Abstract

Insurance serves modern society and commerce by pooling risk to reduce the economic impact of disasters. Concurrently, Disaster Risk Management (DRM) scientists, responders and policymakers are co-developing proactive resilience and mitigation strategies with European citizens against accelerating climate-related natural catastrophes. The increasing frequency and severity of natural catastrophes exacerbates the insurance coverage gap by incurring even greater losses for (re)insurers, leading to higher premiums in exchange for cover or the withdrawal of services entirely. This paper presents a conceptual framework for cross-sectoral collaboration between the insurance and DRM communities towards open, transparent and optimised disaster risk management for all EU citizens and businesses. Furthermore, this research identifies key enabling technologies (satellite, drone, artificial intelligence, blockchain) and novel risk transfer mechanisms with the potential to accelerate societal resilience to climate disasters through effective risk management. The study emphasises the critical role of the insurance industry in effective DRM and highlights where insurers could take a more active role across the temporal plane of a natural disaster by engaging in ex-ante interventions to protect those vulnerable to climate change-related risk.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

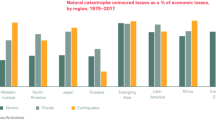

Weather and climate-related extremes in Europe led to economic losses of half a trillion euros between 1980 and 2020 (European Environment Agency 2022). Less than one-third of those losses were insured (ibid.). Climate change will lead to an increased frequency and intensity of disasters, which threaten the economic and social infrastructure of Europe. Further, the increasing frequency and severity of natural catastrophes (Botzen et al. 2019; Coronese et al. 2019; Vellinga and Wood 2002) has the potential to worsen the insurance protection gap by increasing (re)insurers loss exposure and uncertainty. In response, the (re)insurance industry may opt to charge higher premiums in exchange for coverage or to withdraw their services entirely. At the time of writing, insurance companies’ withdrawal of climate-related disaster cover for citizens and businesses introduces significant international policy uncertainty. New policy measures are needed to address these threats. However, meaningful interaction and coordination between cross-sectoral Disaster Risk Management (DRM) stakeholders and the (re)insurance industry remain outstanding. A key priority for policymakers must be to recognise the critical role of insurance in the disaster resilience paradigm and future-proof the industry to ensure it can continue to provide risk transfer mechanisms for vulnerable citizens, businesses, and governments. This paper highlights key challenges facing the (re)insurance sector in continuing its role in protecting societies against the economic impacts of natural disasters in the context of climate change. In response, this paper presents emerging technologies (satellite, autonomous drone, artificial intelligence, blockchain) and novel risk transfer mechanisms (parametric insurance, smart contract-enabled policies) with the potential to bolster insurance capacity and penetration in a climate-disaster-prone future.

The economic losses of natural catastrophes will inevitably intensify even further when considered within the confluence of socioeconomic factors such as population growth, urbanisation, industrialisation in developing areas (Ward and Shively 2012), environmental degradation (Botzen et al. 2010), and changing societal attitudes to compensation resulting in increased reporting (Vellinga and Wood 2002). This economic impact is funded by a combination of government finances, (re)insurance claims payments, private citizen losses, and humanitarian aid. The ‘Economic Definition of Macroeconomic Resilience’ defines instantaneous resilience as limiting the immediate impact on economic activity for a given scale of loss and dynamic resilience to the ability to reconstruct and recover quickly (Hallegatte 2015). Insurance is typically a key enabler of the latter form of resilience. However, delays in post-disaster financial support (claims or aid) result in loss escalation, compounding the socioeconomic impacts of natural catastrophes. It is estimated that early intervention can have 3.5 times the impact of delayed aid payments (RMS 2017). This paper identifies insurance innovations for efficient financial support distribution to promote societal instantaneous resilience in the event of a natural disaster.

Insurance is part of a broader fiscal framework which includes other forms of disaster risk financing, humanitarian interventions, and defensive measures. In fact, the insurance industry and political authorities at local, national, and supra-national levels deal with risk in a symbiotic manner (See Fig. 1). Where insurance provision does not exist, public entities must step in to provide support. There is then a confluence of interests between States and the insurance industry, with both having important welfare functions. That said, engagements between the insurance sector and State authorities remain underdeveloped. In the face of increasing risk, insurers will change their service conditions and this will place additional burdens on national and local authorities. The potential raising of premiums, higher deductibles, lowering limits, and the introduction of exclusions can have a serious impact on consumers and businesses alike. European Commission-funded projects and supervisory bodies, including EIOPA, have been monitoring the effects of such market changes (EIOPA 2020; European Commission 2021b; Europa Re 2023).

Previous European Commission-funded projects have been tasked with developing methods for the insurance industry and DRM community to cope with the climate crisis. The H2020_Insurance project created the ‘Oasis Loss Modelling Framework (LMF)’ for catastrophe and climate extremes risk modelling (European Commission 2021b). The key outcome was the development of an open-source, collaborative, multi-climate-risk assessment framework to better inform the (re)insurance sector and reduce the gap between insured and uninsured climate-related losses. The Oasis platform exemplifies Open Science principles within the insurance CAT modelling domain. The LMF specifies a set of standardised data inputs and a framework for building and running models via the API. Focusing on the intensifying wildfire risk exposure, the TREEADS consortium developed a holistic wildfire management platform centred on disaster risk management, response, and recovery, including identifying risk transfer solutions that limit the economic damage caused by a wildfire event and employing restoration techniques to speed up post-fire recovery efforts (European Commission 2023b). Other projects focussed on improving resilience to fire perils include FirEUrisk, SILVANUS and Fire-RES (European Commission 2021a, c, 2023a). However, despite these examples, there exists relatively little active participation of insurance stakeholders within these EU-funded projects. As a fundamental stakeholder in effective disaster risk resilience, it is critical that the (re)insurance industry become more engaged participants in multi-disciplinary efforts to counteract the societal and economic impacts of climate change.

It is clear that there is an urgent requirement for cross-sectoral collaboration between the insurance and DRM stakeholders towards a coordinated disaster risk management framework. Table 1 highlights key challenges constraining the (re)insurance industry’s role as agents of disaster resilience in the context of climate change. In response to these challenges, Sect. 2 outlines emerging enabling technologies and novel risk transfer innovations with the potential to accelerate societal resilience to climate disasters.

2 Pathway to improved disaster resilience through coordinated action

2.1 Risk transfer innovations

Any set of solutions to problems around accurate risk metrics and insurance coverage must encapsulate the use of big data and AI by insurance companies and other entities in this ecosystem. Recent literature specifies that the persistent level of uncertainty associated with disaster risks precludes the accurate pricing of financial risk transfer products and the setting of appropriate terms (Galeotti et al. 2013; Zhao and Yu 2020). Instead, ex-post pricing adjustments that occur in secondary markets are more accurate indicators of catastrophe risk exposures (Chang et al. 2020). These findings signal a need to depart from a reliance on conventional insurance approaches based on historical loss figures, to the utilisation of greater sources of data offering proactive and nuanced views on risk exposure. Satellite and drone imagery is one such alternative data stream that can offer real-time views on risk exposure, which requires the use of advanced machine vision techniques to analyse. Therefore, big data and AI may be harnessed to develop accurate risk metrics to enable affordable insurance coverage. As highlighted by EIOPA (2021), robust data governance processes will need to be implemented while using satellite datasets to protect public privacy and encourage trust in new risk transfer regimes around weather-related risks.

2.1.1 Parametric insurance

Parametric insurance represents the state-of-the-art in disaster risk transfer innovation (Horton 2018). Such policies insure policyholders against the occurrence of defined disaster event parameters or index with an ex-ante agreed or scheduled amount (Lin and Kwon 2020). These contrast to traditional indemnity policies, wherein payments are aligned to losses after claims adjudication and adjustment. The key benefit of parametric insurance is the speed at which the payments can reach the policyholder. Rapid liquidity post-disaster event exemplifies the product’s utility as a financial hedging instrument against natural or man-made catastrophes for government agencies, NGOs, and businesses (against business interruption risks). However, the efficiency of parametric insurance payments comes at the cost of ‘basis risk’, which is the difference between the payout and the actual loss incurred. Parametric insurance products could leverage satellite and drone technology for enhanced payment trigger validation, and Blockchain-enabled smart contracts for faster claims payments.

2.1.2 Smart contract-enabled insurance policies

Conventional insurance payout systems introduce administrative burdens which represent additional costs for insurers, reduce the capacity for coverage, and delay the deployment of capital to areas impacted by climate-related events. By applying Blockchain and smart contract technology in disaster management, insurers could radically increase the efficiency of modern insurance systems by deploying capital immediately for use in combating ongoing climate events or hastening post-event economic recovery efforts. By uploading policy details and trigger mechanisms to smart contracts stored on a Blockchain, insurance companies can establish predefined criteria that, once met, trigger automated policy payouts in response to data throughputs from real-time catastrophe monitoring technologies. The speed at which capital can be deployed through automated parametric insurance policy systems would have three key benefits: firstly, capital is immediately deployed to local authorities to combat ongoing extreme climate events; secondly, waiting periods for the release of funds to individual policyholders are significantly reduced, thereby enhancing post-event economic recovery prospects; and thirdly, administrative costs and human errors are significantly mitigated.

2.1.3 Drone technology

Drone technologies can be developed for autonomously inspecting properties to be insured and for claims management during and after a disaster event. A drone equipped with multiple onboard sensors can be functionalised to fly over the area to create an accurate 3D model of the property. The model would be semantically analysed using machine vision processing algorithms, facilitating different needs according to the disaster phase. In a pre-loss era, the tool would automatically detect the natural disaster risks a given property may face (e.g., fire risk due to high fuel load in the vicinity). For this purpose, an analysis of the materials present and their properties during natural disasters would be made. With this function, insurance companies would be able to improve the estimation of the actual risks, thereby reducing the costs of expert inspection and improving the affordability of insurance products. During a disaster event, drones can provide a dynamic risk communication tool for insurance companies (via parametric trigger confirmation, loss exposure modelling, and policyholder risk reduction communication) and for public authorities to proactively manage the natural catastrophe in real-time. This tool could leverage early-warning tools, such as the European Flood Awareness System (EFAS 2023) and European Forest Fire Information System (EFFIS 2023), to identify instances of probable natural disaster events. During the post-disaster event phase, the tool would allow insurance companies to process the claims and improve the adjudication process quickly, thereby reducing the possibility of fraud.

2.1.4 Satellite technology

Remote sensing has been considered a potentially valuable source of contextual information for the insurance industry for several years (European Space Agency 2021a, b, 2018). The availability of catalogues of parameterised and quantified phenomena and ground items from remote sensing coverage can serve in the framework of risk assessment and reduction in the insurance industry. In parallel, these features may be leveraged by the insurance industry to elicit hazard, vulnerability, and exposure data to calibrate novel NATCAT models for new regions. Micro-satellite-based remote sensing can be functionalised by the insurance sector for discrete tasks [e.g., regional risk profile change reporting (e.g., coastal erosion)] and dynamic tasks (e.g., natural catastrophe verification).

2.2 Catastrophe modelling

Catastrophe modelling is a long-established practice within the insurance industry for loss exposure management, risk pricing, and capital reserving. The methodology generates economic loss estimates resulting from “High-Impact Low-Probability” (HILP) catastrophic events, such as natural perils (e.g., flood, wildfire, windstorm) and man-made perils (e.g., warfare, terrorism, cyber breaches). The development of regional catastrophe models is a complex, multi-disciplinary undertaking requiring expert input from insurance, geophysical, engineering, technology, and, often, local authority stakeholders (see Fig. 2). For this reason, significant gaps exist in the catastrophe model landscape (Winspear 2020). However, there is scope to accelerate model development with the aforementioned technological advances in satellite and drone technology combined with better coordination of disaster risk data, including sources from the European Commission Disaster Risk Management Knowledge Centre (EC DRMKC 2023), (re)insurance industry, and regional data sources.

Insurance catastrophe models integrate regional and peril-specific hazard, exposure, vulnerability, and loss components to estimate expected loss (Mitchell-Wallace et al. 2017). The architecture design of a catastrophe model

Advances in methods and technology may be leveraged to overcome barriers to NATCAT model development, predictive performance and validation. For instance, region-specific disaster scenarios can be used within the Open Source Oasis Model Development Toolkit (Oasis LMF 2023). Modern advances in dynamic satellite data connectivity can be used to enhance the development, validation, and calibration of the NATCAT Models. For these validation methods, model predictions are compared to actual outcome and event impact observations derived from the satellite technology. These models may also incorporate transboundary scenarios to overcome challenges related to cross-border data availability and standardisation. There have been advances in the integration of AI methods into NATCAT and geohazard modelling (Dtissibe et al. 2020; Zhang et al. 2022; Dikshit and Pradhan 2021), however, the challenges of dataset availability, climate change and anthropogenic activities present challenges (Dikshit et al. 2021). Combining satellite data and drone imaging will allow for the extraction of novel features to be used as inputs for probabilistic diagnostic, predictive forecasting, and prescriptive recommendation algorithms for improved DRM and disaster risk pricing. For example, dynamic imagery can be used for local risk profile adaption (e.g., inland and coastal flood propensity), vulnerability assessments and disaster verification procedures.

Increased comprehension of loss exposure to natural disasters would result in better risk management decision-making by policymakers and planners. Building on better risk understanding, insurance companies can design innovative insurance products to cover these perils in a sustainable manner. In addition, the public and local authorities can make informed risk management decisions and investments with increased awareness of their loss exposure to catastrophes. Consequently, vulnerable communities will be more resilient in the event of a HILP disaster, reducing the resulting direct disaster economic losses. This would directly contribute to the United Nations Sendai Framework for Disaster Risk Reduction target by reducing the direct disaster economic loss as a percentage of global gross domestic product (GDP) by 2030 (UNISDR 2015).

2.3 Disaster risk communication

Risk perception among European citizens is key to building resilience in the face of climate change-related weather events. Opening vectors to enhance engagement between the public and the insurance industry by providing insights into how insurance pricing models operate would improve risk literacy and increase trust levels in insurance across Europe. Risk communication practices need to include and expand on local stakeholder engagements in high climate-risk affected areas, and inform all citizens on the cascading (direct and indirect) impact of climate risks, including the disproportionate impact of climate change on marginalised groups. A better understanding of disaster risk exposure would encourage informed decision-making by public authorities and its citizens. For example, a tool to communicate the changing risk profiles and insurability of specific areas over a range of future climate change scenarios could strengthen efforts for sustainable governance and behaviour change. This could be achieved through the aggregation of risk, disaster loss and satellite data sources, such as the EC DRMKC (2023), Copernicus (2023) Earth Observational Programme, insurance industry (e.g., EIOPA), and regional geophysical data sources, in order to both establish baseline risk and understand changing risk profiles.

2.4 Public–private partnerships

The absence of a collaborative public–private disaster risk management strategy could lead to an insurability issue in HILP (High-Impact, Low-Probability) at-risk locations, resulting in further reliance on government disaster relief. Therefore, partnerships between public and private entities [Public–Private Partnerships (PPPs)] are essential constituents in the solution to this challenge. PPPs are an effective means of countering the short-term thinking around HILP events and encourage proactive investment in risk reduction measures prior to a disaster, reduce affordability issues, and increase insurance capacity for catastrophic risks (Kunreuther 2015). However, the structure, risk, and income allocation, and governance structures for PPPs vary considerably. Since the climate crisis will demand more robust and sustainable PPPs, there is a need to draw together impacted communities, including State and local authorities, (re)insurance companies, regulators and civil society to stress-test new PPP frameworks. For example, nationally based PPPs can introduce negative externalities around border regions. That said, one of the key advantages of PPPs is the ‘bundling’ of upfront and ongoing costs and operations. The budgetary constraints under which governments and municipal authorities operate make it attractive for such costs to be reduced while continuing to deliver a social good to their constituents (Levin and Tadelis 2010). One early example of the adoption of PPPs for the mitigation of natural hazards is the US creation of the Flood Mitigation Assistance (FMA) programme by the Federal Emergency Management Agency (FEMA). This FEMA programme funds risk-mitigation measures such as flood-proofing and elevation of the property, and is itself funded through the National Flood Insurance Program (NFIP); a partnership between the “Federal government, the property and casualty insurance industry, states, local officials, lending institutions, and property owners” (FEMA 2022).

In Japan, the government has partnered with insurance companies to reduce the cost of premiums for consumers conditional on seismic retrofitting (Tsubokawa 2004), while the mandatory Turkish Catastrophe Insurance Pool (TCIP) programme mitigates the impacts of earthquakes in the region (Gurenko 2006; Cummins and Mahul 2009). Empirical evidence from India suggests the success of a PPP microinsurance programme can result in higher insurance penetration (Clarke and Grenham 2013). Low insurance penetration rates in at-risk regions mean that the burden of disaster relief rests on governments (Yao et al. 2017). Thus, incentivising retrofitting and individual risk-mitigation measures is necessary to reduce the economic and societal costs of a natural disaster and ensure the longer-term social good of the PPP arrangement.

2.5 Capital market innovations

The rising cost of insuring against natural disasters, particularly in the wake of Hurricane Andrew in 1992, led to the advent of catastrophe (CAT) bonds as a sub-asset class of insurance-linked securities (ILS). Since their first issuance in 1997, CAT bonds have amassed a total outstanding notional of €37.7 billion (Artemis 2022) and have become a prominent means of enhancing the insurability of non-financial risks, including human catastrophes and natural disasters. While significant advancements have been made in the sophistication of catastrophe modelling (Chang et al. 2020), the intensifying pace of natural catastrophes has called into question the credibility of models used to assess insurers’ risk exposure to natural perils, particularly as it pertains to secondary peril costs and the potential knock-on effects of climate change (Mohrenweiser 2022).

ILS are essential for increasing insurance market capacity, thereby increasing the insurability of human catastrophes and natural disasters. CAT bonds (an ILS category) operate as a mechanism for transferring catastrophe risks to highly liquid capital markets and are favoured by capital market investors for offering yields largely uncorrelated with ongoing macroeconomic conditions. In return, investors assume the risk of losing some or all of their investment when catastrophes occur, at which point the bond principal is returned to insurers to offset disaster-related losses. CAT bonds are triggered through three mechanisms: parametric, industry loss, and indemnity. Parametric triggers align payouts to the occurrence and strength of the catastrophe rather than the losses incurred. Indemnity and industry loss triggers are both based on the size of the economic losses. While indemnity triggers base CAT bond payouts on the actual insurance loss experienced by the issuer, industry loss triggers base payouts on the aggregate losses assumed by the entire insurance industry. To generate accurate assessments of industry-wide losses, third-party assessors are contracted to provide independent estimates, which impacts the efficiency of payments. The greatest benefit afforded by CAT bonds is their ability to increase insurance capacity and penetration in areas particularly exposed to natural hazards, which may otherwise be deemed “uninsurable” (Jaffee and Russell 1997). By transferring climate-related peril risks to large institutional investors, risk-linked securities, such as catastrophe bonds, increase the level of coverage that insurers can offer.

2.6 Improving insurance penetration

Improving insurance penetration across the EU single market would bring with it many positive externalities. While there is currently significant heterogeneity across Europe regarding insurance coverage, with some regions exhibiting significant vulnerability, EIOPA has identified a number of protection gaps in specific insurance markets (EIOPA 2020). This protection gap means that citizens and businesses are not well covered for disaster-related risk. Core to the issue of a high protection gap is local affordability and prevailing risk conditions. This is further exacerbated by insurers’ inability to differentiate between high-risk and low-risk areas. Modern insurance innovations, such as parametric insurance, can be used to accommodate diverse temporal (time-of-day clause) and spatial (distance clause) policy terms. Furthermore, blended finance and PPPs may strategically stimulate sustainable catastrophe insurance market development in high-risk regions with low insurance penetration rates. Two such business models that close protection gaps while encouraging the development of catastrophe insurance markets include:

2.6.1 Targeted insurance services for marginalised communities in high-risk areas

Marginalised communities are disproportionately impacted by climate change since they have limited resources to adapt to, and recover from, volatile climatic conditions. Micro-insurance has emerged as a low-cost insurance solution for individuals seeking small-scale risk coverage in exchange for paying small-scale premiums. Micro-insurance policies operate under strict maximum payout limits in order to ensure immediate access to capital. In the case of a natural catastrophe context, insurance companies can formulate index-based policies that pay out immediately when an adverse climate event is verified using spatial and temporal monitoring tools (local meteorological, hydrological, and climatological resources, drones and satellite imaging). Providing targeted micro-insurance services to vulnerable communities can allow for immediate relief for emergency supplies until such time that lengthy indemnification claims can be processed and policyholders reimbursed in full, where applicable.

2.6.2 Subsidised public–private insurance policies with ‘local spend’ conditions

Research on the spatial pattern of economic activity following extreme weather events indicates that neighbouring locations take over activities from the affected area, hampering local economy recovery efforts (Felbermayr et al. 2022). Key to the development of economic and societal resilience in areas impacted by climate disasters is the injection of capital to spend locally following an adverse event as a means of hastening economic recovery. The public–private partnership (PPP) insurance framework may include conditional subsidies to incentivise greater insurance penetration and increase demand for policies amongst exposed stakeholders. For example, local authorities could significantly subsidise the premiums offered to policy-seekers on condition that claim payouts are spent locally on the recovery effort. The envisioned utility of the PPP insurance subsidies lies in the creation of a closed-loop system that spurs an economic rebound from climate events and instils societal resilience to further climate events.

2.7 Cross-border disaster risk management

Despite the borderless nature of natural catastrophe events, cross-regional alliance frameworks are underdeveloped across national borders for both disaster risk management and insurance. For instance, there is potential for significant disparity in insurance capacity and penetration on either side of a national border [e.g., flood-insurance along the River Foyle which separates Donegal (Republic of Ireland) and Derry (Northern Ireland)]. This calls for a multi-risk approach to cross-regional collaborative efforts to mitigate the threat and impact of extreme climate events across borders. This includes the development of frameworks for risk assessments, regulatory assessments, risk communications, and risk transfer solutions to address the impact of transboundary natural disasters.

3 Concluding remarks

The (re)insurance community has historically played a key role in managing disaster risks. Collecting and processing risk data, chiefly for underwriting, pricing, and claims management, have always been at the core of the insurance value-chain. Consequently, the operation of the insurance market has significant economic and welfare functions for the wider society. From a sociological perspective, insurance can be defined as a social institution with extensive welfare and disciplinary effects on multiple actors (Baker 2010; Ericson and Doyle 2004). Insurance thus presents a par-excellence test-case for interrogating disaster risk pricing and reduction as it comprises a confluence of human security, risk transfer capacities, and cooperation networks.

New risk transfer innovations around climate change may leverage digital developments in human-centric and trustworthy artificial intelligence (AI) and machine vision to construct dynamic and accurate risk pricing models. Risk transfer products may, therefore, be underpinned by satellite data on a macro level and by images captured by autonomous drones on a more micro basis for exposure prediction and claims assessment. Blockchain and smart contract technologies can be leveraged to develop parametric claim triggers, enabling more prompt and efficient claim payments and leading to proactive disaster risk-mitigation by immediately deploying capital to afflicted regions to combat an ongoing event or hastening post-event economic recovery efforts.

Advancements in Artificial Intelligence (AI) and Big Data Analytics (BDA) have afforded the insurance sector many opportunities (OECD 2020; Riikkinen et al. 2018). Its implementation allows for broadening the scope and affordability of insurance, even to customers previously lacking cover. Core value-chain components like underwriting and claims handling can be improved by enabling insurers to make better-informed decisions and improve the transfer of disaster risks. However, effective AI governance and model transparency and explainability are essential within the applied insurance context (Owens et al. 2022). This view is echoed in the NATCAT research, with Dikshit et al. (2021) proposing the need for interpretable and explainable AI methods to be applied within the geohazard modelling domain. AI governance principles, including human oversight and data governance, are being developed by the AI HLEG (2019) and EIOPA’s Consultative Expert Group on Digital Ethics in insurance (EIOPA 2019).

Societal resilience to natural disasters is often hindered by administrative burdens relating to insurance claim payouts, slowing economic recovery efforts in areas affected by extreme climate events.However, advancements in Blockchain platforms have the potential to automate payments on catastrophe insurance policies. The employment of smart contract technology for disaster management significantly reduces waiting periods for the release of funds in combating ongoing extreme weather and ecological events and for use in post-event economic recovery efforts. Shifting elements of the insurance payout process along the temporal plane could create a series of win–win scenarios. Resources would be freed up to improve mitigation measures and reduce the gross claims over time. Parametric smart contract-enabled insurance products could be used to enact this task.

There are several examples of parametric insurance being used to improve regional resilience to catastrophes, including the African Risk Capacity Group (2023) (Parameters: Climate risk metrics; Third-party verifier: Africa RiskView satellite weather surveillance system) and AXA Climate (2022) (Parameters: US Tropical Cyclone; Third-party verifier: RMS, a Moody’s Analytics company). Given the predefined nature of the payment mechanisms, the pricing of parametric insurance is underpinned by scientific principles and transparent methodologies. Improved data quality is a key enabler for product design. Satellite data and autonomous drone imaging may be used to enhance risk exposure estimate pre-event, verify parametric triggers (at-event), and estimate disaster loss impact (post-event). Furthermore, traditional insurance policies can be designed with embedded parametric triggers. These will foster proactive risk prevention and reduction behaviours amongst policyholders in the event of a disaster. Faster access to funds combined with dynamic risk communication from the insurer will suppress disaster losses and accelerate community resilience to disasters.

Given the economic and societal effects of natural and anthropogenic hazards, systematic and cross-sectoral disaster risk management is critical. The DRM community and insurance industry interests are aligned in terms of their efforts to mitigate climate-related disasters. This alignment should be reflected in improved institutional linkages. Better facilitation of the exchange of knowledge, technologies and innovation is needed. The (re)insurance industry plays a central role in protecting societies, businesses and governments from the adverse impacts of climate-related natural catastrophes. However, there is significant heterogeneity across Europe regarding insurance coverage, with some regions exhibiting significant vulnerability. EIOPA’s investigations into insurance markets with significant protection gaps must be central to the EU’s ongoing efforts to build a disaster-resilient society (EIOPA 2020). Finally, protecting the supply side for risk transfer solutions and improving catastrophe insurance penetration across the EU single market offers substantial welfare benefits for the citizenry of the EU.

References

African Risk Capacity Group (2023). https://www.arc.int/. Accessed 31 March 2023

AI HLEG (2019) High-level expert group on artificial intelligence. https://www.aepd.es/sites/default/files/2019-12/ai-definition.pdf

Artemis (2022) Deal Directory | Catastrophe bond & ILS market charts, statistics and data. https://www.artemis.bm/dashboard/cat-bond-ils-market-statistics/. Accessed 30 March 2023

AXA Climate (2022) AXA Climate selects RMS HWind for wind parametric triggers. https://www.artemis.bm/news/axa-climate-rms-hwind-us-wind-parametric-trigger/

Baker T (2010) Insurance in sociolegal research. Annu Rev Law Soc Sci 6:433–447. https://doi.org/10.1146/annurev-lawsocsci-102209-152839

Botzen W, van den Bergh J, Bouwer L (2010) Climate change and increased risk for the insurance sector: a global perspective and an assessment for the Netherlands. Nat Hazards 52:577–598. https://doi.org/10.1007/s11069-009-9404-1

Botzen WW, Deschenes O, Sanders M (2019) The economic impacts of natural disasters: a review of models and empirical studies. Rev Environ Econ Policy. https://doi.org/10.1093/reep/rez004

Chang CW, Wang Y-J, Yu M-T (2020) Catastrophe bond spread and hurricane arrival frequency. N Am J Econ Financ 54:100906. https://doi.org/10.1016/j.najef.2019.01.003

Clarke DJ, Grenham D (2013) Microinsurance and natural disasters: challenges and options. Environ Sci Policy 27:S89–S98. https://doi.org/10.1016/j.envsci.2012.06.005

Copernicus (2023) Copernicus: the European Union’s Earth observation programme. https://www.copernicus.eu/en. Accessed 30 March 2023

Coronese M, Lamperti F, Keller K, Chiaromonte F, Roventini A (2019) Evidence for sharp increase in the economic damages of extreme natural disasters. Proc Natl Acad Sci USA 116:21450–21455. https://doi.org/10.1073/pnas.1907826116

Cummins JD, Mahul O (2009) Catastrophe risk financing in developing countries: principles for public intervention. World Bank Publications, Washington. https://doi.org/10.1596/978-0-8213-7736-9

Dikshit A, Pradhan B (2021) Interpretable and explainable AI (XAI) model for spatial drought prediction. Sci Total Environ 801:149797. https://doi.org/10.1016/j.scitotenv.2021.149797

Dikshit A, Pradhan B, Alamri AM (2021) Pathways and challenges of the application of artificial intelligence to geohazards modelling. Gondwana Res 100:290–301. https://doi.org/10.1016/j.gr.2020.08.007

Dtissibe FY, Ari AAA, Titouna C, Thiare O, Gueroui AM (2020) Flood forecasting based on an artificial neural network scheme. Nat Hazards 104:1211–1237. https://doi.org/10.1007/s11069-020-04211-5

EC DRMKC (2023) European Commission Disaster Risk Management Knowledge Centre. https://drmkc.jrc.ec.europa.eu/risk-data-hub/. Accessed 30 March 2023

EFAS (2023) European Flood Awareness System. https://www.efas.eu/en. Accessed 30 March 2023

EFFIS (2023) European Forest Fire Information System. https://effis.jrc.ec.europa.eu/. Accessed 30 March 2023

EIOPA (2019) EIOPA establishes consultative expert group on digital ethics in insurance. https://www.eiopa.europa.eu/eiopa-establishes-consultative-expert-group-digital-ethics-insurance-2019-09-17_en

EIOPA (2020) The pilot dashboard on insurance protection gap for natural catastrophes. https://www.eiopa.europa.eu/publications/pilot-dashboard-insurance-protection-gap-natural-catastrophes_en. Accessed 30 March 2023

EIOPA (2021) EIOPA-BoS-14/253 EN: guidelines on system of governance. https://www.eiopa.europa.eu/sites/default/files/publications/eiopa_guidelines/eiopa-bos-14-253_gl_on_system_of_governance.pdf

Ericson RV, Doyle A (2004) Uncertain business: risk, insurance and the limits of knowledge. University of Toronto Press, Toronto

EUROPA RE (2023) Europa RE as Implementation Agency in response to climate change projects. Accessed 30 March 2023

European Commission (2021a) FirEUrisk multi-perspective strategy: a novel approach to build resilient communities towards wildfires. https://fireurisk.eu/. Accessed 30 March 2023

European Commission (2021b) H2020_Insurance: oasis innovation hub for catastrophe and climate extremes risk assessment. https://cordis.europa.eu/project/id/730381. Accessed 30 March 2023

European Commission (2021c) SILVANUS integrated technological and information platform for wildfire management. https://cordis.europa.eu/project/id/101037247. Accessed 30 March 2023

European Commission (2023a) Fire-RES innovative technologies & socio-ecological-economic solutions for fire resilient territories in Europe. https://fire-res.eu/. Accessed 30 March 2023

European Commission (2023b) TREEADS proposes a new approach towards fire-resilient European forests and communities. https://treeads-project.eu/. Accessed 30 March 2023

European Environment Agency (2022) Economic losses from weather and climate-related extremes in Europe reached around half a trillion euros over past 40 years. https://www.eea.europa.eu/highlights/economic-losses-from-weather-and

European Space Agency (2018) Customised forest assessment service for insurance. https://eo4society.esa.int/wp-content/uploads/2021/06/CASSIA_Final_Report.pdf. Accessed 30 March 2023

European Space Agency (2021a) Operational EO-based flood disaster risk financing. https://eo4society.esa.int/2021/07/12/operational-eo-based-flood-disaster-risk-financing/. Accessed 30 March 2023

European Space Agency (2021b) Space in support for the insurance sector. https://commercialisation.esa.int/2021/11/space-in-support-for-the-insurance-sector/. Accessed 30 March 2023

Felbermayr G, Gröschl J, Sanders M, Schippers V, Steinwachs T (2022) The economic impact of weather anomalies. World Dev 151:105745. https://doi.org/10.1016/j.worlddev.2021.105745

FEMA (2022) The National Flood Insurance Program provides insurance to help reduce the socio-economic impact of floods. https://www.fema.gov/flood-insurance. Accessed 30 March 2023

Galeotti M, Gürtler M, Winkelvos C (2013) Accuracy of premium calculation models for CAT bonds—an empirical analysis. J Risk and Insurance 80:401–421. https://doi.org/10.1111/j.1539-6975.2012.01482.x

Gurenko E (2006) Earthquake insurance in turkey: history of the turkish catastrophe Insurance Pool. World Bank Publications, Washington. https://doi.org/10.1596/978-0-8213-6583-0

Hallegatte S (2015) The indirect cost of natural disasters and an economic definition of macroeconomic resilience. World Bank Policy Research Working Paper

Horton JB (2018) Parametric insurance as an alternative to liability for compensating climate harms. Carbon Clim Law Rev 12:285–296. https://doi.org/10.21552/cclr/2018/4/4

Jaffee DM, Russell T (1997) Catastrophe insurance, capital markets, and uninsurable risks. J Risk Insurance. https://doi.org/10.2307/253729

Kunreuther H (2015) The role of insurance in reducing losses from extreme events: the need for public–private partnerships. Geneva Pap Risk Insurance-Issues Pract 40:741–762. https://doi.org/10.1057/gpp.2015.14

Levin J, Tadelis S (2010) Contracting for government services: theory and evidence from US cities. J Ind Econ 58:507–541. https://doi.org/10.1111/j.1467-6451.2010.00430.x

Lin X, Kwon WJ (2020) Application of parametric insurance in principle-compliant and innovative ways. Risk Manag Insurance Rev 23:121–150. https://doi.org/10.1111/rmir.12146

Mitchell-Wallace K, Jones M, Hillier J, Foote M (2017) Natural catastrophe risk management and modelling: a practitioner’s guide. Wiley, New York. https://doi.org/10.1002/9781118906057

Mohrenweiser JKL (2022) Hurricane Ian fallout will test cat bond investor appetite. https://www.fitchratings.com/research/insurance/hurricane-ian-fallout-will-test-cat-bond-investor-appetite-17-10-2022

Oasis LMF (2023) Oasis loss modelling framework. https://oasislmf.org/. Accessed 30 March 2023

OECD (2020) The impact of big data and artificial intelligence (AI) in the insurance sector. OECD, Paris

Owens E, Sheehan B, Mullins M, Cunneen M, Ressel J, Castignani G (2022) Explainable Artificial Intelligence (XAI) in insurance. Risks 10:230. https://doi.org/10.3390/risks10120230

Riikkinen M, Saarijärvi H, Sarlin P, Lähteenmäki I (2018) Using artificial intelligence to create value in insurance. Int J Bank Mark. https://doi.org/10.1108/IJBM-01-2017-0015

RMS (2017) UK government Department for International Development (DFID) commissioned report on disaster losses and aid payments. https://forms2.rms.com/DFID-Executive-Summary.html

Tsubokawa H (2004) Japan’s earthquake insurance system. J Jpn Assoc Earthq Eng 4:154–160. https://doi.org/10.5610/jaee.4.3_154

UNISDR, U (2015) Sendai framework for disaster risk reduction 2015–2030. In: Proceedings of the 3rd United Nations World Conference on DRR, Sendai, Japan

Vellinga M, Wood RA (2002) Global climatic impacts of a collapse of the Atlantic thermohaline circulation. Clim Change 54:251–267. https://doi.org/10.1023/A:1016168827653

Ward P, Shively G (2012) Vulnerability, income growth and climate change. World Dev 40:916–927. https://doi.org/10.1016/j.worlddev.2011.11.015

Winspear N (2020) Challenges in catastrophe modelling. https://oasislmf.org/application/files/7615/8693/7485/FINAL_Challenges_in_CAT_Modelling.pdf

Yao X, Wei H-H, Shohet IM, Skibniewski MJ (2017) Public-private partnership for earthquake mitigation involving retrofit and insurance. Technol Econ Dev Econ 23:810–826. https://doi.org/10.3846/20294913.2015.1075443

Zhang W, Gu X, Tang L, Yin Y, Liu D, Zhang Y (2022) Application of machine learning, deep learning and optimization algorithms in geoengineering and geoscience: comprehensive review and future challenge. Gondwana Res 109:1–17. https://doi.org/10.1016/j.gr.2022.03.015

Zhao Y, Yu M-T (2020) Predicting catastrophe risk: evidence from catastrophe bond markets. J Bank Financ 121:105982. https://doi.org/10.1016/j.jbankfin.2020.105982

Funding

Open Access funding provided by the IReL Consortium.

Author information

Authors and Affiliations

Contributions

The authors confirm the contribution to the paper as follows: BS: Conceptualization, Investigation, Writing—Original Draft, Visualization, Writing—Review & Editing. MM: Conceptualization, Investigation, Writing—Original Draft, Writing—Review & Editing. DS: Investigation, Writing—Original Draft, Writing—Review & Editing. OM: Investigation, Writing—Original Draft, Writing—Review & Editing.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Sheehan, B., Mullins, M., Shannon, D. et al. On the benefits of insurance and disaster risk management integration for improved climate-related natural catastrophe resilience. Environ Syst Decis 43, 639–648 (2023). https://doi.org/10.1007/s10669-023-09929-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10669-023-09929-8