Abstract

If larger pension savings lead to deeper capital markets, this can be expected to have a positive effect on economic growth in particular for firms that rely on external finance. We employ this differential impact on firms with less or more external finance to identify the effect of pension saving on economic growth. Using data for 69 industrial sectors in 34 OECD countries for the period 2001–2010, we find a significant impact of pension assets on growth for sectors that are more dependent on external financing. This relation is not significantly changed by the 2007–2008 banking crisis.

Similar content being viewed by others

1 Introduction

Many countries promote private pension saving in response to population ageing and the rising burden of PAYG (pay-as-you-go) pensions (OECD 2017). A larger role of funded pensions is seen as necessary to keep up individual pensions. Moreover it could strengthen economic growth by deepening capital markets (World Bank 1994). Pension saving may directly fuel economic growth by providing more funds for investment. In addition, and maybe more important, funded pensions may deepen private capital markets thereby leading to better allocation of capital, and thus improving overall efficiency. Larger pension saving could also strengthen the role of institutional investors which can be expected to more be committed to long term investment (e.g. Lakonishok et al. 1992). Finally, these institutional investors may increase efficiency in firms directly by improving governance by acting as large shareholders (Thomas and Spataro 2016).

Although the arguments for a positive effect on growth seem convincing at first sight, such a positive effect of pension savings on economic growth is hard to substantiate in empirical studies. Direct tests of the impact of pension saving on growth in aggregate cross-country regressions (see e.g. Davis and Hu 2008; Zandberg and Spierdijk 2013) typically suffer from endogeneity and causality problems. Moreover, the number of observations (i.e. countries) is relatively small compared to the many diverse factors that may affect pensions and growth.

In this paper we follow a different approach. If direct evidence of an impact of pensions on growth is hard to get, we can look for a ‘smoking gun’ by focusing on the transmission mechanism. This method is established in a seminal paper by Rajan and Zingales (1998), and followed by others when investigating the impact of financial development on growth (see Pasali (2013) for a survey). Our study fits in this tradition, but focuses on the pension system as one of the key determinants of the financial system. The hypothesis is as follows: if larger pension funding leads to deeper capital markets, one would expect especially those firms to benefit that rely stronger on external finance. Thus, we focus on the interaction between an industry’s dependence on external finance with the size of pension assets at the national level. This approach mitigates the endogeneity problem that is innate in standard regressions for pension savings and growth.

We study the effect of pension assets on economic growth using a data set for 69 manufacturing industries in 34 OECD countries for the period 2001–2010. We find that pension savings have a positive effect on the growth in sectors that rely more on external finance relative to sectors with less external finance. One has to be careful to interpret this as a positive effect on growth at the aggregate level. The estimates refer to the differential effect on growth in industries. Yet it is interesting to get some indication of the potential effect on growth through this causal mechanism. Under some assumptions we may conjecture that an increase in pension assets as a fraction of GDP by 40 percentage points would increase growth for the sector with average external dependency by 0.24 percentage points.

Interestingly, this positive relation between pension funding and growth is not significantly changed during the banking crisis. This is relevant as there have been concerns that larger pension funding may have a negative side-effect on the banking sector (Davis 1998; Cecchetti et al. 2011). With pension funds and insurance companies taking over some of the financial intermediation activities this may draw long term savings away from banks, thus weakening their deposit base (Davis and Steil 2004). This could have made banks more vulnerable during the financial crisis, with detrimental effects for credit and growth. Our results, however, give little support for this concern.

Our paper contributes to the sparse empirical literature on the effect of pension systems on economic growth.Footnote 1 Davis and Hu (2008) find a positive effect of pension savings on output for both OECD countries and Emerging Market Economies in the period 1960–2002. For example, for Chile they find that a 1% increase in pension assets can contribute to lead to an increase in output by 0.14% in the long run. In general, for emerging countries stronger effects are found than for the OECD countries. These positive results are not confirmed in the study of Zandberg and Spierdijk (2013). Using standard cross-country regressions, they find no significant effects of pension savings on economic growth in the 2001–2010 period for 54 OECD and non-OECD countries. Only when using a 5-year period growth model with rolling windows, which is non-standard in empirical growth literature, do they find a weak significantly positive effect. This finding is, however, not robust to exclusion of individual countries. Some other papers focus on the impact of pension reforms on aggregate savings. Samwick (2000) shows that countries with PAYG pensions tend to have lower aggregate saving rates than countries with funded pensions. Similar results were found by Bailliu and Reisen (1998) for both OECD countries and developing countries. Finally, in a recent study Altiparmakov and Nedelkovic (2018) analyze the growth consequences of carve-out pension privatization in Latin America and Eastern Europe. Applying different econometric methods on a panel of 36 countries over the period 1990–2013 they find only limited impact on aggregate savings, and no statistically significant effects on growth.

Our paper also relates to a much larger literature on financial structure and economic growth. Although for low levels of financial development the consensus is that more finance—as measured by bank credit or stock market turnover—enhances growth, conclusions are mixed for higher levels of financial development, see e.g. the literature reviews by Levine (2005), Ang (2008) and Pasali (2013) and the meta studies by Valickova et al. (2015) and Arestis et al. (2015). Our study shows that taking into account the pension system could be a relevant factor in assessing the impact of the financial structure on growth.

More specific, the Rajan–Zingales methodology has been used in several papers studying the impact of the financial sector on economic growth. Dell’ariccia et al. (2008) use the methodology to identify the impact of banking crises on the real economy, Laeven and Valencia (2013) to find the effect of financial sector intervention on the real economy, and Beck et al. (2016) for the impact of financial innovation on growth and volatility. Typically these papers look at period averages for growth. Our paper distinguishes from this literature by using a panel, for the period 2001–2010.

The paper is structured as follows. Section 2 provides some background on the increasing role of pension savings, and discusses the potential impact on the financial landscape and economic growth. Section 3 presents the econometric methodology and describes the data. Section 4 presents our empirical results applying the Rajan and Zingales (1998) methodology in a cross-industry, cross-country comparison. Section 5 discusses the robustness of the results, and Sect. 6 concludes.

2 Funded Pensions, Financial Intermediation and Economic Growth

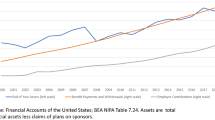

The role of funded pensions in the provision of retirement income has grown significantly in the past two decades, reflecting efforts by many countries to relieve pressure on unsustainable PAYG pensions. The growing importance of pension savings is illustrated in Fig. 1. Despite the considerable losses due to the financial crises in 2002 and 2008, total pension assets relative to GDP increased by 11 percentage points in OECD countries, from 31% on average in 2001 to 42% in 2010.Footnote 2 Most of the increase is driven by OECD countries with already larger funded pension systems. The ratio of pension assets for this group increased with nearly 25 percentage points from 74.7 to 98.6%. However, also for the average PAYG country the ratio of pension assets more than doubled from 3.4 to 8.2%. Despite this common trend for pension savings to increase, great diversity remains across individual countries as illustrated by Table 1. In general countries with Bismarckian PAYG systems possess less pension assets than Beveridgean countries that more rely on (private) funded pensions. These latter countries feature pension assets ratios that even may exceed 100% of GDP, which can be expected to have a substantial impact on the financial landscape in these countries. Pension policies are typically determined at the national level, and are subject to specific historical and political circumstances, and are sometimes erratic.Footnote 3

There are several mechanisms that can potentially explain a positive impact of the size of funded pensions on economic growth. There are two broad categories of explanations.

-

1.

Pension savings may lead to deeper and more efficient capital markets. Pension savings directly increase funds in capital markets available for private investment. In addition, deeper capital markets may lead to better allocation of capital, thereby improving overall efficiency and economic growth (Wurgler 2000).

-

2.

Higher pension savings may affect the financial landscape, increasing the weight of institutional investors as pension funds and life-insurance companies. Given the long maturity of liabilities of these institutional investors, they can afford to make long-term investments, for example through long-term equity stakes. Pension funds and insurance companies are generally found to behave as long term investors (e.g. Lakonishok et al. 1992). Furthermore, the presence of big institutional investors may lead to better governance of firms by reducing free-riding incentives, which in turn improves these firms’ efficiency and hence may lead to higher growth (Davis and Steil 2004).

In contrast to these positive effects, there are also concerns that higher pension savings could have adverse effects through their impact on banks. This could happen if larger capital funding of pensions diverts private savings from banks to pension funds and life-insurance companies, thereby weakening the base of stable household deposits for banks. This could be aggravated if better prospects on pension income induce households to lengthen their balance sheets by taking on more mortgage and other debt (Davis 1998; Cecchetti et al. 2011). Larger funding gaps of banks in countries with strong funded pensions imply that banks are more dependent on wholesale financing through money markets. This does not have to be a problem in normal times, as institutional investors buy bank bonds and thus closing the financing gap, but it may increase liquidity risks in bad states of the world. Cecchetti et al. (2011) argue that higher loan-to-deposit ratios and larger funding gaps are associated with worse performance during the banking crisis. This would imply that the impact of pension assets on economic growth is less favorable, or even negative, in particular in bad states of the world. In the subsequent empirical analysis we check this by examining whether the relation between pensions assets and economic growth was changed during the banking crisis.

3 Method and Data

We analyze the effect of pension assets on economic growth in OECD countries for the period 2001–2010 using a cross-industry, cross-country regression focusing on the difference in dependence on external finance across manufacturing industries.Footnote 4 Following Rajan and Zingales (1998), we define an index of the dependence of firms on external finance as the fraction of investment not financed through retained earnings. Specifically, it is defined as the gap between capital expenditures on fixed assets and the cash flow from operations taken as a fraction of capital expenditures on fixed assets:

Rajan and Zingales have constructed the index using data for listed US (United States) firms, and extended it to the industry level. By using data for the US—the country with the best developed financial markets—the observed external dependence can be considered as being determined by structural firm characteristics (i.e. technology) rather than—possibly restrained—capital market conditions. The authors argue that differences in external dependence are persistent and essentially technologically determined, and therefore typical for an industry over time and across countries.

Our hypothesis is that domestic industries with high dependence on external finance (EDi) should disproportionately benefit from an increase in the size of pension assets as this is contributes to deeper and more efficient financial markets. Essentially we estimate the impact of differences in pension systems across countries—as measured by the size of pension assets as a percentage of GDP—on similar industries with a particular external dependency, taking the US sectors as a benchmark. More specific, we test whether an industry with a large external dependence (ED) grows more in countries with large pension assets (PA) compared to sectors with small ED.

Equation (2) shows the basic model with cross-industry, cross-country fixed effects. In addition, we include a crisis dummy to see whether the relation changed during the banking crisis, or even might have changed sign.

Here, the dependent variable yc,i,t is the value-added growth (in logs) for sector i in country c and year t, μc,i denotes country-industry fixed effects and γc,t denotes country-time fixed effects. ISc,i,t−1 is the size of sector i in country c relative to total manufacturing of that particular countryFootnote 5; this accounts for the possibility that larger, more saturated industries experience slower growth. We interact the level of total pension assets per country with dependence on external finance per industry PAc,t−1EDi. Here the PA-to-GDP ratio (PAc,t−1) is taken as a lagged variable as it takes time for additional pension savings to lead to higher investment and growth. The external dependence variable is included as a time-invariant characteristic per industry. The US is excluded from the regression because it is the benchmark for external dependence per industry. Because of the endogeneity issuesFootnote 6 arising due to presence of a lagged dependent variable on the right-hand side in Eq. (1), we estimate the model using the two-step systemFootnote 7 GMM estimator of Blundell and Bond (1998) with the Windmeijer (2005) correction for the standard errors.

To examine whether the relation of pension assets and economic growth might have changed during the crisis, we also include a crisis dummy in the interaction term \( PA_{c,t - 1} ED_{i} crisis_{t} \). We expect the coefficient on this term to be negative if the crisis has hit countries with large funded pensions harder, and firms with large external financing suffer from impaired bank lending in particular. We define the crisis period dummy to be one from 2008 to 2010 and zero otherwise in our preferred model specification.

Our panel includes all 34 OECD countries and 69 manufacturing industries. The OECD provides annual data on total pension assets relative to its country’s nominal GDP (current prices, local currency) for all OECD countries in the 2001–2010 period.Footnote 8 Total pension assets comprise pension fund assets, pension insurance contracts, funds managed as part of financial institutions and the value of funds book reserve systems. We prefer this broad measure of pension assets over the series for ‘pension funds assets’ also supplied by the OECD, although the role of pension funds with regard to economic performance could also be interesting per se. We therefore perform a robustness test (Sect. 5) using the data for pension funds assets. The difference between the two definitions of pension assets for each country is illustrated in Fig. 2.

Missing pension asset data for Japan are complemented by total PA-to-GDP ratio from the Bank of Japan.Footnote 9 Limited availability of industry data (INDSTAT) and a change in sector classification restricts our regressions to the period 2001–2010, where for the year 2010 data are available only for Australia, Canada, Estonia, Japan, Mexico and Slovenia. Taken together we have 13,682 available observations for 1862 unique country and sector combinations. The panel is not perfectly balanced; there are some missing years for specific countries or industries.

Our estimation period 2001–2010 is more recent than the period 1980–1989 for which the ED index was constructed by Rajan and Zingales. This raises the question whether this index is still relevant. According to the authors the index may be expected to be robust across countries and over time as technological characteristics of sectors are persistent. Indeed, several papers use this index when analyzing growth in more recent periods (e.g. Laeven and Valencia 2013). Yet the assumption that technological characteristics of sectors are persistent may not be fully obvious. For example, it is well-known that firms feature a life-cycle pattern with larger needs for external finance early in life and, and less external funding when becoming more mature. Rajan and Zingales, however, show that this is true for individual firms only in the very early stages of life; thereafter the need for external finance proves to be stable. Moreover, at industry level it can be expected that life cycles of individual firms average out as the formation of firms is spread over time. Indeed, several papers have checked robustness by constructing the measure with more recent data yielding similar results. For example, Laeven and Valencia recalculated the index for an extended observation period 1980–2010, and found a correlation of 75% with the original Rajan–Zingales data. Earlier, Kroszner et al. (2007) found a similar result when comparing the external dependency in the 1980s and the 1980–1999 period (correlation 82%).

Rajan and Zingales distinguish 36 manufacturing industries which has been extended to 70 manufacturing industries at four digit ISIC level by Raddatz (2006). The authors take the median of the (time-averaged) external dependence of all listed firms per sector in the 1980–1989 period to compute the aggregate external dependence ratio. Note that the external dependence index is not constrained to be positive. Sectors range from the leather industry, with the lowest external dependence (− 1.53), to manufacturing of drugs and medicines, with the highest external financial needs (1.47).Footnote 10 We use the original Rajan–Zingales set as has been enlarged by Raddatz.

Table 2 provides some descriptives of the data. We use annual value-added growth per manufacturing sector which is the net output per sector after adding up all outputs and subtracting intermediate inputs (source: World Bank). This output indicator is given in local currency and current prices; as we focus on differences across sectors it is fair to use nominal growth rates; a country’s inflation is captured in country-time fixed effects.Footnote 11

4 Empirical Results

In this section we estimate the model in Eq. (2). The results are summarized in Table 3 for our baseline model, first without crisis dummy and then including this dummy. To account for country- and sector-specific effects, as well as for omitted variables, each regression includes country-industry and country-year fixed effects with standard errors clustered by country-industry. Furthermore, in line with Kroszner et al. (2007), we winsorize the top and bottom 1% of the outliers which caps negative output growth from − 551 to − 86% and positive growth from 323 to 75%. Also, the top and bottom 1% of our industry size variable are winsorized capping the top 1% ratio from 0.57 to 0.10, and is normalized. The PA-to-GDP ratio has no extreme outliers. External dependence does have an extreme outlier; we cap (negative) external dependence from − 1.53 to − 0.6.Footnote 12 Moreover, we normalize external dependence so that it ranges from 0 for the sector with the lowest ED and 1 for the sector with the highest ED. The GMM results are given in columns (1) and (2). The p-values for the Hansen test indicate that the null hypothesis for joint validity of the instruments is not rejected at conventional levels. The same holds for the Arellano–Bond test for no second-order correlation in differences. For the sake of completeness, also the biased OLS and least square dummy variables (LSDV) estimations are reported, in columns (3) to (6).

In correspondence with Rajan and Zingales (1998), we find that large industry size in the previous period has a negative effect on growth (see column (1) in Table 3). The intuition behind this result is that saturated markets with high industry sizes and more competition inevitably hinder growth. The results for the key interaction PAc,t−1 * EDi are significant at the 99% confidence level in all models and, moreover, stable across alternative specifications of the model when estimated by system GMM (see column (1) in Tables 3, 8 in “Appendix 2”). Larger pension savings thus positively stimulate growth of manufacturing sectors with a higher dependence on external financing, pointing to a positive impact of deeper capital markets on financial intermediation and, thereby, on economic growth.

The estimates apply to the growth differential between industries with less or more external dependence. In order to obtain some feeling for the size of the effect we can follow Rajan and Zingales and calculate the effect of an increase in pension assets (PA) going from the 25th to the 75th percentile (per country) on the growth differential between the sectors with the 75th percentile and 25th percentile in external dependence (ED). For our model this gives an increase in growth of 0.6 percentage points for the sector with higher external dependence (0.35) relative to the sector with lower external dependence (accidently 0.00) when pension assets rise from 6 to 67%.

Still, this gives only information on the growth differential between sectors. Strictly spoken our analysis delivers no result for the effect of pension assets on growth in absolute terms. Yet it could be interesting to have some impression of the possible size of aggregate effect. Therefore we could make the following conjecture following Raddatz (2006); if the impact of higher pension assets on growth would be zero for the sector with the lowest ED, then we find that an increase in pension assets as a fraction of GDP by one standard deviation of 40 percentage points (Table 2) would increase growth for the sector with average external dependency of 0.21 (Table 2) by 0.24 percentage points.Footnote 13 Obviously, one should be careful in taking our result to the aggregate level.Footnote 14

To investigate whether this relation between pension assets and growth changes during the banking crisis, column (2) in Table 3 includes a dummy for the crisis period (2008–2010) interacted with our key external dependency variable.Footnote 15 This variable turns out to be insignificant. Thus, we find no support for the argument that larger pension savings may make the economy more vulnerable for a banking crisis. The coefficient is persistently negative across different specifications and robustness tests, however, and in some—non preferred—specifications also statistically significant. So, if anything, there might be some suspicion of a smaller impact of pension funding on growth during the crisis. Our analysis is, however, not able to provide better evidence for such an effect.

Table 3 also reports the OLS and LSDV estimates. As these estimates do not address the endogeneity problem, they will be biased. From Table 3, we observe that results indeed vary across the OLS (column 3) and LSDV specification (column 5). However, the bounds implied by OLS and LSDV for yc,i,t−1 provide a check on the two-step GMM results (Blundell and Bond 2000). According to Roodman (2006), good estimates of the lagged parameter should be within or close to these bounds, which, in our view, holds.

5 Robustness of the Results

We have performed a range of additional robustness tests on our preferred specification (see column (1) in Table 3). The main results are reported in Table 4. First, we have redone our initial regressions and take the top and bottom 2.5% of output growth as threshold for winsorization [columns (1) and (2)]. Second, as an alternative to winsorization we trim the 1% outliers [columns (3) and (4)], in the same vein as Dell’Ariccia et al. (2008). Third, noting that several papers correct output growth for inflation, we convert our nominal output growth to real growth with the GDP deflator retrieved from INDSTAT and winsorize the new variable at 1% [columns (5) and (6)]. All these robustness tests produce significant results for the key variable at the 99% confidence level.

Table 5 reports the results when ‘pension fund assets’ is taken as an explanatory variable instead of the broader measure of total pension assets. The results are remarkably similar to those in our baseline model. The coefficient for differential impact of PA is a little higher than in the original model. The banking crisis dummy is still insignificant (and again negative).

Finally, we also check robustness of our results to inclusion of domestic credit to the private sector (DCPSc,t−1) and stock market turnover (STc,t−1) as control variables. These variables are often taken as indicators of financial development, for example, in studies on the impact of the financial sector on economic growth (e.g. Rajan and Zingales 1998). It could be argued that countries with larger financial sector may have both more efficient financial markets and high pension savings not endogenous so that the effect of pension assets on growth could be due to spurious correlation. Moreover, checking for the impact of these variables on our results may provide some insight into the underlying mechanism. Table 6 summarizes the results.

First, we find significant positive effects for these financial indicators on economic growth when taken separately from the pension assets variable [columns (2), (3) and (4)]. This corresponds to the results found by Rajan and Zingales. This lends support to the idea underlying our analysis that finance matters for growth. Next, including both pension assets and these control variables, we find diverging results. Stock market turnover has little effect on the relation between pension assets and growth [column (5)]. This is different for the credit variable. Adding this variable keeps the basis results the same but takes away all significance from the pension assets variable [column (6)]. It should be noted here that the credit variable is strongly correlated with pension assets, with correlation coefficient 0.63. We therefore interpret this result as indicating that pension saving find their way to the private investment at least partly through the banking sector, giving little evidence for the funding gap argument according to which pension saving may crowd-out banking credit by channeling long-term savings away from banks. As a final test we randomly assigned external dependence to sectors in order to check for spuriousness of our results (not reported). We find that results become insignificant.

6 Conclusion

Many countries encourage private funded pensions as a supplement to public pensions, which face increasing demographic pressure. It is likely that the role of institutional investors as pension funds and insurance companies in financial intermediation will increase in the future. This may positively affect economic growth as these institutional investors can be expected to be more committed to long term investments. We focus on this feature when analyzing the impact of private pension savings on economic growth. Following Rajan and Zingales (1998), we use the differential impact on firms that less or more rely on external finance to identify the effect on growth, thus mitigating endogeneity issues in standard growth regressions. Using data on 69 manufacturing industry sectors in 34 OECD countries for the period 2001–2010 we find that increased pension savings are associated with higher growth of firms that rely more on external finance. Although our analysis only applies to the growth differential between industries, we may—under some strong assumptions—obtain some indication for the absolute size of the impact through this transmission mechanism. For a sector with average external dependence we then find that an increase in the pension assets to GDP ratio by one standard deviation (40 percentage points) increases growth by 0.24 percentage points for the manufacturing sector with average dependence on external finance.

We do not find support for a change in this relation during the 2008 financial crisis. This may alleviate concerns that larger pension savings may weaken the banking sector by reallocation savings from banks to pensions funds, and thus make the economy more vulnerable to shocks like the banking system.

Notes

Also the theoretical literature is quite scarce, and most of the time focuses on aggregate savings and portfolios, see e.g. Staveley-O'Carroll and Staveley-O'Carroll (2017).

Unweighted average for all 34 OECD countries (Source: OECD—total pension assets to GDP statistics). For a detailed description, see “Appendix 1”.

The recent incidents in Poland and Hungary where private pensions were re-nationalized—mainly for budgetary reasons—fall outside the scope of our observation period.

For a detailed description of the data, see “Appendix 1”.

\( I\!S_{c,i,t - 1} = \frac{{IndustrySize_{c,i,t - 1} }}{{\mathop \sum \nolimits_{i = 1}^{n} IndustrySize_{c,i,t - 1} }} \) where the sum of total value added is given as a variable in the INDSTAT dataset.

To strengthen the instrument set without using outside instruments, we prefer to use system GMM over first-differenced GMM, as suggested by Bond et al. (2001).

Total pension assets, Flow of Funds, Bank of Japan (BOJ) codes: FOF_FFAS800A100 till FOF_FFAS800A900. There is a difference between total pension asset data of Japan as reported by the OECD and the BOJ. We use BOJ data due to their larger and more detailed time series data on total pension assets.

Further details about data adjustments for the value added data is elaborated in “Appendix 1”.

As an additional robustness check, we estimate the model without capping the external dependence outlier. This does not affect the point estimate and t-statistic (rounded at two decimals).

Note that the coefficient is estimated for the normalized ED; for the impact on growth one has therefore divide the effect by 2.07 being the difference between the highest and the lowest ED.

Also for the manufacturing industries one has to treat this figure with care; it may be biased as sectors relying on external finance tend to be smaller in size; the aggregate effect can therefore be expected to be smaller.

As an additional robustness check, following Laeven and Valencia (2013), we define the crisis period dummy to be one from 2008 to 2010 for the following countries in our sample: Austria, Belgium, Czech, Denmark, Estonia, France, Germany, Greece, Hungary, Iceland, Ireland, Luxembourg, Netherlands, Portugal, Slovakia, Spain, Sweden and the United Kingdom and re-estimate our model. This variable turns out to be insignificant as well (estimated coefficient of − 0.0477 and a t-statistic of − 0.40).

References

Altiparmakov, N., & Nedelkovic, M. (2018). Does pension privatization increase economic growth? Evidence from Latin America and Eastern Europe. Journal of Pension Economics and Finance, 17, 46–84.

Ang, J. B. (2008). A survey of recent developments in the literature of finance and growth. Journal of Economic Surveys, 22(3), 536–576.

Arestis, P., Chortareas, G., & Magkonis, G. (2015). The financial development and growth nexus: A meta-analysis. Journal of Economic Surveys, 29(3), 549–565.

Bailliu, J. N., & Reisen, H. (1998). Do funded pensions contribute to higher aggregate savings? A cross-country analysis. Weltwirtschaftliches Archiv, 134(4), 692–711.

Beck, T., Chen, T., Lin, C., & Song, F. M. (2016). Financial innovation: The bright and the dark sides. Journal of Banking and Finance, 72, 28–51.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143.

Blundell, R., & Bond, S. (2000). GMM estimation with persistent panel data: An application to production functions. Econometric Reviews, 19(3), 321–340.

Bond, S. R., Hoeffler, A., & Temple, J. R. (2001). GMM estimation of empirical growth models (CEPR discussion paper no. 3048). Available at SSRN: http://ssrn.com/abstract=290522. Accessed 19 June 2018.

Cecchetti, S. G., King, M., & Yetman, J. (2011). Weathering the financial crisis: Good policy or good luck? (BIS working paper no. 351). Available at SSRN: http://ssrn.com/abstract=1942165. Accessed 19 June 2018.

Davis, E. P. (1998). Pension fund reform and European financial markets. Special paper 107, Financial Markets Group, London School of Economics.

Davis, E. P., & Hu, Y. W. (2008). Does funding of pensions stimulate economic growth? Journal of Pension Economics and Finance, 7(2), 221–249.

Davis, E. P., & Steil, B. (2004). Institutional investors. London: MIT Press.

Dell’Ariccia, G., Detragiache, E., & Rajan, R. (2008). The real effect of banking crises. Journal of Financial Intermediation, 17(1), 89–112.

Kroszner, R. S., Laeven, L., & Klingebiel, D. (2007). Banking crises, financial dependence, and growth. Journal of Financial Economics, 84(1), 187–228.

Laeven, L., & Valencia, F. (2013). The real effects of financial sector interventions during crises. Journal of Money, Credit and Banking, 45(1), 147–177.

Lakonishok, J., Shleifer, A., & Vishny, R. W. (1992). The impact of institutional trading on stock prices. Journal of Financial Economics, 32(1), 23–43.

Levine, R. (2005). Finance and growth: Theory and evidence. In Ph. Aghion & S. N. Durlauf (Eds.), Handbook of economic growth (pp. 865–934). Amsterdam: Elsevier. https://doi.org/10.1016/s1574-0684(05)01012-9.

Nickell, S. (1981). Biases in dynamic models with fixed effects. Econometrica, 49(6), 1417–1426.

OECD. (2017). Pensions at a Glance 2017, Paris.

Pasali, S. S. (2013). “Where is the cheese? Synthesizing a giant literature on causes and consequences of financial sector development. World Bank Policy Research Working Paper 6655. Available at SRRN: https://ssrn.com/abstract=2341371. Accessed 19 June 2018.

Raddatz, C. (2006). Liquidity needs and vulnerability to financial underdevelopment. Journal of Financial Economics, 80(3), 677–722.

Rajan, R. G., & Zingales, L. (1998). Financial dependence and growth. The American Economic Review, 88(3), 559–586.

Roodman, D. (2006). How to do xtabond2: An introduction to difference and system GMM in Stata (Center for Global Development working paper no. 103). Available at SSRN: http://ssrn.com/abstract=982943. Accessed 19 June 2018.

Samwick, A. A. (2000). Is pension reform conducive to higher saving? Review of Economics and Statistics, 82(2), 264–272.

Staveley-O’Carroll, J., & Staveley-O’Carroll, O. M. (2017). Impact of pension system structure on international financial capital allocation. European Economic Review, 95, 1–22.

Thomas, A., & Spataro, L. (2016). The effects of pension funds on markets performance: A review. Journal of Economic Surveys, 30, 1–33.

Valickova, P., Havranek, T., & Horvath, R. (2015). Financial development and economic growth: A meta-analysis. Journal of Economic Surveys, 29(3), 506–526.

Windmeijer, F. (2005). A finite sample correction for the variance of linear efficient two-step GMM estimators. Journal of Econometrics, 126(1), 25–51.

World Bank. (1994). Averting the old-age crisis: Policies to protect the old and promote growth. Washington, DC: Oxford University Press.

Wurgler, J. (2000). Financial markets and the allocation of capital. Journal of Financial Economics, 58(1), 187–214.

Zandberg, E., & Spierdijk, L. (2013). Funding of pensions and economic growth: Are they really related? Journal of Pension Economics and Finance, 12(2), 151–167.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper is supported by the MoPAct (Mobilising the potential of active aging) Program of the EU Seventh Framework program.

Appendices

Appendix 1: Data Description

This appendix provides more detailed information on the data used. For the industry output data, we use annual value added in local currency and current prices from 152 sectors in the manufacturing industry for the period 1999–2010 from INDSTAT. We focus on sectors for which we have the dependence of external financing ratio from Raddatz (2006). We construct a concordance table between isic3 codes from INDSTAT and the isic2 codes from Raddatz. Some of the isic2 sectors include either two or three isic3 sectors as can be seen in Table 7 of this appendix. At the country level, some observations of one of the isic3 subgroups that belong to the same isic2 group are missing. In order to maintain consistency of the former group we only compute the total sector value of these subgroups if there are no missing values in that time series. For some countries the calculation of an industry’s value added has changed from some particular year onwards. We identify the transition year and ignoring this specific output growth observation to eliminate distorted growth values resulting from the change in definition. We end up with 69 sectors which have the dependence of external financing ratio from Raddatz.

Figures 3 and 4 show annual pension assets-to-GDP growth as retrieved from OECD.Stat for all countries included in the sample. Figure 3 shows the external dependence ratio as obtained from Raddatz (2006). Finally, Fig. 2 comparing total pension assets and pension fund assets as percentage of GDP (unweighted average over the ten years period) for all 34 OECD countries is based on the OECD Database (2013).

Appendix 2: Additional Robustness Check

See Table 8.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Bijlsma, M., Bonekamp, J., van Ewijk, C. et al. Funded Pensions and Economic Growth. De Economist 166, 337–362 (2018). https://doi.org/10.1007/s10645-018-9325-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10645-018-9325-z