Abstract

Search frictions, defined as the costs of finding trading partners, are a common feature of most permit markets. In these markets prices are not publicly available, buyers and sellers need to find their trading partners, trades often take place bilaterally, and there is often no central market-clearing mechanism. In this paper, we study the search and trading decisions of participants in a permit market with search frictions. We build an analytical model of the trading decision in a market with search frictions and show that individuals set a reservation price and an optimal search effort. The model shows that in the presence of search frictions, those who intend to trade (buy or sell) greater quantities search more. This trading behavior is not expected in a market without search frictions. Furthermore, we show that trading ratios affect the probability of trades taking place. We test the predictions of the model using a unique dataset of trades from a groundwater market with trading ratios that was designed to reduce a spatially explicit externality. We find that search frictions are significant so that buyers or sellers who trade greater quantities search more. Furthermore, we show that while the trading ratio system provides incentives to participants to reduce the spatial externality, search frictions reduces the effectiveness of the market by affecting the pool of potential trading partners for participants in the market.

Similar content being viewed by others

Notes

The market is different from most water quality markets in that, the participants are all agricultural producers and no point source-nonpoint source trades take place. In most water quality markets, search is one-sided and point source buyers look for non-point source sellers (Reeling et al. 2020).

Unites States Department of Agriculture National Agricultural Statistics Service

TPNRD refers both to the region and the management body.

These rules are in line with the objectives of the TPNRD to encourage the movement of irrigation away from the river.

Sometimes traders bear some of the costs, e.g., participants could be responsible for monitoring and reporting the amount of pollution.

Proofs of Equations are provided in the Appendix.

While it is possible that a seller can buy irrigation rights in the future, we assume that this is not explicitly part of their plan at the time that they sell their irrigation rights. Furthermore, if a producer sells their irrigation rights at time t and decides to buy irrigation rights at \(t+s\), their decision at time \(t+s\) will be that of a buyer, which is a separate decision starting at time \(t+s\).

Fixed costs of trade, such as registration costs, can be modeled as a lower bound on the integral in Equation 4

In practice, the final price received by a seller may depend on the negotiation between a buyer and the seller. The final price still needs to be above the seller’s reservation price.

We focus only on the sellers because the quantity traded and the distance between the buyers and the sellers is the same for buyers and the sellers.

The shapes in the figure have been slightly modified to hide the actual shapes of the irrigated acres traded.

Since the signs of the coefficients are of interest, we do not present their marginal effects.

Greater land capability class means a lower quality land for the specific practice.

Soil data were obtained from gSSURGO.

Another variable considered in the Water Optimizer is well capacity. However, estimated irrigated corn profits are not sensitive to well capacity. As a result, we assume a uniform 800 gpm well capacity across parcels.

References

Atkinson SE, Tietenberg Thomas H (1982) The empirical properties of two classes of designs for transferable discharge permit markets. J Environ Eco-n Manag 9(2):101–121

Bjornlund H (2004). Formal and informal water markets: drivers of sustainable rural communities? Water Resour Res 40.9

Braden John B et al (1989) Optimal spatial management of agricultural pollution. Am J Agric Econ 71(2):404–413

Burtraw D et al (2005) Economics of Pollution Trading for SO2 and NO x. Annu Rev Environ Resour 30:253–289

Carey J, Sunding DL, Zilberman D (2002) Transaction costs and trading behavior in an immature water market. Environ Dev Econ 7(4):733–750

Chan G et al (2012) The SO2 allowance trading system and the Clean Air Act Amend-ments of 1990: reflections on twenty years of policy innovation. Technical report, National Bu-reau of Economic Research

Coase RH (1960) The problem of social cost. J Law Econ 3:1–44

Colby BG (1990) Transactions costs and efficiency in Western water allocation. Am J Agric Econ 72(5):1184–1192

Dales JH (1968) Land, water, and ownership. Can J Eco-n/Revue canadienne d’Economique 1(4):791–804

Dales JH (1968) Pollution, property & prices: an essay in policy-making and economics. University of Toronto Press, Toronto

Debaere P et al (2014) Water markets as a response to scarcity. Water Policy 16(4):625–649

Easter KW, Rosegrant MW, Dinar A (1999) Formal and informal mar- kets for water: institutions, performance, and constraints. World Bank Res Obs 14(1):99–116

Foster T, Nicholas B, Adrian PB (2014). Modeling irrigation be-havior in groundwater systems. Water Resour Res 50(8), 6370–6389.issn: 1944-7973. https://doi.org/10.1002/2014WR015620.url: http://dx.doi.org/10.1002/2014WR015620

Fowlie M, Holland SP, Mansur ET (2009) What Do Emissions Mar- kets Deliver and to Whom? Evidence from Southern California’s NOx Trading Program. Tech. rep, National Bureau of Economic Research

Gangadharan, Lata (2000). Transaction costs in pollution markets: an empirical study. Land Economics 76(4)

Garrick D, Whitten SM, Coggan A (2013) Understanding the evolu- tion and performance of water markets and allocation policy: a transaction costs analysis framework. Ecol Econ 88:195–205

Genius M et al (2013) Information transmission in irrigation technology adop- tion and diffusion: social learning, extension services, and spatial effects. Am J of Agric Econ 96(1):328–344

Gesch D et al (2002) The national elevation dataset. Photogramm Eng Remote Sens 68(1):5–32

Glover RE, Balmer GG (1954) River depletion resulting from pumping a well near a river. Eos Tran Am Geophys Union 35(3):468–470

Graziano M, Kenneth G (2014). Spatial patterns of solar pho- tovoltaic system adoption: the influence of 3neighbors and the built environment \({\ddagger }\). J Econ Geograp 15(4): 815–839. issn: 1468-2702. https://doi.org/10.1093/jeg/lbu036.eprint: http://oup.prod.sis.lan/joeg/article-pdf/15/4/815/7370549/lbu036.pdf. url: https://doi.org/10.1093/jeg/lbu036

Haacker EMK, Kendall AD, Hyndman DW (2016) Water level declines in the High Plains Aquifer: predevelopment to resource senescence. Groundwater 54(2):231–242

Hahn RW, Hester GL (1989) Marketable permits: lessons for theory and practice. Ecology LQ 16:361

Hahn RW, Hester GL (1989) Where did all the markets go-an analysis of EPA’s emissions trading pro- gram. Yale J Reg 6:109

Hearne RR, Easter KW (1995). Water allocation and water markets: an analysis of gains-from-trade in Chile. V315. World Bank Publications

Horan RD, Shortle JS (2005) When two wrongs make a right: Second- best point-nonpoint trading ratios. Am J Agric Econ 87(2):340–352

Howe CW, Goemans C (2003) Water transfers and their impacts: lessons from three Colorado water markets1. JAWRA J Am Water Resour Assoc 39(5):1055–1065

Howitt RE (1994) Empirical analysis of water market institutions: the 1991 Cali- fornia water market. Resour Energy Econ 16(4):357–371

Jaraitė-Kažukauskė J, Kažukauskas A (2015) Do transaction costs influence firm trading behaviour in the european emissions trading system? Environ Resour Econ 62(3):583–613

Johnson Bruce B et al (2011) Nebraska irrigation fact sheet. University of Nebraska- Lincoln, Department of Agricultural Economics

Joskow PL, Richard S, Elizabeth MB (1998). The market for sulfur dioxide emissions. Am Econ Rev, 669–685

Juchems EM, Karina S, Nicholas B (2013). Predicting ground- water trading participation in the Upper Republican Natural Resource District.

Kerr S, David M (1998). Transaction costs and tradable permit markets: the United States lead phasedown. Manuscript, Motu Econ Public Policy Re- s, New Zealand

Kuwayama Y, Brozović N (2013) The regulation of a spatially hetero- geneous externality: tradable groundwater permits to protect streams. J Environ Econ Manag 66(2):364–382

Lankoski J, Lichtenberg E, Ollikainen M (2008) Point/nonpoint effluent trading with spatial heterogeneity. Am J Agric Econ 90(4):1044–1058

Lentz AH, Ando AW, Brozović N (2014) Water quality trading with lumpy investments, credit stacking, and ancillary benefits. JAWRA J Am Water Resour Assoc 50(1):83–100

Lewis DJ, Barham BL, Robinson B (2011) Are there spatial spillovers in the adoption of clean technology? The case of organic dairy farming. Land Eco- n 87(2):250–267

Martin D et al. (2007). Water Optimizer, a decision support tool for producers with limited water. In: University of Nebraska-Lincoln Departments of Biological Systems Engineer- ing and Agricultural Economics, Lincoln, Nebraska

Montero JP (1997). Volunteering for market-based environmental regulation: the substitution provision of the SO? emissions trading program.

Mortensen, DT et al. (1970). A theory of wage and employment dynamics. Microe- conomic foundations of employment and inflation theory 219

Muller NZ, Mendelsohn R (2009) Efficient pollution regulation: getting the prices right. Am Econ Rev 99(5):1714–39

Newell RG, Sanchirico JN, Kerr S (2005) Fishing quota markets. J Environ Econ Manag 49(3):437–462

Palazzo A, Brozović N (2014) The role of groundwater trading in spatial water management. Agric Water Manag 145:50–60

Peterson SM, Flynn AT, Traylor JP (2016) Groundwater-Flow Model of the Northern High Plains Aquifer in Colorado, Kansas, Nebraska, South Dakota, and Wyoming. Tech. rep, US Geological Survey

Reeling C, Horan RD, Garnache C (2020) When the Levee Breaks: Can multi-pollutant markets break the dam on point-nonpoint market participation? Am J Agric Econ 102(2):625–640

Ribaudo MO, Gottlieb J (2011) Point-nonpoint trading-can it work? 1. JAWRA J Am Water Resour Assoc 47(1):5–14

Rogerson R, Shimer R, Wright R (2004) Search-theoretic models of the labor market-a survey. Tech. rep, National Bureau of Economic Research

Saliba BC (1987) Do water markets work? market transfers and trade-offs in the southwestern states. Water Resour Res 23(7):1113–1122

Sampson, GS, Edward DP (2018). The role of peer effects in natural resource appropriation – the case of groundwater. Am J Agric Econ 101(1): 154–171. issn: 0002-9092. https://doi.org/10.1093/ajae/aay090.eprint: http://oup.prod.sis.lan/ajae/article-pdf/101/1/154/27099974/aay090.pdf. url: https://doi.org/10.1093/ajae/aay090

Savage J, Nicholas B (2009). Irrigation technology adoption under factor price uncertainty: groundwater-irrigated production in Nebraska, 1960–2005. Tech. rep

Shortle J (2013) Economics and environmental markets: lessons from water-quality trading. Agric Resour Econ Rev 42(1):57–74

Stavins Robert N (1995) Transaction costs and tradeable permits. J Envi- ron Econ Manag 29(2):133–148

Stavins RN (1998) What can we learn from the grand policy experiment? Lessons from SO2 al- lowance trading. J Econ Perspect 12(3):69–88

Stephenson K, Shabman L (2017) Where did the agricultural nonpoint source trades go? Lessons from Virginia water quality trading programs. JAWRA J Am Water Resour Assoc 53(5):1178–1194

Suter JF, Spraggon JM, Poe GL (2013) Thin and lumpy: an exper- imental investigation of water quality trading. Water Resour Econ 1:36–60

Towe C, Chad L (2013). The contagion effect of neighboring foreclosures. Am Econ J : Econ Policy 5(2): 313–335. issn: 19457731, 1945774X. http://www.jstor.org/stable/43189336

Wu JJ, Segerson K (1995) The impact of policies and land characteristics on potential groundwater pollution in Wisconsin. Am J Agric Econ 77(4):1033–1047

Young RK, Brozović N (2016) Innovations in groundwater management: smart markets for transferable groundwater extraction rights. Technol Inno- v 17(4):219–226

Young RA (1986) Why are there so few transactions among water users? Am J Agric Econ 68(5):1143–1151

Zlotnik VA, Huihua H, James JB Jr (1999). Evaluation of stream de- pletion considering finite stream width, shallow penetration, and properties of streambed sediments.

Acknowledgments

We thank Richael Young and the staff of the Twin Platte Natural Resources District for assistance. This work was supported by USDA-NIFA grant 2015-68007-23133 and USDA-OCE Cooperative Agreement number 58-011-17-006.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This work was supported by USDA-NIFA grant 2015-68007-23133 and USDA-OCE Cooperative Agreement number 58-011-17-006.

This paper has not been submitted elsewhere in identical or similar form, nor will it be during the first three months after its submission to the Publisher.

Appendix

Appendix

1.1 Derivation of Eq. 1

For a potential seller, the payoff of selling the permits equals a one-time payment of \(\omega Q\) for the Q number of permits sold and the present value of a stream of payments under production with no permits, \(\pi ^{0} Q\), is:

where \(\delta\) is the discount factor. We can rewrite the equation above as:

We can also write Eq. 18 as:

Combining Eqs. 19 and 20, we get:

Rearranging the terms in Eq. 21, we get:

\(\delta\) is the discount factor. As a result, we can write \(\frac{\delta }{(1-\delta )}\) in terms of discount rate: \(\frac{\delta }{(1-\delta )} = \frac{1}{r}\) and modify Eq. 22 to:

Finally, we can write Eq. 23 as:

Which is the Eq. 1.

1.2 Derivation of Eq. 2

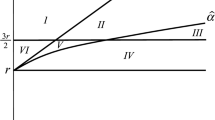

The payoff of not selling the permits in the current period is equal to producing with the permits in the next period, \(\delta \pi ^{1} Q\), while looking for a trading partner. The search process results in meeting a trading partner with probability \(\alpha\). The probability of trade can increase but it’s costly, \(g(\alpha )\). After meeting the potential buyer, a price is realized from the distribution \(F(\omega )\). This is the price offered by the potential buyer to the seller. If the payoff from selling the price is greater than the payoff of not selling the permits, the seller will sell the permits and the payoff of the next period will be \(W_s(\omega )\). Otherwise, if the payoff of selling the permits is less than that of not selling the permits, the seller will wait another period to sell their permits and receive a payoff of \(U_s\) in the next period.

We can rearrange Eq. 25 as:

1.3 Derivation of Reservation Price

The reservation price, R, is the price where the payoff of selling the permits is equal to the payoff of not selling the permits and wait another period, i.e., at the reservation price, Eq. 1 is equal to Eq. 2:

where \(\Delta \pi = \pi ^{1} - \pi ^{0}\) is the profit differential. We can also write:

replacing \(W_s(\omega ) - U\) with \((\omega - R) Q\), in Eq. 27, we get:

Rearranging the terms above, we get the reservation price for a potential seller:

We can further simplify the integral in Eq. 30 as:

Using integration by parts, we can write the above equation as:

Given that \(F(\bar{\omega }) = 1\), we can write \(\int _R^{\bar{\omega }} \! (\omega - R) \, \mathrm {d}F(\omega )\) as \(\int _R^{\bar{\omega }} \! (1- F(\omega )) \, \mathrm {d}\omega\). We can then write the reservation price for a seller as (Tables 4 and 5):

Which is Eq. 3. The effort level that maximizes the seller’s present payoff (Eq. 6) can be derived as:

Rights and permissions

About this article

Cite this article

Rouhi Rad, M., Mieno, T. & Brozović, N. The Role of Search Frictions and Trading Ratios in Tradable Permit Markets. Environ Resource Econ 82, 101–132 (2022). https://doi.org/10.1007/s10640-022-00664-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-022-00664-3