Abstract

The reduction in energy consumption in shipping is a crucial issue to achieve a more sustainable sector. Nevertheless, investments in energy efficiency are inhibited by barriers. Consequently, under a Principal-Agent approach, this study aims to analyze the factors affecting the investment preference for either technical or operational measures. To date, the research problem has barely been addressed from a similar approach. This work further integrates agency theory with the identification of barriers and drivers, as well as the cost–benefit ratio from both an environmental and a financial perspective. This makes it possible to consider shipping management from a more comprehensive perspective. The study sample is current and representative (658 individual bulk carriers). The research was carried out utilizing two binominal logistic models that provide similar results when testing the proposed hypotheses. The outcomes show that regulatory factors, such as the distance of a vessel’s technical emissions from EEDI requirements (standardized coefficients: −2.8352 and −2.5069), and Principal-Agent problems, such as split incentives (standardized coefficients: −1.0059 and −0.9828), have the greatest influence on investment preferences. As a consequence of Principal-Agent problems, vessels operating under Time Charter contracts are less likely to invest in technical measures than in operational ones. Verified information and activity promote technical measures. Maritime regulation promotes technical measures in younger vessels, especially those meeting only the minimum requirements. Better knowledge can help achieve a more environmentally responsible shipping sector. The role of shipowners and charterers should be highlighted, and transparency should be promoted to enable well-informed decisions to be made.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

An increase of around 90–130% over 2008 maritime shipping emission levels has been forecasted by 2050 (IMO et al., 2021). Furthermore, there is an increasing trend in fuel prices that may make it difficult to assume energy costs (Fig. 1).

Source: MABUX Global Bunker Index (Marine Bunker Exchange, 2022). HSFO—High Sulfur Fuel Oil or HFO—Heavy Sulfur Fuel Oil; MGOLS—Marine Gas Oil Low Sulfur or MGO—Marine Gas Oil; VLS FO—Very Low Sulfur Fuel Oil

Evolution of fuel prices (2006–2022) in USD/mt.

This situation poses a major threat to sustainable shipping development, since transportation is responsible for one-third of supply chain emissions and subsequent environmental concerns (Abbasi & Ahmadi Choukolaei, 2023). Investment in energy efficiency (EE) becomes a relevant issue that can help to manage energy consumption and reduce emissions (Acciaro et al., 2013; Bouman et al., 2017; IEA, 2007). Each type of energy efficiency measure (EEM) has its own peculiarities, and those with a greater potential to reduce consumption and lower costs would be preferred. Nevertheless, their selection can also be affected by factors that either inhibit or promote investments (Dewan et al., 2018; Johnson & Andersson, 2016; Rehmatulla et al., 2017a, 2017b; Sorrell et al., 2004). The application of new technologies (machinery, propulsion and design) can help to resolve and prevent environmental issues. This is also true of nanotechnology and nanostructures (Esfahani et al., 2023; Rezayeenik et al., 2022; Zinatloo-Ajabshir & Salavati-Niasari, 2016, 2019; Zinatloo-Ajabshir et al., 2019, 2020, 2021) and the use of low-Sulfur fuels to meet SOx and particulate matter emission limits (Fig. 2) (ABS Advisory, 2021; IMO, 2022b).

Source: Own creation based on “Sulphur oxides (SOx) and Particulate Matter (PM) – Regulation 14” (IMO, 2022b)

SOx and particulate matter emission limits.

Based on these premises, we have focused the research problem on the investment preference for either technical or operational measures in maritime shipping, from the perspective of a Principal-Agent problem. So far, little quantitative research has analyzed the factors influencing investment decisions with this approach, much less as applied to the shipping sector (Acciaro et al., 2013; Adland et al., 2017; Agnolucci et al., 2014; Dirzka & Acciaro, 2021; Longarela-Ares, 2022; Longarela-Ares et al., 2020; Rehmatulla & Smith, 2015a, 2015b, 2020) or with an extensive study sample, such as the one in this work. This paper also integrates aspects commonly addressed in isolation in the literature: the valuation of costs and benefits of the implemented EEMs; the analysis of agency problems and barriers/drivers. Our study is based on a binomial logistic regression model with two specifications: one from a financial perspective and another from an environmental perspective. Considering both perspectives allows for a more detailed analysis than has been done to date. This study could thus make a significant contribution to advancing knowledge in this field. The aim is to analyze the barriers and drivers considered and to determine the conditions under which the decision-maker prefers to invest in one type of EEM over another.

This paper focuses on business responses to sustainability issues to improve ship performance. This is a paramount issue, since EE is one of the key aspects of international policy in both private and public management in relation to Sustainable Development Goals (SDG). It stimulates cross-sectoral exchanges to promote innovative EEMs and reduce Principal-Agent problems. Consequently, this work links sustainable investment to EE management; it falls within several different scopes related to energy savings management, environmental impacts and investment. Furthermore, as a unique feature, it highlights multiple dimensions of sustainable development.

It should be noted that the study focuses on the period 2006–2019. The COVID-19 epidemic could affect transport and the sustainability of supply chain management in the coming years (Abbasi & Erdebilli, 2023; Abbasi et al., 2021, 2022a, 2022b, 2023a, 2023b, 2023c); however, it does not affect the period under consideration, since this crisis was unknown at the time when the investment decisions were originally made.

The following research questions (RQ) are considered:

-

RQ1 What are the most influential factors affecting the preference between technical and operational measures?

-

RQ2 Which factors inhibit/promote investment in each type of EEM?

-

RQ3 Could one factor act as an investment barrier in one type of EEM and as a driver in another?

-

RQ4 Do factors related to the Principal-Agent problem in agency theory have different effects on the preference for either technical or operational measures?

-

RQ5 Are the conclusions similar from both perspectives?

This paper is structured as follows: Sect. 2 presents a literature review. Section 3 presents the methodology, hypotheses and model (3.1); the definition of variables (3.2); study sample (3.3.); and statistical treatment (3.4). Section 4 reports on the empirical findings. Finally, Sect. 5 presents the main conclusions and findings (5.1), research limitations (5.2) and suggests future lines of research (5.3).

2 Background and literature review

EE can be increased through investments in technical energy efficiency measures (TMs) and operational energy efficiency measures (OMs) (Bouman et al., 2017; Psaraftis, 2016). Their reduction potential varies, depending on the characteristics of the EEMs (RightShip, 2020) and their costs change depending on the type of vessel in which they are implemented, its size and lifetime. Both EEM types coexist; larger investments in one type may be preferred over another. This decision falls into two general groups (Schwartz et al., 2020). EEMs with greater consumption reduction may be more expensive, so investors should consider both the costs and benefits (Ahn et al., 2017; Atodiresei et al., 2017; de Oliveira et al., 2022; Yuan et al., 2019). Adoption rates tend to be higher for projects with lower costs and greater benefits (Anderson & Newell, 2004). Consequently, measures with a higher benefit–cost ratio should theoretically be preferred, as seen from a financial and an environmental perspective.

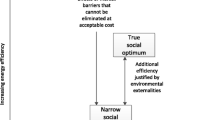

Nevertheless, the investment decision depends not only on the measure itself, it can also be affected by barriers and drivers, which have been analyzed in detail in the literature (Dewan et al., 2018; Johnson & Andersson, 2016; Maddox Consulting, 2012; Rehmatulla, 2014). We focus on the application of economic barriers (market barriers and failures) and drivers from a Principal-Agent approach (Dewan et al., 2018; Dirzka & Acciaro, 2021; Rehmatulla & Smith, 2015a, 2020).

Market barriers are related to capital constraints and the EE gap (Sorrell et al., 2004). TMs usually entail higher investment costs than OMs, and the latter may even have a negative or zero cost (Dewan et al., 2018; Faber et al., 2009; Jafarzadeh & Utne, 2014; Johnson et al., 2014). Therefore, financial barriers may be a more significant hindrance to TM investments (Dewan et al., 2018). Capital constraints can also hinder investment, unless they produce returns above the minimum expected by investors (Bukarica & Tomšić, 2017; Jafarzadeh & Utne, 2014; Schleich & Gruber, 2008; Stulgis et al., 2014). Another market barrier is heterogeneity; a measure may be considered cost-effective and implemented in one vessel type, but not in another (Bouman et al., 2017; Rehmatulla, 2012). Hidden costs can outweigh the benefits of EEMs (Acciaro et al., 2013; Jafarzadeh & Utne, 2014; Maddox Consulting, 2012; Sorrell et al., 2004) and uncertainty and risks may delay or lead to the rejection of a viable project (Sorrell et al., 2004).

Split incentives and informational barriers are the most important market failures (Blumstein et al., 1980; Brown, 2001; Jensen & Meckling, 1976; Ross, 1973). They result from transaction costs, as well as imperfect and asymmetric information (Bukarica & Tomšić, 2017; Sanstad & Howarth, 1994; Sorrell et al., 2000). In shipping, it is quite difficult to obtain reliable information and discern which means of energy consumption reduction are due to technological, exogenous or management factors. Information asymmetries can lead to opportunism, limited rationality, risk aversion and giving priority to other types of projects (Anderson & Newell, 2004; Faber et al., 2009; Jaffe & Stavins, 1994; Reddy & Painuly, 2004).

Shipowners and charterers may have different goals and few incentives to invest. Shipowners prefer to reduce possible investment costs if they cannot recover them through energy cost savings (Agnolucci et al., 2014). Charterers want shipowners to improve EE to obtain savings or a more innovative vessel (Rehmatulla, 2014). Consequently, reaching a socially optimal level of EE can be difficult, due to split incentives (Rehmatulla & Smith, 2015a; Stulgis et al., 2014).

Informational failures and split incentives cause Principal-Agent problems in agency relationships, since the verification of an agent’s actions can be complicated (Akerlof, 1970). The most common example in the field of EE is the landlord-tenant relationship in the residential sector (Blumstein et al., 1980). In shipping, the principal (charterer) delegates the investment decision to an agent (shipowner) in exchange for a freight rate, while the principal obtains a benefit and the agent has decision-making capacity as the principal’s representative (Dirzka & Acciaro, 2021; Jensen & Meckling, 1976; Ross, 1973).

The Principal-Agent relationship can be classified according to each party’s responsibilities, as reflected by Vernon and Meier (2012),IEA (2007), Meier and Eide (2007) and Murtishaw and Sathaye (2006). This classification can be extrapolated to shipping and its impact has already been investigated (Agnolucci et al., 2014; Dirzka & Acciaro, 2021; Longarela-Ares et al., 2020; Rehmatulla & Smith, 2015a, 2020). Previous findings indicate that there are two possible kinds of split incentives: one concerning the technical efficiency of the end-use device (efficiency problems) and another concerning the demand for energy services (usage problems). It depends on whether the charter contract type under which the vessel operates is a Time Charter (TC) or a Voyage Charter (VY) contract. The shipowner usually decides on the EE level and the implementation of TMs and pays the investment and vessel costs. The main differences to consider are who has operational control and who bears the energy costs (Plomaritou, 2014). Under TC contracts, the charterer has operational control and assumes the travel costs, including fuel charges, so it reaps the financial benefit (Bouman et al., 2017; Plomaritou, 2014; Rehmatulla, 2014). Consequently, shipowners have no incentive to invest in TMs unless they can recoup their investment through energy cost savings; the same applies to charterers, since they do not own the vessel (Agnolucci et al., 2014). Therefore, charterers may be more likely to implement OMs to improve voyage efficiency, which can mitigate the efficiency problem (Bouman et al., 2017; Rehmatulla, 2014).

Under VY contracts, shipowners assume all costs, decide on the EEMs and may demand a higher freight rate from charterers, since the latter pay no travel costs (Plomaritou, 2014; Rehmatulla & Smith, 2015a). Charterers are not the end-users, as the operation is still carried out by the shipowners (Plomaritou, 2014; Rehmatulla, 2014). Therefore, the usage problem may not apply. Moreover, the established speed may not be always the most energy-efficient one, since charterers do not pay the freight rate in direct relation to it, suggesting an incentive for shipowners to prefer TMs (Rehmatulla, 2012, 2014).

With regard to drivers, economic-financial drivers can help to reduce capital constraints and Principal-Agent problems (Stulgis et al., 2014; Thollander et al., 2013). They include funding to lower the risk and reduce capital costs (Cagno et al., 2015; Stevens et al., 2015; Thollander & Ottosson, 2008) from equity firms or third-party financing sources (Maddox Consulting, 2012; Makinson, 2006; Painuly et al., 2003; Stulgis et al., 2014).

Regulation can assist by demanding mandatory compliance with emissions reduction requirements. In this sense, the International Maritime Organization (IMO) has responded to the need to decarbonize the shipping industry (Yuan et al., 2019) at the 62nd session (July 2011) of the IMO MEPC (Marine Environment Protection Committee),with the adoption of amendments to MARPOL Annex VI (IMO, 2011b,(IMO requirements) establish the Energy Efficiency Design Index (EEDI) and the Ship Energy Efficiency Management Plan (SEEMP). The SEEMP focuses on operational aspects applicable to the existing and future fleet (Dewan et al., 2018; Psaraftis, 2016), and compliance with EEDI necessitates technical investment in vessels built in or after 2013 that have a Gross Tonnage over 400 GT (IMO, 2011b, Psaraftis, 2016). Furthermore, as seen in the ABS Advisory (2021), the IMO’s Sulfur Cap tightened SOx emission limits. MARPOL Annex VI and its revisions require the use of low-Sulfur fuels, depending on the maritime areas in which the vessels operate (ABS Advisory, 2021; IMO, 2022a). This, together with key managerial performance indicators, can also contribute to developing environmentally sustainable ports and assist with decision-making within the inter-organizational relationships with shipping lines (Di Vaio et al., 2018). Regulations, shareholders and managers can also put pressure on stakeholders to foster a responsible image of the business (Armstrong & Banks, 2015; Rojon & Dieperink, 2014).

Reliable information counteracts informational failures, reducing the risk and uncertainty of vessel performance (Agrell & Bogetoft, 2017; Hrovatin & Zorić, 2018; Maddox Consulting, 2012). In addition to other indicators, such as the Existing Vessel Design Index (EVDI) (RightShip, 2013), the IMO can help to develop an adequate EEDI calculation and counteract the lack of transparency (Gençsü & Hino, 2015). Moreover, the digitalization of operational processes and artificial knowledge in digital transformation training can contribute to sustainable and innovative shipping development (Di Vaio et al., 2023a; Giudice et al., 2022). This information can prompt charterers to opt for more efficient vessels, and thus shipowners are more likely to increase the EE of vessels to be more competitive. Furthermore, additional training could be needed to improve the information quality. In particular, training for women is called for, to support gender equality and technological development in shipping management (Di Vaio et al., 2023a, 2023b).

The eligibility of EEMs could obviously be affected by benefits and costs and different factors that inhibit or promote investment. We consider these aspects to take into account the barriers and drivers that impact the investment preference between TMs and OMs, in terms of the financial and environmental performance of EEM types.

3 Methodology

The hypotheses are formulated based on the literature review and the predictable investment preference for either TMs or OMs is indicated; the variables are also defined and the data and statistical treatment are shown.

3.1 Hypotheses and model

The hypotheses allow us to analyze, on a vessel level, the impact of Principal-Agent problems, regulation and activity on the investment preference for either TMs or OMs (Table 1).

H1 focuses on Principal-Agent problems and split incentives from charter contracts. If vessels operate under TC contracts, shipowners will be less likely to invest in TMs, since they cannot recoup the investment costs through energy costs savings that are not fully reflected in the second-hand market or freight rates (Adland et al., 2017; Agnolucci et al., 2014; Dirzka & Acciaro, 2021; Rehmatulla & Smith, 2015a). TMs would only be applied to vessels with enough lifetime to fully recover investment costs (Faber et al., 2009; Sorrell et al., 2004; Wang et al., 2010) or if sufficient energy cost savings percentage can be recovered (Adland et al., 2017; Agnolucci et al., 2014; Rehmatulla & Smith, 2020). Similarly, charterers will also choose not to invest in TMs, since they do not own the vessels and the contract duration may be too short for this purpose (Rehmatulla & Smith, 2015a). Meanwhile, under VY contracts, investments in OMs are less likely, since shipowners may prefer technologies that maintain the profit margin (Dewan et al., 2018; Rehmatulla, 2012). This may be explained by the charterer’s lack of direct control over vessel operations and the recovery of energy cost savings by shipowners (Rehmatulla, 2012; Rehmatulla & Smith, 2015b).

H2 allows us to observe the information quality effects. Usually, information about technical aspects is more accessible and less difficult to monitor than operational information, thus reducing failures and improving the probability of investing in TMs (Hochman & Timilsina, 2017; Schleich & Gruber, 2008). Verified information leads to greater reliability. Nevertheless, the lack of information or informational asymmetry could favor OMs, as they could entail lower costs (Agnolucci et al., 2014; Rehmatulla, 2014).

H3 and H4 focus on regulatory aspects. H3.a focuses on vessel age and H3.b focuses on EEDI requirements related to vessel age (Agnolucci et al., 2014; IMO, 2011a, 2011b). The probability of investing in TMs over OMs is expected to decrease as the vessel ages, since TMs are usually expensive and older vessels have a short remaining lifetime in which to recover the investment (Dewan et al., 2018). This probability increases in younger vessels built in or after 2013, due to EEDI requirements (H3.b) (Longarela-Ares et al., 2020).

H4 refers to EEDI requirements related to additional investments (IMO, 2020a). Consequently, the wider the gap is from EEDI requirements, the lower the probability of investing in TMs is over OMs. This is because vessels with a value lower than the minimum required EEDI value already comply with IMO requirements in terms of technical emissions (IMO, 2011a, 2011b). Nevertheless, shipowners could be motivated to improve technical efficiency beyond regulatory requirements to be competitive (RightShip, 2013) or in anticipation of a new tightening of requirements. Therefore, if the disparity concerning EEDI requirements decreases, additional investments could be needed (Bazari & Longva, 2011; CE Delft, 2016; Dewan et al., 2018).

H5 focuses on vessel activity. Activity promotes investment as a long-term energy strategy to improve the company’s green image and its competitiveness (Cagno et al., 2015; Hasanbeigi et al., 2010; Saether et al., 2021; Trianni et al., 2017). Shipowners must compare the risk of having an innovative vessel that may depreciate faster than expected to the risk of a conventional vessel with higher costs (Faber et al., 2009; Rehmatulla & Smith, 2015b). Vessels with intensive activity can emit more harmful emissions, sometimes even if they are more efficient than less active vessels. They can also bear higher investment costs and permit easier access to capital, if greater activity implies greater incomes.

H6 focuses on vessel size. Larger vessels can have more stable freight rates for a longer time (Goulielmos, 2013) and be more efficient than smaller ones. Therefore, even though size does not follow a fixed pattern (Arvanitis & Ley, 2013), larger vessels might be less likely to invest in TMs than in OMs.

3.2 Definition of variables

Variables were defined based on the hypotheses and the literature. EEMs help to reduce energy consumption, resulting in energy cost savings and a reduction in CO2 emissions. The investment decision among EEMs makes it possible to classify vessels according to their preference for either TMs or OMs, which can be compared based on monetary aspects and environmental sustainability. Consequently, we propose two models, one from a financial perspective (FBC) and the other from an environmental perspective (EBC). Both models have a dichotomous dependent variable, and their purpose is to determine the preference of each vessel for either TMs or OMs, depending on whether it maximizes the value of the financial or environmental aspects. Below is an explanation of how the dependent and independent variables are defined.

3.2.1 Dependent variables

In the FBC model, the dependent variable for each vessel \(i\) of \(I\) (\({FBC}_{i}\)) takes on the value of the type of EEM with the higher financial benefit per cost unit of the vessel, as shown in Eq. (1). In the EBC model, the dependent variable for each vessel \(i\) of \(I\)(\({EBC}_{i}\)) has the value of the type of EEM with the higher environmental benefit per cost unit, as shown in Eq. (2).

The \({FBC}_{iTM}\) and \({FBC}_{iOM}\) of each vessel \(i\) are calculated as shown in Eq. 3. The \({EBC}_{iTM}\) and \({EBC}_{iOM}\) of each vessel \(i\) are calculated as shown in Eq. 4. The four values are based on the criterion of benefit–cost ratio (see Ahn et al., 2017; Albi & Onrubia, 2016; Wang & Corbett, 2007;; Wang et al., 2015), considering the aggregate effect of each measure type (TMs or OMs) as specified by Schwartz et al. (2020) and Yuan et al. (2016). Both equations have the same denominator, which refers to the maximum potential annualized cost in USD for each EEM type. The numerator of Eq. (3) refers to the annualized maximum potential savings of energy costs in USD for each EEM type, where \({\eta }_{i}\) is the set of EEMs of type \(\eta\) (TM or OM) implemented by the vessel \(i\) and \(\#{\eta }_{i}\) is the number of EEMs in \({\eta }_{i}\). The numerator of Eq. (4) refers to the maximum annual emission reduction potential of emissions in mt of CO2 for each EEM type. The components of Eqs. 3 and 4, \({FC}_{i}\), \({FP}_{im}\),\({AEE}_{im}\), \({CAPEX}_{im}\), \({OPEX}_{im}\), k, \({t}_{im}\) and \({EF}_{im}\), are defined below.

\({FC}_{i}\) represents the annual fuel consumption of each vessel \(i\) in mt (Eq. (5)). \({MCR}_{i}\) is the total engine power of the vessel \(i\), estimated according to the Cepowski method (2019) in kW, considering the mean values of bulk carrier parameters based on Deadweight Tonnage (DWT) capacity and design speed. \({d}_{i}\) is the average hour/year at sea of the vessel \(i\), based on estimations from the Fourth IMO GHG Study (IMO et al., 2021). \(\tau =180*0.907185*{10}^{-6}\) is the typical fuel consumption for medium-speed and high-speed main engines in mt/kWh, according to engine manufacturers (Psaraftis & Kontovas, 2009; Wild, 2005).

\({FP}_{im}\) represents the annualized fuel price in USD per mt of each vessel \(i\) and implemented EEM. \(m\). \({FP}_{im}\) is the average between the maritime areas \(h\) of \({\widetilde{AFP}}_{imh}\), weighted by the percentage of vessels traveling in each area (\({PV}_{ih}\)), as shown in Eq. (6). \({\widetilde{AFP}}_{imh}\) is the annualized price in USD of the sum of the \({AFP}_{rh}\) discounted in each of \(H\) maritime areas \(h\) for each \({t}_{im}\) years from \({r}_{im}\), based on the annuity method and \(k\) factor (Eq. (7)). \({AFP}_{rh}\) is the average fuel price in USD of the area \(h\) in the year \(r\) for the combination of HFO380, VLSFO and MGOLS fuel types, according to the fuel types authorized by IMO’s Sulfur restrictions (see ABS Advisory, 2021), considering the combination of fuel types with a proportion of 90–95% of days at sea and 5–10% of days at sea entering and leaving an area close to a coast or port, as per a maritime expert’s advice. \({t}_{im}\) is the minimum value of either an EEM \(m\) lifetime (\({LFM}_{m}\)) or the \(i\) lifetime of each vessel during the implementation year of the EEM \(m\) (\({r}_{im}\)), considering 25 years as the average maximum vessel lifetime and where \({YOB}_{i}\) is the year a vessel \(i\) is built (Eq. (8)). \(k\) is the discount rate in percentage obtained from Eq. (9), considering the CAPM (Capital Asset Pricing Model), where \({R}_{f}\) is the average of the risk-free rate in real terms of T-Bonds from \({r}_{max-10}\) to \({r}_{max}\), where \({r}_{max}\) is the maximum \({r}_{im}\); \(E\left({R}_{m}\right)\) is the average of the implied equity risk premium and \(\beta\) is the average unlevered beta from the shipbuilding and marine industry.

.

\({AEE}_{im}\) is the potential reduction in fuel consumption by the engine in terms of the percentage that a vessel \(i\) expects to obtain from an EEM \(m\). \({CAPEX}_{im}\) represents the capital expenditures associated with purchasing and installing an EEM \(m\) in USD,and was annualized based on the annuity method and \(k\) factor.\({OPEX}_{im}\) represents the annual operating expenditures of a vessel \(i\) associated with an EEM \(m\) in USD. Both \({CAPEX}_{im}\) and \({OPEX}_{im}\) also depend on the DWT and vessel type. This study assumes that the EEMs were applied during the scheduled dry-dock period, so there are no opportunity costs, as in Irena et al. (2021).

\({EF}_{im}\) is the annual emissions conversion factor of a vessel \(i\) and an EEM \(m\). It is obtained from the average between the maritime areas \(h\) of \(\overline{AE{F }_{imh}}\) pondered weighted by the percentage of vessels traveling in each maritime area (\({PV}_{ih}\)), as shown in Eq. (10). \(\overline{AE{F }_{imh}}\) is calculated as shown in Eq. (11) and is the average of the sum of \({AEF}_{rh}\) in each of the \(H\) maritime areas \(h\) for every \({t}_{im}\) years from \({r}_{im}\). \({AEF}_{rh}\) is the emission conversion factor at sea for bulk carriers in zone \(h\) during year \(r\), combined according to the fuel types authorized under the IMO’s Sulfur restrictions (see ABS Advisory, 2021). The combination of fuel types over \({t}_{im}\) and in each area \(h\) considers the same proportion as \({AFP}_{rh}\). HFO/VLSFO (see Entec UK Limited, 2002; Merk, 2014). MDO/MGO (Marine Diesel Oil/Marine Gasoil Oil) conversion factors in gCO2/kWh, based on general proportions from Merk (2014) with HFO/VLSFO, were considered in mtCO2/mt, taking into account that 180 g/kWh is the typical fuel consumption for medium- and high-speed main engines, according to the advice from engine manufacturers and experts (Psaraftis & Kontovas, 2009; Wild, 2005).

3.2.2 Independent variables

Furthermore, it must be noted that investments are not isolated decisions, rather they are integrated into the overall strategy of a business. Aspects such as Principal-Agent problems, information, activity and regulation are factors that can influence the choice from among the EEM types that were considered in this research (Table 2).

CTC (the most common charter contract type under which the vessel operates) shows the impact of split incentives derived from the shipowner-charterer relationship (IEA, 2007; Murtishaw & Sathaye, 2006; Rehmatulla & Smith, 2015a, 2020; Vernon & Meier, 2012). CTC was defined similarly to chartering ratios, according to which a value of 1 represents TC contracts with efficiency problems and a value of 0 indicates VC contracts with usage problems (Rehmatulla, 2014; Rehmatulla & Smith, 2015a).

IFE (quality of information on technical emissions) is a variable related to informational issues and failures. IFE indicates whether or not information about technical emissions is verified (RightShip, 2020) based on dichotomous variables (Aravena et al., 2016; Hrovatin & Zorić, 2018; Schleich & Gruber, 2008).

AGE (EEDI requirements impact by age range) shows the need to comply with EEDI requirements based on \({YOB}_{i}\), which is mandatory for the \(YV\) group or vessels built in or after 2013 (IMO, 2011b). \(YV\) is the reference level with which the \(MV\) group of vessels (built in 2006 or later, up to and including the year 2012), and the \(AV\) group of vessels (built before 2006) are compared.

DEE (distance of the vessel’s technical emissions from EEDI requirements) shows the distance of the vessel’s technical emissions (\(AttainedEEDI\)) from the minimum value required by the regulation (\(RequiredEEDI\)), estimated as indicated in Annex 19 of Resolution MEPC.203(62) adopted on July 15, 2011 (IMO, 2011a). DEE is positive for vessels that comply with the regulation.

ACT (annual vessel activity) shows the intensity of a vessel’s activity. Activity can be measured in different ways, such as anticipated demand or sales (Arvanitis & Ley, 2013; Makinson, 2006). In this research, ACT is defined as the average annual number of contracts a vessel \(i\) has in the period between the greatest value of either the \({YOB}_{i}\) or 2006 and the year 2019.

SIZE (vessel size) represents the DWT of a vessel, a characteristic measured as in previous studies (Acciaro et al., 2013; Longarela-Ares et al., 2020), albeit with a change in scale.

3.3 Study sample

Data were collected from different sources, focusing on bulk carrier vessels active from 2006 to 2019 that also invested in EEMs, where \({r}_{max}\) is 2019.

Information about vessel characteristics (age, \({YOB}_{i}\) and size) and information about vessel contracts (charter contract type, activity and maritime areas traveled) were obtained from Refinitiv Eikon (2020). Information about \(AttainedEEDI\) and IFE were obtained on a vessel level from Rightship (Lockley et al., 2013; RightShip, 2013, 2020). The \(AttainedEEDI\) value is not publicly available for all vessels. In light of this, the EVDI indicator is used, since it is supported by reliable data sources, such as RightShip’s Ship Vetting Information System (SVIS), the IHS Fairplay database, classification societies and ownership-sourced data (ABB, 2012; Svensson & Andersson, 2011).

In relation to the implemented EEMs, \({AEE}_{im}\) and \({r}_{im}\) measurements were obtained at a measure level from Rightship (Lockley et al., 2013; RightShip, 2013, 2020). EEMs implemented in sample vessels are combinable and based on real data. Anonymous vessel information was used to ensure data confidentiality. \({CAPEX}_{im}\) and \({OPEX}_{im}\), dependent on DWT and vessel type, and \({LFM}_{m}\) were obtained from the manufacturers, the literature and IMO reports (Buhaug et al., 2009; DNV GL & IMO, 2016a, 2016b; IMarEST, 2010; IMO et al., 2014, IMO et al., 2021; Irena et al., 2021).

IMO requirements were consulted to determine regulatory aspects related to AGE and DEE (IMO, 2011a, 2011b) and the IMO’s Sulfur restrictions were consulted to determine the fuel types authorized in each area \(h\) and year \(r\), considering \(H=7\) maritime areas: ECAs, EU, China and global areas with and without scrubbers (ABS Advisory, 2021). Prices of HSFO380, VLSFO and MGOLS fuel types were obtained from the MABUX Global Bunker Index (Marine Bunker Exchange, 2022); fuel price estimations of the impact of future fuel prices were made within a range of results similar to the literature (IMarEST, 2011; Irena et al., 2021). \({R}_{f}, E\left({r}_{m}\right)\) and \(\beta\) were obtained from Damodaran (2022). \(k\) is close to 6.9%, which agrees with the literature (Ahn et al., 2017; Eide et al., 2011; IMO et al., 2021; Irena et al., 2021). Table 3 summarizes the data sources and the aforementioned data collection process.

The data were merged and unified into a sample with \(I=658\) unique vessels using the statistical program R (2018). Vessels with incomplete data or under 10,000 DWT were discarded. This research considers a representative sample, making it possible to study on a large scale issues similar to those considered in previous works focused on a limited number of ships or measurements (Ahn et al., 2017; Rehmatulla & Smith, 2020; Yuan et al., 2019). Furthermore, the sample allows the true influence of barriers and drivers to be observed by using data on actual investments.

3.4 Statistical treatment

In this study, two specifications of a binominal logistic regression were carried out (Aldás & Uriel, 2017; Hilbe, 2009) based on previous studies concerning factors that influence investment decisions (Arvanitis & Ley, 2013; Hrovatin & Zorić, 2018; Hrovatin et al., 2016; Trotta, 2018). The model allows us to determine the investment preference between TMs and OMs for each vessel. The dependent variable of each specification of the model (Y) has a binomial distribution and is conditioned by the different values of the variables (Xj). The dependent variables are IFBC in the FBC model and IEBC in the EBC model, as explained in Table 2.

Logistic regression models are estimated according to maximum likelihood. The model has a non-linear expression, which is given in Eq. 12. For an individual vessel \(i\) with characteristics represented by \(n\) variables in the model specifications, Eq. 12 estimates the probability that the dependent variable has a value of 1 (preferring investments in TMs over OMs). As usual, a linear relationship between the dependent variable and the explanatory variables has been considered.

A stepwise process was used to select the variables for both specifications. The process was carried out based on a saturated model, with the rest of the explanatory variables already defined (Table 2). A Wald test of significance for each estimated coefficient and a likelihood ratio test of the overall significance of the model were applied. The variables selected must be relevant, with a significance level of 0.05, and present signs consistent with those theoretically expected from the hypotheses (Table 1).

The significance of each estimated coefficient indicates whether the influence of the factor on the investment preference for TMs or OMs is statistically significant. The sign of the estimated coefficient indicates whether a factor inhibits (barrier) or promotes (driver) the investment preference. Each variable is measured in standard deviation units with standardized coefficients, and may therefore be compared on an equal basis. The standardized coefficient makes it possible to rank the relevant factors according to their level of influence on the investment preference when they have different metrics, as in this case. The standardized coefficient of the \({\beta }_{j}\) or estimated coefficient of the factor \({X}_{j}\) (\({SC}_{j})\) is defined by the Eq. 13, where \(\frac{{\varvec{\pi}}}{\sqrt{3}}\) is the standard deviation of the fixed logistic distribution and \(\sigma ({X}_{j})\) is the standard deviation of \({X}_{{\varvec{j}}}\) standard deviation (Hilbe, 2009).

To analyze the explanatory power of the estimated model specifications, we use goodness-of-fit statistics. LL is the natural logarithm of the likelihood function. It is unbounded and uninterpretable. The higher the value is the better the fit. The Fitting factor (FF) is the percentage of observations in the sample correctly classified by the model. The minimum value required is usually 62.5%. Nagelkerke (\({\rho }^{2}\)) correction of Cox and Snell’s (Nagelkerke, 1991) and McFadden’s Pseudo R2 has adequate values at levels between 10–60% in the logistic regression (Liao & McGee, 2003).

4 Results and discussion

The results from both models (Table 4) are similar and show that all the variables are statistically significant. Their estimated coefficient signs confirm the hypotheses (Table 1) and all the relationships with the dependent variable are validated. The goodness-of-fit and validation statistics are similar and produce acceptable results in the logistic regression (FF above 78% and Nagelkerke \({\rho }^{2}\) greater than 0.16).

The standardized coefficient columns (Table 4) show that the most influential variable in the two models is DEE (standardized coefficients: −2.8352 and −2.5069), followed by other regulatory factors (CTC:DEE and AGE) and split incentives (CTC). These results confirm the great impact that EEDI requirements from IMO and Principal-Agent problems associated with charter contracts have on TM and OM selection, which is consistent with the reviewed literature (Agnolucci et al., 2014; Bouman et al., 2017; Dirzka & Acciaro, 2021; Longarela-Ares et al., 2020; Rehmatulla & Smith, 2015a) and the justification of the hypotheses. Principal-Agent issues in this work have a more relevant impact on the selection of EEMs than on the investment decision itself (Longarela-Ares et al., 2020). IMO plays a relevant role in the limitation of the harmful impact of human activities to tackle climate change, which is in accordance with SDG (IMO, 2020b; Wu et al., 2020). The activity (ACT), information quality (IFE) and SIZE are significant variables, but they have little influence on EEM selection. In particular, the lower information impact could be due to the fact that most of the sample vessels have a verified EVDI.

CTC results show that split incentives still inhibit the adoption of one type of EEM over another, depending on the associated charter contract type and agency problems (H1). The more frequent the operations are under TC contracts, the lower the investment probability is in TMs than in OMs (standardized coefficients: −1.0059 and −0.9828), reflecting similar implications as in previous studies (Faber et al., 2009; Rehmatulla & Smith, 2015a; Rehmatulla et al., 2017a, 2017b) and in contrast with the results by Rehmatulla and Smith (2020). The latter considered that the disconnection between their hypothesis and findings could be due to research limitations. If investors do not have monetary benefits, they will be less likely to invest (Schwartz et al., 2020), while charterers are more likely to invest in OMs. If shipowners could recover a high percentage of energy cost savings or monetize the benefits of CO2 emissions reduction appropriately through freight rates or additional activity, this could help to counteract efficiency problems. For this purpose, savings could be included in contracts and freight agreements so that investors could also gain some benefit from the investment, as Schwartz et al. also conclude (2020). Meanwhile, under VY contracts, vessels are more likely to invest in TMs, since shipowners can benefit directly from savings.

Information quality regarding technical efficiency promotes investment in TMs over OMs (standardized coefficients: 0.5886 and 0.5690), thus corroborating H2. Nevertheless, most of the vessels seem to have few informational failures, which can help to reduce agency problems, but still more reinforcement is needed. In a situation of informational failures, shipowners are more likely to opt for OMs, perhaps since most imply lower investment costs (Agnolucci et al., 2014; Rehmatulla, 2014).

Related to the vessel’s age and EEDI requirements, older vessels are less likely to invest in TMs than OMs as compared to younger vessels, as AGE_AM (standardized coefficients: −1.278 and −1.2724) and AGE_AV (standardized coefficients: −1.4984 and −1.4779) show, corroborating H3.a (IMO, 2011b). The negative sign is also coherent with the positive sign of H3.b, since H3.b was formulated based on AGE_YV. This corroborates the impact of EEDI requirements on younger vessels, increasing the probability of investment in TMs as opposed to OMs, aided by the fact that longer lifetimes provide a longer time frame over which to recover the investment costs, in coherence with previous studies (Faber et al., 2009; Longarela-Ares et al., 2020; Wang et al., 2010).

Nevertheless, it is not only the building date that must be considered, since younger vessels can present different levels of compliance with regulations. The negative sign for DEE validates H4, since vessels with a greater distance from the required EEDI have a lower probability of investing in TMs as compared to OMs, possibly because they are still much more efficient than required by the regulation. Moreover, if vessels are close to the minimum required emissions or exceed them, they might prefer TMs. Even vessels that do not have to comply with this regulation may be more likely to invest in TMs to improve their competitiveness, responsible image or in anticipation of stricter requirements (IMO, 2021). As we can see in CTC:DEE, the DEE impact is lower in vessels operating under TC contracts. The distance of the vessel’s technical emissions from EEDI requirements can also have a different impact on the investment decision, depending on the charter contract type.

Despite the low impact in terms of activity (H5) and size (H6), smaller and more active vessels are more likely to invest in TMs as compared to OMs (standardized coefficients of SIZE: −0.5733 and −0.6057 SIZE; standardized coefficients of ACT: 0.6962 and 0.7089). This may be because larger vessels can be more efficiently designed, and intense maritime traffic entails more harmful emissions, but can also result in higher income. Therefore, vessels with high activity levels could bear TMs costs with fewer capital constraints, despite being more technically efficient (Schlomann & Schleich, 2015).

5 Conclusions

5.1 Findings

Understanding barriers to EEM investment is the first step to reducing their impact. We focus on comparing the influence of barriers and drivers on the preference for greater benefits per USD invested in TMs or OMs in agency situations. The first perspective considers financial benefits, such as energy cost savings (FBC), while the second considers environmental benefits, such as emissions reduction (EBC). This study provides some additional evidence supporting certain ideas taken from the reviewed literature with similar findings.

An appropriate answer has been provided to all the research questions, namely:

RQ1: the proven factors affecting the preference between TMs and OMs in the most influential way are regulatory factors and split incentives, as can be seen in the standardized coefficients columns in Table 4. The most influential variable is DEE (standardized coefficients: −2.8352 and −2.5069).

RQ2: the impact of each factor depends on its sign value. Regulation and activity encourage the adoption of TMs as compared to OMs. Vessels whose values far exceed those of EEDI requirements are less likely to invest in TMs than in OMs. Nevertheless, the opposite is true of vessels that merely comply with the minimum requirements or that are unaffected by these requirements. Reliable information favors TMs over OMs. Split incentives and efficiency problems (TC contracts) contribute to the fact that shipowners are less likely to invest in TMs as compared to OMs (standardized coefficients: −1.0059 and −0.9828), while usage problems (VY contracts) have the opposite effect.

RQ3: the same factor was confirmed, which can act as a barrier to TMs and at the same time as a driver to OMs and vice versa.

RQ4: depending on the type of contract, split incentives can have a greater impact on the preference for a specific type of measure over another, and the quality of information regarding EVDI favors investment in TMs (standardized coefficients: 0.5886 and 0.5690).

RQ5: the same conclusions are reached for both models. Consequently, either can be valid to analyze the research problem and determine the vessels in which one type of EEM is more or less likely to be implemented.

Our findings lead to important implications for a more sustainable shipping sector, since EE investment decisions will impact managerial areas related to finance, operations, energy, environment and governance. Split incentives still have an impact through charter contracts on EEM investment decisions. Nevertheless, regulation is contributing to reducing efficiency problems. Enforcement through regulation and policies is necessary when it is not possible to wait for the economic pull to take effect or there are agency problems (Eide et al., 2011). In this sense, the IMO will set more stringent requirements related to vessel emissions after 2022 (IMO, 2021), but work is still required to avoid limiting the ability to mitigate climate change (IMO, 2020b). Furthermore, greater implementation of EEMs is required and regulation cannot be the only way to promote them (Rehmatulla et al., 2017a, 2017b). The market may be starting to correct agency problems through contracts aligned with incentives and investment mechanisms. The role of shipowner-charterer market failures should be emphasized, focusing on funding to facilitate new financial solutions (Abadie et al., 2012; Acciaro et al., 2013; Charlier, 2015; Stulgis et al., 2014). Moreover, transparency regarding vessel efficiency through registries (Agnolucci et al., 2014; Rehmatulla & Smith, 2020) should be enforced to facilitate making well-informed decisions.

6 Research limitations

There are certain limitations to the data, as assumptions are made about certain vessel performance characteristics, fuel prices and interest rates in such a highly volatile market as the shipping sector. Furthermore, it was not possible to observe the impact of the COVID-19 epidemic during the sampling period.

6.1 Recommendations for future research

It would be valuable to expand upon this research, applying Principal-Agent problems to other stakeholders; analyzing EEM disbursement; considering the impacts of COVID-19; analyzing the Energy Efficiency Existing Ship Index (EEXI) and the Carbon Intensity Indicator (CII) in terms of future investments. It would also be interesting to consider future debates on the monetarization of CO2 emissions in shipping, once a regulatory framework comes into force. The latter topic addresses one of the demands of the sector to gain competitive advantages and would help to mitigate split incentives and informational asymmetries and to monetize CO2 reduction to benefit the contractual parties, as alleged by Schwartz et al. (2020) and Dirzka and Acciaro (2021).

Data availability

The data that support the findings of this study come from different sources. Some data are available from RightShip and Refinitiv Eikon Thomson Reuters, but restrictions apply to the availability of these data, which were used with the authorization of RightShip and with a Refinitiv Eikon license. They are not publicly available, since they contain sensitive information that could compromise the business privacy of maritime shipping companies without their consent. However, data are available from the authors upon reasonable request and with the permission of RightShip and Refinitiv Eikon. The authors declare that the other data supporting these study findings are available within the article and all the sources from which they have been obtained are referenced.

References

Abadie, L. M., Ortiz, R. A., & Galarraga, I. (2012). Determinants of energy efficiency investments in the US. Energy Policy, 45, 551–566. https://doi.org/10.1016/j.enpol.2012.03.002

ABB. (2012). An introduction to energy efficiency instruments. Generations, Chapter A. https://library.e.abb.com/public/f2d725f8505d277ec1257a8a002ba373/Generations_2012_single_page.pdf

Abbasi, S., Daneshmand-Mehr, M., & Kanafi, A. (2023). Designing a tri-objective, sustainable, closed-loop, and multi-echelon supply chain during the COVID-19 and lockdowns. Foundations of Computing and Decision Sciences, 48.

Abbasi, S., & Ahmadi Choukolaei, H. (2023). A systematic review of green supply chain network design literature focusing on carbon policy. Decision Analytics Journal, 6, 100189. https://doi.org/10.1016/j.dajour.2023.100189

Abbasi, S., Daneshmand-Mehr, M., & Ghane Kanafi, A. (2021). The sustainable supply chain of CO2 emissions during the coronavirus disease (COVID-19) pandemic. Journal of Industrial Engineering International, 17(4), 83–108. https://doi.org/10.30495/jiei.2022.1942784.1169

Abbasi, S., Daneshmand-Mehr, M., & Ghane Kanafi, A. (2022a). Designing sustainable recovery network of end-of-life product during the COVID-19 pandemic: A real and applied case study. Discrete Dynamics in Nature and Society, 2022, e6967088. https://doi.org/10.1155/2022/6967088

Abbasi, S., Daneshmand-Mehr, M., & Ghane Kanafi, A. (2023a). Green closed-loop supply chain network design during the coronavirus (COVID-19) pandemic: A case study in the Iranian Automotive Industry. Environmental Modeling & Assessment, 28(1), 69–103. https://doi.org/10.1007/s10666-022-09863-0

Abbasi, S., & Erdebilli, B. (2023). Green closed-loop supply chain networks’ response to various carbon policies during COVID-19. Sustainability, 15(4), 4. https://doi.org/10.3390/su15043677

Abbasi, S., Khalili, H. A., Daneshmand-Mehr, M., & Hajiaghaei-Keshteli, M. (2022b). Performance measurement of the sustainable supply chain during the COVID-19 pandemic: A real-life case study. Foundations of Computing and Decision Sciences, 47(4), 327–358. https://doi.org/10.2478/fcds-2022-0018

Abbasi, S., Sıcakyüz, Ç., & Erdebilli, B. (2023c). Designing the home healthcare supply chain during a health crisis. Journal of Engineering Research. https://doi.org/10.1016/j.jer.2023.100098

ABS Advisory. (2021). Marine Fuel Oil Advisory. ABS Advisory. https://ww2.eagle.org/content/dam/eagle/advisories-and-debriefs/marine-fuel-oil-advisory.pdf

Acciaro, M., Hoffmann, P. N., & Strandmyr Eide, M. (2013). The energy efficiency gap in maritime transport. Journal of Shipping and Ocean Engineering, 3, 1–10.

Adland, R., Alger, H., Banyte, J., & Jia, H. (2017). Does fuel efficiency pay? Empirical evidence from the drybulk timecharter market revisited. Transportation Research Part a: Policy and Practice, 95, 1–12. https://doi.org/10.1016/j.tra.2016.11.007

Agnolucci, P., Smith, T., & Rehmatulla, N. (2014). Energy efficiency and time charter rates: Energy efficiency savings recovered by ship owners in the Panamax market. Transportation Research Part a: Policy and Practice, 66, 173–184. https://doi.org/10.1016/j.tra.2014.05.004

Agrell, P. J., & Bogetoft, P. (2017). Decentralization policies for supply chain investments under asymmetric information. Managerial and Decision Economics, 38(3), 394–408. https://doi.org/10.1002/mde.2783

Ahn, J., You, H., Ryu, J., & Chang, D. (2017). Strategy for selecting an optimal propulsion system of a liquefied hydrogen tanker. International Journal of Hydrogen Energy, 42(8), 5366–5380. https://doi.org/10.1016/j.ijhydene.2017.01.037

Akerlof, G. A. (1970). The market for “Lemons”: Quality uncertainty and the market mechanism. The Quarterly Journal of Economics, 84(3), 488–500. https://doi.org/10.2307/1879431

Albi, E., & Onrubia, J. (2016). Institucionalizar la evaluación económica de políticas públicas: Eficiencia y rentabilidad social. Papeles De Economía Española, 26(147), 18.

Aldás, J., & Uriel, E. (2017). Análisis multivariante aplicado con R (2nd ed.). Paraninfo. https://www.paraninfo.es//catalogo/9788428329699/analisis-multivariante-aplicado-con-r--2a-ed-

Anderson, S., & Newell, R. (2004). Information programs for technology adoption: The case of energy-efficiency audits. In Resource and energy economics (Vol. 26, Número 1, pp. 27–50). Elsevier. https://doi.org/10.1016/j.reseneeco.2003.07.001

Aravena, C., Riquelme, A., & Denny, E. (2016). Money, comfort or environment? Priorities and determinants of energy efficiency investments in Irish households. Journal of Consumer Policy, 39(2), 159–186. https://doi.org/10.1007/s10603-016-9311-2

Armstrong, V. N., & Banks, C. (2015). Integrated approach to vessel energy efficiency. Ocean Engineering, 110, 39–48. https://doi.org/10.1016/j.oceaneng.2015.10.024

Arvanitis, S., & Ley, M. (2013). Factors determining the adoption of energy-saving technologies in Swiss firms: An analysis based on micro data. Environmental and Resource Economics, 54(3), 389–417. https://doi.org/10.1007/s10640-012-9599-6

Atodiresei, D., Nicolae, F., & Cotorcea, A. (2017). Cost-benefit analysis of photovoltaic systems installed on ships on the trade routes in the northwest Black Sea basin. Journal of Environmental Protection and Ecology, 18(1), 40–45.

Bazari, Z., & Longva, T. (2011). Assessment of IMO mandated energy efficiency measures for international shipping. International Maritime Organization. Lloyd’s Register, DNV. https://www.schonescheepvaart.nl/downloads/rapporten/doc_1362490668.pdf

Blumstein, C., Krieg, B., Schipper, L., & York, C. (1980). Overcoming social and institutional barriers to energy conservation. Energy, 5(4), 355–371. https://doi.org/10.1016/0360-5442(80)90036-5

Bouman, E. A., Lindstad, E., Rialland, A. I., & Strømman, A. H. (2017). State-of-the-art technologies, measures, and potential for reducing GHG emissions from shipping—A review. Transportation Research Part d: Transport and Environment, 52, 408–421. https://doi.org/10.1016/j.trd.2017.03.022

Brown, M. A. (2001). Market failures and barriers as a basis for clean energy policies. Energy Policy, 29(14), 1197–1207. https://doi.org/10.1016/S0301-4215(01)00067-2

Buhaug, Ø., Corbett, J. J., Endresen, Ø., Eyring, V., Faber, J., Hanayama, S., Lee, D. S., Lee, D., & Lindstad, H. (2009). Second IMO GHG study. International Maritime Organization (IMO). https://www.imo.org/en/OurWork/Environment/Pages/Second-IMO-GHG-Study-2009.aspx

Bukarica, V., & Tomšić, Ž. (2017). Energy efficiency policy evaluation by moving from techno-economic towards whole society perspective on energy efficiency market. Renewable and Sustainable Energy Reviews, 70, 968–975. https://doi.org/10.1016/j.rser.2016.12.002

Cagno, E., Trianni, A., Abeelen, C., Worrell, E., & Miggiano, F. (2015). Barriers and drivers for energy efficiency: Different perspectives from an exploratory study in the Netherlands. Energy Conversion and Management, 102, 26–38. https://doi.org/10.1016/j.enconman.2015.04.018

CE Delft. (2016). Readily Achievable EEDI Requirements for 2020. https://seas-at-risk.org/wp-content/uploads/2021/03/2016.21.06.-EEDI-Requirements-2020.pdf

Cepowski, T. (2019). Regression formulas for the estimation of engine total power for tankers, container ships and bulk carriers on the basis of cargo capacity and design speed. Polish Maritime Research, 26(1), 82–94. https://doi.org/10.2478/pomr-2019-0010

Charlier, D. (2015). Energy efficiency investments in the context of split incentives among French households. Energy Policy, 87, 465–479. https://doi.org/10.1016/j.enpol.2015.09.005

Damodaran, A. (2022). Damodaran Online: Home Page for Aswath Damodaran. Damodaran. https://pages.stern.nyu.edu/~adamodar/

de Oliveira, M. A. N., Szklo, A., & Castelo Branco, D. A. (2022). Implementation of Maritime Transport Mitigation Measures according to their marginal abatement costs and their mitigation potentials. Energy Policy, 160, 112699. https://doi.org/10.1016/j.enpol.2021.112699

Dewan, M. H., Yaakob, O., & Suzana, A. (2018). Barriers for adoption of energy efficiency operational measures in shipping industry. WMU Journal of Maritime Affairs, 17(2), 169–193. https://doi.org/10.1007/s13437-018-0138-3

Di Vaio, A., Varriale, L., & Alvino, F. (2018). Key performance indicators for developing environmentally sustainable and energy efficient ports: Evidence from Italy. Energy Policy, 122(C), 229–240. https://ideas.repec.org//a/eee/enepol/v122y2018icp229-240.html

Di Vaio, A., Latif, B., Gunarathne, N., Gupta, M., & D’Adamo, I. (2023a). Digitalization and artificial knowledge for accountability in SCM: A systematic literature review. Journal of Enterprise Information Management. https://doi.org/10.1108/JEIM-08-2022-0275

Di Vaio, A., Zaffar, A., Balsalobre-Lorente, D., & Garofalo, A. (2023b). Decarbonization technology responsibility to gender equality in the shipping industry: A systematic literature review and new avenues ahead. Journal of Shipping and Trade, 8(1), 9. https://doi.org/10.1186/s41072-023-00140-1

Dirzka, C., & Acciaro, M. (2021). Principal-agent problems in decarbonizing container shipping: A panel data analysis. Transportation Research Part d: Transport and Environment, 98, 102948. https://doi.org/10.1016/j.trd.2021.102948

DNV GL, & IMO. (2016b). Project Report—EE appraisal tool for IMO (2015-0823). DNV GL for IMO. https://wwwcdn.imo.org/localresources/en/OurWork/Environment/Documents/Air%20pollution/Final%20EE%20Appraisal%20Tool%20Report.pdf

DNV GL, & IMO. (2016a). Appraisal Tool [Software]. https://www.imo.org/en/OurWork/Environment/Pages/Computer-based-model-to-appraise-the-technical-and-operational-energy-efficiency-measures-for-ships.aspx

Eide, M. S., Longva, T., Hoffmann, P., Endresen, Ø., & Dalsøren, S. B. (2011). Future cost scenarios for reduction of ship CO2 emissions. Maritime Policy & Management, 38(1), 11–37. https://doi.org/10.1080/03088839.2010.533711

Entec UK Limited. (2002). Quantification of emissions from ships associated with ship movements between ports in the European Community.

Esfahani, M. H., Zinatloo-Ajabshir, S., Naji, H., Marjerrison, C. A., Greedan, J. E., & Behzad, M. (2023). Structural characterization, phase analysis and electrochemical hydrogen storage studies on new pyrochlore SmRETi2O7 (RE = Dy, Ho, and Yb) microstructures. Ceramics International, 49(1), 253–263. https://doi.org/10.1016/j.ceramint.2022.08.338

Faber, J., Markowska, A., Nelissen, D., Davidson, M., Eyring, V., Cionni, I., Selstad, E., Kågeson, P., Lee, D., Buhaug, Ø., Lindtsad, H., Roche, P., Humpries, E., Graichen, J., Cames, M., & Schwarz, W. (2009). Technical support for European action to reducing Greenhouse Gas Emissions from international maritime transport. CE Delft; Faculty of Science (FNWI); Institute for Biodiversity and Ecosystem Dynamics (IBED). https://dare.uva.nl/search?metis.record.id=401570

Faber, J., Behrends, B., & Nelissen, D. (2011). Analysis of GHG Marginal Abatement Cost Curves. CE Delft. https://cedelft.eu/publications/analysis-of-ghg-marginal-abatement-cost-curves/

Faber, J., Behrends, B., Lee, D. S., Nelissen, D., & Smit, M. (2012). The Fuel Efficiency of Maritime Transport. CE Delft. https://www.cedelft.eu/en/publicatie/the_fuel_efficiency_of_maritime_transport/1320

Gençsü, & Hino. (2015). Raising Ambition to Reduce International Aviation and Maritime Emissions (New Climate Economy). New Climate Economy. https://newclimateeconomy.report/workingpapers/workingpaper/raising-ambition-to-reduce-international-aviation-and-maritime-emissions/

Giudice, M. D., Vaio, A. D., Hassan, R., & Palladino, R. (2022). Digitalization and new technologies for sustainable business models at the ship–port interface: A bibliometric analysis. Maritime Policy & Management, 49(3), 410–446. https://ideas.repec.org//a/taf/marpmg/v49y2022i3p410-446.html

Goulielmos, A. M. (2013). An econometric analysis of the impact of vessel size on weekly time charters: A study in volatility (Panamax and Cape). International Journal of Transport Economics / Rivista internazionale di economia dei trasporti, 40(1), 31–48. https://www.jstor.org/stable/42748316

Hasanbeigi, A., Menke, C., & du Pont, P. (2010). Barriers to energy efficiency improvement and decision-making behavior in Thai industry. Energy Efficiency, 3(1), 33–52. https://doi.org/10.1007/s12053-009-9056-8

Hilbe, J. M. (2009). Logistic regression models. CRC Press.

Hochman, G., & Timilsina, G. R. (2017). Energy efficiency barriers in commercial and industrial firms in Ukraine: An empirical analysis. In Energy economics (Vol. 63, pp. 22–30). Elsevier. https://doi.org/10.1016/j.eneco.2017.01.013

Hrovatin, N., Dolšak, N., & Zorić, J. (2016). Factors impacting investments in energy efficiency and clean technologies: Empirical evidence from Slovenian manufacturing firms. Journal of Cleaner Production, 127, 475–486. https://doi.org/10.1016/j.jclepro.2016.04.039

Hrovatin, N., & Zorić, J. (2018). Determinants of energy-efficient home retrofits in Slovenia: The role of information sources. Energy and Buildings, 180, 42–50. https://doi.org/10.1016/j.enbuild.2018.09.029

IEA. (2007). Mind the Gap: Quantifying Principal-Agent Problems in Energy Efficiency. International Energy Agency (IEA). https://www.oecd-ilibrary.org/energy/mind-the-gap_9789264038950-en

IMarEST. (2010). MEPC 61/INF.18 REDUCTION OF GHG EMISSIONS FROM SHIPS. Marginal abatement costs and cost-effectiveness of energy-efficiency measures. https://www.rina.org.uk/hres/mepc%2061_inf_18.pdf

IMarEST. (2011). MEPC 62/INF.17 REDUCTION OF GHG EMISSIONS FROM SHIPS. Marginal Abatement Costs and Cost Effectiveness of Energy-Efficiency Measures. https://www.uncclearn.org/wp-content/uploads/library/marginal_abatement_cost.pdf

IMO. (2011b). Report of the Marine Environment Protection Committee on its Sixty-Second Session. IMO.

IMO. (2011a). ANNEX 19 RESOLUTION MEPC.203(62) Adopted on 15 July 2011. https://wwwcdn.imo.org/localresources/en/OurWork/Environment/Documents/Technical%20and%20Operational%20Measures/Resolution%20MEPC.203(62).pdf

IMO. (2020b). IMO and the Sustainable Development Goals. International Maritime Organization (IMO). http://www.imo.org/en/MediaCentre/HotTopics/Pages/SustainableDevelopmentGoals.aspx

IMO. (2020a). Energy Efficiency Measures. https://www.imo.org/en/OurWork/Environment/Pages/Technical-and-Operational-Measures.aspx

IMO. (2021). IMO Marine Environment Protection Committee Seventy-sixth Session MEPC 76. https://www.imo.org/en/MediaCentre/MeetingSummaries/Pages/MEPC76meetingsummary.aspx

IMO. (2022a). Prevention of Air Pollution from Ships. https://www.imo.org/en/OurWork/Environment/Pages/Air-Pollution.aspx

IMO. (2022b). Sulphur oxides (SOx) and Particulate Matter (PM) – Regulation 14. https://www.imo.org/en/OurWork/Environment/Pages/Sulphur-oxides-(SOx)-%E2%80%93-Regulation-14.aspx

IMO, Faber, J., Hanayama, S., Zhang, S., Pereda, P., Comer, B., Hauerhof, E., & van der Loeff, W.S., Smith, T., Zhang, Y., Kosaka, H., Adachi, M., Bonello, J.-M., Galbraith, C., Gong, Z., Hirata, K., Hummels, D., Kleijn, A., Lee, D.S., Liu, Y., Lucchesi, A., Mao, X., Muraoka, E., Osipova, L., Qian, H., Rutherford, D., Suárez de la Fuente, S., Yuan, H., Velandia Perico, C., Wu, L., Sun, D., Yoo, D.-H. & Xing, H. (2021). Fourth Greenhouse Gas Study 2020. International Maritime Organization (IMO). https://wwwcdn.imo.org/localresources/en/OurWork/Environment/Documents/Fourth%20IMO%20GHG%20Study%202020%20-%20Full%20report%20and%20annexes.pdf

IMO, Smith, T. W. P., & Anderson, B. A., Corbett, J. J., Faber, J., Hanayama, S., O’Keeffe, E., Parker, S., Johansson, L., Aldous, L., Raucci, C., Traut, M., Ettinger, S., Nelissen, D., Lee, D. S., Ng, S., Agrawal, A., Winebrake, J. J., Hoen, M., Chesworth, S. & Pandey, A. (2014). Third IMO GHG Study 2014. International Maritime Organization (IMO). https://www.cedelft.eu/en/publicatie/third_imo_ghg_study_2014/1525

Irena, K., Ernst, W., & Alexandros, C. (2021). The cost-effectiveness of CO2 mitigation measures for the decarbonisation of shipping. The case study of a globally operating ship-management company. Journal of Cleaner Production. https://doi.org/10.1016/j.jclepro.2021.128094

Jafarzadeh, S., & Utne, I. B. (2014). A framework to bridge the energy efficiency gap in shipping. Energy, 69, 603–612. https://doi.org/10.1016/j.energy.2014.03.056

Jaffe, A. B., & Stavins, R. N. (1994). The energy-efficiency gap What does it mean? Energy Policy, 22(10), 804–810. https://doi.org/10.1016/0301-4215(94)90138-4

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Johnson, H., & Andersson, K. (2016). Barriers to energy efficiency in shipping. WMU Journal of Maritime Affairs, 15(1), 79–96. https://doi.org/10.1007/s13437-014-0071-z

Johnson, H., Johansson, M., & Andersson, K. (2014). Barriers to improving energy efficiency in short sea shipping: An action research case study. Journal of Cleaner Production, 66, 317–327. https://doi.org/10.1016/j.jclepro.2013.10.046

Liao, J., & McGee, D. (2003). Adjusted coefficients of determination for logistic regression. American Statistician, 57(3), 161–165. https://doi.org/10.1198/0003130031964

Lockley, P., Jarabo-Martin, A., Sharma, K., & Hill, J. (2013). Ship efficiency: The guide. Fathom.

Longarela-Ares, Á. (2022). Barreras económicas e impulsores de las inversiones en eficiencia energética en el transporte marítimo de mercancías: Una aproximación desde el problema del agente-principal [Universidade da Coruña]. https://ruc.udc.es/dspace/handle/2183/32381

Longarela-Ares, Á., Calvo-Silvosa, A., & Pérez-López, J.-B. (2020). The influence of economic barriers and drivers on energy efficiency investments in maritime shipping, from the perspective of the principal-agent problem. Sustainability, 12(19), 19. https://doi.org/10.3390/su12197943

Maddox Consulting. (2012). Analysis of market barriers to cost effective GHG emission reductions in the maritime transport sector. Publications Office of the European Union. http://op.europa.eu/en/publication-detail/-/publication/b641a090-04c8-4459-99fe-4302bb5b9176

Makinson, S. (2006). Public finance mechanisms to increase investment in energy efficiency, A Report For Policymakers And Public Finance Agencies. Basel Agency for Sustainable Energy (BASE); UNEP Sustainable Energy Finance Initiative (SEFI). https://energy-base.org/app/uploads/2020/03/3.SEFI-Public-Finance-Mechanisms-to-Increase-Investment-in-Energy-Efficiency-2006.pdf

Marine Bunker Exchange. (2022). Mabux: Global Bunker Index Prices. https://www.mabux.com/

Meier, A., & Eide, A. (2007). How many people actually see the price signal? Quantifying market failures in the end use of energy. Lawrence Berkeley National Laboratory, University of California. https://escholarship.org/uc/item/71c6j081

Merk, O. (2014). Shipping emissions in ports. OECD. https://doi.org/10.1787/5jrw1ktc83r1-en

Murtishaw, S., & Sathaye, J. (2006). Quantifying the Effect of the Principal-Agent Problem on US Residential Energy Use. Lawrence Berkeley National Laboratory, University of California. https://escholarship.org/uc/item/6f14t11t

Nagelkerke, N. J. D. (1991). A note on a general definition of the coefficient of determination. Biometrika, 78(3), 691–692. https://doi.org/10.1093/biomet/78.3.691

Painuly, J. P., Park, H., Lee, M.-K., & Noh, J. (2003). Promoting energy efficiency financing and ESCOs in developing countries: Mechanisms and barriers. Journal of Cleaner Production, 11, 659–665. https://doi.org/10.1016/S0959-6526(02)00111-7

Plomaritou. (2014). A review of Shipowner’s & charterer’s obligations in various types of charter. Journal of Shipping and Ocean Engineering. https://doi.org/10.17265/2159-5879/2014.06.002

Psaraftis, H. N. (2016). Green maritime transportation: Market based measures. International Series in Operations Research and Management Science, 226, 267–297. https://doi.org/10.1007/978-3-319-17175-3_8

Psaraftis, H. N., & Kontovas, C. A. (2009). CO2 emission statistics for the world commercial fleet. WMU Journal of Maritime Affairs, 8(1), 1–25. https://doi.org/10.1007/BF03195150

R Core Team 3.4.4 (3.4.4). (2018). [Software]. The R Foundation for Statistical Computing.

Reddy, S., & Painuly, J. P. (2004). Diffusion of renewable energy technologies—Barriers and stakeholders’ perspectives. Renewable Energy, 29(9), 1431–1447. https://doi.org/10.1016/j.renene.2003.12.003

Refinitiv Eikon. (2020). https://eikon.thomsonreuters.com/index.html

Rehmatulla, N. (2014). Market failures and barriers affecting energy efficient operations in shipping [Ph.D. Thesis, UCL, University College London]. https://discovery.ucl.ac.uk/id/eprint/1448234/

Rehmatulla, N. (2012). Barriers to uptake of energy efficient operational measures Survey Report. University College London. https://doi.org/10.13140/RG.2.2.13364.86401

Rehmatulla, N., Calleya, J., & Smith, T. (2017a). The implementation of technical energy efficiency and CO2 emission reduction measures in shipping. Ocean Engineering, 139, 184–197. https://doi.org/10.1016/j.oceaneng.2017.04.029

Rehmatulla, N., Parker, S., Smith, T., & Stulgis, V. (2017b). Wind technologies: Opportunities and barriers to a low carbon shipping industry. Marine Policy, 75, 217–226. https://doi.org/10.1016/j.marpol.2015.12.021

Rehmatulla, N., & Smith, T. (2015a). Barriers to energy efficiency in shipping: A triangulated approach to investigate the principal agent problem. Energy Policy, 84, 44–57. https://doi.org/10.1016/j.enpol.2015.04.019

Rehmatulla, N., & Smith, T. (2015b). Barriers to energy efficient and low carbon shipping. Ocean Engineering, 110, 102–112. https://doi.org/10.1016/j.oceaneng.2015.09.030

Rehmatulla, N., & Smith, T. (2020). The impact of split incentives on energy efficiency technology investments in maritime transport. Energy Policy, 147, 111721. https://doi.org/10.1016/j.enpol.2020.111721

Rezayeenik, M., Mousavi-Kamazani, M., & Zinatloo-Ajabshir, S. (2022). CeVO4/rGO nanocomposite: Facile hydrothermal synthesis, characterization, and electrochemical hydrogen storage. Applied Physics A, 129(1), 47. https://doi.org/10.1007/s00339-022-06325-y

RightShip. (2013). Calculating and Comparing CO2 Emissions from the Global Maritime Fleet. Rightship.

RightShip. (2020). RightShip—Experts in Maritime Safety & Environmental Sustainability. RightShip. https://www.rightship.com/

Rojon, I., & Dieperink, C. (2014). Blowin’ in the wind? Drivers and barriers for the uptake of wind propulsion in international shipping. Energy Policy, 67, 394–402. https://doi.org/10.1016/j.enpol.2013.12.014

Ross, S. A. (1973). The Economic Theory of Agency: The Principal’s Problem. The American Economic Review, 63(2), 134–139. JSTOR. https://www.jstor.org/stable/1817064

Saether, E. A., Eide, A. E., & Bjørgum, Ø. (2021). Sustainability among Norwegian maritime firms: Green strategy and innovation as mediators of long-term orientation and emission reduction. Business Strategy and the Environment, 30(5), 2382–2395. https://doi.org/10.1002/bse.2752

Sanstad, A. H., & Howarth, R. B. (1994). ‘Normal’ markets, market imperfections and energy efficiency. Energy Policy, 22(10), 811–818. https://doi.org/10.1016/0301-4215(94)90139-2

Schleich, J., & Gruber, E. (2008). Beyond case studies: Barriers to energy efficiency in commerce and the services sector. Energy Economics, 30(2), 449–464. https://doi.org/10.1016/j.eneco.2006.08.004

Schlomann, B., & Schleich, J. (2015). Adoption of low-cost energy efficiency measures in the tertiary sector—An empirical analysis based on energy survey data. Renewable and Sustainable Energy Reviews, 43, 1127–1133. https://doi.org/10.1016/j.rser.2014.11.089

Schwartz, H., Gustafsson, M., & Spohr, J. (2020). Emission abatement in shipping – is it possible to reduce carbon dioxide emissions profitably? Journal of Cleaner Production, 254, 120069. https://doi.org/10.1016/j.jclepro.2020.120069

Sorrell, S., O’Malley, E., Schleich, J., & Scott, S. (2004). The Economics of Energy Efficiency: Barriers to Cost-Effective Investment. Edward Elgar Publishing. https://www.esri.ie/publications/the-economics-of-energy-efficiency-barriers-to-cost-effective-investment

Sorrell, S., Schleich, J., Scott, S., O’malley, E., Trace, F., Boede, U., Ostertage, K., & Radgen, P. (2000). Barriers to energy efficiency in public and private organisations, science and technology policy research. University of Sussex.

Stevens, L., Sys, C., Vanelslander, T., & van Hassel, E. (2015). Is new emission legislation stimulating the implementation of sustainable and energy-efficient maritime technologies? Research in Transportation Business & Management, 17, 14–25. https://doi.org/10.1016/j.rtbm.2015.10.003

Stulgis, V., Smith, T., Rehmatulla, N., Hoppe, J., Mcmahon, H., & Lee, T. (2014). Hidden Treasure: Financial Models for Retrofits. Carbon War Room, University College London Energy Institute. https://discovery.ucl.ac.uk/id/eprint/1470429/1/Stulgis%20et%20al.%20(2014)%20CWR%20Shipping%20Efficiency%20Finance%20Report.pdf

Svensson, E., & Andersson, K. (2011). Inventory and Evaluation of Environmental Performance Indices for Shipping (Report No R 11:132). Chalmers University of Technology. https://research.chalmers.se/publication/162305

Thollander, P., Backlund, S., Trianni, A., & Cagno, E. (2013). Beyond barriers—A case study on driving forces for improved energy efficiency in the foundry industries in Finland, France, Germany, Italy, Poland, Spain, and Sweden. Applied Energy, 111, 636–643. https://doi.org/10.1016/j.apenergy.2013.05.036

Thollander, P., & Ottosson, M. (2008). An energy efficient Swedish pulp and paper industry—Exploring barriers to and driving forces for cost-effective energy efficiency investments. Energy Efficiency, 1(1), 21–34. https://doi.org/10.1007/s12053-007-9001-7

Trianni, A., Cagno, E., Marchesani, F., & Spallina, G. (2017). Classification of drivers for industrial energy efficiency and their effect on the barriers affecting the investment decision-making process. Energy Efficiency, 10(1), 199–215. https://doi.org/10.1007/s12053-016-9455-6

Trotta, G. (2018). The determinants of energy efficient retrofit investments in the English residential sector. Energy Policy, 120, 175–182. https://doi.org/10.1016/j.enpol.2018.05.024

Vernon, D., & Meier, A. (2012). Identification and quantification of principal–agent problems affecting energy efficiency investments and use decisions in the trucking industry. Energy Policy, 49, 266–273. https://doi.org/10.1016/j.enpol.2012.06.016

Wang, H., Faber, J., Nelissen, D., Russel, B., & St. Amand, D. (2010). Reduction of GHG emissions from ships. Marginal abatement costs and cost-effectiveness of energy-efficiency measures. CE Delft. https://www.osti.gov/etdeweb/biblio/21360761

Wang, X., Lu, M., Mao, W., Ouyang, J., Zhou, B., & Yang, Y. (2015). Improving benefit-cost analysis to overcome financing difficulties in promoting energy-efficient renovation of existing residential buildings in China. Applied Energy, 141, 119–130. https://doi.org/10.1016/j.apenergy.2014.12.001

Wang, & Corbett. (2007). The costs and benefits of reducing SO2 emissions from ships in the US West Coastal waters. Transportation Research Part d: Transport and Environment, 12(8), 577–588. https://doi.org/10.1016/j.trd.2007.08.003

Wild, Y. (2005). Determination of energy cost of electrical energy on board sea-going vessels. Ingenieurbüro GmbH. http://www.effship.com/PartnerArea/MiscPresentations/Dr_Wild_Report.pdf

Wu, X., Zhang, L., & Luo, M. (2020). Discerning sustainability approaches in shipping. Environment, Development and Sustainability, 22(6), 5169–5184. https://doi.org/10.1007/s10668-019-00419-z

Yuan, J., Nian, V., He, J., & Yan, W. (2019). Cost-effectiveness analysis of energy efficiency measures for maritime shipping using a metamodel based approach with different data sources. Energy, 189. https://doi.org/10.1016/j.energy.2019.116205

Yuan, J., Ng, S. H., & Sou, W. S. (2016). Uncertainty quantification of CO2 emission reduction for maritime shipping. Energy Policy, 88, 113–130. https://doi.org/10.1016/j.enpol.2015.10.020

Zinatloo-Ajabshir, S., Heidari-Asil, S. A., & Salavati-Niasari, M. (2021). Simple and eco-friendly synthesis of recoverable zinc cobalt oxide-based ceramic nanostructure as high-performance photocatalyst for enhanced photocatalytic removal of organic contamination under solar light. Separation and Purification Technology, 267, 118667. https://doi.org/10.1016/j.seppur.2021.118667

Zinatloo-Ajabshir, S., Morassaei, M. S., Amiri, O., & Salavati-Niasari, M. (2020). Green synthesis of dysprosium stannate nanoparticles using Ficus carica extract as photocatalyst for the degradation of organic pollutants under visible irradiation. Ceramics International, 46(5), 6095–6107. https://doi.org/10.1016/j.ceramint.2019.11.072

Zinatloo-Ajabshir, S., Morassaei, M. S., & Salavati-Niasari, M. (2019). Eco-friendly synthesis of Nd2Sn2O7–based nanostructure materials using grape juice as green fuel as photocatalyst for the degradation of erythrosine. Composites Part b: Engineering, 167, 643–653. https://doi.org/10.1016/j.compositesb.2019.03.045

Zinatloo-Ajabshir, S., & Salavati-Niasari, M. (2016). Facile route to synthesize zirconium dioxide (ZrO2) nanostructures: Structural, optical and photocatalytic studies. Journal of Molecular Liquids, 216, 545–551. https://doi.org/10.1016/j.molliq.2016.01.062

Zinatloo-Ajabshir, S., & Salavati-Niasari, M. (2019). Preparation of magnetically retrievable CoFe2O4@SiO2@Dy2Ce2O7 nanocomposites as novel photocatalyst for highly efficient degradation of organic contaminants. Composites Part b: Engineering, 174, 106930. https://doi.org/10.1016/j.compositesb.2019.106930

Acknowledgments

The authors want to acknowledge the advice of experts and data support given by Rightship.

Funding