Abstract

The proposed study analyzes the efficiency of the European energy mix of electricity generation technologies from two perspectives: environmental and economic. The context is that of European energy dependence and a technology mix conditioned by the import of fossil fuels. The impact is centered, among other elements, on the leakage of national income and the emission of polluting gases. The aim is to determine the participation that each type of power plant in each country should present in order to minimize the total environmental impact. In order to solve this problem, a double optimization is proposed through the use of two methodologies: one based on a multi-criteria decision-making method (MCDM) model with which to evaluate the environmental performance of each power plant, and a second optimization based on a quadratic model of portfolios modern portfolio theory (MPT), with which to evaluate the efficiency of the portfolio of technologies from the cost/risk binomial. The results confirm that an environmentally efficient portfolio leads to higher levels of economic risk-taking, with a slight increase in the level of assumed cost. Nevertheless, from the results obtained, it is possible to say that hydro (with a share between 11 and 13%) and wind (37–44% mix participation) technologies resulted to be preferred options both environmentally and in terms of minimum risk efficiency. Nuclear power generation stands out as one of the main baseload technologies with shares between 25 and 35% in environmental and cost/risk efficiency. As main findings, Hydro, supercritical lignite, solar PV and wind are identified as preferential technologies to be present in both minimum risk and minimum cost efficient portfolios. In case European Union pursues for minimizing the cost of electricity production, the shares of supercritical lignite, nuclear, solar PV and wind energy go up to the maximum allowed limits. The novelty lies in the application of both methodologies with which to complement the analysis and design efficient portfolios of energy technologies from environmental and economic points of view. One possible future approach would be to assess (with the MPT model) new environmentally optimal portfolios obtained through the application of other MCDM techniques.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and objectives

Particularly relevant for any territory is the resolution of the energy security problem: This means generating energy in a secure way, based on continuous and reliable access to quality energy resources; doing so at a reasonable cost; not negatively affecting the economic competitiveness of the territory; and all within an environmentally and socially responsible context.

In this sense, the European Union (EU) consumes around 20% of the energy produced in the world, and its energy dependence exceeds 50% (Eurostat, 2022). It imports around 45% of the coal, 87% of the oil and 67% of the natural gas it consumes. Consequently, every year, the EU spends nearly 1 billion euros per day on imported energy resources (European Commission, 2014). Russia leads the way as the main supplier, supplying more than 30–35% of each of the imported fossil fuels. The relevance of this energy dependence has become evident in the wake of the Russian invasion of Ukraine (Steffen & Patt, 2022).

It is in this context that the role played by renewable energies in European energy planning over the last 30 years makes sense. There are numerous positive effects derived from the presence of renewable energies in the portfolio. Generally speaking, renewable energies contribute to reducing the negative pressure on the environment (Cartelle Barros et al., 2020). They also help to diversify the type and origin of the inputs needed to produce energy. This reduces external dependence and increases the security of supply. In other words, renewable energies reduce the exposure to risks such as the fossil fuel price variability and volatility, revenue leakage or environmental externalities, among others. They are also based on the use of natural resources, which means that the territory has open and free access to them. It is also an industry that generates qualified employment in the communities where these technologies are implemented and improves access to energy for the different population centers, thus consolidating greater decentralization. Furthermore, renewable energies are indispensable for the electrification of the road network. The expansion of electric cars that rely on a fossil-fueled electricity mix would not serve to reduce current environmental deterioration. On the other hand, an increase in renewable electricity production will pose a challenge for managing the electricity system.

In the existing literature, many authors have dealt with energy planning problems with different objectives, adopting different approaches, and also using a wide variety of methodologies. Solving energy planning problems usually involves selecting the optimal generation portfolio according to a predetermined objective. Under the traditional approach, this means searching for the portfolio that minimizes the total generation cost. Nevertheless, in recent times, other objectives have been added to this target, such as environmental and risk objectives, among others.

In this regard, modern portfolio theory (MPT) stands out as one of the most widely used techniques for solving energy planning problems in recent years (DeLlano Paz et al., 2017). MPT was initially developed by Markowitz for financial applications (Markowitz, 1952), although its use has been extended to other fields. The original objective of MPT was to assess different portfolios of financial assets, taking into account both the expected return and the associated risk. The latter is usually understood as the variability (variance or standard deviation) of the portfolio. MPT is based on the fact that the interaction among assets is more relevant than their separate individual value (Tapia Carpio, 2021a, 2021b). Its application allows the user to obtain the so-called efficient frontier. It consists of all the optimal combinations of assets. In other words, each one of the portfolios included in this frontier is efficient in the sense that it returns the maximum profit for a certain level of risk (Martinez-Fernandez et al., 2018; Roques et al., 2010). It is also possible to say that each efficient portfolio has the minimum possible risk for a certain expected return. The usefulness of MPT and, in particular, the efficient frontier is that not all investors are equally risk-averse (Brandi & dos Santos, 2020). Consequently, some seek lower risks at the cost of lower returns, while others are willing to take greater risks. More information about the mathematical foundations of MPT is included in Sect. 2.

When MPT is applied to the energy sector, the financial assets are usually replaced by different energy technologies. Each portfolio is assessed according to different binomials: return and risk, cost and risk, electricity generation and risk, among many others, always with the objective of determining the efficient frontier. On the other hand, it is also common to assess specific portfolios, for example, those designed or projected by the country’s decision-makers for future time horizons, to check whether they are efficient or not. Table 1 presents some of the existing studies dealing with the application of MPT (sometimes in combination with other techniques) to the energy sector.

According to Table 1, it is clear that many authors have used MPT to solve different problems in the energy sector, considering different technologies and binomials, and with diverse temporal and geographical scales. However, in most of the existing studies, the environmental dimension is either absent or plays a residual role. Furthermore, once the corresponding efficient frontier has been obtained, the authors usually assess current scenarios and future projections of these scenarios, usually those proposed by international organizations, such as the International Energy Agency (IEA). Once again, environmental impacts are not taken into account in any real depth when these future scenarios are projected and assessed. The energy sector and, in particular, fossil fuels, are major contributors to global warming (Khandaker et al., 2022; Qamar et al., 2022). The consequences of the climate change are already being felt around the globe (Halder et al., 2022; Karimi et al., 2022a, 2022b; Rizvi et al., 2020). Nevertheless, the energy sector also generates many other environmental impacts that are often ignored in the existing literature (acidification, eutrophication, toxicity and resource depletion, among others). The time has come to shed light on these gaps in the current knowledge. Therefore, the main objectives and the novel aspects of the present study are:

-

The modern portfolio theory is applied to the European Union with the objective of determining the efficient frontier in terms of total generation costs and risk for different years: 2020, 2030, 2040 and 2050. The most common types of renewable and non-renewable power plants, including several technology variants, were considered. A set of constraints has been specified with the aim of limiting the maximum possible generation of each type of power plant. These constraints were defined on the basis of both public and private institutions.

-

Once the efficient frontiers were determined, different scenarios were defined and assessed in terms of costs and risks. The first scenario represents the real portfolio for EU-27Footnote 1 and the UK for year 2017. The other three scenarios represent another novel aspect of this study. They were proposed by Cartelle Barros et al. (2022) in a previous study. Specifically, the authors presented and solved an optimization problem using the EU-27 and the UK as a case study. They determined, in three different scenarios, the participation that each type of power plant in each country should present in order to minimize the total environmental impact. In other words, Cartelle Barros et al. (2022), from the real mix for 2017, obtained three optimal portfolios from an environmental point of view. Each one of these portfolios can be associated with a specific time horizon, as they were calculated on the basis of different sets of constraints. Fifteen environmental impact categories (not only those limited to the emission of harmful gases) were taken into account for this purpose. This is intended to check whether environmentally optimal portfolios are efficient when an MPT approach is adopted.

-

To complete the analysis, the distances between the portfolios of the different scenarios studied and the efficient frontier have been calculated. This distance can be interpreted as the reduction in costs/risks that would have to be assumed in order to achieve efficiency, based on the change in the composition of the portfolio to shift from a non-efficient to an efficient one. The level of diversification of each portfolio was assessed using the Herfindahl–Hirschman Index.

To the best of the authors’ knowledge, there is no similar study in the existing literature. On the other hand, the reader should bear in mind that there are other types of energy planning problems besides the one presented here. Although an extensive review of the state of the art on energy planning problems is beyond the scope of this paper, the reader can consult Harish et al.(2022), Niet et al. (2022), Chang et al. (2021), Dranka et al. (2021), Babatunde et al. (2019), Dagoumas and Koltsaklis (2019), or Koltsaklis and Dagoumas (2018), among many others, for more information on literature reviews.

The remainder of this article is structured as follows. The methodology implemented in this study is included in Sect. 2. In particular, it contains a description on how Cartelle Barros et al. (2022) obtained the three portfolios assessed in this paper. It also includes information about the modern portfolio theory (MPT) model used to determine the efficient frontiers. The results are presented and discussed in Sects. 3 and 4, respectively. Finally, the conclusions, limitations and possible future developments are discussed in Sect. 5.

2 Materials and methods

The general methodology followed in this study is presented in Fig. 1. As indicated in the previous section, the modern portfolio theory (MPT) is applied in order to obtain the efficient frontiers (total generation costs and risks) for the European Union for different time horizons. Subsequently, three environmentally optimal portfolios are assessed in terms of costs and risks. These three portfolios are the result of a previous study conducted by Cartelle Barros et al. (2022). Therefore, even though the environmentally optimal portfolios are evaluated once MPT has been applied, it is possible to say that the results presented in Cartelle Barros et al. (2022) are the starting point of this study, as shown in Fig. 1.

Similarly, the results included in Cartelle Barros et al. (2022) are, in turn, based on a previous multi-criteria decision-making model (MCDM) (Cartelle Barros et al., 2020). Consequently, in order to understand the approach taken, it is necessary to provide additional information on the studies developed by Cartelle Barros et al., (2020, 2022), in Fig. 2.

In Cartelle Barros et al. (2020) (Fig. 2), the authors developed a MCDM model based on the MIVES (Modelo Integrado de Valor para una Evaluación Sostenible, in Spanish) method (de la Cruz et al., 2014). This model allows the user to assess the environmental performance of any type of power plant by taking into account the 15 midpoint environmental impact indicators suggested by the International Reference Life Cycle Data System Handbook (ILCD) (European Commission, 2011), which are shown in Fig. 2. It is important to note that the 15 environmental indicators are not only limited to the environmental impacts derived from the emission of harmful gases. Other environmental impacts such as ionizing radiation, resource depletion, land use and particulate matter are included, since they are also detrimental to the “health” of the planet and its species. The relative importance of each of the 15 indicators was established according to Kupfer et al. (2017). On the other hand, the MIVES model returns a dimensionless environmental index that varies between 0 and 1, the worst and best possible results, respectively. The reader should bear in mind that the model adopts a cradle-to-grave approach. In this regard, it is important to remark that all types of power plants, including those relying on renewable energies, generate all types of environmental impacts when all stages of the life cycle are analyzed. The widespread belief that renewable energies do not generate negative environmental impacts is erroneous (Cartelle Barros et al., 2020). In fact, the environmentally perfect technology does not yet exist. Despite this, renewable energies are, on average, better options than conventional power plants. The reader can find more information about the MIVES model in the study by Cartelle Barros et al. (2020).

By using the MIVES model (Cartelle Barros et al., 2020), Cartelle Barros et al. (2022) assessed the environmental performance of the European electricity sector for the year 2017. In particular, the 27 countries belonging to the European Union (EU-27), as well as the UK, were considered. In other words, the authors estimated an environmental index for each European country. The percentage of participation of each type of power plant in each country was taken from Eurostat (2017). The environmental data to feed the MIVES model for each country was provided by Thinkstep databases (Thinkstep, 2018a, 2018b). These databases provided the value that each environmental indicator adopts for each type of power plant when generating 1 kWh of electricity. These values are measured in the corresponding units. For instance, the value that a certain type of power plant in a specific country obtains for climate change is expressed in kg of CO2-eq./kWh. Figure 2 of Cartelle Barros et al. (2022) includes all the units of measurement. Similarly, the authors also estimated an environmental index for the European electricity sector as a whole for 2017. The reader can find more information about the calculation process of both each country environmental index and the European environmental index in Cartelle Barros et al. (2022) (Fig. 2).

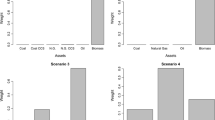

Finally, Cartelle Barros et al. (2022) proposed and solved an optimization problem in three different scenarios, with the goal of obtaining three environmentally optimal portfolios. The aim was to maximize the environmental index for Europe, using the electricity mix for 2017 as a starting point (baseline scenario). In other words, the production percentages of each type of power plant in each country were defined as optimization variables. Therefore, the objective was to determine the amount of electricity that each type of power plant should produce in each country in order to minimize the environmental impacts (maximum European environmental index). Coal, lignite, natural gas, nuclear, wind, solar photovoltaic (PV) and hydro alternatives were the main types of power plants considered. All those alternatives with irrelevant levels of participation were discarded (for example, wave and tidal technologies, among others). The three scenarios are theoretical, and each of them starts from the European electric mix for 2017. Therefore, the difference among them lies in the extent to which the production of each type of power plant in each country can vary from the baseline scenario. In particular, a variation up to 50% was allowed in Scenario 1, while this limit adopted a value of 25% and 5% for Scenarios 2 and 3, respectively. Such a variation can either be in the form of an increase or a decrease (Fig. 3).

On the other hand, as indicated in Fig. 3, some common constraints were defined for the three scenarios (Cartelle Barros et al., 2022). In particular:

-

The percentage of electricity generated by each country in relation to the European total for 2017 is constant.

-

Only the technologies included in the baseline scenario (2017) in each country can produce electricity. In other words, if a given country produced no nuclear electricity in year 2017, for example, that production will remain equal to zero after the optimization problem. The reason for this is to avoid the installation of new technologies in each country (large investments), demonstrating that better environmental results are possible by modifying the participation of the existing technologies.

-

The environmental index for each country cannot be lower than the one obtained for the baseline scenario.

Taking into account the time needed to modify the European electric mix for 2017, the MIVES results for Scenario 1 (variation of up to 50%) can be identified with years 2040 and 2050, while Scenarios 2 and 3 can be associated with the 2030- and 2020-time horizons, respectively. The results obtained by Cartelle Barros et al. (2022) for the three scenarios are included in Table 2.

On the other hand, as explained in Sect. 1, the modern portfolio theory (MTP) is also applied in this study, in this case, to power generation and energy policy design. Therefore, it is necessary to characterize the different energy generation technologies according to a specific binomial, in this case, the total generation cost (€/MWh) and risk. The latter is measured as the standard deviation of the total generation cost (€/MWh). The total cost includes investment cost, operation and maintenance cost (O&M), fuel costs, decommissioning and emission costs.

On the basis of the cost and risk binomial, it is possible to represent the individual technologies as well as different combinations of them (portfolios) on a cost/risk coordinate axis. The MPT model provides as a solution a set of efficient portfolios, i.e., the efficient frontier. Each of the portfolios included on this frontier has the lowest possible cost for a certain risk value. It can also be said that each efficient portfolio presents the lowest possible risk value for a certain cost. In other words, it is not possible to find a portfolio with lower costs or risk, unless higher levels of risk or cost, respectively, are assumed. All the portfolios that are not included on this frontier are inefficient. Their distance to the efficient frontier will determine their level of inefficiency.

From a mathematical point of view, the MPT model seeks to minimize the generation risk by solving a quadratic programming problem, such as the one presented in Eq. (1), where \({\mathbf{x}} \in {\mathbb{R}}^{{\mathbf{n}}}\) is the unknown quantity vector that contains the shares of each technology in the generation, \({\mathbf{S}} \in {\mathbb{R}}^{{{\mathbf{n}} \times {\mathbf{n}}}}\) is the variance–covariance matrix and \({\mathbf{E}}({{\varvec{\upsigma}}}_{{\mathbf{P}}} )\) is the expected risk of the generation portfolio represented in the vector \({\mathbf{x}}\).

A set of constraints has also been defined with the aim of limiting the maximum generation of each technology for different time horizons, as shown in Table 3. These constraints are a reflection of global and European energy policies. They also represent an appropriate diversification of energy sources proposed by both public and private institutions (Ciscar et al., 2013; European Commission, 2016; International Energy Agency, 2018; Russ et al., 2009).

The environmentally optimal portfolios provided by Cartelle Barros et al. (2022) do not distinguish among all the technologies included in Table 3. Consequently, some of them were combined. In particular, pulverized coal with and without carbon capture and storage (CCS) was grouped together. The same has been done for natural gas. On the other hand, onshore and offshore wind was also grouped. The shares for solar photovoltaic energy in different European regions were also aggregated. Large and small hydropower plants were also grouped together, while geothermal energy, which has a low shareholding, was discarded. Appendix includes a table with the individual costs of each technology (Table 7), as well as the variance–covariance matrix (Table 8) considered in the MPT model. They can be considered representative of the European Union.

After generating the efficient frontiers and assessing the different scenarios (portfolios), it is useful to calculate some distances. In particular, especially relevant is the distance that exists on the coordinate plane between the portfolios and the corresponding efficient frontier. This distance, indicative of the proximity or remoteness to efficiency, can be interpreted as the cost/risk reduction that would have to be assumed in order to achieve efficiency. In terms of the portfolio, this would mean modifying the composition of a portfolio that is not efficient in order to make it efficient, replacing certain technologies with others and/or modifying the share of existing technologies.

Depending on the position of the efficient frontier in relation to the origin of coordinates—point (0,0)—and the position of a non-efficient portfolio, it might be possible to obtain the point of intersection of the efficient frontier with this origin of the coordinate plane. In those cases where this is not possible, the distances between the analyzed portfolio of the corresponding scenario and the most significant portfolios of the efficient frontier will be calculated: the global minimum variance portfolio (GMV) and the global minimum cost portfolio (GMC). The global minimum variance portfolio (GMV) is on the far left of the efficient frontier. It is the lowest risk-efficient portfolio offered by the model. Conversely, the global minimum cost portfolio (GMC) is located on the far right of the efficient frontier. GMC is the efficient portfolio with the lowest possible cost offered by the model. Depending on the objective to be met by the decision-maker (cost or risk minimization), one or the other will be designated as the reference portfolio to be followed, with the efficient weights defined for the different technologies.

Finally, the Herfindahl–Hirschman Index for the different portfolios is estimated (Rhoades, 1993). This index is usually employed in different contexts as a measure of concentration/diversification. Lower values are associated with a less concentrated “market.” In other words, in energy planning problems, low values of this estimator represent diversified portfolios and, consequently, adequate electric mixes from the perspective of energy security.

3 Results

Figure 4 shows the position of the environmentally optimal portfolios from the environmental point of view (orange dot-Scenario 1 (portfolio 1); green dot-Scenario 2 (portfolio 2); and red dot-Scenario 3 (portfolio 3)). Their locations lead to slightly higher cost values than those of the absolute minimum risk portfolios, and they also present a higher risk in all cases.

Table 4 shows the cost and risk values for the three scenarios resulting from the environmental optimization (Cartelle Barros et al., 2022), as well as the results for the base case (European Union and the UK for 2017). It also includes the change in both cost and risk relative to the baseline. These variations are dimensionless, as they were calculated as the difference between the value for each scenario and the baseline, divided by the cost or risk for the base case. In the case of not considering maximum participation restrictions, the efficient frontiers would be those represented by the dashed lines. Similarly, Table 5 includes the composition of all the relevant scenarios, including the global minimum risk (GMV) and the global minimum cost (GMC) scenarios for the different time horizons. The corresponding costs, risks as well as the Herfindahl–Hirschman Indices are also shown in Table 5.

As can be deducted from Tables 4 and 5, the environmentally optimal portfolios corresponding to the 3 scenarios present worse cost and risk results than the base scenario portfolio (EU 2017). In this case, the portfolio derived from the environmental optimization with the smallest possible variation (5%) in the shares of the technologies—Scenario 3—is the one that offers the least deviation from the EU 2017 reference portfolio. It also presents the least deviation from the efficient frontier. However, from the point of view of portfolio theory methodology, none of the three portfolios is efficient in terms of MPT.

The location on the cost/risk coordinate axis of the three environmentally optimal portfolios shows that they are not cost/risk efficient. In fact, they are located further to the right and above the efficient frontiers generated by the quadratic portfolio optimization model (MPT). It can therefore be concluded that these are environmentally optimal portfolios, but not cost/risk efficient from an MPT perspective. From a cost/risk efficiency point of view, it could be concluded that as the potential variation in the share of each technology in the environmentally (MIVES) optimal scenarios increases, portfolios with higher costs and risks in comparison with the base case will appear.

These results call into question the limitation of both models individually. A priori, it seems reasonable to think that an environmentally optimal portfolio should also be efficient (or close to the efficient frontier) when a MPT approach is adopted. It therefore seems necessary to advance in the definition of a new mixed model that corrects this situation. One possibility would be to incorporate all externalities into the MPT model. In other words, the potential costs arising from all the environmental impacts should be taken into account at the time of calculating the total generating cost, as well as the corresponding risks. These external costs should not be limited to the emission of greenhouse gases. This should help to correct the market failure caused by the non-consideration of externalities. In other words, the technologies that contribute the most to environmental degradation will experience an increase in their costs, even above the cost of some types of power plants that are currently not cost-effective. Therefore, environmentally harmful technologies will no longer be an option for decision-makers. Another possibility which may be compatible with the first one is to add the environmental dimension into the MPT optimization process. By doing so, a third variable should be included on the original two-dimensional coordinate axis (cost and risk).

With the above in mind, the distances from the environmentally optimal (MIVES) portfolios to each efficient frontier for 2020, 2030, 2040 and 2050 are shown in Fig. 5. It stands out that only the 2020 frontier is intersected by the segment connecting the origin of the coordinate plane (0,0). In this case, point A in Fig. 5 represents the intersection between such a segment and Portfolio 3 from the MIVES model. Analogous points for the different environmentally optimal portfolios can also be represented. On the other hand, the efficient frontiers for years 2030, 2040 and 2050 are too small and are shifted to the left in such a way that an intersection point between each environmentally optimal portfolio and the origin (0,0) is not possible. Therefore, in these cases, it has been decided to calculate the distances to GMV (on the left side of the efficient frontier) and GMC (on the right side of the efficient frontier) portfolios.

Table 6 shows the numerical values of the distances included in Fig. 5. As can be seen, Portfolio 3 (variations of electricity production of each type of power plant of ± 5%, Fig. 3) and the EU 2017 portfolio are very close to each other, with differences of less than 5% in most of the cases. Portfolio 3 is the one that is closest to the efficient minimum risk MPT portfolio (0.37). Therefore, it can be said that variations of up to 5% in the European portfolio for 2017 would serve to move toward the efficient frontier for 2020, when the objective is to minimize the risk. On the other hand, if the objective is to minimize the total generation costs, the closest portfolio to the efficient frontier for 2020 proved to be the baseline case, with a distance of €28.51/MWh.

The environmentally optimal (MIVES) portfolios 1 and 2 are far from their corresponding efficient frontiers. In fact, portfolio 2 is far from the GMV and GMC portfolios for 2030 (57.86 and €117.48/MWh, respectively). Similarly, portfolio 1 is far from GMV and GMC portfolios for 2040 and 2050.

4 Discussion

The results presented in Sect. 3 are discussed below. Furthermore, some comparisons with the existing literature are also made. In this regard, the reader should note that this study is novel in several aspects (Sect. 1). It is therefore difficult to make direct comparisons with the results presented by other authors, since the approaches differ. Despite this, some valuable comparisons are possible, even if they are only partial.

Based on the results obtained with the modern portfolio theory (MPT) model, it is possible to identify the preferential technologies, i.e., those that reach the participation limit in both GMV and GMC portfolios for different time horizons. According to this, “Hydro,” “Lignite,” “Solar PV” and “Wind” are the best alternatives. In fact, their participation allows electricity to be produced at the lowest possible risk and cost. If only the 2020- and 2050-time horizons are considered, “Nuclear” also joins this group of preferred technologies (Table 5). These options were previously identified as promising solutions by other studies adopting an MPT approach. For instance, Arnesano et al. (2012) found that both “Nuclear” and “Wind” alternatives should play an important role in the Italian electric mix. However, in this case, the authors considered a return–risk binomial in the MPT model. Cucchiella et al. (2017) stated that lower-risk portfolios have a considerable presence of hydro power plants. Although the authors limited the analysis to Italy, it serves to partially validate the results of Table 5. In fact, “Hydro” has reached the maximum possible share in all the GMV portfolios (Table 5). Similar results were obtained by Awerbuch and Yang (2007) for the European Union. According to the authors, “Wind” and “Nuclear” technologies increase their shares in the optimal portfolios. These results are in line with the ones presented in this study. In a previous study, Awerbuch and Berger (2003) found that optimal European portfolios in terms of costs and risks include a strong presence of “Wind” energy. This is consistent with the results presented in Table 5, in which “Wind” reached the maximum possible share in all GMV and GMC portfolios. “Hydro” and “Wind” technologies also proved to be preferential options for the European Union, according to DeLlano Paz et al. (2014). “Wind,” “Hydro” and “Nuclear” power plants were also identified as the best options in another study carried out for the European Union, in this case, for two different time horizons: 2020 and 2030 (DeLlano Paz et al., 2015). In a later study, DeLlano Paz et al. (2018) extended the list of preferential technologies, including solar photovoltaic.

For the particular case of China, Gao et al. (2014) also obtained similar results. In particular, according to the authors, “Hydro” and “Nuclear” dominate the electric mix for 2020, while “Wind” and “Solar” resulted to be the best options for 2030. Furthermore, the authors also indicated that renewable energies will not completely substitute conventional power plants. This reinforces the maximum shares obtained by some non-renewable sources in this study, in particular, “Lignite” for all time horizons and “Nuclear” and “Natural gas” for certain years (see Table 5). Lucheroni and Mari (2017) also highlighted the necessity of including “Nuclear” in baseload portfolios as a way of reducing risks (price variability). On the other hand, Wu and Huang (2014) argue that “Natural Gas” power plants should still be present in the electric mix for the particular case of Thailand. According to the authors, “Natural Gas” is an adequate technology to cover the intermittency of renewable energies in optimal portfolios. Although Thailand has certain singularities that make it different from European countries, this statement is valid to justify, at least partially, the share that “Natural Gas” has obtained for years 2030 and 2040 in Table 5. Likewise, Lyrio de Oliveira et al. (2022) found that “Natural Gas” is the preferred non-renewable option, in this case, for Brazil. Furthermore, the model proposed by the authors also returns maximum expansions for “Hydro,” “Wind” and “Solar” technologies, results that are in line with those here presented. Malala and Adachi (2020) claim that optimal portfolios require additional investments in “Natural Gas,” “Wind” and “Solar” technologies. Although the results are specific to Kenya, they are in line with those obtained here for the European Union.

In other words, the results obtained with the MPT model for the European Union are largely in line with the conclusions previously reached by other authors for this and other regions. However, the technologies that have maximized their participation when seeking to minimize risk or costs are not exactly the best technologies from an environmental point of view. Therefore, it is now time to compare the composition of the environmentally optimal portfolios with the GMV and GMC portfolios. In doing so, it is possible to extract some relevant ideas. In particular:

-

Portfolio 3 (+/-5% variation in the share of each technology) can be compared to the portfolios generated by the MPT model for the 2020 horizon. In general terms, it is possible to say that this environmentally optimal portfolio presents efficient cost/risk combinations for the “Hydro,” “Natural Gas,” “Nuclear” and “Wind energy” technologies, as they present similar shares.

One of the main differences is found in “Coal.” The MPT model completely eliminates this option, while the environmentally optimal portfolio still maintains it. In any case, the participation of “Coal” in Portfolio 3 has considerably decreased in comparison with the baseline scenario, which is in line with the “movement” suggested by the MPT model. The opposite occurs for “Lignite” power plants. The GMV and GMC portfolios present around two times the share for this technology as compared to Portfolio 3.

In terms of risks and costs (MPT model), it could be concluded that the main difference between a minimum risk and a minimum cost portfolio lies in the share of “Hydro” and “Natural Gas.” If the objective is to minimize the risk, “Hydro” should increase its participation by 5%, while “Natural Gas” should decrease its share by the same value. The opposite must be the case if the objective is to minimize the total cost. All this is for year 2020.

-

Portfolio 2 (+/-25% variation in the share of each technology) can be compared to the portfolios generated by the MPT model for the 2030 horizon. In this case, the differences are greater. The GMV portfolio is closer to Portfolio 2 than GMC. In particular, GMV and Portfolio 2 present similar technology shares for: “Coal” (9.61–10%), “Hydro” (13.50–12.77%) and “Nuclear” (26.69–25.56%). In order to bring Portfolio 2 closer to an optimal solution in terms of risk, it would be necessary to increase the participation of “Lignite,” “Solar PV” and “Wind” energy.

-

Portfolio 1 (+/-50% variation in the share of each technology) can be assimilated into the MPT portfolios for 2040 and 2050, since it is the one with the greatest possible variation, which often requires more time for the changes to be made effective. Portfolio 1 prioritizes the participation of three technologies: “Hydro,” “Wind” and “Natural Gas.” Nevertheless, if the objective is to minimize the risk, Portfolio 1 still needs an additional expansion in terms of “Wind” energy. A greater participation of “Nuclear” and “Solar PV” technologies is also required.

With regard to the diversification index—the Herfindahl–Hirschman Index—it can be seen that there is systematically a greater concentration in GMC portfolios than in their GMV counterparts. Therefore, it is possible to conclude that portfolios with minimum costs are associated with lower levels of energy security.

Looking at the role of technologies in both the environmentally optimal and the MPT portfolios, the following can be noted:

-

“Coal” is a technology that would only participate in the efficient MPT portfolios when the objective is to minimize the risk. From an environmental point of view, its progressive abandonment is confirmed. In the latter case, this is because it is a technology that can generate considerable environmental impacts in terms of the potential for global warming, acidification, terrestrial eutrophication and human toxicity (non-cancerous effects), among other possible environmental indicators (Cartelle Barros et al., 2020, 2022).

-

“Lignite” proved to be a preferential option in MPT portfolios (irrespective of whether the objective is to minimize risk or cost. On the contrary, the MIVES environmental model progressively reduces its share as the possibility of variation increases. It is important to note that lignite-fired power plants have very poor environmental performance. Compared to other alternative technologies, they contribute greatly to global warming, particulate matter and acidification, among other possibilities. In fact, according to the MIVES model, its environmental index in European countries rarely exceeds a value of 0.5, with 1 being the best possible result.

-

“Natural Gas” is a technology with a relevant share for the 2020-time horizon for efficient portfolios in terms of costs and risk. However, as later time horizons are considered, “Natural gas” would only take part in the GMC portfolios. On the other hand, from an environmental point of view, it was identified as a preferred technology, as its share increases in all scenarios. The reason for this is that this technology proved to be the best non-renewable energy that can be used for the baseload from an environmental point of view. In fact, its environmental performance per kWh of electricity produced even surpasses certain renewable energies, such as solar photovoltaic. Its contribution to global warming is lower than that of other thermal power plants. It is also the best alternative in terms of ionizing radiation (Cartelle Barros et al., 2020).

-

“Nuclear” technology is preferential in terms of MPT for 2020 and 2050. Its share varies from 25.56% in 2030 to 35.46% in 2050. In contrast, it gradually reduces its share in the environmentally optimal scenarios. However, some clarifications are needed. Nuclear energy has been identified as the second-best non-renewable alternative for the baseload from an environmental point of view, only surpassed by natural gas (even outperforming this technology in certain countries). Therefore, the share of nuclear energy in MIVES scenarios does not increase due to the way in which the optimization was proposed in the study developed by Cartelle Barros et al. (2022). In this study, the best environmental alternatives increase their share in order, from best to worst, trying to take advantage of all the freedom provided by the constraints. At the same time, the worst alternatives decrease their share, also in an orderly fashion, but in this case in the opposite direction. These two processes occur simultaneously, always respecting the constraints and with the objective of maximizing the overall environmental performance at European level. Under these circumstances, the optimization process very often leads to increasing only the share of “Hydro,” “Wind” and “Natural Gas” alternatives. This should then be followed by an increase in the share of alternatives such as “Solar photovoltaic” or “Nuclear.” However, this usually runs counter to the objective function or the constraints. Therefore, taking into account how the optimization problem was modeled in Cartelle Barros et al. (2022), nuclear decreases its share in the European Union as a whole. Nevertheless, this is not always the case if a country-by-country analysis is performed (Cartelle Barros et al., 2022). Furthermore, if other constraints are set and also if other real barriers are considered, there would most likely be scenarios in which nuclear would increase its share, also with the aim of maximizing the EU’s environmental performance.

-

“Hydro” is a preferred technology from an environmental point of view. It is also a good alternative in the MPT model if minimum risk is proposed as an objective.

-

“Solar PV” is a preferential technology in the MPT model to achieve efficiency in terms of both risk and assumed cost. Its final share is four times the participation of the 2020 portfolios. However, from an environmental point of view, it is not considered a preferred technology. The comments made for nuclear are also applicable to this technology. In any case, Solar photovoltaic is the clear example that not all renewable energies generate negligible environmental impacts as compared to non-renewable energies, in particular, if a cradle-to-grave approach is adopted and also if the impacts are analyzed per unit of electricity generated, as has been the case in the study conducted by Cartelle Barros et al. (2020). In this line, the environmental results of “Solar PV” is considerably worse than those of other renewable energies, such as “Hydro” or “Wind.” In fact, its environmental performance is closer to that of natural gas or even to the typical performance of a nuclear power plant. Solar PV obtained discrete environmental results for indicators such as resource depletion or freshwater ecotoxicity.

-

“Wind” proved to be an outstanding option in both “MIVES” and “MPT” models. It is a technology, therefore, that excels in both environmental and cost/risk optimization. A higher share of this technology would be needed, which could place it at a level of 37–44% in the 2050 efficient portfolio.

According to the modern portfolio theory, when the objective is to minimize the risk for the 2030, 2040 and 2050 horizons, “Natural Gas” should be abandoned from 2030 on. Similarly, “Lignite” and “Coal” technologies should also experience a progressive abandonment. On the other hand, “Nuclear,” “Solar PV” and “Wind energy” should increase their share. If the objective is to minimize the cost of the portfolio, “Hydro” should be replaced by “Natural Gas” and “Coal.” Furthermore, “Lignite,” “Nuclear,” “Solar PV” and “Wind” would reach the maximum permitted limits.

5 Conclusions, limitations and future developments

The modern portfolio theory (MPT) is one of the most commonly used techniques in order to solve energy planning problems. The aim of this methodology is to determine the efficient frontier. It usually consists of all the optimal combinations of power plants according to a specific binominal, for instance, cost and risk. Once this frontier has been calculated, the assessment of potential future energy scenarios is a common practice in the existing literature. The idea is to test whether those future portfolios are efficient when an MPT method is applied and, if not, to analyze how the share of each technology must change in order to approach the efficient frontier. These scenarios are usually future projections proposed by public and private organizations at different geographic levels. Nevertheless, to the best of the authors’ knowledge, the environmental dimension is not taken into account to the extent that it should be. This is one of the main shortcomings to be resolved.

In other words, in this study the MPT method is applied to the European Union with the objective of determining the efficient frontier (total generation costs and risk) for several years: 2020, 2030, 2040 and 2050. After that, different scenarios were assessed. In particular, the real electric mix for the European Union for year 2017, as well as three environmentally optimal portfolios proposed in a previous work developed by Cartelle Barros et al. (2022). Finally, the distances between the portfolios and the efficient frontier have been calculated. This distance can be interpreted as the reduction in costs/risks that would have to be assumed in order to achieve efficiency.

The efficient frontiers generated by the MPT model show an improvement in the cost/risk levels as the time horizon increases, since they shift on the coordinate axis to the left (lower risk) and downward (lower cost). It is therefore confirmed that future projections advance the creation of cost/risk-efficient portfolios for the European Union. On the other hand, the results indicated that the environmentally optimal portfolios are not cost/risk efficient. In fact, environmentally efficient portfolios entail a slightly higher cost than absolute minimum risk portfolios and present a higher risk in all cases. In greater detail, the environmentally optimal scenario for 2030 should replace “Natural Gas” with “Lignite,” “Wind” and “Solar PV” technologies in order to be more efficient in terms of costs and risk. Similar conclusions were also obtained for the 2040–2050-time horizon. In this case, “Natural Gas” should be substituted by “Nuclear,” “Solar PV” and “Wind” energy. In terms of technologies, “Hydro,” “Lignite,” “Solar PV” and “Wind” were identified as the best technologies in terms of cost/risk. “Nuclear” power joins this group of preferred alternatives for 2020 and 2050. In other words, the share of these technologies in the European electric mixes should be as high as possible for different time horizons. If the cost/risk and environmental approaches are analyzed together, the following conclusions can be drawn:

-

“Lignite” technology is preferred for cost/risk efficiency, but is discarded from an environmental point of view.

-

The “Natural Gas” technology continues to be preferred for environmental optimization as the time horizon progresses, while it is discarded for cost/risk efficiency if minimum risk is sought.

-

“Nuclear” power generation resulted to be an acceptable baseload technology from an environmental point of view. However, if it is possible to increase the capacity of other better alternatives such as “Wind,” “Hydro” or “Natural Gas,” its share will not increase. “Nuclear” resulted to be a preferential option in terms of cost/risk for the 2020 and 2050 horizons, with a share between 25 and 35%.

-

“Hydro” is a preferred technology in the MIVES model and in MPT if minimum risk is proposed as an objective. Its efficient share is between 11 and 13%.

-

“Solar PV” is a preferred technology in the MPT model, but not for environmental optimization. Its final share in 2050 would be multiplied by 4 (from 3 to 13%) in the case of pursuing cost/risk efficiency.

-

“Wind” is preferential in both “MIVES” and “MPT” models. It is a technology, therefore, that excels in both environmental and cost/risk optimization. In terms of cost/risk efficiency, the EU should have a share of 37–44% in the efficient portfolio in 2050.

In case the EU opts for an objective of minimizing the cost of electricity production, the “Hydro” share should be abandoned and replaced by “Natural Gas” and “Coal.” The shares of “Lignite,” “Nuclear,” “Solar PV” and “Wind energy” increase to the maximum allowed limits.

Some of the limitations of this study are associated with possible future developments. By way of example, the environmentally optimal scenarios assessed in terms of costs and risk were obtained through the application of a multi-criteria decision-making (MCDM) method, in particular MIVES. However, there are many other MCDM methods in the existing literature (Koppiahraj et al., 2021). Consequently, one possible future approach would be to assess (with the MPT model) new environmentally optimal portfolios, in this case, obtained through the application of other MCDM techniques. Although each MCDM method has its own peculiarities, this future development should not lead to conclusions that are very different from those presented here. Another potential line of future research is based on studying the feasibility of a mixed model that incorporates the environmental dimensions of the MCDM optimization model and the economic-financial dimensions of the quadratic optimization portfolio theory model.

Data availability

All data generated or analyzed during this study are included in this published article (and its supplementary information files).

Notes

EU-27: the 27 countries belonging to the European Union (EU) after the UK left the EU.

References

Arnesano, M., Carlucci, A. P., & Laforgia, D. (2012). Extension of portfolio theory application to energy planning problem—The Italian case. Energy, 39, 112–124. https://doi.org/10.1016/j.energy.2011.06.053

Awerbuch, S., & Berger, M. (2003). Applying portfolio theory to EU electricity planning and policy-making. Paris. www.iea.org.

Awerbuch, S., & Yang, S. (2007). Efficient electricity generating portfolios for Europe: Maximising energy security and climate change mitigation. European Investment Bank (EIB) Papers, 12(2), 8–37.

Babatunde, O. M., Munda, J. L., & Hamam, Y. (2019). A comprehensive state-of-the-art survey on power generation expansion planning with intermittent renewable energy source and energy storage. International Journal of Energy Research. https://doi.org/10.1002/er.4388

Brandi, H. S., & dos Santos, S. F. (2020). Measuring sustainable development goals: An application of modern portfolio theory on sustainability systems. Clean Technologies and Environmental Policy, 22, 803–815. https://doi.org/10.1007/s10098-020-01822-1

Carneiro, T. C., Ferreira Batista Lima, M. A., Marquesde Carvalho, P. C., Guimarães Batista, J., & Fernández-Ramírez, L. M. (2022). Methodology for integration of wind resource forecasts based on artificial neural networks. International Journalof Energy Research, 46, 8271–8287. https://doi.org/10.1002/er.7728

Cartelle Barros, J. J., de Llano Paz, F., Lara Coira, M., de la Cruz López, M. P., del Caño Gochi, A., & Soares, I. (2022). New approach for assessing and optimising the environmental performance of multinational electricity sectors: A European case study. Energy Conversion and Management. https://doi.org/10.1016/j.enconman.2022.116023

Cartelle Barros, J. J., Lara Coira, M., de la Cruz López, M. P., del Caño Gochi, A., & Soares, I. (2020). Probabilistic multicriteria environmental assessment of power plants: A global approach. Applied Energy, 260, 114344. https://doi.org/10.1016/j.apenergy.2019.114344

Castro, G. M., Klöckl, C., Regner, P., Schmidt, J., & Pereira, A. O. (2022). Improvements to modern portfolio theory based models applied to electricity systems. Energy Economics, 111, 106047. https://doi.org/10.1016/j.eneco.2022.106047

Chang, M., Thellufsen, J. Z., Zakeri, B., Pickering, B., Pfenninger, S., Lund, H., & Østergaard, P. A. (2021). Trends in tools and approaches for modelling the energy transition. Applied Energy, 290, 116731. https://doi.org/10.1016/j.apenergy.2021.116731

Chu, C. T., & Hawkes, A. D. (2020). Optimal mix of climate-related energy in global electricity systems. Renewable Energy, 160, 955–963. https://doi.org/10.1016/j.renene.2020.06.104

Ciscar, J. C., Saveyn, B., Soria, A., Szabo, L., van Regemorter, D., & van Ierland, T. (2013). A comparability analysis of global burden sharing GHG reduction scenarios. Energy Policy, 55, 73–81. https://doi.org/10.1016/j.enpol.2012.10.044

Cucchiella, F., Gastaldi, M., & Trosini, M. (2017). Investments and cleaner energy production: A portfolio analysis in the Italian electricity market. Journal of Cleaner Production, 142, 121–132. https://doi.org/10.1016/j.jclepro.2016.07.190

Dagoumas, A. S., & Koltsaklis, N. E. (2019). Review of models for integrating renewable energy in the generation expansion planning. Applied Energy, 242, 1573–1587. https://doi.org/10.1016/j.apenergy.2019.03.194

de Faria, V. A. D., de Queiroz, A. R., & DeCarolis, J. F. (2022). Optimizing offshore renewable portfolios under resource variability. Applied Energy, 326, 120012. https://doi.org/10.1016/j.apenergy.2022.120012

de la Cruz, M. P., Castro, A., del Caño, A., Gómez, D., Lara, M., & Cartelle, J. J. (2014). Comprehensive methods for dealing with uncertainty in assessing sustainability part 1: The MIVES-monte carlo method. In M. S. García-Cascales, J. M. Sánchez-Lozano, A. D. Masegosa, & C. Cruz-Corona (Eds.), Soft computing applications for renewable energy and energy efficiency (pp. 69–106). Hershey: IGI Global.

DeLlano Paz, F., Antelo, S. I., Calvo Silvosa, A., & Soares, I. (2014). The technological and environmental efficiency of the EU-27 power mix: An evaluation based on MPT. Energy, 69, 67–81. https://doi.org/10.1016/j.energy.2014.02.036

DeLlano Paz, F., Calvo-Silvosa, A., Antelo, S. I., & Soares, I. (2017). Energy planning and modern portfolio theory: A review. Renewable and Sustainable Energy Reviews, 77, 636–651. https://doi.org/10.1016/j.rser.2017.04.045

DeLlano Paz, F., Calvo-Silvosa, A., Antelo, S. I., & Soares, I. (2018). Power generation and pollutant emissions in the European Union: A mean-variance model. Journal of Cleaner Production, 181, 123–135. https://doi.org/10.1016/j.jclepro.2018.01.108

DeLlano Paz, F., Calvo-Silvosa, A., Iglesias Antelo, S., & Soares, I. (2015). The European low-carbon mix for 2030: The role of renewable energy sources in an environmentally and socially efficient approach. Renewable and Sustainable Energy Reviews, 48, 49–61. https://doi.org/10.1016/j.rser.2015.03.032

Dranka, G. G., Ferreira, P., & Vaz, A. I. F. (2021). A review of co-optimization approaches for operational and planning problems in the energy sector. Applied Energy, 304, 117703. https://doi.org/10.1016/j.apenergy.2021.117703

European Commission. (2011). International reference life cycle data system handbook—Recommendations for life cycle impact assessment in the European context. European Commission. https://doi.org/10.2788/33030

European Commission. (2014). Communication from the Commission to the European Parliament and the Council. European Energy Security Strategy.

European Commission. (2016). Energy, transport and GHG emissions, trends to 2050: EU reference scenario 2016. European Commission.

Eurostat. (2017). Energy statistics. Quantities and annual data. 2017. https://ec.europa.eu/eurostat/data/database.

Eurostat. (2022). Shedding light on energy in the EU. https://doi.org/10.2785/640865.

Gao, C., Sun, M., Shen, B., Li, R., & Tian, L. (2014). Optimization of China’s energy structure based on portfolio theory. Energy, 77, 890–897. https://doi.org/10.1016/j.energy.2014.09.075

Halder, B., Karimi, A., Mohammad, P., Bandyopadhyay, J., Brown, R. D., & Yaseen, Z. M. (2022). Investigating the relationship between land alteration and the urban heat island of Seville city using multi-temporal Landsat data. Theoretical and Applied Climatology, 150, 613–635. https://doi.org/10.1007/s00704-022-04180-8

Harish, V. S. K. V., Anwer, N., & Kumar, A. (2022). Applications, planning and socio-techno-economic analysis of distributed energy systems for rural electrification in India and other countries: A review. Sustainable Energy Technologies and Assessments, 52, 102032. https://doi.org/10.1016/j.seta.2022.102032

International Energy Agency. (2018). World Energy Outlook 2018. www.iea.org/weo.

Karimi, A., Kim, Y. J., Mohammad Zadeh, N., García-Martínez, A., Delfani, S., Brown, R. D., et al. (2022a). Assessment of outdoor design conditions on the energy performance of cooling systems in future climate scenarios—A case study over three cities of Texas, Unites States. Sustainability, 14, 14848. https://doi.org/10.3390/su142214848

Karimi, A., Mohammad, P., García-Martínez, A., Moreno-Rangel, D., Gachkar, D., & Gachkar, S. (2022b). New developments and future challenges in reducing and controlling heat island effect in urban areas. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-022-02530-0

Khandaker, S., Bashar, M. M., Islam, A., Hossain, M. T., Teo, S. H., & Awual, M. R. (2022). Sustainable energy generation from textile biowaste and its challenges: A comprehensive review. Renewable and Sustainable Energy Reviews, 157, 112051. https://doi.org/10.1016/j.rser.2021.112051

Kim, Y. J., Cho, S. H., & Sharma, B. P. (2021). Constructing efficient portfolios of low-carbon technologies. Renewable and Sustainable Energy Reviews, 150, 111515. https://doi.org/10.1016/j.rser.2021.111515

Koltsaklis, N. E., & Dagoumas, A. S. (2018). State-of-the-art generation expansion planning: A review. Applied Energy, 230, 563–589. https://doi.org/10.1016/j.apenergy.2018.08.087

Koppiahraj, K., Bathrinath, S., Venkatesh, V. G., Mani, V., & Shi, Y. (2021). Optimal sustainability assessment method selection: A practitioner perspective. Annals of Operations Research. https://doi.org/10.1007/s10479-021-03946-z

Kupfer, T., Baitz Martin, Colodel, C. M., Kokborg, M., Schöll, S., Rudolf, M., et al. (2017). GaBi database and modelling principles 2017. Leinfelden-Echterdingen. http://www.gabi-software.com/fileadmin/GaBi_Databases/GaBi_Modelling_Principles_2017.pdf.

Lucheroni, C., & Mari, C. (2017). CO2 volatility impact on energy portfolio choice: A fully stochastic LCOE theory analysis. Applied Energy, 190, 278–290. https://doi.org/10.1016/j.apenergy.2016.12.125

Lyrio de Oliveira, L., de Oliveira Ribeiro, C., & Qadrdan, M. (2022). Analysis of electricity supply and demand intra-annual dynamics in Brazil: A multi-period and multi-regional generation expansion planning model. International Journal of Electrical Power and Energy Systems, 137, 107886. https://doi.org/10.1016/j.ijepes.2021.107886

Malala, O. N., & Adachi, T. (2020). Portfolio optimization of electricity generating resources in Kenya. The Electricity Journal, 33, 106733. https://doi.org/10.1016/j.tej.2020.106733

Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91. https://doi.org/10.1111/j.1540-6261.1952.tb01525.x

Martinez-Fernandez, P., deLlano-Paz, F., Calvo-Silvosa, A., & Soares, I. (2018). Pollutant versus non-pollutant generation technologies: A CML-analogous analysis. Environment, Development and Sustainability, 20, 199–212. https://doi.org/10.1007/s10668-018-0195-y

Niet, T., Arianpoo, N., Kuling, K., & Wright, A. S. (2022). Increasing the reliability of energy system scenarios with integrated modelling: A review. Environmental Research Letters, 17, 043006. https://doi.org/10.1088/1748-9326/ac5cf5

Qamar, S., Ahmad, M., Oryani, B., & Zhang, Q. (2022). Solar energy technology adoption and diffusion by micro, small, and medium enterprises: Sustainable energy for climate change mitigation. Environmental Science and Pollution Research, 29, 49385–49403. https://doi.org/10.1007/s11356-022-19406-5

Rhoades, S. A. (1993). The Herfindahl–Hirschman Index. Federal Reserve Bulletin, 79, 188–189.

Rizvi, S. H., Fatima, H., Iqbal, M. J., & Alam, K. (2020). The effect of urbanization on the intensification of SUHIs: Analysis by LULC on Karachi. Journal of Atmospheric and Solar-Terrestrial Physics, 207, 105374. https://doi.org/10.1016/j.jastp.2020.105374

Rocha, P., & Kuhn, D. (2012). Multistage stochastic portfolio optimisation in deregulated electricity markets using linear decision rules. European Journal of Operational Research, 216, 397–408. https://doi.org/10.1016/j.ejor.2011.08.001

Roques, F., Hiroux, C., & Saguan, M. (2010). Optimal wind power deployment in Europe-A portfolio approach. Energy Policy, 38, 3245–3256. https://doi.org/10.1016/j.enpol.2009.07.048

Roques, F. A., Newbery, D. M., & Nuttall, W. J. (2008). Fuel mix diversification incentives in liberalized electricity markets: A mean-variance portfolio theory approach. Energy Economics, 30, 1831–1849. https://doi.org/10.1016/j.eneco.2007.11.008

Russ, P., Ciscar, J.-C., Saveyn, B., Soria, A., van Ierland, T., van Regemorter, D., & Virdis, R. (2009). Economic assessment of post-2012 global climate policies: Analysis of greenhouse gas emission reduction scenarios with the POLES and GEM-E3 models. Publications Office. https://doi.org/10.2791/70332

Scala, A., Facchini, A., Perna, U., & Basosi, R. (2019). Portfolio analysis and geographical allocation of renewable sources: A stochastic approach. Energy Policy, 125, 154–159. https://doi.org/10.1016/j.enpol.2018.10.034

Steffen, B., & Patt, A. (2022). A historical turning point? Early evidence on how the Russia-Ukraine war changes public support for clean energy policies. Energy Research and Social Science, 91, 102758. https://doi.org/10.1016/j.erss.2022.102758

Surmonte, F., Perna, U., Scala, A., Rubino, A., & Facchini, A. (2021). A Data-driven approach to renewable energy source planning at regional level. Energy Sources, Part b: Economics, Planning and Policy, 16(11–12), 1064–1075. https://doi.org/10.1080/15567249.2021.1926598

Tapia Carpio, L. G. (2021a). Efficient spatial allocation of solar photovoltaic electric energy generation in different regions of Brazil: A portfolio approach. Energy Sources, Part b: Economics, Planning and Policy, 16(6), 542–557. https://doi.org/10.1080/15567249.2021.1931987

Tapia Carpio, L. G. (2021b). Mitigating the risk of photovoltaic power generation: A complementarity model of solar irradiation in diverse regions applied to Brazil. Utilities Policy, 71, 101245. https://doi.org/10.1016/j.jup.2021.101245

Thinkstep. (2018a). Energy database 2018a. GaBidatabase 2018a LCI documentation. http://www.gabi-software.com/international/support/gabi/gabi-database-2017-lci-documentation/extension-database-ii-energy/.

Thinkstep. (2018b). Professional database 2018b. GaBi database 2018b LCI documentation.

Vithayasrichareon, P., & MacGill, I. F. (2012). Portfolio assessments for future generation investment in newly industrializing countries—A case study of Thailand. Energy, 44, 1044–1058. https://doi.org/10.1016/j.energy.2012.04.042

Wu, J. H., & Huang, Y. H. (2014). Electricity portfolio planning model incorporating renewable energy characteristics. Applied Energy, 119, 278–287. https://doi.org/10.1016/j.apenergy.2014.01.001

Acknowledgements

The authors would like to thank the Editor and the anonymous reviewers for a constructive and encouraging review, which helped enhance the paper.

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature. Funding for open access charge: Universidade da Coruña/CISUG. No funding was received to assist with the preparation of this manuscript.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors have no competing interests to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

deLlano-Paz, F., Cartelle-Barros, J.J. & Martínez-Fernández, P. Application of modern portfolio theory to the European electricity mix: an assessment of environmentally optimal scenarios. Environ Dev Sustain 26, 15001–15029 (2024). https://doi.org/10.1007/s10668-023-03232-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-023-03232-x