Abstract

We study the incidence of social security contributions (SSCs) in France relying on the strategy developed by Alvaredo et al. (De Econ, 2017. doi:10.1007/s10645-017-9294-7). This strategy infers the incidence of SSCSs from the discontinuities in earnings distributions created by kink points in the SSC schedule. Using administrative data on earnings for the period 1976–2010, we study approximately 200 such kink points and do not find that they systematically induce a discontinuity in the distribution of gross earnings. This allows us to reject the hypothesis that SSCs are incident on workers, at least locally around kinks. Additionally, we exploit the large variations in SSC rates across kinks and years to estimate the local incidence of both employer and employee SSCs around these thresholds. We find that employer SSCs are shifted to employers while employee SSCs are shifted to employees. These findings are consistent with the economic incidence of SSCs being aligned with their statutory incidence, locally around kink points.

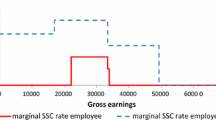

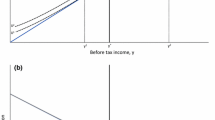

Sources IPP tax and benefit tables (April 2016); TAXIPP 0.4

Sources IPP tax and benefit tables (April 2016); TAXIPP 0.4

Sources IPP tax and benefit tables (April 2016); TAXIPP 0.4

Sources IPP tax and benefit tables (April 2016); TAXIPP 0.4

Similar content being viewed by others

Notes

Note that the analysis is complicated by the fact that there are two different types of SSCs (employer and employee SSCs) whose incidence may be different. As one earning concept is usually observed (typically earnings gross of employee SSCs and net of employer SSCs), the discontinuity in this earning concept can reflect a mix of the incidence of employer and employee SSCs if the marginal rate of both of them changes discontinuously at the considered threshold. See Alvaredo et al. (2017) and below for details.

We were granted access to the DADS data by the decisions of the Comité du secret statistique ME27 of 02/10/2013, ME56 of 25/06/2014 and ME91 of 25/06/2015.

The variable reported in the data is the tax base for Contribution sociale généralisée, a concept close but not exactly the same as the gross earnings tax base of SSCs (some forms of remunerations are included in the former, but not in the latter).

Income tax also induces mechanical discontinuities in earnings distribution at thresholds in its schedule. However, the thresholds in the income tax schedule are different from those in the SSC schedule. There is therefore no risk of contamination of our local estimates by the income tax, and we do not model it for simplicity.

We consider here the largest kink for non-executives at the SST during the post-1993 period. Note that the kink at the SST has almost entirely disappeared for executives in 1996, which is one of the reasons why, for this group, we investigate higher up in the distribution where large kinks have appeared.

Those sample statistics include estimates at the placebo kink at 2*SST. Also, the very small number of non-executives with earnings around 4*SST does not allow to convincingly estimate the discontinuity in non-executives’ earnings at this threshold using all four methods for some years.

To ensure consistency across estimations, we used a common polynomial order for each group of estimates. We did not therefore apply the optimal estimation procedure separately for each discontinuity, which may explain the fact that the share of significant discontinuities at the 5% level is slightly higher than the nominal rate of 5%.

Note that the standard errors reported in this table do not account for the fact that the dependent variable is itself estimated.

References

Alvaredo, F., Breda, T., Roantree, B., & Saez, E. (2017). Contribution ceilings and the incidence of payroll taxes. De Economist. doi:10.1007/s10645-017-9294-7.

Bosch, N., & Micevska-Scharf, M. (2017). Who bears the burden of social security contributions in the Netherlands? Evidence from Dutch administrative data. De Economist. doi:10.1007/s10645-017-9296-5.

Bozio, A., Breda, T., & Grenet, J. (2017). Incidence of social security contribution: Evidence from France. Working paper.

McCrary, J. (2008). Manipulation of the running variable in the regression discontinuity design: A density test. Journal of Econometrics, 142(2), 698–714.

Müller, K.-U., & Neumann, M. (2017). Who bears the burden of social security contributions in Germany? Evidence from 35 years of administrative data. De Economist. doi:10.1007/s10645-017-9298-3.

Neumann, M. (2015). Earnings responses to social security contributions: Evidence from two German administrative data sets. DIW discussion paper no. 1489.

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank participants of the Open research area (ORA) consortium from CPB, DIW, IFS and PSE. We acknowledge financial support from Agence nationale de la recherche (ANR) under the Grant Number ANR-12-ORAR-0004 under the ORA call.

Appendix: Estimation of Discontinuities in the Distribution of Earnings at Kink Points

Appendix: Estimation of Discontinuities in the Distribution of Earnings at Kink Points

To estimate discontinuities in the distribution of earnings at a kink point k, we set two parameters:

-

(i)

the window w is the total range of earnings that are considered on each side of the kink point k (we only consider symmetric windows around the kink);

-

(ii)

the number of bins \(n_b\) is the number of sub-intervals into which the window will be divided before performing the analysis.

The bin size b is given by \(b=w/n_b\).

1.1 Implementation A

Both the McCrary (2008) density test (Method 1) and the polynomial approach (Method 2) can be implemented after setting the values of the three parameters w, \(n_b\) and b. Our first empirical implementation relies on fixing the window \(w_1\) first, and then use the formula proposed by McCrary (2008) to determine an optimal bin size and the number of bins given the window. We use \(b_1= 2*\sigma _{N}* N^{-1/2}\), where N is the number of observations in the earnings interval \([k-w_1,k+w_1]\) and \(\sigma _{N}\) is the standard deviation of wage observations in this earnings interval.

We set \(w_1=\min (0.4*SST, 0.9*(\text {SST}-\text {MINWAGE}))\) for the kink at \(\text {SST}\), where \(\text {MINWAGE}\) is the French minimum wage; \(w_1=0.9*\text {SST}\) for the kinks at \(2*\text {SST}\) (placebo), \(3*\text {SST}\) and \(4*\text {SST}\); and \(w_1=3.9*\text {SST}\) for the kink at \(8*\text {SST}\). These choices apply to both executives and non-executives (when relevant to them). They are aimed at including as many observations as possible, while keeping other kinks and the minimum wage outside of the considered windows.

1.2 Implementation B

In contrast to implementation A, the second implementation of Methods 1 (McCrary) and 2 (polynomial fit) relies on setting the number of observations n in the first bin to the left of the kink point. We set \(n=200\) for the kink at \(\text {SST}\), \(n=80\) for the placebo kink at \(2*\text {SST}\), \(n=40\) for the kinks at \(3*\text {SST}\) and \(4*\text {SST}\), and \(n=15\) for the kink at \(8*\text {SST}\). These choices reflect a trade-off between the number of observations per bin and the number of possible bins. This is why the number of observations per bin need to be much smaller for kinks in regions of the earnings distribution with few observation. Otherwise, the bins would be too wide and there would be too few bins in a window that excludes other kinks.

The parameter \(b_2\) (bin size) is then determined based on the value of n. The window is subsequently set to include a maximum of 200 bins, while still excluding other kinks and the French minimum wage: \(w_2=\min (200*b_2, 0.9*(\text {SST}-\text {MINWAGE}))\) for the kink at \(\text {SST}\); \(w_2=\min (200*b_2, 0.9*\text {SST})\) for kinks at \(2*\text {SST}\), \(3*\text {SST}\) and \(4*\text {SST}\); and \(w_2=\min (200*b_2, 3.9*\text {SST})\) for the kink at \(8*\text {SST}\). This second approach has the advantage of not arbitrarily imposing a given window.

1.3 Polynomial Degree in the Polynomial Approach (Method 2)

For both implementations of the polynomial approach (estimates 2.A and 2.B), we set the polynomial degree d as follows: \(d=10\) for the kink at \(\text {SST}\); \(d=5\) for the kink at \(2*SST\); \(d=4\) for the kinks at \(3*\text {SST}\) and \(4*\text {SST}\); and \(d=3\) for the kink at \(8*\text {SST}\). The polynomial degree is lower for kinks strictly above the SST because the number of observations around those thresholds is comparatively small.

Rights and permissions

About this article

Cite this article

Bozio, A., Breda, T. & Grenet, J. Incidence and Behavioural Response to Social Security Contributions: An Analysis of Kink Points in France. De Economist 165, 141–163 (2017). https://doi.org/10.1007/s10645-017-9297-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10645-017-9297-4