Abstract

Investigators of the public debt-economic growth nexus have yet to fully address the crucial issue of determining the direction of causality. There is an implicit assumption—or perception—that the causal relationship is mostly from public debt to economic growth. Beyond this, causal relationships may vary according to the presence of structural breaks as well as different frequency characteristics. The focus of this study is to address these issues. In this context, we comparatively investigate how structural changes and frequency characteristics affect the public debt-economic growth nexus using historical data covering the period 1870–2020 for G7 countries. Methodologically, we use Fourier Toda-Yamamoto and frequency-domain causality techniques from time and frequency-based approaches, respectively. Consistent with our expectations, we show that in the link between public debt and economic growth, they differ from or in some cases confirm each other based on the time and frequency-domain approaches. According to both approaches, in Italy and Japan, the feedback effect is valid, implying a mutual interaction between public debt and economic growth. Also, we find that this relationship is permanent. Similarly, we conclude that there is no causal relationship for France according to both approaches. For the remaining countries, however, we provide diverse evidence on both the direction of causality and the temporary/permanent nature of the causal relationship. The results on temporary or permanent causality at different frequencies offer policymakers and researchers detailed insights into an obscure aspect of the existing literature.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Whether public debt (PD) is a boon or bane for economic growth (EG) has long been the focus of academic debates. The global stock of PD, reached its historical highest value of $92 trillion in 2022 which, requires devoted studies of all possible effects of PD to survive economically in a world of debt (UNCTAD 2023). The sharp accumulation in the PD in the first quarter of the twenty-first century—exclusively after COVID-19—has been a component of the economic crisis for many countries. Therefore, we have been seeing that the debates on PD have come to the fore again. However, studies examining effects or threshold values in the PD-EG literature focus on the tip of the iceberg. The investigation of causal connections, which we can essentially define as the formation of the iceberg, has been left to a limited number of studies.

The effects of PD on EG are undoubtedly multidimensional. Simply put, determining the public debt ceiling—ceteris paribus—and keeping the PD safe under uncertainty can alleviate the crowding-out effect and support physical capital formation (Uchida and Ono 2021). In addition, using PD in productive areas (Afonso and Jalles 2013) will also generate positive results in terms of EG (Elmendorf and Mankiw 1999). Further, from a Keynesian perspective, PD, which is used as a countercyclical fiscal policy instrument in economic bottlenecks, can positively affect EG through disposable income and total consumption channels (Kaminsky et al. 2004). However, the unproductive use of PD, the crowding-out effect (Égert 2015a), and thus the decrease in research & development investments of private sector in the long run (Elmeskov and Sutherland 2012), high credit risk premiums arising from the debt burden, and tax increases to cover debt service (Égert 2015a, b) are among the channels negatively affecting EG. Moreover, Cochrane (2011) states that the uncertainty created by PD and the adverse change in expectations may also negatively affect EG through inflation or contractions in financial markets. Aside from these, we should not disregard the assumptions of the Barro-Ricardo equivalence approach, which indicate that the effect of PD on EG is neutral. In summary, the ultimate effect of PD on EG will depend on which of the aforementioned effects or those listed in the derivative scenarios is more dominant.

Reinhart and Rogoff (RR) (2010a) lit the blue touch paper on the ongoing debate over the empirical perspective with their argument that the PD-to-GDP ratio exceeding the 90% threshold will negatively affect EG. However, since Égert (2012, 2015a) and Herndon et al. (2014) tested this hypothesis and pointed out the existence of a weaker effect, the matter has inevitably become a topic of debate among many researchers. A considerable proportion of these studies reported the presence of a nonlinear (Inverted-U or Debt-Laffer curve) association between PD and EG, mixed threshold values (Afonso and Alves 2015; Afonso and Jalles 2013; Baum et al. 2013; Caner et al. 2010; Cecchetti et al. 2011; Checherita-Westphal and Rother 2012; Égert 2015a, b; Ighodalo Ehikioya et al. 2020; Law et al. 2021; Lee et al. 2017; Liu and Lyu 2021; Mencinger et al. 2014; Ndoricimpa 2020; Suliková et al. 2015; Yolcu Karadam 2018). Because threshold values are sensitive to several factors, such as the econometric method, the time dimension, and the sample. Additionally, as reported by RR (2010a), although they detect a nonlinear relationship between PD and EG, several studies argues that a one-size-fits-all threshold cannot be determined (Arčabić et al. 2018; Chudik et al. 2017; Kourtellos et al. 2013; Lof and Malinen 2014; Panizza and Presbitero 2014; Presbitero 2012; Turan and Yanikkaya 2021). Some researchers argue that PD negatively affects EG until it reaches the determined threshold value and has a positive effect after the threshold value (Bentour 2021; Minea and Parent 2012; Okwoche and Nikolaidou 2022). Furthermore, some investigators reveal that the linear impact is positive (Akram 2015; Fincke and Greiner 2015; Owusu-Nantwi and Erickson 2016). However, a significant part of the studies mentioned above suffers from the problem of endogeneity, which possibly will influence their results (Panizza and Presbitero 2013).

The literature focusing on impact-way and threshold values reveals that the relationship between PD and EG is akin to a double-edged sword. After reviewing the theoretical literature and empirical findings, PD's influence on EG remains nebulous. Researchers have discussed whether PD is a threat or an opportunity for EG and whether it is sustainable. Nevertheless, determining linear and nonlinear relationships or the threshold value (if any) as well as the causal relationship between PD and EG, feedback effect (hysteria hypothesis), reverse causality, path dependency, and whether these processes are temporary or permanent, is vital for policymaking. However, one more important question that cannot be overlooked has remained in the background until now. Is the level of EG effectual on PD? Reinhart et al. (2012), Bell et al. (2015) and Dafermos (2015) underline the fact that a country's level of PD will increase when the rate of EG is low, which is the other half the PD-EG nexus.

Still, a limited number of studies concentrate on the issues of causality. These studies are mostly based on the traditional Granger type time-domain causality methodology, and a significant proportion of them investigate the causality at the panel level (Arčabić et al. 2018; Butts 2009; Donayre and Taivan 2017; Ferreira 2009, 2016; Jacobs et al. 2020; Jayaraman and Lau 2009; Puente-Ajovin and Sanso-Navarro 2015; Saungweme and Odhiambo 2020). Except Gómez-Puig and Sosvilla-Rivero (2015) who employed time-varying granger causality.

The other contingent of researchers examine country-specific circumstances (Egbetunde 2012; Karagol 2002; Owusu-Nantwi and Erickson 2016). Nonetheless, it should be noted that causality examinations based on time-domain methodology have multiple weak and fragile aspects. Most importantly, their proponents investigate one causality by producing a single test statistic for the whole series. In addition, the sensitivity to the number of lags and sample size, the loss of information due to differences in nonstationary series, and the need for many pre-tests are also open to criticism. Besides, these methods are linear and are not robust in detecting possible nonlinear causalities. However, although many thresholds and effect-based studies report evidence of nonlinear relationships, only De Vita et al. (2018) and Di Sanzo and Bella (2015) conducted causality tests based on nonlinear methods. In addition, Kempa and Khan (2016), Ozmen (2022) and, Toktas et al. (2019) whose work differ methodologically from other studies, have brought evidence of asymmetric causality (AC) relationships to the literature. In addition, Ozmen and Mutascu (2023) provided a new perspective with both asymmetric and Fourier-based time-domain causality test applications. Under the assumption that the PD-EG relationship exists, there is no empirical evidence for temporary or permanent nature of this relationship. Although there are rare studies on Fourier-based causality tests that allow modeling smooth structural breaks in time series, the frequency domain causality technique, which allows the examination of temporary/permanent causal relationships, has not been used before in the literature.

With this study we focus specifically on filling this gap in the literature with insights obtained from frequency-domain and Fourier-based time-domain causality approaches. In detail, we aim to contribute to the literature by considering the causal relationship among PD and EG, structural change, heterogeneity, nonlinearity, and periodic changes. We fulfill this aim by obtaining heterogeneous results using cutting-edge methods. Within the scope of the study, we research the causality connection for the G7 countries, which consist of developed economies where empirical discussions are concentrated, through a country-specific lens using historical datasets (1870–2020).

The following sections of this study, in which we create a new approach to the literature and a detailed map index for policymakers by internally modeling the smooth structural breaks in the examined period and investigating the causality relationship regarding different frequencies of the series, proceed as follows: The second part includes a review of previous empirical literature. The third section introduces the dataset and methodology. Following that, we will present and discuss the empirical findings. Finally, we will present the results of the study and policy recommendations.

2 Literature review

Theoretical discussions on the effect of PD on EG are much older than empirical studies. However, the interest in PD-EG the first quarter of the twenty-first century has made the empirical literature fragmented in terms of sample, period, and method. This section reviews ongoing PD-EG debates by categorizing them in terms of impact, threshold values, and causality. We take RR (2010a) as a starting point to review the empirical literature.

Can a threshold be found where PD begins to jeopardize EG? As we mentioned before, the debate was sparked by the hypothesis put forward by RR (2010a) that the threshold value of PD as a GDP ratio is 90% and that an increase of 10% will reduce real EG by 1%. Égert (2012, 2015a) and Herndon et al. (2014) found variations of the RR dataset in which exceeding the 90% threshold negatively affected EG, but the effect was not as severe as RR showed. However, these studies could not prevent heated debates to test the hypothesis of RR (2010a). Apart from pioneering studies, there are many dynamic and static panel threshold regression studies performed in which a 90% threshold value is investigated in the literature. Many of these researchers point out that the 90% threshold value is not a magic number as a valid or generally accepted determination for every situation. As in the laws of physics, within the scope of the discipline of economics, it would not be rational to expect everything to end abruptly or reverse once the threshold value is reached. In fact, this is also indicated by RR (2010b).

Afonso and Alves (2015), Afonso and Jalles (2013), Alsamara et al. (2024), Baum et al. (2013), Caner et al. (2010), Cecchetti et al. (2011), Chirwa and Odhiambo (2020), Égert (2015a, b), Law et al. (2021), Lee et al. (2017), Ndoricimpa (2020), and Suliková et al. (2015) asserted that the threshold value is below the 90%. Checherita-Westpal and Rother (2012) and Eberhardt and Presbitero (2015) stated that the threshold value may be around 90%, whereas Yolcu Karadam (2018) concluded that the threshold value may be above 90%. Meanwhile, Minea and Parent (2012) argued that a threshold value below 115% affects EG negatively, and that unlike in most of the empirical literature, there is a U-shaped relationship. Apart from all these, Arčabić et al. (2018), Bentour (2021), Chudik et al. (2017), and Turan and Varol Iyidogan (2023) stated that they could not determine a threshold value for the PD–EG relationship. Considering institutional factors within the scope of this relationship, Chiu and Lee (2017) and Kourtellos et al. (2013) stated that the effect of positive changes in institutional factors generates a threshold-boosting effect.

What effect does PD have on EG? It is also possible to mention many studies whose authors evaluate the PD–EG association in terms of the effect. In general, these researchers seek to answer the question of how and to what extent PD impacts EG. In terms of method, based on time series, Bal and Rath (2014), Barik and Sahu (2022), Gómez-Puig and Sosvilla-Rivero (2018), and Yoong et al. (2020) stated that PD negatively affects EG; Akram (2015) and Mhlaba and Phiri (2019), meanwhile, argued that the composition and maturity structure of PD, the areas in which it is used, and whether it creates a crowding-out effect would affect EG, so its effect is ambiguous.

In terms of panel data techniques, Asteriou et al. (2021), Gunarsa et al. (2020), Ighodalo Ehikioya et al. (2020), Liu and Lyu (2021), Onofrei et al. (2022), Presbitero (2012), and Woo and Kumar (2015) stated that PD has a negative impact on EG. Also, Gómez-Puig et al. (2022) and Gómez-Puig and Sosvilla-Rivero (2024) using panel data techniques with time-varying nature, and Albu and Albu (2021) using wavelet analysis, underlined the negative relationship between PD and EG, whereas Fincke and Greiner (2015) and Owusu-Nantwi and Erickson (2016) reported that it had a positive effect. However, Abubakar and Mammam (2021), Lof and Malinen (2014), Panizza and Presbitero (2014), and Turan and Yanikkaya (2021) stated that the relationship in question is statistically unstable. (See Appendix 1 for details on the methods, samples, and findings.)

What is the direction of the causal relationship between EG and PD? It seems possible to encounter many conclusions about all possibilities in the PD and EG literature. The negative relationship between PD and EG, found in many studies, is explained only by the sign of the estimated coefficient. This situation has two drawbacks, the first being that low EG will possibly lead to high PD (Bell et al. 2015; Dafermos 2015; Reinhart et al. 2012). Because the nominally decreasing GDP ratio is also in the denominator, it will increase the PD-to-GDP ratio without any change in the PD. Another factor is that in most empirical studies, the problem of endogeneity, which may cause this negative relationship, is overlooked. Ignoring the endogeneity problem causes the estimated coefficients to be biased, making the reliability of the findings debatable (Afonso and Jalles 2013). Furthermore, most empirical studies’ authors do not focus on country-specific results rather than panel data analyses in the PD–EG nexus, necessitating the discussion of cross-sectional dependance. Finally, the critical limitation of the literature is the attempt to model alternative EG theories (Kourtellos et al. 2013).

Table 1 demonstrates different findings: noncausality between PD and EG; unidirectional causality from PD to EG, [PD → EG]; unidirectional (reverse) causality from EG to PD, [EG → PD]; and bidirectional (feedback effect) causality between PD and EG, [PD ← → EG]. Table 1 also displays varying outcomes concerning the causal connections of asymmetric shocks between the variables.

Within the scope of studies examining the causality dimension of the PD-EG, relationship, there are researchers examining the total PD, and its components based on its source. Jacobs et al. (2020); Saungweme and Odhiambo (2020) reported a unidirectional Granger causality relationship: [EG → PD]. On the other hand, Ferreira, (2009) and Arčabić et al. (2018) pointed to findings regarding a bidirectional causality relationship [PD ← → EG]. Additionally, Ferreira, (2016) and Owusu-Nantwi and Erickson (2016) stated that bidirectional causality is valid only in the short run. Egbetunde (2012) and Jayaraman and Lau (2009) stated that domestic and external PD, has a bidirectional causal relationship with EG. In addition, among country-specific studies, Karagol (2002) for Turkiye, Butts (2009) for Uruguay use linear causality tests; Toktas et al. (2019) with AC for Turkiye reports the unidirectional causalities from the external PD to the EG.

Kempa and Khan (2016) found a unidirectional causal relationship PD → EG, for Canada, Italy, Germany, and Japan. Interestingly, the authors reported bidirectional causality for the long run in France, while they reported no causal relationship in the short run. While Di Sanzo and Bella (2015) determined causality relationships in different directions within the scope of nonlinear causality tests, De Vita et al. (2018) argue that there is no causal relationship within the scope of aforementioned tests. However, De Vita et al. (2018) stated that they did not attain robust results for a large part of the sample with either linear or nonlinear methods. In addition, Ozmen (2022) examined the relationship between positive and negative shocks in both PD and EG using the panel AC technique. Finally, Ozmen and Mutascu (2023) used Fourier Toda-Yamamoto (FTY) and AC tests to discuss the PD-EG nexus for the USA, the UK, Sweden and Japan.

3 Data and econometric methodology

Within the scope of this study, we will test the relationship between PD and EG in G7 countries using FTY and frequency domain causality methods. We compiled real GDP per capita index (EG) and PD-to-GDP (PD) data from the Macrohistory database (Jordà et al. 2017). We took the logarithms of series. Data range from 1870–2020 for Canada, Italy, the UK, and the USA; 1875–2020 for Japan; 1949–2020 for France; and 1950–2020 for Germany.

It is a methodological necessity to examine the stationary properties of a series with appropriate empirical techniques. Because to apply both time- and frequency-domain causality tests, it is necessary to know the maximum cointegration degrees of the series. The shocks that the time series are exposed to during the period are called structural breaks. These shocks can be caused by internal reasons such as economic crises, political fluctuations, or uncontrollable external causes such as natural disasters. Ignoring these structural breaks may produce biased results (Aydin and Bozatli 2023). Therefore, the Becker et al. (2006) Fourier-based Kwiatkowski–Phillips–Schmidt–Shin (FKPSS) test will be used in this study. Becker et al. (2006) developed the FKPSS method by applying Fourier terms to Kwiatkowski et al. (1992) the KPSS methodology. A priori information about the form and number of structural breaks is not required under the FKPSS. Another advantage of the FKPSS approach is that it allows modeling of smooth structural breaks.

The data generation process for the FKPSS test is as follows:

\(Z_{t} = \left[ {\sin (2\pi kt/T),\cos (2\pi kt/T)} \right]^{\prime}\) and \(\varepsilon_{t}\) represents the error term. The model used for the KPSS test is as follows:

To test the null hypothesis of trend stationarity versus the unit root alternative hypothesis, we calculate the test statistic as follows:

\(\tilde{S}_{t} = \sum\limits_{j = 1}^{t} {\hat{e}_{j} }\) and are the residues from the regression of yt on xt. In the following stages, we will use one of the time-domain causality methods, the FTY method described by Nazlioglu et al. (2016), to investigate the relationship between EG and PD. Additionally we will analyze the existence of a permanent or temporary causality relationship using the Breitung and Candelon (2006) frequency-domain causality method.

The time-domain causality test used in the study is based on the VAR-based Toda-Yamamoto (TY) (1995) causality approach. In the TY causality test, the optimal lag length (p) of the series and the maximum degree of cointegration (dmax) are considered, and it is estimated with a VAR model of order p + dmax. At this point, the success of the results produced by TY depends on the correct determination of p and dmax. That said, TY is criticized for not considering structural breaks and therefore producing biased results (Enders and Jones 2016). To compensate for the weaknesses of TY, Nazlioglu et al. (2016) developed the FTY causality test, which can also consider smooth structural breaks by including Fourier terms (equivalence 1) in the TY test.

Smooth structural breaks caused by economic, social, or political shocks to be followed in the series within the scope of FTY can also be modeled without an external diagnosis, and more reliable results can be obtained. However, according to Nazlioglu et al. (2019), as the sample size increases, the FTY approach produces more effective and reliable results than TY (Akca 2021; Pata and Aydin 2020). Therefore, in the first stage, the causal relationship between EG and PD will be discussed using the FTY approach. It is observed that the time domain approach is dominant in studies that currently investigate a limited number of causal relationships. However, these methods have some disadvantages in themselves. The first of these disadvantages is investigating for a single statistical value for the entire period. This situation prevents researchers from observing possible relationships at different frequencies of the series and revealing causal relationships. In addition, more than time-domain causality approaches is required to detect these relationships in cases where the causality relationship originates from more than one frequency and is temporary or permanent (Bozatli et al. 2023).

The datasets are divided into different frequencies in frequency domain causality tests, and the causality relationships between the series are tested. For this reason, the spectral density function is examined, and periodic fluctuations in the series can be detected (Aydin 2018; Gorus and Aydin 2019). In terms of theoretical development, the frequency domain causality approach was first introduced by Granger (1969) and then developed with the contributions of Geweke (1982), Hosoya (1991), and Breitung and Candelon (2006). Generalizing the suggestions of Geweke (1982), Breitung and Candelon (2006) proposed a frequency-domain causality test based on a bivariate finite-order VAR model:

In Eq. 5, Q(L) is an autoregressive polynomial and is defined as \(1 - \sum\limits_{i = 1}^{p} {Q_{i} } L_{i}\). The authors use the following VAR(p) model to examine frequency causation:

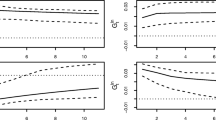

The two degrees of freedom chi-square distribution test the null hypothesis that no Granger causality exists at frequency w. Finally, values of [w] = 0.5 and 2.5 imply permanent and temporary causality, respectively. The empirical analysis process to be followed in the study is as illustrated in Fig. 1.

In summary, the first step in the empirical analysis is to investigate the stationarity properties of the variables. Then, following these two up-to-date causality methodologies, we test the validity of the relationships in the main hypotheses presented in Eqs. (7) and (8). The expression \(\nrightarrow\) implies the absence of a causal relationship.

The main objective of this study is to demonstrate the possibility of reverse causality (i.e., causality from EG to PD), contrary to the consensus and focus of debate in the literature. Moreover, by taking structural breaks and different frequency characteristics into account, we also consider the possible direction of these relationships both in terms of comparison with previous studies and to provide new insights. In doing so, we depart methodologically from previous studies. First, we use both time- and frequency domain-based methods to reveal the role of the time dimension in the PD–EG relationship. We also provide an opportunity to compare the impact of structural changes on the relationship between economic variables with previous empirical studies. Finally, we aim to identify temporary or permanent interactions beyond a single time horizon in the PD–EG relationship. Compared to time-varying models, this approach also utilizes the frequency information of the data instead of directly dividing time, thereby eliminating biases due to incomplete information.

4 Empirical results

First, we investigated the integration degrees of the variables using the FKPSS stationarity test, which considers structural breaks. Table 2 shows the results of the Fourier-based stationary test. The results show that under structural breaks in all countries, EG and PD series are stationary at the first difference, although they are nonstationary at the level. In other words, the degree of integration of the variables in all countries is I(1).

Using this information, we investigated the causal relationship between EG and PD using the FTY method, which considers smooth structural breaks. Table 3 shows the results of the Fourier-based causality test.

The results in Table 3 point to different causal relationships for the G7 countries. For example, Germany and the United States have a unidirectional causality relationship from EG to PD. Conversely, a causal relationship from PD and EG has been identified in the UK. Meanwhile, there is a bidirectional causality relationship between EG and PD in Italy and Japan. Finally, causality findings imply no causal relationship between Canada and France’s PD and EG. However, these findings are based only on the time domain approach. That said, there will likely be temporary or permanent causal relationships between the series. In this context, we investigated the periodic relationships between the series using the frequency domain causality method and present the results in Table 4.

The frequency-domain causality results presented in Table 4 point to remarkably interesting causal relationships. Although the time-domain causality test findings imply that there is no causal relationship in Canada, using the frequency-domain approach, we discover the existence of a temporal unidirectional causality from EG to PD. Conversely, we confirm that there is no causal relationship between PD and EG in France, even at different frequencies. Interestingly, in parallel with the FTY findings, we also confirm the existence of an interplay between EG and PD in Italy and Japan. However, as additional evidence, we reveal that the nature of this interaction is a permanent causal relationship. In the UK, meanwhile, we confirm the causal relationship from PD to EG, but we conclude that this relationship is temporary. Moreover, we reveal a persistent causal relationship from EG to PD in the UK. Finally, in contrast to the time-domain causality findings in Germany and the United States, we discover a persistent causal relationship from PD to EG. We present our summary findings from both approaches in Table 5.

The summarized findings in Table 5 imply several insights into the PD–EG nexus. Primarily, beyond the traditional perspective, it is understood that the relationship between PD and EG is not monotonic. In addition to the fact that there may not be a causal relationship between PD and EG, the relationship is likely to be a reverse or feedback effect. In other words, the different mechanisms of functioning between PD and EG are closely related to the unique characteristics of countries. In some countries, a moderate level of PD may affect EG positively or negatively and vice versa. In another scenario, low EG may be the cause of high PD, while high PD may be the cause of low EG. Apart from all these, there does not necessarily have to be any causal interaction. Moreover, addressing the relationship between PD and EG with a single time horizon provides a narrow understanding. However, neglecting the permanent or temporary relationships between the two variables with this perspective is akin to sweeping the problem under the carpet. The findings point to temporary or permanent aspects of the nature of the PD–EG relationship, justifying this view. Based on these insights and empirical evidence, we argue that the PD–EG relationship is not uniform, that structural breaks can affect the pattern and direction of causal relationships, and finally, that the nature of the relationship may change in a time-sensitive manner.

5 Discussion

Impact and threshold-based examinations of the PD–EG nexus provide information about existing conditions, but examining causality over a long period of time provides critical details for policy recommendations. For these reasons, in this study we mainly dealt with the causal links between EG and PD. In this context, we applied frequency-domain and Fourier-based causality tests, which are novel in the empirical literature, to the historical dataset covering 1870–2020 for the G7 countries. Whereas Fourier-based approaches are considered necessary in terms of capturing smooth structural breaks in the series, the frequency-domain causality test produces valuable results on whether the causality relationship is temporary or permanent because it does not consider the studied series as a whole and allows the causality relationship to be investigated at the different frequency levels. This process, which we follow methodologically, allows us to eliminate the limitations of time-domain causality tests widely used in the literature.

Both FTY and frequency-domain analysis show that there is no causal relationship for France, which is consistent with Barro-Ricardian equivalence hypothesis. Also, Panizza and Presbitero (2014) reported findings that there is no causal relationship. Although we obtained noncausality for Canada from FTY, frequency-domain results reveal temporary unidirectional causality from EG to PD. In comparison, whereas our time-domain causality test results are similar to those of Donayre and Taivan (2017), who examined the period 1970–2009, they differ from the unidirectional causality finding from EG to PD of Kempa and Khan (2016), who examined the period 1980Q1–2013Q4. This indicates the effect of observation frequency as well as the period examined in terms of causality. Therefore, it gives an idea of why frequency domain causality is important. Moreover, our FTY results present a unidirectional causality relationship from EG to PD for Germany and the United States. Similarly, Gómez-Puig and Sosvilla-Rivero (2015) and Kempa and Khan (2016) presented panel-level findings; Di Sanzo and Bella (2015), Donayre and Taivan (2017), and Puente-Ajovin and Sanso-Navarro (2015) also reported unidirectionality from EG to PD. Remarkably, our frequency-domain results provide evidence of a persistent unidirectional causal link from PD to EG for Germany and the United States. Using time-varying granger causality techniques, Gómez-Puig and Sosvilla-Rivero (2015) found a no-causal connection for Germany, whereas Kempa and Khan (2016) found a causal relationship for both Germany and the United States in full sample but not in short sample which covers 1980Q1–2007Q4. For Italy and Japan, we discerned bidirectional causal relationships in a permanent manner according to frequency domain causality. Similarly, for Italy, the findings on permanent bidirectional causality obtained with both methods are in parallel with those of Di Sanzo and Bella (2015) and Puente-Ajovin and Sanso-Navarro (2015). However, Ozmen (2022), who used the AC technique, did not find causality for Italy; using the time-varying causality approach, Gómez-Puig and Sosvilla-Rivero (2015) reported that they found a unidirectional causality relationship from PD to EG for Italy, as did Donayre and Taivan (2017) for Japan. Our FTY results for the United States are parallel to the time-domain causality results of Ozmen and Mutascu (2023) and support a unidirectional causal relationship from EG to PD. Our frequency-domain results, conversely, provide findings on bidirectional but permanent relations from EG to PD and temporary relations from PD to EG.

Researchers who examined different periods for developing countries interestingly reached conclusions about unidirectional causality from PD to EG. In the other part of the literature, causality studies conducted at the panel level reveal results that are far from consent (Arčabić et al. 2018; Butts 2009; Ferreira 2009, 2016; Gómez-Puig and Sosvilla-Rivero 2015; Jacobs et al. 2020; Jayaraman and Lau 2009; Panizza and Presbitero 2014; Puente-Ajovin and Sanso-Navarro 2015). In this context, it is possible to list studies whose authors applied linear and nonlinear techniques (De Vita et al. 2018; Di Sanzo and Bella 2015) and asymmetric methods (Kempa and Khan 2016; Ozmen and Mutascu 2023) to the causal relationship.

Before discussing policy recommendations, we would also like to compare our results with macroeconomic theory. It is possible to distinguish four different causality hypotheses within the scope of the ongoing theoretical debates in the PD and EG literature. The first is the situation associated with the Barro-Ricardian equivalence hypothesis, which argues that there is no causality in both directions (Panizza and Presbitero 2013). In other words, households that are aware that future taxes will finance the changes in the PD stock increase their savings in proportion to the change in the debt stock, and thus, PD ceases to be a determinant of EG. The second hypothesis is rooted in the Keynesian school and is based on the view that unidirectional causality runs from PD to EG in the short run. However, neoclassical and endogenous growth models state that PD can negatively affect EG through the crowding-out effect (in the long run) (Elmeskov and Sutherland 2012; Elmendorf and Mankiv 1999). The third hypothesis discusses unidirectional causality from EG to PD, also called path dependence or reverse causality. In other words, low long-term EG creates nominally high PD (Dafermos 2015). The fourth hypothesis is the intersection set of the traditional approach and path dependence. In this context, PD and EG have a bidirectional causal relationship, and this relationship is often called the feedback effect and hysteria hypothesis (Ozmen and Mutascu 2023).

In our study we deal with examples of countries not hitherto specifically examined in the empirical literature, using historical datasets with more than one novel model that has yet to be preferred. In addition, it is thought that the development of our study, which we carried out in the center of the G7 countries, which are developed economies, for developing and underdeveloped countries with excessive debt in the future, has the potential to present exciting results in terms of literature.

6 Conclusion and recommendations

Our investigation, in which we employed cutting-edge empirical techniques and analysis of historical datasets (1870–2020), has revealed multiple causal links between gross PD and real EG in G7 countries (Canada, France, Germany, Italy, Japan, UK, USA). Our study has yielded significant implications critical for the literature on the relationship between PD and EG. (a) Our 150-year dataset allows a long-run analysis of the PD–EG nexus and displays critical parameters to the heterogeneity across countries. Until now, the empirical literature has relied only on a handful of different techniques apart from the conventional Granger causality tests, which are generally time-domain. Of course, we do not deny the existence of studies on asymmetric, time-varying, and Fourier-based causality tests. (b) However, this study adds evidence from frequency-domain causality testing to the empirical literature agenda. (c) While taking traditional time-domain causality tests one step further by modeling soft structural breaks in time series with FTY, we reveal hidden causal relationships by investigating the causality connection at the lower frequencies of the time series with the frequency domain causality test. (d) Moreover, we reveal whether the causality relationship is temporary or permanent.

We would like to underline that there is no single “sacred” correct answer to the question of whether debt is blessing or curse because, within the scope of our analysis, debt sometimes appeared as a cause and sometimes as a result.

Such studies, which model the social and economic-based structural breaks observed in time series for a long period and whether the causal link is temporary or permanent, offer policymakers a detailed map index rather than a route. The heterogeneous results we obtained regarding the PD–EG nexus show that there cannot be a unique solution to the puzzle, with the main reason being heterogeneity in country-specific macroeconomic conditions, political objectives, and debt absorption capacities. However, this does not prevent us from making some inferences based on similarities in debt stock and shared risks.

In the light of our findings and our ongoing examination of the continuing discussions in the theoretical literature, we can offer some policy suggestions to mitigate the possible negative effects of PD on EG, to attain maximum efficiency from PD, and to benefit more from the positive gains of PD. Initially, we are addressing the unidirectional causality from PD to EG. Policymakers should prepare countercyclical fiscal policies for slowing down public deficits to ease possible adverse effects of PDs. To achieve this target, countries should improve their budget capacities to manage potential forthcoming shocks. Therefore, it would be rational to refocus on fiscal austerity for expenditure-side policies rather than engage in additional borrowing to finance anticipated public expenditures. Additional borrowings to be financed by increasing tax rates regarding the existing tax base have the risk of exacerbating the economic contraction by limiting disposable income and private sector savings. Therefore, additional steps must be taken to expand the tax base to avoid tax pressure.

That said, what needs to be done for examples containing the finding of unidirectional causality from EG to PD is slightly different. In this context, policies need to be examined from the perspective of EG. First, contractionary monetary policies combating inflationary processes create an economic cooling process by initiating interest rate cycles. These conditions will make borrowable funds more expensive, the alternative cost of investments higher, and the burden of debt service heavier. While this process continues, great importance should be given to ensuring that PD is at a sustainable level so as not to create an additional burden due to risks. Furthermore, the reverse causality or low growth–high debt spiral is a risk that policymakers should pay attention to. Additionally, contractionary, monetary, and expansionary fiscal policy practices will not be sufficient to ensure stability in today’s conditions where the interest responsiveness of investments increases. To ensure macroeconomic stability, these policies need to be harmonized with each other.

Finally, the feedback effect (hysteria hypothesis) should not be disregarded. Macroeconomic instabilities such as pandemics and wars that led to the contraction of the global economy and inflation that emerged after these shocks have led to both an increase in PD and a tightening in EG. Great attention should be paid to delays in the withdrawal of fiscal support packages, which are the main reason for the exceptional fiscal deficits of G7 economies that lead to an expansion of the debt stock. Limiting PD is not an adequate solution because continuing fiscal expansion could strengthen inflationary pressure and lead to higher borrowing costs and increasing PD, subsequently negatively affecting global growth. Moreover, the fact that PD is a burden for future generations should be taken into consideration, and intergenerational equity should not remain in the background in these discussions.

PD and EG are multi-layered riddle in structure. For the G7 countries examined, we did not encounter any obvious barriers created by PD in terms of EG. In the empirical literature, in studies examining the nonlinear structure of the PD-EG connection, there is a convincing harmony that the PD to GDP threshold value for developed economies is 90–100%. When we combine all these possibilities, we are in the prohibitive part of the Laffer-type PD-EG connection for G7 countries. Many indicators, such as the global PD stock reaching $92 trillion, increasing economic instability, and slowing global EG, indicate that the first stone that will cause a domino effect has fallen. It should not be ignored that a causal relationship exists between public budget deficits and PD stock. Shortly, contractionary monetary policies and fiscal austerity initiatives will radically change economic conditions. These conditions require a multidimensional examination of public debt-economic growth theories, especially the reverse causality relationship regarding the PD-EG connection.

Finally, the idea that the causal relationship can be from EG to PD and PD to EG should be addressed. In other words, the possibilities of reverse causality or bidirectional causality between PD and EG are issues to be considered in future studies. We should include some limitations and recommendations before concluding the study. In this context, our main limitation is that our dataset focuses only on developed countries and assumes that there is no effect of possible instrumental variables. In addition, the fact that the total PD is considered is our limitation. In future studies, examining the causality of explanatory variables related to PD and EG will possibly provide beneficial findings to the literature. Moreover, in causality studies to be conducted with recent techniques in future studies, modeling economic crises or institutional factors as instrumental variables by separating PD into its components and expanding the preferred samples to include developing or underdeveloped countries will provide exciting results in terms of the development of the literature.

References

Abubakar AB, Mamman SO (2021) Permanent and transitory effect of public debt on economic growth. J Econ Stud 48(5):1064–1083. https://doi.org/10.1108/JES-04-2020-0154

Afonso A, Alves J (2015) The role of government debt in economic growth. Rev Public Econ 215(4):9–26. https://doi.org/10.7866/HPE-RPE.15.4.1

Afonso A, Jalles JT (2013) Growth and productivity: the role of government debt. Int Rev Econ Financ 25:384–407. https://doi.org/10.1016/j.iref.2012.07.004

Akca H (2021) Environmental Kuznets Curve and financial development in Turkey: evidence from augmented ARDL approach. Environ Sci Pollut Res 28(48):69149–69159. https://doi.org/10.1007/s11356-021-15417-w

Akram N (2015) Is public debt hindering economic growth of the Philippines? Int J Soc Econ 42(3):202–221. https://doi.org/10.1108/IJSE-02-2013-0047

Albu A-C, Albu L-L (2021) Public debt and economic growth in Euro area countries. A wavelet approach. Technol Econ Dev Econ. https://doi.org/10.3846/tede.2021.14241

Alsamara M, Mrabet Z, Mimouni K (2024) The threshold effects of public debt on economic growth in MENA countries: Do energy endowments matter? Int Rev Econ Finan 89:458–470. https://doi.org/10.1016/j.iref.2023.10.015

Arčabić V, Tica J, Lee J, Sonora RJ (2018) Public debt and economic growth conundrum: nonlinearity and inter-temporal relationship. Stud Nonlinear Dyn Econ. https://doi.org/10.1515/snde-2016-0086

Asteriou D, Pilbeam K, Pratiwi CE (2021) Public debt and economic growth: panel data evidence for Asian countries. J Econ Finance 45(2):270–287. https://doi.org/10.1007/s12197-020-09515-7

Aydin M (2018) Natural gas consumption and economic growth nexus for top 10 natural Gas-Consuming countries: a Granger causality analysis in the frequency domain. Energy 165:179–186. https://doi.org/10.1016/j.energy.2018.09.149

Aydin M, Bozatli O (2023) The impacts of the refugee population, renewable energy consumption, carbon emissions, and economic growth on health expenditure in Turkey: new evidence from Fourier-based analyses. Environ Sci Pollut Res 30(14):41286–41298. https://doi.org/10.1007/s11356-023-25181-8

Bal DP, Rath BN (2014) Public debt and economic growth in India: a reassessment. Econ Anal Policy 44(3):292–300. https://doi.org/10.1016/j.eap.2014.05.007

Barik A, Sahu JP (2022) The long-run effect of public debt on economic growth: evidence from India. J Public Aff 22(1):1–9. https://doi.org/10.1002/pa.2281

Baum A, Checherita-Westphal C, Rother P (2013) Debt and growth: new evidence for the euro area. J Int Money Financ 32:809–821. https://doi.org/10.1016/j.jimonfin.2012.07.004

Becker R, Enders W, Lee J (2006) A stationarity test in the presence of an unknown number of smooth breaks. J Time Ser Anal 27(3):381–409. https://doi.org/10.1111/j.1467-9892.2006.00478.x

Bell A, Johnston R, Jones K (2015) Stylised fact or situated messiness? The diverse effects of increasing debt on national economic growth. J Econ Geogr 15(2):449–472. https://doi.org/10.1093/jeg/lbu005

Bentour EM (2021) On the public debt and growth threshold: One size does not necessarily fit all. Appl Econ 53(11):1280–1299. https://doi.org/10.1080/00036846.2020.1828806

Bozatli O, Bal H, Albayrak M (2023) Testing the export-led growth hypothesis in Turkey: new evidence from time and frequency domain causality approaches. J Int Trade Econ Dev 32(6):835–853. https://doi.org/10.1080/09638199.2022.2144932

Breitung J, Candelon B (2006) Testing for short- and long-run causality: a frequency-domain approach. J Econ 132(2):363–378. https://doi.org/10.1016/j.jeconom.2005.02.004

Butts HC (2009) Short term external debt and economic growth—granger causality: evidence from Latin America and the Caribbean. Rev Black Polit Econ 36(2):93–111. https://doi.org/10.1007/s12114-009-9041-7

Caner M, Grennes TJ, Kohler-Geib FN (2010) Finding the tipping point—when sovereign debt turns bad. Policy Research Working Paper Series 5391, The World Bank. https://doi.org/10.2139/ssrn.1612407

Cecchetti SG, Mohanty MS, Zampolli F (2011) The real effects of debt. BIS Working Paper Series 352. https://papers.ssrn.com/abstract=1946170

Checherita-Westphal C, Rother P (2012) The impact of high government debt on economic growth and its channels: an empirical investigation for the euro area. Eur Econ Rev 56(7):1392–1405. https://doi.org/10.1016/j.euroecorev.2012.06.007

Chirwa TG, Odhiambo NM (2020) Public debt and economic growth nexus in the euro area: a dynamic panel ARDL approach. Sci Ann Econ Bus 67(3):291–310. https://doi.org/10.47743/saeb-2020-0016

Chiu Y-B, Lee C-C (2017) On the impact of public debt on economic growth: Does country risk matter? Contemp Econ Policy 35(4):751–766. https://doi.org/10.1111/coep.12228

Chudik A, Mohaddes K, Pesaran MH, Raissi M (2017) Is there a debt-threshold effect on output growth? Rev Econ Stat 99(1):135–150. https://doi.org/10.1162/REST_a_00593

Cochrane JH (2011) Understanding policy in the great recession: Some unpleasant fiscal arithmetic. Eur Econ Rev 55(1):2–30. https://doi.org/10.1016/j.euroecorev.2010.11.002

Dafermos Y (2015) The ‘other half’of the public debt–economic growth relationship: a note on Reinhart and Rogoff. Eur J Econ Econ Policies 12(1):20–28. https://doi.org/10.4337/ejeep.2015.01.03

De Vita G, Trachanas E, Luo Y (2018) Revisiting the bi-directional causality between debt and growth: evidence from linear and nonlinear tests. J Int Money Financ 83:55–74. https://doi.org/10.1016/j.jimonfin.2018.02.004

Di Sanzo S, Bella M (2015) Public debt and growth in the euro area: evidence from parametric and nonparametric Granger causality. The BE J Macroecon 15(2):631–648. https://doi.org/10.1515/bejm-2014-0028

Donayre L, Taivan A (2017) Causality between public debt and real growth in the OECD: a country-by-country analysis. Econ Pap J Appl Econ Policy 36(2):156–170. https://doi.org/10.1111/1759-3441.12175

Eberhardt M, Presbitero AF (2015) Public debt and growth: heterogeneity and non-linearity. J Int Econ 97(1):45–58. https://doi.org/10.1016/j.jinteco.2015.04.005

Egbetunde T (2012) Public debt and economic growth in Nigeria: evidence from granger causality. Am J Econ 2:101–106. https://doi.org/10.5923/j.economics.20120206.02

Égert B (2015a) Public debt, economic growth and nonlinear effects: Myth or reality? J Macroecon 43:226–238. https://doi.org/10.1016/j.jmacro.2014.11.006

Égert B (2015b) The 90% public debt threshold: the rise and fall of a stylized fact. Appl Econ 47(34–35):3756–3770. https://doi.org/10.1080/00036846.2015.1021463

Égert B (2012) Public debt, economic growth and nonlinear effects: Myth or reality? (OECD Economics Department Working Papers No. 993; pp 1–34. OECD. https://doi.org/10.1787/5k918xk8d4zn-en

Elmendorf DW, Gregory Mankiw N (1999) Chapter 25:Government debt. In: Handbook of macroeconomics, Vol 1, pp 1615–1669. Elsevier. https://doi.org/10.1016/S1574-0048(99)10038-7

Elmeskov J, Sutherland D (2012). Post-Crisis Debt Overhang: Growth Implications across Countries. https://doi.org/10.2139/ssrn.1997093

Enders W, Jones P (2016) Grain prices, oil prices, and multiple smooth breaks in a VAR. Stud Nonlinear Dyn Econom 20(4):399–419. https://doi.org/10.1515/snde-2014-0101

Ferreira C (2016) Debt and economic growth in the european union: a panel granger causality approach. Int Adv Econ Res 22(2):131–149. https://doi.org/10.1007/s11294-016-9575-y

Ferreira MC (2009) Public debt and economic growth: a Granger causality panel data approach. IESG Working Papers 24/2009/DE/UECE. https://www.repository.utl.pt/handle/10400.5/1863

Fincke B, Greiner A (2015) Public debt and economic growth in emerging market economies. S Afr J Econ 83(3):357–370. https://doi.org/10.1111/saje.12079

Geweke J (1982) Measurement of linear dependence and feedback between multiple time series. J Am Stat Assoc 77(378):304–313. https://doi.org/10.1080/01621459.1982.10477803

Gómez-Puig M, Sosvilla-Rivero S (2015) The causal relationship between debt and growth in EMU countries. J Policy Model 37(6):974–989. https://doi.org/10.1016/j.jpolmod.2015.09.004

Gómez-Puig M, Sosvilla-Rivero S (2018) Public debt and economic growth: further evidence for the euro area. Acta Oeconomica 68(2):209–229. https://doi.org/10.1556/032.2018.68.2.2

Gómez-Puig M, Sosvilla-Rivero S (2024) Assessing heterogeneous time-varying impacts in debt-growth nexus. Appl Econ. https://doi.org/10.1080/00036846.2024.2311068

Gómez-Puig M, Sosvilla-Rivero S, Martínez-Zarzoso I (2022) On the heterogeneous link between public debt and economic growth. J Int Finan Markets Inst Money 77:101528. https://doi.org/10.1016/j.intfin.2022.101528

Gorus MS, Aydin M (2019) The relationship between energy consumption, economic growth, and CO2 emission in MENA countries: causality analysis in the frequency domain. Energy 168:815–822. https://doi.org/10.1016/j.energy.2018.11.139

Granger CW (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica. https://doi.org/10.2307/1912791

Gunarsa S, Makin T, Rohde N (2020) Public debt in developing Asia: A help or hindrance to growth? Appl Econ Lett 27(17):1400–1403. https://doi.org/10.1080/13504851.2019.1683147

Herndon T, Ash M, Pollin R (2014) Does high public debt consistently stifle economic growth? A critique of Reinhart and Rogoff. Camb J Econ 38(2):257–279. https://doi.org/10.1093/cje/bet075

Hosoya Y (1991) The decomposition and measurement of the interdependency between second-order stationary processes. Probab Theory Relat Fields 88(4):429–444. https://doi.org/10.1007/BF01192551

Ighodalo Ehikioya B, Omankhanlen AE, Osagie Osuma G, Iwiyisi Inua O (2020) Dynamic relations between public external debt and economic growth in African countries: A curse or blessing? J Open Innov Technol Mark Complex 6(3):88. https://doi.org/10.3390/joitmc6030088

Jacobs J, Ogawa K, Sterken E, Tokutsu I (2020) Public debt, economic growth and the real interest rate: a panel VAR approach to EU and OECD countries. Appl Econ 52(12):1377–1394. https://doi.org/10.1080/00036846.2019.1673301

Jayaraman TK, Lau E (2009) Does external debt lead to economic growth in Pacific island countries. J Policy Model 31(2):272–288. https://doi.org/10.1016/j.jpolmod.2008.05.001

Jordà Ò, Schularick M, Taylor AM (2017) Macrofinancial history and the new business cycle facts. NBER Macroecon Annu 31(1):213–263. https://doi.org/10.1086/690241

Kaminsky GL, Reinhart CM, Végh CA (2004) When It rains, it pours: procyclical capital flows and macroeconomic policies. NBER Macroecon Annu 19:11–53. https://doi.org/10.1086/ma.19.3585327

Karagol E (2002) The causality analysis of external debt service and GNP: the case of Turkey. Central Bank Rev 2(1):39–64

Kempa B, Khan NS (2016) Government debt and economic growth in the G7 countries: Are there any causal linkages? Appl Econ Lett 23(6):440–443. https://doi.org/10.1080/13504851.2015.1080797

Kourtellos A, Stengos T, Tan CM (2013) The effect of public debt on growth in multiple regimes. J Macroecon 38:35–43. https://doi.org/10.1016/j.jmacro.2013.08.023

Kwiatkowski D, Phillips PCB, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? J Econ 54(1):159–178. https://doi.org/10.1016/0304-4076(92)90104-Y

Law SH, Ng CH, Kutan AM, Law ZK (2021) Public debt and economic growth in developing countries: nonlinearity and threshold analysis. Econ Model 98:26–40. https://doi.org/10.1016/j.econmod.2021.02.004

Lee S, Park H, Seo MH, Shin Y (2017) Testing for a debt-threshold effect on output growth. Fisc Stud 38(4):701–717. https://doi.org/10.1111/1475-5890.12134

Liu Z, Lyu J (2021) Public debt and economic growth: Threshold effect and its influence factors. Appl Econ Lett 28(3):208–212. https://doi.org/10.1080/13504851.2020.1740157

Lof M, Malinen T (2014) Does sovereign debt weaken economic growth? A panel VAR analysis. Econ Lett 122(3):403–407. https://doi.org/10.1016/j.econlet.2013.12.037

Mencinger J, Aristovnik A, Verbic M (2014) The Impact of growing public debt on economic growth in the European Union. Amfiteatru Econ J 16(35):403–414

Mhlaba N, Phiri A (2019) Is public debt harmful towards economic growth? New evidence from South Africa. Cogent Econ Finance 7(1):1603653. https://doi.org/10.1080/23322039.2019.1603653

Minea A, Parent A (2012) Is high public debt always harmful to economic growth? Reinhart and Rogoff and some complex nonlinearities. Working Paper E2012.18; Etudes et Documents, CERDI. https://ideas.repec.org//p/cdi/wpaper/1355.html

Nazlioglu S, Gormus NA, Soytas U (2016) Oil prices and real estate investment trusts (REITs): gradual-shift causality and volatility transmission analysis. Energy Econ 60:168–175. https://doi.org/10.1016/j.eneco.2016.09.009

Nazlioglu S, Gormus A, Soytas U (2019) Oil prices and monetary policy in emerging markets: structural shifts in causal linkages. Emerg Mark Financ Trade 55(1):105–117. https://doi.org/10.1080/1540496X.2018.1434072

Ndoricimpa A (2020) Threshold effects of public debt on economic growth in Africa: a new evidence. J Econ Dev 22(2):187–207. https://doi.org/10.1108/JED-01-2020-0001

Okwoche PU, Nikolaidou E (2022) Public debt, growth, and threshold effects: A comparative analysis based on income categories. School of Economics, University of Cape Town (No. 2022–02)

Onofrei M, Bostan I, Firtescu BN, Roman A, Rusu VD (2022) Public debt and economic growth in EU Countries. Economies 10(10):1–23. https://doi.org/10.3390/economies10100254

Owusu-Nantwi V, Erickson C (2016) Public debt and economic growth in Ghana. Afr Dev Rev 28(1):116–126. https://doi.org/10.1111/1467-8268.12174

Ozmen I (2022) New evidence from government debt and economic growth in core and periphery European Union Countries: asymmetric panel causality. J Econ Forecast 3:167–187

Ozmen I, Mutascu M (2023) Public debt and growth: new insights. J Knowl Econ. https://doi.org/10.1007/s13132-023-01441-3

Panizza U, Presbitero AF (2013) Public debt and economic growth in advanced economies: a survey. Swiss J Econ Stat 149:175–204. https://doi.org/10.1007/BF03399388

Panizza U, Presbitero AF (2014) Public debt and economic growth: Is there a causal effect? J Macroecon 41(1):21–41. https://doi.org/10.1016/j.jmacro.2014.03.009

Pata UK, Aydin M (2020) Testing the EKC hypothesis for the top six hydropower energy-consuming countries: evidence from Fourier Bootstrap ARDL procedure. J Clean Prod 264:121699. https://doi.org/10.1016/j.jclepro.2020.121699

Presbitero AF (2012) Total public debt and growth in developing countries. Eur J Dev Res 24(4):606–626. https://doi.org/10.1057/ejdr.2011.62

Puente-Ajovín M, Sanso-Navarro M (2015) Granger causality between debt and growth: evidence from OECD countries. Int Rev Econ Financ 35:66–77. https://doi.org/10.1016/j.iref.2014.09.007

Reinhart CM, Rogoff KS (2010a) Growth in a time of debt. Am Econ Rev 100(2):573–578. https://doi.org/10.1257/aer.100.2.573

Reinhart CM, Reinhart VR, Rogoff KS (2012) Public debt overhangs: advanced-economy episodes since 1800. J Econ Perspect 26(3):69–86. https://doi.org/10.1257/jep.26.3.69

Reinhart C, Rogoff K (2010b) Debt and growth revisited. MPRA Paper 24376, University Library of Munich, Germany

Saungweme T, Odhiambo NM (2020) Causality between public debt, public debt service and economic growth in an emerging economy. Studia Universitatis Babes Bolyai Oeconomica 65(1):1–19

Šuliková V, Djukic M, Gazda V, Horváth D, Kulhánek L (2015) Asymmetric impact of public debt on economic growth in selected EU countries. J Econ 63(9):944–958

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66(1):225–250. https://doi.org/10.1016/0304-4076(94)01616-8

Toktas Y, Altiner A, Bozkurt E (2019) The relationship between Turkey’s foreign debt and economic growth: an asymmetric causality analysis. Appl Econ 51(26):2807–2817. https://doi.org/10.1080/00036846.2018.1558360

Turan T, Varol Iyidogan P (2023) Non-linear impacts of public debt on growth, investment and credit: a dynamic panel threshold approach. Prague Econ Pap 32(2):107–128. https://doi.org/10.18267/j.pep.825

Turan T, Yanikkaya H (2021) External debt, growth and investment for developing countries: some evidence for the debt overhang hypothesis. Port Econ J 20(3):319–341. https://doi.org/10.1007/s10258-020-00183-3

Uchida Y, Ono T (2021) Political economy of taxation, debt ceilings, and growth. Eur J Polit Econ 68:101996. https://doi.org/10.1016/j.ejpoleco.2020.101996

UNCTAD (2023) A World of Debt A growing burden to global prosperity. United Nations. https://unctad.org/publication/world-of-debt/dashboard

Woo J, Kumar MS (2015) public debt and growth. Economica 82(328):705–739. https://doi.org/10.1111/ecca.12138

Yolcu Karadam D (2018) An investigation of nonlinear effects of debt on growth. J Econ Asymmetries 18:e00097. https://doi.org/10.1016/j.jeca.2018.e00097

Yoong FT, Latip ARA, Sanusi NA, Kusairi S (2020) Public debt and economic growth nexus in Malaysia: an ARDL approach. J Asian Finance Econ Bus 7(11):137–145. https://doi.org/10.13106/JAFEB.2020.VOL7.NO11.137

Funding

Open access funding provided by the Scientific and Technological Research Council of Türkiye (TÜBİTAK). Open access funding provided by the Scientific and Technological Research Council of Türkiye (TÜBİTAK).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that he has no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bozatli, O., Serin, S.C. & Demir, M. The causal relationship between public debt and economic growth in G7 countries: new evidence from time and frequency domain approaches. Econ Change Restruct 57, 136 (2024). https://doi.org/10.1007/s10644-024-09716-8

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10644-024-09716-8