Abstract

This paper investigates the usefulness of non-choice data, namely response times, as a predictor of threshold behavior in a simple global game experiment. Our results indicate that the signals associated to the highest or second highest response time at the beginning of the experiment are both unbiased estimates of the threshold employed by subjects at the end of the experiment. This predictive ability is lost when we move to the third or higher response times. Moreover, the response time predictions are better than the equilibrium predictions of the game. They are also robust, in the sense that they characterize behavior in an “out-of-treatment” exercise where we use the strategy method to elicit thresholds.

Similar content being viewed by others

Notes

Such a process is counter to the typical revealed preference methods used by economists (see, for example, Gul and Pesendorfer 2008).

The distinction between Intuitionists and Learners that we are making is not very different from what happens when we ask two different people who was the director of a film. While one person may know the answer but is not able to recall it (it is “on the tip of my tongue”), the other may never have known it. If you mentioned names to the first type (the Intuitionist) she would be easily able to reject wrong answers because she would know the right answer when she hears it. The second type (the Learner) would have to go through a very different process and perhaps need to do a search of each name mentioned, since they know they never knew the answer.

See Spiliopoulos and Ortmann (2014) for a discussion on the usefulness of RT in experimental economics.

See Morris and Shin (2003) for an overview on global games.

In general, \({\overline{\theta }}\) and \({\underline{\theta }}\) are set in such a way that we can differentiate two dominance regions for \(\theta\) (one for \(\theta \le {\underline{\theta }}\) and one for \(\theta \ge {\overline{\theta }}\) ) and an intermediate region (for \(\theta \in \left( {\underline{\theta }}, {\overline{\theta }}\right)\)) which, in the presence of complete information, would exhibit multiple equilibria. Notice that in this intermediate region the optimality of taking action A heavily depends on the expectation that agents have about \(\theta\) with respect to T. In order to make the game non-trivial, T is assumed to be strictly smaller than \({\overline{\theta }}\).

Note that the value of the threshold depends on the precision of the signal, which in the case of a normally distributed signal is equal to the inverse of its variance. In this case, the precision of the private signals is equal to \(\sigma ^{-2}\).

A unique solution to Eq. (1) is ensured as long as the private signals are precise enough with respect to the prior, i.e. when \(\frac{\sigma }{\sigma _{\theta }}<K\), where \(\sigma _{\theta }\)is the standard deviation of the prior about \(\theta\) and K is a constant that depends on the parameters of the model. This is a standard condition in the global games literature and it is met for the parameters used in the experiment (for a detailed discussion about the conditions for uniqueness see Theorem 1 in Szkup and Trevino 2019).

The RT analysis is performed for the direct action choice treatment only. We use the strategy method treatment to provide out-of-sample evidence that is consistent with our RT analysis.

Having a subject click on a button gives more certainty in terms of when a subject actually first sees the signal, reducing the noise for cases when they might be day dreaming.

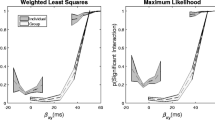

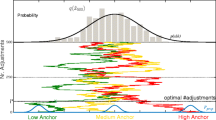

Notice that on average, subjects do not seem to follow the equilibrium threshold predicted by the theory, which corresponds to 35.31. This is consistent with findings in the global games literature (see Heinemann et al. 2004, and Szkup and Trevino 2019). However, the purpose of this study is not to establish optimality of thresholds with respect to the theory, but to predict observed thresholds with RT.

Note that we do not expect to observe these differences to be exactly zero because individual thresholds are estimated numbers and the probability of getting a signal realization exactly equal to this number is very small.

Notice that the median difference between signal and threshold decreases again in period 8. This difference, however, is statistically different from 0 at the 1% level of significance.

The vertical lines at \(\lambda =0\) and \(\lambda =1\) include subjects whose threshold can be explained only by one of these measures because they’re either greater or smaller than both measures. So these lines really correspond to \(\lambda \le 0\) or \(\lambda \ge 1\), respectively.

Our use of term Intuitionist differs from Rubinstein (2007). For Rubinstein intuitionists tend to have lower RTs to a given problem, while in our paper there is no particular difference between the duration of the first or second longest RTs for Intuitionists and Learners. What we find is that Intuitionists discover their threshold in earlier rounds than Learners.

We have 37 intuitionists and 39 learners in our sample. 8 subjects were dropped from the sample because they do not use threshold strategies.

Such a difference might lead one to think that perhaps a better way to classify subjects would be by calling them either fast or slow learners and choosing some arbitrary number of periods before a BPRT is determined to separate them. While this would have the benefit of being an exogenous classification scheme, it would offer no explanation as to why some subjects are fast and some slow and would be unable to offer any insights into the stability of behavior in our SM treatment to be discussed later on.

It is important to note that the stable behavior that characterizes Intuitionists is not a consequence of matching. That is, it is not the case that Intuitionist subjects are better coordinated with their opponent in the game. In fact, looking at the composition of pairs Intuitionists are not more likely to be paired with other Intuitionists than Learners.

One might wonder if Learners are just noisier decision makers than Intuitionists. To investigate this we look at average violations of individual thresholds in the last 25 rounds for these 2 groups by counting, for each subject, the number of times that their action in the last 25 rounds is not consistent with the threshold we estimate. We then take the average of these numbers for the subjects in each group. We find, on average, 2.11 violations for Intuitionists and 3.87 for Learners. However, the larger number of violations of Learners is mainly driven by 3 subjects. If we remove these outliers, we have, on average, 2.67 violations. Since these numbers are fairly similar, once we remove outliers, we remain agnostic about the potential role of RT in identifying noisy players in later rounds.

It is not surprising to see that the thresholds of Intuitionists are better approximated by choice data since their behavior is in general very stable. To look at violations of individual thresholds in the last 25 round, for each group, we count, for each subject, the number of times that their action in the last 25 rounds is not consistent with the threshold we estimate. We then add these numbers and divide them by the total number of subjects in each group. We find, on average, 2.11 violations for intuitionists and 3.87 for learners. However, the larger number of violations of learners is mainly driven by 3 subjects. If we remove these outliers, we have, on average, 2.67 violations. Since these differences are not too stark (controlling for outliers), we remain agnostic about the role of RT in identifying noisy players in later rounds of the experiment.

The online appendix can be found at: https://econweb.ucsd.edu/~itrevino/pdfs/online_appendix_rt.pdf.

This lack of statistical significance is expected since there are very few data points to have sufficient power.

References

Alos-Ferrer, C., Granic, D. G., Kern, J., & Wagner, A. K. (2016). Preference reversals: Time and again. Journal of Risk and Uncertainty, 52(1), 65–97.

Busemeyer, J. R. (1985). Decision making under uncertainty: A comparison of simple scalability, fixed-sample, and sequential-sampling models. Journal of Experimental Psychology: Learning, Memory, and Cognition, 11(3), 538–564.

Caplin, A., & Dean, M. (2015). Revealed preference, rational inattention, and costly information acquisition. American Economic Review, 105(7), 2183–2203.

Carlsson, H., & van Damme, E. (1993). Global games and equilibrium selection. Econometrica, 61(5), 989–1018.

Chabris, C. F., Laibson, D. I., Morris, C. L., Schuldt, J. P., & Taubinsky, D. (2009). The allocation of time in decision-making. Journal of the European Economic Association, 7(2/3), 628–637.

Clithero, J. A. (2018). Improving out-of-sample predictions using response times and a model of the decision process. Journal of Economic Behavior & Organization, 148, 344–375.

Fehr, E., & Rangel, A. (2011). Neuroeconomic foundations of economic choice—Recent advances. Journal of Economic Perspectives, 25(4), 3–30.

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Fudenberg, D., Strack, P., & Strzalecki, T. (2018). Speed and the optimal timing of choices. American Economic Review, 108, 3651–3684.

Gabaix, X., & Laibson, D. (2005). Bounded rationality and directed cognition. Cambridge: Harvard University.

Gabaix, X., Laibson, D., Moloche, G., & Weinberg, S. (2006). Costly information acquisition: Experimental analysis of a boundedly rational model. American Economic Review, 96, 1043–1068.

Gul, F., & Pesendorfer, W. (2008). The case for mindless economics. In A. Caplin & A. Shotter (Eds.), The foundations of positive and normative economics. Oxford: Oxford University Press.

Heinemann, F., Nagel, R., & Ockenfels, P. (2004). The theory of global games on test: Experimental analysis of coordination games with public and private information. Econometrica, 72(5), 1583–1599.

Konovalov, A., & Krajbich, I. (2019). Revealed strength of preference: Inference from response times. Judgment and Decision Making, 14(4), 381–394.

Krajbich, I., Armel, C., & Rangel, A. (2010). Visual fixations and the computation and comparison of value in simple choice. Nature Neuroscience, 13(10), 1292–1298.

Krajbich, I., Oud, B., & Fehr, E. (2014). Benefits of neuroeconomic modeling: New policy interventions and predictors of preference. American Economic Review: Papers and Proceedings, 104(5), 501–506.

Milosavljevic, M., Malmaud, J., Huth, A., Koch, C., & Rangel, A. (2010). The drift diffusion model can account for the accuracy and reaction times of value-based choice under high and low time pressure. Judgment and Decision Making, 5, 437.

Morris, S., & Shin, H. (2003). “Global games: Theory and applications. In Eight world congress: Advances in economics and econometrics: Theory and applications Cambridge: Cambridge University Press.

Morris, S., & Shin, H. S. (1998). Unique equilibrium in a model of self-fulfilling currency attacks. American Economic Review, 88(3), 587–597.

Piovesan, M., & Wengstrom, E. (2009). Fast or fair? A study of response times. Economic Letters, 105, 193–196.

Ratcliff, R. (1978). A theory of memory retrieval. Psychological Review, 85(2), 59.

Ratcliff, R., & McKoon, G. (2008). The diffusion decision model: Theory and data for two-choice decision tasks. Neural Computation, 20, 873–922.

Rubinstein, A. (2007). Instinctive and cognitive reasoning: A study of response times. The Economic Journal, 117, 1243–1259.

Rubinstein, A. (2008). Comments on neuroeconomics. Economics and Philosophy, 24, 473–483.

Rubinstein, A. (2013). Response time and decision making: An experimental study. Judgement and Decision Making, 8(5), 540–551.

Spiliopoulos, L., & Ortmann, A. (2014). The BCD of response time analysis in experimental economics. Experimental Economics, 21, 383–433.

Szkup, M., & Trevino, I. (2019). Sentiments, strategic uncertainty, and information structures in coordination games, mimeo.

Webb, R. (2019). The (neural) dynamics of stochastic choice. Management Science, 64(1), 230–255.

Wilcox, N. T. (1993). Lottery choice: Incentives, complexity, and decision time. The Economic Journal, 103, 1397–1417.

Woodford, M. (2014). Stochastic choice: An optimizing neuroeconomic model. American Economic Review: Papers and Proceedings, 104(5), 495–500.

Acknowledgements

We would like to thank the National Science Foundation via Grant SES-105962 and the Center for Experimental Social Science at New York University for financial support. We would also like to thank Colin Camerer, Paul Glimcher, David Laibson, Ross Metusalem and Elizabeth Schotter for their advice.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Schotter, A., Trevino, I. Is response time predictive of choice? An experimental study of threshold strategies. Exp Econ 24, 87–117 (2021). https://doi.org/10.1007/s10683-020-09651-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-020-09651-1