{^{\prime}}}\) are not feasible solutions, set \({ATP}_{21}^{(j)}\left({K}_{21}^{**},{T}_{21}^{**}\right)=-\mathrm{inf},\) go to step C9.

-

C9.

If \({ATP}_{21}^{(j)}\left({K}_{21}^{**}, {T}_{21}^{**}\right)\ge -{\pi }_{j}D,\) the optimal solutions \({K}_{21}^{**}\) and \({T}_{21}^{**}\) are found and stop. Otherwise, go to step C10.

-

C10.

Set \(\left({K}_{21}^{**}, {T}_{21}^{**}\right)=\left(0,\infty \right), {ATP}_{21}^{(j)}\left({K}_{21}^{**}, {T}_{21}^{**}\right)=-{\uppi }_{j}D.\)

Appendix 10

Algorithm D: Determine (\({K}_{22}^{**},{T}_{22}^{**}\)) and \({ATP}_{22}^{(j)}\left({K}_{22}^{**}, {T}_{22}^{**}\right)\)

-

D1.

Calculate \({\varphi }_{22i}\left(i=\mathrm{1,2},\dots ,6\right)\) from Eqs.(61)-(66), go to step D6.

-

D2.

Calculate \({\beta }_{22}\) from Eq. (68), if \({\beta \le \beta }_{22}\), go to step D4; else if \({\beta >\beta }_{22}\), calculate \({T}_{22}\) from Eq. (69). If \({T}_{22}\) is feasible, go to step D3; if not, go to step D4.

-

D3.

Compute \({K}_{22}\) from Eq. (70), if \({K}_{22}\le 1,\) go to step D5; if not, go to step D4.

-

D4.

Set \({K}_{22}=1,\) determine \({T}_{22}\) from Eq.(D7) in Appendix 4. If \({T}_{22}<{T}_{w},\) set \(\left({K}_{22}^{*},{T}_{22}^{*}\right)=(1,{T}_{w})\) and go to step D7; else if \({T}_{22}>{M}_{j},\) set \(\left({K}_{22}^{*},{T}_{22}^{*}\right)=(1,{M}_{j})\) and go to step D7; Otherwise, set \(\left({K}_{22}^{*},{T}_{22}^{*}\right)=(1,{T}_{22})\) and go to step D7.

-

D5.

If \({{T}_{w}\le K}_{22}{T}_{22}\le {M}_{j},\) set \(\left({K}_{22}^{*},{T}_{22}^{*}\right)=({K}_{22},{T}_{22})\) and go to step D7; if not, go to step D6.

-

D6.

If If \({K}_{22}{T}_{22}<{T}_{w},\) obtain \(\left({K}_{22}^{*},{T}_{22}^{*}\right)=\left({K}_{22}^{^{\prime}},{T}_{22}^{^{\prime}}\right)\) by employing Table 2.Then if \({T}_{22}^{*}\) and \({K}_{22}^{*}\) are feasible, go to step D7; if not, go to step D4. On the other hand, if \({K}_{22}{T}_{22}>{M}_{j}\), obtain \(\left({K}_{22}^{*},{T}_{22}^{*}\right)=\left({K}_{22}^{^{\prime}},{T}_{22}^{^{\prime}}\right)\) using Table 2. Now, if \({T}_{22}^{*}\) and \({K}_{22}^{*}\) are feasible, go to step D7; if not, go to step D4.

-

D7.

Calculate order quantity \({Q}_{j}=D{T}_{22}^{*}\left[\left(1-{K}_{22}^{*}\right)\beta +{K}_{22}^{*}\right]\), and go to step D8.

-

D8.

Determine the relationship between \({Q}_{j}\) and \(\left[{q}_{j},\left.{q}_{j+1}\right)\right.\) using the following sub-steps.

-

D8.1

If \({q}_{j}\le {Q}_{j}<{q}_{j+1},\) set \(\left({K}_{22}^{**},{T}_{22}^{**}\right)=\left({K}_{22}^{*},{T}_{22}^{*}\right).\) Calculate the retailer’s annual profit \({ATP}_{22}^{(j)}\left({K}_{22}^{**}, {T}_{22}^{**}\right)\) using Eq. (10) and go to step D9.

-

D8.2

If \({Q}_{j}\ge {q}_{j+1},\) then \({T}_{22}^{*}\) and \({K}_{22}^{*}\) are not feasible solutions, set \({ATP}_{22}^{(j)}\left({K}_{22}^{*},{T}_{22}^{*}\right)=-\mathrm{inf}.\)

-

D8.3

If \({Q}_{j}<{q}_{j},\) then \({T}_{22}^{*}\) and \({K}_{22}^{*}\) are not feasible solutions. However, \({ATP}_{22}^{(j)}\left({K}_{22}^{*},{T}_{22}^{*}\right)\) at point \(T=\frac{{q}_{j}}{D\left[\left(1-\beta \right)K+\beta \right]}\) has a maximum value. Thus, calculate \({K}_{22}^{{^{\prime}}{^{\prime}}}\) from Eq. (90) in Appendix 6. If \({K}_{22}^{{^{\prime}}{^{\prime}}}\) is feasible, go to step D8.3.1; if not, go to step D8.3.2.

-

D8.3.1

If \({T}_{w}{\le {K}^{^{\prime}}}_{22}{{T}^{^{\prime}}}_{22}\le {M}_{j}\), set \(\left({K}_{22}^{**},{T}_{22}^{**}\right)=\left({K}_{22}^{{^{\prime}}{^{\prime}}},{T}_{22}^{{^{\prime}}{^{\prime}}}\right),\) and calculate the retailer’s annual profit \({ATP}_{22}^{(j)}\left({K}_{22}^{**}, {T}_{22}^{**}\right)\) using Eq. (10), go to step D9. Otherwise,\({T}_{22}^{^{\prime}}\) and \({K}_{22}^{^{\prime}}\) are not feasible solutions, set \({ATP}_{22}^{(j)}\left({K}_{22}^{**},{T}_{22}^{**}\right)=-\mathrm{inf},\) go to step D9.

-

D8.3.2

Let \({K}_{22}^{\mathrm{^{\prime}}}=1\) and \({T}_{22}^{\mathrm{^{\prime}}}={q}_{j}/D.\) If \({T}_{w}{\le {K}^{\mathrm{^{\prime}}}}_{22}{{T}^{\mathrm{^{\prime}}}}_{22}\le {M}_{j},\) set \(\left({K}_{22}^{**},{T}_{22}^{**}\right)=(1,{q}_{j}/D),\) and calculate the retailer’s annual profit \({ATP}_{22}^{(j)}\left({K}_{22}^{**}, {T}_{22}^{**}\right)\) using Eq. (10) and go to step D9.

Otherwise, \({T}_{22}^{^{\prime}}\) and \({K}_{22}^{^{\prime}}\) are not feasible solutions, set \({ATP}_{22}^{(j)}\left({K}_{22}^{**},{T}_{22}^{**}\right)=-\mathrm{inf},\) go to step D9.

-

D9.

If \({ATP}_{22}^{(j)}\left({K}_{22}^{**}, {T}_{22}^{**}\right)\ge {-\pi }_{j}D,\) the optimal solutions \({K}_{22}^{**}\) and \({T}_{22}^{**}\) are found and stop. Otherwise, go to step D10.

-

D10.

Set \(\left({K}_{22}^{**},{T}_{22}^{**}\right)=\left(0,\infty \right),{ATP}_{22}^{(j)}\left({K}_{22}^{**}, {T}_{22}^{**}\right)=-{\uppi }_{j}D.\)

Rights and permissions

About this article

Cite this article

Mahato, C., Mahata, G.C. Sustainable partial backordering inventory model under linked-to-order credit policy and all-units discount with capacity constraint and carbon emissions. Flex Serv Manuf J 35, 896–944 (2023). https://doi.org/10.1007/s10696-022-09456-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10696-022-09456-9