Abstract

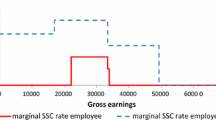

This paper provides evidence on the question of who bears the burden of social security contributions (SSC) in Germany over a long-term horizon. Following Alvaredo et al. (De Econ, 2017) we exploit kinks in the budget set generated by a drop in the marginal SSC rate at earnings caps for health and long-term care insurance. These concave kinks lead to discontinuities in the distributions of gross earnings, net earnings, or labor costs which—in the absence of labor supply responses—are informative about economic incidence. Administrative data for West Germany from 1975 to 2010 facilitate a comprehensive incidence analysis. Finding no evidence for labor supply responses and no significant discontinuities in gross earnings distributions, we conclude that neither employers nor employees shift a substantial part of their SSC burden. These results are consistent over the whole time period and hold for several robustness checks corroborating previous findings for Germany. A small trend towards a slight increase in the SSC burden for employees is not statistically significant.

Source: German Statistical Office; own calculations

Source: ICTWSS: Database on Institutional Characteristics of Trade Unions, Wage Setting, State Intervention and Social Pacts in 51 countries between 1960 and 2014 (figures for 1970–1990, see http://www.uva-aias.net/208); German Establishment Panel (figures for 2000–2010, see Fischer et al. 2008, 2009)

Source: SIAB; own calculations

Source: SIAB; own calculations

Similar content being viewed by others

Notes

The German name is Stichprobe der Integrierten Arbeitsmarktbiografien. See Dorner et al. (2011) for a detailed description of the data.

References

Alvaredo, F., Bozio, A., Roantree, B., & Saez, E. (2017). Using threshold to estimate earnings responses to Social Security Contributions. De Economist.

Bosch, N., & Micevska-Scharf, M. (2017). Who bears the burden of Social Security Contributions in the Netherlands? Evidence from Dutch administrative data. De Economist.

Bozio, A., Breda, T., & Grenet, J. (2017). Incidence and behavioural response to social security contributions: Analysis of Kink Points in France. De Economist.

Dorner, M., König, M., & Seth, S. (2011) Stichprobe der Integrierten Arbeitsmarktbiografien. Regionalfile 1975-2008 (SIAB-R 7508), Documentation on labour market data, Institute for Employment Research (IAB), Nuremberg.

Fischer, G., Janik, F., Müller, D., & Schmucker, A. (2008). The IAB Establishment Panel—from Sample to Survey to Projection, FDZ Methodenreport. Methodological aspects of labour market data No. 200801EN, Institut für Arbeitsmarkt- und Berufsforschung (IAB), Nürnberg [Institute for Employment Research, Nuremberg, Germany].

Fischer, G., Janik, F., Müller, D., & Schmucker, A. (2009). The IAB establishment panel—things users should know. Schmollers Jahrbuch. Journal of Contextual Economics, 129(1), 133–148.

Fitzenberger, B., Kohn, K., & Lembcke, A. C. (2013). Union density and varieties of coverage: The anatomy of union wage effects in Germany. Industrial and Labor Relations Review, 66(1), 169–197.

Grabka, M. (2004). Alternative Finanzierungsmodelle einer sozialen Krankenversicherung in Deutschland—Methodische Grundlagen und exemplarische Durchführung einer Mikrosimulationsstudie., Dissertation, Technical University Berlin.

Hamermesh, D. (1987). The demand for labor in the long run. In Ashenfelter, O., & Layard, R. (Eds.), Handbook of labor economics vol. 1, chap. 08, pp. 429–471. Elsevier, 1 edn.

McCrary, J. (2008). Manipulation of the running variable in the regression discontinuity design: A density test. Journal of Econometrics, 142(2), 698–714.

Melguizo, A., & Gonzalez-Paramo, J. (2013). Who bears labour taxes and social contributions? A meta-analysis approach. SERIEs, 4(3), 247–271.

Müller, K.-U., & Neumann, M. (2016). The Economic Incidence of Social Security Contributions: A discontinuity approach with linked employer-employee data, discussion paper, DIW discussion papers no. 1578, German Institute for Economic Research (DIW Berlin), Berlin.

Neumann, M. (2015). Earnings Responses to Social Security Contributions, Discussion paper, DIW Discussion Paper No. 1489, German Institute for Economic Research (DIW Berlin).

OECD. (2016). OECD revenue statistics, https://stats.oecd.org/Index.aspx?DataSetCode=REV; accessed 2015.

Saez, E., Matsaganis, M., & Tsakloglou, P. (2012). Earnings determination and taxes: Evidence from a cohort-based payroll tax reform in Greece. The Quarterly Journal of Economics, 127(1), 493–533.

vom Berge, P., Burghardt, A., & Trenkle, S. (2013a). Sample of integrated labour market biographies: regional file 1975-2010 (SIAB-R 7510), FDZ Datenreport. Documentation on Labour Market Data 201309EN, Institut für Arbeitsmarkt- und Berufsforschung (IAB), Nürnberg [Institute for Employment Research, Nuremberg, Germany].

vom Berge, P., König, M., & Seth, S. (2013b). Sample of Integrated Labour Market Biographies (SIAB) 1975–2010, FDZ Datenreport. Documentation on Labour Market Data 201301EN, Institut für Arbeitsmarkt- und Berufsforschung (IAB), Nürnberg [Institute for Employment Research, Nuremberg, Germany].

Acknowledgements

We would like to thank Peter Haan who read and commented on an earlier draft of this paper. We are also indepted to Stuart Adam, Leon Bettendorf, Nicole Bosch, Antoine Bozio, Thomas Breda, Julien Grenet, Luke Haywood, and Barra Roantree for helpful comments and discussions. This research has been conducted within the project “The Impact of Social Security Contributions on Earnings: Evidence from administrative data in France, Germany, the Netherlands and the UK” (HA 5526/3-1 (ORA)) funded by the German Research Foundation (Deutsche Forschungsgemeinschaft, DFG).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Müller, KU., Neumann, M. Who Bears the Burden of Social Security Contributions in Germany? Evidence from 35 Years of Administrative Data. De Economist 165, 165–179 (2017). https://doi.org/10.1007/s10645-017-9298-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10645-017-9298-3