Abstract

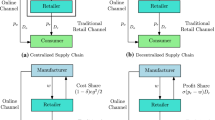

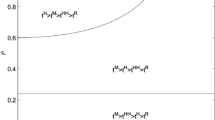

This article considers a closed-loop green supply chain with both forward and reverse dual-channels, where a manufacturer produces and sells a single green product to the potential customers through both the direct online channel (e-tail/internet) and the traditional retail channel in the forward dual-channel, and collects the used products for remanufacturing from the customers through both the retail and the direct online channels in the reverse dual-channel (Model II). The pricing and greening strategies for the channel members and the whole supply chain are derived both analytically and numerically under centralized and three decentralized scenarios viz. manufacturer-led and retailer-led decentralized scenarios and Nash game. These results are compared with those in the case when reverse logistic does not exist (Model I). Two special cases are examined when the products are returned through only online channel and only retail channel. Sensitivity analysis is performed to explore the effect of key model-parameters on optimal decisions. From numerical analysis, it is observed that the retail price in the centralized scenario is higher than that in the decentralized scenario, which contradicts the result due to double marginalization, and the retailer-led decentralized policy provides higher profit than the other decentralized policies. Model II gives better result in terms of profit of the whole supply chain, whereas Model I suggests a more environment-friendly product. It is also observed that the channel members gain more profit when the retailer only collects the used products.

Similar content being viewed by others

References

Ahn H, Duenyas I, Zhang R (2002) Price competition between retailers and manufacturer-owned stores. Working Paper, University of California at Berkeley

Balasubramanian S (1998) Mail versus mall: a strategic analysis of competition between direct marketers and conventional retailers. Market Sci 17(3):181–195

Batarfi R, Jaber MY, Aljazzar SM (2017) A profit maximization for a reverse logistics dual-channel supply chain with a return policy. Comput Ind Eng 106:58–82

Cai GG, Zhang ZG, Zhang M (2009) Game theoretical perspectives on dual-channel supply chain competition with price discounts and pricing schemes. Int J Prod Econ 117(1):80–96

Cai GG (2010) Channel selection and coordination in dual-channel supply chains. J Retail 86(1):22–36

Cao E (2014) Coordination of dual-channel supply chains under demand disruptions management decisions. Int J Prod Res 52(23):7114–7131

Chen J, Liang L, Yao DQ, Sun S (2017) Price and quality decisions in dual-channel supply chains. Eur J Oper Res 259:935–948

Chen YC, Fang SC, Wen UP (2013) Pricing policies for substitutable products in a supply chain with Internet and traditional channels. Eur J Oper Res 224:542–551

Chiang WYK, Chhajed D, Hess JD (2003) Direct marketing, indirect profits: a strategic analysis of dual-channel supply-chain design. Manag Sci 49(1):1–20

Choi TM, Li Y, Xu L (2013) Channel leadership, performance and coordination in closed-loop supply chains. Int J Prod Econ 146:371–380

Chun SH, Kim JC (2005) Pricing strategies in B2C electronic commerce: analytical and empirical approaches. Decis Support Syst 40(2):375–388

David A, Adida E (2015) Competition and coordination in a two-channel supply chain. Prod Oper Manag 24(8):1358–1370

De Giovanni P, Zaccour G (2014) A two-period game of a closed-loop supply chain. Eur J Oper Res 232:22–40

El Saadany A, Jaber MY (2010) A production/remanufacturing inventory model with price and quality dependant return rate. Comput Ind Eng 58(3):352–362

Fleischmann M, Krikke HR, Dekker R, Flapper SDP (2000) A characterisation of logistics networks for product. Omega 28(6):653–666

Geyskens I, Gielens K, Dekimpe MG (2002) The market valuation of Internet channel additions. J Market 66(2):102–119

Ghosh D, Shah J (2012) A comparative analysis of greening policies across supply chain structures. Int J Prod Econ 135(2):568–583

Ghosh D, Shah J (2015) Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int J Prod Econ 164:319–329

Giri BC, Maiti T (2014) Service competition in a supply chain with two retailers under service level sensitive retail price and demand. Int J Manag Sci Eng Manag 9(2):133–146

Giri BC, Roy B (2016) Dual-channel competition: the impact of pricing strategies, sales effort and market share. Int J Manag Sci Eng Manag 11(4):203–212

Giri BC, Chakraborty A, Maiti T (2017a) Pricing and return product collection decisions in a closed-loop supply chain with dual-channel in both forward and reverse logistics. J Manuf Syst 42:104–123

Giri BC, Mondal C, Maiti T (2017b) Optimal product quality and pricing strategy for a two-period closed-loop supply chain with retailer variable markup. RAIRO-Oper Res. https://doi.org/10.1051/ro/2017061

Guide VDR, Van Wassenhove LN (2009) The evolution of closed-loop supply chain research. Oper Res 57(1):10–18

Hanssens DM, Parsons LJ, Schultz RL (2003) Market response models: econometric and time series analysis, vol 12. Springer, Berlin

Hong IH, Yeh JS (2012) Modeling closed-loop supply chains in the electronics industry: a retailer collection application. Transp Res E Logist Transp Rev 48(4):817–829

Hua GW, Wang SY, Cheng TCE (2010) Price and lead time decisions in dual-channel supply chains. Eur J Oper Res 205(1):113–126

Hua GW, Cheng TCE, Wang SY (2011) Electronic books: To E or not to E? A strategic analysis of distribution channel choices of publishers. Int J Prod Econ 129(2):338–346

Huang W, Swaminathan JM (2009) Introduction of a second channel: implications for pricing and profits. Eur J Oper Res 194(1):258–279

Huang S, Yang C, Zhang X (2012) Pricing and production decisions in dual-channel supply chains with demand disruptions. Comput Ind Eng 62(1):70–83

Huang S, Yang C, Liu H (2013a) Pricing and production decisions in a dual-channel supply chain when production costs are disrupted. Eco Model 30:521–538

Huang M, Song M, Lee LH, Ching WK (2013b) Analysis for strategy of closed-loop supply chain with dual recycling channel. Int J Prod Econ 144:510–520

Kurata H, Yao DQ, Liu JJ (2007) Pricing policies under direct versus indirect channel competition and national versus store brand competition. Eur J Oper Res 180:262–281

Levary R, Mathieu RG (2000) Hybrid retail: integrating e-commerce and physical stores. Ind Manag 42(5):6–13

Li B, Zhu M, Jiang Y, Li Z (2016) Pricing policies of a competitive dual-channel green supply chain. J Clean Prod 112:2029–2042

Li Y, Xu L, Li D (2013) Examining relationships between the return policy, product quality, and pricing strategy in online direct selling. Int J Prod Econ 144:451–460

Lin YH, Tseng ML (2014) Assessing the competitive priorities within sustainable supply chain management under uncertainty. J Clean Prod 24(1):1–12

Liu N, Choi TM, Yuen CWM, Ng F (2012) Optimal pricing, modularity, and return policy under mass customization. IEEE Trans Syst Man Cybern Part A Syst Humans 42(3):604–614

Moriarty RT, Moran U (1990) Managing hybrid marketing systems. Harv Bus Rev 68(6):146–155

Murphy P, Poist R (2003) Green perspectives and practices: a ‘comparative logistics’ study. Supply Chain Manag Int J 8(2):122–131

Mukhopadhyay SK, Setoputro R (2004) Reverse logistics in e-business: optimal price and return policy. Int J Phys Distrib Logist Manag 34(1):70–89

Saha S, Sarmah SP, Moon IK (2016) Dual channel closed-loop supply chain coordination with a reward-driven remanufacturing policy. Int J Prod Res 54(5):1503–1517

Savaskan RC, Bhattacharya S, Van Wassenhove LN (2004) Closed-loop supply chain models with product remanufacturing. Manag Sci 50(2):239–252

SeyedEsfahani MM, Biazaran M, Gharakhani M (2011) A game theoretic approach to coordinate pricing and vertical co-op advertising in manufacturer-retailer supply chains. Eur J Oper Res 211:263–273

Sharma A, Mehrotra A (2007) Choosing an optimal channel mix in multichannel environments. Ind Market Manag 36(1):21–28

Srivastava SK (2007) Green supply-chain management: a state-of-the-art literature review. Int J Manag Rev 9:53–80

Swami S, Shah J (2013) Channel coordination in green supply chain management. J Oper Res Soc 64:336–351

Tsay A, Agrawal N (2004) Channel conflict and coordination in the E-commerce age. Prod Oper Manag 13(1):93–110

Tseng ML, Lin YH, Tan K, Chen RH, Chen YH (2014) Using TODIM to evaluate green supply chain practices under uncertainty. Appl Math Model 38(11):2983–2995

Wu Z, Pagell M (2011) Balancing priorities: decision-making in sustainable supply chain management. J Oper Manag 29(6):577–590

Xie J, Neyret A (2009) Co-op advertising and pricing models in manufacturer–retailer supply chains. Comput Ind Eng 56(4):1375–1385

Xing X, Yang Z, Tang F (2006) A comparison of time-varying online price and price dispersion between multichannel and dotcom DVD retailers. J Int Market 20(2):3–20

Xu A, Hu X, Gao S (2011) Game model between enterprises and consumers in green supply chain of home appliance industry. In: 2011 tenth international symposium on distributed computing and applications to business, engineering and science (DCABES). IEEE, pp 96–99

Yan R (2008) Pricing strategy for companies with mixed online and traditional retailing distribution markets. J Prod Brand Manag 17(1):48–56

Yi P, Huang M, Guo L, Shi T (2016) Dual recycling channel decision in retailer oriented closed-loop supply chain for construction machinery remanufacturing. J Clean Prod 137:1393–1405

Zhang Q, Tang W, Zhang J (2016) Green supply chain performance with cost learning and operational inefficiency effects. J Clean Prod 112:3267–3284

Zhao J, Hou X, Guo Y, Wei J (2017) Pricing policies for complementary products in a dual-channel supply chain. App Math Model 49:437–451

Zheng B, Yang C, Yang J, Zhang M (2017) Dual-channel closed loop supply chains: forward channel competition, power structures and coordination. Int J Prod Res 55(12):3510–3527

Zhu Q, Sarkis J, Geng Y (2005) Green supply chain management in China: pressures, practices and performance. Int J Oper Prod Manag 25(5):449–468

Acknowledgments

The authors are sincerely thankful to the anonymous reviewers for their helpful comments and suggestions on the earlier version of the manuscript.

Funding

The funding was provided by University Grants Commission (F.No. 16-9(June 2017)/2018(NET/CSIR)) and Council of Scientific and Industrial Research (Grant Number 25(0282)/18/EMR-II).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 1

From (6), we have

The Hessian matrix is given by

Now, \(|H^{IC}_1| = - 2 \alpha _0 < 0\),

Again, \(|H^{IC}| = 2 [\alpha _1 \gamma _0^2 + 2 \beta \gamma _0 \gamma _1 + \alpha _0 \gamma _1^2 - 4 \lambda ( \alpha _0 \alpha _1 - \beta ^2 )]\).

\(< 0, \hbox {if}\, \lambda > \frac{\alpha _1 \gamma _0^2 + 2 \beta \gamma _0 \gamma _1 + \alpha _0 \gamma _1^2}{4 (\alpha _0 \alpha _1 - \beta ^2) }.\)

Therefore, \(H^{IC}\) is negative definite if and only if \(\lambda > \hbox {max}\{\frac{\gamma _0^2}{4 \alpha _0},\frac{\alpha _1 \gamma _0^2 + 2 \beta \gamma _0 \gamma _1 + \alpha _0 \gamma _1^2}{4 (\alpha _0 \alpha _1 - \beta ^2)}\}.\)

If the Hessian matrix is negative definite then there exists a unique optimal solution which can be obtained by solving \(\frac{\partial \Pi ^{IC}}{\partial p_0} = 0,\frac{\partial \Pi ^{IC}}{\partial \theta } = 0 \,\hbox {and}\, \frac{\partial \Pi ^{IC}}{\partial p} = 0\) simultainously, as given in Proposition 1. \(\square\)

Proof of Proposition 2

The retailer’s reaction

From (5), we have the second order sufficient condition \(\frac{\partial ^2\Pi _r^{IM}}{\partial p^2} = - 2 \alpha _1 < 0\), which ensures that unique optimal solution exists. From the first order optimality condition \(\frac{\partial \Pi _r^{IM}}{\partial p} = 0\), we get the optimal reaction as \(p^{IM} = \frac{ \rho a + \beta p_0 + \gamma _1 \theta + \alpha _1 w}{2 \alpha _1}.\)

The manufacturer’s reaction

After getting the reaction of the retailer, the manufacturer maximizes his profit and determines the optimal decisions. The Hessian matrix associated with the profit function \(\Pi _m^{IM}\) is given by

Now, \(|H^{IM}_2| = \frac{8 (\alpha _0 \alpha _1 - \beta ^2)}{4}\). As \(\alpha _i > \beta _i\, (i = 0,1)\), \(|H^{IM}_2| > 0\).

Again, \(|H^{IM}| = \frac{(2 \alpha _1^2 \gamma _0^2 + 4 \alpha _1 \beta \gamma _0 \gamma _1 + (\beta ^2 + \alpha _0 \alpha _1) \gamma _1^2) - 8 \alpha _1 \lambda ( \alpha _0 \alpha _1 - \beta ^2)}{2 \alpha _1}\)

\(< 0, \hbox {if}\, \lambda > \frac{(2 \alpha _1^2 \gamma _0^2 + 4 \alpha _1 \beta \gamma _0 \gamma _1 + (\beta ^2 + \alpha _0 \alpha _1) \gamma _1^2) }{8 \alpha _1 ( \alpha _0 \alpha _1 - \beta ^2) }\).

Therefore, \(H^{IM}\) is negative definite if and only if \(\lambda > \frac{(2 \alpha _1^2 \gamma _0^2 + 4 \alpha _1 \beta \gamma _0 \gamma _1 + (\beta ^2 + \alpha _0 \alpha _1) \gamma _1^2) }{8 \alpha _1 ( \alpha _0 \alpha _1 - \beta ^2) }\). Under this condition, the unique optimal solution can be obtained from the first order optimality conditions as given in Proposition 2. \(\square\)

Proof of Proposition 3

The manufacturer’s reaction

The Hessian matrix associated with the profit function \(\Pi _m^{IR}\) is given by

It is clear that \(|H_1^{IR}| < 0\) and \(|H^{IR}| = 4 \alpha _0 \lambda - \gamma _0^2 > 0\), if \(\lambda > \frac{\gamma _0^2}{4 \alpha _0}\). Therefore, \(H^{IR}\) is negative definite if and only if \(\lambda > \frac{\gamma _0^2}{4 \alpha _0}\) and the unique optimal decisions of the manufacturer is then given by

The retailer’s reaction

After getting the reaction of the manufacturer, the retailer optimizes his profit and determines his/her optimal decision. We have \(\frac{\partial ^2\Pi _r^{IR}}{\partial p^2} = \frac{\big (\alpha _1 \gamma _0^2 + 2 \beta \gamma _0 \gamma _1 + \alpha _0 \gamma _1^2 \big ) - \lambda \big ( 4 \alpha _0 \alpha _1 - 3 \beta ^2 \big )}{ ( 4 \alpha _0 \lambda - \gamma _0^2)} < 0\),

if \(\lambda > \frac{\big (\alpha _1 \gamma _0^2 + 2 \beta \gamma _0 \gamma _1 + \alpha _0 \gamma _1^2 \big )}{(4 \alpha _0 \alpha _1 - 3 \beta ^2)}.\)

So, with this restriction on \(\lambda ,\) the unique optimal decision of the retailer is obtained as

where \(\Psi _3 = \lambda (4 \alpha _0 \alpha _1 - 3 \beta ^2) - (\alpha _1 \gamma _0^2 + 2 \beta \gamma _0 \gamma _1 + \alpha _0 \gamma _1^2 ).\)\(\square\)

Proof of Proposition 4

It is easy to see that \(\frac{\partial ^2\Pi _r^{ID}}{\partial p^2} = - \alpha _1 < 0\), \(\frac{\partial ^2\Pi _m^{ID}}{\partial p^2_0} = - 2 \alpha _0 < 0\) and \(\frac{\partial ^2\Pi _m^{ID}}{\partial \theta ^2} = - 2 \lambda < 0\). The associated Hessian matrix is given by

which is negative definite if \(\lambda > \frac{\gamma _0^2}{4 \alpha _0}\).

Then, from the first order condition of optimality, the optimal decisions \((p_0^{ID}, \theta ^{ID}, p^{ID}, w^{ID})\) of the decentralized policy can be obtained as given in Proposition 4. \(\square\)

Proof of Property 1

From (3), using the first order optimality condition of \(\Pi ^{C}\), we get p in terms of \(p_0\). Now \(\frac{\partial p^{C}}{\partial p_0} = \frac{\gamma _0 \gamma _1 + 4 \lambda \beta }{4 \alpha _1 \lambda - \gamma _1^2} > 0\).

Again from (3), using the first order optimality condition of \(\Pi ^{C}\), we get \(p_0\) in terms of p. Now \(\frac{\partial p_0^{C}}{\partial p} = \frac{\gamma _0 \gamma _1 + 4 \lambda \beta }{4 \alpha _0 \lambda - \gamma _0^2} > 0\).

Also, \(\frac{\partial p^{C}}{\partial \theta } = \frac{ \alpha _0 \gamma _1 + \beta \gamma _0}{2(\alpha _0 \alpha _1 - \beta ^2)} > 0\).

and \(\frac{\partial p_0^{C}}{\partial \theta } = \frac{ \alpha _1 \gamma _0 + \beta \gamma _1 }{2(\alpha _0 \alpha _1 - \beta ^2)} > 0\).

From (1), using the first order optimality condition of \(\Pi _m\), we get \(p_0\) and \(\theta\) in terms of p. Also \(\frac{\partial p_0^{IIR}}{\partial p} = \frac{\gamma _0 \gamma _1 + 6 \lambda \beta }{2 (4 \alpha _0 - \gamma _0^2)} > 0\) and \(\frac{\partial \theta ^{IIR}}{\partial p} = \frac{2 \alpha _0 \gamma _1 + 3 \gamma _0 \beta }{2 (4 \alpha _0 - \gamma _0^2)} > 0\). \(\square\)

Proof of Property 2

From (2), using the first order optimality condition of \(\Pi _r\), we get \(p^M = \frac{\rho a + \beta p_0 + \gamma _1 \theta + \alpha _1 w}{2 \alpha _1}\). Now \(\frac{\partial p^M}{\partial \theta } = \frac{\gamma _1}{2 \alpha _1} > 0\).

Putting this value of \(p^M\) in Eq. (1), and using the first order optimality condition we get,

\(w^M=\frac{c_m \alpha _0 \alpha _1 + a \beta - c_m \beta ^2 + \beta \gamma _0 \theta + \alpha _0 \gamma _1 \theta + a (\alpha _0 - \beta ) \rho }{2 \alpha _0 \alpha _1 - 2 \beta ^2}\) and \(p_0^M=\frac{c_m \alpha _0 \alpha _1 - c_m \beta ^2 + \alpha _1 \gamma _0 \theta + \beta \gamma _1 \theta + a (\alpha _1 - \alpha _1 \rho + \beta \rho )}{2 \alpha _0 \alpha _1 - 2 \beta ^2}\). Then \(\frac{\partial w^M}{\partial \theta } = \frac{ \alpha _0 \gamma _1 + \beta \gamma _0}{2(\alpha _0 \alpha _1 - \beta ^2)} > 0\). and \(\frac{\partial p_0^M}{\partial \theta } = \frac{ \alpha _1 \gamma _0 + \beta \gamma _1 }{2(\alpha _0 \alpha _1 - \beta ^2)} > 0\).

Again from (2), \(\frac{\partial \Pi _r^M}{\partial \theta } = \frac{\gamma _1 (\rho a + \beta p_0 + \gamma _1 \theta - \alpha _1 w )}{2 \alpha _1} > 0 \, \hbox {if} \, w < \frac{\rho a + \beta p_0 + \gamma _1 \theta }{\alpha _1}\). \(\square\)

Rights and permissions

About this article

Cite this article

Mondal, C., Giri, B.C. & Maiti, T. Pricing and greening strategies for a dual-channel closed-loop green supply chain. Flex Serv Manuf J 32, 724–761 (2020). https://doi.org/10.1007/s10696-019-09355-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10696-019-09355-6