Abstract

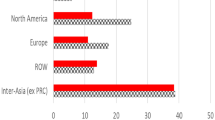

This paper investigates the transmission of foreign shocks to economic activity and macroeconomic policies in three South Eastern European (SEE) economies: Croatia, Macedonia and Bulgaria. Specifically, we provide empirical evidence on the influence of several policy and non-policy shocks (euro-zone output gap, money market rate and inflation) on economic activity as well as monetary and fiscal policies in the three countries. The main motivation behind our empirical investigation is the fact that all of these economies are small open economies with rigid exchange rate regimes and different degree of integration within the European Union (EU). As for the methodological issues, we employ recursive vector autoregressions to identify the exogenous shocks in the euro-area. Generally, the estimated results imply that euro-zone economic activity has significant and relatively strong influence on these economies where foreign output shocks are transmitted relatively quickly. The results also suggest that the effects of foreign shocks are of larger magnitude in the countries that are more integrated with the EU. An additional finding is that positive foreign interest rate shocks trigger a contractionary response of domestic monetary policy notwithstanding the fact that domestic money market rates are not linked with euro-zone interest rates. Finally, euro-zone inflation is instantly transmitted to domestic inflation. We can explain these effects by several factors, such as: the fixed exchange rates, the relatively high trade integration of SEE economies within the euro-zone as well as the dependence of SEE banks on foreign financing.

Similar content being viewed by others

Notes

The results from the unit root tests are available from the authors upon request.

This argument is based on estimating correlation coefficients between central and general government balances for a broader sample of 31 countries that are member states of the European Union (EU) including the aggregated data for EU and the Euro-zone (EMU). The correlation coefficients based on annual data set indicated that there is a highly positive association (estimated higher than 0.9), in almost all countries in the sample with the exceptions of Latvia, Poland and Sweden where the level of correlation was estimated a bit lower around 0.8. All these correlation coefficients are statistically significant at 1 % level.

Cyclical adjustment of the budget revenues and expenditures was done according to the output gap movements with imposed elasticity coefficients for budget revenues of 1 and for budget expenditures of 0.

The results from the lag length selection criteria, residual-based diagnostic tests and stability tests are available from the authors upon request.

References

Agénor PR, Montiel PJ (1996) Development macroeconomics. Princeton University Press, Princeton

Amisano G, Giannini C (1997) Topics in structural VAR econometrics, 2nd edn. Springer, Heidelberg

Angelovska-Bezoska A, Bogoev J, Mitreska A, Kadievska-Vojnovic M (2011) Investigating the cyclical behavior of fiscal policy in the Republic of Macedonia during the period of transition. Croat Econ Surv 13(1):57–104

Aslanidis N (2010) Business cycle synchronization between the CEEC and the Euro-area: evidence from threshold seemingly unrelated regressions. Manch Sch 78:538–555

Balabanova Z, Brüggemann R (2012) External information and monetary policy transmission in new EU member states: results from FAVAR models. Working paper series, no. 05. Department of Economics, University of Konstanz

Beetsma RMWJ, Jensen H (2002) Monetary and fiscal policy interactions in a micro-funded model of a monetary union. Working paper no. 166. European Central Bank

Belvisio F, Milani F (2006) Structural factor-augmented VARs (SFAVARs) and the effects of monetary policy. B E J Macroecon 6(3):1–46

Benčík M (2011) Business cycle synchronisation between the V4 countries and the euro area. Working paper 1/2011. National Bank of Slovakia

Benczur P, Koren M, Ratfai A (2004) The transmission of Eurozone shocks to CEECs. Central European University (manuscript), Budapest

Benkovskis K, Bessonovs A, Feldkircher M, Worz J (2011) The transmission of Euro area monetary shocks to Czech Republic, Poland and Hungary: evidence from a FAVAR model. Focus Eur Econ Integr 3:8–36

Blanchard O, Quah D (1989) The dynamic effects of aggregate demand and aggregate supply disturbances. Am Econ Rev 79(4):655–673

Bogoev J (2011) What drives bank lending in domestic and foreign currency loans in a small open transition economy with fixed exchange rate? The case of Macedonia. Comp Econ Stud 53(2):307–331

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relationships over time. J R Stat Soc 37(2):149–192

Bryson JH (1994) Macroeconomic stabilization trough monetary and fiscal policy coordination: implication for European Monetary Union. Open Econ Rev 5(4):307–326

Chudic A, Pesaran MH (2014) Theory and practice of GVAR modeling. Working paper no. 180. Federal Reserve Bank of Dallas, Globalization and Monetary Policy Institute

Crespo-Cuaresma J, Eller M, Mehrota A (2011) The economic transmission of fiscal policy shocks from Western to Eastern Europe. BOFIT discussion papers no. 12

Cushman DO, Zha T (1997) Identifying monetary policy in a small open economy under flexible exchange rates. J Monet Econ 39(3):433–448

Efron B, Tibshirani RJ (1993) An introduction to the bootstrap. Chapman & Hall, New York

Eickmeier S, Breitung J (2006) How synchronized are new EU member states with the euro area? Evidence from a structural factor model. J Comp Econ 34(3):538–563

Enders W (2010) Applied time series econometrics, 3rd edn. Wiley, Hoboken

Fidrmuc J, Korhonen I (2003) Similarity of supply and demand shocks between the euro area and the CEECs. Econ Syst 27(3):313–334

Fidrmuc J, Korhonen I (2006) Meta-analysis of the business cycle correlation between the Euro area and the CEECs. J Comp Econ 34(3):518–537

Frenkel M, Nickel C (2005) How symmetric are the shocks and the shock adjustment dynamics between the Euro area and Central and Eastern European countries? J Common Mark Stud 43(1):53–74

Galí J, Monacelli T (2008) Optimal monetary and fiscal policy in a currency union. J Int Econ 76:116–132

Hall P (1992) The bootstrap and edgeworth expansion. Springer, New York

Horváth R, Rusnák M (2009) How important are foreign shocks in a small open economy? The case of Slovakia. Glob Econ J 9(1). doi:10.2202/1524-5861.1420

Hossain A, Chowdhury A (1996) Monetary and financial policies in developing countries. Routledge, London

Jha R (1994) Macroeconomics for developing countries. Routledge, London

Jiménez-Rodriguez R, Morales-Zumaquero A, Égert B (2010) The effect of foreign shocks in Central and Eastern Europe. J Policy Model 32(4):461–477

Karakitsos E (1992) Macrosystems—the dynamics of economic policy. Blackwell, Oxford

Korhonen I (2003) Some empirical tests on the integration of economic activity between the euro area and the accession countries. Econ Transit 11(1):177–196

Kraft E (2003) Monetary policy under dollarisation: the case of Croatia. Comp Econ Stud 45(3):256–277

Krugman P (1988) External shocks and domestic policy responses. In: Dornbusch R, Helmers FLCH (eds) The open economy—tools for policymakers in developing countries. Oxford University Press for The World Bank, Oxford

Krznar I, Kunovac D (2010) Impact of external shocks on domestic inflation and GDP. Working paper series, W-26. Croatian National Bank

Lang M, Krznar I (2004) Transmission mechanism of monetary policy in Croatia. In: Paper presented at the tenth Dubrovnik economic conference

Lutkepohl H, Kratzig M (2004) Applied time series econometrics. Cambridge University Press, Cambridge

Lutkepohl H, Kratzig M, Boreiko D (2006) VAR analysis in JmulTi. http://www.jmulti.de/. (Accessed 15 July 2012)

Mackiewicz M (2008) Determinates of cyclicality of fiscal surpluses in the OECD countries. Munich personal RePEc archive working paper no. 16304

Minea A, Rault C (2011) External monetary shocks and monetary integration: evidence from the Bulgarian currency board. Econ Model 28:2271–2281

Obstfeld M, Rogoff K (1996) Foundations of international macroeconomics. MIT Press, Cambridge

Petrevski G, Bogoev J (2012) Interest rate pass-through in South East Europe: an empirical analysis. Econ Syst 36(4):571–593

Petrovska M (2012) Business cycle regimes in a group of South East European economies. Evidence from a threshold SUR approach. Int J Econ Policy Emerg Econ 5(3):272–292

Prachowny MFJ (1984) Macroeconomic analysis for small open economies. Clarendon Press, Oxford

Shone R (1989) Open economy macroeconomics. Harvester-Wheatsheaf, New York

Stock JH, Watson MW (2001) Vector autoregressions. J Econ Perspect 15(4):101–115

Unevska-Andonova D, Petkovska M (2012) The transmission of external shocks to the Macedonian economic activity. Working paper. National Bank of the Republic of Macedonia

Veličkovski I (2010) Potential costs of Euro adoption for transition countries: a case study for Macedonia. VDM, Frankfurt

Velickovski I (2013) Assessing independent monetary policy in small, open and euroized countries: evidence from Western Balkan. Empir Econ 45(1):137–156

Acknowledgments

This research was supported by a grant from the CERGE-EI Foundation under a programme of the Global Development Network. The authors are grateful to the Journal’s editor and the two anonymous referees, as well as Sergey Slobodyan, Karsten, Staehr, Magdalena Petrovska, and participants at workshops and conferences in Skopje and Banja Luka for their helpful comments and suggestions. All opinions expressed are those of the authors and have not been endorsed by CERGE-EI, GDN, the National Bank of the Republic of Macedonia or the World Bank Group.

Author information

Authors and Affiliations

Corresponding author

Additional information

While writing the paper Jane Bogoev was with the National Bank of the Republic of Macedonia.

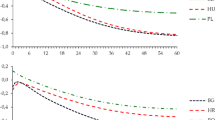

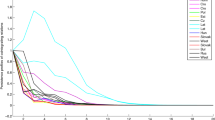

Appendices: IRFs of recursive VAR with 95 % confidence intervals of Efron and Hall, respectively

Appendices: IRFs of recursive VAR with 95 % confidence intervals of Efron and Hall, respectively

1.1 Appendix 1: Impulses generated from the output gap in the euro-zone

1.2 Appendix 2: Impulses generated from the Euribor

1.3 Appendix 3: Impulses generated from the euro-zone inflation

Rights and permissions

About this article

Cite this article

Petrevski, G., Bogoev, J. & Tevdovski, D. The transmission of foreign shocks to South Eastern European economies. Empirica 42, 747–767 (2015). https://doi.org/10.1007/s10663-014-9275-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-014-9275-x