Abstract

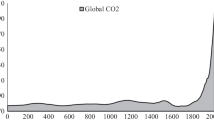

This study applies a large battery of state-of-the-art nonlinear unit root tests to examine the stationarity properties of carbon dioxide emission series for 28 industrialized countries, five BRICS and seven transition economies over a very long horizon, in some cases over more than two and a half centuries. The application of time-dependent and state-dependent nonlinear unit root tests separately provides mixed evidence regarding the time-series properties of CO2 emissions and a high degree of variability across the different tests. However, the use of hybrid nonlinear unit root tests, combining the presence of structural breaks with symmetric or asymmetric ESTAR adjustment, leads to the rejection of the unit root hypothesis in each of the countries under study with at least one of the hybrid tests. This has important climate policy implications.

Similar content being viewed by others

Availability of Data and Material

The data on CO2 emissions are freely available at https://cdiac.ess-dive.lbl.gov/trends/emis/tre_coun.html. They can be also obtained from the authors upon request.

Code Availability

Codes for the computation of the statistics are embedded in the following online page ran from one of the authors (Prof. Tolga Omay) accessible at https://tolgaomay.shinyapps.io/Non-Stat_Panel_Unit_Root_Test/.

Notes

The latter has been more ambitious by targeting: (1) a reduction of 40% of greenhouse gas emissions relative to 1990, (2) reaching at least a 27% final consumption of renewable sources of energy, (3) raising energy efficiency by 27% and (4) completing the internal energy market by increasing the interconnection across EU members.

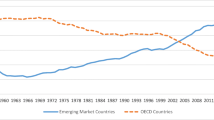

Arguably, if developing countries continue rising energy demands on current trends, their emissions are expected to surpass those of the industrialized countries. However, developing countries claim that, historically, emissions from the industrialized world are the main cause of the climate change problem and they should be the first to solve it.

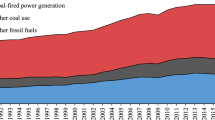

Renewables, including solar, wind, hydro, biofuels and others, are at the heart of the transition to a less carbon-intensive and more sustainable energy system.

Besides the policy consequences of the nonstationarity properties of CO2 emissions, the presence of a unit root in emission levels has crucial implications for economic modelling of the CO2 emissions in a multivariate framework. The work of Granger and Newbold [50] and Phillips [51] among others established that traditional estimation of systems involving nonstationary variables leads to spurious results as the test-statistics no longer follow standard distributions. As a result, if the variables entering the system are nonstationary–I(1)–and non-cointegrated, the best modelling strategy to circumvent the spurious result problem is a vector autoregression in first differences, while if the variables are I(1) and cointegrated, then a vector error-correction model is suitable for modelling the system.

The evidence found by Zerbo and Darné [2] and Awaworyi-Churchill et al. [4] on the importance of asymmetries in the duration of cyclical phases of CO2 emissions–with contractionary phases of CO2 emissions to be relatively lengthier than expansionary phases–gives further support for the introduction of nonlinearities in CO2 emissions. Besides, Presno et al. [5] note that in economic systems, the transition between regimes usually occurs gradually due to the expected delay between the ocurrence of the shock and economic agents’ response. Hence, given that economic activity–which is nonlinear in nature–is partly responsible for CO2 emissions, these nonlinear patterns will be transmitted to them. In addition, there is a strand of the literature predicting the existence of an inverted U-shaped relationship between measures of environmental degradation and income levels, which is known as the environmental Kuznets curve. All the above justifies the use of unit root tests that explicitly account for nonlinearities in the trend function of the CO2 emissions series.

For comparison purposes, we also present the results from the application of nonlinear unit root tests that allow for time-dependent or state-dependent nonlinearities separately.

DF represents the ADF test without lag augmentation.

In a companion paper, McKitrick et al. [52] reject the unit root hypothesis for global per capita CO2 emissions over the 1950–2006 period after allowing for two breaks via the two-break LM test. One break at 1979 is detected. Individually, the unit root null is not rejected for 30 of the 117 countries investigated.

In a companion paper, Romero-Avila [53] applies the same test to a panel of 23 OECD countries over the 1960–2002 period, finding evidence of stationarity in relative CO2 emissions for both the no trend and trend specifications. This favored the existence of stochastic and deterministic convergence in emissions.

This allows for changes that can be either abrupt (break model) or gradual (smooth transition model).

Both ESTAR and AESTAR models allow for nonlinear adjustment dynamics between the nonstationary middle regime and the globally stationary outer regimes when there is sufficient distance from the threshold. However, the series behaves as a nonstationary process in the neighborhood of the threshold, that is, in the central regime. If the outer regimes differ depending on whether the deviation is positive or negative, AESTAR transition dynamics prevail.

The equilibrium level would be determined by the Fourier function in the case of the CL test.

More specifically, the data on CO2 emissions are available at https://cdiac.ess-dive.lbl.gov/trends/emis/tre_coun.html.

For expositional purposes, we refer to these as industrialized or rich, though we admit some differences across countries.

CO2 emissions data for Russia are only available since 1992, which is clearly insuficient for the purpose of long-run analysis. Hence, we omit this country from the analysis.

Strictly speaking, the BRICS group does not include Indonesia. However, this emerging country shares many economic features of the BRICS, in addition to having a large population (almost 300 million inhabitants). Therefore, for expositional purposes, we include this country in the BRICS group.

An economy in transition is assigned to those economic systems that intend to take the step from a centralized to a market economy. Conceptually, Turkey is not generally included in this group. Turkey has a mixed economy in which there is a growing private sector combined with centralized economic planning and government regulation. Given that it is closer to the definition of a transition economy, than to a fully industrialized country, we include it in the former.

The EG would account for sudden adjustment dynamics, while the KSS and Sollis tests would capture smooth and gradual changes.

The estimated frequency is provided in the unpublished appendix.

The unpublished appendix provides the frequency parameter for the SOR test.

It is worth noting that the SOR test, despite incorporating multiple smooth breaks–via the Fourier function–into the LNV test, hardly improves on the latter, since rejection of the nonstationarity null takes place for 23 countries vs. the 22 rejections with the LNV test. This further corroborates that the EL test performed very poorly, as given by only six rejections across both specifications. Along similar lines, model A* in the SOR test only improves model C in the LNV test by rejecting the null for 18 countries rather than 16.

Across the three specifications of the OEHa test, a total of 31 countries favor the nonlinear stationarity alternative. This includes 20 rich economies (out of the 28 in our sample), all the six BRICS and five out of the seven transition economies under study.

The critical values for the trend specification of the CL test are provided in Emirmahmutoglu et al. [48].

Table 7 provides a summary table of the results for all the tests and groups of tests.

Almost 80% of total emissions correspond to energy-related emissions, which is why the rise in energy efficiency and the shift from fossil-fuel sources to renewables are central to climate change abatament policies.

The Paris Agreement combats climate change by maintaining the rise in global temperature this century well below 2 °C above pre-industrial levels.

References

Gil-Alana, L. A., & Trani, T. (2019). Time trends and persistence in the global CO2 emissions across Europe. Environmental and Resource Economics, 73(1), 213–228.

Zerbo, E., & Darné, O. (2019). On the stationarity of CO2 emissions in OECD and BRICS countries: A sequential testing approach. Energy Economics, 83, 319–332.

Kapetanios, G., Shin, Y., & Snell, A. (2003). Testing for a unit root in the nonlinear STAR framework. Journal of Econometrics, 112(2), 359–379.

Awaworyi-Churchill, S., Inekwe, J., Ivanoski, K., & Smyth, R. (2020). Stationarity properties of per capita CO2 emissions in the OECD in the very long-run: A replication and extension analysis. Energy Economics, 90, 1–11.

Presno, M. J., Landajo, M., & Fernández-González, P. (2018). Stochastic convergence in per capita CO2 emissions. An approach from nonlinear stationarity analysis. Energy Economics, 70, 563–581.

Christopoulos, D., & Leon-Ledesma, M. A. (2010). Smooth breaks and non-linear mean reversion: Post-bretton-woods real exchange rates. Journal of International Money and Finance, 20, 1076–1093.

Omay, T., & Yildirim, D. (2014). Nonlinearity and smooth breaks in unit root testing. Econometrics Letters, 1(1), 1–8.

Omay, T., Emirmahmutoglu, F., & Hasanov, M. (2018). Structural break, nonlinearity and asymmetry: A re-examination of PPP proposition. Applied Economics, 50, 1289–1308.

Sun, L., & Wang, M. (1996). Global warming and global dioxide emission: An empirical study. Journal of Environmental Management, 46, 327–343.

Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74, 427–431.

Campbell, J. Y., & Perron, P. (1991). Pitfalls and opportunities: What macroeconomists should know about unit roots. NBER Macroeconomic Annual, 1991, 141–201.

DeJong, D. N., Nankervis, J., Savin, N. E., & Whiteman, C. H. (1992). The power problems of unit root tests in time series with autoregressive errors. Journal of Econometrics, 53, 323–343.

Perron, P. (1989). The great crash, the oil price shock, and the unit root hypothesis. Econometrica, 57(6), 1361–1401.

Lanne, M., & Liski, M. (2004). Trends and breaks in per capita carbon dioxide emissions, 1870–2028. The Energy Journal, 25(4), 41–65.

Vogelsang, T., & Perron, P. (1998). Additional tests for a unit root allowing for a break in the trend function at an unknown time. International Economic Review, 39(4), 1073–1100.

McKitrick, R., & Strazicich, M. C. (2005). Stationarity of global per capita carbon dioxide emissions: implications for global warming scenarios. Ontario, Canada: University of Guelph, Department of Economics and Finance Working Papers 0503.

Lee, J., & Strazicich, M. (2003). Minimum LM unit root test with two structural breaks. Review of Economics and Statistics, 85, 1082–1089.

Phillips, P. C. B., & Perron, P. (1988). Testing for unit roots in time series regression. Biometrika, 75(2), 335–346.

Lee, J., & List, J. A. (2004). Examining trends of criteria air pollutants: Are the effects of governmental intervention transitory? Environmental and Resource Economics, 29, 21–37.

Carrion-i-Silvestre, J. L., Kim, D., & Perron, P. (2009). GLS-based unit root tests with multiple structural breaks under both the null and alternative hypotheses. Econometric Theory, 25(6), 1754–1792.

Barros, C. P., Gil-Alana, L. A., & de Gracia, F. P. (2016). Stationarity and long range dependence of carbon dioxide emissions: Evidence for disaggregated data. Environmental and Resource Economics, 63(1), 45–56.

Gil-Alana, L. A., Cunado, J., & Gupta, R. (2017). Persistence, mean-reversion and non-linearities in CO2 emissions: Evidence from BRICS and G7 countries. Environmental and Resource Economics, 67(4), 869–883.

Heil, M. K., & Selden, T. M. (1999). Panel stationarity with structural breaks: Carbon emissions and GDP. Applied Economics Letters, 6, 223–225.

Im, K. S., Pesaran, M. H., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal of Econometrics, 115(1), 53–74.

Lee, C.-C., & Lee, J.-D. (2009). Income and CO2 emissions: Evidence from panel unit root and cointegration tests. Energy Policy, 37(2), 413–423.

Dinda, S., & Coondoo, D. (2006). Income and emission: A panel data-based cointegration analysis. Ecological Economics, 57, 167–181.

Levin, A., Lin, C., & Chu, C. J. (2002). Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics, 108(1), 1–24.

Richmond, A. K., & Kaufmann, R. K. (2006). Is there a turning point in the relationship between income and energy use and/or carbon emissions? Ecological Economics, 56, 176–189.

Romero-Ávila, D. (2008). Questioning the empirical basis of the environmental Kuznets curve for CO2: New evidence from a panel stationarity test robust to multiple breaks and cross-dependence. Ecological Economics, 64, 559–574.

Carrion-i-Silvestre, J. L., del Barrio-Castro, T., & López-Bazo, E. (2005). Breaking the panels: An application to the GDP per capita. Econometrics Journal, 8(2), 159–175.

Christidou, M., Panagiotidis, T., & Sharma, A. (2013). On the stationarity of per capita carbon dioxide emissions over a century. Economic Modelling, 33, 918–925.

Chong, T., Hinich, M., Liew, V., & Lim, K.-P. (2008). Time series test of nonlinear convergence and transitional dynamics. Economic Letters, 100(3), 337–339.

Sollis, R. (2009). A simple unit root test against asymmetric STAR nonlinearity with an application to real exchange rates in Nordic countries. Economic Modelling, 26, 118–125.

Chiang, M. H., Kuan, C. M., & Lo, C. H. (2007). Panel unit root test under smooth transition. Taiwan: National Cheng Kung University Working Paper.

Becker, R., Enders, W., & Lee, J. (2006). A stationarity test in the presence of an unknown number of smooth breaks. Journal of Time Series Analysis, 27, 381–409.

Tiwari, A. K., Kyophilavong, P., & Tiberiu, A. C. (2016). Testing the stationarity of CO2 emissions series in Sub-Saharan African countries by incorporating nonlinearity and smooth breaks. Research in International Business and Finance, 37, 527–540.

Landajo, M., & Presno, M. J. (2010). Stationarity testing under nonlinear models: Some asymptotic results. Journal of Time Series Analysis, 31(5), 392–405.

Enders, W., & Granger, C. W. J. (1998). Unit-root tests and asymmetric adjustment with an example using the term structure of interest rates. Journal of Business and Economic Statistics, 16, 304–311.

Leybourne, S., Newbold, P., & Vougas, D. (1998). Unit roots and smooth transitions. Journal of Time Series Analysis, 19, 83–97.

Çorakcı, A., Emirmahmutoğlu, F., & Omay, T. (2017). PPP hypothesis and temporary structural breaks. Economics Bulletin, 37(3), 1–9.

Enders, W., & Lee, J. (2012). The flexible Fourier form and Dickey-Fuller type unit root tests. Economics Letters, 117(1), 196–199.

Sollis, R., Leybourne, S. J., & Newbold, O. (2002). Tests for symmetric and asymmetric mean reversión in real exchange rates. Journal of Money, Credit and Banking, 34, 686–700.

Park, J. Y., & Shintani, M. (2016). Testing for a unit root against transitional autoregressive models. International Economic Review, 7(2), 635–664.

Shahbaz, M., Omay, T., & Roubaud, D. (2019). Sharp and smooth breaks in unit root testing of renewable energy consumption: The way forward. The Journal of Energy and Development, 44(1–2), 5–39.

Marland, G., Boden, T. A., & Andres, R. J. (2005). Global, regional, and national fossil fuel CO2 emissions. In trends: A compendium of data on global change. Oak Ridge, Tenn., U.S.A.: Carbon Dioxide Information Analysis Center, Oak Ridge National Laboratory, U.S. Department of Energy. http://cdiac.ornl.gov/trends/emis/em_cont.htm. Accessed on 05 April 2021.

Hamilton, J. D. (2003). What is an oil shock? Journal of Econometrics, 113(2), 363–398.

Hasanov, M., & Telatar, E. (2011). A re-examination of stationarity of energy consumption: Evidence from new unit root tests. Energy Policy, 39(12), 7726–7738.

Emirmahmutoglu, F., Omay, T., Shahzad, S. J. H., & Nor, S. M. (2021). Smooth break detection and de-trending in unit root testing. Mathematics, 9, 371.

Luukkonen, R., Saikkonen, P., & Teräsvirta, T. (1988). Testing linearity against smooth transition autoregressive models. Biometrika, 75, 491–499.

Granger, C. W., & Newbold, P. (1974). Spurious regressions in econometrics. Journal of Econometrics, 2, 111–120.

Phillips, P. C. B. (1986). Understanding spurious regressions in econometrics. Journal of Econometrics, 33, 311–340.

McKitrick, R., Strazicich, M. C., & Lee, J. (2013). Long-term forecasting of global carbon dioxide emissions: Reducing uncertainties using a per capita approach. Journal of Forecasting, 32, 432–451.

Romero-Ávila, D. (2008). Convergence in carbon dioxide emissions among industrialized countries revisited. Energy Economics, 30, 2265–2282.

Granger, C. W., & Teräsvirta, T. (1993). Modelling nonlinear economic relationships. Oxford University Press.

Teräsvirta, T. (1994). Specification, estimation and evaluation of smooth transition autoregressive models. Journal of the American Economic Association, 89, 208–218.

Acknowledgements

The authors would like to thank both referees and the editor for helpful and detailed comments that have led to substantial improvements of the original manuscript. We also thank seminar participants at Pablo de Olavide University for helpful comments.

Funding

This work was supported by the Spanish Ministry of Science, Innovation and Universities [grant number ECO2017-86780-R, AEI/FEDER, UE]; and Junta de Andalucía [grants number I+D+i project P20_00808, PAIDI SEJ-513].

Author information

Authors and Affiliations

Contributions

DRA: conceptualization, data curation, visualization, investigation, writing–original draft preparation, writing–reviewing and editing. TO: methodology, software, formal analysis, validation, writing–reviewing and editing.

Corresponding author

Ethics declarations

Ethics Approval

This is an empirical study that requires no ethical approval.

Consent to Participate

Not applicable.

Consent for Publication

Not applicable.

Conflict of Interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Romero-Ávila, D., Omay, T. Are CO2 Emissions Stationary After All? New Evidence from Nonlinear Unit Root Tests. Environ Model Assess 27, 621–643 (2022). https://doi.org/10.1007/s10666-022-09835-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10666-022-09835-4

Keywords

- CO2 emissions

- Nonlinearities

- Unit root

- Time dependence

- State dependence

- LSTAR process

- ESTAR process

- AESTAR process

- Structural breaks