Abstract

This paper measures the ecological performance and reference carbon taxes of 12 Commonwealth of Independent States between 1993 and 2008. I adapted an ecologist’s model into widely used non-parametric directional distance functions approach. On average, countries perform fairly well: eco-efficiency is around 87 %. Enhancing energy consumption would lead to further reductions in CO2 emissions. I find that there was a relative decoupling of GDP from emissions growth. The estimated shadow price of carbon (mean of US$74.37/tCO2) is reasonable and falls into a range proposed by climate scientists. The richer countries had lower shadow prices with smaller range compared to less affluent ones. Overall, given decoupling, the introduction of revenue-neutral carbon tax could have certain merits.

Similar content being viewed by others

Notes

Unger (2012) argues that preventing the accumulation of fossil-fuel CO2 emissions is considered the onlysustainable path to protect the environment in the long run.

See Article 17 of the Kyoto Protocol for more details.

In the frame of present study a carbon tax is essentially a tax on carbon dioxide (CO2) arising from burning fossil-fuels or energy consumption.

The CIS is a regional union founded in 1991 with population above 280 million, around 7.7 % of world carbon emissions, surge in energy use, and rapidly expanding economies. All countries share similar historical past, language, borders and political order. "Mineral and raw materials potentialities of CIS countries include practically all kinds of minerals. Mining, use (processing) and exports of mineral resources is one of the main kinds of economic activities for many states of the Commonwealth. As a whole CIS countries take one of the first places in the world by volume of explored resources of gas, petroleum, coal, iron and manganese ores, many non-ferrous metals, potassium salts and other important kinds of minerals. The main place by mineral energy resources belongs to the Russian Federation. Its share in CIS makes up the greatest part of resources of coal, petroleum, natural gas, peat and also practically all resources of oil-shale. Kazakhstan and Ukraine have considerable reserves of coal, Azerbaijan, Kazakhstan and Turkmenistan—petroleum, Turkmenistan and Uzbekistan—natural gas. Not great reserves of petroleum are explored also in Belarus, Kyrgyzstan and Tajikistan…" taken from official website of CIS organization available on http://www.cisstat.com/eng/frame_about.htm. (Accessed on 17.08.2015).

Other generic policy instruments include: cap and trade, emission reduction credits, clean energy standards and fossil-fuel subsidy reduction (Aldy and Stavins 2013).

See, arguments related to carbon emissions externality, SCC and reflections on recent estimates from integrated assessment models (IAMs). In sum, he proposes to start taxing a carbon even in face of many unknowns and not delay this policy (Pindyck, 2013).

The EU integrated carbon tax incorporates not only the pay for actual CO2 emissions but also prices the carbon content of fossil-fuels such as coal, oil and natural gas and other detrimental natural resources. It punishes both upstream (producers, refineries and importers of petroleum products, coal miners) and downstream (natural gas operators and consumers) market users and, therefore, applies to firms and individuals.

It is when a cumulative tax is put not only on CO2 emissions, but also on carbon content of other pollution-causing factors.

The IPAT and its variations, STIRPAT (Stochastic version) and ImPACT are widely applied to study the impact of greenhouse gas emissions (York et al. 2003; Shi 2003; Rosa et al. 2004; Fan et al. 2006; Marin and Mazzanti 2013; Wei 2011; Knight and Rosa 2012; Zhu and Peng 2012; Zhang and Lin 2012; Liddle 2013 and Brizga et al. 2013).

For popularity of the DEA approach, please refer to the study of Emrouznejad et al. (2008) where authors present advantages and applications of this non-parametric technique for the past 30 years. Cooper et al. (2004) overview applications of DEA for different countries. Liu et al. (2013) summarize the DEA applications literature with citations documented in Web of Science database for the period 1978–2010.

The term eco-efficiency and ecological performance will be used interchangeably thought this report.

According to United Nations Environmental Program (UNEP) the relative decoupling is when the growth rate of CO2 is lower than of GDP. Impact decoupling is when the negative impact of CO2 diminishes while maintaining GDP. Resource decoupling is when the rate of resource use per unit of economic activity drops.

For a thorough overview, address Zhou et al. (2008) who discuss 100 publications with application of frontier models in energy and environmental issues. Liu et al. (2010) provide systematic investigation of model DEA model building in the presence of undesirable outputs and inputs. For theoretical improvements in DEA environmental performance measurements consult Song et al. (2012).

A recent survey on applications of DDF and its variations in environmental and energy studies over 1997–2013 is composed by Zhang and Choi (2014).

Our modeling assumptions are related to the concept of environmentally adjusted production efficiency (EAPE) and frontier eco-efficiency (FEE) models as described in Lauwers (2009). The author also advocated the incorporation of material balance principle (MBP) into frontier-based efficiency models. See studies by Coelli et al. (2007) and Hoang and Coelli (2011) for application of MBP in agricultural production. Yet, another approach named sustainable efficiency (SE) based on concept of exergy balance principle (EBP) was introduced by Hoang and Rao (2010). The innovative approach that combines MBP and EBP into unified framework and applied in agricultural study was proposed by Hoang and Alauddin (2012). Later, Kuosmanen and Kuosmanen (2013) proposed a dynamic MBP model based on standard capital accumulation model. Note, all these new approaches are promising directions to be explored in modeling the ecological efficiency on macro level.

The high statistically significant correlation between energy consumption and CO2 is detected (see Table 2).

Null-jointness: if (\( y^{g} ,y^{b} ) \in P\left( x \right) \) and \( y^{b} = 0 \), then \( y^{g} = 0 .\)

Weak disposability: if (\( y^{g} ,y^{b} ) \in P\left( x \right) \) and \( 0 \le \theta \le 1 \), then (\( \theta y^{g} ,\theta y^{b} ) \in P\left( x \right) \).

Strong disposability of good output: if (\( y^{g} ,y^{b} ) \in P\left( x \right) \) and (\( y^{g'} ,y^{b} ) \le \left( {y^{g} ,y^{b} } \right) \), then (\( y^{g'} ,y^{b} ) \in P\left( x \right) \).

Ineffective regulation does not mean that firms (DMU's) didn't sacrifice their material resources. It means that state could not increase a tax collection for national budget due to market failure, i.e. presence of underground economy that might helped to avoid this state regulation.

The recent "rDEA" R package version 1.2–2 developed by Jaak Simm and Galina Besstremyannaya, 2015-08-04, can be found on the CRAN website https://cran.r-project.org/web/packages/rDEA/rDEA.pdf.

Specifically, we transform x p into negative variable by multiplying it by (−1) in order to account for its non-controllability. This methodology is presented by (Bogetoft and Otto 2011: 118–120).

From 18 August 2008 the Georgia was withdrawn and from 18 August 2009 (effective) is not a member of the CIS.

The R package "Benchmarking", version 023, 2011-04-15 ($Date: 2013-01-20 17:54:54 +0100 (20 Jan. 2013) $), developed by Peter Bogetoft and Lars Otto was utilized for estimation.

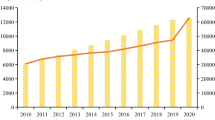

To facilitate the discussion we put up additional graphs in online supplementary material (SM).

Note that the majority of low income countries (US$1000–2000 GDP/capita) had zero \( p^{co2} \). This suggests that their resources (human and energy) were used inefficiently. Conversely, as per capita GDP rose above US$2800, no countries had zero \( p^{co2} \). The EEC minimum SPC value is twice bigger than of EIC, US$28.64 vs.US$15.30 (see Table 7).

The 2012 report “The Critical Decade: International Action on Climate Change” by Climate Commission of Australian government that monitors events surrounding emissions around the world reports the following carbon dioxide (CO2) tax rates in different countries: Australia ($A23/tCO2 in 2012–2013); China (plans to introduce in 2013 in seven cities and provinces); USA (only few states enforced a tax); Canada (only Quebec and British Columbia use carbon tax); India(set a nationwide tax, 50 rupees per ton of coal produced and imported, equal less than $A1 in 2010); Japan (put ¥289/tCO2, equal to $A3.30 in 2012); European Union (EC proposed a carbon tax between €4–30/mtCO2 only in 2010, not all 27 States agreed); Finland (introduced in 1991, €20/tCO2 from 2010); Sweden (first introduced in 1991, 0.25 SEK/kg ($US100/tCO2) and was later raised to $US150); Denmark (put $US 18/tCO2 from 2002); Switzerland (put CHF 36/tCO2 from 2008) and South Africa (plans to start in 2013, putting $A14/tCO2 above threshold). The full report could be consulted through the following link: https://www.climatecouncil.org.au/international-action-report and summary on http://www.sbs.com.au/news/article/1492651/Factbox-Carbon-taxes-around-the-world (Accessed on 18.08.2014).

To elaborate and clarify, the shadow prices of carbon per tonne of CO2 found in this study is further translated into differentiated carbon tax rate depending on specific fuel type and become few cents per liter, cubic meter or tonne. See the British Columbia's Ministry of Finance document "How the carbon tax works" and section on "Tax Rates on Fuels" available on http://www.fin.gov.bc.ca/tbs/tp/climate/A4.htm. Accessed on 30.08.15.

The best example is the European Union Emissions Trading System (EU ETS). More detailed information could be consulted on http://ec.europa.eu/clima/policies/ets/index_en.htm. Accessed on 16.08.2015.

See the post by Alisher Khamidov named "Kazakhstan: Carbon Trade Scheme Fuels divisions in Kazakhstan " available on http://www.eurasianet.org/node/67229. Accessed on 14.08.2015. Also see the case study" Kazakhstan-The World’s Carbon Markets: A Case Study Guide to Emissions Trading" International Emissions Trading Association (IETA) available on http://www.ieta.org/worldscarbonmarkets. Accessed on 24.08.15.

Two policy instruments are considered cost-effective: (a) carbon tax and (b) cap-and-trade according to extensive economic studies by Goulder and Parry (2008) and Fischer and Newell (2008) where authors analyze various carbon control policy measures. Repetto (2013), for example, argues for the cap-and-trade instead of carbon tax. Aldy and Stavins (2012) review various carbon-pricing mechanisms of developed countries that could serve as a guideline for transition economies of CIS. Sadler (2013) discusses the recent carbon capture and storage and commercialization of carbon possibilities. Winkler and Marquard (2011) advocate for carbon tax in South Africa.

Other scholars propose a shift to climate adaptation strategies, as success in combating greenhouse emissions has been limited to date (Green 2009).

References

Agrell P, Bogetoft P, Tind J (2005) DEA and dynamic yardstick competition in scandinavian electricity distribution. J Prod Anal 23:173–201

Alcott B (2010) Impact caps: why population, affluence and technology strategies should be abandoned. J Clean Prod 18(6):552–560

Aldy JE, Stavins RN (2012) The promise and problems of pricing carbon: theory and experience. J Environ Dev 21(2):152–180

Apergis N, Payne JE (2010) The emissions, energy consumption, and growth nexus: evidence from the Commonwealth of Independent States. Energ Policy 38:650–655

Arcelus FJ, Arocena P (2005) Productivity differences across OECD countries in the presence of environmental constraints. J Oper Res Soc 56:1352–1362

Baiocchi G, Minx JC (2010) Understanding changes in the UKs CO2 emissions: A global perspective. Environ Sci Technol 44(4):1177–1184

Ball VE, Lovell CAK, Nehring R, Somwaru A (1994) Incorporating undesirable outputs into models of production: an application to U.S. Agriculture. Cahiers d’Économie et Sociologie Rurales 31:59–74

Bampatsou C, Hadjiconstantinou G (2009) The use of the DEA method for simultaneous analysis of the interrelationships among economic growth, environmental pollution and energy consumption. Int J Econ Sci Appl Res 2(2):65–86

Banker RD, Morey R (1986) Efficiency analysis for exogenously fixed inputs and outputs. Oper Res 34(4):513–521

Bian Y, Yang F (2010) Resource and environment efficiency analysis of provinces in China: a DEA approach based on Shannon’s entropy. Energ Policy 38(4):1909–1917

Bogetoft P, Otto L (2011) Benchmarking with DEA, SFA, and R. Springer Science + Business Media, LLC

Brizga J, Feng K, Hubacek K (2013) Drivers of CO2 emissions in the former Soviet Union: a country level IPAT analysis from 1990 to 2010. Energy 59:743–753

Chambers RG, Chung Y, Färe R (1998) Profit, directional distance functions, and Nerlovian efficiency. J Optimiz Theory App 98(2):351–364

Charnes A, Cooper WW, Rhodes E (1978) Measuring efficiency of decision making units. Eur J Oper Res 2:429–444

Chertow MR (2000) The IPAT equation and its variants: changing views of technology and environmental impact. J Ind Ecol 4(4):13–29

Chung YH, Färe R, Grosskopf S (1997) Productivity and undesirable outputs: a directional distance function approach. J Environ Manage 51:229–240

Coelli T, Lauwers L, Huylenbroeck GV (2007) Environmental efficiency measurement and the materials balance condition. J Prod Anal 28:3–12

Coelli TJ, Gautier A, Perelman S, Saplacan-Pop R (2013) Estimating the cost of improving quality in electricity distribution: a parametric distance function approach. Energ Policy 53:287–297

Coggins JS, Swinton JR (1996) The price of pollution: a dual approach to valuing SO2 allowances. J Environ Econ Manag 30:58–72

Cooper WW, Seiford LM, Thanassoulis E, Zanakis SH (2004) DEA and its uses in different countries. Eur J Oper Res 154:337–344

Cooper WW, Seiford LM, Tone K (2007) Data envelopment analysis: A comprehensive text with models, applications, references and DEA-solver software, 2nd edn. Springer Science + Business Media, New York

Cottrell J, Meyer E (2012) Ecological tax reform in Europe and Central Asia. In: Kreiser L et al (eds) Carbon pricing, growth, and the environment. Edward Elgar Publishing Limited, UK, pp 67–87

Daraio C, Bonaccorsi A, Geuna A, Lepori B, Bach L, Bogetoft P et al (2011) The European university landscape: a micro characterization based on evidence from the aquameth project. Res Policy 40(1):148–164

Ehrlich PR, Holdren JP (1971) Impact of population growth. Science 171:1212–1217

Ekins P (2004) Step changes for decarbonising the energy system: research needs for renewables, energy efficiency and nuclear power. Energ Policy 32(17):1891–1904

Emrouznejad A, Parker BR, Tavares G (2008) Evaluation of research in efficiency and productivity: a survey and analysis of the first 30 years of scholarly literature in DEA. Socio Econ Plan Sci 42:151–157

Fan YL, Liu C, Wu G, Wei Y-M (2006) Analyzing impact factors of CO2 emissions using the STIRPAT model. Environ Impact Asses 26:377–395

Färe R, Grosskopf S (2000) Theory and application of directional distance function. J Prod Anal 13:93–103

Färe R, Grosskopf S (2004) Modeling undesirable factors in efficiency evaluation: comment. Eur J Oper Res 157:242–245

Färe R, Grosskopf S, Lovell CAK, Pasurka CA (1989) Multilateral productivity comparisons when some outputs are undesirable: a nonparametric approach. Rev Econ Stat 71:90–98

Färe R, Grosskopf S, Lovell CAK, Yaisawarng S (1993) Derivation of shadow prices for undesirable outputs: a distance function approach. Rev Econ Stat 75:374–380

Färe R, Grosskopf S, Weber WL (2001) Shadow prices of Missouri public conservation land. Public Financ Rev 29(6):444–460

Färe R, Grosskopf S, Hernando-Sanchez F (2004) Environmental Performance: an index number approach. Resour Energy Econ 26(4):343–352

Färe R, Grosskopf S, Noh DW, Weber WL (2005) Characteristics of a polluting technology: theory and practice. J Econometrics 126:469–492

Färe R, Grosskopf S, Pasurka CA (2007) Environmental production functions and environmental directional distance functions. Energy 32:1055–1066

Fischer C, Newell RG (2008) Environmental and technology policies for climate mitigation. J Environ Econ Manag 55(2):142–162

Golany B, Roll Y (1989) An application procedure for DEA. Omega 1(3):237–250

Goulder LH, Parry IWH (2008) Instrument choice in environmental policy. Rev Environ Econ Pol 2(2):152–174

Green KP (2009) Climate change: the resilience option. American Enterprise Institute, Energy and Environmental Outlook 4. http://www.aei.org/outlook/energy-and-the-environment/climate-change-the-resilience-option/. Accessed March 2013

Hoang V-N, Alauddin M (2012) Input-orientated data envelopment analysis framework for measuring and decomposing economic, environmental and ecological efficiency: an application to OECD agriculture. Environ Resour Econ 51:431–452

Hoang V-N, Coelli T (2011) Measurement of agricultural total factor productivity growth incorporating environmental factors: a nutrients balance approach. J Environ Econ Manage 62(3):462–474

Hoang V-N, Rao DSP (2010) Measuring and decomposing sustainable efficiency in agricultural production: a cumulative exergy balance approach. Ecol Econ 69(9):1765–1776

Hua Z, He P, Bian Y (2008) Improving eco-efficiency of a system through allocation of non-discretionary input. Inform Manage Sci 19(1):75–91

ICAP (2015) Emissions trading worldwide. International carbon action partnership status report

Ichikawa N, Tsutsumi R, Watanabe K (2002) Environmental indicators of transition. Eur Env 12(2):64–76

Jacobs M, Ward J, Smale R, Krahé M, Bassi S (2012) Less pain, more gain: the potential of carbon pricing to reduce Europe’s fiscal deficits. Policy Paper, Centre for Climate Change Economics and Policy Grantham Research Institute on Climate Change and the Environment

Johnson TL, Hope C (2012) The social cost of carbon in U.S. regulatory impact analyses: an introduction and critique, J Environ Stud Sci 2(3): 205–221

Kiuila O, Markandya A (2009) Can transition economies implement a carbon tax and hope for a double dividend? The case of Estonia. Appl Econ Lett 16:705–709

Knight KW, Rosa EA (2012) Household dynamics and fuelwood consumption in developing countries: a cross-national analysis. Popul Environ 33(4):365–378

Kuosmanen N, Kuosmanen T (2013) Modeling cumulative effects of nutrient surpluses in agriculture: a dynamic approach to material balance accounting. Ecol Econ 90:159–167

Lauwers L (2009) Justifying the incorporation of the materials balance principle into frontier-based eco-efficiency models. Ecol Econ 68:1605–1614

Lee JD, Park JB, Kim TW (2002) Estimation of the shadow prices of pollutants with production/environment inefficiency taken into account: a non parametric directional distance function approach. J Environ Manage 64(4):365–375

Liddle B (2013) Population, affluence, and environmental impact across development: evidence from panel cointegration modeling. Environ Modell Softw 40:255–266

Liu W, Nishijima S (2013) Productivity and openness: firm level evidence in Brazilian manufacturing industries. Econ Chang and Restruc 46(4):363–384

Liu WB, Meng W, Li XX, Zhang DQ (2010) DEA models with undesirable inputs and outputs. Ann Oper Res 173:177–194

Liu JS, Lu LYY, Lu WM, Lin BJY (2013) A survey of DEA applications. omega 41:893–902

Lozano S, Gutiérrez E (2008) Non-parametric frontier approach to modelling the relationships among population, GDP, energy consumption and CO2 emissions. Ecol Econ 66:687–699

Luenberger DG (1992) Benefit functions and duality. J Math Econ 21:461–481

Maradan D, Vassiliev A (2005) Marginal costs of carbon dioxide abatement: empirical evidence from cross-country analysis. Swiss J Econ Stat 141(3): 377–410

Marin G, Mazzanti M (2013) The evolution of environmental and labor productivity dynamics. J Evol Econ 23(2):357–399

Morgan D (2012) A carbon tax would harm U.S. competitiveness and low-income americans without helping the environment. Backgrounder 2720, August 21, 2012

NERA Economic Consulting (2011) The demand for greenhouse gas emissions reduction investments: an investors’ marginal abatement cost curve for kazakhstan. Prepared for EBRD

Oldfield JD (2001) Russian environmentalism. Eur Environ 12(2):117–129

Organization for Economic Co-operation and Development (2007) Policies for a better environmental progress in eastern Europe. OECD Publishing, Caucasus and Central Asia. ISBN 9789264027343, OECD Code: 972007101P1

Orlov A, Grethe H, McDonald S (2013) Carbon taxation in Russia: prospects for a double dividend and improved energy efficiency. Ener Econ 37:128–140

Picazo-Tadeo AJ, Reig-Martinéz E, Hernandes-Sancho F (2005) Directional distance functions and environmental regulation. Resour Energy Econ 27:131–142

Pindyck SR (2013) Pricing carbon when we don’t know the right price. Regulation 36(2):43–46

Pittel K, Rübbelke DTG (2008) Climate policy and ancillary benefits: a survey and integration into the modelling of international negotiations on climate change. Ecol Econ 68:210–220

Ramanathan R (2005) An analysis of energy consumption and carbon dioxide emissions in countries of the middle East and North Africa. Energy 30:2831–2842

Ramanathan R (2006) A multi-factor efficiency perspective to the relationships among world GDP, energy consumption and carbon dioxide emissions. Technol Forecast Soc 73:483–494

Ramseur JL, Leggett JA, Sherlock MF (2012) Carbon tax: deficit reduction and other considerations. CRS Report for Congress, Congressional Research Service 7–5700:R4273

Repetto R (2013) Cap and trade contains global warming better than a carbon tax. Challenge 56(5):31–61

Rosa E, York R, Dietz T (2004) Tracking the anthropogenic drivers of ecological impacts. J Hum Environ 32:509–512

Ruggiero J (1998) Non-discretionary inputs in data envelopment analysis. Eur J Oper Res 111:461–469

Saati S, Hatami-Marbini A, Tavana M (2011) A data envelopment analysis model with discretionary and nondiscretionary factors in fuzzy environments. Int J Prod Qual Manage 8(1):45–63

Sadler TR (2013) Carbon capture and a commercial market for CO2. Int Adv Econ Res 19(2):189–200

Sahoo BK, Luptacik M, Mahlberg B (2011) Alternative measures of environmental technology structure in DEA: an application. Eur J Oper Res 215:750–762

Salnykov MI, Zelenyuk VP (2005) Estimation of environmental efficiencies of economies and shadow prices of pollutants in countries in transition. EERC WP 05/06

Seiford LM, Zhu J (2002) Modeling undesirable factors in efficiency evaluation. Eur J Oper Res 142:16–20

Shi A (2003) The impact of population pressure on global carbon dioxide emissions, 1975–1996: evidence from pooled cross-country data. Ecol Econ 44:29–42

Shi GM, Bi J, Wang JN (2010) Chinese regional industrial energy efficiency evaluation based on a DEA model of fixing non-energy inputs. Energ Policy 38:6172–6179

Söderholm P (2001) Environmental policy in transition economies: Will pollution charges work? J Environ Dev 10(4):365–390

Song M, An Q, Zhang W, Wang Z, Wu J (2012) Environmental efficiency evaluation based on data envelopment analysis: a review. Renew Sust Energ Rev 16:4465–4469

Sueyoshi T, Goto M (2012) DEA radial measurement for environmental assessment and planning: desirable procedures to evaluate fossil fuel power plants. Energ Policy 41:422–432

Sun CC (2011) Evaluating and benchmarking productive performances of six industries in Taiwan Hsin Chu Industrial Science Park. Expert Syst Appl 38:2195–2205

Timilsina RG, Csordás S, Mevel S (2011) When does a carbon tax on fossil fuels stimulate biofuels? Ecol Econ 70(12):2400–2415

Tol RSJ (2009) The economic effects of climate change. J Econ Perspect 23(2):29–51

Tol RSJ (2011) The social cost of carbon, ESRI working paper, No. 377

Tone K, Tsutsui M (2011) Applying an efficiency measure of desirable and undesirable outputs in DEA to U.S. electric utilities. J Centrum Cathedra 4 (2): 236–249

Tonini A (2012) A Bayesian stochastic frontier: an application to agricultural productivity growth in European countries. Econ Chang Restruc 45(4):247–269

Tyrowicz L, Jeruzalski T (2013) (In)Efficiency of matching: the case of a post-transition economy. Econ Chang Restruc 46(2):255–275

Unger N (2012) Global climate forcing by criteria air pollutants. Annu Rev Eviron Res 37:1–24

Waggoner PE, Ausubel JH (2002) A framework for sustainability science: a renovated IPAT identity. P Natl Acad Sci 99(12):7860–7865

Wang Q, Cui Q, Zhou D, Wang S (2011) Marginal abatement costs of carbon dioxide in China: a nonparametric analysis. Energ Procedia 5:2316–2320

Wei T (2011) What STIRPAT tells about effects of population and affluence on the environment? Ecol Econ 72:70–74

Wilson PW (2012) Asymptotic properties of some non-parametric hyperbolic efficiency estimators. In: van Keilegom I, Wilson PW (ed) Exploring research frontiers in contemporary statistics and econometrics: a festschrift for Léopold Simar, Chapter 6. Physica-Verlag HD

Winkler H, Marquard A (2011) Analysis of the economic implications of a carbon tax. J Energ in Southern Africa 22(1):55–68

Yang H, Pollitt M (2010) The necessity of distinguishing weak and strong disposability among undesirable outputs in DEA: environmental performance of Chinese coal-fired power plants. Energ Policy 38:4440–4444

York R, Rosa EA, Dietz T (2003) STIRPAT, IPAT and ImPACT: analytic tools for unpacking the driving forces of environmental impacts. Ecol Econ 46(3):351–365

Zhang N, Choi Y (2014) A note on the evolution of directional distance function and its development in energy and environmental studies 1997–2013. Renew Sust Energ Rev 33:50–59

Zhang C, Lin Y (2012) Panel estimation for urbanization, energy consumption and CO2 emissions: a regional analysis in China. Energ Policy 49:488–498

Zhou P, Ang BW, Poh KL (2008) A survey of data envelopment analysis in energy and environmental studies. Eur J Oper Res 189:1–18

Zhou P, Ang BW, Wang H (2012) Energy and CO2 emission performance in electricity generation: a non-radial directional distance function approach. Eur J Oper Res 221:625–635

Zhu Q, Peng X (2012) The impacts of population change on carbon emissions in China during 1978–2008. Environ Impact Asses 36:1–8

Acknowledgments

The author would like to thank the journal Editor and two anonymous Referees for their constructive comments and valuable suggestions. Special gratitude goes to Rachel Strohm (AuthorAID) for great support. The usual declaimer applies.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Arazmuradov, A. Economic prospect on carbon emissions in Commonwealth of Independent States. Econ Change Restruct 49, 395–427 (2016). https://doi.org/10.1007/s10644-015-9176-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-015-9176-4