Abstract

This study investigates whether manufactured exports contribute to economic growth and whether imports can augment the role of exports in fostering export diversification. In the case of the latter, the study also examines which categories of imports are most likely to facilitate economic growth in the long run. In particular, the study focuses on the case of Kuwait over the period 1970–2019 and utilizes a Cobb–Douglas production function augmented with manufactured exports and primary and manufactured imports. The long-run relationships between the model variables are explored using two cointegration tests, namely the Johansen test and the dynamic ordinary least squares. The short-run causality is investigated utilizing the multivariate Granger approach in a vector autoregressive model, the parameters of which are assessed for stability using the CUSUM of squares test and recursive residuals plots. To examine the causal relationships in the long run, the Toda and Yamamoto test is applied. The cointegration tests show that the variables are cointegrated, while the Granger causality test shows that manufactured exports and disaggregated imports, together with the inputs of production, cause economic growth in the short run, which, in turn, leads to import growth. In the long run, the expansion of both primary and manufactured imports drives export diversification, whereas manufactured exports do not contribute to economic growth. These findings are very important for Kuwait’s policymakers to consider in their plans to implement Kuwait Vision 2035 as overseas demand for oil wanes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Numerous studies have shown that manufactured export expansion facilitates an increase in intermediate and capital goods imports needed for manufacturing. This leads to technological advancement and increased investment, higher productivity and the development of human capital, all of which lead to more rapid economic growth. Economic growth, in turn, finances further import expansion, permitting export diversification (Coe and Helpman 1995; Herzer et al. 2006; Kalaitzi and Cleeve 2018). However, the degree to which imports positively affect economic growth and, in turn, the expansion of exports depends on the categories of exports and imports in which the expansion occurs.

At the same time, evidence from a number of studies suggests that primary exports expansion either hinders economic growth (Sachs and Warner 1995; Sheridan 2014) or has no impact (Levin and Raut 1997), as unlike manufacturing, primary exports fail to offer positive externalities and knowledge spillovers to non-export sectors (Greenaway et al. 1999; Herzer et al. 2006). In contrast, primary imports can accelerate economic growth, as they are used as inputs in manufacturing production (Kalaitzi 2018; Wamalwa and Were 2019), providing a country has the capacity to take advantage of the technology in imported goods (Oghanna 2015). Similarly, imports of manufactured goods may contribute to economic growth, through technology transfer and know-how (Belitz and Mölders 2016). Further, as Wagner (2012) suggests, both exports and imports have a greater impact on the productivity and competitiveness of manufacturers than they do on those of primary good producers. Trade in manufactured goods is also more likely to foster improved transportation, communications, financial intermediation and other forms of business infrastructure (Lee and McKibbin 2018). What is not clear is whether these relationships hold for an economy heavily dependent on a single output: in the case of Kuwait, oil. Kuwait is widely viewed as the most oil-dependent nation among GCC states, if not the world, and, within the Gulf region, the country that has made the least progress toward economic diversification (Ellis 2021; Telci and Rakipoglu 2021). This is in spite of the fact that, following a report prepared by former British prime minister Tony Blair in 2010, Kuwait embarked on an economic and social development plan known as Kuwait Vision 2035. A central theme of the plan was to diversify the nation’s economy. However, to date, the plan’s mission remains unfulfilled, with infrastructure projects stalled, record government budget deficits (Middle East Institute 2021) and the downgrading of the national debt twice by S&P Global Ratings in the past two years (Bloomberg 2021).

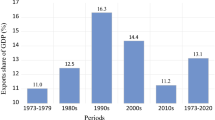

During the period 1970–2019, Kuwait’s real manufactured exports increased at an average annual growth rate of 8.9%, while primary and manufactured imports increased at average rates of 5.2 and six percent, respectively. Although trade has expanded significantly, the real gross domestic product (GDP) of Kuwait has only increased at an average annual rate of 2.3%, while global GDP growth and that of high-income countries have been estimated at 3.1 and 2.6%, respectively, for this period. The present study examines the effects of manufactured exports and imports on economic growth in Kuwait and attempts to identify the category(ies) of imports that contribute most to export diversification.

Previous evidence for Kuwait has shown that a bi-directional causality runs between exports of goods and economic growth, while imports cause economic growth in the short run. In the long run, the causality runs from imports to economic growth, and from imports and economic growth to exports (Kalaitzi and Chamberlain 2021). It should be noted that the causality among manufactured exports, disaggregated imports and economic growth does not appear to have been examined previously. By investigating whether an increase in the level of trade diversification will foster further economic growth in Kuwait, this study contributes to the discussion and planning in oil-dependent nations like Kuwait as they endeavor to maintain and build their economies in a post-oil world.

The results of this study show that manufactured exports and disaggregated imports, together with domestic investment and human capital, jointly cause short-run economic growth in Kuwait. In turn, economic growth causes the expansion of both primary and manufactured imports. In the long run, causality runs from primary and manufactured imports to manufactured exports, while there is no causal relationship between manufactured exports and economic growth. In keeping with Sheridan (2014), this suggests that a country must develop its human capital and build its infrastructure in order to transform successfully from a reliance on primary exports to a diversified export sector that includes manufactured goods or services.

The rest of this study is structured as follows: Sect. 2 reviews the literature on the relationships between exports, imports and economic growth. Section 3 presents the study’s methodology, while Sects. 4 and 5 present the empirical results, conclusions and policy implications.

2 Literature review

The economic development literature highlights the importance of exports in economic growth. Export expansion enhances productivity via increasing specialization level in export-oriented sectors, allowing economies of scale, the optimal reallocation of resources, the financing of imports and infrastructure, and the development of human capital essential for manufacturing production and economic growth. This expansion of exports and imports can lead to technology transfer, especially in the export-oriented manufacturing sector, increased investment and the fostering of further economic growth (Baharumshah and Rashid 1999; Ramos 2001; Thangavelu and Rajaguru 2006; Ferreira 2009; Zang and Baimbridge 2012; Sultanuzzaman et al. 2019, Sultanuzzaman et al 2020). In turn, economic growth can contribute to further export growth by improving the existing infrastructure, physical capital and technology enhancements via imports (Shahbaz 2012; Sunde 2017; Çevik et al. 2019).

Baharumshah and Rashid (1999), using a vector autoregressive framework, examine the causality among exports, imports and economic growth in Malaysia over the period 1970–1994. They provide evidence that, in the short run, a bi-directional causality runs between total exports and economic growth, while in the long run, total exports and economic growth jointly cause imports, and imports and economic growth jointly cause total exports. As for manufacturing exports, the authors find that the causality runs from manufacturing exports to economic growth in the short run, while all variables jointly cause economic growth, manufacturing exports and imports. Ramos (2001), using the same methodology, examines the causality among exports, imports and economic growth in Portugal over the period 1965–1998. Like Baharumshah and Rashid, Ramos finds a bi-directional causality between exports and economic growth and also provides evidence of bi-directional causality between imports and economic growth in the short run. He also shows that no causality exists between imports and exports; however, all variables jointly cause economic growth, export and imports in the long run.

Thangavelu and Rajaguru (2006) examine the relationships among exports, imports and labor productivity in the manufacturing sector for rapidly developing Asian countries, using the Johansen cointegration test and Granger causality tests in a VECM framework. Their results show that countries that experience export-led growth, such as India, Malaysia, Philippines and Singapore, also experience import-led growth, indicating that export expansion causes productivity growth, increasing export earnings, financing imports and improving productivity. In contrast, in some countries, such as Indonesia and Taiwan, only the import-led growth hypothesis is valid, indicating that imports, in the form of capital goods or intermediate materials, are a channel for technology transfer into the economy, increasing productivity in the manufacturing sector. These results indicate that exports and imports are important for economic growth. As Thangavelu and Rajaguru note, “in an outer-oriented strategy, countries should allow greater flow of goods and services into the domestic economy by promoting trade in both exports as well as imports” (p. 1090).

Ferreira (2009) examines the causality among exports and economic growth in Costa Rica over the periods 1960–2007 and 1965–2006. Using the long-run Toda–Yamamoto causality test, the study provides evidence that exports cause economic growth only when imports are included, irrespectively of the inclusion or not of exogenous variables such as foreign economic shocks. Ferreira shows that the causality among exports and economic growth is also affected indirectly via imports, while imports directly cause exports, indicating that imports constitute inputs for export-oriented production.

Zang and Baimbridge (2012) examine the causality among exports, imports and economic growth for Japan and South Korea over the periods 1957–2003 and 1963–2003, respectively, using a Granger causality test in a vector autoregressive framework. The study finds that a bi-directional causality runs between imports and economic growth for both countries, indicating that foreign technology embodied in imports improves economic growth.Footnote 1 As for the exports-economic growth nexus, Japan experiences export-led growth with no feedback effect, while in South Korea economic growth has a negative effect on export growth. As Zang and Baimbridge note, in the case of Japan, export earnings are directed back into the economy, leading to further economic growth, while in South Korea, economic growth leads to a decrease in export growth, suggesting that increased output is diverted to the domestic market.

A recent study by Sultanuzzaman et al. (2019), using a generalized method of moments (GMM) model, examines the impact of exports and technology on economic growth in sixteen emerging Asian countries. The study provides evidence of a positive and significant effect of exports and technology on economic growth in both the short run and the long run. As the authors note, policies that accelerate technology improvement and trade may foster sustained economic growth.

The extent to which exports enhance economic growth, and, in turn, economic growth drives export expansion further, it depends on the type of exported and imported goods in which the expansion takes place. In particular, expansion of primary exports can decelerate economic growth, while manufacturing exports can accelerate economic growth, through knowledge spillovers to the whole economy (Fosu 1990; Gylfason et al. 1999; Sala-i-Martin and Subramanian 2003; Behdubi et al. 2010; Kalaitzi and Cleeve 2018; Kalaitzi and Chamberlain 2020). At the same time, based on an examination of export composition and economic growth in Sri Lanka, Dunusinge (2009) concludes that growth will be limited to the export sector in the absence of infrastructure to facilitate spill overs to other sectors. As for imports, primary and capital goods in the form of raw material and technology transfer are essential for the export-oriented manufacturing production (Zhang and Zou 1995; Alam 2003; Kilavuz and Altay Topcu 2012; Belitz and Mölders 2016; Kalaitzi 2018).

Fosu (1990), using data for sixty-four developing countries over the period 1960–1980 and a production function, notes that the heterogeneity of exports explains the variation in the economic growth rate among different nations. The results show that in countries with lower level of development, primary exports have a negligible effect on economic growth. In contrast, an expansion of the manufacturing export sector can accelerate economic growth. In addition, Gylfason et al. (1999), using cross-sectional and panel regressions, provide evidence that a negative relationship exists between primary exports and economic growth for 125 countries over the period 1960–1992. Similar results are obtained by Sala-i-Martin and Subramanian (2003), who find that natural resource exports have a negative effect on long-run economic growth in seventy-one countries over the period 1960–1998.

Greenaway et al. (1999), using a GMM approach, examine the relationship between export composition and economic growth among sixty-nine countries between 1975 and 1998. They find that manufactured exports give rise to larger externalities and more diversification. The positive impact of export diversification and growth is also reported by Gutierrez-de-Pineras and Ferrantino (2000), Feenstra and Kee (2004), Balaquar and Cantavella-Jorda (2004), Herzer et al. (2006), Matthee and Naude (2007), Amjad et al. (2018), and, in a review article, by Sarin et al. (2020).

As for oil producing countries, Behdubi et al. (2010), Kalaitzi and Cleeve (2018) and Kalaitzi and Chamberlain (2020) show that primary exports negatively affect economic growth. Kalaitzi and Cleeve examine the causality among primary exports, manufactured exports and economic growth in the UAE and find that, in the short run, a circular causal relationship exists between manufactured exports and economic growth, while no causality runs between primary exports and growth. Kalaitzi and Chamberlain focus on fuel-mining exports and find that this export category has a negative impact on economic growth in the long run. As for the causality between fuel-mining exports and economic growth, the study shows that no causality exists neither in the short run nor in the long run.

In addition to the effect of export composition on economic growth, the role of import composition is examined in the development literature (Zhang and Zou 1995; Alam 2003; Kilavuz and Altay Topcu 2012; Belitz and Mölders 2016; Kalaitzi 2018). Zhang and Zou examine the effect of foreign technology imports on economic growth in fifty developing countries over the period 1965–1988. Their results suggest that foreign technology embodied in capital imports is one of the most important factors in explaining the different levels of economic growth among developing countries. Alam (2003) investigates the relationship between manufactured exports, capital goods imports and economic growth in Mexico and Brazil, over the periods 1959–1990 and 1955–1990, respectively. He finds that capital goods imports are very important for both countries’ economic growth. In addition, Alam provides evidence that while manufactured exports offer neither technological spillovers nor enhanced productivity, they can finance capital goods imports by relaxing the foreign exchange constraint.

Kilavuz and Altay Topcu (2012) investigate the impact of high and low technology exports and imports on economic growth using data for twenty-two developing countries over the period 1998–2006. Their results indicate that high-tech manufacturing exports positively affect economic growth, while low-tech manufacturing imports and high-tech manufacturing imports have positive and negative effects, respectively. In addition, Belitz and Mölders (2016) examine the effect of knowledge spill overs on total factor productivity through high-technology imported goods and the internationalization of business R&D. Using a heterogeneous sample of seventy-seven countries over the period 1990–2008, their study confirms the importance of high-technology imports on total factor productivity, with a stronger effect in developing countries. However, Kalaitzi (2018) shows that primary good imports are also important for economic growth. Using data for the UAE for the period 1980–2016 and vector autoregressive models, Kalaitzi provides evidence that a short-run bi-directional causality exists between primary imports and economic growth. At the same time, an indirect causality runs from manufactured imports to economic growth in the short run, via primary imports and exports. However, these short-run effects do not persist in the long run.

With regard to Kuwait, four studies have examined the relationship between exports and economic growth, but only one of them has examined the effect of disaggregated exports, while the effect of disaggregated imports has not been examined at all. In particular, the studies of Al-Yousif (1997), El-Sakka and Al-Mutairi (2000) and Kalaitzi and Chamberlain (2021) investigate the exports-economic growth nexus using total exports, while the study by Merza (2007) uses oil and non-oil exports. Al-Yousif, using an augmented production function and applying cointegration tests and regression analysis, finds that there is no cointegration among exports and economic growth in Kuwait, while in the short run, exports positively affect economic growth. El-Sakka and Al-Mutairi, using bivariate Granger causality tests, confirm the results of Al-Yousif regarding the non-existence of cointegration between the variables, but also find that no causality runs between exports and economic growth in the short run. Merza uses oil and non-oil exports and multivariate causality techniques. His study provides evidence that a bi-directional causality exists between oil exports and economic growth, while a uni-directional relationship runs from non-oil exports to economic growth. Kalaitzi and Chamberlain, using a production function with exports and imports, and Granger causality tests in a vector autoregressive model, find that in Kuwait, a bi-directional causality exists between exports and economic growth in the short run, while imports cause economic growth. In the long run, economic growth causes exports, while imports cause economic growth. The present study extends the work of Kalaitzi and Chamberlain (2021) by focusing on manufactured exports and disaggregating imports into primary and manufactured imports.

3 Data and methodology

3.1 Data

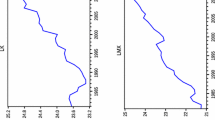

This study uses annual time series data for the period 1970–2019, obtained from UNCTAD, World Bank and International Monetary Fund sources. In particular, manufactured exports (MXt) and disaggregated imports (PIMPt and MIMPt) are from UNCTAD,Footnote 2 while gross domestic product (Yt), gross fixed capital formation (Kt) and working age population (HCt) are from the IMF-International Financial Statistics and the World Bank-World Development Indicators. All variables are expressed in logarithmic form and real terms. The plots of the logarithmic transformed variables are presented in Fig. 1.

3.2 Methodology

The present study uses a neoclassical production function, where, in addition to human and physical capital, manufactured exports, primary imports and manufactured imports are included as inputs, following Herzer et al. (2006), Kalaitzi and Cleeve (2018) and Kalaitzi (2018). The following framework is used to examine the causality among manufactured exports and disaggregated imports and economic growth:

Yt denotes the domestic production of Kuwait’s economy at time t, while Kt and HCt represent the neoclassical inputs of production, physical capital and human capital, respectively. At is total factor productivity, which can be expressed as follows:

where MXt represents manufactured exports, PIMPt and MIMPt, primary and manufactured exports, respectively, and Ct, other exogenous factors:

α, β, γ, δ and ζ represent the elasticities of production with respect to the inputs of production: Kt, HCt, MXt, PIMPt and MIMPt. Taking the natural logs of both sides of Eq. (3):

c is the intercept, the coefficients α, β, γ, δ and ζ are constant elasticities and εt is the error term.

3.2.1 Econometric methods

To examine the stationary properties of the model’s variables, this study performs the conventional augmented Dickey-Fuller (ADF) and Kwiatkowski-Phillips-Schmidt-Shin (KPSS) unit root tests. In addition, the modified ADF test with a breakpoint (ADFBP)Footnote 3 is applied, as Kuwait’s economy was subject to a number of oil shocks during the period 1970–2019.

Provided that the variables are integrated of order one, the Johansen cointegration test (Johansen 1988, 1995) can be applied in order to confirm the existence of long-run relationships among the variables. The likelihood ratio (LR) trace test is used to determine the number of long-run relationships. The trace statistic is adjusted for small samples, as proposed by Reinsel and Ahn (1992).Footnote 4 In addition, the Pantula principle (Pantula 1989) is used for the inclusion of deterministic terms in the cointegrating vectors.

In addition, this study applies dynamic ordinary least squares (DOLS) to confirm the Johansen estimates. The DOLS models for economic growth and manufactured exports are as followsFootnote 5:

where α, β, γ, δ and ζ represent the long-run elasticities, while φ1, φ2, φ3, φ4 and φ5 are the coefficients of the lead and lag differences. The number of leads and lags in each equation is determined by minimizing the Schwarz information criterion (SIC) and the final models are determined following Hendry’s (1995) general-to-specific approach.Footnote 6

After confirming the existence of long-run relationship(s) among the variables, the following restricted VAR is used to investigate the causal relationship between manufactured exports, disaggregated imports and economic growth:

Δ is the difference operator; βij, γij, δij, ζij, μij, θij and λij are the regression coefficients; ECTt−1 is the error correction term derived from the cointegration equation; and p is the optimal lag length, selected by minimizing the value of the SIC. Once the above equations are estimated, diagnostic tests are conducted in order to determine whether the models are well specified and stable. These tests include the Jarque–Bera normality test, the Portmanteau and Breusch–Godfrey LM tests for the existence of autocorrelation, the White heteroskedasticity test and the AR roots stability test. In addition, the cumulative sum of the squares of recursive residuals (CUSUMQ) test, proposed by Brown et al. (1975), and residual plots are applied to assess the parameter stability of the VECM estimates.

The CUSUM of squares test uses the squared recursive residuals, wt2, and is based on the plot of the statistic:

The numerator \(y_{t} - x_{t}^{\prime } b_{t - 1}\) is the forecast error, and \(x_{t}^{\prime }\) is the row vector of observations on the regressors in period t, while Xt−1 denotes the (t − 1) × k matrix of the regressors from period 1 to period t − 1. The St are plotted together with the 5% critical lines for parameter stability and movements inside the 5% critical lines show stability during the sample period. If the CUSUMQ test indicates structural instability, an exogenous variable should be included in order to obtain more efficient estimates. In addition, the recursive residual plots are examined to confirm stability of the estimates.

After estimating the VECM model and investigating the constancy of the model parameters, this study applies the multivariate causality test (Granger 1969, 1988). The causality from manufactured exports and disaggregated imports to economic growth and vice versa can be examined by applying the chi-square test to the VECM coefficients. In particular, the following hypotheses are tested: \(H_{0} :\mathop \sum \limits_{j = 1}^{p} \zeta_{1j} = \, 0\), \(H_{0} :\mathop \sum \limits_{j = 1}^{p} \beta_{4j} = 0\), \(H_{0} : \mathop \sum \limits_{j = 1}^{p} \mu_{1j} = \, 0\), \(H_{0} : \mathop \sum \limits_{j = 1}^{p} \theta_{1j} = \, 0\), \(H_{0} :\mathop \sum \limits_{j = 1}^{p} \beta_{5j} = 0\) and \(H_{0} :\mathop \sum \limits_{j = 1}^{p} \beta_{6j} = 0\).

The separate causal effect of manufactured exports or disaggregated imports on economic growth in the long run cannot be captured in a VECM framework. For this reason, the modified version of the Granger causality test proposed by Toda and Yamamoto (1995) is used to assess the individual causal effect of each variable on the dependent variable. The model employed is as follows:

p is the optimal lag length, selected by minimizing the value of SIC, while dmax is the maximum order of integration of the variables in the model based on unit root tests results. In particular, the selected lag length (p) is augmented by the maximum order of integration (dmax) and the chi-square test is applied to the first p VAR coefficients. In particular, the following hypotheses are tested: \(H_{0} :\mathop \sum \limits_{j = 1}^{{p + {\text{dmax}}}} \zeta_{1j} = \, 0\), \(H_{0} :\mathop \sum \limits_{j = 1}^{{p + {\text{dmax}}}} \beta_{4j} = 0\), \(H_{0} :\mathop \sum \limits_{j = 1}^{{p + {\text{dmax}}}} \mu_{1j} = \, 0\), \(H_{0} :\mathop \sum \limits_{j = 1}^{{p + {\text{dmax}}}} \theta_{1j} = 0\), \(H_{0} :\mathop \sum \limits_{j = 1}^{{p + {\text{dmax}}}} \beta_{5j} = \, 0\) and \(H_{0} :\mathop \sum \limits_{j = 1}^{{p + {\text{dmax}}}} \beta_{6 \, j} = \, 0\).

4 Empirical results

Tables 1 and 2 report the ADF, KPSS and ADFBP stationarity test results for each variable at logarithmic level and first differences, respectively. The ADF results indicate that the null hypothesis of non-stationarity cannot be rejected, except for LPIMPt, at conventional significance levels. Specifically, the null hypothesis of non-stationarity is rejected for LPIMPt at five percent. The KPSS results, in contrast, show that the null hypothesis of stationarity is rejected for all variables. The null hypothesis of stationarity is rejected for LYt and LPIMPt at five percent, while LKt and LHCt are found to be non-stationary at the one percent level. As for LMXt and LMIMPt, they are found to be non-stationary at ten percent. When a structural break is considered, the null hypothesis of non-stationarity can only be rejected for LHCt, and only at the ten percent level. After taking the first difference of the variables, the ADF test results show that the null hypothesis of non-stationarity can be rejected at the one percent level for all variables except ΔLHCt. The ADFBP test results indicate that all the first differenced variables are stationary at one percent, which is confirmed by the KPSS results. Therefore, all the model variables are integrated of order one.

Since all model variables are I(1), the Johansen cointegration test and DOLS can be applied to examine whether the variables are cointegrated. This is important for ensuring that any inferences drawn from our results are not based on spurious correlations among the variables in our models. The results are reported in Tables 3, 4 and 5. The adjusted trace statistics used to test for cointegration indicate that the null hypothesis of one cointegrating vector is rejected at the five percent significance level and, therefore, the variables are cointegrated with two cointegrating vectors. In addition, the DOLS results confirm the existence of a long-run relationship in both equations LYt and LMXt over the period 1970–2019. In particular, the null hypothesis of no cointegration (Ho: α = β = γ = δ = ζ = 0) is rejected, showing that a long-run relationship exists among the variables in both DOLS models.Footnote 7

After confirming that the variables are cointegrated, a VECMFootnote 8 is estimated and the short-run causality results are presented in Table 6. The Granger test indicates that the hypothesis of non-causality from manufactured exports to economic growth cannot be rejected; that is, manufactured exports do not on their own cause economic growth in the short run. As for the imports-economic growth nexus, short-run causality runs from economic growth to primary imports and manufactured imports and is significant in both cases at five percent. Manufactured exports also cause primary imports at the five percent level. These results are similar to those of Alam (2003) for Mexico and Brazil and suggest that primary imports are needed for production. In addition, all the variables in the model jointly cause economic growth, primary imports and manufactured imports at the five, one and five percent levels, respectively.

Since this study investigates the causality between manufactured exports, primary and manufactured imports, the CUSUMQ and recursive residuals plots are used to assess the constancy of the parameters of the estimated Eqs. Footnote 9(7), (10) (11) and (12). As can be seen in Fig. 2, there is no movement outside the boundaries of parameter stability at the five percent level. The ECM models for economic growth, manufactured exports, primary and manufactured imports are stable, even during periods of crisis, such as the 1990 Iraqi invasion of Kuwait.

As for the long-run causality among the variables, the Toda and Yamamoto Granger test indicates that the null hypothesis of non-causality from manufactured exports to economic growth cannot be rejected, as was the case with the short-run causality tests. In contrast, the hypotheses of non-causality from primary and manufactured imports to manufactured exports are rejected at ten and five percent, respectively, suggesting that Kuwait has the potential to take advantage of the technology in imported goods and install sustainable manufacturing capacity. In addition, all variables jointly cause manufactured exports, and primary and manufactured imports, at five percent, in the long run (Table 7).

While Kuwait may be viewed as an extreme case of a country whose exports are largely concentrated in a single commodity, our results are similar to those reported by Ferreira (2009) for Costa Rica, a country with a much more diversified export sector. They are also consistent with Sheridan’s (2014) observation that manufactured exports alone will not foster economic growth. Targeted human capital and physical infrastructure are also required.

5 Conclusions

This study examines the causal relationship between manufactured exports, primary imports, manufactured imports and economic growth in Kuwait over the period 1970–2019, a period during which the price of the country’s dominant export, oil, initially increased and subsequently fluctuated widely. The Johansen cointegration test and DOLS results confirm the existence of long-run relationships among the variables in the model. The Granger causality test indicates that causality does not run from manufactured exports to economic growth in the short run. At the same time, all of the variables in the model jointly cause economic growth.

As for other relationships in the model, a uni-directional short-run causality runs from economic growth to primary imports and to manufactured imports, indicating that economic growth creates new needs that are covered by imported goods. At the same time, manufactured exports cause primary imports, showing that primary imports are used as inputs in production. In addition, all the variables in the model jointly cause primary imports and manufactured imports, providing evidence that further economic growth, physical and human capital accumulation and export diversification contribute to the expansion of both categories of imports.

The Toda and Yamamoto test indicates that long-run causality does not run from manufactured exports to economic growth either. In contrast, long-run causality does run from primary and manufactured imports to manufactured exports, indicating that both categories of imports are essential for export diversification. At the same time, all the variables in the model jointly cause manufactured exports, and primary and manufactured imports, in the long run, showing that all variables contribute to achieving export diversification and financing imports, which are essential for manufacturing production.

Kuwait Vision 2035 contemplates diversification of the Kuwait economy away from its dependence on oil, particularly in the export sector. However, the results of this study indicate that export diversification itself is not a sufficient condition for growth in either the short or the long run. Previous studies, outlined earlier, have demonstrated that sustained economic growth is not founded in primary goods exports, but, rather, in the exports of manufactured goods and services. The position of Kuwait is particularly bleak, not only because of its dependence on a single commodity, but also because the demand for that commodity will inexorably fall in the coming decades. Achieving long-run economic growth through export diversification requires revisiting and revising export promotion policies and making parallel investments in physical and human capital. Successful policy intervention, in turn, requires, as a first step, a thorough examination of disaggregated data in order to understand how export diversification affects the various sectors of the economy. Once this has been done, Kuwait policymakers must identify the forms of human capital that need to be developed and the physical infrastructure that needs to be created in order to develop those sectors in which Kuwait can compete on a global scale.

Notes

As noted by Zang and Baimbridge (2012), the existence of bi-directional causality between imports and economic growth might also be a consequence of limited natural resources in these countries. However, there is evidence in the development literature that in some natural resources-abundant countries, the import-led growth hypothesis is also valid.

Based on the Standard International Trade Classification, Revision 1.

The trace statistic is adjusted by using the correction factor (T- n*p)/T. T is the sample size, while n and p are the number of variables and optimal lag length, respectively.

The DOLS method provides unbiased and asymptotically efficient estimates of long-run relationships, even in the presence of potential endogeneity (Stock and Watson 1993).

Diagnostic tests are performed to ensure that the DOLS models are well specified, while their parameters’ stability is confirmed based on cumulative sum of recursive residuals (CUSUM) estimations.

The VECM is estimated with the inclusion of two impulse dummy variables for the years 1974 and 1991 and a step dummy variable for the year 2001, as the CUSUMQ of the initially estimated ECMs for economic growth, manufactured exports and primary imports show evidence of structural instability. In addition, a visual inspection of the plots of the variables confirms the inclusion of the dummy variables.

The diagnostic tests for the ECMs reveal that the residuals are multivariate normal and homoscedastic, and there is no evidence of serial correlation. Diagnostic test results are available upon request.

References

Alam I (2003) Manufactured exports, capital goods imports, and economic growth: experience of Mexico and Brazil. Int Econ J 17(4):85–105

Al-Yousif K (1997) Exports and economic growth: some empirical evidence from the Arab Gulf countries. Appl Econ 29(6):693–697

Amjad Y, Nareem NAM, Azman-Saini WNW, Masron TA, Krishkumar K (2018) Export-led growth hypothesis in Malaysia: new evidence using disaggregated data of export. Jurnal Ekonomi Malaysia 52(3):175–188

Baharumshah A, Rashid S (1999) Exports, imports, and economic growth in Malaysia: empirical evidence based on multivariate time series. Asian Econ J 13(4):389–406

Balaguer J, Cantavella-Jorda M (2004) Structural change in exports and economic growth: cointegration and causality analysis for Spain (1961–2000). Appl Econ 36(5):473–477

Behbudi D, Mamipour S, Karami A (2010) Natural resource abundance, human capital, and economic growth in petroleum exporting countries. J Econ Dev 35(3):81–102

Belitz H, Mölders F (2016) International knowledge spillovers through high-tech imports and R&D of foreign-owned firms. J Int Trade Econ Dev 25(4):590–613

Bloomberg (2021) Kuwait credit rating cut for second time in two years by S&P, 16 July 2021

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relationships over time. J R Stat Soc 37(2):149–192

Çevik Eİ, Atukeren E, Korkmaz T (2019) Trade openness and economic growth in Turkey: a rolling frequency domain analysis. Economies 7(41):1–16

Coe DT, Helpman E (1995) International R&D spill overs. Eur Econ Rev 39(1):859–887

Dolado J, Jenkinson T, Sosvilla-Rivero S (1990) Cointegration and unit roots. J Econ Surv 4(3):33–49

Dunusinghe P (2009) On export composition and growth: evidence from Sri Lanka. South Asia Econ J 10(2):275–304

Ellis E (2021) Financial markets. Is it too late for late for Kuwait? Euromoney, 30 April 2021

El-Sakka MI, Al-Mutairi NH (2000) Exports and economic growth: the Arab experience. Pak Dev Rev 39(2):153–169

Feenstra RC, Kee HL (2004) Export variety and country productivity. NBER Working Paper 10830. Boston, MA: Bureau of Economic Research

Ferreira GFC (2009) The expansion and diversification of the export sector and economic growth: the Costa Rican experience. Doctoral dissertation, Louisiana State University

Fosu AK (1990) Export composition and impact of exports on economic growth of developing countries. Econ Lett 34(1):67–71

Granger CWJ (1969) Investigating causal relations by economic models and cross-spectral models. Econometrica 37(3):424–438

Granger CWJ (1988) Some recent developments in a concept of causality. J Econom 39(1):199–211

Greenaway D, Morgan W, Wright P (1999) Exports, export composition and growth. J Int Trade Econ Dev 8(1):41–51

Gutierrez-de-Pinera SA, Ferrantino M (2000) Export dynamics and economic growth in Latin America: a comparative perspective. Ashgate, Burlington, VT

Gylfason T, Herbertsson T, Zoega G (1999) A mixed blessing: natural resources and economic growth. Macroecon Dyn 3(2):204–225

Hendry DF (1995) Dynamic econometrics. Oxford University Press, Oxford

Herzer D, Nowak-Lehmann F, Siliverstovs B (2006) Export-led growth in Chile: assessing the role of export composition in productivity growth. Dev Econ 44(3):306–328

Johansen S (1988) Statistical analysis of cointegrating vectors. J Econ Dyn Control 12(2–3):231–254

Johansen S (1995) Likelihood-based inference in cointegrated vector autoregressive models. Oxford University Press, Oxford

Kalaitzi AS (2018) The causal effects of trade and technology transfer on human capital and economic growth in the United Arab Emirates. Sustainability 10(5):1–15

Kalaitzi AS, Chamberlain TW (2020) Fuel-mining exports and growth in a developing state: the case of the UAE. Int J Energy Econ Policy 10(4):300–308

Kalaitzi AS, Chamberlain TW (2021) The validity of the export-led growth hypothesis: some evidence from GCC countries. J Int Trade Econ Dev 30(2):224–245

Kalaitzi AS, Cleeve E (2018) Export-led growth in the UAE: multivariate causality between primary exports, manufactured exports, and economic growth. Eur Bus Rev 8(3):341–365

Kilavuz E, Altay Topcu B (2012) Export and economic growth in the case of the manufacturing industry: Panel data analysis of developing countries. Int J Econ Financ Issues 2(2):201–215

Lee JW, McKibbin WJ (2018) Service sector productivity and economic growth in Asia. Econ Model 74:247–263

Levin A, Raut LK (1997) Complementarities between exports and human capital in economic growth: evidence from the semi-industrialized countries. Econ Dev Cult Change 46(1):155–174

Mackinnon J, Haug A, Michelis L (1999) Numerical distribution function of likelihood ratio tests for cointegration. J Appl Economet 14(5):563–577

Matthee M, Naude WA (2007) The determinants of regional manufactured exports from a developing country. UN-WIDER Research Report 2007/10

Merza E (2007) Oil exports, non-oil exports and economic growth: Time series analysis for Kuwait (1970–2004). Doctoral dissertation, Kansas State University

Middle East Institute (2021) Kuwait fractious politics undermine much-needed fiscal measures. 11 March 2021

Oghanna BC (2015) The effects of disaggregated imports on economic growth in Nigeria. J Bank 5(1):25–46

Pantula SG (1989) Testing for unit roots in time series data. Economet Theor 5(2):256–271

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econometrica 57(6):1361–1401

Ramos F (2001) Exports, imports, and economic growth in Portugal: evidence from causality and cointegration analysis. Econ Model 18(4):613–623

Reinsel GC, Ahn SK (1992) Vector autoregressive models with unit roots and reduced rank structure: estimation, likelihood ratio tests and forecasting. J Time Ser Anal 13(4):353–375

Sachs JD, Warner AM (1995) Natural resource abundance and economic growth. NBER Working Paper 5398. Boston, MA: National Bureau of Economic Research

Sala-i-Martin X, Subramanian A (2003) Addressing the natural resource curse: An illustration from Nigeria. NBER Working Paper 9804. Boston, MA: National Bureau of Economic Research

Sarin V, Mahapatra SK, Sood N (2020) Export diversification and economic growth: a review and future research agenda. J Public Aff. https://doi.org/10.1002/pa.2524

Schwert GW (1989) Test for unit roots: a Monte Carlo investigation. J Bus Econ Stat 7(2):147–159

Shahbaz M (2012) Does trade openness affect long run growth? Cointegration, causality and forecast error variance decomposition tests for Pakistan. Econ Model 29(6):2325–2339

Sheridan BJ (2014) Manufacturing exports and growth: When is a developing country ready to transition from primary exports to manufacturing exports? J Macroecon 42(C):1–13

Stock JH, Watson MW (1993) A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica 61(4):783–820

Sultanuzzaman MR, Fan H, Mohamued EA, Hossain MI, Islam MA (2019) Effects of export and technology on economic growth: selected emerging Asian economies. Econ Res 32(1):2515–2531

Sultanuzzaman MR, Lee C-C, Tunviruzzaman R, Muhammad AT, Riaz D (2020) Disaggregated exports and economic growth: a sustainable development of Bangladesh. In: Proceedings of the 24th annual western hemisphere trade conference. Laredo, TX. April 2020

Sunde T (2017) Foreign direct investment, exports, and economic growth: ARDL and causality analysis for South Africa. Res Int Bus Financ 41:434–444

Telci IN, Rakipoglu M (2021) Hedging as a survival strategy for small states: the case of Kuwait. All Azimulth 10(2):213–229

Thangavelu S, Rajaguru G (2006) Is there an export or import-led productivity growth in rapidly developing Asian countries? A Multivariate VAR Analysis. Appl Econ 36(10):1083–1093

Toda HY, Yamamoto T (1995) Statistical inferences in vector autoregressions with possibly integrated processes. J Econom 66(1–2):225–250

Vogelsang TJ, Perron P (1998) Additional test for unit root allowing for a break in the trend function at an unknown time. Int Econ Rev 39(1):1073–1100

Wagner J (2012) International trade and firm performance: a survey of empirical studies since 2006. Rev World Econ 148(2):235–277

Wamalwa P, Were M (2019) Is export-led growth a mirage? The case of Kenya. UN-WIDER Res Rep 2019:115

Zang W, Bainbridge M (2012) Exports, imports and economic growth in South Korea and Japan: a tale of two economies. Appl Econ 44(3):361–372

Zhang X, Zou H (1995) Foreign technology imports and economic growth in developing countries. World Bank Policy Research Working Paper 1412

Acknowledgements

The authors thank Iman Al-Ali for research assistance.

Funding

This study is funded by the LSE Kuwait Academic Collaboration supported by the Kuwait Foundation for the Advancement of Sciences (KFAS).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Kalaitzi, A.S., Chamberlain, T.W. Manufactured exports, disaggregated imports and economic growth: the case of Kuwait. Econ Change Restruct 56, 919–940 (2023). https://doi.org/10.1007/s10644-022-09444-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-022-09444-x