Abstract

Using a unique proprietary dataset from a large European commercial bank containing granular loan-level information on credit lines to mid-corporate firms, we investigate the bank’s decisions to allow firms to retain existing credit at a time of acute financial instability. Our results highlight the importance of bank-firm relationships during crisis times. Existing borrowers who actively used their credit lines were not rationed, unless they posed an increased credit risk. We do not find evidence of evergreening practices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Access to bank credit is an important source of external finance for mid-corporate firms, as they often have limited access to capital markets. Yet, during crisis periods, empirical evidence points to decreased loan supply (Kashyap and Stein 2000; Jimenez et al. 2014), which might disproportionately affect private, more informationally opaque firms (DeYoung et al. 2015). This asymmetry can be, at least partially, offset in existing lending relationships whereby banks can exploit private information about borrowers.Footnote 1 Indeed, relationship lending is not only considered an appropriate tool for lending to more opaque, smaller firms, but evidence suggests it could allow banks to continue lending to firms during crisis periods (Gobbi and Sette 2014; Presbitero et al. 2014; Bolton et al. 2016; Beck et al. 2018). While maintaining bank-firm relationships during periods of financial turbulence might be beneficial to both the bank and the borrowers, it can also generate inefficiencies as it may affect the allocation of credit and result in evergreening, that is the practice of extending credit to troubled borrowers (Caballero et al. 2008; Giannetti, and Simonov 2013). Emerging evidence indicates that this behaviour, also known as forbearance lending or zombie lending, became widespread in Europe following the financial crisis (Acharya et al. 2019).

In this paper, we investigate the drivers of a bank’s decision to renew credit availability to existing borrowers when market liquidity conditions worsen. We investigate two key propositions: (i) during crisis periods, the bank values close ties with the firms and aims to preserve existing bank-borrower relationships without compromising on lending standards; and (ii) during crisis periods, the bank supports otherwise insolvent existing borrowers, thus potentially leading to evergreening.

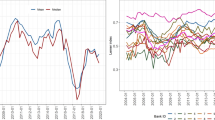

We address these questions by studying how the bank managed the liquidity shock that occurred in late 2011 and how its subsequent lending decisions affected credit availability for existing borrowers. For EU banks, the late summer of 2011 was a particularly difficult period; the intensification of the Eurozone crisis led international investors to reallocate their portfolios away from Euro area banks.Footnote 2 Interbank spreads increased dramatically (see Fig. 1). In late August 2011, the 3-month interbank spread on euro markets (Euribor – Eurepo) increased by 33.5 basis points from 0.403% to 0.738%. This increase was sudden and represents a largely unexpected exogenous shock to EU banks, whose cost of funding increased, thereby placing additional stress on already constrained balance sheets.Footnote 3

Interbank Spreads on Euro Markets (Q1:2011-Q4:2012). The figure shows the series of spreads between the Euribor (the average interest rate for unsecured Euro term deposits, the reference rate in the short-term unsecured interbank market) for four different maturities and the corresponding Eurepo (the average interest rate for secured money market transactions in the euro area). The four maturities shown are: one month (1 m); two months (2 m); three months (3 m); and six months (6 m). Data are from the European Money Markets Institute (EMMI) (https://www.emmi-benchmarks.eu/)

We employ a unique proprietary cross-sectional dataset from a large European commercial bank containing granular loan-level information on commercial credit lines to mid-corporate firms (defined as firms with an annual turnover between €150 mn and €1bn). Mid-corporates are an important market segment for many EU economies; nonetheless, in almost all EU countries these firms sustained greater losses during the crisis, compared to either large or small firms.Footnote 4 On the one hand, large corporates are on average less dependent on domestic bank lending and managed to partly compensate for the low growth in the Eurozone by boosting their exports. On the other hand, smaller firms are traditionally less susceptible to macroeconomic fluctuations, relying more on informal finance from family and friends (Lee and Persson 2016). The mid-corporate segment is thus a perfect setting for our analysis, as it is highly dependent on bank credit and but also less transparent than large corporates, therefore increasing a bank’s incentives to invest in the production proprietary information. Our data allow us to capture this private information and are enhanced by detailed borrower specific information, including applicants’ characteristics used by the bank when assessing the credit application.

The prevailing form of commercial lending is via credit lines, which are arrangements through which customers may borrow and repay at will, subject to a maximum amount granted. Firms pay a fee in exchange for the right to draw on funds when needed.Footnote 5 Credit lines can be of two typologies: fully committed (i.e., irrevocable) or uncommitted (i.e., revocable).Footnote 6 The existence of financial covenants and the periodic re-evaluation of borrowers’ riskiness limit the liquidity insurance provided by credit lines and expose borrowers to the risk of credit rationing. Importantly, banks’ revocation of credit lines tends to happen at times of tighter market liquidity, when firms need the credit lines most, as banks increase their monitoring efforts to preserve their financial health (Acharya et al. 2014).

Our goal is to analyse the variation in a bank’s lending decisions to a portfolio of existing borrowers following a shock to bank funding. Our analysis comprises several ingredients that help us mitigate identification issues. First, we exploit the shock to bank funding liquidity which took place in August 2011, and we consider credit decisions in the period September 2011 to August 2012. The assumption is that the shock in bank funding does not affect firms’ performance independently of the bank during our time-period. To put it another way, we assume that supply-side effects dominate demand-side effects in the initial phase of the financial crisis.Footnote 7 Second, we rely on a very detailed loan-level dataset that includes information on the entire population of credit applications and renewals for our specific bank during the sample period. The richness of the database allows us to capture the bank’s private information and to consider firm-specific credit rating and the probability of default, among other characteristics, improving our understanding of banks’ credit decisions. Third, one of the key challenges in the literature investigating bank lending is to disentangle the supply of credit from its demand. During crisis periods, both demand and supply of credit might decrease as the same shocks that affect banks can also adversely affect borrowers. Demand may fall because firms revise their investment decisions as the cost of financing increases. Supply may contract as banks face funding liquidity shocks and increase both their lending standards and monitoring efforts to preserve their financial health, as already indicated. The literature has used new loan applications as a tool for the identification of credit availability and has established that, during a crisis, the number of new applications for all types of loans decreases (Puri et al. 2011) and that, for a given number of applications, the percentage of loan approvals decreases (Jimenez et al. 2012). To avoid our results being driven by the decrease both in the number of applications and approvals, we focus on the mandatory annual renewal of credit lines of existing borrowers. This should also help us minimise the asymmetric information problems that are put forward to explain the increasing wedge between loan supply and demand during crisis times and allow us to identify the drivers of the lender’s decision to extend, reduce or revoke credit lines. Finally, by exploiting the mandatory internal annual credit monitoring process, we avoid self-selection problems resulting only in firms with specific characteristics applying for and receiving funding during a crisis.

Our results indicate that credit availability did not dry up for mid-corporate private firms during the initial phase of Eurozone crisis, suggesting that credit rationing for existing borrowers was limited. These results are in line with the evidence provided by Campello et al. (2012) and Ippolito et al. (2016), thus indicating that bank-firm relationships are particularly important during crisis times as banks might tighten the supply of new loans rather than rationing existing facilities.

We document that credit lines’ usage is a significant determinant of credit rationing, with borrowers that use more credit being less likely to be rationed. These results hold even in terms of the actual amount rationed, measured as the change in the amount of credit granted to a borrower following the renewal of the credit line. We provide evidence that firms using their credit lines more experience a smaller reduction in the amount of credit granted. Firms using their credit lines provide banks with valued private information. This effect, however, is mitigated by rating decreases: the bank is more likely to cut credit to a borrower that is fully using its credit line when the latter experience a rating decrease. We explain this result as follows. When banks face an increased capital charge due to a riskier credit line and an increased probability of the loan becoming non-performing, their incentives to continue investing in the relationship with an existing borrower decrease. We conclude that, when lending to mid-corporates, banks value existing relationships as they have invested in the collection of private information. They are therefore less likely to ration existing borrowers who actively use their credit line unless they pose an increased credit risk. In this respect, our results do not provide support to the hypothesis of forbearance lending that may encourage the evergreening of existing bad loans during periods of instability.

We contribute to the literature along several dimensions. First, we contribute to the literature on the role of relationship banking during times of economic and financial crises. This literature uses credit registry data to identify access to credit in a single country and finds that banks are more likely to continue to lend to long-term clients.Footnote 8 Our main contribution to this growing literature lies in the possibility to exploit a very detailed proprietary dataset which allows us to use direct measures of a bank’s credit decisions. Our results suggest that not only banks are reluctant to reduce credit availability for existing borrowers, but also that the usage of credit lines allows banks to gather more information and monitor firms’ liquidity choices. We build on the work of Ippolito et al. (2016) and provide evidence of bank risk management following a shock in bank funding liquidity.

We also contribute to the literature on credit rationing. Recent literature has decomposed credit rationing in three forms that can exist in the presence of contract heterogeneity (Beyhaghi et al. 2020): (i) self-imposed rationing, which typically considers discouraged borrowers, as they did not apply for fear of being rejected; (ii) market-tightness rationing, which relates to borrowers who applied and were only partially granted. Under this type of rationing, lenders can limit the size of loan per applicant and only partially grant the amount of loan applied for; and (iii) low-type rationing, relating to borrowers who applied and were rejected. In our empirical analysis, we focus on the case of market-tightness rationing. Understanding the different ways credit rationing manifests itself is particularly important considering the widespread use of bank credit as the main source of external financing for almost all types of firms in the Eurozone. We argue that this type of credit rationing also has direct implications for the speed of economic recovery through the credit channel. The extant empirical literature on this type of credit rationing is limited, mainly due to the lack of data. There are at least two aspects that contribute to the absence of data. First, there are no formal requirements for lenders to report details on their internal credit rationing practices, Second, lenders and loan applicants typically do not have an incentive to systematically report the credit rationing that they practice or experience. As a result, empirical studies necessarily rely on occasional large-scale surveys, often conducted by central banks and international monetary agencies to assess the extent of discouraged borrowers. Our empirical set-up allows us to investigate the credit rationing practices of a large EU lending institution during a period of market tightness.

Finally, departing from the literature that analyse credit line usage in the context of syndicated lending to large corporates (Ivashina and Scharfstein 2010; Acharya et al. 2019), we focus on credit line renewals to mid-corporates. Subject to firm performance and credit line usage, banks do not credit ration existing borrowers during a crisis. This evidence is in line with Campello et al. (2012) and Beck et al. (2018) and suggests that bank-firm relationships in Europe are valuable to firms as they help them to minimise the risk of having their credit rationed when it is needed the most.

The rest of the paper is organised as follows. Section 2 reviews the previous literature and derives the testable hypotheses; Section 3 describes the credit renewal process, as it is central to our investigation, and presents our empirical approach. Section 4 illustrates the data, the sample and the variables used in our analysis. In Section 5 we discuss our baseline results and in Section 6 we provide robustness tests. Section 7 concludes.

2 Prior literature and hypotheses development

2.1 Relationship banking and credit availability

The literature on relationship banking has provided extensive evidence on how credit relationships could benefit the bank’s borrowers and, at least partially, insulate them from the occurrence of a credit crunch (Berger and Udell 1995; Presbitero et al. 2014; Bolton et al. 2016; Beck et al. 2018). The literature also emphasises several factors in determining the importance of the credit relationship: for smaller, more informationally opaque firms the value of private information is higher compared to larger and more transparent firms (Boot 2000; Cornee 2017). Ferri et al. (2019) find that firms’ export prospects improve when their bank has access to private information, particularly for informationally opaque firms. The authors provide support to the use of relationship banking technologies and conclude that, following an external shock, banks’ ability to correctly establish borrowers’ risk class – due to access to private information – can mitigate the shock transmission to the real sector. Other studies show that the scope of relationship banking in terms of the number of products the firm has with the bank increases information production and therefore has a beneficial effect on rationing probabilities (Cahn et al. 2018). Finally, Agarwal and Hauswald (2010) illustrate the impact of physical distance on the acquisition and use of private information in informationally opaque credit markets and show that borrower-bank proximity facilitates the collection of private information leading to greater availability of credit. Based on the relationship banking literature, we envisage that the bank will value the access to private information in times of crisis, and therefore will be reluctant to curtail the flow of information as it allows them to better predict the company’s future outcomes. On the other hand, the bank’s access to private information might make it more likely they will decrease access to funding to firms with poorer potential prospects, not yet reflected in the firms’ accounts. Accordingly, we formulate the following hypothesis.

-

H1: After a negative shock to bank funding costs, the bank reduces credit availability less when it has a close lending relationship with the borrower.

2.2 Relationship banking and forbearance lending

The second of our empirical predictions focuses on the role of borrowers’ creditworthiness changes in the bank’s decision to reduce credit availability. In this context, we assume that the worsening of the borrower’s position is firm-specific. The literature on forbearance lending focuses on its negative economic consequences, as it distorts credit allocation by funding low productivity firms and limiting access to credit to new borrowers (Caballero et al. 2008). Recent studies show that the practice of lending to zombie firms, defined as existing borrowers that have persistent problems, have hampered the post-crisis economic recovery in the Eurozone (Adalet McGowan et al. 2018; Acharya et al. 2019; Bonfim et al. 2020). Nevertheless, forbearance lending could be beneficial if firms face temporary difficulties and can help them survive a period of weak demand. The intuition for this prediction is straightforward: banks actively manage credit risk and are likely to tighten credit standards during crises. Hence, banks are more likely to reduce credit availability when borrowers face a decrease in their credit rating evaluation. However, banks may choose not to credit ration existing borrowers, despite the worsening of credit standards, which may lead to the evergreening of bad loans. Banks have fewer incentives to ration struggling firms as the latter may fail and the loan may not be repaid therefore leading to bank losses (Giannetti and Simonov 2013). Based on this stream of the literature, we formulate the following hypothesis.

-

H2: After a negative shock to bank funding costs, the bank reduces credit availability less when it has a close lending relationship with the borrower, even when the borrower faces a decrease in rating.

3 Empirical strategy

3.1 The bank credit renewal process

The bank’s existing borrowers undergo an annual process of credit monitoring aimed at assessing both their credit structure and their creditworthiness/needs. During this process, the bank can review its past credit decisions, either confirming the credit previously granted or revising it. While the application for a new line of credit is a firm’s choice and firms may choose not to apply if they expect their application to be rejected, the renewal process we examine is not. The renewal process is mandatory for all borrowers if they want to maintain their credit line with the bank and it does not require borrowers to file a formal application.

The timing of the credit monitoring and renewal process is in line with the bank overall risk management framework. The loan officer accountable for managing the bank-firm relationship liaises with the borrowing firm to understand its financing needs and collect its most recent available data. During this process, the borrowing firm may ask for either maintaining the status quo or revising the amount of its existing credit lines. After liaising with the borrowing firm, the loan officer conducts a credit quality evaluation of the borrower, supported by a thorough investigation of the most recent information collected. The loan officer then submits its proposal to the bank’s approving authority, which may either confirm the renewal of the borrower’s existing credit lines or review its past credit decisions by increasing (e.g., increased demand for credit) or decreasing (e.g., deteriorated borrower’s creditworthiness) the amount of credit available to the borrower. The bank may also proceed to the total revocation of the borrower’s existing credit lines under exceptional circumstances. The key step in the credit renewal process is the rating attribution process, resulting in the production of a borrower’s updated rating, which is then attached to the credit application. The bank uses a hybrid credit scoring process in which the borrower’s final rating depends on quantitative as well as qualitative information. Quantitative information is obtained from the borrower’s financial statements and future business plans, where available. This generates a statistical rating by the bank’s credit scoring tool, which reflects the firm’s financials, and it is entirely based on hard information. In addition, through interviews and plant visits, the loan officer also collects private information. The final output is represented by the generation and attribution of a final rating to a given borrower, composed of maximum fifteen rating notches, defined according to the creditworthiness of the borrower, where the fifteenth notch represents the riskiest one and it is equivalent to an S&P’s rating judgment of CCC. These fifteen rating notches are then aggregated into three macro rating classes: (i) Low Risk; (ii) Medium Risk; and (iii) High Risk.

If both quantitative and qualitative parameters are unvaried, the credit renewal process ends with a confirmation of the status quo in the current lines of credit. When one or more of such parameters mutate, among other possibilities, in terms of (i) creditworthiness deterioration/improvement; (ii) under/over usage of existing credit lines; (iii) pricing uncorrelated with updated credit risk; (iv) new credit needs; the loan officer has the possibility to propose a modification of the current credit structure, by increasing or rationing borrower’s credit lines, subject to approval by the bank officer with the proper loan approving authority.

3.2 Identification strategy

Our challenge is to identify (credit) supply-side effects. The escalation of the sovereign debt crisis could also affect firms’ growth rates and therefore impact negatively on the demand for credit. Our empirical strategy includes several steps to alleviate identification issues. First, we exploit the exogenous shock to bank funding liquidity in August 2011 and consider how it affected credit decisions in the following one-year period (September 2011 to August 2012). The assumption is that the shock in bank funding does not affect firms’ performance independently of the bank during our time-period. We consider the period September 2011-August 2012 as the financial phase of the crisis, after which the demand-side effects become more relevant. This assumption is similar in spirit to Duchin et al. (2010), which study supply effects in the first year of the financial crisis of 2007–08 (July 2007-June 2008). Second, we rely on a very detailed loan-level dataset that includes information on the entire population of existing mid-corporate borrowers for our bank. Third, we focus on credit line renewals to avoid selection biases. While the application for a new line of credit is a firm’s choice and firms may not apply if they expect their application to be rejected, the renewal process we examine is not. This annual renewal process is mandatory for the borrowers if they want to maintain the credit line with the bank. Our sample is composed of all existing borrowers that underwent the annual renewal process at different points in time during our sample period. The typical mid-sized borrower does not apply for a lower amount of credit during the annual renewal process, especially in a crisis period. This is, in part, due to the characteristics of credit lines: while there are set-up fees and fixed costs for the borrowing firms, the interest rate is paid on the drawn part of the credit line. As such, borrowers are more likely to increase the unused part of the credit line rather than actively reducing their credit limit. We do not observe a decrease in demand for credit from exiting borrowers in our sample.

To test our hypothesis about the role of relationship lending on credit availability, our key variable of interest is the borrower’s used portion of the credit line (Used). We posit that if the bank values the private information it collects from borrowers by observing the usage of the credit line, the value of the relationship decreases with the increase in the unused portion of the credit line. To test our second hypothesis on forbearance lending, and to explore whether the bank tightened its credit standards as an indication of active credit risk management, we use the change in final rating from the previous credit review (Downgrade).

3.3 Empirical model & methodology

We first investigate the likelihood that the bank rations a borrower in our sample. Thus, we employ the following logit model:

where Credit Rationed is a binary variable taking value 1 if there is a decrease in the amount of credit granted following the renewal process; Downgrade captures the worsening of the creditworthiness of the borrower; Used is the drawn portion of the credit line as a percentage of the credit granted before the renewal; and X is the set of control variables, which changes with the specification of the models. X always includes time fixed effects and industry fixed effects. Time fixed effects, which are based on 4-month periods, capture differences in the severity of the crisis over time. We include industry fixed effects to control for the demand of credit. We also add geographical dummies, to account for the region where the borrowers are located.

In addition to the probability of rationing a borrower, we also examine the change in the amount of credit granted. The OLS model we use is the following:

where \(\Delta {Credit}_{i}\) is the change in the credit granted by the bank to a borrower following the renewal process. We scale this variable by the total debt granted by the bank to the business group to account for the importance of the credit reduction on the overall exposure of the bank to the group. As in Eq. 1, X always includes time fixed effects and industry fixed effects.

Finally, as additional analysis, since credit rationing may consist in a reduction of the amount granted as well as the closure of the credit line, we estimate an ordered probit model to capture the intensity of the rationing. The model is the following:

where Rationing Order is a variable that takes value 0 if there is no credit rationing; 1 if there is credit rationing but the credit line is not closed; and 2 if the credit line is closed. \({k}_{i}\) are the j cutpoints of the model (j = 3).

4 Data, sample and variables

4.1 Data and sample

In line with the credit renewal process, data are consistently collected across a sample of credit folders reflecting mid-corporate loan applications managed by the Corporate and Investment Banking (CIB) Division of a major European banking group from September 2011 to August 2012. According to the bank policy rules, the mid-corporate segment is populated by those firms generating an annual turnover between €150 million and €1 billion. The Corporate and Investment Banking Division of our data provider—which is responsible for the mid-corporate loan applications that we examine in this study—is structured in 24 corporate branches spread out over the bank’s home country in 12 different regions. These corporate branches reflect an organisational structure that separates mid-corporate banking from the retail banking activity associated with small firms and households at traditional branches.Footnote 9

The initial sample of mid-corporate loan applications includes all (approved and non-approved) credit lines applications from both new and existing borrowers.Footnote 10 We then restrict the dataset to include only those observations relevant to our analysis. Firstly, since we want to examine how the bank behaves at the time of the renewal of credit line applications of existing borrowers, we proceed to drop new borrowers from the sample of loan applications. Secondly, we exclude from our sample applications related to borrower’s intragroup-mergers and to a change in the bank managing the credit relationship within our given banking group. Our final dataset is composed of 400 credit renewals applications. The definition of the variables used in our empirical analysis is provided in the Appendix Table 9.

4.2 Credit line variables

We present summary statistics for lines of credit in Table 1. At the time of the application for the renewal of the credit line, the average credit granted is €7.56 million (Granted Amount t). Even though the median amount is only €2.06 million, these values are considerably larger than those reported in studies on small firms in Europe (see, for example, Kirschenmann 2016). The average (median) credit granted by the bank marginally decreases after the renewal process (Granted Amount t + 1). In fact, the average (median) credit is €7.51 million (€2 million). We measure the change in credit availability resulting from the credit renewal process as the revision (upwards or downwards) of the bank’s past credit decisions (ΔGranted Amount t + 1). The average (median) change in the credit extended by the bank is a negative €144 thousand (€0), corresponding to about 5.4% of the credit previously granted to the firm’s group (ΔGranted t + 1). Studying smaller firms, Kirschenmann (2016) finds that the granted loan amount is 92% of the requested loan amount. Overall, our data indicate that credit rationing for mid-corporates was limited. However, several firms faced a reduction in their credit lines: we find that about 37% of the sample firms are partially or totally rationed (Credit Rationed t + 1). Interestingly, the percentage of rationed firms in our sample is comparable to the 35.8% found in Becchetti et al. (2011) that study credit rationing during the pre-crisis period.

In our sample, all credit lines include an uncommitted portion, which in 82.75% of the cases represent the entire line of credit. Indeed, committed credit lines are present in only 17.25% of the observations. It is, therefore, not surprising that the average share of uncommitted (committed) credit lines is 90.10% (9.9%). The average uncommitted granted amount is €5.55 million, while the average committed granted amount is about €1.57 million. So, despite not being very common, committed credit lines are not negligible when existing.

Panel B of Table 1 presents summary statistics for Used, Credit Rationed, and Binding Credit Rationing. Contrary to the literature, our data suggests that the unused portion of the credit line is a decreasing function of the rating class. Not surprisingly, we observe more credit rationing for high-risk firms.

4.3 Relationship banking variables

We present the summary statistics for the variables associated with relationship banking in Table 2. Regarding the usage of the credit line (Used), we define it as Used Granted Amount at time t divided by the Granted Amount at time t. Looking at credit line usage by firms at the time of the renewal process, we find that borrowers are not, on average, financially constrained. Indeed, they are using about 39% (33%) of the credit granted by the bank the previous year on average (median). The drawdown of credit lines in our sample is slightly less than the 44% (50% median) reported by Campello et al. (2012) for a sample of private and public European firms in 2009. Looking at the usage of committed and uncommitted credit lines, we observe a substantial difference between the two types. The drawdown is, as expected, high in committed lines (average 80.7%; median 100%), while uncommitted credit lines remain for the most part untapped, with an average usage of 33.40% (median 20.16%).

Size is the log of total assets and proxies for the importance of the relationship for the bank. Lenders may be more reluctant to ration large borrowers either due to the strength of the relationship (Cenni et al. 2015) or because the latter are more transparent, thus decreasing potential information asymmetry issues (Kirschenmann 2016). Bank Market Share is the fraction of the borrower’s debt issued by the bank and captures the relative importance of the relationship with the bank for the borrower. The bank issues, on average, about 36.60% of the total debt of the firm, suggesting that the relationship is of primary importance for the firms going through the renewal process. Scope of relationship captures the breadth of the bank-firm relationship (Filomeni et al. 2021). In our sample, more than half of the borrowers buy at least one additional product from the bank beside the loan. A growing literature has shown the importance of the effects of geography on financial decisions. Degryse and Ongena (2005) document that distance matters in lending relationships. However, this effect is concentrated among transactional borrowers, for which the loan rates decreasing with the distance between the firm and the lending bank. Relationship borrowers are essentially unaffected by the lender–borrower distance. We compute the physical distance between the borrower’s headquarters and the bank branch where the loan officer is located. The variable Distance 50 is a binary variable that takes value one if the firm is within 50 kms, which corresponds to less than a 1-h drive, from the bank branch. We find that 48% of the firms are within 50 km of the bank branch.Footnote 11

We also control for group membership (Group), which can potentially impact the credit renewal decision in two ways. First, pyramidal structures create incentives for the controlling shareholder to expropriate minority investors through various tunnelling activities, especially during crises when returns from the firm’s investments decrease (Johnson et al. 2000; Bae et al. 2002; Bertrand et al. 2002; Baek et al. 2006; Bae et al. 2012). Second, profitable companies within the business group can provide the financing the struggling units need to survive a crisis (Friedman et al. 2003; Bae et al. 2012; Lins et al. 2013). The great majority of our sample companies belong to a business group (88%). This is not unusual in Europe, where pyramidal structures are relatively common (Faccio and Lang 2002). Masulis et al. (2011) observe that business groups throughout the world are in clear majority controlled by family firms, which in times of crisis are known to prioritise the survival of the companies belonging to the group (Lins et al. 2013).

4.4 Forbearance lending variables

The summary statistics for the variables associated with forbearance lending are also shown in Table 2. Since we examine the renewal decisions of existing credit lines, rating changes, especially decreases, are more relevant than the rating levels. In fact, rating changes affect the capital requirements for credit risk increasing the capital charge associated with the credit line. For this reason, we focus our attention on the change in the final rating with respect to the final rating in force in the previous credit review (Downgrade).Footnote 12 We observe a downgrade in the borrower’s final rating in more than 40% of the observations. These downgrades result in a change of the credit rating class in 18.8% observations.

In addition to credit ratings, the bank also estimates the probability of default (PD) of the borrower (PD Borrower). Cerqueiro et al. (2016) show that collateral plays an important and positive role in the provision of lending, concluding that collateral is an important contractual device that affects the behaviour of borrowers and lenders. Despite this importance, we find that borrowers in our sample are not likely to provide Collateral for their lines of credit. Indeed, only 38% of the loans offer this type of credit risk mitigation. A possible explanation for the low share of secured loans is the established relationship between the bank and the borrowers. Moreover, Canales and Nanda (2012) note that the liquidation value of collateral posted by small and medium-sized enterprises is often of negligible value to the banks. Finally, we use profitability as a further control. The average (median) firm profitability, measured by the return on assets (ROA), is a relatively healthy 7% (6.5%), especially given the crises that hit Europe.

5 Empirical analysis

5.1 Baseline model

We present the results of our baseline model in Table 3. In Columns (I), (II) and (III), we employ a logit regression analysis where the dependent variable is a binary variable taking value 1 if the granted loan amount has decreased with respect to the previous period. We use OLS regressions in Columns (IV), (V) and (VI), in which the dependent variable is the difference between the granted credit line after the renewal process and the existing credit line, scaled by the group debt. All models include both industry and time fixed effects as well as geographic dummies.

Our main finding is that the drawdown of the line of credit impacts credit rationing. Used is negative and significant in all models, indicating that borrowers that use more their line of credit are less likely to be rationed by the bank at the time of the renewal of their credit facility application. This result indicates that the bank is more eager to reduce credit to firms that are not using their credit lines, thereby providing support to the importance of relationship lending. Size is not statistically significant in our models. This result is consistent with Campello et al. (2012), which show that European CFOs do not believe that firm size affects the renewal of a line of credit. Buying additional services from the bank does not affect the credit rationing decision either. This is likely due to the fact we investigate renewals of credit lines, which implies an already existing relationship between borrowers and the bank. Consistent with the evidence for Belgian relationship borrowers (Degryse and Ongena 2005), firms headquartered close to the branch in which the loan officer is located do not receive a more favourable treatment. The bank market share of the borrower’s debt or whether the borrower belongs to a group do not seem to influence the decision to ration credit.

These results are also economically significant. We compute the change in the predicted probability of a credit rationing event for an interquartile change in Used. In Model I of Table 3, an interquartile change in Used corresponds from going from 0 (25th percentile) to 77.71% (75th percentile). The change in the probability of a cut is substantial: the probability of a reduction in credit is 42.59% when Used is at the 25th percentile, but it drops to 20.18% when Used reaches its 75% percentile, a change of 22.41%. We replicate this analysis also for Model 3 of Table 3 with similar results. Indeed, we observe a decrease of 25.22% in the probability of a cut (from 43.09% to 17.87%) when Used increases from 0 (25th percentile) to 79.77% (75th percentile).

Downgrade has the expected positive sign, and it is significant in Column (III), suggesting that the bank actively manage its risk exposure if the borrower’s creditworthiness deteriorates. Contrary to Cerqueiro et al. (2016), we do not find Collateral to reduce the likelihood to be credit rationed. Possible explanations are associated with the decreased redeployability of the assets offered as collateral during a severe crisis (Campello and Giambona 2013) and with the negligible value of the collateral to the bank (Canales and Nanda 2012). The probability of default, which is computed internally by the bank, does not affect the credit rationing decision. ROA, our proxy of cash flows generated internally by the firm, is not significant.

We also test if the drawdown of the credit line affects the decision of how much credit to ration. In Columns (IV), (V) and (VI), we report the estimate of OLS models where the dependent variable is the change in the amount credit granted following the renewal. We find a positive coefficient for Used, suggesting that firms using their credit lines more are those that experience a smaller reduction in the credit granted. This reduction is also economically significant: a one-standard deviation increase in the used portion of the credit line results in an increase of the credit line between 5.5% and 5.7%. This result contrasts with the findings of Accornero et al. (2017) who report a negative coefficient for the drawdown, but consider all types of loans, not just credit lines. These results provide further evidence that the bank manages its credit risk after a decrease in the quality of the borrower with respect to the previous review (Columns IV to VI). Regarding the other variables, there are a few differences with respect to the models for the probability of being rationed. We find a positive coefficient for ROA, which is consistent with Campello et al. (2012) and Sufi (2009). Also, Group and Group Support are positive and significant in Column VI, suggesting that the bank is less eager to reduce the amount of credit extended to a firm if the borrower is part of a business group, especially if financially sound.

Table 4 extends the analysis of credit rationing by capturing the different intensity of the credit rationing. In Columns (I) to (III), we employ an ordered logit model where the dependent variable takes values between 0 and 2. We assign a value of 0 to the dependent variable if the firm is not rationed, i.e. the change in the credit amount granted is positive or, at worst, zero; a value of 1 if there is a partial credit rationing, i.e. the credit amount decreases but the firm still receives some credit; and, finally, a value of 2 if the credit line is closed. Again, we find that undrawn credit positively impacts the probability of a credit reduction, even accounting for its intensity. In Column (III), we find some weak evidence that an increase in the credit risk of the borrower, captured by Downgrade, positively affects the probability of a credit reduction. Results for all control variables are similar to those presented in the main analysis.

In Columns (IV) to (VI), the dependent variable of the logit where the dependent variable is Binding Credit Rationing. This binary variable captures a decrease in the amount of credit granted that forces the borrower to return at least part of the drawn credit, i.e., it takes value 1 if the reduction is larger than the unused portion of the credit line, 0 otherwise. Not surprisingly, Used has a negative coefficient that is either not significant (Column IV) or weakly significant (Column VI). These results are due to the mechanical effect that a larger unused portion of the credit line decreases the likelihood of having a binding credit rationing. When we look at binding credit reductions, we observe a more significant role of variables related to the bank credit risk management. Indeed, an increase in the probability of default of the borrower significantly raises the probability of being rationed. Interestingly, in Column (VI), collateral has the expected negative coefficient, suggesting that banks value collateral when they take credit reduction decisions that may cause liquidity problems for the borrowers.

5.2 Credit lines usage, credit rationing and ratings

In Table 5, we consider how proxies of credit risk and relationship lending affect the bank’s decision to renew the credit granted to the borrower. Results show the used portion of the credit line plays an important role in the provision of credit, while we find less conclusive results for credit risk. However, so far, we have not considered the interaction between the two risks. Previous literature has documented that credit line drawdowns are higher for riskier firms (Jimenez et al. 2009; Kizilaslan and Manakyan Mathers 2014), because of the incentive for riskier firms to accumulate precautionary balances in anticipation of performance declines. On the other hand, the cost of using credit lines can be too high for risky firms, leading them to use proportionally more cash. In this case, riskier firms have lower drawdowns (Sufi 2009; Acharya et al. 2014). Moreover, if a borrower experiences a decrease in its creditworthiness, the bank may have an incentive to cut unused lines of credit (i.e., low drawdowns) to avoid a costly capital charge.

In Table 5, we interact Used with Downgrade. Column (I) shows the results for the probability of being rationed. Results are remarkably similar to those presented in Table 3, with Used negative and highly significant. The decrease in rating neither amplifies nor reduces the effect associated with Used. The interaction between Used and Downgrade takes a negative sign, but it is not significant in this model. We replicate the same logit model in Column (2) using Binding Credit Rationing as dependent variable. Results follow closely the ones presented in Table 4, with no effect associated with either Used or its interaction with Downgrade. Column (3) presents the results for the change in the credit granted. Again, results are highly consistent with those in Table 3. In particular, Used is always positive and significant. The interaction of Downgrade with Used is also significant and positive. These results document that an increase in the cost of maintaining the credit line, i.e., more capital charges associated to the worse credit rating, induces the bank to reduce even more the credit extended to a borrower that is not using the facilities. Unsurprisingly, we find a negative and statistically significant coefficient for Downgrade. ROA and Collateral positively impact the variation in credit granted. Overall, these results do not provide support to the forbearance lending hypothesis.

6 Additional analysis and robustness checks

6.1 Totally unused credit lines

More than one-third of the credit lines in our sample is totally unused (see Table 2). During a liquidity shock, the bank may opt to cut these credit lines first, as these do not provide any information. Moreover, these credit lines are of secondary importance to the borrower. Indeed, at the time of the shock, these credit lines provide flexibility to the borrower, but no liquidity. In Columns (I) and (II) of Table 6, we show that the bank is indeed more likely to ration borrower if they do not use at least partially their credit lines, supporting once again the view that the relationship between bank and borrower affects the bank decisions in a crisis time. We also find that borrowers that are part of a business group where at least some of the firms are in good financial health and thus can help the borrower, are less rationed. Finally, the bank rations firms whose credit rating worsened.

We also provide evidence about the intensity of the credit reduction in Columns (III) and (IV). Differently from Table 3, we do not find evidence that the amount of change in credit granted (as a percentage of the firm debt) is correlated with the dummy Totally Unused. Thus, leaving a credit facility completely undrawn affects the probability of being rationed but not the amount. We also observe that the variation in the credit granted is positively affected by being part of a group, especially if in good financial health, and by collateral and firm performance (ROA). This provides further evidence against zombie lending.

6.2 Uncommitted credit lines

The credit facilities we investigate can encompass both committed and uncommitted credit lines; the difference between these two types lies in the binding commitment for banks to provide the granted credit in the case of committed credit lines, while they may revoke uncommitted credit lines at will. Most of the credit lines in our sample are uncommitted, but in a few cases, committed ones are relevant. Since the drawdown of committed and uncommitted lines is remarkably different (see Table 1), our results may be driven by the composition of the credit line. To rule out this possibility, we replicate our main analysis using the undrawn credit from uncommitted facilities as a proxy for relationship lending. We do not observe substantial changes when we use Used Uncommitted in Table 7. The drawn portion of the uncommitted loan is still highly significant and with the expected sign.

An additional concern with uncommitted credit lines is that the bank the bank could ration a borrower holding an uncommitted credit line at any time. However, in practice this rarely happens. The bank monitors borrowers on an ongoing basis, but decisions as to whether revoke or decrease credit lines (committed or uncommitted) are generally taken on a yearly basis. In fact, the internal control system for our bank for this type of credit line exposure is the mandatory annual renewal process we analyse. However, the bank could act outside the process and monitor borrowers at more frequent intervals. Banks review multiple times the borrower’s credit line in 18 cases. During the period between September 2011 and August 2012, and we collapsed the data at individual borrower level considering the different reviews as part of a unique process terminating with the final review in our sample period. As a robustness check, we replicate the analysis presented in Table 3 of the paper without the observations with multiple reviews. The results are largely unchanged, with Used still significant.

6.3 Additional analyses

In our baseline analysis, scale the dependent variable by the total debt granted by the bank to the business group to account for the importance of the credit reduction on the overall exposure of the bank to the group. We believe this is the most appropriated scaling because profitable companies within the business group can provide the financing the struggling units need to survive a crisis (Friedman et al. 2003; Bae et al. 2012; Lins et al. 2013). If resources can be shuffled within the group, then what it matters is the overall credit granted to the group rather than to the individual firm itself.

However, alleviate potential concerns regarding the impact of the scaling, we rerun the analysis using a more a more traditional scaling factor for the loan growth in the literature, the lagged credit amount. The analysis with lagged credit as scaling factor is presented in Panel A of Table 8. The panel presents OLS regression analyses for the variation in credit granted measured as the change in credit granted divided the by the initial credit granted (i.e., (Granted t + 1- Granted t)/ Granted t) in Column I and the natural logarithm transformation in II (ln(1 + Granted t + 1/Granted t)). These columns replicated model (VI) of Table 3. As shown in the Table, the different scaling does not impact our main result regarding the variable Used, which remains positive and significant in all four models.

In Panel B of Table 8, we present the results of the baseline analysis, clustering standard errors by geography. The results for the main variable of interest remain unaffected by the change and are overall consistent with those shown in Table 3.

7 Conclusions

In this paper, we analysed how banks managed the funding liquidity shock they experienced in August 2011, concomitant with the intensification of the Eurozone crisis. We exploit loan-level information regarding the renewal of credit lines to a pool of existing mid-corporate borrowers generating an annual turnover between €150 mn and €1bn. The mid-corporate segment is highly dependent on bank credit and in almost all EU countries sustained greater losses during the crisis, compared to either large or small-sized firms. By focusing on all existing borrowers holding a credit line and by exploiting the internal annual credit monitoring process, we mitigate self-selection problems resulting only in firms with specific characteristics applying for and receiving funding during a crisis.

Our results indicate that, during the initial phase of the Eurozone crisis, access to credit for mid-corporate private firms did not decrease substantially. We also find that credit rationing for existing borrowers was limited. Nevertheless, several firms’ credit lines were either reduced or revoked, particularly those granted to firms that experienced a decrease in their credit rating compared to the previous monitoring exercises. Our findings provide support to the literature on relationship banking as they indicate that, in mid-corporate business lending, banks value existing relationships as they have invested in the collection of proprietary information. Banks are less likely to ration existing borrowers unless they pose an increased credit risk undermining the bank’s financial health.

Our empirical findings have a clear policy implication as they suggest that, through relationship lending, banks can cushion existing customers during economic downturns. A concern is that this positive effect might lead to credit misallocation and evergreening of bad loans and come at the cost of a decrease in new credit origination. An increased emphasis on relationship lending might incentivise banks to extend credit to existing borrowers while forsaking more profitable investment opportunities. Our results suggest that banks actively manage both their credit and liquidity risk and decrease credit availability when risk increases. In this respect, our results do not provide support to the claim that the 2011 liquidity shock and the subsequent long-term liquidity injections by the European Central Bank may have encouraged the evergreening of existing bad loans.

Notes

This sharp reduction in international funding was further exacerbated by a regulatory reform in the US which required money market funds to disclose their portfolios. This led to money market funds cutting their holdings of large time deposits issued by US subsidiaries of large Eurozone banks (Correa et al. 2016).

Because of the severity of the funding shock facing Eurozone banks, the ECB established two Long-Term Refinancing Operations (LTROs), in December 2011 and February 2012.

Eurostat. Industry and Services Statistics. Available at http://ec.europa.eu/eurostat/statistics-explained/index.php/Industry_and_services_statistics_introduced#Small_businesses_and_entrepreneurship.

Credit lines are particularly important for corporations, as evidenced by Sufi (2009), who finds that 85% of the US firms he analysed had a line of credit, representing on average 16% of book assets. Consistently, Demiroglu and James (2011) provide evidence that, in the U.S., around 75% of aggregate bank lending to firms arises from credit line drawdowns. Concerning the European market, Campello et al. (2012) show that credit lines accounted for 27% of the total assets of European firms in 2009.

Uncommitted credit lines are defined as “revocable” as they allow lenders the discretion to revoke access to further credit drawdowns in bad states of the world. Committed credit lines, on the other hand, can be revoked in case of breach of covenants.

See Duchin et al. (2010) for a similar assumption in their analysis of the financial crisis of 2007–08.

Our European banking group is representative of the general population of banks in the Eurozone. At the time of the data collection, the group had total assets of 646 billion euros, a total market capitalisation of about 50 billion euros and subsidiaries in twelve central-eastern European and Mediterranean countries. Specifically, in the home country (to which data refer), the group is among the leading players with 14 affiliated banks and about 4,500 branches and a market share of about 15% in the loan and deposit markets. In particular, the lead bank (the data provider) operates in the home country with about 1,900 traditional branches located in 16 regions.

The approved credit facility includes short-, medium-, and long-term financing granted by the bank to a given borrower, including both uncommitted and committed lines of credit.

To control for geographic factors, we divide our sample in five regions: North-West, where the headquarter of the bank is located, North-East, Centre, South, and a residual category for foreign borrowers. More than half of the firms in our sample are based in the North-West region, the most developed area of the country.

These internal ratings are organized over 15 levels, which are divided into three classes. For our analysis, we convert the 15 levels into numerical values, with higher values corresponding to worse ratings.

References

Accornero M, Alessandri P, Carpinelli L, Sorrentino AM (2017) Non-performing loans and the supply of bank credit: Evidence from Italy. Bank of Italy Occasional Paper No. 374, available at SSRN: Accessed on March 6, 2021 https://ssrn.com/abstract=2954995

Acharya V, Almeida H, Ippolito F, Perez A (2014) Credit lines as monitored liquidity insurance: Theory and evidence. J Financ Econ 112:287–319

Acharya V, Eisert T, Eufinger C, Hirsch CW (2019) Whatever it takes: The real effects of unconventional monetary policy. Rev Financ Stud 32:3366–3411

Adalet McGowan M, Andrews D, Millot V (2018) The Walking Dead? zombie firms and productivity performance in OECD countries. Econ Policy 33:685–736

Agarwal S, Hauswald R (2010) Distance and private information in lending. Rev Financ Stud 23:2757–2788

Bae KH, Kang JK, Kim JM (2002) Tunneling or value added? Evidence from mergers by Korean business groups. J Finance 57:2695–2740

Bae KH, Baek JS, Kang JK, Liu WL (2012) Do controlling shareholders’ expropriation incentives imply a link between corporate governance and firm value? Theory and evidence. J Financ Econ 105:412–435

Baek JS, Kang JK, Lee I (2006) Business groups and tunneling: Evidence from private securities offerings by Korean chaebols. J Finance 61:2415–2449

Becchetti L, Garcia MM, Trovato G (2011) Credit Rationing and credit view: Empirical evidence from an ethical bank in Italy. J Money Credit Bank 43:1217–1245

Beck T, Degryse H, De Haas R, van Horen N (2018) When arm’s length is too far. Relationship banking over the business cycle. J Financ Econ 127:174–196

Berger A, Udell G (1995) Relationship lending and lines of credit in small firm finance. J Bus 68:351–381

Berger A, Udell G (2006) A more complete conceptual framework for SME finance. J Bank Financ 30:2945–2966

Bertrand M, Mehta P, Mullainathan S (2002) Ferreting out tunneling: An application to Indian business groups. Q J Econ 117:121–148

Beyhaghi M, Firoozi F, Jalilvand A, Samarbakhsh L (2020) Components of credit rationing. J Financ Stabil 50:100762

Bolton P, Freixas X, Gambacorta L, Mistrulli PE (2016) Relationship and transaction lending in a crisis. Rev Financ Stud 29:2643–2676

Bonfim D, Cerqueiro G, Degryse H, Ongena S (2020) On-Site Inspecting Zombie Lending. Swiss Finance Institute Research Paper No. 20–16

Boot A (2000) Relationship banking: what do we know? J Financ Intermed 9:7–25

Caballero RJ, Hoshi T, Kashyap AK (2008) Zombie lending and depressed restructuring in Japan. Am Econ Rev 98:1943–1977

Cahn C, Girotti M, Salvade F (2018) External credit ratings and bank lending. WP N. 691, Banque de France, August

Campello M, Giambona E (2013) Real assets and capital structure. J Financ Quant Anal 48:1333–1370

Campello M, Giambona E, Graham J, Harvey CR (2012) Access to liquidity and corporate investment in Europe during the financial crisis. Rev Financ 16:323–346

Canales R, Nanda R (2012) A darker side to decentralized banks: Market power and credit rationing in SME lending. J Financ Econ 105:353–366

Cenni S, Monferrà S, Salotti V, Sangiorgi M, Torluccio G (2015) Credit rationing and relationship lending. Does firm size matter? J Bank Financ 53:249–265

Cerqueiro G, Roszbach K, Ongena S (2016) Collateralization, bank loan rates and monitoring. J Finance 71:1295–1322

Cornee S (2017) The relevance of soft information for predicting small business credit default: Evidence from a social bank. J Small Bus Manage 57:600–719

Correa R, Sapriza H, Zlate A (2016) Liquidity shocks, dollar funding costs, and the bank lending channel during the European sovereign crisis. Federal Reserve Bank of Boston, Risk and Policy Analysis Unit, Working Paper RPA 16–4

Degryse H, Ongena S (2005) Distance, lending relationships, and competition. J Finance 60:231–266

Demiroglu C, James C (2011) The use of bank lines of credit in corporate liquidity management: A review of empirical evidence. J Bank Financ 35:775–782

DeYoung R, Gron A, Torna G, Winton A (2015) Risk overhang and loan portfolio decisions: Small business loan supply before and during the financial crisis: Risk overhang and loan portfolio decisions. J Finance 70:2451–2488

Duchin R, Ozbas O, Sensoy BA (2010) Costly external finance, corporate investment, and the subprime mortgage credit crisis. J Financ Econ 97:418–435

Faccio M, Lang LHP (2002) The ultimate ownership of Western European corporations. J Financ Econ 65:365–439

Ferri G, Minetti R, Murro P (2019) Credit relationships in the great trade collapse. Micro evidence from Europe. J Financ Intermed 40:1–11

Filomeni S, Udell GF, Zazzaro A (2021) Hardening soft information: Does Organisational Distance matter? Eur J Finance 27:897–927

Friedman E, Johnson S, Mitton T (2003) Propping and tunneling. J Comp Econ 31:732–750

Giannetti M, Simonov A (2013) On the real effects of bank bailouts: Micro evidence from Japan. Am Econ J-Macroecon 5:135–167

Gobbi G, Sette E (2014) Do firms benefit from concentrating their dorrowing? Evidence from the Great Recession. Rev Finance 18:527–560

Ippolito F, Peydró JL, Polo A, Sette E (2016) Double bank runs and liquidity risk management. J Financ Econ 122:135–154

Ivashina V, Scharfstein D (2010) Bank lending during the financial crisis of 2008. J Financ Econ 97:319–338

Iyer R, Peydró JL, da-Rocha-Lopes S, Schoar A, (2014) Interbank liquidity crunch and the firm credit crunch: Evidence from the 2007–2009 crisis. Rev Financ Stud 27:347–372

Jimenez G, Lopez J, Saurina J (2009) Empirical analysis of corporate credit lines. Rev Financ Stud 22:5069–5098

Jimenez G, Ongena S, Peydró JL, Saurina J (2012) Credit supply: identifying balance-sheet channels with loan applications and granted loans. Am Econ Rev 102:2301–2326

Jimenez G, Ongena S, Peydró JL, Saurina J (2014) Hazardous times for monetary policy: what do twenty-three million bank loans say about the effects of monetary policy on credit risk-taking? Econometrica 82:463–505

Johnson S, La Porta R, Lopez-de-Silanes F, Shleifer A (2000) Tunneling. Am Econ Rev 90:22–27

Kashyap AK, Stein JC (2000) What do a million observations on banks say about the transmission of monetary policy? Am Econ Rev 90:407–428

Kirschenmann K (2016) Credit rationing in small firm-bank relationships. J Financ Intermed 26:68–99

Kizilaslan A, Manakyan Mathers A (2014) Strategic credit line usage and performance. J Financ Resh 37:243–265

Kysucky V, Norden L (2016) The benefits of relationship lending in a cross-country context: a meta-analysis. Manage Sci 62:90–110

Lee S, Persson P (2016) Financing from family and friends. Rev Financ Stud 29:2341–2386

Lins K, Volpin P, Wagner H (2013) Does family control matter? International evidence from the 2008–2009 financial crisis. Rev Financ Stud 26:2583–2619

Masulis R, Pham P, Zein J (2011) Family business groups around the world: costs and benefits of pyramids. Rev Financ Stud 24:3556–3600

Presbitero A, Udell GF, Zazzaro A (2014) The home bias and the credit crunch: A regional perspective. J Money Credit Bank 46:53–85

Puri M, Rocholl J, Steffen S (2011) Global retail lending in the aftermath of the US financial crisis: Distinguishing between supply and demand effects. J Financ Econ 100:556–578

Sette E, Gobbi G (2015) Relationship lending during a financial crisis. J Eur Econ Assoc 13:453–481

Sufi A (2009) Bank lines of credit in corporate finance: an empirical analysis. Rev Financ Stud 22:1057–1088

Funding

Open access funding provided by Università Cattolica del Sacro Cuore within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interests/Competing interests

The authors also have no conflicting and competing interests to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Casu, B., Chiaramonte, L., Croci, E. et al. Access to Credit in a Market Downturn. J Financ Serv Res (2022). https://doi.org/10.1007/s10693-022-00388-x

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10693-022-00388-x