Abstract

We show that IRS monitoring exerts a significantly negative effect on the cost of syndicated loans. A one standard deviation increase in the probability of an IRS audit decreases loan spreads by around nine basis points. We also find that this effect is stronger for borrowers with better lending relationships and credible access to public markets. These results indicate that IRS monitoring could increase the bargaining power of borrowers and restrain banks from extracting informational rents from their lending relationships. Thus, they provide a novel insight into how IRS monitoring could lower the cost of financing from the banking system.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Does monitoring from the US Internal Revenue Service (IRS) reduce the cost of bank loans? The IRS and its tax enforcement provide external monitoring to US corporations. External monitors help reduce information asymmetries in the financial and credit markets. For example, Dyck et al. (2010) show that external monitoring mechanisms such as credit rating agencies, the SEC, institutional ownership, and others collectively identify around 40% of corporate fraud cases in the US. Several studies also find that external monitors improve the corporate information environment and exert a chilling effect on the opportunistic behavior of managers to misuse (divert) corporate income for personal benefit (Bannier and Hirsch 2010; Boone and White 2015; Chen et al. 2015). The vital role of external monitoring in alleviating information asymmetries induces banks to charge borrowers a lower cost for loans (Booth 1992; Sufi 2007; Cen et al. 2016; Ni and Yin 2018). However, to the best of our knowledge, no study has investigated the effects of IRS monitoring on the cost of bank loans.

An examination of these effects is important for two reasons. The first is that debt is the most important source of new financing for corporations in the US. Around 75% of new corporate financing comes in the form of debt (Contessi et al. 2013). Moreover, most of this financing comes from bank loans, even for large public corporations (Bharath et al. 2008; Hasan et al. 2014). This fact highlights the significant role that bank financing plays in US corporations and justifies the growing research interest in its determinants. Therefore, from the perspectives of managers and public policy, exploring the relationship between IRS monitoring and the cost of bank loans for US corporations is useful.

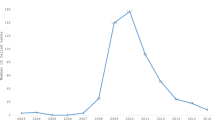

The second is an ongoing policy debate in the US about the future of the IRS. The US Senate passed the Inflation Reduction Act in August 2022, which contains provisions for a significant increase in IRS funding ($80bn in total, $45.6bn for enforcement). In previous years, the overall IRS budget declined from around $14 billion in 2010 to $12 billion in 2018 (ProPublica 2019). In addition, its tax enforcement budget also experienced a 23% decline over the same period. Funding has an impact on the ability of the agency to enforce taxes. Nessa et al. (2020) show that fewer IRS resources weaken tax enforcement by decreasing the audit rate of tax returns. Indeed, the Transactional Records Access Clearing House (2019) reports that corporations' IRS audit rates dropped significantly from 2010 to 2018. This situation has raised the interest of researchers to examine the efficacy of the IRS and the potential effects that its funding and monitoring capacity could have on the economy. We aim to add to this debate by exploring the effects of IRS monitoring on the cost of bank loans. We pose the question-should firms welcome or fear the possibility of increased IRS monitoring? Providing evidence that IRS monitoring decreases the cost of bank financing for US corporations could form an additional argument in favor of the agency’s activities.

The literature has shown that monitoring by a tax enforcement agency can reduce information asymmetry. The main concern of the tax authorities is the compliance of firms with the tax code. However, managers that engage in aggressive tax practices try to distort firms' information environment to conceal such activities (Leuz et al. 2003; Desai and Dharmapala 2006). Furthermore, this obfuscation of firms' information environment facilitates insiders' misuse of the firm's income. Hence, a by-product of monitoring by the tax agency is the improvement in firms' information environment (Desai et al. 2007; Hanlon et al. 2014; Bauer et al. 2021) and a decrease in the potential for managerial diversion (Desai and Dharmapala 2009; Mironov 2013). Therefore, our first hypothesis (H.1) is that IRS monitoring negatively affects the cost of bank loans by reducing information asymmetry.

We also investigate two potential mechanisms through which this reduction could prompt banks to decrease loan prices. The first is that IRS monitoring could enable banks to incur savings in screening and monitoring costs. Banks could consequently pass these savings on to borrowers through lower loan prices. The second is that IRS monitoring could enhance the bargaining power of borrowers vis-à-vis banks. Factors that decrease information asymmetries induce the markets for external financing to be more contestable (Mazumdar and Sengupta 2005; Schenone 2010; Kim et al. 2011; Florou and Kosi 2015; Cahn et al. 2021; Saidi and Žaldokas 2021). Therefore, IRS monitoring could ease borrowers' access to alternative sources of external financing (e.g., other banks and the public markets). Some studies have shown that IRS monitoring decreases the costs of bonds (Guedhami and Pittman 2008) and equity (El Ghoul et al. 2011) but increases bank lending (Gallemore and Jacob 2020). Consequently, borrowers' bargaining power could increase because banks, when negotiating loan prices, may consider the alternative options for external financing that borrowers have (Sharpe 1990; Rajan 1992).

To identify which of these two mechanisms is the dominant driver of the potentially negative association between IRS monitoring and the cost of bank loans, we rely on theories about lending relationships. When banks have repeated interactions with the same borrower, they accumulate valuable private information on the former (Diamond 1984; Rajan 1992). Therefore, strong lending relationships could reduce banks' screening and monitoring costs which induce them to decrease loan prices (Boot and Thakor 1994; Petersen and Rajan 1994; Boot 2000; Bharath et al. 2011). Hence, if the dominant channel is the decrease in screening and monitoring costs, we predict this association will be less evident for borrowers with strong lending relationships with banks (hypothesis H.2A).

On the other hand, the private information on borrowers that banks collect through strong lending relationships enables the latter to have an informational advantage compared to other providers of external financing. Banks could exploit this informational advantage when pricing the loans that they are making to relationship borrowers (Sharpe 1990; Rajan 1992; Degryse and Ongena 2005; Ioannidou and Ongena 2010; Schenone 2010; Mattes et al. 2013; Hasan et al. 2019). By decreasing information asymmetries, IRS monitoring could erode relationship banks' informational advantage over other providers of external financing, such as private lenders and the public markets. Hence, the borrowers' bargaining power vis-à-vis banks with which they have strong lending relationships could increase and facilitate a decrease in loan prices. Thus, if the dominant mechanism is the increase in the borrowers' bargaining power, we predict this association will be more evident for borrowers that have strong lending relationships with banks (hypothesis H.2B).

For our examination, we source data from Thomson One Banker and construct a sample of 7,054 syndicated loan facilities to 1,335 US firms from 1993 to 2017.Footnote 1 Using the syndicated loan market provides some advantages in investigating the determinants of bank loans. We have detailed data on bank loans, such as their price, size, maturity, and information on borrowers and lenders. Furthermore, according to Sufi (2007), the syndicated loan market provides a promising ground for investigating information asymmetry because firms from the whole credit spectrum (e.g., private, public, rated, and unrated) use this method of external financing.

We measure the cost of bank loans as the all-in-spread that is the interest payment in basis points above LIBOR plus the annual fee (in basis points) for a loan facility of a firm (Hasan et al. 2014). We use the yearly rate of face-to-face corporate audits by the IRS to capture its monitoring. These audit rates use IRS records about the corporate tax returns received and audits completed by size class (eight classes based on total assets) each year. Thus, the all-in-spread varies with the size class and the calendar year. We source the data on IRS audit rates from the Transactional Records Access Clearing House (TRAC) of Syracuse University. This measure is widely used in the literature (Guedhami and Pittman 2008; El Ghoul et al. 2011; Hoopes et al. 2012; Hanlon et al. 2014; Bauer et al. 2021) to gauge the level of monitoring of US firms by the IRS.

After controlling for several characteristics of both borrowing firms and loans, the main finding is that IRS monitoring exerts a negative and significant effect on the cost of syndicated loans. The baseline estimates show that a one standard deviation increase in the IRS audit rate results in an 8.84 basis points reduction in the loan spreads. Considering the average size ($522 million) and the average maturity (3.4 years) of loans in our sample, this reduction in loan spreads translates into $1.49 million in interest savings on average. This finding supports H.1 that more stringent IRS monitoring reduces loan spreads for US firms.

We use three lending relationship variables to test H.2A and H2.B. Using models with interaction terms, we show that the negative effect of the IRS audit rate on the cost of bank loans is more pronounced for firms with a stronger lending relationship with the lead bank that provides the loan. This finding is consistent with H2.B and provides empirical support to the argument that the dominant mechanism driving the negative association between IRS monitoring and the cost of bank loans is the increase in borrowers' bargaining power vis-à-vis banks. Thus, IRS monitoring restricts banks' ability to extract informational rents from their relationship borrowers.

In further tests, we show that the negative interaction between IRS monitoring and the lending relationship measures is more evident for firms with credible access to the public markets for external financing (i.e., for listed firms, firms that have an investment-grade S&P credit rating, and firms belonging to the S&P 500 index). This finding is consistent with the idea that external monitoring is more useful for the public markets than for private lenders because of the former’s weak monitoring incentives and the substantial need for high-quality publicly available hard information (Diamond 1984; Boot and Thakor 2009; Bharath and Hertzel 2019; Liberti and Petersen 2019). This result is also consistent with the studies that show that IRS monitoring facilitates less costly access to the equity and public debt markets (Guedhami and Pittman 2008; El Ghoul et al. 2011), which enhances the bargaining power argument.

We run numerous additional tests and robustness exercises to support the baseline results. One challenge is that the primary IRS monitoring variable of size class relates by construction to the size of the borrowing firms. For this reason, in the baseline models, we control for size by using the natural log of the total assets of the borrowing firms. Furthermore, we add size class fixed effects to the baseline specifications to capture any systematic relationship between the costs of bank loans and borrowing firms in each IRS-defined size class. In further robustness checks, we also perform estimations where we add the squared and cubed values of the size to account for potential non-linearities. Also, we control for alternative measures of the size of the borrowing firms, such as the natural logs of sales and equity, and run models with time trends for each IRS-defined size class.

The results are robust when we use alternative IRS monitoring proxies, as in Guedhami and Pittman (2008), that do not hinge on the IRS-defined size class of the borrowing firm. For example, we use IRS staffing levels, penalties, and prosecutions as monitoring proxies. In another test, we introduce a geographic source of variation in IRS monitoring to our models. We find that the negative association between IRS monitoring and the cost of bank loans becomes more pronounced for firms located in states with a larger number of IRS offices.

Another challenge is potential endogeneity through a feedback effect between the cost of bank loans and IRS monitoring. For example, the cost of bank financing could affect the availability of funds firms can use to engage in tax-related lobbying (see, e.g., Hill et al. 2013; Kim and Zhang 2016). For this reason, we also perform two-stage least squares instrumental (2SLS-IV) variable estimations. To this end, we use two instruments. For the first instrument, we follow the study of Hoopes et al. (2012) and use the lagged number of corporate tax returns filed in each IRS-defined size class. Further, we construct a second instrument by assigning to each firm the average lagged audit rate of all the size classes, excluding the audit rate of the specific size class to which a firm belongs.Footnote 2 The results from the 2SLS-IV estimations provide further evidence in support of the baseline findings.

Further, the negative relationship between IRS monitoring and the cost of bank loans remains robust to additional tests. These are the alternative ways of clustering of the standard errors (at the size class and year levels and the borrowing firm and bank levels), such as dropping from the sample observations the largest size class that the IRS audits (i.e., firms with a size larger than $250 million that are the majority of the sample) while controlling for syndicate size and the index of the state-level tax climate for businesses.

We also test H.1, H.2A, and H.2.B for the non-price terms of the loan contracts. We find that more stringent IRS monitoring decreases the probability that a loan will contain covenants (H.1). Furthermore, we show that the negative association of IRS monitoring with the probability that loans will contain covenants becomes more prominent for firms with stronger lending relationships (H2.B).

This study contributes to the literature in several ways. It belongs to the literature that examines the role of external monitors on the cost of bank financing. Several studies explore the effect of external monitoring mechanisms such as credit rating agencies, the SEC, shareholder litigation rights, financial analyst coverage, the media, and principal customers on the cost of bank loans (e.g., Booth 1992; Sufi 2007; Cen et al. 2016; Bushman et al. 2017; Coyne and Stice 2018; Ni and Yin 2018). We add to this literature by finding that the IRS provides valuable external monitoring that reduces bank financing costs for US firms in the syndicated loan market.

This study also complements those of Guedhami and Pittman (2008) and El Ghoul et al. (2011), who examine the effect of IRS monitoring on the cost of bonds and equity, respectively. We do so in the challenging setting of syndicated lending and provide a novel insight into how IRS monitoring reduces the cost of corporate financing through the banking system. We show that this negative association becomes more pronounced for firms with stronger bank lending relationships. This finding is also more evident for firms with credible access to the equity and public debt markets. Our results show that banks acknowledge the increased bargaining power of borrowers that IRS monitoring facilitates, especially for borrowers with access to the public markets. This increased bargaining power renders banks less able to extract informational rents from their lending relationships.

Thus, we also contribute to the studies that use the setting of lending relationships to examine the borrowers' bargaining power as a mechanism that affects the cost of bank loans (e.g., Schenone 2010; Saidi and Žaldokas 2021; Cahn et al. 2021). These studies show that factors that reduce information asymmetries, such as increased corporate disclosure after an IPO (Schenone 2010), increased innovation disclosure (Saidi and Žaldokas 2021), and improvement in rating information (Cahn et al. 2021), erode the informational advantage of relationship banks' vis-à-vis other providers of external financing. Hence, borrowers face decreased loan prices from their relationship banks. Our findings are consistent with the results of these studies from the standpoint of IRS monitoring.

We also add to the literature that examines the effect of tax-related issues on the cost of bank loans (e.g., Lim 2011; Hasan et al. 2014; Isin 2018). For example, Hasan et al. (2014) and Isin (2018) find a positive relationship between tax avoidance and bank loan spreads. We add to this literature by finding that IRS monitoring decreases the cost of bank loans. By controlling for several tax avoidance measures, we also show that the negative effect of IRS monitoring is incremental to the effect of tax avoidance. Hence, our findings indicate that IRS monitoring plays a broader monitoring and informational role in the loan market, consistent with the studies showing that tax enforcement benefits the corporate information environment and disciplines managers (Desai et al. 2007; Hanlon et al. 2014).

One could view the findings of our study in conjunction with that of Gallemore and Jacob (2020). They find that IRS monitoring induces banks to increase the loan supply to small and midsized enterprises (SMEs). Together, these studies demonstrate that the IRS prompts positive spillovers to the US economy through the banking sector beyond the traditional role of a tax enforcement agency. Using confidential IRS data, Nessa et al. (2020) estimate a conservative 2:1 return on enforcement for the audits of large US corporations. The return on enforcement measure represents the ratio of the expected increase in tax revenue to the cost of IRS audits and other related expenses. Hence, enhancing the monitoring resources of the IRS through the Inflation Reduction Act of 2022 could potentially benefit both government finances and the development of US corporations from a bank credit standpoint. Thus, our findings could also contribute to the public policy debate about the future of the IRS.

The rest of the study is organized as follows: Section 2 presents some theoretical considerations and develops the hypotheses. Section 3 presents the data, research design, and descriptive statistics. Sections 4 and 5 present the main findings and a summary of robustness tests, respectively, while Section 6 concludes.

2 Hypotheses development

2.1 The association of IRS monitoring with the cost of bank loans

IRS monitoring could facilitate a decrease in information asymmetries. This decrease could stem from an improved corporate information environment under higher levels of tax enforcement. Desai and Dharmapala (2006) posit that aggressive tax practices induce a complex and opaque information environment that is aimed at reducing the possibility of detection from the tax agency. The tools to achieve such an obfuscation comprise earnings manipulations, related party transactions, and the hoarding of information (Wilson 2009; Chen et al. 2010; Kim et al. 2011). Monitoring from the tax agency could restrict these practices (Hoopes et al. 2012). Thus, a beneficial spillover effect of tax enforcement is that it improves the quality of the information available to outsiders (Desai et al. 2007; Hanlon et al. 2014). Also, tax enforcement could lessen information asymmetry by reducing managers' incentives to divert firm resources for their benefit. Desai and Dharmapala (2009) maintain that stricter tax enforcement prevents firms' insiders from misusing corporate income. Managers could exploit the obfuscation of the firms' information environment that stems from aggressive tax practices to conceal rent-seeking from outsiders (Leuz et al. 2003). Jia and Gao (2021) provide recent evidence that US firms favor this source of managerial diversion. Therefore, by improving firms' information environment, tax enforcement also reduces the potential for managerial diversion (El Ghoul et al. 2011; Mironov 2013). Overall, IRS monitoring could decrease information asymmetry by improving the quality of corporate information and restricting the potential for managerial diversion.

A decrease in information asymmetry could facilitate two potential channels through which IRS monitoring could decrease the cost of bank loans. The first is that the improved corporate information environment may enable banks to dedicate fewer resources to their screening and monitoring when evaluating borrowers. The second potential channel is an increase in borrowers' bargaining power vis-à-vis banks. When setting loan prices, banks consider the degree to which borrowers could access alternative sources of external financing (e.g., other banks or the public markets) at competitive prices (Sharpe 1990; Rajan 1992). An improvement in borrowers' information environment could ease such access and prompt these alternates to become more contestable (Mazumdar and Sengupta 2005; Schenone 2010; Kim et al. 2011; Florou and Kosi 2015; Cahn et al. 2021; Saidi and Žaldokas 2021).

Several studies have shown that the public and private markets for external financing value IRS monitoring. Regarding the public markets, Guedhami and Pittman (2008) show that IRS monitoring decreases the cost of bonds, while El Ghoul et al. (2011) find a negative association between IRS monitoring and the cost of equity. Bauer et al. (2021) show a negative relationship between IRS monitoring and the crash risk of stocks. Concerning the private debt market, Gallemore and Jacob (2020) find that banks increase their lending activity when IRS monitoring is more stringent.Footnote 3 Together, these studies indicate that IRS monitoring could facilitate easier access to the public and private markets of external financing.Footnote 4 Improved access to alternative sources could increase the bargaining power of borrowing firms that may push banks to reduce their costs to maintain their customer base.

Based on the above discussion, we conjecture that more stringent IRS monitoring could lead to lower bank loan spreads for firms. Our first and main hypothesis (H.1), therefore, is the following:

-

H.1 IRS monitoring has a negative association with the cost of bank loans.

2.2 The conditioning effect of lending relationships on the association of IRS monitoring with the cost of bank loans

To identify the dominant channel through which IRS monitoring could reduce the cost of bank loans, we examine if lending relationships could influence the association between IRS monitoring and loan spreads. Using lending relationships as a potential mediating factor to investigate which of the two potential channels prevails has a solid theoretical basis.

The literature has identified two distinct but coexisting features of lending relationships that relate information asymmetries with screening and monitoring costs and borrowers' bargaining power (Alexandre et al. 2014). The first feature associates the decrease in information asymmetry that lending relationships prompt with a reduction in screening and monitoring costs. Repeated lending interactions with the same firms give banks access to valuable private information about borrowers that otherwise would be costly to obtain (Diamond 1984; Rajan 1992). As lending relationships become intense, banks incur savings in screening and monitoring borrowers. Several studies have shown that banks pass these savings on to borrowers through decreased loan prices (Boot and Thakor 1994; Petersen and Rajan 1994; Boot 2000; Bharath et al. 2011). The above arguments indicate that IRS monitoring may be less valuable as a mechanism that could assist banks' screening and monitoring when lending relationships are more potent. Hence, if this reduction is the dominant channel through which IRS monitoring decreases bank loans' cost, we predict that this effect will be less evident for borrowers with stronger lending relationships.

Hence, we formulate hypothesis H.2A as follows:

-

H.2A The negative association of IRS monitoring with the cost of bank loans will be weaker for loans given to firms with stronger lending relationships.

Another strand of the literature posits that strong lending relationships enable banks to extract rents from relationship borrowers (Sharpe 1990; Rajan 1992; Degryse and Ongena 2005; Ioannidou and Ongena 2010; Schenone 2010; Hasan et al. 2019). Through repeated lending transactions with borrowers, informed banks gain access to proprietary information that is unavailable to other uninformed providers of external financing. This access, in turn, increases the informational advantage of these banks vis-à-vis other providers (Schenone 2010; Dass and Massa 2011). As a result, lending relationships could enable the extraction of informational rents in the form of higher loan spreads. This is the so-called lock-in or hold-up effect that relationship borrowers could face due to the higher information asymmetry between them and outside providers of external financing in comparison with relationship banks (Sharpe 1990; Rajan 1992).

Based on this discussion, the informational advantage of relationship banks indicates decreased bargaining power for relationship borrowers. When negotiating loan prices, relationship banks account for the degree to which their informational advantage limits the ability of relationship borrowers to access alternative sources of external financing at competitive prices. Several studies have shown that the factors that improve borrowers' information environment have led to a decrease in the informational advantage of relationship banks vis-à-vis other providers of external financing (e.g., outside banks and the public markets), thus increasing borrowers' bargaining power. This increased power could translate into lower loan spreads for relationship borrowers.

Schenone (2010) shows that positive information shocks about corporations decrease relationship banks' informational advantage and restrict their ability to "hold-up" borrowers. In particular, Schenone (2010) finds that in the period after a relationship borrowers' IPO, increased corporate disclosure levelled the informational playing field between relationship banks and outside lenders. Consequently, relationship borrowers' bargaining power increases, and they enjoy lower loan spreads from their relationship banks. Saidi and Žaldokas (2021) show that after the passage of legislation that increases public disclosure about corporate innovation (the American Inventor's Protection Act of 1999—AIPA), relationship banks were less able to "hold-up" their relationship borrowers. They find that relationship banks significantly decrease the loan spreads for their relationship borrowers in the period after AIPA. They also show that AIPA has facilitated easier access for relationship borrowers to outside banks and the public markets. Cahn et al. (2021) provide analogous evidence from the French market. They find that a refinement in the rating certifier's information reduces the ability of relationship banks to extract informational rents from affected relationship borrowers and improves access to alternative providers of external financing.Footnote 5

Similar to these studies, we posit that IRS monitoring could diminish relationship banks' informational advantage vis-à-vis alternative providers of external financing by decreasing information asymmetries. This decrease in relationship banks' informational advantage could make credit and public financing markets more contestable. This is plausible because research has shown that these providers appreciate the beneficial effects of IRS monitoring on the corporate information environment (Guedhami and Pittman 2008; El Ghoul et al. 2011; Bauer et al. 2021; Gallemore and Jacob 2020). Consequently, IRS monitoring could decrease banks' ability to extract informational rents and increase relationship borrowers' bargaining power. Therefore, if an increase in borrowers' bargaining power is the dominant channel through which IRS monitoring reduces bank loan costs, we predict that this effect will be more evident for borrowers with stronger lending relationships.

Thus, we formulate the following competing hypothesis H.2B:

-

H.2B The negative association of IRS monitoring with the cost of bank loans will be pronounced for loans granted to firms with stronger lending relationships.

3 Data and Methods

3.1 Sample

We source data on syndicated loans from the Thomson One Banker database. This database has provided comprehensive coverage of syndicated loans in the US since 1985 and has been used in several other studies (e.g., Isin 2018). It has comprehensive information on the characteristics of each loan facility (borrowing loan spread, amount, maturity, and covenants) and identifies the firm that receives each loan. This identification facilitates the matching of the firms from Thomson One Banker to Compustat to obtain firms' accounting and financial information. A firm could obtain multiple loan facilities in the same year, and we treat each loan facility as an individual observation.Footnote 6 We also exclude loans to financial services firms (SIC codes 6000–6999) because these firms are subject to heavy regulation, and their borrowing terms may differ significantly from the rest of the firms in the sample. This matching process yields 15,858 loan facilities for 2,448 unique borrowing firms for the period from 1985 to 2017. At the firm-year level, we combine the available IRS tax enforcement data that starts in 1992 and the rest of the firm-level control variables to have a sample that comprises up to 7,054 firm-year observations for 1,335 unique firms for the period from 1993–2017.Footnote 7 Table 1 provides the definitions and calculations of the variables we use in the analysis.

3.2 Measures of IRS monitoring

The primary IRS monitoring measure we use relies on data that we obtain from the Transactional Records Access Clearing House (TRAC). TRAC is a non-profit research institute associated with Syracuse University that collects data directly from the IRS. We source TRAC data on yearly IRS face-to-face corporate audit rates to use them as the main measure of IRS monitoring. These audit rates use information from the IRS about the corporate tax returns received and audits completed for eight size classes in terms of total assets each year.Footnote 8 Thus, the IRS audit rates vary by size class and the calendar year. In particular, the variable Audit rate stands for the number of corporate audits completed in year t for a given IRS size class, divided by the number of the corporate tax returns received in the previous year (t-1) for the same size class. Therefore, the IRS audit rate captures the probability of a firm belonging to a specific size class that experienced a face-to-face IRS audit in a given year. Our identification strategy incorporates lagged IRS audit rates as the actual IRS audit rates become available to the public with a delay. The reason is that there is a lag between the time that a firm reports its tax returns to the IRS and the time that the IRS completes its investigations (Graham and Tucker 2006). Furthermore, using lagged values of the main variable of interest attenuates any concerns about endogeneity. We focus on the Audit rate measure of IRS monitoring because we are interested in capturing bank managers' view that a firm will experience an IRS audit in a given year.

To reinforce the reliability of our tax enforcement measure, the IRS Oversight annual reports submitted to the US Congress regularly refer to TRAC's statistics on corporate audit rates. Furthermore, IRS audit rates apply only to the US. This exclusivity eliminates issues stemming from institutional differences that plague cross-country data on tax enforcement (Hanlon et al. 2014). The credibility of the IRS audit rates as a measure of tax enforcement is evident in its wide use by the government and other academic studies (e.g., Guedhami and Pittman 2008; El Ghoul et al. 2011; Hoopes et al. 2012; Hanlon et al. 2014; Bauer et al. 2021).

3.3 Measures of lending relationships

We represent the strength of relationship lending between lenders and borrowing firms with two continuous measures of relationship intensity as in Bharath et al. (2011). We define the first measure as the volume of loans made by the same lead bank to the same borrowing firm during the last five years before the initiation of a new loan over the total volume of loans made to this borrower over that period (RIA).Footnote 9 To this end, we use the following formula to calculate the relationship intensity for bank j lending to borrower i:

This measure ranges from zero to one. Values closer to one show that the borrowing firm has a stronger lending relationship with a particular lead bank. This measure is widely used by other studies (e.g., Bharath et al. 2011; Yildirim 2020; Delis et al. 2021). The second continuous measure we use is the ratio of the number of loans made by the same lead bank to a specific borrowing firm during the last five years over the total number of loans made to the same borrowing firm during the same period (RIN). Therefore, we measure the number-based relationship intensity for bank j lending to borrower i using the following specification:

Next, we use one dichotomous variable as the third proxy of relationship intensity. This variable equals one if the lead bank made more than one loan to the same firm in the last five years, while it equals zero otherwise (REL DUM). These two measures (RIN and REL DUM) are also widely used in the literature.

3.4 Regression specifications

We test H.1 with the following equation:

where \({Log(loan spread)}_{t}\) is the natural logarithm of the all-in-spread drawn (AISD) that is the loan interest payment in basis points above LIBOR plus the annual fee for a loan facility that a firm obtains in year t.Footnote 10\({Audit rate}_{t-1}\) is the probability that a firm in a given size class will experience a face-to-face IRS audit in year t-1. We control for the following firm characteristics: size, leverage, profitability, tangibility, liquidity, risk, and the cash effective tax rate, all of which follow other empirical studies (e.g., Graham et al. 2008; Hasan et al. 2014). We also control for the listing status of each borrowing firm by using a binary variable that equals one if a firm is listed (Listed) in the stock market and zero otherwise. We also use a dummy variable to control for whether a borrowing firm is a member of the S&P 500 index. We further use a control variable for the credit rating of each borrowing firm. The dummy variable captures whether a firm has an investment-grade credit rating (INV GRADE) from Standard and Poor's (S&P). INV GRADE equals one if a borrowing firm has an equal to or above "BBB-" long-term credit rating from S&P, while it equals zero if the rating is below "BBB-" or if the firm is unrated. We use lagged information if the firm correlates from one year before the loan initiation to lessen concerns about endogeneity. We source the data for the firm-level variables from Compustat and Thomson One Banker. Details on the control variables are available in Table 1.

Two of these firm-level controls are essential to this study. The first is firm size, total, the natural log of total assets. This is because the IRS audit rates depend on the size class; hence, we must control for the size of the borrowing firms and to not confound the effect of IRS monitoring on the cost of bank loans with the effect of size. Furthermore, we also add the size class fixed effects to account for any potential systematic relationship between the costs of bank loans and borrowing firms belonging to a specific IRS-defined size class. The second important control in the regression model is the tax avoidance of the borrowing firms. We aim to investigate the effect of IRS monitoring on the cost of bank loans that stems from its role in reducing information asymmetry. Hence, not controlling for tax avoidance could confound this role with its role in reducing tax avoidance. The baseline model uses the cash-effective tax rate (CASH ETR) to measure tax avoidance. We measure CASH ETR as the ratio between cash taxes paid scaled by pre-tax book income minus special items. This measure gauges the impact of aggressive deferral and permanent tax strategies. As in Cen et al. (2017), we winsorize the cash-effective tax rate at zero and one, and we also multiply it by minus one (-1) for higher values to reflect higher tax avoidance.

Next, we add loan-level attributes to control for size and maturity as well as dummies for the type and purpose. Further, we add a dummy variable that equals one if a loan comprises covenants and zero otherwise. We also use a set of fixed effects that comprise the fixed effects for the year, industry (2-digit Standard Industrial Classification), lead bank, and the size class.

To test H.2A and H2.B, we use the following equation:

The coefficient of interest in Eq. (4) comes from the interaction between IRS monitoring (\({Audit rate}_{t-1}\)) and the three measures of lending relationships (RIA, RIN, REL DUM) that we explained in subSection 3.3.

3.5 Descriptive statistics and correlations

Table 2 presents the lagged IRS audit rates by size class and time obtained from the TRAC database. We observe considerable variation across time and the different size classes in the same calendar year. For example, the lagged IRS audit rate for firms that fell within the largest size class in 2005 was 38.1%, while in 2017, it plummeted to a record low of 17.8%. Table 2 also shows the number of firm-year observations in each of the IRS size classes. The majority of our sample comprises large firms with assets beyond $250 million, as in other similar studies (Guedhami and Pittman 2008; Hoopes et al. 2012).

Table 3 presents the summary statistics of the main explanatory variables of the empirical specifications. Loan characteristics show the average loan size and spread to be $522 million and 188 basis points, respectively. Furthermore, the mean loan maturity is around 3.4 years. These descriptive statistics align with Graham et al. (2008) and Hasan et al. (2014). Also, the mean values of the relationship intensity measure (0.470, 0.468, and 0.541) are consistent with those other studies. Table 4 presents the Pearson correlation coefficients among the main variables in our analysis. This preliminary evidence indicates that Audit rate t-1 and Loan spread are negatively associated that supports H.1. Altogether, we observe that Audit rate t-1, and the rest of the explanatory variables have a low correlation. This correlation attenuates any concerns about collinearity that could influence our estimations.

4 Empirical findings

4.1 Tests for Hypothesis H.1: The association between IRS monitoring and the cost of bank loans

4.1.1 Baseline and 2SLS-IV estimations

Table 5 presents the baseline estimations regarding H.1. Our models show a good fit with a 54% adjusted R2 on average. In model 1 of Table 5, we control only for the effect of Audit ratet-1 on the cost of bank loans; while in model 2 of Table 5, we also account for loan characteristics; and in model 3, we add firm-level controls as well. The coefficients for Audit rate t-1 are significant at the 1% level and negative (-0.021, -0.022, -0.020) in models 1, 2, and 3 of Table 5, respectively.

Overall, these results support H.1 that firms' bank loan spreads decrease when IRS monitoring is more stringent. Based on the average of the three coefficients of the lagged IRS audit rate in the first three models of Table 5 (-0.021), our findings, economically, indicate that one standard deviation increase in the lagged IRS audit rate (8.651) leads to an 8.84 basis points decrease in bank loan spreads (8.834 = \({e}^{0.021}*8.651)\). Another way to assess the relevance of these findings is reflected by the interest savings based on the average loan size in our sample of $522 million, and the average time to maturity of around 3.4 years. As per our estimates, a one standard deviation increase in Audit ratet-1 means around $1.49 million in interest savings (1.49 = 522*0.00084*3.4). Additionally, we show that larger firms with more tangible assets, higher profitability, lower risk, lower tax avoidance, less leverage, higher rating, and listed on the S&P enjoy lower borrowing costs, which is in line with similar studies (Graham et al. 2008; Bharath et al. 2011; Hasan et al. 2014; Huang et al. 2020). Furthermore, large loans with a shorter maturity are associated with lower loan spreads. These findings are consistent with Chava and Roberts (2008) who show that banks exposed to the risk of a longer maturity charge higher loan spreads as compensation.

The findings from the baseline models in Table 5 show that the lagged IRS audit rates and the cost of bank loans are negatively related. These results support H.1. This support is due to the ability of stringent IRS monitoring to decrease information asymmetry.

The baseline models 1–3 in Table 5 assume that the IRS audit rate variable is exogenous to the cost of bank loans measure. We try to ease endogeneity concerns in our baseline models by using lagged IRS audit rates. To further address the potential endogeneity between the IRS audit rate and the cost of bank loans, we proceed with a two-stage least squares instrumental variable (2SLS-IV) estimation. In the first stage, we obtain predicted values of the IRS Audit rate t-1 using an OLS regression that comprises two instruments and all the control variables we employ in our baseline analysis. In the second stage, we replace the IRS audit rate variable with its predicted values that we obtain from the first stage.

For the first instrument, we follow the extant literature (Hoopes et al. 2012) and use the natural logarithm of the number of corporate tax returns in each asset size class filed in the previous year (Ln tax returns of size class t-2). By previous year we mean with respect to the Audit rate t-1. Hence, this instrument has a two-year lag from the dependent variable (i.e., the cost of bank loans). The IRS audit rate represents the number of actual corporate returns audited by the IRS in each firm size class in a given year divided by the number of corporate tax returns filed in each firm asset size class in the previous year. Consequently, IRS audit rates depend on fluctuations of corporate tax returns filed across time in the same firm size group. The numerator component (i.e., the number of corporate tax returns audited by the IRS) represents the IRS audit effort in each asset size class. In the case of a feedback effect, firms could, at least in theory, attempt to influence the IRS audit effort in their asset size class. Hence, the numerator component of the IRS audit measure, which represents the IRS audit effort, is more susceptible to endogeneity concerns. The denominator component (i.e., the number of corporate tax returns filed in each asset size class in the previous year), which we use as an instrument following Hoopes et al. (2012), is less susceptible to reverse causality because it is not likely that a firm will try to influence its IRS audit probability rate by not filing a tax return. Furthermore, since this instrument is not a measure of the IRS audit effort, it is unlikely that it would affect the cost of bank loans in a way other than its influence on the IRS audit rate for each asset size class (i.e., the exclusion restriction). We expect a negative and significant correlation of this instrument with the IRS audit rate in the first stage of the IV estimation.

We rely on the intuition that the IRS faces budget constraints each year for the second instrument. Such constraints mean that the IRS has limited audit resources to allocate to each asset size class each year. The IRS, in different periods, shifts its resources to specific target groups for auditing purposes (Scholz and Wood 1998; Bagchi 2016), such as, in our case, specific firm size classes. This action constraints the resources that the IRS could dedicate to monitoring and auditing firms in other asset-size groups. The shift of resources of the IRS to specific target groups for auditing purposes is also compatible with anecdotal evidence from the IRS operations. For example, the Transactional Records Access Clearinghouse (TRAC) states in 2008, '…By ordering its revenue agents to concentrate on the smaller corporations that normally take a lot less time to audit, the agency (i.e., the IRS) was able to push up the overall number of corporate audits…'. Based on the above discussion, we construct a second instrument by assigning to each borrowing firm in a given asset size class the lagged average IRS audit rate of the rest of the asset size classes (Average IRS audit rate of other size classes t-1). We expect this instrument to have a negative and significant relationship with the IRS audit rate of each asset size class. Furthermore, this instrument should, in principle, not directly affect the cost of bank loans for firms in a given asset size class since it does not represent the IRS audit rate for this specific group of firms (i.e., the exclusion restriction).

In model 4 of Table 5, we use the 2SLS-IV. The first-stage results show that the first instrument (Ln tax returns of size class t-2) has a significant association with the IRS audit rate at the 1% level and has the expected (i.e., negative) coefficient sign (see the lower part of model 4 in Table 5). Also, the first-stage findings show that the second instrument (Average IRS audit rate of other size classes t-1) displays a negative and significant relationship with the IRS audit rate at the 1% level (see the lower part of model 5 in Table 5). In model 6 of Table 5, we run 2SLS estimations using both instruments. We find that our two instruments continue to have a negative and significant association with the IRS audit rate at the 1% level. These results show that both instruments fulfil the inclusion criterion.

Furthermore, in model 6 of Table 5, the validity of the instruments is supported by the under-identification LM test (UIT), the weak identification Wald F-Test (WIT) using critical values from Stock and Yogo (2005), and the Hansen over-identification test of Hansen (OIT). The second stage results (models 4–6 of Table 5) show that the predicted values of the IRS audit rate (Pred Audit rate t-1) exert a negative and significant effect on the cost of bank loans at the 1% level. These findings further support H.1.

4.2 Tests for hypotheses H.2A and H.2B: The conditioning effect of lending relationships

4.2.1 Main tests

We use three alternative proxies of lending relationships to test H.2A and H.2B: RIA, RIN, and REL DUM. Table 6 depicts the results.

In models 1, 3, and 5, we first run the baseline specification with all three variables. They have a negative but non-significant coefficient in these models. This finding is consistent with other studies (e.g., Hagendorff et al. 2021). A potential explanation is that the potential savings in screening and monitoring could be offset by the extraction of informational rents (Hasan et al. 2019). This is rational since both hold-up effects and savings in screening and monitoring costs coexist in lending relationships (Alexandre et al. 2014).

Models 2, 4, and 6 in Table 6 comprise the interactions between the three variables (RIA, RIN, and REL DUM) and Audit rate t-1. In models 2 and 4, we find that the interactions between Audit rate t-1 and RIA and RIN have negative and significant coefficients at the 1% level. In the same models, the individual effect of Audit rate t-1 on loan spreads is also negative and significant at the 1% level. We find similar results when using REL DUM in model 6 of Table 6.

These findings show that the negative association between IRS monitoring and loan spreads becomes pronounced for firms with strong lending relationships. These findings are consistent with H.2B.

The positive and significant individual effect of the lending relationship variables (RIA, RIN, and REL DUM) denotes that when IRS monitoring is weak, banks are more able to extract informational rents from their relationships with borrowers. However, as IRS monitoring becomes stringent, relationship banks' informational advantage vis-à-vis other providers of external financing diminishes. Consequently, banks are less able to hold-up their relationship borrowers as the negative interaction between the lending relationships variables and the IRS monitoring proxy indicates.

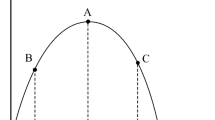

To visually demonstrate the findings that support hypothesis H.2B, we offer two interaction plots of RIA and RIN with Audit rate t-1. These interaction plots in Figs. 1 and 2 illustrate that the negative association between IRS monitoring and loan spreads becomes more apparent when lending relationships intensify.

The empirical evidence supporting H.2B is consistent with studies that identify the factors that decrease information asymmetries and improve firms’ information environment and therefore increase borrowers' bargaining power and decrease banks' ability to extract informational rents from their lending relationships (Schenone 2010; Cahn et al. 2021; Saidi and Žaldokas 2021). In our context, the ability of IRS monitoring to decrease information asymmetry could weaken the informational advantage of incumbent banks and render it more credible that relationship borrowers could access alternative providers of external financing (Guedhami and Pittman 2008; El Ghoul et al. 2011; Bauer et al. 2021; Gallemore and Jacob 2020). Hence, banks may perceive that their relationship borrowers have increased bargaining power in the presence of more stringent IRS monitoring.

4.2.2 The role of credible access to the public markets for external financing

Next, we investigate the type of borrowers for which the findings for H.2B are more evident. The public markets for external financing rely more strongly than the private lending market on external monitoring from entities such as the IRS. Investors in the public market have weaker monitoring incentives than banks because they are usually more widely dispersed (Diamond 1984; Boot and Thakor 2009; Bharath and Hertzel 2019). Furthermore, the public markets depend more strongly than banks on high-quality publicly available hard information (Liberti and Petersen 2019). Banks could supplement this information with inside (private) information on the borrowing firm that public investors do not have access to (Fama 1985; Dass and Massa 2011). Thus, the public markets are likely to more highly value the ability of the IRS to decrease information asymmetry than private lenders. Therefore, IRS monitoring might be more important for decreasing the informational advantage, and hence the capacity to extract rents from the lending relationships of incumbent banks vis-à-vis the public markets than other private lenders.

We use three variables to represent a firm's ability to access the public markets for external financing. The first variable indicates if a firm is listed in the stock market (Listed). The second is the variable that captures if a firm is a member of the prestigious S&P 500 index (S&P500). The third variable denotes if a firm has an investment-grade credit rating (INV GRADE). Then, we use models that comprise triple interaction terms between these three proxies and Audit rate t-1 and RIA, RIN, and REL DUM.

Table 7 depicts the findings. In Panel A of Table 7, we run models that estimate the effect of the triple interaction term on the cost of bank loans. Panel A shows that the triple interaction is negative and significant across all models (1–3), at least at the 10% level. In Panel B of Table 7, we repeat this exercise using the S&P500 dichotomous variable as one of the regressors in the triple interaction. We observe similar findings in models 1–3 where we use the three alternative measures of lending relationships. The triple interactions are negative and significant, at least at the 5% level. Lastly, we run similar estimations using INV GRADE. Model 3 in Panel C shows that the triple interactions are negative and significant at the 1% level like our earlier findings.

These findings support our theoretical prediction that under more stringent IRS monitoring, the cost of bank loans decreases more for relationship borrowers that have credible access to the public markets of external financing. By decreasing information asymmetry, IRS monitoring reduces incumbent banks’ informational advantage and facilitates less costly access to the public markets (Allen and Gottesman 2006; Santos and Winton 2008; Hale and Santos 2009; Saunders and Steffen 2011). Therefore, the borrowers' bargaining power vis-à-vis banks could increase. As a consequence, the ability of incumbent banks to extract informational rents from lending relationships diminishes.

4.2.3 Split-sample analysis based on the strength of lending relationships

Next, we perform a split sample analysis based on the median of RIA and RIN. This exercise provides further insights into the conditioning effect of lending relationships on the association between IRS monitoring and the cost of bank loans. The results are in Table 8. We show that the interactions between RIA and RIN and Audit rate t-1 are negative and significant for both subsamples (see models 1–2 of Panel A and 3–4 of panel B of Table 8). These findings support H.2B.

The different results for the two subsamples reflect that the individual effect of Audit rate t-1 on loan spreads is negative and significant only for low lending relationships (compare models 1 and 2 with models 3 and 4 in Panel A of Table 8). We interpret this result in the following way: When lending relationships are weaker, the ability of the IRS monitoring to decrease information asymmetry could be of some value to the banks' lending. Weaker lending relationships mean that banks have not yet collected a high level of private information on borrowers. Therefore, IRS monitoring could be helpful for the screening and monitoring of borrowers at this stage. For example, the quality of borrowers' information environment, such as the financial reporting transparency that IRS monitoring enhances, could be more useful when banks hold less proprietary information and are less familiar with borrowers (Bharath et al. 2008; Berger et al. 2017).

However, as lending relationships strengthen, the negative association between Audit rate t-1 and loan spreads becomes more evident through its negative and significant interaction with RIA and RIN. This finding indicates that at a higher level of lending relationships, IRS monitoring increases borrowers' bargaining power and restrains banks' ability to extract rents from the private information they accumulate on borrowers. Indeed, for the high lending relationship subsample (see models 1 and 2 of Panel B of Table 8), the negative association of IRS monitoring with loan spreads occurs only via the negative and significant interaction with the lending relationship variables (i.e., H.2B). The insignificant coefficient for Audit rate t-1 in the high lending relationship subsample further indicates that in this context, the low information asymmetry stemming from past interactions renders IRS monitoring less beneficial for the relationship banks' screening and monitoring operations.

Another difference between the lower and higher lending relationship subsamples is that the coefficients for RIA and RIN are different; the one for the first is positive and significant but the one for the second is not significant. A potential explanation is the confluence of the distinct hold-up and the pass-through savings effects of screening and monitoring that coexist in lending relationships (Alexandre et al. 2014). After gaining a new borrower, banks tend to increase loan prices that is a behavior consistent with the hold-up effect (Ioannidou and Ongena 2010). When lending relationships intensify to a high level, the information asymmetry between borrowers and banks reaches a minimum. Consequently, substantial savings in screening and monitoring could offset the hold-up effect.

We continue the split sample analysis with models that comprise the triple interaction terms between Audit rate t-1; RIA and RIN; and Listed, S&P500, and INV GRADE. The results from these tests are available in Table 9.

For the high lending relationships subsample, we find negative and significant triple interaction terms between Audit rate t-1, RIA and RIN, and the Listed and S&P500 dummies (see models 3 and 4 in Panels A and B of Table 9). The interaction term between the lending relationship measures and IRS monitoring in the same models loses significance. These findings show that credible access to external public financing facilitates the negative association between IRS monitoring and the cost of bank loans for firms that display strong lending relationships with their banks (i.e., H.2B).

The results for the low lending relationship subsample show that the negative interactions between Audit rate t-1 and RIA and RIN remain negative and significant. However, the triple interaction terms with Listed, S&P500, and INV GRADE are not significantly different from zero. These findings show that for the low lending relationship subsample, the negative interaction between IRS monitoring and lending relationships (i.e., H.2B) is apparent for both bank-dependent firms and firms with credible access to external public financing.

Firms in the high lending relationship subsample rely mainly on their relationship banks to access bank credit. The informational advantage of these relationship banks vis-à-vis other private lenders is strong. Hence, the ability of IRS monitoring to decrease information asymmetry might not be able to adequately erode incumbent banks' informational advantage to make losing relationship borrowers to outside banks more plausible.

5 Summary of further analyses and additional robustness tests

We perform further analyses and robustness tests that we tabulate and discuss in more detail in the Internet Appendix.

We investigate the association between IRS monitoring and some non-price loan contract terms. The results are in line with the main analysis. We provide evidence that IRS monitoring negatively affects the probability that a loan will contain covenants. We also show that the negative association between IRS monitoring and covenant presence becomes more pronounced for firms with more intense lending relationships. These findings support hypotheses H.1 and H.2B, respectively.

The probability of an IRS audit, which is our main IRS monitoring measure, hinges on the size class, as defined by the IRS, to which it belongs. We carry out several additional tests to ensure that our findings are not driven by firm size. We run models that comprise the squared and cubed values of a firm’s size. Furthermore, we perform estimations that use the natural log of sales and equity as alternative measures of size. To account for potential time trends in each size class (e.g., larger firms may have become less risky over time), we also run estimations with time trends for each size class.

To further mitigate concerns about our main IRS monitoring proxy, we use alternative IRS monitoring proxies, as in Guedhami and Pittman (2008). For example, we use IRS staffing levels as a monitoring proxy. Some research has acknowledged that staffing is crucial in strengthening IRS tax enforcement (Weisman 2004; Rapperort 2017). We also use data on IRS referrals, prosecutions, and penalties to capture further aspects of IRS monitoring. In another test, we introduce a geographic source of variation in IRS monitoring to our models. Kubick et al. (2017) show that IRS monitoring is more stringent when a firm is closer to an IRS office (territory manager office. We find that the negative association between IRS monitoring and loan spreads is more evident for borrowers in states with more IRS offices.

In the main analysis, we control for tax avoidance using the cash-effective tax rate (Cash ETR). In the Internet Appendix, we use several other tax avoidance measures as control variables. We continue to find a negative effect of IRS monitoring on loan pricing that is incremental to the effect of tax avoidance and consistent with the monitoring and informational role of the IRS in financial markets.

In another exercise, we reestimate the baseline models using alternative ways to cluster the standard errors. We estimate models in which we cluster the standard errors at the size class and year levels because Audit rate t-1 displays variation in both cases. We also depict the results from specifications where we cluster the standard by borrowing firms and banks because the lending relationship variables are based on firm-bank pairs.

Finally, we perform several other tests. These comprise the estimation of models that exclude the loans granted to firms belonging to the largest IRS-defined size class: models that use the contemporaneous IRS audit rate, models that control for the syndicate size, and models that control for the state-level index that reflects the time-variant, business tax climate. In all these tests, we continue to find a negative and significant association between IRS monitoring and the cost of bank loans.

6 Conclusion

This study sheds some light on the relationship between IRS monitoring and the cost of bank loans in the US syndicated loan market. We hypothesize that the IRS has a valuable role in external monitoring that alleviates information asymmetry that can lower loan prices. Our findings provide strong empirical support for this conjecture. We show that IRS monitoring has a negative and significant effect on the cost of bank loans. Furthermore, we show that this association is economically significant. This finding holds in a series of tests, such as instrumental variable estimations that mitigate the concerns for endogeneity and models that use alternative IRS monitoring proxies.

We also investigate potential mechanisms through which IRS monitoring reduces the cost of bank loans. We show that the negative association of IRS monitoring with the cost of bank loans is more evident for loans granted to firms with stronger lending relationships, especially when these borrowers have credible access to the public markets of extremal financing. These results are consistent with the argument that the ability of IRS monitoring to decrease information asymmetry erodes the informational advantage that banks acquire through lending relationships and renders the markets for external financing more contestable. Therefore, IRS monitoring increases borrowers' bargaining power and restricts banks' ability to extract rents from their lending relationships. The finding that these effects are more apparent for borrowers with credible access to the public markets underlines the vital importance of external monitors for investors in these markets.

This study is useful from a theoretical standpoint because it provides a novel insight into how IRS monitoring could drive the reduction in the cost of corporate financing through the banking system. From a public policy perspective, this study is timely and highlights the usefulness of the IRS to the US economy. Except for its primary function as a tax collection agency, the IRS exerts a positive spillover to the US economy in the form of lower bank loan costs. This is an important finding because bank loans are the most crucial source of external financing for US corporations. Therefore, this study informs from this perspective the policy debate about the future of the IRS.

Data Availability

In this paper, we employ a merged dataset from three different sources: Thomson One Banker (Loan pricing and characteristics), Compustat (Firm characteristics), TRAC (information on IRS audit rates and the other measures of tax enforcement). Data from Thomson One Banker and Compustat are proprietary and require a subscription. Regarding TRAC, although this is a not‐for‐profit institute, it still requires a subscription to access the data. The subscription cost is low, and interested parties can check subscription rates on TRAC website. Once access to the above databases is granted, interested parties could easily follow our analysis as we provide detailed information regarding the empirical analysis in the paper.

Notes

The start in 1993 reflects the availability of data on IRS tax enforcement.

We discuss in detail the potential of these two instruments to satisfy the inclusion and exclusion restrictions in subSection 4.1.1 of the manuscript.

Although, Gallemore and Jacob (2020) focus on SMEs lending, where information asymmetry is more severe in comparison with larger firms, it is plausible that private lenders could value IRS monitoring for lending to larger firms. For example, Hanlon et al. (2014) show that IRS monitoring improves the quality of financial reporting from comparatively larger Compustat firms, while Mazumdar and Sengupta (2005) show that the quality of financial reporting enhances the access to private debt for such firms.

We do recognize that IRS monitoring might be more useful for public providers of external financing in comparison with private lenders. Banks possess superior access to private information on borrowers and stronger monitoring ability (Bharath et al. 2008; Shevlin et al. 2020). We discuss this distinction theoretically and provide the results of relevant empirical tests in subSection 4.2.2 of the manuscript.

These studies (Schenone 2010; Cahn et al. 2021; Saidi and Zaldokas 2021) show that positive information shocks decrease relationship banks' information advantage and, thus, increase borrowers' bargaining power. However, other studies examine how a decrease in the bargaining power of borrowers enables relationship banks to extract information rents. For example, Chen et al. (2020) show that stock market illiquidity enables banks to charge higher loan prices to their relationship borrowers. The authors posit that this finding is consistent with the decreased bargaining power channel. All in all, several studies use the setting of lending relationships to provide evidence of the borrowers' bargaining power channel on the cost of bank loans.

We follow other studies and perform our analysis at the loan facility level and not at the loan package level (e.g., Hasan et al. 2014; Hasan et al. 2017). Each loan package could contain more than one loan facility. Two loan facilities, even when they are part of the same loan package, could have different sizes, maturities, and types. Therefore, ignoring the differences between loan facilities could introduce estimation bias.

Our analysis starts from 1993 as IRS tax enforcement data became available in 1992, and we use the values of lagged audit rates in our regressions.

There are eight size classes based on the level of firms’ total assets. These are the following: more than $250 million, $100-$250 million, $50-$100 million, $10-$50 million, $5-$10 million, $1-$5 million, $0.25-$1 million and $0-$0.25 million. Note that our sample uses observations from the seven biggest categories. This is because we could not find any firm in the smallest size class of $0-$0.25 million that had obtained a syndicated loan in the period under study.

Following Chakraborty et al. (2018), we consider that a lending relationship is established between the lead bank of the syndicate and a borrowing firm. Lead banks are the key lending institutions in syndicated loans as they determine the price of the loan and the other non-price terms (e.g., maturity and size). Lead banks are also responsible for the screening and monitoring of the borrowing firm (Ivashina 2009; Prilmeier 2017; Gustafson et al. 2020). To identify the lead bank of a syndicated loan, we follow the method used by Sufi (2007).

We use the natural log of the loan spread as the dependent variable that follows the other studies on the determinants of the cost of bank loans (see, e.g., Lin et al. 2018).

References

Alexandre H, Bouaiss K, Refait-Alexandre C (2014) Banking relationships and syndicated loans during the 2008 financial crisis. J Financ Serv Res 46(1):99–113

Allen L, Gottesman A (2006) The informational efficiency of the equity market as compared to the syndicated bank loan market. J Financ Serv Res 30(1):5–42

Bagchi S (2016) The political economy of tax enforcement: a look at the Internal Revenue Service from 1978 to 2010. J Publ Policy 36(3):335–380

Bannier CE, Hirsch CW (2010) The economic function of credit rating agencies–What does the watchlist tell us? J Bank Finance 34(12):3037–3049

Bauer AM, Fang X, Pittman J (2021) The importance of IRS enforcement to stock price crash risk: The role of CEO power and incentives. The Accounting Review 96(4):81–109

Berger PG, Minnis M, Sutherland A (2017) Commercial lending concentration and bank expertise: Evidence from borrower financial statements. J Account Econ 64(2–3):253–277

Bharath ST, Hertzel M (2019) External governance and debt structure. Rev Financ Stud 32(9):3335–3365

Bharath ST, Sunder J, Sunder SV (2008) Accounting quality and debt contracting. Account Rev 83(1):1–28

Bharath S, Dahiya S, Saunders A, Srinivasan A (2011) Lending relationships and loan contract terms. Rev Financ Stud 24(4):1141–1203

Boone AL, White JT (2015) The effect of institutional ownership on firm transparency and information production. J Financ Econ 117(3):508–533

Boot A (2000) Relationship Banking: What Do We Know? J Financ Intermed 9:7–25

Boot WA, Thakor AV (1994) Moral hazard and secured lending in an infinitely repeated credit market game. Int Econ Rev 899–920

Boot A, Thakor AV (2010) The accelerating integration of banks and markets and its implications for regulation. The Oxford handbook of banking 58–90

Booth JR (1992) Contract costs, bank loans, and the cross-monitoring hypothesis. J Financ Econ 31(1):25–41

Bushman RM, Williams CD, Wittenberg-Moerman R (2017) The informational role of the media in private lending. J Account Res 55(1):115–152

Cahn C, Girotti M, Salvadè F (2021) Credit ratings and the hold-up problem in the loan market. Working paper

Cen L, Dasgupta S, Elkamhi R, Pungaliya RS (2016) Reputation and loan contract terms: The role of principal customers. Rev Financ 20(2):501–533

Cen L, Maydew EL, Zhang L, Zuo L (2017) Customer–supplier relationships and corporate tax avoidance. J Financ Econ 123(2):377–394

Chakraborty I, Goldstein I, MacKinlay A (2018) Housing price booms and crowding-out effects in bank lending. Rev Financ Stud 31(7):2806–2853

Chava S, Roberts R (2008) How does financing impact investment? The role of debt covenants. J Financ 63:2085–2121

Chen S, Chen X, Cheng Q, Shevlin T (2010) Are family firms more tax aggressive than non-family firms? J Financ Econ 95(1):41–61

Chen T, Harford J, Lin C (2015) Do analysts matter for governance? Evidence from natural experiments. J Financ Econ 115(2):383–410

Chen J, Gong D, Muckley C (2020) Stock market illiquidity, bargaining power and the cost of borrowing. J Empir Financ 58:181–206

Contessi S, Li L, Russ K (2013) Bank vs. bond financing over the business cycle. Economic Synopses 31:1–3

Coyne J, Stice D (2018) Do banks care about analysts’ forecasts when designing loan contracts? J Bus Financ Acc 45(5–6):625–650

Dass N, Massa M (2011) The impact of a strong bank-firm relationship on the borrowing firm. Rev Financ Stud 24(4):1204–1260

Degryse H, Ongena S (2005) Distance, lending relationships, and competition. J Financ 60(1):231–266

Delis M, Kim S, Politsidis P, Wu E (2021) Regulators vs. markets: Are lending terms influenced by different perceptions of bank risk? J Bank Financ 122:105990

Desai MA, Dharmapala D (2006) Corporate tax avoidance and high-powered incentives. J Financ Econ 79(1):145–179

Desai A, Dharmapala D (2009) Corporate tax avoidance and firm value. Rev Econ Stat 91:537–546

Desai A, Dyck A, Zingales L (2007) Theft and taxes. J Financ Econ 84:591–623

Diamond DW (1984) Financial intermediation and delegated monitoring. Rev Econ Stud 51(3):393–414

Dyck A, Morse A, Zingales L (2010) Who blows the whistle on corporate fraud? J Financ 65:2213–2253

El Ghoul S, Guedhami O, Pittman J (2011) The role of IRS monitoring in equity pricing in public firms. Contemp Account Res 28:643–674

Fama EF (1985) What’s different about banks? J Monet Econ 15(1):29–39

Florou A, Kosi U (2015) Does mandatory IFRS adoption facilitate debt financing? Rev Acc Stud 20(4):1407–1456

Gallemore J, Jacob M (2020) Corporate tax enforcement externalities and the banking sector. J Account Res 58(5):1117–1159

Graham J, Tucker A (2006) Tax shelters and corporate debt policy. J Financ Econ 81(3):563–594

Graham R, Li S, Qiu J (2008) Corporate misreporting and bank loan contracting. J Financ Econ 89:44–61

Guedhami O, Pittman J (2008) The importance of IRS monitoring to debt pricing in private firms. J Financ Econ 90:38–58

Gustafson M, Ivanov I, Meisenzahl R (2020) Bank monitoring: Evidence from syndicated loans. Available at SSRN 2831455

Hagendorff J, Lim S, Nguyen D (2021) Lender trust and bank loan contracts. Available at SSRN 3183155

Hale G, Santos J (2009) Do banks price their informational monopoly? J Financ Econ 93(2):185–206

Hanlon M, Hoopes L, Shroff N (2014) The effect of tax authority monitoring and enforcement on financial reporting quality. J Am Tax Assoc 36:137–170

Hasan I, Hoi S, Wu Q, Zhang H (2014) Beauty is in the eye of the beholder: The effect of corporate tax avoidance on the cost of bank loans. J Financ Econ 113:109–130

Hasan I, Hoi CK, Wu Q, Zhang H (2017) Social capital and debt contracting: Evidence from bank loans and public bonds. J Financ Quant Anal 52(3):1017–1047

Hasan I, Ramirez G, Zhang G (2019) Lock-In Effects in Relationship Lending: Evidence from DIP Loans. J Money Credit Bank 51(4):1021–1043

Hill MD, Kubick TR, Lockhart GB, Wan H (2013) The effectiveness and valuation of political tax minimization. J Bank Finance 37(8):2836–2849

Hoopes L, Mescall D, Pittman JA (2012) Do IRS audits deter corporate tax avoidance? Account Rev 87:1603–1639

Huang Y, Hasan I, Huang CY, Lin CY (2021) Political uncertainty and bank loan contracts: does government quality matter? J Financial Serv Res 60:157–185

Ioannidou V, Ongena S (2010) “Time for a change”: loan conditions and bank behavior when firms switch banks. J Financ 65(5):1847–1877

Isin AA (2018) Tax avoidance and cost of debt: The case for loan-specific risk mitigation and public debt financing. J Corp Finan 49:344–378

Ivashina V (2009) Asymmetric information effects on loan spreads. J Financ Econ 92(2):300–319

Jia Y, Gao X (2021) Is managerial rent extraction associated with tax aggressiveness? Evidence from informed insider trading. Rev Quant Financ Acc 56(2):423–452

Kim C, Zhang L (2016) Corporate political connections and tax aggressiveness. Contemp Account Res 33(1):78–114

Kim JB, Li Y, Zhang L (2011) Corporate tax avoidance and stock price crash risk: Firm-level analysis. J Financ Econ 100(3):639–662

Kubick TR, Lockhart GB, Mills LF, Robinson JR (2017) IRS and corporate taxpayer effects of geographic proximity. J Account Econ 63(2):428–453

Leuz C, Nanda D, Wysocki PD (2003) Earnings management and investor protection: an international comparison. J Financ Econ 69(3):505–527

Liberti JM, Petersen MA (2019) Information: Hard and soft. Rev Corp Financ Stud 8(1):1–41

Lim Y (2011) Tax avoidance, cost of debt and shareholder activism: Evidence from Korea. J Bank Finance 35(2):456–470

Lin CY, Tsai WC, Hasan I (2018) Private benefits of control and bank loan contracts. J Corp Finan 49:324–343

Mattes J, Steffen S, Wahrenburg M (2013) Do information rents in loan spreads persist over the business cycles? J Financ Serv Res 43(2):175–195

Mazumdar SC, Sengupta P (2005) Disclosure and the loan spread on private debt. Financ Anal J 61(3):83–95

Mironov M (2013) Taxes, theft, and firm performance. J Financ 68(4):1441–1472

Nessa M, Schwab CM, Stomberg B, Towery EM (2020) How do IRS resources affect the corporate audit process? Account Rev 95(2):311–338

Ni X, Yin S (2018) Shareholder litigation rights and the cost of debt: Evidence from derivative lawsuits. J Corp Finan 48:169–186

Petersen M, Rajan R (1994) The benefits of lending relationships: Evidence from small business data. J Financ 49(1):3–37

Prilmeier R (2017) Why do loans contain covenants? Evidence from lending relationships. J Financ Econ 123(3):558–579

ProPublica (2019) Gutting the IRS: Who wins when crucial agency is defunded. Available at https://www.propublica.org/series/gutting-the-irs#. Accessed 15 Jan 2021

Rajan R (1992) Insiders and outsiders: The choice between informed and arm’s-length debt. J Financ 47(4):1367–1400

Rapperort A (2017) Under Trump, an Already Depleted I.R.S. Could Face Deep Cuts. The New York Times. Available at: http://www.latimes.com/politics/washington/la-na-essential-washington-updates-trump-budget-to-slash-irs-funding-1489665882-htmlstory.html. Accessed 20 Jan 2021

Saidi F, Žaldokas A (2021) How does firms’ innovation disclosure affect their banking relationships? Manage Sci 67(2):742–768

Santos J, Winton A (2008) Bank loans, bonds, and information monopolies across the business cycle. J Financ 63(3):1315–1359

Saunders A, Steffen S (2011) The costs of being private: Evidence from the loan market. Rev Financ Stud 24(12):4091–4122

Schenone C (2010) Lending relationships and information rents: Do banks exploit their information advantages? Rev Financ Stud 23(3):1149–1199

Scholz JT, Wood BD (1998) Controlling the IRS: principals, principles, and public administration. Am J Pol Sci 141–162