Abstract

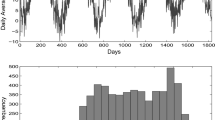

This paper discusses the pricing methodology of the temperature index insurance based on spatial temporal modelling of temperature. The crucial problem here is the location of the potential insurance buyer relative to the station where index is calculated. Since the observed temperatures at particular station are not always correlated to the temperature where the insurance holder lives, it is important to consider spatial issues in the pricing methodology. Thus, we model the temperature using spatial temporal stochastic processes and employ the universal Kriging method to predict the future temperature at some specific locations. Based on temperature index, we may then price the temperature insurance. We illustrate the pricing methodology using 20 years data from five stations in Malaysia. The findings are important for the development of weather index insurance.

Similar content being viewed by others

Notes

The data are available at Malaysian Meteorological Department in Kuala Lumpur, Malaysia.

There is a built in function for nonlinear fitting called nlinfit in MATLAB.

References

Barnett, B. J., Barrett, C. B., & Skees, J. R. (2008). Poverty traps and index based risk transfer products. World Development, 36, 1766–1785.

Barnett, B. J., & Mahul, O. (2007). Weather index insurance for agriculture and rural areas in lower income countries. American Journal of Agricultural Economics, 89, 1241–1247.

Barth, A., Benth, F. E., & Potthoff, J. (2011). Hedging of spatial temperature risk with market-traded futures. Applied Mathematical Finance, 18(2), 93–117.

Benth, F. E., Kallsen, J., & Meyer-Brandis, T. (2007). A non-Gaussian Ornstein–Uhlenbeck process for electricity spot pice modelling and derivatives pricing. Applied Mathematical Finance, 14(2), 153–169.

Benth, F. E., Klüppelberg, C., Müller, G., & Vos, L. (2011). Futures pricing in electricity markets based on stable CARMA spot models. Submitted manuscript. arXiv:1201.1151.

Benth, F. E., & Šaltytė, B. J. (2013). Modelling and pricing in financial markets for weather derivatives (Vol. 17, p. 17). Singapore: World Scientific.

Benth, F. E., Šaltytė, B. J., & Koekebakker, S. (2008). Stochastic modelling of electricity and related markets. Singapore: World Scientific.

Collier, B., Skees, J. R., & Barnett, B. J. (2009). Weather index insurance and climate change: Opportunities and challenges in lower income countries. Geneva Papers on Risk and Insurance-Issues and Practice, 34, 401–424.

Gundogdu, K. S., & Guney, I. (2007). Spatial analyses of groundwater levels using universal kriging. Journal of Earth System Science, 116(1), 49–55.

Kambhammettu, B. V. N. P., Allena, P., & King, J. P. (2011). Application and evaluation of universal kriging for optimal contouring of groundwater levels. Journal of Earth System Science, 120, 413–422.

Mandallaz, D. (2000). Estimation of the spatial covariance in universal kriging: Application to forest inventory. Environmental and Ecological Statistics, 7, 263–284.

Šaltytė, B. J., Benth, F. E., & Jalinkas, P. (2007). A spatial-temporal model for temperature with seasonal variance. Journal of Applied Statistics, 34(7), 823–841.

Taib, C. M. I. C., & Benth, F. E. (2012). Pricing of temperature index insurance. Review of Development Finance, 2, 2231.

Acknowledgements

C.M.I.C.Taib acknowledges financial support from Malaysian Ministry of Higher Education under grant FRGS:59382.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Taib, C.M.I.C., Darus, M. Spatial-Temporal Modelling of Temperature for Pricing Temperature Index Insurance. Asia-Pac Financ Markets 26, 87–106 (2019). https://doi.org/10.1007/s10690-018-9259-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-018-9259-0