Abstract

Financial development is a multidimensional process that contributes to economic growth but sometimes it has a devastating effect on climate change. No country can achieve sustainable development goals without caring the environmental quality. The present study investigates the moderating role of globalization (KOF) in determining the financial development (FD) on environmental degradation in the SAARC countries from 1990 to 2020. The long-run coefficients are estimated using the panel quantile regression (PQR) approach at lower, middle and upper quantile groups. The study shows the U-shaped relationship across three quantile groups based on financial development and carbon emissions. The moderator globalization (KOF) brings up the change in the turning point and flattens before the maturity of the U-shaped curve at the middle quantile while flattens after the maturity of the U-shaped curve at the upper quantile. The study recommends that by using energy-efficient technologies, better financial sector interaction with globalization enhances the environmental quality in SAARC countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Nowadays, global warming has been the most debatable topic among researchers, governments, policymakers, and international organizations all over the world. To achieve higher economic growth, most of the economies rely on fossil fuel consumption by the massive industrialization (Abad-Segura et al. 2020; Hsu et al. 2021). It badly pollutes the environmental quality which causes global warming, flooding, melting ice caps, and climate vulnerability (Amjad et al. 2021b). The most recent conference on climate change COP26 paid special attention to decline greenhouse gases. It was warned that if there is no collective effort to decline environmental pollution, then no country can achieve sustainable development goals. The IPCC (2022) estimated the concentration of CO2 emissions in the atmosphere was around 278 ppm from 1750 to 1800, while in March 2021, it increased 50% and reached to 417 ppm. Furthermore, it was emphasized that if we fail to reduce carbon concentration in the atmosphere, it will double from the pre-industrial stage in 2035 and reach 556 ppm (Wang et al. 2022a, 2022b).

To achieve the sustainable development goals (SDG), many researchers have used financial inclusion (Amjad et al. 2021a; Kim et al. 2018; Rani et al. 2022a, 2022b; Saleem et al. 2022). The development of a country depends upon its strong and reliable financial system. No doubt, the financial system provides saving mobilization channels, capital allocation, risk diversification, investment monitoring, lower borrowing costs, and transaction facilitation. The financial institutions may change consumer patterns, increase investment flows, and improve R & D in technical activities in contemporary economic settings (Xu, 2022). Policymakers now agreed that it is impossible to achieve the SDG without controlling the environmental pollution.

The policymakers have failed to investigate the exact relationship between financial development (FD) sector and environmental pollution. There are numerous studies available in the literature which has pointed out that FD sector deteriorates the environment due to a poor financial system (Shen et al. 2021; Tahir et al. 2021). Usually, in developing countries, the FD sector is not developed. These countries face the problem of credit facilities which force their industries to use outdated technologies that emit massive carbon emissions. While on the other hand, many studies have examined the role of financial development in improving the environmental quality. These studies evaluated that the financial sector is critical for improving productive units, institutions, and markets, substantially contributing to economic growth (Bindu et al. 2021; Das & McFarlane, 2021; Usman & Hammar, 2021). The easy access to loans for small- and medium-sized industries motivates investors to invest in environment friendly technologies that not only generate employment opportunities but also reduce income disparity.

The present study is carried out in South Asian Association for Regional Cooperation (SAARC) countries to formulate consistent policies for improving environment with the inclusion of FD sector. The most recent study by Rani et al. (2022a, 2022b) conducted on SAARC countries explored that the FD sector deteriorates the environmental quality. Due to poor financial sectors, there is lack of credit facilities available to investors forcing them to use outdated technologies run by polluted energy, which causes massive CO2 emissions.

Figure 1 shows the upward trend of CO2 emissions in SAARC economies, which have been continuously increasing in the last thirty years. It is also observed that the Maldives is the major contributor to CO2 emissions. India is the second one which spreads pollution the region. Pakistan is in the third position, while Afghanistan discharges lowest emissions.

A question arises here how does this financial inclusion improve the environmental quality? Sheraz et al. (2021) used globalization as the moderator with the inclusion of FD sector to improve the environmental quality. Since the beginning of the present century, through globalization, the movement of commodities and services between countries has risen. This has generated competition between developed and developing countries. Therefore, countries are putting forth significant efforts to improve their welfare and physical and human capital (Du et al. 2022). Researchers are of opinion that globalization provides ecologically beneficial technology; the quality of the environment will improve as trade volume and foreign direct investment increase (Ahmad et al. 2021).

This study is an attempt to explore the moderating role of globalization in determining the FD sector with CO2 emissions in SAARC countries. In G-20 countries, Sheraz et al. (2021) investigated the moderation effect of globalization with linear financial inclusion on environmental quality. The present study follows Rani et al. (2022a, 2022b) who found that financial development has a U-shaped relationship with carbon emissions in SAARC countries. The current study is very novel as it uses the moderation effect of globalization (KOF index) with the interaction of the U-shaped curve FD sector on CO2 emissions. In addition, the moderating effect of globalization is analyzed to promote environmental quality. The significance of this study is to fill the research gap through nonlinear analysis of financial development by using the moderation effect of globalizations because not many studies have empirically verified this relationship in SAARC countries. This study will try to verify the null hypothesis that the moderation effect of globalization does not change the turning point of the U-shaped curve of the FD and CO2 emissions in SAARC countries.

The primitive contributions of this research are as follows: (1) it analyzes the panel data of eight SAARC economies during 1990 to 2020, which is the latest three-decade after the strategy of ecological civilization proposed by the SAARC governments. (2) A nonlinear estimation approach as panel quantile regression (QPR) at the lower, middle, and upper quartiles (Q1, Q2, and Q3) is used.

The remainder of the study is organized as follows. The literature review is presented in Sect. 2. Data, methodology and theoretical model are explained in Sect. 3. Results and discussion are presented in Sect. 4, whereas conclusion and policy recommendations are given in Sect. 5.

2 Review of literature

Previous studies have discussed the link between financial development (FD) sector and CO2 emissions worldwide. Nowadays, the FD sector has got special importance for agriculture, industries, education, and service sectors. The economic activities in these sectors directly affect the environmental quality. However, the researchers are failed to investigate the acceptable connection between FD and environmental quality. The current literature have pointed out that improvement in the FD sector deteriorates the environmental quality through extensive CO2 emissions as the development in the financial sector motivates the investors to invest in cheaper technologies which increase CO2 emissions (Jiang & Ma, 2019; Khan et al. 2022; Shahbaz et al. 2020a, 2020b). Contrary to the above, several studies have examined that the FD enhances the quality of environment. The strong and healthy financial sector induces the investment in environment friendly technologies which reduce CO2 emissions (Abid et al. 2022; Shobande & Ogbeifun, 2022; Farooq et al. 2022; Shahbaz et al. 2013). All of the above-mentioned studies have shown the linear association between FD and environmental quality. Due to many fluctuations in the financial sectors in all the countries of the world, it is quite difficult to capture the true picture of environmental quality by treating FD as linear. Still, not many studies have analyzed the nonlinear quadratic relationship between FD and CO2 emissions. Rani et al. (2022a, 2022b) explored a U-shaped association between FD and CO2 emissions in South Asian countries.

There are limited studies which have explored the connection between FD and CO2 emissions by using the moderator variable of FD, which modifies the impact of FD on the environment. Ojeyinka and Osinubi (2022) worked 22 sub-Saharan countries to find the association between FD and CO2 emissions. The results of the study show that FD is negatively associated with sustainable development, but the inclusion of globalization increases the CO2 emissions. Similarly, Sheraz et al. (2021) used globalization as a moderator with the FD on CO2 emissions in G20 countries. The study showed that the financial sector enhances CO2 emissions in the complete sample, but this effect becomes negative with the interaction of the moderator. Additionally, the financial sector enhanced CO2 emissions in the subsample of developing countries following interaction. Rani et al. (2022a) have found that FD not only improves the economic growth of a country but also damages the environmental quality of the economies. Liu et al. (2019) pointed out that it is difficult for policymakers to predict whether FD has a good or bad impact on CO2. Furthermore, the use of different econometric technique, changes in sample size, and proxies may produce mixed results (Amin et al. 2020).

Several academicians have examined the impact of globalization on CO2 emissions. Akadiri et al. (2019) conducted a ground breaking analysis of KOF in Turkey from the year 1970 to 2014. The outcomes indicate that KOF reduces CO2 emissions. Salahuddin et al. (2019) pointed out that KOF has no harmful effect on the environment in sub-Saharan African countries. Zaidi et al. (2019) explored that KOF increases the CO2 emission in OPEC countries. Additionally, Shahbaz et al. (2019) evaluated the link between KOF and CO2 emissions in 87 OECD economies and pointed out that KOF is beneficial in reducing CO2 emissions. In addition Chen et al. (2020) focused on the impact of KOF on CO2 emissions in 36 OECD countries. The results showed that KOF has a significant negative impact on CO2 emissions. Moreover, Kirikkaleli et al. (2022) analyzed the impact of KOF and energy consumption on carbon emissions in Bangladesh from 1972 to 2016. The result showed that KOF is the main driving factor in reducing CO2 emissions, while fossil fuels increase the chances of ecological issues. Similarly, Rahman (2020) studied the effect of KOF on CO2 emissions. The outcomes showed that KOF promotes environmental excellence. Wang et al. (2021) investigated the influence of KOF in 137 countries from 1970 to 2014 and discovered that KOF reduces CO2 emissions in developed countries. However, Guan et al. (2022) claimed that KOF had become a reason for increasing environmental degradation in G-10 countries. From the review of the above literature, it can be observed that some researchers found that KOF reduces CO2 emissions. While, few researchers have found the opposite results and concluded that KOF increases CO2 emissions. These contradictory results may be due to certain factors, like the use of different sample sizes and estimation techniques. This calls for the need to analyze the relationship between the variables using recent econometric development.

Education has become an integral part of human life, which has changed the way of thinking. It has not only changed the lifestyle but also brought about changes in the techniques of production, which help in reducing CO2 emissions by encouraging R&D. Furthermore, education has become an effective instrument in the fight against climate change, which has exerted a bad impact on agricultural productivity in all countries in the world. Researchers and academicians are agreed to reduce CO2 emissions through education. Bano et al. (2018) explored that increasing education is the most effective way of handling undesirable environmental factors in Pakistan. The study concluded that people should be made aware of the use of green technologies rather than conventional energy sources. Zafar et al. (2020) introduced a new paradigm to study the impact of education on the environment in OECD economies and explored a significant impact of quality education on environmental sustainability. Katircioglu et al. (2020) concluded that information still has an essential role in mitigating environmental degradation. Mukherjee (2018) opined that different types of courses, seminars, and conferences related to CO2 emissions and harmonizing society raise awareness among the public. The above discussion reveals that education is an important tool that can be used to reduce CO2 emissions particularly in developing countries.

Economic growth and environmental pollution go side by side because fossil fuel energy consumption in industries for producing output has become a major cause of greenhouse gases, which are harmful to living creatures. Many researchers have explored the relationship amid economic growth and CO2. Beside it, Ahmed et al. (2022) focused a relationship between China’s economic growth and CO2 emissions. The results show that on one side, rapid industrialization increases the development process, but on the other hand, it deteriorates ecological excellence. Similarly, Tang and Tan (2015) conducted studies on Vietnam to analyze the link between growth, foreign investment and CO2 emissions. The results show that growth and investment have a meaningful impact on the ecological footprint. Additionally, Razak et al. (2013) investigated the link amid economic growth and environmental pollution by using the IPAT-fuzzy model. The results show that Malaysian growth is also a cause of ecological footprint. Several studies have shown that population exerts bad impact on environment due to the lack of resources, rising demand for housing, massive consumption of fossil fuels, and huge demand for medical and transport facilities, which disturb the sustainability of the environment (Kim et al. 2020; Yang & Wang, 2020).

The review of above literature brings up that limited studies have examined the moderation effect of KOF with FD on CO2 emissions. Furthermore, the moderation effect of KOF with linear and quadratic FD on CO2 emissions has not been researched properly. This study is an attempt to explore such link in the context of SAARC countries.

3 Theoretical framework

The theoretical model of this study is motivated by the EKC hypothesis. This study examines the impact of the FD sector on CO2 emissions in SAARC countries. The FD influences the CO2 emissions through income, capital, technology, and polices (Yuxian & Chen, 2011). The researchers have failed to identify the exact association between FD and CO2 emissions. The developed countries have developed FD sector which induces the investors to invest in environment friendly technologies (Abid et al. 2022; Shobande & Ogbeifun, 2022; Farooq et al. 2022; Godil et al. 2021; Shahbaz et al. 2013). On the other hand, the developing countries having poor FD sector cannot properly tackle the problem of CO2 emissions and poor FD sector encourages investment in cheaper environment polluting technologies (Jiang & Ma, 2019; Khan et al. 2022; Shahbaz et al. 2020a, 2020b; Tahir et al. 2021). The present study is conducted in the SAARC countries where the FD sector has observed many fluctuations due to 1990s oil shocks, 9/11 incident, war on terrorism, financial crisis, COVID-19 pandemics, and the most recent Russia-Ukrain war. This indicates that FD sector in these countries will behave nonlinear quadratic relationship with CO2 either U-shaped or inverted U-shaped relationship. Followed by Rani et al. (2022a, 2022b), FD sector proposed the U-shaped relationship with CO2 emissions in South Asian countries.

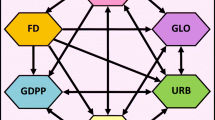

The U-shaped relationship demonstrates that poor FD increases CO2 emissions, while developed FD sector degrades the environment (Rani et al. 2022a, 2022b). This study uses KOF index as the moderator with the FD sector to determine CO2 emissions. The moderator variable changes the turning point of the U-shaped curve. In this study, the inclusion of moderator KOF with both linear and quadratic FD will change turning point of the U-shaped curve. The inverted U-shaped Kuznets’ curve shows that the inclusion of KOF in linear FD deteriorates the environment, while the inclusion of KOF in quadratic FD improves the CO2 (Sardar & Rehman, 2022). Figure 2 shows the theoretical framework of this study.

4 Data and methodology

The present study uses panel data from SAARC countries for the period 1990–2020. The data have been collected to analyze the effect of FD on environmental deterioration and the moderation effect of globalization. The reason for selecting SAARC countries is that in these countries, CO2 emissions were recorded at an average of 1.672 metric tons per capita in 2019, which was higher than all lower-income countries (WDI-2022). The environmental degradation is dependent variable which is proxied by CO2 emissions. The main independent variable is FD. Globalization is proxied by the KOF index and is used as a moderator variable in this study. Furthermore, economic growth is proxied by GDP per capita and urban populations are denoted by URPOP, which serve as the control variables. These variables are taken into the natural logarithm for elasticity-base comparison whose main purpose is to minimize the outlier-based heteroskedasticity (Benoit 2011). Table 1 presents the unit and data source of the variable.

4.1 FD index

Several proxies of FD have been used in the literature, such as the FD index of M2 and liquid liabilities. According to Jalil and Feridun (2011) and Creane et al. (2006), M2 and liquid liabilities do not accurately represent the FD index because M2 only monitors currency consistency, while liquid liabilities only gauge the size of the financial sector. In several studies, domestic credit to the private sector is often used as a proxy for the FD index (Boutabba, 2014; Hunjra et al. 2020). However, this proxy only assesses the FD index depth. Still, the researchers could not find the suitable FD proxy. According to the World Bank’s global FD report (2016), FD has been measured by proxy variables regarding financial depth, access, efficiency, and stability (World Bank, 2016). This study constructs the FD index by combining four FD proxies based on depth, access, efficiency, and stability. This index serves as more accurate and dependable data. This study uses bank credit to bank deposits (%) as an indicator of stability, bank return on assets (%) as an indicator of efficiency, domestic credit to the private sector (%) as an indicator of depth, and firms using banks to finance investments (%), an indicator for access and bank deposits to GDP (%) as an indicator for others.

4.2 Model specification and methodology

Based on the current literature, this study examines the association between FD and CO2 emissions by using the moderating variable along with control variables:

where CO2 is used as a proxy for environmental degradation, FD is the main explanatory variable; KOF is the moderating variable of FD. While EDUI, GDPPC and URPOP are the control variables. Equation (1) can be represented in econometric form as

Following Sheraz et al. (2021), this study uses globalization (KOF) as a moderator factor to solve this problem. In Eq. (3), the interaction between FD and KOF is used.

FD sector has a nonlinear relationship with CO2 emissions by the recommendation of Table 2. In this study, we employed the FD and the square of the FD term which is presented in Eqs. (4), the moderating variable is likewise applied to the quadratic FD.

where \({\alpha }_{0}\) \({\beta }_{0}\) and \({\gamma }_{0}\) are the intercept terms, while \({\alpha }_{1 }, {\alpha }_{2}, \dots {\alpha }_{5}\) are coefficients of the model, whereas\({\beta }_{1}\),\({\beta }_{2}\),\(\dots .. {\beta }_{6}\) indicate coefficients of the second model,\({ \gamma }_{1}\), \({\gamma }_{2,\dots \dots }{\gamma }_{8}\) are coefficients of the third model and \({\varepsilon }_{\mathrm{it}}\) is the residual. FD of SAARC economies was not stable from 1990 to 2020. Therefore, in this case, Model 3 is not appropriate. So, Eq. 4 is appropriate which demonstrates the moderation effect of the KOF turning point of the U-shaped relationship curve. The turning point is estimated by using the first derivate of Eq. 4 with respect to FD and set it equal to zero as follows:

Furthermore, the shifting of the turning point depends upon the moderator KOF. So, we use partial derivative concerning KOF as follows:

In Eq. 6, the denominator has a quadratic term which shows a positive effect, so the shifting of the turning point depends upon the coefficients of the numerator \(\left({\gamma }_{1}{\gamma }_{5}-{\gamma }_{2}{\gamma }_{4}\right)\). The positive value of the numerator shows the turning point will shift rightward, while the negative numerator will shift the turning point leftward. However, the flattens and steepens depend upon the mathematical sign of \({\gamma }_{5}\). If \({\gamma }_{5}\) is negative, then the U-shaped curve will be flattened otherwise steepens (Haans et al. 2016).

4.3 Estimation technique

The panel quantile regression (PQR) technique presented by Koenker and Bassett (1978) is applied. Since most of the series are not stationary, pool OLS does not offer accurate results. As the series contains many outliers, PQR is an appropriate technique as it is quite useful for reducing cross-sectional heteroscedasticity and autocorrelation (Hassan et al. 2020). The data in this study have more than 30 observations for each country, and it is appropriate to apply both panel unit root and co-integration tests (Pedroni, 2004).

5 Results and discussion

Table 2 presents the results of descriptive statistics. The high Kurtosis values indicate the presence of outliers, showing that the data are not linear across countries. The Jarque–Bera values are quite high, and the probability values are statistically significant, indicating that the series is not normally distributed.

The correlation plot in Fig. 3 shows pairwise correlation between the variables. It is displayed through different shades. The dark red color presented the perfect positive correlation between variables. The light red color between independent variables shows lower multicollinearity issue.

The VIF results are presented in Table 3. The values of VIF are less than 10 which indicated no issue of multicollinearity.

This study uses Levin, Lin & Chu (LLC), Im Pesaran and Shin (IPS) and Augmented Dickey-Fuller (ADF) unit root tests to identify the order of integration of all the variables included in the model. The results presented in Table 4 show that all variables have a mixed order of integration.

In Table 5, the KAO co-integration test with the moderating effect of KOF in all SAARC countries has been used to observe the linear relation impact of FD on CO2 emissions. The null hypothesis is rejected because the ADF values of the Kao test are statistically significant at 5%. It verifies the existence of a long-run link between FD and carbon emissions.

Table 6 presents the panel quantile regression (PQR) outcomes at the lower, middle, and upper quartiles (Q1, Q2, and Q3). The lower values of pseudo R2 show the goodness of fit by comparing the sum of weighted deviations of this model to the same model with an intercept (Sial et al. 2022). Equation 4 uses the moderating effect of KOF to show the connection between the FD and environmental degradation. At level, the coefficient of the FD index has negative impact on CO2 emissions (Godil et al. 2021; Ojeyinka & Osinubi, 2022), whereas the quadratic coefficient of the FD index has a positive influence on CO2 emissions in Q1, Q2, and Q3 (Tahir et al. 2021). The level and quadratic coefficients of the FD index propose a U-shaped relationship (Rani et al. 2022a, 2022b), which means that a higher level of FD in SAARC countries degrades CO2. The moderator variable KOF improves the environmental quality and decreases the CO2 emissions in Q2 and Q3 (Amjad et al. 2021b; Sun et al. 2021; Rahman, 2020). However, Guan et al. (2022) found that KOF decreases CO2 emissions. At the level, the interaction of FD index and KOF has a positive association with CO2 emissions; in contrast, the quadratic FD index and KOF interaction negatively influence CO2 emissions in Q2 and Q3 (Mehmood, 2022; Usman et al. 2022). However, Sheraz et al. (2021) found similar results in the linear interaction between FD and KOF in G20 countries. When we trace this effect by using the mean and standard deviation of KOF and FD, it proposed shifting the turning point of the U-shaped curve as shown in Fig. 4a and b) at Q2 and Q3.This leads us to reject our null hypothesis that the moderation effect of KOF does not change the turning point of the U-shaped curve of the FD and CO2 emissions in SAARC countries.

By referring Eq. 6, at Q2, the value of the numerator is negative \({(\gamma }_{1}{\gamma }_{5}-{\gamma }_{2}{\gamma }_{4}=-0.00049\)) which indicates that the turning point is shifted to the left side of the U-shaped curve, while on the other hand, at Q3, the value of the numerator is positive \({(\gamma }_{1}{\gamma }_{5}-{\gamma }_{2}{\gamma }_{4}=0.00064\)) which shows the turning point is shifted to the right side of the U-shaped curve. Furthermore, in both Q2 and Q3, the value of the coefficient of \({\gamma }_{5}\) is negative which shows the flattening of the U-shaped curve. The above-mentioned discussion indicates that moderate KOF index improves the FD and declines CO2 emissions in SAARC countries. Therefore, these countries should import more energy-efficient technologies to reduce CO2 emissions. Moderate globalization boosts technical innovation by allowing for new carbon-reducing industrial strategies. Global competition among businesses improves product quality, which is also good for the environment. Furthermore, all countries are increasingly intertwined due to globalization, making it easier for financial institutions to fund green projects.

Similarly, the urban population is correlated with an increase in CO2 emissions. The results suggest that a one percent increase in the urban population deteriorates the environment by 0.484 percent in Q1, 0.676 percent in Q2, and 0.85 percent in Q3. No doubt, an increase in the urban population demands more resources for housing, transport, and medical facilities. Furthermore, it boosts the demand for fossil fuels, which increases the global temperature (Kim et al. 2020; Rahman & Alam, 2021; Yang & Wang, 2020). Economic growth in the SAARC countries also increases CO2 emissions in all quantile groups. No doubt, resource consumption leads to rapid economic growth but it puts a lot of pressure on the atmosphere (Khan et al. 2021; Usman et al. 2021; Wang et al. 2022a, 2022b). However, education has played a significant role in reducing CO2 emissions. It is undisputed to claim that the war against climate change cannot be won without encouraging research and development. Information and skill have a crucial role to mitigate environmental degradation (Ahmed & Wang, 2019; Zafar et al. 2020).

6 Conclusion and policy recommendations

The present study has examined the impact of FD sector on CO2 emissions in SAARC countries from 1990 to 2020 through utilizing the moderating effect of globalization. The FD index is constructed using four proxies based on financial depth, access, efficiency, and stability. Typically, in developing countries, the FD sector increases CO2 emissions. However, the moderation effect of globalization (KOF) can decline CO2 emissions. Long-run coefficients are evaluated by using the panel quantile regression (PQR). The PQR approach estimated the U-shaped relationship between the FD sector and CO2 emissions in SAARC countries (Rani et al. 2022a, 2022b). In order to observe the change in the turning point of the U-shaped relationship, KOF index is used as the moderator. It shifts the turning point before the maturity of the U-shaped curve at the middle quantile group and after the maturity of the U-shaped curve at upped quantile group (for details, see; Abbasi et al. 2022; Green et al. 2021; Adebayo et al. 2021; Baydoun & Aga, 2021). This indicates that we reject the null hypothesis that moderation KOF index does not change the turning point of the U-shaped curve based on FD and CO2 emissions in SAARC countries. By using energy-efficient technologies, better financial sector interaction with moderate globalization process can enhance environmental condition in SAARC countries. Furthermore, this study also explored that urbanization and GDP per capita increase CO2 emissions. However, education helps in achieving energy efficiency by encouraging research and development and increasing awareness regarding the benefits of a clean environment.

This study recommends that the green finance should be promoted to achieve the sustainable development. For this purpose, the financial institutions must encourage environment friendly investments. The SAARC countries should pay proper attentions to globalization process, because it declines CO2 emissions. Through globalization, this region can easily control environmental degradation by sharing environmental friendly technologies as these countries are interconnected through boundaries to each other.

The present study suffers from some limitations. This study is based on only SAARC countries. This research work can be extended to developing and developed countries. Furthermore, firm-level data analysis may provide relatively clear picture of the role of FD in reducing CO2 emissions through green technology innovation. Furthermore, the environmental tax, urbanization, human capital and institutional quality can be used as the moderator in future research.

References

Abad-Segura, E., González-Zamar, M. D., & Belmonte-Ureña, L. J. (2020). Effects of circular economy policies on the environment and sustainable growth: Worldwide research. Sustainability, 12(14), 5792. https://doi.org/10.3390/su12145792

Abbasi, K. R., Hussain, K., Haddad, A. M., Salman, A., & Ozturk, I. (2022). The role of FD and technological innovation towards sustainable development in Pakistan: Fresh insights from consumption and territory-based emissions. Technological Forecasting and Social Change, 176, 121444. https://doi.org/10.1016/J.TECHFORE.2021.121444

Abid, A., Mehmood, U., Tariq, S., & Haq, Z. U. (2022). The effect of technological innovation, FDI, and FD on CO2 emission: evidence from the G8 countries. Environmental Science and Pollution Research, 29(8), 11654–11662. https://doi.org/10.1007/s11356-021-15993-x

Adalı, Z., Dinçer, H., Eti, S., Mikhaylov, A., & Yüksel, S. (2022). Identifying new perspectives on geothermal energy investments. Multidimensional Strategic Outlook on Global Competitive Energy Economics and Finance. https://doi.org/10.1108/978-1-80117-898-320221002

Adebayo, T. S., Akinsola, G. D., Bekun, F. V., Osemeahon, O. S., & Sarkodie, S. A. (2021). Mitigating human-induced emissions in Argentina: role of renewables, income, globalization, and FD. Environmental Science and Pollution Research, 28(47), 67764–67778. https://doi.org/10.1007/S11356-021-14830-5

Ahmad, M., Jabeen, G., Irfan, M., Işık, C., & Rehman, A. (2021). Do inward foreign direct investment and economic development improve local environmental quality: aggregation bias puzzle. Environmental Science and Pollution Research, 28(26), 34676–34696. https://doi.org/10.1007/s11356-021-12734-y

Ahmed, Z., & Wang, Z. (2019). Investigating the impact of human capital on the ecological footprint in India: An empirical analysis. Environmental Science and Pollution Research, 26(26), 26782–26796. https://doi.org/10.1007/S11356-019-05911-7

Ahmed, F., Ali, I., Kousar, S., & Ahmed, S. (2022). The environmental impact of industrialization and foreign direct investment: Empirical evidence from Asia-Pacific region. Environmental Science and Pollution Research. https://doi.org/10.1007/S11356-021-17560-W

Akadiri, S., Alola, A. A., & Akadiri, A. C. (2019). The role of globalization, real income, tourism in environmental sustainability target. Evidence from Turkey. Science of the Total Environment, 687, 423–432. https://doi.org/10.1016/j.scitotenv.2019.06.139

Amin, A., Dogan, E., & Khan, Z. (2020). The impacts of different proxies for financialization on carbon emissions in top-ten emitter countries. Elsevier. https://www.sciencedirect.com/science/article/pii/S0048969720336482

Amjad, M. A., Asghar, N., & Rehman ur, H. (2021). Investigating the role of energy prices in enhancing inflation in pakistan fresh insight from asymmetric ARDL model. Review of Applied Management and Social Sciences, 4(4), 811–822. https://doi.org/10.47067/ramss.v4i4.185

Amjad, M. A., Asghar, N., & Rehman, H. U. (2021b). Can FD help in raising sustainable GDPPC and reduce environmental pollution in Pakistan? Evidence from non linear ARDL model. Review of Economics and Development Studies, 7(4), 475–491.

Apanisile, O. T. (2021). Remittances, FD and the effectiveness of monetary policy transmission mechanism in Nigeria: A DSGE approach (1986–2018). Indian Economic Review, 56(1), 91–112. https://doi.org/10.1007/S41775-021-00110-Z

Arnaut, J., & Lidman, J. (2021). Environmental sustainability and GDPPC in Greenland: Testing the environmental Kuznets curve. Mdpi.Com. https://doi.org/10.3390/su13031228

Arshed, N., Hanif, N., Aziz, O., & Croteau, M. (2022). Exploring the potential of institutional quality in determining technological innovation. Elsevier. https://www.sciencedirect.com/science/article/pii/S0160791X21003341

Asteriou, D., & Hall, S. (2011). Applied econometrics second edition. Academia.Edu. https://www.academia.edu/download/61722645/Appli120200108-101688-1vtjv80.pdf

Balsalobre-Lorente, D., Leitão, N., & Bekun, F. (2021). Fresh validation of the low carbon development hypothesis under the EKC scheme in Portugal Italy, Greece and Spain. Mdpi. Com. https://doi.org/10.3390/en14010250

Bano, S., Zhao, Y., Ahmad, A., Wang, S., & Liu, Y. (2018). Identifying the impacts of human capital on carbon emissions in Pakistan. Elsevier. https://www.sciencedirect.com/science/article/pii/S0959652618303123

Baydoun, H., & Aga, M. (2021). The effect of energy consumption and GDPPC on environmental sustainability in the GCC countries: Does FD Matter? Mdpi Com. https://doi.org/10.3390/en14185897

BenoitM K. (2011). Linear regression models with logarithmic transformations. Links.Sharezomics.Com. https://links.sharezomics.com/assets/uploads/files/1600247928973-from_slack_logmodels2.pdf

Bindu, S., Sridharan, P., Swain, R. K., & Das, C. P. (2021). Causal Linkage between remittances and FD : Evidence from the BRICS (Brazil, Russia, India, China, and South Africa). Journal of East-West Business. https://doi.org/10.1080/10669868.2021.1976348

Boutabba, M. (2014). The impact of FD , income, energy and trade on carbon emissions: evidence from the Indian economy. Elsevier. https://www.sciencedirect.com/science/article/pii/S0264999314000911

Chen, T., Gozgor, G., Koo, C. K., & Lau, C. K. M. (2020). Does international cooperation affect CO2 emissions? Evidence from OECD countries. Environmental Science and Pollution Research, 27(8), 8548–8556. https://doi.org/10.1007/s11356-019-07324-y

Cherni, A., & Jouini, S. (2017). An ARDL approach to the CO2 emissions, renewable energy and GDPPC nexus: Tunisian evidence. Elsevier. https://www.sciencedirect.com/science/article/pii/S0360319917332986.

Creane, S., Goyal, R., Mubarak, A., & Sab, R. (2006). Measuring FD in the Middle East and North Africa: a new database. Springer. https://link.springer.com/article/https://doi.org/10.2307/30035923

Danish, Z. B., Wang, Z., & Wang, B. (2018). Energy production, GDPPC and CO2 emission: Evidence from Pakistan. Natural Hazards, 90(1), 27–50. https://doi.org/10.1007/S11069-017-3031-Z

Das, A., & McFarlane, A. (2021). Non-linear relationship between remittances and FD in Jamaica. International Migration. https://doi.org/10.1111/IMIG.12911

Du, Q., Wu, N., Zhang, F., Lei, Y., & Saeed, A. (2022). Impact of financial inclusion and human capital on CO2: Evidence from emerging economies. Environmental Science and Pollution Research. https://doi.org/10.1007/S11356-021-17945-X

Dumitrescu, E., & Hurlin, C. (2012). Testing for Granger non-causality in heterogeneous panels. Elsevier. https://www.sciencedirect.com/science/article/pii/S0264999312000491

Farooq, S., Ozturk, I., Majeed, M., & Akram, R. (2022). KOFand CO2 emissions in the presence of EKC: A global panel data analysis. Elsevier. https://www.sciencedirect.com/science/article/pii/S1342937X22000478

Gissi, E., Manea, E., Mazaris, A., & Fraschetti, S. (2021). A review of the combined effects of climate change and other local human stressors on the marine environment. Elsevier. https://www.sciencedirect.com/science/article/pii/S0048969720360939

Godil, D., Ahmad, P., Ashraf, M., & Sarwat, S. (2021). The step towards environmental mitigation in Pakistan: Do transportation services, urbanization, and FD matter? Springer, 28(17), 21486–21498. https://doi.org/10.1007/s11356-020-11839-0

Green, A., Bilal, A., Li, X., Zhu, N., Sharma, R., & Jahanger, A. (2021). Green technology innovation, globalization, and CO2 emissions: recent insights from the OBOR economies. Sustainability, 14(1), 236. https://doi.org/10.3390/SU14010236

Guan, C., Rani, T., Yueqiang, Z., Ajaz, T., & Haseki, M. I. (2022). Impact of tourism industry, globalization, and technology innovation on ecological footprints in G-10 countries. Economic Research-Ekonomska Istraživanja, 1–17. https://doi.org/10.1007/s11356-022-19799-3

Guo, J., Zhang, Y., & Zhang, K. (2018). The key sectors for energy conservation and carbon emissions reduction in China: evidence from the input-output method. Elsevier. https://www.sciencedirect.com/science/article/pii/S0959652618300945?casa_token=4rDqaSYnnr4AAAAA:8lk_5nBudY-ik3V2kGIuAIBoaCISHyzbVp9jzwHQXrCGbxxM7V1aZCYWVlQItJTvYVEY2GH9Ecs

Gygli, S., Haelg, F., Potrafke, N., & Sturm, J. E. (2019). The KOF Globalisation Index – revisited. Review of International Organizations, 14(3), 543–574. https://doi.org/10.1007/S11558-019-09344-2

Haans, R. F., Pieters, C., & He, Z. L. (2016). Thinking about U: theorizing and testing U-and inverted U-shaped relationships in strategy research. Strategic Management Journal, 37(7), 1177–1195. https://doi.org/10.1002/smj.2399

Haseeb, A., Xia, E., Baloch, M., & Abbas, M. (2018). FD, globalization, and CO 2 emission in the presence of EKC: evidence from BRICS countries. Springer. https://doi.org/10.1007/s11356-018-3034-7

Hassan, M. S., Iqbal, M., & Arshed, N. (2021). Distribution-based effects of disaggregated GDP and CO2—a case of quantile on quantile estimates. Environmental Science and Pollution Research, 28(22), 28081–28095. https://doi.org/10.1007/S11356-021-12630-5

Hassan, S. T., Khan, S. U. D., Xia, E., & Fatima, H. (2020). Role of institutions in correcting environmental pollution: An empirical investigation. Sustainable Cities and Society, 53, 101901. https://doi.org/10.1016/j.scs.2019.101901

Hsu, C., Zhang, Y., Ch, P., Aqdas, R., & Chupradit, S. (2021). A step towards sustainable environment in China: The role of eco-innovation renewable energy and environmental taxes. Elsevier. https://www.sciencedirect.com/science/article/pii/S0301479721016716

Hunjra, A. I., Tayachi, T., Chani, M. I., Verhoeven, P., & Mehmood, A. (2020). The moderating effect of institutional quality on the FD and CO2 nexus. Mdpi Com. https://doi.org/10.3390/su12093805Katircioglu

Jalil, A., & Feridun, M. (2011). Impact of FD on GDPPC: empirical evidence from Pakistan. Journal of the Asia Pacific Economy, 16(1), 71–80. https://doi.org/10.1080/13547860.2011.539403

Jiang, C., & Ma, X. (2019). The impact of financial development on carbon emissions: a global perspective. Mdpi.Com. https://doi.org/10.3390/su11195241

Kandil, M., Shahbaz, M., & Nasreen, S. (2015). The interaction between KOFand inancial development: New evidence from panel cointegration and causality analysis. Empirical Economics, 49(4), 1317–1339. https://doi.org/10.1007/S00181-015-0922-2

Katircioglu, S., Katircioĝlu, S., & Saqib, N. (2020). Does higher education system moderate energy consumption and climate change nexus? Evidence from a small island. Air Quality, Atmosphere and Health, 13(2), 153–160. https://doi.org/10.1007/S11869-019-00778-6

Katircioĝlu S, S., & Saqib, N. (2020). Does higher education system moderate energy consumption and climate change nexus? Evidence from a small island. Air Quality, Atmosphere and Health, 13(2), 153–160. https://doi.org/10.1007/S11869-019-00778-6

Kaur, D., Tiwana, A. S., Kaur, S., & Gupta, S. (2022). Climate Change: Concerns and Influences on Biodiversity of the Indian. Himalayas. https://doi.org/10.1007/978-3-030-92782-0_13

Khan, S., Khan, M. K., & Muhammad, B. (2021). Impact of FD and energy consumption on environmental degradation in 184 countries using a dynamic panel model. Environmental Science and Pollution Research, 28(8), 9542–9557. https://doi.org/10.1007/S11356-020-11239-4

Khan, H., Weili, L., & Khan, I. (2022). Institutional quality, FD and the influence of environmental factors on carbon emissions: evidence from a global perspective. Environmental Science and Pollution Research, 29(9), 13356–13368. https://doi.org/10.1007/s11356-021-16626-z

Khan, M., Teng, J., Khan, M., & Khan MO. (2019). Impact of globalization, economic factors and energy consumption on CO2 emissions in Pakistan. Elsevier. https://www.sciencedirect.com/science/article/pii/S0048969719326336

Kihombo, S., Saud, S., Ahmed, Z., & Chen, S. (2021a). The effects of research and development and FD on CO2 emissions: Evidence from selected WAME economies. Environmental Science and Pollution Research, 28(37), 51149–51159. https://doi.org/10.1007/S11356-021-14288-5

Kihombo, S., Vaseer, A., Ahmed, Z., & Chen, S. (2021). Is there a tradeoff between financial globalization, GDPPC, and environmental sustainability? An advanced panel analysis. Springer. https://doi.org/10.1007/s11356-021-15878-z

Kim, J., Lim, H., & Jo, H. (2020). Do aging and low fertility reduce carbon emissions in Korea? Evidence from IPAT augmented EKC analysis. Mdpi. Com. https://doi.org/10.3390/ijerph17082972

Kirikkaleli, D., Ali, M., & Altuntaş, M. (2022). Environmental sustainability and public–private partnerships investment in energy in Bangladesh. Environmental Science and Pollution Research. https://doi.org/10.1007/S11356-022-19771-1

Koenker, R., & Bassett, J. G. (1978). Regression quantiles. JSTOR, 46(1), 33–50.

Kumar, S., Raut, R., Nayal, K., Kraus, S., & Yadav, V. (2021). To identify industry 4.0 and circular economy adoption barriers in the agriculture supply chain by using ISM-ANP. Elsevier. https://www.sciencedirect.com/science/article/pii/S0959652621002432

Li, K., & Lin, B. (2015). Impacts of urbanization and industrialization on energy consumption/CO2 emissions: does the level of development matter? Elsevier. https://www.sciencedirect.com/science/article/pii/S1364032115008321

Lin, X., Zhao, Y., Ahmad, M., Ahmed, Z., Rjoub, H., Adebayo, T. S., Errico, M., Salehi, H., & Giuliano, A. (2021). Linking innovative human capital, GDPPC, and CO2 emissions: An empirical study based on Chinese provincial panel data. Mdpi. Com. https://doi.org/10.3390/ijerph18168503

Liu, R., Wang, D., Zhang, L., & Zhang, L. (2019). Can green FD promote regional ecological efficiency? A case study of China. Natural Hazards, 95(1–2), 325–341. https://doi.org/10.1007/S11069-018-3502-X

Mehmood, U. (2022). Examining the role of financial inclusion towards CO2 emissions: Presenting the role of renewable energy and KOFin the context of EKC. Environmental Science and Pollution Research, 29(11), 15946–15954. https://doi.org/10.1007/S11356-021-16898-5

Meng, X., & Han, J. (2018). Roads, economy, population density, and CO2: A city-scaled causality analysis. Resources, Conservation and Recycling, 128, 508–515. https://doi.org/10.1016/J.RESCONREC.2016.09.032

Mikayilov, J., Galeotti, M., & Hasanov, F. (2018). The impact of GDPPC on CO2 emissions in Azerbaijan. Elsevier. https://www.sciencedirect.com/science/article/pii/S0959652618319280

Mukherjee, S. (2018). A study of awareness towards environmental degradation among the urban and rural undergraduate students. Aensi.In. http://www.aensi.in/assets/uploads/doc/aed15-163-167.14329.pdf

Musah, M., Owusu-Akomeah, M., Kumah, E. A., Mensah, I. A., Nyeadi, J. D., Murshed, M., & Alfred, M. (2022). Green investments, FD, and CO2 in Ghana: Evidence from the novel dynamic ARDL simulations approach. Environmental Science and Pollution Research. https://doi.org/10.1007/S11356-021-17685-Y

Ojeyinka, T. A., & Osinubi, T. T. (2022). The moderating role of FD in the globalization-sustainable development nexus in some selected African Countries. Economic Change and Restructuring. https://doi.org/10.1007/S10644-021-09376-Y

Panarello, D. (2021). Economic insecurity, conservatism, and the crisis of environmentalism: 30 years of evidence. Elsevier. https://www.sciencedirect.com/science/article/pii/S003801211930566X

Paramati, S., Apergis, N., & Ummalla, M. (2017). Financing clean energy projects through domestic and foreign capital: The role of political cooperation among the EU, the G20 and OECD countries. Elsevier. https://www.sciencedirect.com/science/article/pii/S014098831630305X

Park, S., Lee, I. H., & Kim, J. E. (2020). Government support and small- and medium-sized enterprise (SME) performance: The moderating effects of diagnostic and support services. Asian Business and Management, 19(2), 213–238. https://doi.org/10.1057/S41291-019-00061-7

Pata, U. K. (2021). Renewable and non-renewable energy consumption, economic complexity, CO2 emissions, and ecological footprint in the USA: Testing the EKC hypothesis with a structural break. Environmental Science and Pollution Research, 28(1), 846–861. https://doi.org/10.1007/S11356-020-10446-3

Pedroni, P. (2004). Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric Theory, 20(3), 597–625. https://doi.org/10.1017/S0266466604203073

Rahman, M. M. (2020). Environmental degradation: The role of electricity consumption, economic growth and globalisation. Journal of Environmental Management, 253, 109742. https://doi.org/10.1016/j.jenvman.2019.109742

Rahman, M., & Alam, K. (2021). Clean energy, population density, urbanization and environmental pollution nexus: Evidence from Bangladesh. Elsevier. https://www.sciencedirect.com/science/article/pii/S0960148121004596

Rahman, M., Nepal, R., & Alam, K. (2021). Impacts of human capital, exports, GDPPC and energy consumption on CO2 emissions of a cross-sectionally dependent panel: Evidence from the newly. Elsevier. https://www.sciencedirect.com/science/article/pii/S1462901121000885

Rani, T., Amjad, M. A., Asghar, N., & Rehman, H. U. (2022a). Revisiting the environmental impact of FD on economic growth and carbon emissions: evidence from South Asian economies. Clean Technologies and Environmental Policy, 1–9. https://doi.org/10.1007/s10098-022-02360-8

Rani, T., Wang, F., Rauf, F., & Ali, H. (2022b). Linking personal remittance and fossil fuels energy consumption to environmental degradation: Evidence from all SAARC countries. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-022-02407-2

Razak, M., Ahmad, I., Bujang, I., Talib, A. H., & Ibrahim, Z. (2013). IPAT-fuzzy model in measuring air pollution: evidence from Malaysia. American International Journal of Contemporary Research, 6, 62–69. https://doi.org/10.2495/SC130581

Rjoub, H., Odugbesan, J., Adebayo, T., & Wong, W. (2021). Sustainability of the moderating role of FD in the determinants of environmental degradation: Evidence from Turkey. Mdpi Com. https://doi.org/10.3390/su1304

Sabir, S., & Gorus, M. S. (2019). The impact of KOFon ecological footprint: Empirical evidence from the South Asian countries. Environmental Science and Pollution Research, 26(32), 33387–33398. https://doi.org/10.1007/S11356-019-06458-3

Salahuddin, M., Gow, J., Ali, M. I., Hossain, M. R., Al-Azami, K. S., Akbar, D., & Gedikli, A. (2019). Urbanization-globalization-CO2 emissions nexus revisited: Empirical evidence from South Africa. Heliyon, 5(6), e01974. https://doi.org/10.1016/j.heliyon.2019.e01974

Saleem, H., Khan, M. B., & Mahdavian, S. M. (2022). The role of green growth, green financing, and eco-friendly technology in achieving environmental quality: evidence from selected Asian economies. Environmental Science and Pollution Research, 1–20. https://doi.org/10.1007/s11356-022-19799-3

Sardar, M. S., & Rehman, H.-u. (2022). Transportation moderation in agricultural sector sustainability—a robust global perspective. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-022-20097-1

Sarkodie, S. (2021). Environmental performance, biocapacity, carbon & ecological footprint of nations: drivers, trends and mitigation options. Elsevier. https://www.sciencedirect.com/science/article/pii/S0048969720354413

Shahbaz, M., Haouas, I., Sohag, K., & Ozturk, I. (2020a). The FD -environmental degradation nexus in the United Arab Emirates: the importance of growth, KOFand structural breaks. Environmental Science and Pollution Research, 27(10), 10685–10699.

Shahbaz, M., Khan, S., Ali, A., & Bhattacharya, M. (2017). The impact of KOFOn Co2 emissions in China. Singapore Economic Review, 62(4), 929–957. https://doi.org/10.1142/S0217590817400331

Shahbaz, M., Khan, S., & Tahir, M. I. (2013). The dynamic links between energy consumption, economic growth, financial development and trade in China: fresh evidence from multivariate framework analysis. Energy Economics, 40, 8–21. https://doi.org/10.1016/j.eneco.2013.06.006

Shahbaz, M., Mahalik, M. K., Shahzad, S. J. H., & Hammoudeh, S. (2019). Testing the globalization-driven carbon emissions hypothesis: International evidence. International Economics, 158, 25–38.

Shahbaz, M, Raghutla, C., Song, M., Zameer, H., & iao, Z. (2020b). Public-private partnerships investment in energy as new determinant of CO2 emissions: the role of technological innovations in China. Elsevier. https://www.sciencedirect.com/science/article/pii/S0140988320300037

Sharma, M., & Choubey, A. (2022). Green banking initiatives: A qualitative study on Indian banking sector. Environment, Development and Sustainability, 24(1), 293–319. https://doi.org/10.1007/S10668-021-01426-9

Shen, Y., Su, Z., Malik, M., Umar, M., & Khan, Z. (2021). Does green investment, FD and natural resources rent limit carbon emissions? A provincial panel analysis of China. Elsevier. https://www.sciencedirect.com/science/article/pii/S0048969720360678

Sheraz, M., Deyi, X., Ahmed, J., Ullah, S., & Ullah, A. (2021). Moderating the effect of KOFon FD, energy consumption, human capital, and carbon emissions: Evidence from G20 countries. Environmental Science and Pollution Research, 28(26), 35126–35144. https://doi.org/10.1007/S11356-021-13116-0

Shobande, O. A., & Ogbeifun, L. (2022). The criticality of FD and energy consumption for environmental sustainability in OECD countries: evidence from dynamic panel analysis. International Journal of Sustainable Development & World Ecology, 29(2), 153–163. https://doi.org/10.1080/13504509.2021

Sial, M. H., Arshed, N., Amjad, M. A., & Khan, Y. A. (2022). Nexus between fossil fuel consumption and infant mortality rate: a non-linear analysis. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-022-19975-5

Sun, Y., Yesilada, F., Andlib, Z., & Ajaz, T. (2021). The role of eco-innovation and globalization towards carbon neutrality in the USA. Journal of Environmental Management, 299, 113568. https://doi.org/10.1016/j.jenvman.2021.113568

Tahir, T., Luni, T., Majeed, M. T., & Zafar, A. (2021). The impact of FD and KOFon CO2: Evidence from South Asian economies. Environmental Science and Pollution Research, 28(7), 8088–8101. https://doi.org/10.1007/S11356-020-11198-W

Tang, C., & Tan, B. (2015). The impact of energy consumption, income and foreign direct investment on carbon dioxide emissions in Vietnam. Elsevier. https://www.sciencedirect.com/science/article/pii/S0360544214012882

Touratier-Muller, N., Machat, K., & Jaussaud, J. (2019). Impact of French governmental policies to reduce freight transportation CO2 emissions on small-and medium-sized companies. Elsevier. https://www.sciencedirect.com/science/article/pii/S0959652619300605

Usman, M., & Hammar, N. (2021). Dynamic relationship between technological innovations, FD, renewable energy, and ecological footprint: Fresh insights based on the STIRPAT model for Asia Pacific Economic Cooperation countries. Environmental Science and Pollution Research, 28(12), 15519–15536. https://doi.org/10.1007/S11356-020-11640-Z

Usman, M., Anwar, S., Yaseen, M. R., Makhdum, M. S. A., Kousar, R., & Jahanger, A. (2021). Unveiling the dynamic relationship between agriculture value addition, energy utilization, tourism and environmental degradation in South Asia. Journal of Public Affairs. https://doi.org/10.1002/PA.2712

Usman, M., Balsalobre-Lorente, D., Jahanger, A., & Ahmad, P. (2022). Pollution concern during KOFmode in financially resource-rich countries: Do FD, natural resources, and renewable energy consumption matter? Renewable Energy, 183, 90–102. https://doi.org/10.1016/J.RENENE.2021.10.067

Verma, P., Kumari, T., & Raghubanshi. (2021). Energy emissions, consumption and impact of urban households: A review. Elsevier. https://www.sciencedirect.com/science/article/pii/S1364032121004986

Walayat, K., & Mehmood, K. (2021). Impact of globalization on environmental degradation. Pu.Edu.Pk, 58(3). http://pu.edu.pk/images/journal/history/PDF-FILES/13_58_3_21.pdf

Wang, H. J., Geng, Y., Xia, X. Q., & Wang, Q. J. (2021). Impact of economic policy uncertainty on carbon emissions: evidence from 137 multinational countries. International Journal of Environmental Research and Public Health, 19(1), 4. https://doi.org/10.3390/ijerph19010004

Wang, L., Vo, X. V., Shahbaz, M., & Ak, A. (2020). KOFand carbon emissions: Is there any role of agriculture value-added, FD, and natural resource rent in the aftermath of COP21? Journal of Environmental Management, 268, 110712. https://doi.org/10.1016/J.JENVMAN.2020.110712

Wang, F., Rani, T., & Razzaq, A. (2022). Environmental impact of fiscal decentralization, green technology innovation and institution’s efficiency in developed countries using advance panel modelling. Energy & Environment. https://doi.org/10.1177/0958305X221074727

Wang, H., Asif Amjad, M., Arshed, N., Mohamed, A., Ali, S., Haider Jafri, M. A., & Khan, Y. A. (2022). Fossil energy demand and economic development in BRICS Countries. Front. Energy Res, 10, 842793.

Wang, Q., & Su, M. (2019). The effects of urbanization and industrialization on decoupling GDPPC from carbon emission–a case study of China. Elsevier. https://www.sciencedirect.com/science/article/pii/S2210670719300010

World Bank (2016). World development report 2016: Digital dividends. https://www.worldbank.org/en/publication/wdr2016

Xu, G. (2022). From financial structure to GDPPC: Theory, evidence and challenges. Economic Notes. https://doi.org/10.1111/ECNO.12197

Xu, Z., Baloch, M., Meng, F., & Zhang, J. (2018). Nexus between FD and CO 2 emissions in Saudi Arabia: analyzing the role of globalization. Springer. https://doi.org/10.1007/s11356-018-2876-3

Yang, T., & Wang, Q. (2020). The nonlinear effect of population aging on carbon emission-Empirical analysis of ten selected provinces in China. Elsevier. https://www.sciencedirect.com/science/article/pii/S0048969720335774

Yao, Y., Ivanovski, K., Inekwe, J., & Smyth, R. (2019). Human capital and energy consumption: Evidence from OECD countries. Energy Economics. https://doi.org/10.1016/J.ENECO.2019.104534

Yuxiang, K., & Chen, Z. (2011). Financial development and environmental performance: evidence from China. Environment and Development Economics, 16(1), 93–111. https://doi.org/10.1017/S1355770X10000422

Zafar, W., Wasif, M., Shahbaz, M., Sinha, A., Sengupta, T., & Qin, Q. (2020). How renewable energy consumption contribute to CO2? The role of education in OECD countries. Elsevier. https://www.sciencedirect.com/science/article/pii/S095965262032196X

Zaidi, S. A. H., Zafar, M. W., Shahbaz, M., & Hou, F. (2019). Dynamic linkages between globalization, FD and carbon emissions: Evidence from Asia Pacific Economic Cooperation countries. Journal of Cleaner Production, 228, 533–543.

Zakaria, M., & Bibi, S. (2019). FD and environment in South Asia: The role of institutional quality. Environmental Science and Pollution Research, 26(8), 7926–7937. https://doi.org/10.1007/S11356-019-04284-1

Zhao, X., Zhang, X., Li, N., Shao, S., & Geng, Y. (2017). Decoupling GDPPC from carbon dioxide emissions in China: a sectoral factor decomposition analysis. Elsevier. https://www.sciencedirect.com/science/article/pii/S0959652616317462?casa_token=yKWmF0WuzmEAAAAA:jIaGmBxAFTqvzf8ai1LHmqbQGzZnnphu5pLYGzZy4L7u6Xq5UkvLU5ZpeKsL9_nyoPRf7-UCTQQ

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Rani, T., Amjad, M.A., Asghar, N. et al. Exploring the moderating effect of globalization, financial development and environmental degradation nexus: a roadmap to sustainable development. Environ Dev Sustain 25, 14499–14517 (2023). https://doi.org/10.1007/s10668-022-02676-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-022-02676-x