Abstract

This article quantifies the impact on optimal climate policy, of both damage elasticity and equilibrium climate sensitivity uncertainty, under separable preferences for risk and intergenerational inequality. The primary findings are as follows. (1) Such preferences can depress the social cost of carbon (SCC) when calibration aims at matching actual economic outcomes, countering the prevailing view that the SCC is greater with separable than with conventional entangled preferences. (2) Damage elasticity uncertainty has larger effects on climate policy than equilibrium climate sensitivity uncertainty, even under high impact tail risk of the latter. (3) Risk aversion decisively strengthens optimal climate policy under joint damage and climate sensitivity uncertainty, than with a single source of uncertainty alone. Indeed, failing to account for the interaction between damage and climate sensitivity uncertainty underestimates the cost of climate change by more than US dollars 1 trillion.

Similar content being viewed by others

Notes

The baseline DICE 2013R model for instance predicts a SCC that would start about 2005 US $21 in 2020, and rise monotonically to about 2005 US $143 in 2100. In the latest version of DICE, DICE 2016R, the SCC starts at about $31 and rises at \(\sim 3\%\) for much of this century. The increase in SCC is primarily explained by an updated carbon cycle with a higher climate sensitivity that better tracks the deaccumulation of CO2 over a 4000-year timescale.

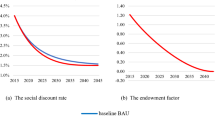

Contrary to a prescriptive calibration where model parameters may be chosen on normative grounds, a descriptive calibration emphasizes choosing model parameters such that the model solution is fully consistent with actual economic outcomes.

To achieve this, I use the pure rate of time preference as the degree of freedom when targeting the observed savings rate.

That is, when solving for the optimal policy, I account for the right-tail realizations of equilibrium climate sensitivity.

Dietz and Stern (2015) and Hwang et al. (2013) also consider climate sensitivity uncertainty for various specifications of the damage function under traditional expected utility preferences. Their results suggest that abatement and the social cost of carbon can be more responsive to climate sensitivity uncertainty for very steep damage functions.

They model abatement inertia by putting a constraint on the growth rate of investment and catastrophic climate risk through a collapse in the Atlantic Thermohaline Circulation.

Key here is that current abatement can indeed mitigate future consequences. If the planner were to end up in a highly undesirable state of the world, and abatement has little effect on mitigating future outcomes, it is possible that little to no abatement becomes the dominant strategy. These views find support in the results of Hwang et al. (2016).

While the literature often uses Monte Carlo methods to approximate the impacts of decision making under uncertainty, Crost and Traeger (2013) argue and present evidence for why this can be misleading.

An exception in this regard is Rudik (2019), who uses data gathered by Howard and Sterner (2017) to estimate the parameters of the damage function. He recovers an estimate for \(b_{1}\) that is twice in size that of DICE and an elasticity for \(b_{2}=1.8\), which is very close to the value used in DICE.

Annan and Hargreaves (2011) show that under reasonable assumptions, much greater confidence in a moderate value for climate sensitivity is easily justified, with an upper 95% probability limit for it easily shown to lie close to \(4\,^{\circ }\text {C}\), and certainly well below \(6\,^{\circ }\text {C}\).

Over the years, DICE’s estimate for equilibrium climate sensitivity has in fact been adjusted upwards with the latest 2016 version having a value of 3.1 (Nordhaus 2017).

Stern (2007) uses a pure rate of time preference of 0.1% for his analysis. This compares with 1.5% that DICE generates under a descriptive calibration.

The expression makes use of the assumption that consumption shocks are idiosyncratic. See the Online Appendix for derivation.

There is of course some tension when calibrating the social planner framework to actual economic outcomes. Indeed, the global economy is decentralized with several distortions, imperfections, externalities, and inefficiencies in markets. Such frictions drive a wedge between the social discount rate (i.e., derived from what is socially optimal) and the investment discount rate (i.e., actual returns on risk-free capital assets), meaning that the two are generally not equalized. Should one then still calibrate the social planner model as though it were fully consistent with observed economic outcomes? Arrow (1999), Arrow et al. (2013), Dasgupta (2007), Drupp et al. (2018) and Nordhaus (2007) discuss this matter, and decide in favour of the descriptive approach.

Since \(\rho\) is unobserved, and its value is typically assumed in empirical work, it provides the natural degree of freedom for calibrating the model when the savings rate is fixed.

DICE presumes the availability of negative emission technologies sometime in the future, a feature that is terminated in this paper’s version of the model.

A key requirement in stochastic programming is nonanticipativity (Shapiro et al. 2009). This in essence restricts choices to depend on the current state and not on the future’s yet unrealized outcomes. This requirement ensures that scenarios sharing a common history, generate similar outcomes. In stochastic DICE, this implies a single optimal outcome for consumption, abatement, emissions, and hence a unique path for all state variables prior to the realization of the shock. The reported expected SCC is obtained as the probabilistic sum over the scenario SCCs.

For \(\gamma <\vartheta\), the planner is willing to sacrifice welfare for the early resolution of uncertainty even if this resolution is not pay-off relevant. With \(\gamma =\vartheta\), the planner is indifferent about when risk is resolved (i.e., temporally risk neutral), but prefers the late resolution of risk (i.e., temporally risk-loving) when \(\gamma >\vartheta\). For further details see e.g., Epstein and Zin (1989, 1991), Kreps and Porteus (1978), Traeger (2009) and Weil (1990, 1989).

The savings rate in the deterministic version of the original DICE model by Nordhaus and Sztorc (2013), is also 26.9%.

Lowering \(\gamma\) to 0.8 explains nearly 150% of the initial increase in the SCC and increasing \(\vartheta\) to 10 from 0.8 explains the remaining nearly 40%.

With \(\gamma =0.8\) and recalibration of the base year savings rate disregarded, the model predicts a base year social consumption discount rate of 2.6%.

For brevity, the ensuing discussion focuses on the descriptive calibration, but impacts on the SCC for the prescriptive calibration are illustrated in Fig. 5.

Because \(\text {SCC}_{t}=\nicefrac {\partial F_{t}}{\partial E_{t}}\), greater emissions correspond to a smaller gain from marginal emissions and thus a smaller expected SCC.

In particular, while DICE sets the parameter that calibrates atmosphere inertia to 51 years, in this counterfactual simulation the parameter is set to 21 years.

The present model cannot be directly compared to the versions used by Lemoine and Rudik (2017b), Jensen and Traeger (2016), and Hwang et al. (2017). Nonetheless, when uncertainty is introduced linearly by assuming the ratio (\(\nicefrac {1}{\zeta }\)), rather than non-linearly by taking only the component \(\zeta\), as uncertain, the SCC is always lower under uncertainty with the former. In particular, it lower by between US$ 2-3 through out the years.

In their setting of fat tails, the mean is technically undefined and thus their use of the mode.

Indeed, I observe a greater SCC under uncertainty, when a ‘modal’ value of 3.0 (rather than the mean of 3.56) is used to recover the deterministic policy. For the baseline and benchmark scenarios, the SCC under uncertainty is greater, relative to the deterministic SCC, by US$ 4.657 and 3.889 in 2020, rising to US$ 18.226 and 15.322 in 2075. In specification ‘\(\gamma =\vartheta =0.8\)’ ( ‘\(\gamma =0.8\)\(\vartheta =0.2\)) the SCC is greater by US$ 3.354 (3.322) in 2020, rising to 10.343 (10.051) in 2075.

They model inertia by constraining attainable cumulative abatement per unit change in time.

Figure 5 shows that this pattern continues to hold even when the recalibration of the discount rate is disregarded for the non-baseline specifications.

In fact, with an exogenous Gaussian process for consumption growth and fixed climate policy, it can be shown that the conditional variance of future welfare outcomes reduces present-day welfare for \(\vartheta >\gamma =1\).

References

Ackerman F, Stanton EA, Bueno R (2010) Fat tails, exponents, extreme uncertainty: simulating catastrophe in dice. Ecol Econ 69(8):1657–1665

Ackerman F, Stanton EA, Bueno R (2013) Epstein–Zin utility in dice: Is risk aversion irrelevant to climate policy? Environ Resour Econ 56(1):73–84. https://doi.org/10.1007/s10640-013-9645-z ISSN 1573-1502

Annan JD, Hargreaves JC (2011) On the generation and interpretation of probabilistic estimates of climate sensitivity. Clim Change 104(3–4):423–436

Arrow KJ (1999) Discounting, morality, and gaming. In: Portney PR, Weyant JP (eds) Discounting and Intergenerational Equity. Resources for the Future, Washington, pp 13–21

Arrow K, Cropper M, Gollier C, Groom B, Heal G, Newell R, Nordhaus W, Pindyck R, Pizer W, Portney P, Sterner T, Tol RSJ, Weitzman M (2013) Determining benefits and costs for future generations. Science 341(6144):349–350. https://doi.org/10.1126/science.1235665

Belaia M, Funke M, Glanemann N (2017) Global warming and a potential tipping point in the atlantic thermohaline circulation: the role of risk aversion. Environ Resour Econ 67(1):93–125. https://doi.org/10.1007/s10640-015-9978-x

Bretschger L, Pattakou A (2018) As bad as it gets: how climate damage functions affect growth and the social cost of carbon. Environ Resour Econ. https://doi.org/10.1007/s10640-018-0219-y

Burke M, Hsiang SM, Miguel E (2015) Global non-linear effect of temperature on economic production. Nature 527(7577):235–239

Burke M, Craxton M, Kolstad CD, Onda C, Allcott H, Baker E, Barrage L, Carson R, Gillingham K, Graff-Zivin J et al (2016) Opportunities for advances in climate change economics. Science 352(6283):292–293

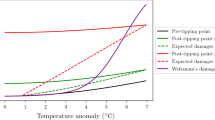

Cai Y, Lenton TM, Lontzek TS (2016) Risk of multiple interacting tipping points should encourage rapid CO2 emission reduction. Nat Clim Change 6(5):520–525. https://doi.org/10.1038/nclimate2964

Crost B, Traeger CP (2013) Optimal climate policy: uncertainty versus monte carlo. Econ Lett 120(3):552–558

Crost B, Traeger CP (2014) Optimal CO2 mitigation under damage risk valuation. Nat Clim Change 4:631–636

Dasgupta P (2007) The stern review’s economics of climate change. Natl Inst Econ Rev 199(1):4–7

Dell M, Jones BF, Olken BA (2012) Temperature shocks and economic growth: evidence from the last half century. Am Econ J Macroecon 4:66–95

Dietz S, Stern N (2015) Endogenous growth, convexity of damage and climate risk: how Nordhaus’ framework supports deep cuts in carbon emissions. Econ J 125(583):574–620

Drupp MA, Freeman MC, Groom B, Nesje F (2018) Discounting disentangled. Am Econ J Econ Policy 10(4):109–34. https://doi.org/10.1257/pol.20160240

Epstein LG, Zin SE (1989) Substitution, risk aversion, and the temporal behavior of consumption and asset returns: a theoretical framework. Econ J Econom Soc 57:937–969

Epstein LG, Zin SE (1991) Substitution, risk aversion, and the temporal behavior of consumption and asset returns: an empirical analysis. J Polit Econ 99(2):263–286

Gollier C, Mahul O, Meddahi N, Nzesseu JT (2017) Term structures of discount rates: an international perspective. Technical report, Toulouse School of Economics

Greenstone M, Kopits E, Wolverton A (2013) Developing a social cost of carbon for us regulatory analysis: a methodology and interpretation. Rev Environ Econ Policy 7(1):23–46. https://doi.org/10.1093/reep/res015

Ha-Duong M, Treich N (2004) Risk aversion, intergenerational equity and climate change. Environ Resour Econ 28(2):195–207

Howard PH, Sterner T (2017) Few and not so far between: a meta-analysis of climate damage estimates. Environ Resour Econ 68(1):197–225

Hwang IC, Reynès F, Tol RSJ (2013) Climate policy under fat-tailed risk: an application of dice. Environ Resour Econ 56(3):415–436

Hwang IC, Tol RSJ, Hofkes MW (2016) Fat-tailed risk about climate change and climate policy. Energy Policy 89:25–35

Hwang IC, Reynès F, Tol RSJ (2017) The effect of learning on climate policy under fat-tailed risk. Resour Energy Econ 48:1–18

Jensen S, Traeger CP (2014) Optimal climate change mitigation under long-term growth uncertainty: stochastic integrated assessment and analytic findings. Eur Econ Rev 69:104–125

Jensen S, Traeger C (2016) Pricing climate risk. Working Paper, School of Economics and Business, Norwegian University of Life Sciences

Keller K, Bolker BM, Bradford DF (2004) Uncertain climate thresholds and optimal economic growth. J Environ Econ Manag 48(1):723–741

Knutti R, Hegerl GC (2008) The equilibrium sensitivity of the earth’s temperature to radiation changes. Nat Geosci 1(11):735–743

Knutti R, Rugenstein MAA, Hegerl GC (2017) Beyond equilibrium climate sensitivity. Nat Geosci 10(10):727

Kreps DM, Porteus EL (1978) Temporal resolution of uncertainty and dynamic choice theory. Econom J Econom Soc 45:185–200

Lemoine D, Rudik I (2017a) Steering the climate system: using inertia to lower the cost of policy. Am Econ Rev 107(10):2947–57

Lemoine D, Rudik I (2017b) Managing climate change under uncertainty: recursive integrated assessment at an inflection point. Annu Rev Resour Econ 9(1):117–142. https://doi.org/10.1146/annurev-resource-100516-053516

Lemoine D, Traeger CP (2016) Economics of tipping the climate dominoes. Nat Clim Change 6(5):514–519

Millner A (2013) On welfare frameworks and catastrophic climate risks. J Environ Econ Manag 65(2):310–325

Murphy JM, Sexton DMH, Barnett DN, Jones GS, Webb MJ, Collins M, Stainforth DA (2004) Quantification of modelling uncertainties in a large ensemble of climate change simulations. Nature 430(7001):768–772

Newbold SC, Griffiths C, Moore C, Wolverton A, Kopits E (2013) A rapid assessment model for understanding the social cost of carbon. Clim Change Econ 4(01):1350001

Nordhaus WD (2007) A review of the stern review on the economics of climate change. J Econ Lit 45(3):686–702

Nordhaus WD (2008) A question of balance: weighing the options on global warming policies. Yale University Press, New Haven

Nordhaus W (2014) Estimates of the social cost of carbon: concepts and results from the DICE-2013R model and alternative approaches. J Assoc Environ Resour Econ 1(1/2):273–312

Nordhaus WD (2017) Revisiting the social cost of carbon. Proc Natl Acad Sci 114(7):1518–1523. https://doi.org/10.1073/pnas.1609244114

Nordhaus W, Sztorc P (2013) DICE 2013R: introduction and users manual. Technical report, Yale University. http://aida.wss.yale.edu/~nordhaus/homepage/Web-DICE-2013-April.htm. Accessed June 2018

Revesz RL, Howard PH, Arrow K, Goulder LH, Kopp RE, Livermore MA, Oppenheimer M, Sterner T (2014) Global warming: improve economic models of climate change. Nature 508(7495):173–175

Roe GH, Baker MB (2007) Why is climate sensitivity so unpredictable? Science 318(5850):629–632

Rudik I (2019) Optimal climate policy when damages are unknown. SSRN

Schmidt MGW, Held H, Kriegler E, Lorenz A (2013) Climate policy under uncertain and heterogeneous climate damages. Environ Resour Econ 54(1):79–99. https://doi.org/10.1007/s10640-012-9582-2

Shapiro A, Dentcheva D, Ruszczynski A (2009) Lectures on stochastic programming. MPS-SIAM series on optimization, vol 9. SIAM, Philadelphia, p 3

Stern N (2007) The economics of climate change: the Stern review. Cambridge University Press, Cambridge

Tahvonen O, Quaas MF, Voss R (2018) Harvesting selectivity and stochastic recruitment in economic models of age-structured fisheries. J Environ Econ Manag 92:659–676

Thimme J (2017) Intertemporal substitution in consumption: a literature review. J Econo Surv 31(1):226–257

Tol RSJ (2013) Targets for global climate policy: an overview. J Econ Dyn Control 37(5):911–928

Traeger CP (2009) Recent developments in the intertemporal modeling of uncertainty. Annu Rev Resour Econ 1(1):261–286

Traeger CP (2014) A 4-stated dice: quantitatively addressing uncertainty effects in climate change. Environ Resour Econ 59(1):1–37

Weil P (1989) The equity premium puzzle and the risk-free rate puzzle. J Monet Econ 24(3):401–421

Weil P (1990) Nonexpected utility in macroeconomics. Q J Econ 105(1):29–42

Weitzman ML (2009) On modeling and interpreting the economics of catastrophic climate change. Rev Econ Stat 91(1):1–19

Acknowledgements

The article benefited immensely from comments by two reviewers and the editor (David Popp). Additional comments received at the World Congress of Environmental and Resource Economists are appreciated.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix 1: Extra Graphs

SCC (in US$), for alternate degrees of intergenerational inequality aversion and risk aversion. Notes: Left panels: simulation with unadjusted pure rate of preference. Right panels: simulations with pure rate of time preference adjusted such that (base year) savings behaviour is consistent across specifications. Top panels: 2040 uncertainty resolution. Bottom panels: 2100 uncertainty resolution

Response of the SCC to damage elasticity uncertainty (a) and climate sensitivity uncertainty (b), and the interactive effects of damage and climate sensitivity uncertainty (c), for alternate degrees of intergenerational inequality aversion and risk aversion. Notes: Each specification shows the difference between the expected SCC and the deterministic SCC derived from the mean of the ‘uncertain’ damage elasticity and the ‘uncertain’ climate sensitivity. The renormalization of the savings rate is disregarded in the non-baseline specifications

Response of the SCC to climate sensitivity uncertainty in a counterfactual with higher climate inertia. In DICE, the climate inertia parameter is set to fifty years. In this counterfactual, the climate inertia parameter is set to 20 years. Notes: Each specification shows the difference between the expected SCC and the deterministic SCC. The deterministic SCC is obtained using the mean of the ‘uncertain’ climate sensitivity. Renormalization of the savings rate is pursued for all specifications

Appendix 2: Simplified DICE Model

DICE’s atmospheric temperature Eq. (2), can be reorganized as:

where \(\Delta _{T}=z_{1}\nicefrac {\xi }{\zeta }-z_{1}z_{2}\). It is immediate that for \(\iota >t\), \(T_{\iota }\) increases in climate sensitivity, \(\zeta\), at a decreasing rate. DICE sets \(z_{2}=0.008624\), which for simplifying the derivation of the SCC can be set zero, yielding:

The parameter \(z_{1}\) defines the inertia in the climate system. DICE2013 sets this value to 0.098, corresponding to a duration of 51 years. In the counterfactual experiment testing the impact of climate inertia, this parameter is set to 0.25.

Furthermore, it is convenient to disregard the upper and deep ocean carbon sinks and only focus on the atmospheric stock (Jensen and Traeger 2016). The simplified stochastic DICE model becomes :

s.t.

Let \(V_{t}\equiv V\left( K_{t},M_{t},T_{t}\right)\)

Taking FOC with respect to \(C_{t}\) yields:

and with respect to \(E_{t}\):

which is an expression for the SCC.

Finding the quantities \(\nicefrac {\partial V_{t+1}}{\partial M_{t+1}}\) and \(\nicefrac {\partial V_{t+1}}{\partial T_{t+1}}\) requires differentiating the value function.

First consider \(\nicefrac {\partial V_{t+1}}{\partial T_{t+1}}\):

For \(\nicefrac {\partial V_{t+1}}{\partial M_{t+1}}\)

Recall that

Letting \(\frac{\partial M_{t+1}}{\partial E_{t}}=1\) gives the expression in the text.

Rights and permissions

About this article

Cite this article

Okullo, S.J. Determining the Social Cost of Carbon: Under Damage and Climate Sensitivity Uncertainty. Environ Resource Econ 75, 79–103 (2020). https://doi.org/10.1007/s10640-019-00389-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-019-00389-w