Abstract

This paper investigates how the environmental performance of firms impacts their participation in global value chains (GVC). The analysis is based on a dataset of 15,922 firms located in 32 European, Central Asian, Middle Eastern, and North African countries, with information on firm-level environmental practices provided by the recent Green Economy module of the World Bank Enterprise Surveys. We propose the Firm Environmental Performance Index (FEPI), a new index measuring firms’ adoption of environmental actions. The index is used in a two-part instrumental variable approach to estimate the impact of FEPI on both the probability and the intensity of GVC participation, while addressing reverse causality concerns. The results indicate that a one-standard deviation increase in the FEPI increases the probability of participation by 6.4 percentage points, a result consistently observed in all regions and sectors. The effects on the intensity of participation are mostly non-significant. However, a negative effect is observed in exceptional cases, namely for firms that are importers only, have low-technology practices, and are located in less developed regions. The results are robust to alternative definitions of GVC participation, inclusion of alternative instruments, and to partial violations of the exclusion restriction. All in all, they suggest that complying with environmental regulations could lead to higher integration in global markets, albeit with adverse effects in some particular cases.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The enforcement of strict environmental regulations requires firms to adopt green measures to reduce emissions. There is an active debate in the literature on the potential effects of such regulations on firms and their integration in global markets (Forslid et al. 2018; Shapiro and Walker 2018; Kreickemeier & Richter 2014; Porter & van der Linde 1995). While some argue that they might increase trade by inducing innovation and productivity gains (Ambec et al. 2013; Jaffe & Palmer 1997); others stress the opposite, as higher costs could lead to loss of competitiveness (D’Agostino 2015; Porter & van der Linde 1995). Despite the heated discussion, there is a surprisingly low number of studies investigating the impact of environmental regulations on trade flows according to the perspective of individual firms (Cherniwchan & Najjar 2021). This paper aims to close such a gap by using a newly released dataset that accounts for firm actions to comply with environmental regulations. Thus, the main goal of this paper is to examine whether the environmental performance of firms impacts their participation in global value chains (GVC). The analysis is divided into two parts. First, we propose the construction of the Firm Environmental Performance Index (FEPI), a novel index to measure to what extent firms undertake environmental actions. Second, we assess how the FEPI impacts the probability and the intensity of firms’ participation in GVC. The analysis is based on data from the World Bank Enterprise Surveys (WBES), using specifically the recently introduced Green Economy module. The new set of questions provides detailed information on the environmental practices of firms located in 32 European, Central Asian, Middle Eastern, and North African countries. With a total of 15,922 individual firms, it enables the disaggregated micro-level assessment of the impacts of environmental actions.Footnote 1

The proposed analysis contributes to the literature in three ways. First, the novel index is a direct measure of environmental stringency at the firm level, without relying on commonly used indirect measures based on emission intensity, perception of stringency, or aggregated composite indices (Zhang et al. 2022; Galeotti et al. 2020). Second, instead of aggregated levels, the analysis focuses on individual firms from a variety of sectors and countries. There is an extensive number of papers on the relationship between environmental regulations and trade flows at the country- or industry-level, but the same cannot be said for disaggregated levels (Cherniwchan & Najjar 2021). To the best of our knowledge, there are currently a handful of published papers with such a focus.Footnote 2 While they present well-designed empirical approaches and identification strategies, the analyses are limited to regulatory changes in selected manufacturing companies; restricted to Canada and China; and focused exclusively on export flows. Consequently, the external validity of their applications might be debatable. As an alternative, we contribute to the discussion with an empirical setting that allows for comparisons across a wider range of industries and regions. Third, the empirical analysis is based on an instrumental variables’ approach (IV) that addresses reverse causality concerns to identify a causal relationship. The estimation model consists of two parts: (i) an IV probit to estimate the impact of firm environmental performance on the probability to participate in GVC; and (ii) a Fractional Response Model (FRM) with endogenous variables to estimate the impact on intensity of GVC participation. This method is similar to a two-part fractional response model (TP-FRM), albeit with endogenous variables. All in all, the paper provides insights to the growing literature on the determinants of integration into global markets (Fernandes et al. 2021).

The results of the IV estimations indicate that higher compliance with environmental standards are associated with higher probability to participate in GVC, but its average effect on the intensity of participation is not significant. A one standard deviation increase in the FEPI is associated with an increase in the probability of GVC participation by 6.4 percentage points. This result is robust to the use of multiple subsamples and is fairly stable, albeit with higher magnitude for firms in the manufacturing sector and more technology intensive firms. When distinguishing between the direction of trade flows, the effect is mostly driven by exporting firms, for which there is also a positive impact of environmental performance on the intensity of GVC participation. Nonetheless, a negative and significant effect on the intensity of participation is observed for specific sub-samples. This is the case for firms that are importers only, that have low-technology practices, and that are located in less developed regions. Such findings suggest that complying with environmental regulations have clear benefits on the integration of firms in global markets, especially for exporters. However, in some cases, there could be adverse effects, which should be addressed by appropriate policies.

In Sect. 2, we present the theoretical framework and previous findings on the relationship between environmental regulations and trade flows, followed by the set of definitions required and hypotheses tested in the empirical analysis. In Sect. 3, we describe the data, methods, and models used, as well as the construction of the FEPI. In Sect. 4, we present the results of the main specification, subsample analyses, robustness checks, and instrumental variable approach. Finally, we discuss the implications of the key findings for policy making and future research in Sect. 5.

2 Literature review

2.1 Theoretical literature

There are several theoretical strands in the literature analyzing the expected impacts of environmental regulations on trade flows. Some follow a macro approach and use mostly country- or industry-level mechanisms to explain the outcomes. For instance, this is the case of the pollution haven effect (PHE) and the pollution haven hypothesis (PHH). Others, have a micro-based focus and make use of firm-level mechanisms. One example is the duality between the conventional view based on the factor endowments theories, which predict a negative effect on competitiveness, and the Porter hypothesis (PH), according to which regulations could have a positive effect on trade (D’Agostino 2015). In what follows, we discuss several theories on how environmental regulations might impact individual firms’ trade flows.

Regarding studies that focus on aggregated analyses, the PHE describes how stringency in environmental policies affect plant location decisions and trade flows. In their seminal papers, Copeland and Taylor (2004, 1995) use a Ricardian model with two identical economies that are allowed to trade goods with different pollution intensities. The economy with stricter regulations is expected to have lower comparative advantage in dirty goods, reducing their exports while increasing their imports. The opposite is true for the economy with lax regulations. There are two main underlying mechanisms for such an effect. First, there could be a cost effect, where stringent environmental policies result in higher production costs for companies, and higher prices for final consumers. It reduces the firms’ competitiveness and leads to less net exports –more net imports– in affected industries. Second, there could be an FDI effect, where more (less) strict environmental regulations have a push (pull) effect on foreign investments, increasing production on regions with lax regulatory environments (Hanna 2010). In any case, the level of stringency in environmental policies is expected to affect the direction of trade flows of affected goods.

In a free trade scenario, the differences in stringency could lead to the relocation of dirty industries to countries with relatively lax policies. According to Copeland and Taylor (2004) this is a stronger version of the PHE and it is commonly known as the PHH. Both terminologies are often interchanged in the literature, but the authors stress the importance to make a clear distinction between them. While the PHE is corroborated by a sound theoretical model and empirical evidence, the same is not entirely true about the PHH (Zhang et al. 2022; Cherniwchan and Najjar 2021). The contributions of this paper are more closely related to the discussion on the PHE.

When it comes to studies that focus on disaggregated analyses, there are two opposing views on the effect of environmental regulations on firms’ characteristics and, ultimately, trade flows. On the one hand, there is the conventional view, indicating that environmental policies would have a negative effect on trade. The regulations would require firms to allocate resources to pollution reduction and environmental management, imposing extra production costs, diverting capital from investments in R&D, and limiting the technologies and processes that could be used in the production (D’Agostino 2015; Ambec et al. 2013; Jaffe and Palmer 1997). Consequently, firms’ productivity and international competitiveness would decrease, and so would their levels of trade.

On the other hand, the PH states that well-designed environmental regulations could lead to higher levels of international trade. In this case, strict regulations could motivate firms to innovate, as a way to compensate for the increase in costs associated with complying to regulations (D’Agostino 2015; Porter and van der Linde 1995). When the benefits of innovation offset the compliance costs, there is an increase in productivity and international competitiveness, leading to higher levels of integration into global markets. Jaffe and Palmer (1997) further distinguish the PH into the weak and strong versions, depending on whether the impact of environmental regulations is expected on innovation or on economic performance, respectively. As it will be discussed in the following subsection, the weak version seems to be more supported by the literature. Furthermore, D’Agostino (2015) combines the PHH with the PH and suggests that firms would choose to relocate their activities only if they are unable to innovate as a response to stricter regulations. In any case, according to this strand of the literature, a positive impact of environmental regulations on trade flows is expected.

In addition, some studies propose novel models to explain the relationship between regulations and trade flows applied to specific contexts. Cherniwchan and Najjar (2021) investigate the impact of stricter air quality standards on the export levels of Canadian firms and propose an underlying theoretical model. Even though it was conceived based on a specific type of regulation, their insights could be applied to other types of environmental regulations. The authors propose a general equilibrium model with small economies and government control of pollution, where firms are allowed to choose the method of compliance to regulations endogenously—either by innovating, suffering penalties, or exiting the market. According to the model, environmental regulations inevitably increase costs, leading to two possible outcomes depending on the firms’ productivity level. First, low-productive firms are likely exit the export market altogether when maximizing their profits, as the extra cost burden would make exporting unfeasible. Second, for companies that stay in the export market, regulations would reduce average export revenues, where such a reduction is higher for small exporters. In either way, the model predicts a heterogeneous impact of environmental regulations on trade flows at the firm-level.

2.2 Empirical literature

As noted by Copeland and Taylor (2004), empirical findings prior to 1997 pointed to a non-significant impact of environmental regulations on trade. This has changed recently, as studies applied panel data and quasi-experimental techniques to address endogeneity concerns and correctly identify causal relationships. In the late 2000s, there seems to be a wide range of papers that support the PHE. For example, Kellenberg (2009) used an IV approach and found a negative effect of environmental stringency on the production growth of U.S. multinational firms. The effect on international competitiveness is even more pronounced on firms with branches in developing countries. Using a similar IV approach, Broner et al. (2012) showed that the magnitude of the impact of environmental stringency on comparative advantage is similar to the one observed for traditional determinants, such as physical and human capital. Regarding the impact on plant location decisions, Hanna (2010) evidenced that stricter regulations of the Clean Air Act resulted in production shifts to companies outside the U.S. All in all, the PHE seems to be generally supported by the evidence, at least when analyzed at higher aggregation levels.Footnote 3

Regarding effects using disaggregated data, the vast majority of studies focuses on the effects of regulations on innovation, productivity or other firm-level characteristics; but not on exports or GVC participation per se. For instance, the number of studies that investigate the PH, relating environmental stringency to innovation or productivity, is overwhelming (see van Leeuwen and Mohnen 2017; D’Agostino 2015; for detailed reviews). In a nutshell, there seems to be a general support for the weak version of the PH, but not for the strong version. Such a finding could indicate that even though environmental regulations might lead to higher levels of innovation, the benefits are not translated into productivity and economic performance gains.

When it comes to the empirical evidence on the impact of environmental regulations on disaggregated trade flows, there is a surprisingly low number of studies (Cherniwchan an d Najjar 2021). To the best of our knowledge, there are currently four published papers that investigate the effects of environmental regulations on trade flows using disaggregated data. Shi and Xu (2018) provided one of the first attempts to conduct such an analysis, with an industry-level dataset. The authors investigated the impact of the pollution reduction measures established by China’s eleventh Five-Year Plan on exports of Chinese industries. The plan served as a natural experiment to estimate causal relationships applying a differences-in-differences approach. They found that stricter environmental regulations reduced the probability to export, as well as the volume exported. Based on a firm-level dataset, Zhang et al. (2020) used a similar method and found that stricter wastewater discharge standards implemented in the Chinese province of Jiangsu decreased the exporting likelihood and intensity of local firms affected by the measures. In the context of the establishment of stricter air quality standards in Canada, Cherniwchan and Najjar (2021) found a negative effect on the firms’ probability to export and a positive one on the likelihood of firms to stop exporting altogether. Finally, Zhang et al. (2022) exploited the variation resulted from the Cleaner Production Audit in China to assess the impact on firm’s export. In accordance with the three previous studies, the authors found a negative effect on export volume, albeit heterogeneous, as the magnitude of the effect is dependent on state ownership, size, and location of firms. All in all, the findings of the four studies seem to suggest that environmental regulations have a negative impact, both on the probability and intensity of participating in global markets.

These previous studies had well designed identification strategies, exploiting exogenous increases in environmental stringency to assess the causal impacts on trade flows. It is worth noting, however, that such analyses are highly context-specific and based on a limited number of industries, in the manufacturing sector; countries, namely Canada and China; and only focus on exports. Therefore, the external validity of such findings might be debatable. In this regard, there is still the need for studies that are based on firms acting in a wider range of industries and regions. We aim to address such a need with the present study.

While this paper focuses on the impact of environmental stringency on trade flows, there is a rich debate in the literature on the opposite effect: how international trade influences the environment or emissions. In this regard, there are numerous studies based on the seminal contribution of Melitz (2003), who proposed a dynamic model to understand the impact of trade exposure on industry-specific characteristics and within industry reallocations. For instance, Kreickemeier and Richter (2014) investigated how trade influences aggregated and firm-level emissions. The authors demonstrate that in the presence of heterogeneous firms aggregated emissions decrease only as a result of firm-level emission reductions from productivity gains.

Barrows and Ollivier (2018) found evidence of such a conclusion when analyzing the case of Indian firms: higher productivity is associated with lower emissions intensity. Additionally, the authors proposed a multi-product and multi-factor model with heterogeneous firms and concluded that in more competitive markets aggregated emission intensity reduces as a result of reallocations across firms, regardless of the emission intensity of their product mix. Similarly, Forslid et al. (2018) suggested that emission taxation results in lower emission intensity of exporting firms due to firms’ gains in productivity and abatement investments. According to their model, exporting implies higher production volume, which lowers emission intensity. The authors found support to such a conclusion when analyzing the case of Swedish firms. Shapiro and Walker (2018) arrive at a different conclusion. The authors aim at understanding what motivated the emission reductions in the U.S. manufacturing sector, based on changes in trade patterns, productivity or environmental regulations. According to their estimation results, most of the variation in emissions is explained by changes in environmental regulations, instead of productivity or trade volume variations.

Lastly, it is worth emphasizing the contribution of Siewers et al. (2024), who also used the Green Economy Module of the WBES dataset, but focused on the impact of GVC participation on the environmental performance of firms, that is, the causality direction evaluated is the opposite as in this paper. After applying a propensity score matching and difference-in-difference approaches, the authors found that GVC participating firms are generally greener, performing better in a number of environmental indicators, such as adoption of green actions, compliance with environmental standards, and carbon dioxide monitoring. Such findings, stress the importance of regulations in reducing trade emissions.

3 Main hypothesis, data, variables and methods

In this section we first present the main definitions and testable hypotheses based on the described theories (3.1). Next, we outline the data used and explain the construction of the index in 3.2; and finally, describe the econometric methods in 3.3.

3.1 Definitions and hypotheses

As previously described, the studies that aim at understanding the impact of environmental stringency on trade flows focused mostly on exports. In contrast, we assess the impacts on GVC participation, which consists of both export and import flows. Consequently, we define that GVC participation of firms is determined by their participation in international activities.

Baseline definition of GVC participation Firms that are two-way traders, that is, export and import directly or indirectly participate in GVC.

Some papers in the recent literature discuss the pertinence of categorizing two-way traders as GVC participating in this setting. The World Bank (2020), among others, use a similar definition. Quoting the World Bank: “[w]hen a given firm in a given country both imports and exports, it is natural to conclude that this firm participates in GVCs” (World Bank, 2020, p. 30). Moreover, our baseline definition of GVC participation captures both direct as well as indirect trading. For instance, a firm that only exports and imports indirectly is also counted as a two-way trader and, therefore, as participating in GVCs, such that we do not miss those that are linked to international supply chains exclusively via national intermediaries.

Based on the theoretical expectations and empirical evidence discussed so far, there are two possible outcomes for the impact on the probability of GVC participation, and on the intensity of participation. For instance, environmental performance could either have a positive or a negative effect on the probability of GVC participation. Possible channels for a positive effect include access to markets with relatively strict environmental regulations; whereas for a negative effect the channels include high initial investments to comply to regulations and, hence, access to such markets (Ederington and Minier 2003). Therefore, our first hypothesis is that environmental performance has an ambiguous effect on the firms’ probability to participate in GVC.

Regarding the intensity of GVC participation, firms’ environmental actions can either be beneficial or detrimental for the strengthening of two-way trade. On the one hand, a positive effect could be explained by the PH, where higher levels of trade volumes could result from an increase in innovation and productivity. On the other hand, a negative effect could be explained by a PHE, where increased costs lead to decrease in international competitiveness and, hence, the amount traded. Accordingly, our second hypothesis states that conditional on participation, firm environmental performance has an ambiguous effect on the intensity of GVC participation. Therefore, it is an empirical question to determine whether the positive or negative channels prevail.

3.2 Data sources and variables

The dataset is composed of firm- and country-level variables from several sources. Firm-level data are from the World Bank Enterprise Surveys (WBES) database, which provides comprehensive information on firm’s operational characteristics, sales, trade, management approach, future expectations, etc. In its most recent surveys, the WBES included a specific module on the environmental practices of firms, the Green Economy module. It was implemented in a selected pool of 32 countries located in Europe, Central Asia, Middle East, and North Africa. As with all WBES data, the information is collected via face-to-face interviews with company senior managers, who respond to the questions directly. The WBES uses a stratified random sampling technique to select respondents according to their industry, size, and location to ensure representativeness (Dethier et al. 2011). The number of firms varies across countries proportional to their population size and the questionnaires are standardized to ensure cross-country comparability (Grover and Karplus 2020). In addition to the firm-level variables, country-level data comes from two additional World Bank databases: the World Development Indicators, and the Worldwide Governance Indicators. A description of all variables used and their sources can be found in Table 10 in the Appendix.

The dataset consists of 15,922 firms from 27 industries and 32 countries. The novel Green Economy module limits the availability of environmental-specific data to a single period, corresponding to interviews conducted mostly between 2018 and 2019. A list of firms across different regions and industries is provided in Tables 11 and 12 in the Appendix. The majority of firms in the dataset belong to the manufacturing sector (54.5%), are located in Europe (69.8%), and conduct relatively low-technology activities (43.8%).Footnote 4 The industries with the greatest number of firms are Retail (18.0%), Food (13.4%), and Construction (8.1%). The countries with the greatest number of firms are Turkey (8.8%), Ukraine (7.2%), and Russia (7.2%). The vast majority of firms in the dataset actively participates in GVC to some extent (68.0%) and, conditional on participation, the average intensity is relatively high (53.3%). Hence, the average firm in the dataset is highly integrated into the global markets. Latvia, Montenegro, and Kosovo are among the countries with the highest levels of GVC participation and intensity; while tobacco, electronics, and machinery and equipment are the industries with the highest integration.

Crucial to the analysis is how to define GVC participation and intensity. Although there are a number of alternatives in the literature that range from encompassing what motivates the firms to export or import (Bernard et al. 2018; Bernard and Jensen 2004; Melitz 2003) to measuring the use of intermediary imports on exports (Torres Mazzi et al. 2021; Antràs 2020); as indicated in the previous sub-section, we consider two-way trading (Del Prete et al. 2017; Reddy et al. 2020; Siewers et al. 2024; World Bank 2020). Siewers et al. (2024) emphasize that it has the advantage of including firms that export and import indirectly, accounting for those that participate in GVC through national intermediaries.Footnote 5

In this regard, the participation can be defined in a weak sense, where firms that export and import, at any level, are considered to participate in GVC; or in a strong sense, where only firms that are two-way traders and hold an internationally recognized certification are considered integrated into GVC (Del Prete et al. 2017; Reddy et al. 2020). In addition, it is possible to set thresholds based on the amount of trade to make the definitions more restrictive. For instance, Del Prete et al. (2017) establish that only firms who export at least 10% of its production and import at least 10% of its inputs are considered to participate in GVCs. This paper follows the weak and strong definitions of GVC participation: firms are considered to participate in GVC if they are two-way traders (weak definition) and hold an international certification (strong definition). As a robustness check, more restrictive versions of the weak and strong definitions with at least 10% of trade volume are considered.

The GVC intensity variable derives from the participation variables and can be understood as the ratio of exports on total sales or the ratio of imports on total inputs. Variations include considering only two-way traders, only firms that follow certification standards, or only firms with export or import ratios beyond a certain threshold. As with the participation, the main definitions followed concerning GVC intensity are the weak and the strong ones. Their description can be found in Table 10 in the Appendix. In all cases, the variables are based on WBES questions regarding the ratio of exports on total sales and the ratio of foreign inputs on total inputs.

The WBES also provide information on key explanatory variables, namely the FEPI and multiple firm-level controls. According to the literature on the determinants of GVC participation at the firm-level, a number of controls should be included to isolate the effect of the explanatory variable of interest. Firm size, age, labor productivity and foreign ownership were found to have a significant and positive effect, as larger and older firms often face lower financial constraints which enables the investments required to export or import, while firms that are more productive and have previous foreign ownership might benefit from greater competitiveness in foreign markets (Urata and Baek 2020; Cieslik et al. 2019; Criscuolo and Timmis 2017). In light of such findings, we considered a number of firm-level controls throughout the regression analyses, which include labor productivity, firm size (measured by the number of employees), firm age, foreign ownership, and the requirement of environmental standards. A list of the description of variables can be found in Table 10 in the Appendix.

Regarding country-level controls, Fernandes et al. (2021) found that factor endowments, political stability, geography, liberal trade policies, FDI and domestic industrial capacity are significant components to explain GVC participation. When analyzing the specific case of East European and Central Asian countries, Cieslik et al. (2019) found that EU membership is positively associated with trade integration, especially for smaller firms in East European countries. In our regressions, we omitted country-level variables and decided to include instead country dummy variables to fully control for country heterogeneity.

The variable of interest in the analysis is the FEPI, which measures the extent to which firms are undertaking actions to minimize their environmental impact. To construct the index, we considered the answers to two questions of the Green Economy Module: (1) Which environmental protection measures were recently adopted by the firm?; and, (2) Which of those contributed the most to reduce the company’s negative environmental impact?. The descriptive statistics of these questions can be found in Table 15 in the Appendix.

When responding to the WBES questionnaires, firms are asked whether they have taken 10 key environmental actions over the last 3 years (question 1). These include the adoption of more climate friendly energy generation on site, air pollution control measures, and energy management. Around 75% of the firms in the sample adopted at least one measure that protects the environment. Improvements to lightning (48.8%), machines and equipment (45,5%), and heating and cooling systems (37.3%) are among the measures adopted the most by the firms in the sample. The respondents also report which of the adopted measures were most helpful in reducing environmental impact (question 2). The relative frequencies associated with this question serve as a proxy for their relative importance in reducing negative environmental externalities and are used as weights to construct the FEPI index. Table 15 in the Appendix provides a summary of the answers in the dataset. According to the firms’ perception, the measures that contributed the most to offset environmental impact are machinery and equipment upgrades (22.3%), waste management and recycling (16.7%), and heating and cooling improvements (14.2%).

The FEPI combines the information of questions 1 and 2. It is composed by the sum of each adopted environmental measure weighted by its relative importance in the industry:

where the environmental performance of firm i in industry j is given by the sum of each environmental measure adopted, represented by the dummy \({M}_{ijk}\) (based on the answer to question 1), which takes the value of 1 if the firm i in industry j adopted the measure k, multiplied by the relative importance of the measure in industry j, \({w}_{jk}\), which is based on the answer to question 2 in the WB questionnaire. FEPI ranges from 0 to 1, taking the value of 0 if the firm did not adopt any environmental action in the past three years, and 1 if it adopted all measures.

We propose the use of these two questions in the construction of the index for two main reasons. First, they allow us to directly observe the actions undertaken by the firms, regardless of their motivation or end-line result, while attributing higher weights to those that had the greatest impact by sector of activity. Therefore, we can quantify the extent to which a firm adopts climate friendly measures relative to the importance of the measures in the sector where it is active. Compared to performance indicators based on emissions or on regulatory stringency, this method provides higher granularity in identifying the efforts to reduce the environmental footprint. Second, these questions are applied to companies of all industries, from both manufacturing and service sectors. It renders the index more comparable than others that use exclusively information concerning emissions and green regulations, which are mostly targeted to manufacturing companies.

Tables 16 and 17 in the Appendix present summary statistics of the FEPI according to country and industry classifications. The average FEPI for the sample is 0.39. Greece (0.57), Malta (0.57) and Kosovo (0.56) are the countries with the highest averages of environmental performance. The average index for EU countries (0.45) is almost 10 percentage points higher than the average for non-EU countries (0.36). At the same time, the average for European countries (0.39) is slightly lower than the one for Central Asian countries (0.42). Regarding the different industries in the sample, Refined Petroleum Products (0.60), Paper (0.49), and Plastics and Rubber (0.47) are the industries with the greatest FEPI averages. Interestingly, these industries are notorious for their high level of GHG emissions (Ritchie and Roser 2020). The average for the manufacturing sector (0.42) is higher than the one for the service sector (0.35). Furthermore, the higher the technological intensity of the industry, the higher the associated levels of FEPI. These preliminary figures suggest two key takeaways. First, countries with higher levels of development tend to host firms with higher FEPI. Second, firms and industries that have a higher impact on the environment seem to be taking more actions to offset their environmental impact.

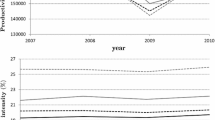

To better understand such relationships, Figs. 1 and 2 present the plots between averages of FEPI and country- or firm-level variables. According to Fig. 1, there seems to be a positive correlation between FEPI and GDP per capita, trade ratio, and Rule of Law, suggesting that higher levels of development are associated with higher adoption of environmental measures by firms. However, there seems to be no correlation between CO2 emissions per capita and FEPI.

Figure 2 provides the correlations of FEPI with firm-level variables. On the one hand, there seems to be a positive relationship between the age and firm size among different industries and the average FEPI. This is in line with expectations that bigger, older firms are more capable of implementing environmental protection measures (Batrakova and Davies 2012). On the other hand, there seems to be no relationship between the FEPI and productivity indicators, such as labor productivity and volume of sales.

It is important to note the limitations on such an analysis. First, the small number of observations makes statistical inference difficult, as there are 32 countries and 27 sectors in the sample. Second, it is not possible to derive causal inference as endogeneity concerns are not addressed. One example would be with respect to CO2 emissions and GDP per capita, variables that are notoriously interlinked through the environmental Kuznets curve. In spite of such limitations, this exercise provides anecdotal evidence on the relationship between the variables used in the regression analyses.

Table 1 presents the main summary statistics for dependent variables, the FEPI, firm-level controls, and the instrumental variables used in the identification strategy. According to the summary, 14% of firms are required to follow environmental standards, 8% are foreign-owned, and about one third are from EU countries. The explanatory variables are not highly correlated, as illustrated by the cross-correlation analysis in Table 14.

3.3 Model specification

Estimating a relationship between firm environmental performance and its participation in GVC is not straight forward due to potential endogeneity concerns. Del Prete et al. (2016) stress that firms who joins global markets can have performance benefits stemmed from increased levels of specialization, economies of scale, and knowledge spillovers. Trading globally could promote better practices, including the adoption of environmental actions. Hence, reverse causality could be an issue as GVC participation might also affect FEPI. Furthermore, the firm-level data used to compute the dependent and independent variables in the regression equations are prone to measurement errors due to the self-reporting nature of the WBES, which adds further endogeneity concerns. We attempt to address these endogeneity issues with an instrumental variable approach.

To investigate the impact of environmental performance on both the probability and intensity of GVC participation, we first considered a generalized two-part fractional response model (GTP-FRM). This method allows the error terms of the two parts (a probit model for the probability, and a fractional response model for the intensity) to be correlated. For instance, the adoption of environmentally friendly measures could be associated with higher levels of interpersonal contact and creativity in the workplace, leading to higher innovation and productivity, key determinants of intensity of GVC participation (Reddy et al. 2020; Spanjol et al. 2015; Delmas and Pekovic 2013). In this case, estimating the probit and fractional response model separately would lead to biased coefficients of the fractional response model. If, however, there is no correlation between them, the GTP-FRM reduces to a two-part model where the probit and fractional response models can be estimated separately (Wulff 2019). Therefore, we started by testing for the correlation between the two parts in several subsamples and using different definitions of the dependent variables. When using instruments for the FEPI, the tests pointed to the independence of the two models, indicating that the estimation of the probit and FRM could be done separately without the use of the GTP-FRM method. Therefore, we used a two-part model. This estimation method allows for both decisions to be treated separately from each other. This is particularly useful in our case, as treating the decisions to trade and how much to trade independently simplify the IV estimation procedure (Martínez-Zarzoso and Johannsen 2018; Farewell et al. 2017). In the first part, we estimate an IV probit model to assess the impact on probability of participation. The specification is given by:

where the GVC participation probability of firm i, in industry j, and country k follows a non-linear function \(\varphi\) and is determined by the FEPI and a set of firm-level control variables described previously. We include industry \({\kappa }_{j}\) and country \({\iota }_{k}\) dummies to control for unobserved heterogeneity at the industry and country level. The non-linear function \(\varphi\) is the standard normal cumulative distribution. Due to the lack of time variation, it is not possible to control for time invariant heterogeneity. Hence, an important assumption is that unobserved firm-level characteristics are not correlated with the FEPI.

The second part is a fractional response model that assesses the impact of environmental performance on the intensity of GVC participation, conditional on participation. Equation (3) provides the empirical specification. In this case, the non-linear function \(\omega\) is bounded between 0 and 1, and it is estimated by a fractional probit regression, as the dependent variable is restricted to the interval [0,1].

where \({GVC int}_{i,j,k}\) denotes the intensity of GVC participation of firm i, in industry j of country k, which can take different values depending on the definitions used (weak or strong) as indicated previously.

A key assumption for the validity of this two-part procedure is that these two parts must be independent from each other, which allows them to be modelled by different and uncorrelated functions (Oberhofer and Pfaffermayr 2012; Papke and Wooldridge 1996). As indicated above, in our case, unobserved factors that affect the probability to participate are not correlated with unobserved factors that affect the intensity of participation. Therefore, estimating both functions separately should not lead to biased coefficients (Belotti et al. 2015; Wooldridge 2010).

For the identification strategy we use three instruments that follow the same logic; an interaction between a country-level variable that denotes a strong environmental regulatory system and a firm-level variable that indicates the adoption of environmental protection measures by the firm. The first instrument is the interaction between an EU dummy, which takes the value of 1 if the country is part of the European Union, and the Monitoring intensity variable, which captures how many sources of emissions a firm monitors.Footnote 6 The EU has one of the strictest environmental regulations and its member countries are consistently among the ones with the highest environmental performances (Wendling et al. 2020). Furthermore, monitoring emissions are closely linked with the implementation of emission reduction actions and the greater the number of items monitored, the higher the expected commitment with achieving goals by the firms. Their interaction is expected to be highly correlated with the environmental performance of a firm, while satisfying the exclusion restriction required for the validity of the IV, as the variables are not direct determinants of GVC participation (firms exporting and importing simultaneously). The second instrument is the interaction between a dummy that captures whether a country has high levels of regulatory qualityFootnote 7 and a dummy that takes the value of 1 if the firm mentioned environmental issues in its corporate objectives. Regulatory quality is found to be linked with higher environmental policy stringency (Fredriksson and Mani 2002) and, therefore, is a good proxy for countries with higher environmental regulations. When interacted with the mention of environmental in objectives, the instrument would capture firms that are more likely to take environmental actions. As a robustness check, we use an additional IV following the same logic: the interaction between the rule of law and the requirement to adhere to environmental standards.

The relevance and validity of the instrumental variables used is tested with the corresponding exogeneity, joint significance, and overidentification tests, as described in Sect. 4. Since we cannot guarantee with absolute certainty that the exclusion restriction holds, we conducted a sensitivity analysis to potential violations as a robustness check, based on the plausibly exogenous method proposed by Conley et al. (2012). Regarding the estimation methods, we assess the impact of environmental performance on the probability and intensity of participation using an IV Probit and an FRM with endogenous variables, respectively (Wooldridge 2010). In both regressions, we bootstrap the standard errors to address sampling issues.

4 Empirical results

4.1 Main results

The main specification is estimated using the IV probit and FRM with endogenous variables methods. Tables 2 and 3 present the second-stage results when using the weak and strong definitions of GVC participation, respectively. In both tables, columns (1) and (2) present the results when using the interaction of EU and monitoring intensity as instrument; columns (3) and (4) when using regulatory quality interacted with environmental objectives; and, columns (5) and (6) when using both instruments simultaneously. In all cases, environmental performance (FEPI variable) has a positive and significant impact on the probability of GVC participation. The magnitude of the coefficients is larger for the weak definition of GVC participation (Table 2), and varies between 0.23 and 0.29. When using two instruments, a one standard deviation increase in the FEPI increases the probability to participate in GVC by 9.1 p.p. a result, the coefficient is significant at the 1% level. For the strong definition (Table 3), the magnitude of the effect is lower, around 0.19, and a one standard deviation increase in FEPI results in a probability to participate 6.4 p.p. higher. This positive and significant impact, however, is not observed on the intensity of GVC participation. Throughout all the regressions, environmental performance seems to have no significant effect on the extent to which firms trade globally. All in all, we find evidence for our first hypothesis, but not for the second. The main results indicate that adopting environmentally friendly measures seems to benefit the probability of firm’s to enter into global markets, while neither benefiting nor harming the volume traded. The results differ from the previous findings of the literature, according to which environmental regulations had a negative effect on both the probability and the extent of trade, albeit analyzing only export flows.

Finally, the firm-level controls are generally stable in all cases and present the expected sign according to the empirical literature. The firm-level controls are mostly positive and significant, with magnitudes similar to those found in other empirical studies (Reddy et al. 2020). Foreign owned, bigger, and more productive firms are associated with higher probability of GVC participation. While foreign ownership and productivity are also associated with higher intensity of participation, the association with age and size seems to be negative.

Table 18 in the Appendix presents the first-stage results for both definitions of GVC participation and when using the different combinations of IV. Regarding the validity of the IV approach, there are no issues with respect to relevance of the instruments. In all cases, there is a positive and significant impact of the IV on the FEPI. Additionally, the Cragg-Donald Wald F-statistics are consistently higher than the Stock-Yogo critical values, evidencing that there seems to be no weak IV problems in the estimations. One point of attention, however, is the overidentification test for the GVC intensity, column (6) of Tables 2 and 3. In this case the null hypothesis of the Hansen J-test is rejected at the 10% level, indicating that the validity of the IV is rejected. In order to further assess this issue, we consider another potential instrument and evaluate whether the instruments are plausibly exogenous (Conley et al. (2012), as discussed in the following robustness subsections.

4.2 Robustness I: subsample analysis and single indicators

We conduct subsample analyses in order to assess the presence of heterogeneity across industries, technology intensities, regions and only exporter versus only importers. Table 4 presents the impact of FEPI on the probability and intensity of GVC participation for each subsample. Columns (1) and (2) are based on the weak definition, while columns (3) and (4) are based on the strong one.

Regarding the differences between manufacturing and service firms (top part of Table 4), environmental performance has a positive impact on the probability of participation for both sectors, but the magnitude is larger for manufacturing firms. Environmental performance seems to have a negative effect on the intensity of service firms, albeit the effect is only observed on the weak definition. Such a finding might stem from the fact that service firms adopt less measures to reduce their impact in the environment, as discussed in the previous section. These results might evidence that while both sectors seem to have higher chances of integration to GVC by adopting climate friendly practices, the service sector might suffer adverse effects.

Based on the OECD’s industry classification, the impact of environmental performance differs depending on the firms’ technology intensity. The results in the middle part of Table 4 indicate that while taking environmental actions benefits all firms in terms of probability of participation, the magnitude of the benefit increases for higher-technology firms. Considering the strong definition, the effect is around three times larger for medium or medium–high firms (0.35) when compared to low technology firms (0.11). This might evidence that the higher the technology intensity, the higher the benefits of taking environmental action for firms. This result is in line with recent findings by De Melo and Solleder (2022), who stress that upstream firms, i.e., firms that are more distant from the final consumer, tend to have higher CO2 and lower technology intensities. This would make them more susceptible to environmental regulations. It is worth noting, however, that there is a negative effect on intensity for low technology firms in the weak definition, and for medium firms in the strong one. This might evidence that environmental regulations could burden some firms, decreasing their international competitivity in accordance with the findings in the empirical literature (Cherniwchan and Najjar 2021).

Finally, the impact of environmental performance seems to be fairly stable across regions (results are shown in the bottom part of Table 4). Even though there is more variation when considering the weak definition of GVC participation, the same is not true for the strong one. In this case, there is a similar and positive effect on the probability of around 0.23, and a consistently non-significant effect on the intensity. However, there is a negative effect on the GVC intensity for MENA countries, which is significant for the weak definition and non-significant for the strong. This potentially indicates that there could be heterogeneities in the impact of environmental performance for countries in regions with lower levels of development.

Table 5 presents the results when considering firms that only import and firms that only export to assess heterogeneities between the direction of trade flows. In this case, environmental performance seems to have no benefit on the probability of firms becoming importers, there is even a weakly significant and negative effect on their import intensity. Regarding exporting firms, there is a positive effect on both the probability and intensity of exporting. This result is understandable, as importing firms do not face the same entry barriers from such regulations as exporting firms do, making the benefit of complying to them less relevant for their insertion into global markets. Additionally, complying to the regulations might have a positive cost effect, which could decrease their competitiveness and hence, have a negative effect on the intensity. It is important to note that the reduced number of observations for these samples might hinder comparability with the previous results.

All in all, the results of the subsample analysis indicate that complying with environmental regulations has a consistent positive effect on the probability to participate in GVC, but the effects on the intensity are not as clear and seems to depend on firm- and regional-level characteristics.

Next, acknowledging the shortcomings that are attached to the use of an index (FEPI) to measure firms’ environmental measures, we assess the relationship between each single environmental indicator and our outcomes of interest, GVC participation and intensity. The results are presented in Table 19 in the Appendix and the corresponding estimates are similar in direction and significance to those observed in the main specification. Table 19 in the Appendix reports regression results to assess the impact of separated components of the index on the variables of interest as suggested. Table 19 reports the results of adopting each measure on GVC participation (weak and strong definitions). The results indicate that the adoption of single measures have a positive and significant impact on GCV participation, whereas the impact on GVC intensity is mostly non-significant with two exceptions, for which the impact is negative (waste minimization/ management and recycling and upgrade of vehicles, in both cases for the weak definition).

4.3 Robustness II: violations to the exclusion restriction

The exclusion restriction is crucial to evaluate the validity of an instrumental variable. In our case, we argue that such a requirement holds, as we interact seemingly exogenous country- and firm-level variables that are correlated with a strict regulatory environment, but do not necessarily determine GVC participation. While it is not possible to fully test the validity of the exclusion restriction, we apply the plausibly exogenous method proposed by Conley et al. (2012) and operationalized by van Kippersluis and Rietveld (2018a, b) to investigate whether the results hold in the presence of violations to the exclusion restrictions.

As described by Conley et al. (2012), the method consists of presenting estimates for the effect of the endogenous variable on the outcome variable while relaxing the instrument’s exclusion restriction to different extents. Ideally, the effect of the IV on the outcome variable should be zero, but since this is not always the case the authors propose estimation methods that allow for using priors for this effect being different from zero, i.e., the mean and standard deviation of the IV’s direct effect on the outcome. If they are different from zero and the estimation results indicate that the effect of the endogenous variable is significant and as expected, the IV complies with the “plausibly exogenous” hypothesis.

While the estimation methods are described in detail, Conley et al. (2012) provide limited guidance on how to determine the priors for the IV direct effect. In this regard, van Kippersluis and Rietveld (2018a, b) propose to use as priors the estimation results of a subsample for which the IV does not have a significant effect on the outcome variable. Additionally, the authors propose a sensitivity analysis, in which the direct effect of the IV is multiplied by a [0,1] factor, indicating the degree of violation to the exclusion restriction. Ideally, the causal effect of the endogenous variable on the outcome would remain significant even for complete violations of the exclusion restriction.

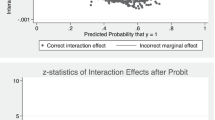

We conducted these two exercises to assess the validity of the IV used in our empirical analysis. Table 6 presents the results of the local to zero estimation method based on the interaction between EU and the monitoring intensity as IV. The effect of FEPI (environmental performance) on the outcome variables remain significant in the plausibly exogenous regressions, although not always with the same sign when compared to the two-stage regressions. This might be indicative that at some level of violation of the exclusion restriction the causal effect of environmental performance could have been rendered zero (van Kippersluis and Rietveld 2018b). The sensitivity analysis presented in Fig. 3 shows that this is indeed the case.

Causal effect of environmental performance on GVC participation (weak definition) according to the IV’s EU*Monitor Intensity violation to the exclusion restriction. Notes all graphs were plotted according to the local to zero method, as described by Conley et al. (2012). The dashed lines represent 95% confidence intervals. “No uncertainty” is based on zero prior variance and “with uncertainty”, on van Kippersluis and Rietveld’s (2018b) suggested variance

Regarding the effect on GVC participation, violations to the exclusion restriction between 38 to 47% renders the causal effect of environmental performance insignificant, depending on the prior level of uncertainty attributed to the IV’s direct effect. Therefore, we find evidence on the causal effect of environmental performance on GVC participation using the suggested IV, albeit partially. When it comes to GVC intensity, the coefficient is insignificant even for small violations of the exclusion restriction. Hence, we do not find evidence of a causal effect of environmental performance on the extent of GVC participation.

The results for the remaining instruments and outcome variable definitions are presented in Tables 20, 21 and Figs. 4, 5, 6, 7 and 8. In all cases, we find evidence on the causal effect of environmental performance on GVC participation, at least partially, and no significant effect on GVC intensity. Such results might serve as evidence that the proposed IV are partially robust to violations to the exclusion restriction.

4.4 Other robustness checks

To further assess the stability of the main results, we conduct two additional robustness checks. First, we use alternative definitions of GVC participation inspired by Del Prete et al. (2017). In the alternative weak definition, Weak 10%, when only firms where at least 10% of revenue comes from exports and at least 10% of inputs are imported are considered to participate in global value chains. Similarly, in the alternative strong definition, Strong 10%, only two-way traders that have at least 10% of their revenue from exports, at least 10% of their inputs as imports, and hold an international certification standard are considered to participate in GVC. Table 7 depicts the results when using both IV. The results are generally in line with the main ones. While the impact on the probability of participation remains positive and significant, the magnitude of the alternative definitions is slightly reduced when compared to the original definitions. The non-significant impact on the intensity is still observed in the more restrictive definitions. Finally, the magnitude and significance of the firm-level controls are stable across both definitions. One point of attention is that the Cragg-Donald Wald F statistics are smaller when compared to original definition, albeit still larger than the Stock-Yogo reference points. Once again, the overidentification tests reject the validity of the IV for the FRM estimations, but not for the IV probit.

To further assess this issue, we have included an additional IV to the analysis, which follows the same construction logic as the previous two: the interaction between a dummy indicating a country with strong Rule of Law and a firm dummy variable indicating the requirement to follow environmental standards. In the main regressions, the environmental standards variable is mostly non-significant for the intensity regressions. Therefore, we have used it to construct the additional IV, while also omitting it as a regressor. Tables 8 and 9 present the first- and second-stage results when using the most restrictive definition of GVC participation.

As with the main regressions, the first-stage results in Table 8 evidence that the IV are relevant and there seems to be no weak IV problems. The second-stage results also corroborate the main findings. There is a consistent positive and significant effect on the probability of around 0.21 and a non-significant effect on the intensity. The firm-level controls are also stable and present the expected sign. However, as in the main estimations, the overidentification tests fail to reject the null hypothesis for the IV probit estimations, but not the second stage ones. This continues to point toward the rejection of the IV in the intensity regressions, indicating that endogeneity concerns might not have been fully addressed in these cases.

4.5 Limitations of the empirical analysis

There are some limitations concerning the empirical results, which involve both the data and the methods used. Regarding the dataset, the WBES is based on questionnaires answered by the firms’ managers. The self-reporting nature of the data could lead to measurement errors, a source of endogeneity that might ultimately bias the results. In addition, the informal sector is disregarded in the surveys, which might hinder external validity given their relative size in developing economies. Furthermore, the Green Economy module was applied at a limited number of countries in Eastern Europe, Central Asia, and MENA. Firms in such countries might also not be representative of the entire global market, as firms in developed countries or in countries with higher trade ratios, such as in Southeast Asian countries, are not in the sample. Therefore, the external validity of the results might be affected.

Regarding the empirical methods, the main point of attention is related to potential endogeneity issues. Firstly, the Green Economy module is a recent entry in the WBES questionnaires and, therefore, only cross-sectional data are available, which does not allow to fully control for unobserved heterogeneity. Hence, this paper relies on the assumption that unobserved firm-level characteristics are uncorrelated with the FEPI. Furthermore, the attempt to control for endogeneity using a two-part IV approach presented some challenges. While the model seems to be correctly specified for the IV probit, the overidentification tests pointed to the rejection of the IV in the FRM with endogenous variables, indicating that the endogeneity concerns in this case might not have been fully addressed. Similarly, the sensitivity analyses based on the plausibly exogenous method indicate that the proposed IV are able to identify the causal effect of environmental performance on GVC participation partially. With respect to the intensity, the results are not as clear, as the exercise returns the same non-significant results as in the main specification.

5 Discussion and conclusion

Despite the heated discussion on the potential negative effects of environmental regulations on trade flows, the number of studies that address the issue from the perspective of individual firms is still scarce. This paper aimed to contribute to such an incipient literature by investigating how the environmental performance of firms impact their participation in GVC.

To this end, the main empirical method consisted of a two-part IV approach to estimate the impact both on the probability and the intensity of GVC participation. On the one hand, higher levels of firm environmental performance are associated with higher probability to participate in GVC, a result observed in several subsamples and robust to alternative definitions of the dependent variable. A one standard deviation increase in FEPI results in a probability to participate in global markets 6.4 percentage points higher. On the other hand, we are not able to find a significant impact of environmental performance on the intensity of participation for the full sample. However, for firms that are importers only, have low-technology levels, and are located in less developed regions a negative effect of environmental performance on intensity was found. Even though the IV approach has its own limitations, the results indicate that environmental regulations could also lead to a negative impact on trade flows of individual firms, depending on the case.

The findings of this paper have direct policy implications. Even though there is a clear benefit of complying to regulations in terms of probability to participate in global markets, the potential negative impacts should be avoided to ensure long-term effectiveness of such regulations. For instance, environmental policies could have evaluation mechanisms to monitor the potential adverse effects or excessive burden on individual economic agents. The mechanisms could generate useful knowledge for future iterations, adjusting measures to reduce side effects. Alternatively, the policies could be accompanied by other programs to offset potential negative effects on agents. One example could be the allocation of subsidies on environmental actions to reduce the potential negative impact on firms’ competitiveness. Naturally, implementing such mechanisms has their own set of challenges, but they could make the path towards emission reduction less rocky.

While this paper presents evidence on the relationship between firms’ environmental measures and integration in global markets, future research could expand the findings by investigating the underlying mechanisms and transmission channels. For instance, an interesting research question would be whether the negative effect on the intensity of GVC participation is caused by a cost effect, which decreases firms’ international competitiveness. If that is the case, the study would provide evidence supporting the pollution haven effect at the individual firm level. Future research could build on the findings of this paper by applying alternative methods to address endogeneity concerns. One avenue would be to expand the dataset by including future waves of the WBES, allowing the use of panel data techniques that better control for unobserved heterogeneity in the sample. Doing so would further increase our understanding on how the different environmental regulations affect individual firms.

Notes

A reduced sample of this dataset has been used by Siewers et al. 2024.

For a detailed review, please refer to Cherniwchan et al. (2017).

According to OECD’s classification of industries based on R&D intensity (Galindo-Rueda and Verger 2016). Industries can be classified from high to low technological intensity, depending on their innovation levels. Table 13 in the Appendix presents how the industries in the dataset were classified according to the OECD’s taxonomy.

The authors also acknowledge the potential limitations of the definition, namely it does not capture GVC governance, arm-length or relational linkages. For a detailed discussion, please refer to Siewers et al. (2024).

In the WBES questionnaires, there are a number of questions on whether the firm monitors activities that might have a negative impact on the environment. The monitoring intensity variable is composed by three questions regarding the monitoring of pollutants’ emissions. The variable ranges between 0, when the company does not monitor emission of pollutants, and 3, when the company monitors its CO2 emissions, the CO2 emissions along the firm’s supply chain, and emissions of other pollutants.

Data from the regulatory quality index by the World Governance Indicators (WGI).

References

Ambec S, Cohen MA, Elgie S, Lanoie P (2013) The porter hypothesis at 20: can environmental regulation enhance innovation and competitiveness? Rev Environ Econ Policy 7(1):2–22

Antràs P (2020) Conceptual aspects of global value chains. World Bank Econ Rev 34(3):551–574

Barrows G, Ollivier H (2018) ‘Cleaner firms or cleaner products? How product mix shapes emission intensity from manufacturing. J Environ Econ Manag 88:134–158

Batrakova S, Davies RB (2012) Is there an environmental benefit to being an exporter? Evidence from firm-level data. Rev World Econ 148(3):449474

Belotti F, Deb P, Manning WG, Norton EC (2015) Twopm: two-part models. Stand Genomic Sci 15(1):3–20

Bernard AB, Jensen JB (2004) Why some firms export. Rev Econ Stat 86(2):561–569

Bernard AB et al (2018) Global firms. J Econ Lit 56(2):565–619

Broner F, Bustos P, Carvalho VM (2012) Sources of comparative advantage in polluting industries, SSRN Scholarly Paper 2136006, Social Science Research Network, Rochester.

Cherniwchan, J. & Najjar, N. (2021), ‘Do Environmental Regulations Affect the Decision to Export?’, American Economic Journal: Economic Policy.

Cherniwchan J, Copeland BR, Taylor MS (2017) Trade and the environment: new methods, measurements, and results. Ann Rev Econ 9:59–85. https://doi.org/10.1146/annurev-economics-063016-103756

Cieslik A, Jakub Michalek J, Szczygielski K (2019) What matters for firms’ participation in global value chains in Central and East European countries? Equilib Q J Econ Econ Policy 14(3):481–502

Conley TG, Hansen CB, Rossi PE (2012) Plausibly exogenous. Rev Econ Stat 94(1):260–272

Copeland BR, Taylor MS (1995) Trade and transboundary pollution. Am Econ Rev 85(4):716–737

Copeland BR, Taylor MS (2004) Trade, growth, and the environment. J Econ Lit 42(1):7–71

Criscuolo C, Timmis J (2017) The relationship between global value chains and productivity. Int Prod Monit 32:61–83

D’Agostino LM (2015) How MNEs respond to environmental regulation: integrating the Porter hypothesis and the pollution haven hypothesis. Econ Polit 32(2):245–269

Del Prete D, Giovannetti G, Marvasi E (2017) Global value chains participation and productivity gains for North African firms. Rev World Econ 153(4):675–701

Delmas MA, Pekovic S (2013) Environmental standards for productivity: understanding the mechanisms that sustain ability. J Organ Behav 34(2):230–252

Dethier J-J, Hirn M, Straub S (2011) Explaining enterprise performance in developing countries with business climate survey data. World Bank Res Obs 26(2):258–309

Ederington J, Minier J (2003) Is environmental policy a secondary trade barrier? An empirical analysis. Can J Econ/revue Canadienne D’économique 36(1):137–154

Farewell V, Long D, Tom B, Yiu S, Siu L (2017) Two-part and related regression models for longitudinal data. Ann Rev Stat Appl 4:283–315

Fernandes AM, Kee HL, Winkler D (2021) Determinants of global value chain participation: cross-country evidence. The World Bank Economic Review (lhab017).

Forslid R, Okubo T, Ulltveit-Moe KH (2018) ‘Why are firms that export cleaner? International trade, abatement and environmental emissions. J Environ Econ Manag 91:166–183

Fredriksson P, Mani M (2002) The rule of law and the pattern of environment protection. IMF Working Papers 02.

Galeotti M, Salini S, Verdolini E (2020) Measuring environmental policy stringency: Approaches, validity, and impact on environmental innovation and energy efficiency. Energy Policy 136:111052

Galindo-Rueda F, Verger F (2016) OECD taxonomy of economic activities based on R&D intensity, OECD Science, Technology and Industry Working Papers 2016/04.

Grover A, Karplus VJ (2020) The energy-management nexus in firms: which practices matter, how much and for whom? World Bank, Washington

Hanna R (2010) US environmental regulation and FDI: evidence from a panel of US-based multinational firms. Am Econ J Appl Econ 2(3):158–189

Jaffe AB, Palmer K (1997) Environmental regulation and innovation: a panel data study. Rev Econ Stat 79(4):610–619

Kellenberg DK (2009) An empirical investigation of the pollution haven effect with strategic environment and trade policy. J Int Econ 78(2):242–255

Kreickemeier U, Richter PM (2014) Trade and the environment: the role of firm heterogeneity. Rev Int Econ 22(2):209–225

Martínez-Zarzoso I, Johannsen F (2018) What explains indirect exports of goods and services in Eastern Europe and Central Asia? Empirica 45(2):283–309

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1695–1725

De Melo J, Solleder JM (2022) CO2 emissions: can GVC participation help decoupling? (regional trends: 1990–2015)

Oberhofer H, Pfaffermayr M (2012) Fractional response models - a replication exercise of Papke and Wooldridge (1996). Contemp Econ 6(3):56

Papke LE, Wooldridge JM (1996) Econometric methods for fractional response variables with an application to 401(k) plan participation rates. J Appl Economet 11(6):619–632

Porter ME, van der Linde C (1995) Toward a new conception of the environment competitiveness relationship. J Econ Perspect 9(4):97–118

Del Prete D, Giovannetti G, Marvasi E (2016) Small and Medium Enterprises’ Competitiveness through Global Value Chains. IEMed Mediterranean Yearbook 2016.

Reddy K, Chundakkadan R, Sasidharan S (2020) Firm innovation and global value chain participation. Small Bus Econ. https://doi.org/10.1007/s11187-020-00391-3

Ritchie H, Roser M (2020) CO2 and greenhouse gas emissions. Our world in data.

Shapiro JS, Walker R (2018) Why is pollution from US manufacturing declining? The roles of environmental regulation, productivity, and trade. Am Econ Rev 108(12):3814–3854

Shi X, Xu Z (2018) Environmental regulation and firm exports: evidence from the eleventh Five-Year Plan in China. J Environ Econ Manag 89:187–200

Siewers S, Martínez-Zarzoso I, Baghdadi L (2024) Global value chains and firms’ environmental performance. World Dev 173:106395

Spanjol J, Tam L, Tam V (2015) employer–employee congruence in environmental values: an exploration of effects on job satisfaction and creativity. J Bus Ethics 130(1):117–130

Torres Mazzi C, Foster-McGregor N, de Sousa E, Ferreira G (2021) Production fragmentation and upgrading opportunities for exporters: an empirical assessment of the case of Brazil. World Dev 138:105151

Urata S, Baek Y (2020) The determinants of participation in global value chains: a cross-country, firm-level analysis, Asian Development Bank, 1116.

van Kippersluis H, Rietveld CA (2018a) Beyond plausibly exogenous. Economet J 21(3):316–331

van Kippersluis H, Rietveld CA (2018b) Pleiotropy-robust Mendelian randomization. Int J Epidemiol 47(4):1279–1288

van Leeuwen G, Mohnen P (2017) Revisiting the Porter hypothesis: an empirical analysis of Green innovation for the Netherlands. Econ Innov New Technol 26(1–2):63–77

Wendling ZA, Emerson JW, de Sherbini A, Esty DC (2020) 2020 Environmental performance index, technical report, Yale Center for Environmental Law & Policy, New Haven

Wooldridge JM (2010) Econometric analysis of cross section and panel data, 2nd edn. MIT Press, Cambridge

World Bank (2020) World development report 2020: trading for development in the age of global value chains. World Bank, Washington, DC

Wulff JN (2019) Generalized two-part fractional regression with cmp. Stand Genomic Sci 19(2):375–389

Zhang Y, Cui J, Lu C (2020) Does environmental regulation affect firm exports? Evidence from wastewater discharge standard in China. China Econ Rev 61:101451

Zhang L, Liu Y, Hu J-L, Liu T, Liao S (2022) Environmental regulation and firm exports: evidence from a quasi-natural experiment in China. Sustainability 14(3):1084

Acknowledgements

We would like to thank the participants at the LEADS Leibniz Environment and Development Symposium (November 2022), in particular Jann Lay; the Göttingen Ibero-American Seminar (July 2022); and the Göttingen Chair of Development Economics Research Colloquium (April 2022) for their helpful comments and suggestions. We also thank Maximilian Mende for proofreading the article. I. Martínez-Zarzoso is grateful for the financial support received from Project PID2020-114646RB-C42 funded by MCIN-AEI/10.13039/501100011033 (Ministerio de Ciencia e Innovación), CIPROM/2022/50 PROMETEO (Generalitat Valenciana) and from project UJI-B2023-30 (Universitat Jaume I).

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Responsible Editor: Paul Raschky.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Figs.

Causal effect of environmental performance on GVC participation (strong definition) according to the IV’s EU*Monitor Intensity violation to the exclusion restriction. Notes all graphs were plotted according to the local to zero method, as described by Conley et al. (2012). The dashed lines represent 95% confidence intervals. “No uncertainty” is based on zero prior variance and “with uncertainty”, on van Kippersluis and Rietveld’s (2018a, b) suggested variance

4,

Causal effect of environmental performance on GVC participation (weak definition) according to the IV’s Strong Regulatory Quality*Environmental Objectives violation to the exclusion restriction. Notes all graphs were plotted according to the local to zero method, as described by Conley et al. (2012). The dashed lines represent 95% confidence intervals. “No uncertainty” is based on zero prior variance and “with uncertainty”, on van Kippersluis and Rietveld’s (2018a, b) suggested variance

5,

Causal effect of environmental performance on GVC participation (strong definition) according to the IV’s Strong Regulatory Quality*Environmental Objectives violation to the exclusion restriction. Notes all graphs were plotted according to the local to zero method, as described by Conley et al. (2012). The dashed lines represent 95% confidence intervals. “No uncertainty” is based on zero prior variance and “with uncertainty”, on van Kippersluis and Rietveld’s (2018a, b) suggested variance

6,

Causal effect of environmental performance on GVC participation (weak definition) according to the IV’s Strong Rule of Law*Environmental Standards violation to the exclusion restriction. Notes all graphs were plotted according to the local to zero method, as described by Conley et al. (2012). The dashed lines represent 95% confidence intervals. “No uncertainty” is based on zero prior variance and “with uncertainty”, on van Kippersluis & Rietveld’s (2018a, b) suggested variance

7 and