Abstract

Empirical studies have been conducted around the impact of foreign direct investment on industrialisation; however, while they have produced inconsistent inferences, the impact channel of this relationship has also been ignored. This study focuses on the role of institution on foreign direct investment for industrialisation in a panel of 43 Sub-Sahara African countries for the period 1996 through 2018. This study uses manufacturing value added per capita to capture industrialisation and based its empirical evidence on the pooled ordinary least squares, fixed effects and system generalised method of moments methods of estimation. From our empirical analysis, the following findings are established: First, persistence level of industrialisation determines to a large extent, the current industrialisation in sub-Saharan Africa. Second, foreign direct investment exerts a negative and significant impact on industrialisation. Last, when indicators of institution are imposed on foreign direct investment in our model, the negative impact existing between foreign direct investment and industrialisation remains apparent except for the political index of institution that moderates and averts this negative effect although the magnitude is meagre. On the policy ground, this study advocates for institutional policies and reforms that targets economic, political and institutional forms of governance.

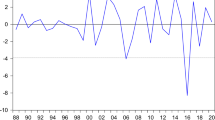

Source: Authors’ computation based on WDI, 2019 dataset

Source: Authors’ computation based on WDI, 2019 dataset

Similar content being viewed by others

Notes

Used interchangeably with governance all through.

(Europe: 206.16%; America and the Caribbean: 85.43%; Asia: 416.59%; Oceania: 2.09%; North Africa: 977.84%; and sub-Saharan Africa: 78.13%) (Authors’ computation based on World Development Indicator (WDI), 2019).

Angola, Benin, Botswana, Burkina Faso, Burundi, Cabo Verde, Cameroon, Central African Republic, Chad, Congo, Dem. Rep., Congo, Rep., Cote d'Ivoire, Equatorial Guinea, Eritrea, Ethiopia, Gabon, Gambia, The, Ghana, Guinea, Guinea-Bissau, Kenya, Lesotho, Liberia, Madagascar, Malawi, Mauritania, Mauritius, Mozambique, Namibia, Niger, Nigeria, Rwanda, Sao Tome and Principe, Senegal, Seychelles, Sierra Leone, South Africa, Sudan, Tanzania, Togo, Uganda, Zambia, Zimbabwe.

References

Adeleke AI (2014) FDI-growth nexus in Africa: does governance matter? J Econ Dev 39(1):111–135

Ajide KB, Raheem ID (2016) Institutions-FDI nexus in ECOWAS countries. J Afr Bus. https://doi.org/10.1080/15228916.2016.1180778

Akinlo EA (2004) Foreign direct investment and growth in Nigeria: An empirical investigation. J Policy Model 26(5):627–639. https://doi.org/10.1016/j.jpolmod.2004.04.011

Alfaro L, Chanda A, Kalemli-Ozcan S, Sayek S (2010) Does foreign direct investment promote growth? Exploring the role of financial markets on linkages. J Dev Econ 91(2):242–256

Alguacil M, Cuadros A, Orts V (2011) Inward FDI and growth: The role of macroeconomic and institutional environment. J Policy Model 33(3):481–496

Álvarez I, Barbero J, Rodríguez-Pose A, Zofío J (2018) Does institutional quality matter for trade? Institutional conditions in a sectoral trade framework. World Dev 103:72–87

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error components models. J Econom 68(1):29–52

Asif M, Majid A, Yasir M, Ali A (2018) Fluctuations in political risk indicators and their impact on FDI inflow in Pakistan. Asian J Technol Innov 26(3):269–289. https://doi.org/10.1080/19761597.2018.1547115

Asongu SA, Odhiambo NM (2019) Remittances, the diffusion of information and industrialisation in Africa. Contemp Soc Sci. https://doi.org/10.1080/21582041.2019.1618898

Asongu SA, Nnanna J, Acha-anyi PN (2020) Inequality and gender economic inclusion: the moderating role of financial access in Sub-Saharan Africa. Econ Anal Policy 65:173–185. https://doi.org/10.1016/j.eap.2020.01.002

Baltagi BH (2008) Forecasting with panel data. J Forecast 27(2):153–173

Barrios S, Görg H, Strobl E (2005) Foreign direct investment, competition and industrial development in the host country. Eur Econ Rev 49:1761–1784

Beck T, Demirgüç-Kunt A, Levine R (2003) Law and finance: Why does legal origin matter? J Comp Econ 31(4):653–675

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87(1):115–143

Bond S (2002) Dynamic Panel Data Models: A Guide to Micro Data Methods and Practice. Working Paper 09/021 Institute for Fiscal Studies London.

Borensztein E, Gregorio JD, Lee JW (1998) How does foreign direct investment affect economic growth? J Int Econ 45(1):115–135

Brambor T, Clark WM, Golder M (2006) Understanding interaction models: improving empirical analyses. Political Anal 14(1):63–82

Buchanan BG, Le QV, Rishi M (2012) Foreign direct investment and institutional quality: some empirical evidence. Int Rev Financ Anal 21:81–89

Carbonell JB, Werner RA (2018) Does foreign direct investment generate economic growth? A new empirical approach applied to Spain. Econ Geogr 94(4):425–456. https://doi.org/10.1080/00130095.2017.1393312

Che Y, Lu Y, Tao Z, Wang P (2013) The impact of income on democracy revisited. J Comp Econ 41:159–169

Chen G, Geiger M, Fu M (2015) Manufacturing FDI in sub-Saharan Africa: trends, determinants, and impact. World Bank, Washington

Chuang Y, Hsu P (2004) FDI, trade, and spillover efficiency: evidence from China’s manufacturing sector. Appl Econ 36(10):1103–1115

Daiyue H, Chao L, Puel G (2012) A study of new industrialization and foreign direct investment (FDI) based on China’s East, Middle and West regions. Afr J Bus Manage 6(27):7931–7937. https://doi.org/10.5897/AJBM11.2825

Dunning J (1993) Multinational enterprises and the global economy, reading. Addison Wesley, MA

Emmanuel B, Nkoa O (2016) Foreign direct investment and industrialization in Africa: a new look. Innovations 51(3):173–196

Enu P, Havi E (2014) The manufacturing sector of ghana: are there any macroeconomic disturbances? Asia Pac J Multidiscip Res 2(3):111–122

Farole T, Winkler D (2014) Making foreign direct investment work for Sub-Saharan Africa: local spillovers and competitiveness in global value chains. World Bank, Washington

FDI-Foreign Direct Investment Intelligence (2016) The Africa Investment Report 2015: An FDI Destination on the Rise. January 4

Fillat C, Woerz J (2011) Good or bad? The influence of FDI on productivity growth. an industry-level analysis. J Int Trade Econ Dev 20(3):293–328. https://doi.org/10.1080/09638190903003010

Freeman D, Yerger D (2000) Does inflation lower productivity? time series evidence on the impact of inflation on labour productivity in 12 OECD nations. Atl Econ J 28(3):315–332. https://doi.org/10.1007/BF02298324

Gui-Diby SL (2014) Impact of foreign direct investments on economic growth in Africa: evidence from three decades of panel data analyses. Res Econ 68(3):248–256

Gui-Diby SR, Renard M (2015) Foreign direct investment inflows and the industrialization of African countries. World Dev 74(10):43–57

Haraguchi N, Martorano B, Sanfilippo M (2018) What factors drive successful industrialization? evidence and implications for developing countries. Struct Chang Econ Dyn. https://doi.org/10.1016/j.strueco.2018.11.002

Hayat A (2019) Foreign direct investments, institutional quality, and economic growth. J Int Trade Econ Dev 28(5):561–579

Heid B, Langer J, Larch M (2012) Income and democracy: evidence from system GMM estimates. Econ Lett 116:166–169

Hu J, Wang Z, Lian Y, Huang Q (2018) Environmental regulation, foreign direct investment and green technological progress—evidence from Chinese manufacturing industries. Int J Environ Res Public Health 15(221):1–14

Jakubiak, M., & Kudina, A. (2008). The Motives and Impediments to FDI in the CIS. CASE Network Studies and Analyses 0370, CASE-Center for Social and Economic Research.

Jolliffe I (2002) Principal component analysis, 2nd edn. Springer, New York

Kaiser H (1974) An index of factor simplicity. Psychometrika 39:31–36

Kang SJ, Lee H (2011) Foreign direct investment and deindustrialisation. World Econ 34(2):313–329

Kaya Y (2010) Globalization and industrialization in 64 developing countries, 1980–2003. Soc Forces 88(3):1153–1182. https://doi.org/10.1353/sof.0.0300

Konings J (2001) The effects of foreign direct investment on domestic firms: evidence from firm level panel data in emerging economies. Econ Transit 9:619–633

Kriaa I, Ettbib R, Akrout Z (2017) Foreign direct investment and industrialization of Africa. Int J Innov Appl Stud 21(3):477–491

Lu F, Liu X (2018) Africa’s industrialization and China’s OFDI in the manufacturing sector: rationales and practices. China Econ J 11(2):126–150

Marconi N, de Borja RCF, de Araújo EC (2016) Manufacturing and economic development: the actuality of Kaldor’s first and second laws. Struct Chang Econ Dyn 37:75–89. https://doi.org/10.1016/j.strueco.2015.12.002

Markusen JR, Venables AJ (1999) Foreign direct investment as a catalyst for industrial development. Eur Econ Rev 43:335–356

Megbowon E, Mlambo C, Adekunle B (2019) Impact of china’s outward FDI on sub-Saharan Africa’s industrialization: evidence from 26 countries. Cogent Econ Financ. https://doi.org/10.1080/23322039.2019.1681054

Mesagan EP, Bello MO (2018) Core infrastructure and industrial performance in Africa: Do institutions matter? Int Rev Econ 65(4):539–562. https://doi.org/10.1007/s12232-018-0314-y

North DC (1990) Institutions, institutional change and economic performance. Cambridge University Press, Cambridge

Nunnenkamp. P., & Spatz, J. (2012). FDI and economic growth in developing economies: how relevant are host-economy and industry characteristics? Kiel Working Papers No. 1176 (Kiel: Institute for World Economics), mimeo.

Ojo JAT, Adegboye FB, Olokoyo FO (2017) The disappointing performance of foreign direct investment in industrial development in Sub-Saharan African countries. Int J Econ Financ Issues 7(2):677–681

Olofin P, Aiyegbusi O, Adebayo A (2019) Analysis of foreign direct investment and economic growth in Nigeria: application of spatial econometrics and fully modified ordinary least square (FMOLS). Foreign Trade Rev 54(3):159–176. https://doi.org/10.1177/0015732519851631

Opoku EEO, Yan IK (2018) Industrialization as driver of sustainable economic growth in Africa. J Int Trade Econ Dev 28(1):30–56. https://doi.org/10.1080/09638199.2018.1483416

Oyinlola MA, Adedeji AA, Bolarinwa MO (2020) Governance, domestic resource mobilization, and inclusive growth in sub-Saharan Africa. Econ Anal Policy 65:68–88. https://doi.org/10.1016/j.eap.2019.11.006

Peres M, Ameer W, Xu H (2018) The impact of institutional quality on foreign direct investment inflows: evidence for developed and developing countries. Econ Res 31(1):626–644

Roodman D (2009a) A note on the theme of too many instruments. Oxford Bull Econ Stat 71(1):135–158

Roodman D (2009b) How to do xtabond2: an introduction to difference and system GMM in Stata. Stata Journal 9(1):86–136

Sabir S, Rafique A, Abbas K (2019) Institutions and FDI: evidence from developed and developing countries. Financ Innov. https://doi.org/10.1186/s40854-019-0123-7

Selhausen, F. (2009). On Geography and Institutions as Determinants of Foreign Direct Investment. A cross country comparative analysis of sub-Saharan African relative to developing countries. ISBN: 978–84–692–9548–9.

Sengupta J (2011) Understanding economic growth: modern theory and experience. Springer, New York. https://doi.org/10.1007/978-1-4419-8026-7

Signe, L., & Johnson, C. (2018). The potential of manufacturing and industrialization in Africa Trends, opportunities, and strategies. London.

Stock JH, Wright JH, Yogo M (2002) A survey of weak instruments and weak identification in generalized method of moments. J Bus Econ Stat 20(4):518–529

Tchamyou VS (2019) The role of information sharing in modulating the effect of financial access on inequality. J Afr Bus. https://doi.org/10.1080/15228916.2019.1584262

Ullah I, Khan MA (2017) Institutional quality and foreign direct investment inflows: evidence from Asian countries. J Econ Stud 44(5):833–860

Umer F, Alam S (2013) Effect of openness to trade and FDI on industrial sector growth: a case study for Pakistan. Romanian Econ J 48:179–198

UNCTAD-United Nations Conference on Trade and Development. (2019). World Investment Report. UNCTAD, Geneva. Retrieved from https://unctad.org/Sections/dite_dir/docs/WIR2019/WIR19_tab01.xlsx

UNECA-United Nations Economic Commission for Africa (2013) Making the most of Africa’s commodities: Industrializing for growth, jobs, and economic transformation. United Nations ECA, Addis Ababa

United Nations Development Organizations (UNIDO). (2017). Statistical indicators of inclusive and sustainable industrialization baseline scenario. Retrieved from https://stat.unido.org/content/publications/statistical-indicators-of-inclusive-and-sustainable-industrialization

UNECA-United Nations Economic Commission for Africa. (2011). Industrial policies for the structural transformation of African economies: Options and best practices. Policy research paper no. 2. Addis Ababa: United Nations Economic Commission for Africa (UNECA).

Wang M, Wong S (2009) Foreign direct investment and economic growth: the growth accounting perspective. Econ Inq 47(4):701–710

World Development Indicator (WDI). (2019). World development indicators, 2019. Retrieved from https://databank.worldbank.org/home.aspx

Zhuang, J., Dios, E., & Lagman-Martin, A. (2010). Governance and Institutional Quality and the Links with Economic Growth and Income Inequality: With Special Reference to Developing Asia. Asian Development Bank. http://hdl.handle.net/11540/1537

Acknowledgements

We would like to thank the Receiving Editor and the anonymous referees for their constructive, helpful and timely comments and suggestions that have greatly improved the quality of this paper. The usual caveat applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1 Persistency of Industrialisation

IND | L.IND | |

|---|---|---|

IND | 1 | |

L1.IND | 0.9542 | 1 |

Appendix 2 List of countries. Source: IMF Regional Economic Outlook in sub-Saharan Africa: A road to recovery (2020)

Resource rich | Non-res. rich | Upper mid inc | Lower mid | Low income |

|---|---|---|---|---|

Angola | Benin | Botswana | Angola | Burkina Faso |

Equatorial Guinea | Burundi | Equatorial Guinea | Benin | Burundi |

Congo Dem. Rep | Cabo Verde | Gabon | Cabo Verde | Central African Republic |

Nigeria | Comoros | Namibia | Cameroon | Chad |

Guinea | Eritrea | South Africa | Comoros | Congo, Dem. Rep |

Gabon | Eswatini | Mauritius | Congo, Rep | Eritrea |

Congo Rep., | Ethiopia | Seychelles | Côte d'Ivoire | Ethiopia |

Chad | Gambia | Ghana | Gambia, The | |

Botswana | Guinea-Bissau | Kenya | Guinea | |

Zambia | Kenya | Lesotho | Guinea-Bissau | |

Sierra Leone | Lesotho | Mauritania | Liberia | |

Mali | Madagascar | Nigeria | Madagascar | |

Namibia | Malawi | Sao Tomé and Principe | Malawi | |

Niger | Mauritius | Senegal | Mali | |

Cameroon | Mozambique | Tanzania | Mozambique | |

Zimbabwe | Rwanda | Zambia | Niger | |

Tanzania | Sao Tomé & Príncipe | Zimbabwe | Rwanda | |

Ghana | Senegal | Sierra Leone | ||

Cen. Africa Republic | Seychelles | Somalia | ||

South Sudan | Togo | South Sudan | ||

Burkina Faso | Uganda | Sudan | ||

Liberia | Togo | |||

South Africa | Uganda | |||

Côte d’Ivoire |

Rights and permissions

About this article

Cite this article

Oduola, M., Bello, M.O. & Popoola, R. Foreign Direct Investment, Institution and Industrialisation in Sub-Saharan Africa. Econ Change Restruct 55, 577–606 (2022). https://doi.org/10.1007/s10644-021-09322-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-021-09322-y