Abstract

We examine experimentally how complexity affects decision-making, when individuals choose among different products with varying benefits and costs. We find that complexity in costs leads to choosing a high-benefit product, with high costs and overall lower payoffs. In contrast, when complexity is in the benefits of the product, we cannot reject the hypothesis of random mistakes. We also examine the role of heterogeneous complexity. We find that individuals still (mistakenly) choose the high-benefit but costly product, even if cheaper and simple products are available. Our results suggest that salience is a main driver of choices under different forms of complexity.

Similar content being viewed by others

Notes

Another related theory of complexity and inattention is, e.g., thinking aversion (Ortoleva 2013).

Relatedly Ausubel (1999) finds that recipients of credit card solicitations overrespond to the introductory interest rate relative to the duration of the introductory offer and to the post introductory interest rate.

See also Stizia et al. (2011).

This does not mean that choices in the field for high-benefit products, but with high costs, are necessarily a mistake. However, controlling for payoffs and choice sets, they are in our experiment.

See Online Appendix A for the instructions and an example screen-shot for the cost choice in SIMPLE.

To prevent subjects from learning the ranking of the payoffs of the three loans (Medium > High = Low), we introduced 9 “dummy” rounds with different rankings.

In these sessions we aimed to repeat each choice three times. However, due to a programming error the actual number of repetitions turned out to be 3, 3, 2 and 4 for ALL SIMPLE, ONLY HIGH COMPLEX, HIGH & LOW COMPLEX and ALL COMPLEX. Therefore, in the analysis only data from the first two repetitions will be used. However, if we include all repetitions, our results remain qualitatively the same.

Note that, in an experiment on search processes where complexity is also manipulated, Caplin et al. (2011) find their results to be robust to the use of time limits.

We provide detailed results by location in Online Appendix B.

In terms of the base parameters, on average 47 points are equal to 1 EUR and 21.5 points are equal to 1 AUD. The exchange rate across locations was adapted to satisfy the expected average payment by hour in each location.

Our approach is related to the concept of Quantal Response Equilibrium (McKelvey and Palfrey 1995). We consider an individual decision problem, while they consider a game theoretic setting. A comprehensive overview of the econometric estimation of different error models for individual decision problems can be found in Blavastkyy and Pogrebna (2010).

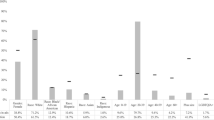

The relative bias towards the High option in the COMPLEX COST treatment is qualitatively the same and yields the same test results with the sample of subjects at Tilburg University than with the sample of students at the University of Queensland. The bias also remains robust over the course of four repetitions. If we consider the first repetition, COMPLEX COST increases the average choice frequency of the High option from 27 % in SIMPLE to 58 %, while it does not increase the choice frequency of the Low option: it is 10 % in SIMPLE and 8 % in COMPLEX COST. Similarly, in the last repetition, the average choice frequency of the High option increases from 5 % in SIMPLE to 24 % in COMPLEX COST, while the increase in the Low option is from 2 % in SIMPLE to 17 % in COMPLEX COST.

Further, the increase in the choice of High is higher in COMPLEX COST compared to SIMPLE, than in COMPLEX BENEFIT (p value < 0.01).

The difference is significant (p value = 0.03).

A regression analysis of decision times, taking into account censoring, is provided in the Online Appendix. Results are qualitatively the same as those reported in the main text using simple tests.

We note that there is a small non-significant difference in decision times across locations in HIGH & LOW COMPLEX. Subjects in Tilburg University spend on average 91.8 s choosing among options, while subjects at the University of Queensland spend on average 82.1 s. This leads to a significant increase in decision times when moving to COMPLEX COST in the latter location, but not in the former. Further details are provided in Online Appendix B.

In the analysis of payoffs we include all periods, including the few instances in which subjects did not make a choice within the time limit. Results remain qualitatively the same if these periods are excluded.

We ran two sessions of the simultaneous treatment at the University of Queensland with a total of 51 subjects. These sessions were ran using the same procedure as outlined above.

References

Abeler, J., & Jäger, S. (2013). Complex tax incentives—An experimental investigation. American Economic Journal (forthcoming).

Ausubel, L. (1999). Adverse selection in the credit card market. Working Paper. University of Maryland.

Bertrand, M., & Morse, A. (2011). Information disclosure, cognitive biases and payday borrowing. Journal of Finance, 66(6), 1865–1893.

Beshears, J., Choi, J. J., Laibson, D., & Madrian, B. C. (2010). How does simplified disclosure affect individuals mutual fund choices? In D. A. Wise (Ed.), Explorations in the Economics of Aging. Chicago: University of Chicago Press.

Blavastkyy, P., & Pogrebna, G. (2010). Stochastic choice and decision theories. Journal of Applied Econometrics, 25, 963–986.

Bordalo, P., Gennaioli, N., & Shleifer, A. (2013). Salience and consumer choice. Journal of Political Economy, 121(5), 803–843.

Brown, J., Hossain, T., & Morgan, J. (2010). Shrouded attributes and information suppression: Evidence from the field. Quarterly Journal of Economics, 125(2), 859–876.

Campbell, J. Y. (2006). Household finance. Journal of Finance, 61(4), 1553–1604.

Caplin, A., Dean, M., & Martin, D. (2011). Search and satisficing. American Economic Review, 101(7), 2899–2922.

Carlin, B. (2009). Strategic pice complexity in financial retail markets. Journal of Financial Economics, 91, 278–287.

Chetty, R., Looney, A., & Kroft, K. (2009). Salience and taxation: Theory and evidence. The American Economic Review, 99(4), 1145–1177.

Choi, J. J., Laibson, D., & Madrian, B. C. (2010). Why does the law of one price fail? An experiment on index mutual funds. Review of Financial Studies, 32(4), 1405–1432.

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10, 171–178.

Finkelstein, A. (2009). E-ztax: Tax salience and tax rates. Quarterly Journal of Economics, 124(3), 969–1010.

Gabaix, X., & Laibson, D. (2006). Shrouded attributes, consumer myopia, and information suppression in competitive markets. Quarterly Journal of Economics, 121, 505–539.

Harrison, G., & List, J. (2004). Field experiments. Journal of Economic Literature, 42(4), 1013–1059.

Huck, S., & Weizsäcker, G. (1999). Risk, complexity, and deviations from expected-value maximization: Results of a lottery choice experiment. Journal of Economic Psychology, 20, 699–715.

Kalaycı, K., & Potters, J. (2011). Buyer confusion and market prices. International Journal of Industrial Organization, 29(1), 14–22.

Kalaycı, K. (2015). Price complexity and buyer confusion in markets. Journal of Economic Behavior and Organization, 111, 154–168.

Köszegi, B., & Szeidl, A. (2013). A model of focusing in economic choice. Quarterly Journal of Economics, 128(1), 53–104.

Luce, D. (1959). Individual choice behaviour. New York: Wiley.

Lusardi, A., & Tufano, P. (2009). Debt literacy, financial experiences, and overindebtedness. NBER Working Paper 14808.

McFadden, D. (1973). Conditional logit analysis of qualitative choice behavior. In P. Zarembka (Ed.), Frontiers in econometrics (Chapter 4). New York: Academic Press.

McKelvey, R. D., & Palfrey, T. R. (1995). Quantal response equilibria for normal form games. Games and Economic Behavior, 10, 6–38.

OECD. (2005). Improving Financial Literacy: Analysis of Issues and Policies. Paris: OECD Publishing.

Ortoleva, P. (2013). The price of flexibility: Towards a theory of Thinking Aversion. Journal of Economic Theory, 148, 903–934.

Read, D., Loewenstein, G., & Rabin, M. (1999). Choice bracketing. Journal of Risk and Uncertainty, 19(1–3), 171–197.

Simon, H. A. (1957). Models of man: Social and rational. New York: Wiley.

Spiegler, R. (2011). Bounded rationality and industrial organization. Oxford: Oxford University Press.

Stizia, S., & Zizzo, D. (2011). Does product complexity matter for competition in experimental retail markets? Theory and Decision, 70, 65–82.

Stizia, S., Zheng, J., & Zizzo, D. (2011). Complexity and smart nudges for inattentive consumers. Working Paper.

Wilcox, N. (1993). Lottery choice: Incentives complexity and decision time. Economic Journal, 103(421), 1397–1417.

Acknowledgments

We would like to thank David Cooper, Enrique Fatas, Paul Frijters, Changxia Ke, Alex Imas, Nikos Nikiforakis, Wieland Müller, Matteo Ploner, Jan Potters and Philipp Wichardt for their comments, as well as the audiences at the University of Munich, 6th Annual Australia New Zealand Workshop on Experimental Economics at Monash University, 2011 European Workshop on Behavioral and Experimental Economics at the University of Munich, 2011 North-American ESA Meeting, 2012 MBEES at Maastricht University and 2012 Experimental Finance Conference at the University of Luxembourg for their comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Kalaycı, K., Serra-Garcia, M. Complexity and biases. Exp Econ 19, 31–50 (2016). https://doi.org/10.1007/s10683-015-9434-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-015-9434-3