Abstract

The COVID-19 pandemic has thrown the world's economy and trade into disarray, putting international reliance in the limelight. This sparked debate on the durability and resilience of global value chains. In this paper, we construct a ‘product riskiness indicator’ for 4700 globally traded products based on components such as market concentration, clustering tendencies, network centrality of players, or international substitutability to determine which products are vulnerable to trade shocks at the global level – referred to as ‘risky’ products. In a second step, bilateral risky product imports are matched to multi-country input–output tables, allowing for an examination of the importance of globally supplied risky products by country and industry. Due to the high percentage of dangerous products in high-tech product categories, higher-tech industries are more vulnerable to supply-chain vulnerabilities. Third, we analyse the GDP impact of reshoring using a “partial global extraction method.” Assuming that risky product imports from non-EU27 nations are re-shored to EU27 countries, the EU27 GDP might rise by up to 0.5 percent. Non-EU27 countries suffer as a result of such reshoring activity. This implies that ensuring robust or at least resilient supply networks is also in the interest of the supplier countries and sectors.

Similar content being viewed by others

1 Introduction

The COVID-19 pandemic demonstrated how worldwide manufacturing networks, global supply and value chains, and global supply and value chains can be vulnerable to a variety of shocks. This is evident in the fact that trade is more volatile than GDP, owing to the numerous interconnections between countries. As seen in Fig. 1, trade volumes in China, the EU27, and the United States all fell in the first half of 2020 before slightly recovering in the second half, with China being the first region to return to pre-pandemic levels. Early in 2021, the United States surpassed the level of 2019, while the EU27 is still at the level of 2019. Exports reacted more strongly than imports in general. Current estimates for annual GDP growth show values of − 5.9% for the EU27 (e.g. − 8% for France, − 4.6% for Germany)Footnote 1 and − 3.4% for the United States. Only China reported a positive growth rate of 2.4%.Footnote 2

In response to the global health crisis and the threat of critical supply shortages, countries around the world began restricting the export of specific products such as masks and other health-related equipment (as well as people's cross-border mobility), reverting to a form of “emergency protectionism”, at least in the short term. Furthermore, multiple supply-side shocks arose as a result of severe lockdowns in various regions or nations, impeding manufacturing and transportation. In a world where industry is organized along global value chains (GVCs), however, the frictionless flow of goods is required to maintain the supply of essential commodities.

Aside from the numerous regionalised production and supply shocks, the pandemic highlighted a heavy reliance on foreign manufacturing. As a consequence, the Environment, Public Health and Food Safety Committee of the European Parliament has urged the European Commission “to find ways to restore pharmaceutical manufacturing in Europe”.Footnote 3 These trends raise the obvious concerns of how vulnerable our economies are to demand and supply shocks – both of which apply in the case of the COVID-19 health crisis – from within and outside the EU in general, as well as what role GVCs play in shock transmission. As a result, the subject of international trade and production integration's resilience is once again becoming a focus of economic research and a goal of public policy to reduce economic and health hazards. As the supply of key materials (like drugs, medicines, masks, etc.) demonstrates, this applies not just to individual enterprises and the way international production integration is organized within regional and global supply chains, but also to public sector activities (whether market-oriented or administered by government agencies).

This study contributes to this literature by identifying potential vulnerabilities of global value chains at the product level. We provide an assessment of the vulnerability of product supplies concerning internationally traded products, by applying a product riskiness index. This index allows us to identify possible vulnerabilities of industry sectors and dependencies on trading partners.

In Sect. 3, following the recent literature, the method for identifying “risky” products is outlined. The method is applied at the level of detailed trade data (Harmonised System HS 6-digit products) including more than 4700 products. A summary of the most important results is then shown descriptively. We will also show the usefulness of this product riskiness index with two applications: First, combining it with multi-country input–output tables to analyse the imports of industries according to the contained share of risky products. Secondly, to assess potential effects of re-shoring policies.

2 Literature review

The COVID-19 pandemic and the resulting economic crisis brought the dependencies of a number of products on a few producer countries to light and triggered a discussion on the resilience and robustness of global production networks and value chains. However, such aspects were already being considered before the pandemic from the EU-perspective in conjunction with the debate on the envisaged ‘open strategic autonomy’ (see e.g. European Parliament 2021; and European Commission 2021) in the phase of geo-political shifts. During the pandemic, the discussion has then particularly focussed on critical goods for combatting the pandemic, such as medical protective equipment, which is to a large extent produced outside the EU. Consequently, as the COVID-19 pandemic took hold in the EU, in some cases countries rushed to secure urgently needed medical equipment and pharmaceuticals and resorted to protectionism by hastily issuing export restrictions – albeit of short duration in most cases – to keep important products within country borders. However, in the literature it is also argued that those global production networks and value chains actually made it possible to cope with the surge in global demand for such products. Still, the crisis made it evident that in global production networks, economic sectors which are largely dependent on imports of certain inputs can be severely impacted by trade shocks or interruptions in the transport systems together with their respective downstream sectors (see e.g. Baldwin and Freeman 2020a). The COVID-19 pandemic has triggered discussions about the vulnerability and fragility of global value chains (GVCs) from the very beginning (see e.g. Baldwin and Freeman 2020a) and potentially emerging trade conflicts (e.g. Baldwin and Freeman 2020b). This vulnerability first became virulent in the supply of health-related products like face masks and other medical protective equipment for which several protectionist policies were imposed (for an overview see González 2020, and Evenett and Fritz 2020).

Policymakers called for more self-reliance and shortening of global value chains. The EU argued for the necessity to increase the resilience of European value chains, although it is unclear how this increased resilience is to be achieved (European Commission 2020a and 2020b). Overdependence on individual suppliers has been identified as a risk factor in the current organisation of international supply chains. Javorcik (2020) hints at the critical aspect of the “just-in-time” principle, which aims to reduce logistics costs by minimising or eliminating warehousing. However, it is by no means clear that a world with reduced global value chains would be a better option. For example, one topic of debate is whether or not the “renationalisation” of value chains could shield countries from the negative economic effects of COVID-19, because the supply bottlenecks due to the lockdown affect both international and national suppliers (Bonadio et al. 2020). It should also be noted that despite severe disruptions, many value chains – for example in the food industry – have continued to function during the crisis (Miroudot, 2020). Baldwin and Freeman (2022) propose a risk-versus-reward framework according to insights from the portfolio theory and discuss foreign exposures and potential supply chain disruptions in an input–output framework. Their results argue using measures based on the global Leontief inverse (i.e. taking direct and indirect linkages into account) that exposures to foreign shocks are higher than direct indicators would suggest.

Our main reference is the work by Korniyenko, Pinat and Dew (2017). Their seminal idea of using trade data and interpreting it as a network to identify structural weaknesses on product level allows us to estimate and classify which products might be at risk of suffering from supply disruptions. Their proposed method is reproduced in the next section. The fact that international trade can be seen as a network that consists of nodes (the trading entities, e.g. countries) and vertices (the trade flows) has received new attention in recent years: See e.g. De Benedictis and Tajoli (2011), Carvalho and Tahbaz-Salehi (2019) or Acemoglu et al. (2012) who consider the linkages between industries (within a national) as a network. Piccardi and Tajoli (2018) show that more complex products are traded in more centralized networks. Since centralized networks are also prone to higher fragility, they argue that the current production and trading system is very vulnerable to shocks.

The availability of multi-country input–output tables (MC-IOTs), such as the WIOD (see Timmer et al. 2015) or EORA (see Lenzen et al. 2012), also have contributed to the rising interest in this research area: For example, Blöchl et al. (2011) show how random walk centrality and betweenness can be calculated and interpreted as economic shocks rippling through a production network. MC-IOTs are also commonly used to analyse global value chains (GVCs), which themselves can be interpreted as paths connection one production stage with the next. Amador et al. (2018) calculate the foreign value-added that is contained in a country’s exports (using MC-IOTs) and use these flows as a network to analyse the role of certain countries within this network.

When seeing international trade as a network, a natural research question is how shocks are transmitted in such a network as, for example, in Frohm and Gunnella (2017). Before COVID-19, researchers saw natural disasters as possible sources of shocks and studied their transmission over the global trade network, as in Carvalho et al. (2016) or Boehm et al. (2016). Nowadays, it is either the pandemic that is seen as the disrupting force, as e.g. in Vidya and Prabheesh (2020) and Fortunato (2020), or the Russian invasion of Ukraine which unsettled especially global energy markets (for an early assessment see Redeker 2022). Due to the disruptions in GVCs there has been also an increasing focus and interest in making GVCs more resilient or robust.

The product risk index developed in this paper helps to identify products that might be more vulnerable to shocks in global supply chains and thus policy targets for increased resilience or robustness. While most research mentioned here looks on the production network from an aggregate, national perspective, Bernard et al. (2019), Bernard and Moxnes (2018) and Tintelnot et al. (2018) consider firms as the trading entity and explore how the production network between firms is formed.

3 Assessing the vulnerability of product trade

In this section we first introduce the methodology of how to define the “riskiness” of trade in products at the detailed HS 6-digit level. Our method identifies more than 400 products as “risky” or vulnerable to supply shocks. A descriptive assessment of the magnitudes of these products and their composition focussing on the EU27 is presented in Sect. 3.2. In the following Sect. 3.3 we validate our findings with results from the existing literature and compare them with the products identified as being “risky” during the COVID-19 pandemic. Linking the import of these products to a multi-country input–output table, the WIOD (Timmer et al. (2015)), we then assess the importance of these risky products as imported intermediate inputs in the industry’s production, indicating the vulnerability of global value chains (Sect. 3.4).

3.1 Methodology

As we extend the product fragility indicator developed by Korniyenko, Pinat and Dew (2017), abbreviated henceforth as KPD, we present a short overview of their product fragility indicator: Their indicator is based on three separate components – the outdegree centrality, the tendency to cluster, and international substitutability – that capture structural dependencies or weaknesses which make the products potentially “risky”, “fragile” or “volatile”. In addition, we add two more components – the Hirschmann-Herfindahl index and accounting for non-tariff measures – to make this indicator more robust and more accurate. The motivation to include the Hirschmann-Herfindahl component is to include a measure for the import concentration (as the outdegree centrality component measures the concentration in the export of goods): a product should be more risky, if a country imports it only from a very small number of exporters. The new non-tariff measures component draws on a different dataset (non-tariff measures notifications) which allows us to incoporate another dimension of riskyness: namely that of riskyness in trade due to legal and organisational restrictions and frictions. The more non-tariff measures are applied on a given product, the more likely it is that the trade of this product willl be interrupted.

Compared to KPD we use a more recent and comprehensive database for human capital and use an older HS revision to obtain a longer, consistent timeframe of product-level trade data on which the calculation of the product fragility indicator is based on. As in KPD we exclude products that are not reported in all years. Contrary to KPD however, we also consider final or consumption products according to the UN BEC classification: while KPD is mainly concerned with shocks that affect supply chains, we are also interested in shocks that might affect end consumers.

In the next subsections we present the method for the components of the indicator. Most calculations below are carried out separately for every product. For ease of presentation, we exclude the product index k where possible.

3.1.1 Outdegree centrality

The first component “outdegree centrality” detects the presence of central players. Central player refers to a country that exports to many countries and has a high market share in the importing countries. As the name suggests, this component is based on the outdegree centrality of all countries, for a given product defined as

Here, \({w}_{ij}\) is the value of country i’s exports to country j, and \(\bar{{w}_{j}}\) is the average value of country j’s imports. Based on this, KPD define the standard deviation of the outdegree centrality.

,where \(\bar{{C}_{i}}\) is the average outdegree centrality, as the first component \({c}_{1}\) of their index. In a situation where one country i is the supplier of all other countries for a specific product, that country will have a high outdegree centrality, while the other countries have an outdegree centrality of 0. In this case the standard deviation for country i has a high value. On the contrary, in a situation where all countries export to all other countries and no country stands out, the outdegree centralities will be similar and the standard deviation will be low.

3.1.2 Tendency to cluster

The second component of the KPD product fragility index is the “tendency to cluster”. If countries form clusters characterised by trade only within this cluster, then a supply disruption within a cluster can have severe effects on the countries in the cluster. To capture this, KPD propose to use the clustering coefficient – which is a commonly used metric in network analysis – to assert the tendency of countries to trade within groups. This clustering coefficient is defined as

where \({k}_{i}\) refers to the number of countries that are connected to node i, \({w}_{ij}\) is the weight of the connection between i and j, \(\overline{{w}_{i}}=\sum {T}_{ij}/{k}_{i}\) is the average weight of i’s connections and \({T}_{ij}\) is an indicator variable that takes a value of 1 when a connection between i and j exists and 0 otherwise. This cluster coefficient is then averaged and multiplied by the diameter \(d\) of the network. The diameter is the longest distance between two nodes that exist in a network. The second component of the product fragility index is then

The more countries that form clusters and the larger “apart” countries are from each other (i.e., the diameter has a high value), the more fragile is this product network.

3.1.3 International substitutability

The third component of the product fragility index captures international substitutability. For this, KPD use the “revealed factor intensity” methodology of Shirotori, Tumurchudur and Cadot (2010) to compute human capital intensities per country and product. They calculate Balassa-style weights from the trade data (\({x}_{i}^{k}\) are the exports of country i and product k and \({x}_{i}\) are the total exports of country i):

The revealed human capital intensity can then be computed as \({L}_{i}^{k}={v}_{i}^{k}\cdot {H}_{i}\) where \({H}_{i}\) refers to a human capital measure (such as years of schooling) in country i. The third component of the fragility index is then again defined as the standard deviation of the revealed human capital intensity (as before, \(\overline{{L}_{i}^{k}}\) is the average human capital intensity for product k):

Trade between countries with very different revealed human capital intensity implies a larger component for the product fragility measure.

3.1.4 Hirschmann–Herfindahl index

In addition to these three components suggested by KPD we add an additional component that captures the situation when an importer country is dependent on just a few exporting countries, meaning that the market concentration among the exporting countries is high. For this we calculate the Hirschmann–Herfindahl index (HHI) that is commonly used to quantify the market concentration of firms in a market. First, we compute the HHI, for a given product, for every importing country in our sample, i.e.

Here, \({x}_{ij}\) is the trade flow from country i to country j and \({x}_{j}\) are total imports of country j. Then we aggregate these country-level HHI values with a weighted average, where the weights are the total imports of a country. This yields the fourth component \({c}_{4}\) which is defined as

where \(w_{j} = x_{j} /\mathop \sum \nolimits_{j = 1}^{n} x_{j}\) so that the weights sum up to one.

3.1.5 Non-tariff measures

In our second addition, we want to identify products that are often targeted by non-tariff measures. As Grübler and Reiter (2021) show, TBT STC and SPS STCFootnote 4 are the two types of non-tariff measures that have the most consistently negative effect on trade flows. We compute the fraction of world trade (for a given product) that is affected by one of the two measures as

where \({NTM}_{ij}\) is a dummy variable indicating whether the flow between exporter i and importer j is affected by a TBT STC or SPS STC.

Figure 2 shows the distribution of the standardized values for all products for both the Hirschmann-Herfindahl and the non-tariff measures component, already differentiated by the risk index (the computation is described in the upcoming section). It shows that products that are considered to be risky tend to have higher Hirschmann-Herfindahl values, thus are characterised by higher concentrations among the suppliers. The differentiation between risky and non-risky products is not as clearly visible for the non-tariff measures component, but we do see that a large mass of risky products is characterised by high values, meaning that these products tend to be more often affected by non-tariff measures. High tech products are characterized by a high degree of technical regulations and TBTs. As we will see below, this group of products is particularly often classified as risky.

The correlation of the product values of the non-tariff measure component with the other four components is low (they range from 0.09 with the Hirschmann-Herfindahl component to 0.163 with the outdegree centrality component), which points to the fact that this component captures important additional information on riskyness: riskyness that is due to legal and organisational restrictions and frictions.Footnote 5

3.1.6 Constructing the “product riskiness indicator”

To calculate the “product riskiness index (PRI)”Footnote 6 the five components are normalised. The normalised scores of the components are then used by the k-means algorithm to find four groups of similar products. The group of products that shows the highest values in all five components over the whole period is considered as the group of risky products. The other three groups of products are considered non-risky. The resulting product riskiness index is thus defined on product level and has no time dimension. That means that short run fluctuations in the trade data have only a limited impact on the product riskiness index. We assess however how the relative importance of these thus defined risky products has evolved over time.

There is one caveat to consider: As the product riskiness index is based on global trade data, it identifies structural weaknesses on the global level. These weaknesses may or may not apply to every single country individually.Footnote 7 Thus further and more detailed information may be required when applying the product riskiness index to the trade flows of a single country (or region like the EU-27). For example, the product riskiness index can be used as a starting point, providing a first possible classification of products into risky/non-risky products after which one can identify “essential products” (e.g. medical appliances or specific drugs) within the risky products. This list of risky and essential products can then be re-evaluated, using e.g. detailed trade data such as the UN Comtrade, to identify to which degree this riskiness also applies to the single country at hand: Which (globally) risky products are actually imported in large quantities? What is the market share of the biggest exporter? Answering these questions can help to identify those products that are “actually” risky for the studied importing country giving important insights about potential vulnerabilities of global value chains relevant for this country. Another potential avenue for further research could be to develop a product riskiness index that has both an importing country and a product dimension. The difficulty is that e.g. the “central player” indicator cannot simply be calculated on the product network of a single country (as such a network has much less nodes and edges which might lead to wrong and/or volatile results). However, restricting the attention to a single country might also have the advantage of allowing the usage of special and more detailed data sources (such as firm micro data, which are available for single countries but not for the whole world), thus achieving a higher degree of accuracy. However, the aim of this paper is to develop such a riskiness indicator for the global trading system and global supply chains.

3.2 Data and descriptive results

The components of the product riskiness index are calculated using the BACI dataset.Footnote 8 To calculate the “International substitutability” and the “Non-tariff measures” components we additionally make use of the following two datasets: First, information on human capital on a country-year level is based on the “mean years of schooling” variable reported in the “Human Development Report” by UNDP (2019). This is a more recent and comprehensive database on human capital compared to the Penn World tables that KPD use. Secondly, data on non-tariff measures is sourced from the wiiw NTM data. This dataset is based on the non-tariff measures database provided by the WTO i-tip, but has been significantly improved by imputation of large fraction of the missing HS codes.Footnote 9

The results of the analysis presented below are based on the BACI dataset. This database spans a period of 23 years (from 1996 to 2019), includes 4706 products and contains more than 200 countries as both exporters and importers. The main advantage of the BACI database is that it provides reconciled trade flows on detailed HS 6-digit level across countries (see Gaulier and Zignago (2010) for a description of the process), which means that differences in the reporting of trade flows from importer or exporter countries have been eliminated.

3.2.1 Characteristics and import shares of risky products

In this section we describe some selected aspects of the risky products. Our product riskiness index identifies 435 out of 4706 products as risky (9%). Of these, 294 risky products are intermediate products (68%) and the remaining 141 goods are classified as final or consumption goods according to the BEC classification.

Table 1 shows ten risky products with the highest share in world trade. The products belong mainly to the HS-Sect. 84 (machinery and mechanical appliances) and group 85 (electrical machinery and equipment); all of them are intermediate products. Interestingly however, a risky final product tops the table. This product (HS code 300,490) consists of medicaments and takes the first position. The other two final goods that are in the top ten are television receivers (852,812) and other plastic articles (392,690).

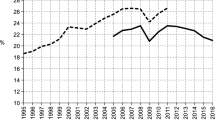

Figure 3 depicts the evolution of the risky product share (as measured by import value) through time for three regions: the United States, the EU27, and the rest of the globe. The three regional patterns were relatively similar until the financial crisis of 2008. In comparison to the EU27 and the rest of the world, the share of riskier products in US imports appears to have increased since the financial crisis.

In Appendix Table 4 we list the number of risky and non-risky products in each of the 96 HS 2-digit product groups. This confirms the product specific results in Table 1. In HS group 8 (which consists of articles of base metals, machinery and mechanical appliances, vehicles, and transport equipment) almost 30% of products are classified as risky. The share is particularly high in HS85 (Electrical machinery and equipment and parts thereof; sound recorders) where more than 40% of the products are classified as risky. The highest number of risky products is reported in HS group 84 (Nuclear reactors, boilers, machinery & mechanical appliance; parts) with 147 out of 475 products (31%). This product group alone accounts for about one third of the number of risky products. A very high share of risky products is also found for HS group 90 (Optical, photo- and cinematographic, measuring, checking, precision instruments) with 57 out of 128 (44%). Note that almost two thirds of the products characterised as risky are part of HS group 8 (including the products from HS group 90 this share increases to 77%) which indicates that high-tech products are mostly considered as being risky products.

In terms of trade values, Fig. 4 shows the shares of both risky and non-risky products in total global trade. The five HS sections with the largest shares in risky products are shown, whereas the remaining HS sections are subsumed under “Other HS sections”. This figure basically confirms the above results: HS Sect. 84 (Nuclear reactors, boilers, machinery, and machinery appliances, etc.) accounts for disproportionally larger shares among risky products than among non-risky products: The products belonging to and classified as risky products in HS Sect. 84 account for, on average, 24% of the traded values among all risky products and for 6.4% of total trade. Contrary, the products in this HS Sect. 84 classified as non-risky account for only 7.7% of traded values in non-risk products, whereas there share in total trade is as well high with 5.6%. The next most important HS section with many risky products is then HS Sect. 85 (electrical machinery, etc. with 14% of the traded values among all risky products), followed by HS Sect. 90 (furniture, bedding, mattress, etc., 8%), HS Sect. 30 (pharmaceuticals, 7%), and HS Sect. 62 (apparel & clothing, 5%).

3.3 Validation

In this section we provide a comparison of the results with other existing studies. Additionally, we analyse the impact of the pandemic crisis on trade and how this relates to the product riskiness of trade.

3.3.1 Comparison with other results

First, promisingly, our results are comparable to the result of KPD even though we use different data sources to achieve a wider coverage in terms of countries and years. For example, for the international substitutability component we use data on mean years of schooling from the UNDP (2019) which is available for more countries and more recent years, compared to the PWT9.1 data that KPD use. Also, for the underlying trade data we use the BACI HS1996 dataset since it is available for a longer period. In addition, we employ further indicators to identify the riskiness of products.

In their work KPD classify 421 products as being risky. With our extended framework and different data sources we find 435 risky products. Thus, in terms of the total number of products being considered as risky our two frameworks are very similar. Furthermore, KPD present two case studies: the 2011 Japanese earthquake and subsequent nuclear catastrophe and the floods in Thailand in the same year. For each of the two natural disasters they identify three products that were mentioned in the media as being severely affected and then check if their methodology had identified those products as being risky. Table 2 shows these six products (according to KPD) as well as the risk classification according to our methodology.

Our product fragility index identifies five out of the six products as risky, like the results in KPD. Only certain semiconductor devices are treated as non-risky. Since our index contains additional information, it is not surprising that our index considers fewer products as risky.

3.3.2 Comparison with COVID-19 related products

The EU Commission produced a list of medicinal goods that are essential to combat the COVID-19 pandemic and are now duty-free in the EU.Footnote 10 There are 103 products on this list, 98 of which fall into our risk/non-risk category.Footnote 11 Approximately one-third of the 98 COVID-19-related items are deemed dangerous. The apparent question is how these product categories’ trade dynamics differ and whether there is a systematic difference between risky and non-risky products.Footnote 12 Table 3 shows the growth rates of EU27 imports from 2019 to 2020, separating the dimensions of non-risky and risky products, as well as whether they are COVID-19 connected or not.

We see that imports of risky products have tended to grow faster (if they are COVID-19 related products) or decline slower (if they are non-COVID-19 related products). Only for extra-EU-trade of COVID-19 related products this does not hold. Also when looking at the level of the 27 European Member States, we discover a similar pattern: in nearly 80% of the cases, imports of risky COVID-19 products have grown more and imports of risky, non-COVID-19-related products have declined less than their non-risky counterparts.

3.4 Risky products in industry supply chains

So far we have considered the shares of risky products in imports based on product classification. However, to analyse the importance and impacts on international production networks and GVCs it is also to consider the industries using intermediary products in their production. Thus, we differentiate between intermediary products and final goods. Focusing on the former we analyse in this section which sectors show a high share of risky products in their imported intermediate inputs allows us to identify industries which are vulnerable to supply shocks and might destabilise an economy.

3.4.1 Risky imports by using industries

Trade data do not include such information on the using industry. We therefore proxy this by combining the trade data from BACI with the input–output data from the World Input–Output Database (WIOD) and by using a mapping from the HS product classification to the NACE Rev. 2 industry classification. In this way we can map the product fragility indices from all HS 6-digit products to the using industries.Footnote 13 This, for example, tells us how much and which electronic products a certain country has imported from, e.g., China. Further information from the world input–output database (WIOD) includes imports of the using industries in a bilateral dimension (i.e. for example how many products the automotive industry of a certain country i imports from the Chinese electronics industry). As also adopted in the construction of WIOD (and generally all existing multi-country input–output tables) due to lack of further detailed information we have to assume that the geographic sourcing structure of a specific products imported by e.g., the automotive industry’s is the same as the geographic sourcing structure of this product of the country’s intermediary imports as a whole (i.e., using the “vertical proportionality” assumption that has also been applied to construct multi-country supply and use tables, see Timmer et al. 2015).Footnote 14 This allows us to calculate a risk score for every cell in the input–output table. By aggregating the share of imported risky products for one industry across all its partner countries and industries we arrive at a riskiness index for each industry. Figure 5 shows how the shares of risky products in imports of the EU27 and the US vary by industry as well as by exporting region.Footnote 15 This exercise strongly suggests that higher-tech manufacturing sectors’ imports have a much higher proportion of risky products than lower-tech manufacturing sectors. It is also self-evident that the United States imports a greater proportion of risky products in all industries. We also see that China exports a big portion of the risky products in the higher-tech manufacturing sectors.

4 Summary and policy conclusions

To summarise, the results demonstrate that the employed method classifies approximately 9% of the examined products (435 out of 4706) as “risky”. The most risky goods are found in HS Sects. 85 (Electrical machinery and equipment and parts thereof; sound recorder), 84 (Nuclear reactors, boilers, machinery and mechanical appliances; parts), and 90 (Nuclear reactors, boilers, machinery and mechanical appliances; parts) (Optical, photo- and cinematographic, measuring, checking, precision instruments). HS group 8 accounts for over two-thirds of the products classified as risky (adding products from HS group 90, the percentage rises to 77 percent), indicating that risky products are largely high-tech.

Risky products account for over 31% of EU27 imports and almost 36% of US imports, with global shares just above 27%. These findings emphasize that supply disruptions of risky products can harm not just firm, but also end consumers. We focus on intermediate imports in Sect. 3.4 since they, too, can have severe knock-on impacts on other, more downstream, economic sectors.

In terms of partner countries, China accounts for a significant portion of both the EU27 and the United States’ risky product imports. In the medium–high-tech and high-tech manufacturing industries, the risky product share is especially high. This shows the growing importance of high-tech imports from China and “factory Asia” for the EU27 and the US.

These findings can be used to underpin various policy recommendations, also frequently argued in the literature and policy debates. More concretely, first, national institutions, policy makers and civil society would have to decide which products they deem to be “essential” or “critical” for the economy and society as a whole (e.g. medical care products, drugs, etc.) and products which are crucial to maintaining future competitiveness (e.g. in high tech products) in the case of the EU. The supply of these products should then be made more robust or resilient, e.g., by pursuing the reshoring of production of these strategically essential products (e.g., inputs to high-tech sectors or medical equipment), wherever it is conceivable and economically viable. For example, initial considerations at the European level on the expansion of technological capacities and the procurement of critical raw materials were made well before the COVID-19 pandemic. In 2011 the European Commission drew up a list of critical raw materials for the first time including 14 materials in this list, which has since been expanded to 30, although these can also be removed from the list again in the event of a corresponding change in demand or supply (European Commission, 2020c). In the European Commission's 2014 “Criteria for the Assessment of the Compatibility of State Aid in Support of Important Projects of Common European Interest”, more commonly known as Important Projects of Common European Interest (IPCEI) establishes certain criteria by which projects should be supported after approval by the European Commission (European Commission 2014). The first project was approved by the European Commission for the field of microelectronics resulting the European Chips Act (European Commission 2022). In 2017, the European Battery Alliance was established, with the aim of building a value chain in Europe, focusing here mainly on the automotive sector. The IPCEI for “pan-European research and innovation project of seven member states on all segments of the battery value chain” was then also the second approved by the European Commission. It aims to develop competitive batteries for electric cars.

Second, the high-tech sectors reliance on Chinese imports needs to be more closely monitored, and efforts should be taken to lessen it in the face of the ongoing geopolitical and geo-economic shifts. Specifically, in September 2021, the European Commission with the EU External Action Service (EEAS) presented its Indo-Pacific Strategy. In political terms, this mentions the consolidation and defence of a rules-based world order, the application of inclusive and efficient multilateral cooperation based on shared values and principles, and the commitment to democracy, human rights, and the rule of law. In addition to the implementation and conclusion of trade agreements, the creation of resilient and diversified supply chains is targeted. Cooperation with partners in the region is to be pursued with regard to protection against unfair trade practices and other practices deemed unfair, such as subsidies for industrial sectors, the exertion of economic pressure, forced technology transfer and the theft of intellectual property. Furthermore, in this strategy the European Commission has set itself the goal of concluding trade agreements with Australia, New Zealand and Indonesia, as well as opening negotiations with India. In addition, a resumption of negotiations with Malaysia, the Philippines and Thailand should be considered or partnership and cooperation agreements should be concluded with Malaysia and Thailand.

Third, trade flows of strategically important products (such as rare earths, which are crucial inputs to high-tech manufacturing processes) might be subject to geopolitical strategies in the face of geopolitical developments such as the US-China conflict and even more so in the wake of the Russian war against Ukraine and the not yet foreseeable geopolitical consequences. Increasing supplier redundancy for these products reduces reliance on a single partner, reducing the possibility of these products’ trade flows being used as a political tool. Robustness and resilience of GVCs can, for example, also be achieved by providing information on potential concentration and bottlenecks along supply chains, urging stress tests for value chains in these categories, or engaging in strategic stockpiling of such products (see, e.g. also Baldwin, 2022, coming to similar conclusions). Thus, there are several overlapping challenges at work here: (i) increase the resilience and robustness of global value chains, (ii) enhance competitiveness in industries and products which are deemed to be strategically (e.g. to gain or maintain leadership in key future technologies) or systemically (e.g. public concerns such as the provision of health services) important. These issues transcend the narrow purview of trade policy alone; a mix of industrial policy, foreign diplomacy, and trade policy is required to address them. The role of trade policy, in our opinion, is primarily to provide a stable regulatory framework.

Fourth, finally, the EU's “open strategic autonomy” (European Parliament 2021) must be substantiated in the near future. The goal of “open strategic autonomy” is to keep the EU open to trade and investment while enabling the EU to shield European enterprises from unfair trade practices and acting as a leader in shaping the world to become both greener and fairer. However, as it still unclear what aspects and products it will cover and which (trade or industrial) policy measures will be included, it is equally unclear what effects it will have on the efficiency and resilience of GVCs. A clearer objective can be seen in the Chips Act proposed by the European Commission (European Commission 2022), where, among other goals, the security of supply should be strengthened by building production facilities on European soil. One should notice that the CHIPS Act, proposed by the current administration in the United States, has a similar goal: to minimize the US economy's reliance on a limited number of suppliers.Footnote 16

As these examples show, countries have to strike a delicate balance between maintaining the rules-based multilateral trading system and shielding themselves from geopolitical risks, which have become more evident than ever. In that respect, one has to acknowledge that policy measures with the goal of increasing resilience or robustness of GVCs, such as reshoring or “friendshoring”, can be achieved by industrial policy measures (which are thus not trade-distorting) and are also more and more applied at firm level (“diversification of supply chains”). Supply-chain resilience or robustness can be achieved by industrial policy instruments (e.g. the EU chips act) and thus work via competitiveness and need not necessarily fostered by trade policy instruments.

Detailed product-level studies like this are a step to identify those products which are prone to be vulnerable in global supply chains and need to be analysed in more detail. Specific measures might then only be applied to those products which are identified as “essential” or strategically important. The above mentioned already implemented or ongoing policy measures go in the direction of increasing the resilience of GVCs and to strengthen competitiveness in critical products (e.g. EU Chips act, EU battery alliance, etc.) as well as the need to combat unfair trade practices (e.g. dumping) in specific products. The backbone of these measures is to maintain the rule-based multilateral trading system which is very much under stress given the geo-political developments from which governments need to shield themselves by reducing strong dependencies.

Notes

The data for China and the United States is reported in the World Economic Databases, managed by the IMF. See https://www.imf.org/en/Publications/WEO/weo-database/2021/October.

TBT STC are special trade concerns (STC) of technical barriers to trade. Specific trade concerns to Sanitary and Phytosanitary measures (SPS STC).

A figure displaying the distribution of all five components and their piecewise correlations can be found in the Appendix.

We refer to this index as the “product riskiness index” as it includes more components than the original “product fragility index” suggested by KPD.

E.g. even if the Hirschmann-Herfindahl index shows a high concentration in exporting countries (on average), this may not apply equally to every importing country.

The BACI trade data is provided by the CEPII institute free of charge: http://www.cepii.fr/CEPII/en/bdd_modele/presentation.asp?id=37.

The WTO i-tip database can be accessed here: https://www.wto.org/english/res_e/statis_e/itip_e.htm. The wiiw NTM data is available from https://wiiw.ac.at/wiiw-ntm-data-ds-2.html. See Ghodsi, Grübler, Reiter and Stehrer (2017) for a description of the data.

For the publication of the EU Commission decision, see: https://ec.europa.eu/taxation_customs/sites/taxation/files/03-04-2020-import-duties-vat-exemptions-on-importation-covid-19.pdf. The updated list of products can be found here: https://ec.europa.eu/eurostat/documents/6842948/11003521/Corona+related+products+by+categories.pdf.

The product list contains 103 products in CN 8-digit codes. The conversion to HS 1996 classification (which is the basis for our product riskiness index) reduces the number of products to 98.

We consider here the longer run (2019–2020) and not short-term fluctuations (see Mirodout 2020, for an assessment of short-term fluctuations for vital medical supplies).

We use the same mapping as has been used for the WIOD.

For clarification, the use of import-use tables in constructing multi-country input–output tables in the WIOD Release 2016 allowed to differentiate to which extent industries import specific intermediary products (such information has not been available in the first WIOD Release 2012). However, one still must assume that the shares by partner country for a specific imported product are the same for all using industries (though, of course, e.g. the automotive industry sources more microchips (of which a certain share stems from China) compared to the tobacco industry (of which the same share stems from China by this assumption of “vertical proportionality”). Deviating from this assumption is impossible without more detailed data sources. Thus, whereas the overall level of imports of risky products is backed by the underlying import use tables, the figures by partner country could be affected by this assumption of “vertical proportionality”. In essence, one would need micro data at the firm level to understand which industries are importing which products from which specific countries. Combining such firm-level information with the riskiness index (which would be possible at least for some countries) would be another way to assess further details and vulnerabilities at a fine grained level in a quantitative and maybe also qualitative way. This avenue of research however has to be relegated to future analysis. We are aware, however, of the implications of violations of this assumption: as, e.g., the automotive industry (very likely) imports car parts to a higher degree than the tobacco and beverages industry it is thus also more dependent and vulnerable to supply shocks of car part products.

We restrict the figure to show only agricultural, mining and manufacturing industries, as they are the main transmitter of shocks and the industries that are the most dependent on international trade flows. See e.g. Stehrer and Stöllinger (2015. p. 6ff) for a discussion of the importance of manufacturing sectors with respect to global value chain participation.

References

Acemoglu D, Carvalho VM, Ozdaglar A, Tahbaz-Salehi A (2012) The network origins of aggregate fluctuations. Econometrica 80(5):1977–2016. https://doi.org/10.3982/ECTA9623

Amador J, Cabral S, Mastrandrea R, Ruzzenenti F (2018) Who’s who in global value chains? A weighted network approach. Open Econ Rev 29(5):1039–1059. https://doi.org/10.1007/s11079-018-9499-7

Baldwin, R. and R. Freeman (2020a). ‘Supply chain contagion waves: thinking ahead on manufacturing “contagion and reinfection’ from the COVID concussion’, VoxEU.org 1st April 2020a

Baldwin, R. and R. Freeman (2020b) ‘Trade conflict in the age of COVID-19’, VoxEU.org, 22nd May 2020b

Baldwin R, Freeman R (2022) Risks and global supply chains: what we know and what we need to know. Annu Rev Econ 14(1):153–180

Bernard AB, Moxnes A (2018) Networks and trade. NBER Working Paper, No. 24556

Bernard AB, Dhyne E, Magerman G, Manova K, Moxnes A (2019) The Origins of Firm Heterogeneity: A Production Network Approach (Working Paper Nr. 25441). National Bureau of Economic Research. https://doi.org/10.3386/w25441

Blöchl F, Theis FJ, Vega-Redondo F, Fisher EON (2011) ‘Vertex centralities in input-output networks reveal the structure of modern economies’. Phys Rev E 83(4):046127

Boehm C, Flaaen AB, Pandalai-Nayar N (2016) The role of global supply chains in the transmission of shocks: firm-level evidence from the 2011 Tōhoku earthquake. FEDS Notes 2016-05-02 Board Gov Fed Reserve Syst (US). https://doi.org/10.17016/2380-7172.1765

Bonadio B, Huo Z, Levchenko A, and Pandalai-Nayar N (2020). ‘Global supply chains in the pandemic’, NBER Working paper No. 27224

Carvalho VM, Nirei M, Saito YU, Tahbaz-Salehi A (2016) Supply chain disruptions: evidence from the great East Japan Earthquake. Columbia Business School Research Paper. (17–5)

Carvalho VM, Tahbaz-Salehi A (2019) Production networks: a primer. Ann Rev Econ 11(1):635–663. https://doi.org/10.1146/annurev-economics-080218-030212

Commission E (2020a) Trade policy reflections beyond the Covid19 outbreak. Chief Econ Note 2:29

De Benedictis L, Tajoli L (2011) The world trade network. World Econ 34(8):1417–1454

European Commission (2014), Criteria for the analysis of the compatibility with the internal market of State aid to promote the execution of important projects of common European interest, ABl. C 188, 20.6.2014, S. 4–12

European Commission (2020b). ‘A renewed trade policy for a stronger Europe. A Consultation Note.’ June 16, 2020b. https://trade.ec.europa.eu/doclib/docs/2020unee/tradoc_158779.pdf

European Commission (2021), Trade policy review–- an open, sustainable and assertive trade policy, COM(2021) 66 final

European Commission (2022), A Chips Act for Europe, COM/2022/45 final

Evenett S, and Fritz J (2020) ‘Collateral damage: cross-border fallout from pandemic policy overdrive’, VoxEU.org, 17th November 2020

Fortunato P (2020) ‘How COVID-19 is changing global value chains’, https://unctad.org/es/node/27709

Frohm E, Gunnella V (2017) Sectoral Interlinkages in lobal value chains: spillovers and network effects (SSRN Scholarly Paper ID 3382284). Social science research network. https://papers.ssrn.com/abstract=3382284

Gaulier G, Zignago S (2010) ‘BACI: international trade database at the product-level (the 1994–2007 version)’. CEPII Working Paper, Nr 2010–23, October 2010

Ghodsi M, Grübler J, Reiter O, Stehrer R (2017) ‘The evolution of non-tariff measures and their diverse effects on trade’, wiiw Research Report, No. 419, May

González A (2020) ‘Yes, medical gear depends on global supply chains. Here’s how to keep them open’, VoxEU.org, 1st April 2020

Grübler J, Reiter O (2021) Non-tariff trade policy in the context of deep trade integration: an ex-post gravity model application to the EU-South Korea agreement. East Asian Econ Rev 25(1):33–71. https://doi.org/10.11644/KIEP.EAER.2021.25.1.390

Javorcik B (2020) Global supply chains will not be the same in the post-COVID-19 world’. In: Baldwin R, Evenett SJ (eds) COVID-19 and Trade Policy: Why Turning Inward Won’t Work VoxEU E-Book. CEPR Press, London, pp 111–116

Europäische Kommission (2020c), Critical raw materials resilience: Charting a path towards greater security and sustainability COM(2020) 474 final, Brüssel

Korniyenko Y, Pinat M, Dew B (2017) ‘Assessing the Fragility of global trade: the impact of localized supply shocks using network analysis.’ IMF Working Papers. doi:https://doi.org/10.5089/9781475578515.001

Lenzen M, Kanemoto K, Moran D, Geschke A (2012) Mapping the structure of the world economy. Environ Sci Technol 46(15):8374–8381. https://doi.org/10.1021/es300171x

Miller ER, Blair PD (2009) ‘Input-output analysis: foundations and extensions’. 2nd Edition, Cambridge University Press

Mirodout S (2020) ‘Resilience versus robustness in global value chains: some policy implications’, VoxEU.org, 18 June 2020

European Parliament (2021) ‘Post COVID-19 value chains: options for reshoring production back to Europe in a globalised economy’, Policy department for external relations. Directorate General for External Policies of the Union

Piccardi C, Tajoli L (2018) Complexity, centralization, and fragility in economic networks. PLoS ONE 13(11):e0208265. https://doi.org/10.1371/journal.pone.0208265

Raza W, Grumiller J, Grohs H, Essletzbichler J, Pintar N (2021) ‘Post COVID-19 value chains: options for reshoring production back to Europe in a globalised economy’, Policy department for External Relations. Directorate General for External Policies of the Union. https://www.europarl.europa.eu/thinktank/en/document/EXPO_STU(2021)653626

Redeker N (2022) Same shock, different effects: EU member states’ exposure to the economic consequences of Putin’s war. Hertie School – Jacques Delors Centre, 7 March

Shirotori M, Tumurchudur B, Cadot O (2010) ‘Revealed Factor Intensity Indices at the Product Level (No. 44)’. United Nations Conference on Trade and Development.

Stehrer R, Stöllinger R (2015) ‘The Central European Manufacturing Core: What is Driving Regional Production Sharing?’, FIW Study

Timmer MP, Dietzenbacher E, Los B, Stehrer R, de Vries GJ (2015) ‘An illustrated user guide to the world input-output database: the case of global automotive production’. Rev Int Econ 23:575–605

Tintelnot F, Kikkawa AK, Mogstad M, Dhyne E (2018) Trade and Domestic Production Networks (Working Paper Nr. 25120). National Bureau of Economic Research. doi:https://doi.org/10.3386/w25120

UNDP (2019) ‘Human Development Report 2019: beyond income, beyond averages, beyond today: inequalities in human development in the 21st Century’. Human development report. United Nations development program

Vidya CT, Prabheesh KP (2020) Implications of COVID-19 pandemic on the global trade networks. Emerg Mark Financ Trade 56(10):2408–2421. https://doi.org/10.1080/1540496X.2020.1785426

Funding

The research leading to these results received funding from the Austrian Federal Ministry for Digital and Economic Affairs under the contract “Lehren aus der Corona-Krise: Towards a Risk-adjusted Trade Policy”.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no competing interests to declare that are relevant to the content of this article.

Additional information

Responsible Editor: Julia Wörz.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Reiter, O., Stehrer, R. Assessing the importance of risky products in international trade and global value chains. Empirica 50, 7–33 (2023). https://doi.org/10.1007/s10663-022-09560-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-022-09560-x