Abstract

This article introduces the Risk Balancing Frontier (RBF), a new portfolio boundary in the absolute risk-total return space: the RBF arises when two risk indicators, the Tracking Error Volatility (TEV) and the Value-at-Risk (VaR), are both constrained not to exceed pre-set maximum values. By focusing on the trade-off between the joint restrictions on the two risk indicators, this frontier is the set of all portfolios characterized by the minimum VaR attainable for each TEV level. First, the RBF is defined analytically and its mathematical properties are discussed: we show its connection with the Constrained Tracking Error Volatility Frontier (Jorion in Financ Anal J, 59(5):70–82, 2003. https://doi.org/10.2469/faj.v59.n5.2565) and the Constrained Value-at-Risk Frontier (Alexander and Baptista in J Econ Dyn Control, 32(3):779–820, 2008. https://doi.org/10.1016/j.jedc.2007.03.005) frontiers. Next, we explore computational issues implied with its construction, and we develop a fast and accurate algorithm to this aim. Finally, we perform an empirical example and consider its relevance in the context of applied finance: we show that the RBF provides a useful tool to investigate and solve potential agency problems.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and literature review

In active portfolio management, several objectives have to be pursued jointly. Typically, a portfolio has to be evaluated simultaneously in terms of absolute and relative risk. Absolute risk is usually evaluated via measures such as portfolio variance or Value-at-Risk (VaR), while relative risk is often measured by the Tracking Error Volatility (TEV), that is the discrepancy to a given benchmark. In some cases, the two goals are at odds with each other.

This implies a complication, with respect to the traditional Markowitz ’s paradigm, since agents evaluate portfolio performance not only by considering return and absolute risk, but also by taking into account some reference measures associated to a benchmark portfolio (see, for example, Chow 1995). In other words, the use of multiple measures of risk should be considered in order to obtain a complete picture of the risk profile of the portfolio and a comprehensive assessment of the investment. In practical situations, an agent choosing the portfolio composition may want to maximize an objective function which involves both types of risk. Alternatively, it could be a consequence stemming from delegation: in contemporary financial markets, most investors delegate their investment decisions to professionals and establish agency relationships.

In this article, we introduce an analytical tool to analyze such cases. Although risk measures could be chosen from a wide variety of alternatives, in this paper we focus on the TEV and VaR, the risk indicators most commonly employed in delegated portfolio management to limit asset manager’s activity. To be specific, our goal is to provide an analytical tool which captures the risk-return relationship of managed portfolios when these two risk indicators are both constrained. Formally, we make the very minimal assumption that the agent’s objective function, given a portfolio \({\varvec{\omega _{}}} \), is increasing in its return and decreasing in its risk (both absolute and relative).

We classify portfolios on the basis of the following criterion: if, for a given return R, a portfolio \({\varvec{\omega _{}}} \) can be modified so as to reduce one source of risk without increasing the other and to remain feasible at the same time, then it is clearly sub-optimal. Therefore, the question of interest is to identify the set \({\mathbb {S}}\) of portfolios that satisfy the following criterion: for a given return \(R({\varvec{\omega _{}}} )\), if \({\varvec{\omega _{}}} \in {\mathbb {S}}\), no other portfolios exist in a neighborhood of \({\varvec{\omega _{}}} \) such that both types of risk decrease.

Thus, from the perspective of economic theory, the set \({\mathbb {S}}\) could be considered as a set of Pareto-efficient portfolios. To be specific, we define a new portfolio frontier that contains all portfolios for which the VaR constraint is minimized for each TEV level. This boundary can be seen as a set of equilibria that necessarily includes the benchmark, where the TEV equals zero by definition, as a special case. Therefore, our main focus is to keep the two types of risk under control, while choosing efficient combinations in terms of portfolio risk and return. This is consistent with the theoretical framework developed by Jorion (2003) and the actual practice in the asset management industry.

The analysis of the relationship between various risk measures and portfolio efficiency has traditionally been undertaken by considering geometric objects in the (\(\sigma _P,\mu _P\)) space, where \(\sigma _P\) and \(\mu _P\) are absolute risk (standard deviation of the returns) and the expected total return of portfolio P. The Mean-Variance frontier (MVF) introduced by Markowitz (1952) is the cornerstone for defining other portfolio frontiers in the (\(\sigma _P,\mu _P\)) space. The MVF is also crucial because it divides the plane into two regions, and identifies the surface area at its left as the set of inadmissible portfolios. Another relevant boundary is the Mean-TEV frontier (MTF), introduced by Roll (1992). This corresponds to a horizontal translation of the MVF since it is derived by minimizing the TEV rather than the portfolio variance. An important feature is that the benchmark portfolio necessarily lies on it.

Considering the constraints of maximum TEV and VaR, two other portfolio frontiers play a key role. Jorion (2003) introduced the Constrained TEV Frontier (CTF), a portfolio frontier which takes an egg-like shape in the (\(\sigma _P,\mu _P\)) space. The maximum TEV delimits a closed and bounded set of feasible portfolios that lie around the benchmark; the more stringent the TEV becomes, the more this boundary narrows around the benchmark itself. Alexander and Baptista (2008) define the Constrained VaR Frontier (CVF) as a positive-slope linear portfolio boundary in the (\(\sigma _P,\mu _P\)) space, to the left of which all portfolios satisfy the VaR constraint. Since the vertical intercept of this function is equal to the negative of the VaR limit, the intercept gets higher as the constraint becomes tighter. These two frontiers are the starting point for our analysis, and we will use them to illustrate the compatibility issues for the TEV and the VaR constraints in Sect. 2. Building on previous work by Alexander and Baptista (2008); Palomba and Riccetti (2012) analyzed the space of feasible portfolios that satisfy both TEV and VaR constraints, and introduced the Fixed VaR-TEV Frontier (FVTF), thus obtaining various scenarios according to the predetermined values assigned to the two risk indicators.Footnote 1

The literature on the relationships between different portfolio frontiers has subsequently developed in several directions. For example, Alexander and Baptista (2010) proposed a strategy for active portfolio management via a new portfolio frontier that contains all portfolios which minimize the TEV for any given ex ante portfolio alpha, where alpha is the intercept of the linear regression of the portfolio return on the benchmark return. This approach provides a new viewpoint about active management strategies and identifies portfolios that simultaneously satisfy more than one criterion. In this context, Stucchi (2015) studies the relationships between the contributions of Roll (1992), Jorion (2003), Alexander and Baptista (2008, 2010) and Palomba and Riccetti (2012), and proposes a unified approach in order to summarize their results into a single optimal allocation strategy that works under different additional risk constraints.

Other authors consider portfolio performance under simultaneous TEV and weight constraints compliance, starting from the contribution of Bajeux-Besnainou et al. (2011) up to the work of Daly and Van Vuuren (2020) in which new constrained portfolio frontiers are defined. Recently, Du Sart and Van Vuuren (2021) focus on two portfolios lying on the Jorion ’s CTF and analyze their composition and performance in comparison with the maximum Sharpe Ratio portfolio. Using data from South Africa, they illustrate how these portfolios perform during bull and bear markets.

Moreover, a large number of contributions put forward enhancements of Jorion’s original proposal by considering constraints on different quantities (see, for instance, Ammann and Zimmermann (2001), El-Hassan and Kofman (2003), Maxwell et al. (2018); Maxwell and Van Vuuren (2019)). Bertrand (2010) proposes an alternative to Jorion’s approach by introducing the Constant Risk Aversion frontier. This boundary is based on the risk aversion parameter, defined as the marginal rate of substitution between the portfolio variance and expected return. Another recent contribution is provided by Stowe (2019), who reformulates the models by Best and Grauer (1990) and Jorion (2003) by considering the maximization of a quadratic utility function under several combinations of linear and quadratic constraints that correspond to different restrictions on the portfolio expected return or on the TEV.

Finally, Palomba and Riccetti (2019) focus on the portfolio efficiency issue when restriction to TEV, VaR and possibly to the overall variance are jointly set. The main result is the formal definition of some portfolio frontiers that satisfy all the restrictions on risk indicators and contain only non-dominated portfolios in terms of variance and return.

The remainder of this article proceeds as follows: in Sect. 2 we introduce our new portfolio boundary, and we discuss its properties and financial implications. In this context, we also present the numerical method for representing it as a curve in the standard deviation-return space. Section 3 provides a short empirical example, and Sect. 4 concludes.

2 The Risk Balancing Frontier (RBF)

In our analysis, we use the same setup as in Alexander and Baptista (2008) and Palomba and Riccetti (2012). We assume that the parties can choose among n risky assets, with \({\varvec{\mu }}\) being the n-dimensional column vector of expected returns, and \({\varvec{\Sigma }}\) their covariance matrix, which we assume non-singular. We define the parameters \(a={\varvec{\iota }}'{\varvec{\Sigma }}^{-1}{\varvec{\iota }}\), \(b={\varvec{\iota }}'{\varvec{\Sigma }}^{-1}{\varvec{\mu }}\) and \(c={\varvec{\mu }}'{\varvec{\Sigma }}^{-1}{\varvec{\mu }}\), where \({\varvec{\iota }}\) is an n-dimensional column vector of ones. A related quantity that will be often used in the following is the scalar \(d=c-b^2/a\): note that \(\sqrt{d}\) is the asymptotic slope of Markowitz’ MVF.

We also define \({\varvec{\omega _{C}}} \) as the “Global Minimum Variance” portfolio and C as the corresponding point on the \((\sigma _P,\mu _P)\) plane; \({\varvec{\omega _{C}}} \) has expected return \(\mu _C=b/a\) and \(\sigma _C^2=1/a\), while \(\mu _B\) and \(\sigma _B^2\) are the benchmark return and variance.

We make the customary assumptions of unlimited short sales, quadratic utility function and/or normally distributed returns; these assumptions rule out skewed and leptokurtic return distributions, so we adopt the portfolio standard deviation as our absolute risk measure.

In active portfolio management, the manager has a reference benchmark B. For any portfolio \(P \in (\sigma _P,\mu _P)\), define \(T(P)=({\varvec{\omega _{P}}} -{\varvec{\omega _{B}}} )'{\varvec{\Sigma }}({\varvec{\omega _{P}}} -{\varvec{\omega _{B}}} )\) as the TEV of P with respect to the chosen benchmark B and \(V(P, \theta ) = z_\theta \sigma _P-\mu _P\) its VaR for a given risk level \(\theta \), where \(z_\theta \) is the standard normal quantile. Now consider the portfolio that minimizes the VaR subject to a given \(\textrm{TEV}=T_0\) given by

we define the Risk Balancing Frontier (RBF from here on) as the subset of (\(\sigma _P,\mu _P\)) space containing all portfolios \({\hat{P}}(T_0, \theta )\) for \(T_0 \in [0, T^{\max }]\). Note that the minimization of \(V(P, \theta )\) is defined under the constraint \(T(P) = T_0\); in fact, it may be more realistic to consider the weak-inequality constraint \(T(P) \le T_0\). This issue will be analyzed in Sect. 2.4.

2.1 Derivation of the RBF

In order to find an explicit solution to Eq. (1), we re-state the optimization problem as

where \({\varvec{\omega _{B}}} \) is the benchmark portfolio. Equation (2) leads to the following Lagrangian:

where the scalars \(\lambda _1\) and \(\lambda _2\) are the shadow prices. For the first order conditions we get

where \(r({\varvec{\omega _{}}} ,\theta )=\displaystyle \frac{z_{\theta }}{\sigma _P({\varvec{\omega _{}}} )}\) is a strictly positive scalar function; Eq. (4) may be transformed by premultiplying \({\varvec{\nabla }}({\varvec{\omega _{}}} ,T_0)\) by the inverse of \({\varvec{\Sigma }}\),

therefore, the solutions for the shadow prices are

By combining Eqs. (5), (6) and (7), for a given level of \(T_0\) we get

where \({\varvec{\omega _{}}} ^*\) is the optimal portfolioFootnote 2 for a given value of the tracking error volatility \(T_0\), \(\mathrm {D({\varvec{\omega _{}}} ,\theta )}\equiv d-\Delta _1 r({\varvec{\omega _{}}} ,\theta )\), while \({\varvec{\omega _{Q}}} = b^{-1}{\varvec{\Sigma }}^{-1}{\varvec{\mu }}\) and \({\varvec{\omega _{C}}} = a^{-1}{\varvec{\Sigma }}^{-1}{\varvec{\iota }}\) are the ‘Maximum Sharpe-Ratio’ and the ‘Global Minimum Variance’ portfolios lying on the MVF.

Therefore, an implicit definition of the optimal portfolio \({\varvec{\omega _{}}} ^*\) can be given as

where

and our Risk Balancing Frontier can be thought of as the set of the points on the \((\sigma _P,\mu _P)\) space corresponding to the portfolios \({\varvec{\omega _{}}} ^*\) for any given level of \(T_0\). As Eq. (8) shows, these portfolios can be represented as a linear combination of three well-known portfolios, namely the benchmark portfolio, the ‘Maximum Sharpe-Ratio’ portfolio, and the ‘Global Minimum Variance’ portfolio, with the three scalar weights summing to unity; these weights are functions of \({\varvec{\omega _{}}} ^*\) and may be outside the [0, 1] interval. Since the benchmark belongs to the RBF by definition when \(T_0 = 0\), we get \(x_1({\varvec{\omega _{}}} ^*)=1\), \(x_2({\varvec{\omega _{}}} ^*)=0\) and \(x_3({\varvec{\omega _{}}} ^*)=0\); conversely, we do not get the triples \({\varvec{x}}({\varvec{\omega _{}}} ^*)=\begin{bmatrix}0&1&0\end{bmatrix}'\) and \({\varvec{x}}({\varvec{\omega _{}}} ^*)=\begin{bmatrix}0&0&1\end{bmatrix}'\) for portfolios \({\varvec{\omega _{Q}}} \) and \({\varvec{\omega _{C}}} \) because they do not lie on the RBF.

The triples with \(x_1({\varvec{\omega _{}}} ^*)=0\), \(x_2({\varvec{\omega _{}}} ^*)\ne 0\) and \(x_3({\varvec{\omega _{}}} ^*)\ne 0\) deserve special attention because Eq. (8) reduces to the well-known Mutual Fund Separation Theorem (Merton, 1972) in which any portfolio belonging to the Mean-Variance boundary can be written as a proper linear combination of \({\varvec{\omega _{C}}} \) and \({\varvec{\omega _{Q}}} \). Under this condition the RBF and the efficient branch of the MVF must contain a common portfolio.

Figure 1 shows that the RBF defines to a specific locus, corresponding to a continuous set of points in the (\(\sigma _P,\mu _P\)) space; this property derives from the RBF being an envelope of several optima under a continuously-varying constraint. Along this path, two notable points can be identified:

\(\mathbf{the \, portfolio}\,{\textbf{Z}},\) defined as the portfolio in which the variance is minimized;

\(\mathbf{the \, portfolio}\,{\textbf{M}},\) defined as the portfolio for which the efficiency lossFootnote 3 is zero. M corresponds to the contact point with the MVF, and minimizes the VaR among all admissible portfolios.

The definition of the RBF implies that its position in the (\(\sigma _P,\mu _P\)) space depends on the benchmark coordinates, as well as the location of the zero efficiency loss portfolio M.

2.2 Relationship of the RBF with Previous Literature

The points contained in the RBF bear an interesting relationship with where Jorion’s CTF and Alexander and Baptista’s CVF (see Sect. 1). The analytical definition of the CTF and CVF boundaries in the (\(\sigma _P,\mu _P\)) space are provided by Eqs. (10) and (11), respectively:

where \(\Delta _1=\mu _B-\mu _C\), \(\Delta _2=\sigma _B^2-\sigma _C^2\), \(\delta _B=\Delta _2-\Delta _1/d\); \(z_\theta \) is the standard normal quantile (with \(0.5\le \theta <1\)) and \(T_0\) and \(V_0\) are the constraints set on TEV and VaR. Equation (10) was introduced by Jorion (2003), and identifies a set of points in (\(\sigma _P,\mu _P\)) space that takes a (somewhat distorted) oval shape. Equation (11), instead, was put forward in Alexander and Baptista (2008) and produces an upward-sloped straight line.

The case of incompatible restrictions on \(V_0\) and \(T_0\) arises when the oval boundary lies completely to the right of the linear one, and there are no intersections. Otherwise, the intersection of the CTF and the CVF contains all portfolios that jointly satisfy the inequalities \(\hbox {TEV}\le T_0\) and \(\hbox {VaR}\le V_0\). If the CTF and the CVF are tangent, a unique portfolio is available, and strict equality holds for both restriction \(\hbox {TEV}=T_0\) and \(\hbox {VaR}=V_0\). In this case, we define this unique portfolio \(K\equiv (\sigma _K,\mu _K)\) as the tangency portfolio, while we use the symbol B to indicate the benchmark the TEV is computed against. In this light, the RBF can be thought of as the set of portfolios that correspond to all possible risk-return space coordinates of the tangency portfolio K for increasing levels of \(T_0\).

Consider for example the depicted scenario in Fig. 2(a), which occurs when the restrictions are mainly aimed at reducing relative risk, so that the constraint on the VaR of the portfolio K is not particularly severe. Conversely, in the scenario in Fig. 2(b) the maximum TEV is larger, so the VaR limit on K is more binding. The eccentricity of the CTF and the intercept of the CVF can be taken as graphical hints on how stringent the constraints on the TEV and on the VaR are. Since the portion of the plane delimited by the CTF increases with \(T_0\), it is apparent from Fig. 2 that the position of portfolio K depends on both \(T_0\) and \(V_0\), with a trade-off between the two.

Therefore, the RBF is entirely contained within the Mean-Variance frontier, where the equality \(\hbox {CTF}(\sigma _P^2,\mu _P;T_0)=\hbox {CVF}(\sigma _P^2,\mu _P;V_0)\) holds and the VaR for each portfolio is the minimum attainable for a given \(\textrm{TEV} = T_0\). Note that its shape is independent of the slope of the CVF, \(z_{\theta }\), and that of the horizontal axis of the CTF, \(\Delta _1\).

As for the slope of the CVF line, we distinguish two cases: the high-confidence case, for which the VaR line has a steeper slope than the asymptotic slope of the MVF (\(z_\theta >\sqrt{d}\)), and the low-confidence case, when the inequality is reversed. The rest of the paper will focus on the high confidence case, that we consider the most realistic one, in the light of the fact that risk management offices customarily set \(\theta \) very close to 1.

2.3 Numerical Calculation of the RBF

Note that an explicit solution to Eq. (8) cannot be found analytically, and numerical techniques are called for. A convenient method to determine the locus is to apply the BFGS numerical optimization algorithm for a grid of values for \(T_0\) (see Broyden 1970; Fletcher 1970; Goldfarb 1970; Shanno 1970).

A description of the algorithm is best given by referring to the geometric objects depicted in Fig. 3. Define two points in the \(\sigma _P,\mu _P\) space as

The point \(J_0\) yields the the CTF-constrained minimum variance allocation, whereas \(J_1\) gives the one with the highest expected return, that also corresponds to the position where the hyperbolic MTF crosses the oval CTF (see Jorion 2003; Palomba and Riccetti 2019).

For any given level of the restriction \(T_0\), the return of the tangency portfolio K will lie in the interval \([\mu _0(T_0),\mu _1(T_0)]\), where the extrema are the TEV-dependent expected returns of the endpoints \(J_0\) and \(J_1\). Consequently, for any given expected return \(\mu _0(T_0)\le \mu \le \mu _1(T_0)\), the function

returns the risk for the portfolio on the arc  which minimizes the VaR for a given \(T_0\).

which minimizes the VaR for a given \(T_0\).

The RBF is found by calculating Eq. (14) on a numerical grid \(T_0=0,h,2h,3h,\ldots ,T^{\max }\), where h is an arbitrary and numerically small increment. Our algorithm can therefore be described as:

-

1.

starting from \(T_0=0\), calculate the extremal returns \(\mu _0(T_0)\) and \(\mu _1(T_0)\),

-

2.

set \({\bar{\mu }}\) as the midpoint between \(\mu _0(T_0)\) and \(\mu _1(T_0)\),

-

3.

minimize numerically the VaR \(V(\mu ) = z_\theta \sqrt{S(T_0,\mu )}-\mu \) via the BFGS algorithm using \({\bar{\mu }}\) as a starting point and call \(\mu ^*\) the solution;

-

4.

determine the coordinates of the resulting portfolio \({\varvec{\omega _{}}} ^*\) using Eq. (14),

-

5.

increment \(T_0\) by h and repeat until \(T_0=T^{\max }\).

For each point on the RBF, the corresponding portfolio \({\varvec{\omega _{}}} ^*\) can be found using the method outlined in Appendix B.

2.4 Geometric Properties of the RBF in the Standard Case

The RBF, as defined in the previous section, is a continuum of portfolios, indexed by the TEV \(T_0\); when \(T_0 = 0\), \({\varvec{\omega _{}}} ^*\) is the benchmark portfolio, and different choices for \(T_0\) lead to different optima \({\varvec{\omega _{}}} ^*\). This set can be split into the following 3 non-overlapping subsets for increasing values of \(T_0\):

These subsets are identified by the fact that

-

1.

there exists a TEV level \(T_Z\) such that the variance of the portfolio \({\varvec{\omega _{Z}}} = {\varvec{\omega _{}}} (T_Z)\) is a minimum within the RBF (see Appendix A for a proof);

-

2.

there exists a TEV level \(T_M\) such that portfolio \({\varvec{\omega _{M}}} = {\varvec{\omega _{}}} (T_M)\) minimizes the VaR. Since we assume that the manager’s confidence level \(z_{\theta }\) is high, such portfolio is Markowitz-efficient. From a geometric point of view, the minimum VaR portfolio M is the tangency portfolio between the linear CVF and the Markowitz’ MVF. The analytical proof is provided in section 2.4.2.

It is useful to distinguish the two situations \(T_Z\le T_M\), which we refer to as the “standard” case, and the “aggressive benchmark” case \(T_Z > T_M\), that occurs when a benchmark with high risk and return is chosen. In the former case we have

while, in the aggressive case, these subsets are defined as

These subsets possess different properties from the financial point of view. We will focus on the standard case first and leave the analysis of the aggressive case for subsection 2.5.

As claimed in Sect. 2.1, the RBF is an envelope that contains all the tangency portfolios between the CTF and CVF curves. Analytically, each point of this frontier yields the solution of a system containing both Eqs. (10) and (11). Palomba and Riccetti (2012) show that the solution is a fourth degree equation in the mean-variance space and proved that the solution depends on the benchmark coordinates together with the values of \(T_0\), \(V_0\) and the confidence level \(\theta \).

From Fig. 3 several important characteristics of the RBF become apparent: the boundary on the (\(\sigma _P,\mu _P\)) space takes a horseshoe-like shape, with one endpoint necessarily at B, where \(T_0=0\). The subsets \(\textrm{RBF}_1\) and \(\textrm{RBF}_2\) correspond to the arcs  ,

,  , and the points to the right of M form the subset \(\textrm{RBF}_3\). The situation in which the benchmark portfolio lies on the efficient branchFootnote 4 of the MVF is notable, since in this case the arc

, and the points to the right of M form the subset \(\textrm{RBF}_3\). The situation in which the benchmark portfolio lies on the efficient branchFootnote 4 of the MVF is notable, since in this case the arc  on the RBF lies on the MVF.

on the RBF lies on the MVF.

2.4.1 The arc

Since portfolio B identifies the passive strategy \(T_0=0\), as the TEV increases the arc  moves away from B; therefore, as a rule, the arc

moves away from B; therefore, as a rule, the arc  can be thought of a line starting from B and going in the North-West direction, with decreasing efficiency loss. In practice, for each portfolio \(P \in \textrm{RBF}_1\), asset managers obtain \(\sigma _P \le \sigma _B\) and \(V_P \le V_B\).

can be thought of a line starting from B and going in the North-West direction, with decreasing efficiency loss. In practice, for each portfolio \(P \in \textrm{RBF}_1\), asset managers obtain \(\sigma _P \le \sigma _B\) and \(V_P \le V_B\).

Let \(Z\equiv (\sigma _Z,\mu _Z)\) be the minimum variance portfolio lying on the RBF: the existence of such portfolio is proven in Appendix A and implies that asset managers can jointly satisfy the pair of constraints \(\hbox {TEV}=T_0\) and \(\hbox {VaR}=V_0\) so as to select a position in which they can also minimize overall portfolio risk. Thus, the arc  is the subset of the RBF where an increase in the TEV limit implies a tighter VaR restriction, leading to more efficient portfolios. In other words, along the

is the subset of the RBF where an increase in the TEV limit implies a tighter VaR restriction, leading to more efficient portfolios. In other words, along the  arc the TEV and VaR move in opposite directions, and a trade-off exists between relative risk (the TEV) and both measures of absolute portfolio risk (the VaR and \(\sigma _P\)).

arc the TEV and VaR move in opposite directions, and a trade-off exists between relative risk (the TEV) and both measures of absolute portfolio risk (the VaR and \(\sigma _P\)).

2.4.2 The arc

In order to analyze the properties of the intermediate subset \(\textrm{RBF}_2\), we begin by considering the portfolio

that minimizes the VaR along the RBF for a given \(\textrm{TEV} = T_0\). Since the first shadow price in Eq. (6) yields the variation of the objective function with respect to \(T_0\)

then \(\hat{{\varvec{\omega _{}}} }\) must satisfy

Now consider M, defined earlier as the portfolio that minimizes the VaR among admissible portfolios: Palomba and Riccetti (2012) prove that its coordinates on the (\(\sigma _P,\mu _P\)) space are

Geometrically, \(M\equiv (\sigma _M,\mu _M)\) is the contact portfolio between the MVF and the linear boundary CVF, and the associated VaR equals \(V_M=z_\theta \sigma _M-\mu _M=-\mu _C+\sqrt{\sigma _C^2(z_\theta ^2-d)}\). This is the most binding assignable VaR because lower values lead to infeasible portfolios.

Since

portfolio M satisfies condition (17). From this result it is easy to see why the RBF takes the shape shown in Fig. 1: starting from the benchmark B, we have \(({\varvec{\omega _{P}}} -{\varvec{\omega _{B}}} )'{\varvec{\mu }}\ge 0\), and therefore the VaR decreases first until it reaches its minimum at portfolio M, and then it rises again for \(\mu _P>\mu _M\).

Most of the properties of the points along  are the same as those of

are the same as those of  ; notably, moving from Z to M, and thus allowing for larger TEV, still leads to portfolios that have lower VaR and feature decreasing efficiency loss. However, contrary to the

; notably, moving from Z to M, and thus allowing for larger TEV, still leads to portfolios that have lower VaR and feature decreasing efficiency loss. However, contrary to the  case, this comes at the price of a larger variance.

case, this comes at the price of a larger variance.

2.4.3 The Upper Branch

At a first glance, this subset of the RBF would have more limited relevance than the previous two. Indeed, from the point M onward, there are progressively less stringent VaR constraints and the tolerable risk relative to the benchmark B increases, which leads to riskier portfolios in terms of overall variance and Value-at-Risk. Hence, the point M can be thought as a watershed between the two opposite TEV-VaR relationships. However, portfolios belonging to this branch could be considered also by investors with a certain level of risk aversion as long as the expected excess returns meet investors’ requirements. Given these premises, we may call this subset the “daredevil” segment of the RBF.

2.4.4 Relationships Along the RBF

Figure 4 summarizes the relationships along the RBF between all the relevant portfolio quantities; note the special importance of the three reference portfolios B, Z and M. Moving from the benchmark B, the portfolio variance and the VaR follow a convex and non-monotonic relationship, while the expected return of the portfolios always increases. The lower-right plot displays the relationship between the two absolute risk measures. Starting from the benchmark, the overall initial risk reduction is accompanied by a progressively more stringent VaR. From portfolio Z onward, the overall portfolio variance increases, while the efficiency loss reduces until the portfolio M is reached. From the point M onward the efficiency loss increases and is accompanied by progressively larger values of \(T_0\) and \(V_0\).

The discussion above entails an important implication: setting a maximum value of the TEV lower than the one of the Z portfolio is a questionable choice for the risk manager, since along the  arc either the expected return and all the absolute risk indicators can be improved by raising the TEV. Moving along the upper branch, any choice beyond M would only lead to extremely risky positions, so it would be a rather extreme one in practice.

arc either the expected return and all the absolute risk indicators can be improved by raising the TEV. Moving along the upper branch, any choice beyond M would only lead to extremely risky positions, so it would be a rather extreme one in practice.

2.5 The Aggressive Benchmark

The “aggressive benchmark” case is a special situation that arises when the benchmark return and variance are greater than the one of the minimum VaR portfolio M, so the benchmark B is itself a high risk-high return portfolio. A more specific definition is provided by Palomba and Riccetti (2012). In this context, B is the portfolio with the highest available expected return on the RBF, but this feature entails considerable risk. As a consequence, loosening the TEV constraint makes it optimal to reduce the associated risk, rather than increase the portfolio return, and Eq. (16) holds instead of (15). Figure 5 shows the shape of the RBF in this case.

The boundary starts from the benchmark and proceeds South-West, reaches the tangency portfolio M and stops at the point of minimum risk Z.

Technically, the RBF can be extended beyond portfolio Z for values of the TEV higher than \(T_Z\), but from a financial point of view this would lead to inefficient portfolios, i.e. dominated under any possible metric (variance, return, VaR or portfolio efficiency loss).Footnote 5 Therefore, we truncate the boundary at Z and set the condition \(\textrm{RBF}_3=\varnothing \) in Eq. (16). Using Eq. (17), the condition \(({\varvec{\omega _{P}}} -{\varvec{\omega _{B}}} )'{\varvec{\mu }}<0\) always holds so the VaR increases all along the arc  .

.

3 Empirical Example and the RBF’s Economic Implications

An interesting question arises by considering the sensitivity of the RBF to systemic risk. A tool for analysing the impact of systemic risk is the CoVaR measure, put forward in Adrian and Brunnermeier (2016). From the analytical viewpoint, systemic risk affects the RBF by modifying the distribution of the returns by modifying the expected returns \({\varvec{\mu }}\) and/or their covariance matrix \({\varvec{\Sigma }}\). The main rationale behind CoVaR is that systemic risk may modify such parameters, so it makes sense to study the changes in the quantiles of a portfolio (the VaR) conditional to such events. However, our RBF is defined via parameters that describe an unconditional distribution. Modifying our setup to make the RBF a conditional boundary would entail assumptions about the analytical link between measures of systemic risk and the distributional parameters we considered given at each point in time. As a result, a COVaR-like boundary would make it necessary to redefine all variables in a conditional context, which is a topic for further research. However, the sensitvity of the RBF to global shocks is taken into consideration in our empirical example by choosing to analyse the RBF behaviour during the COVID-19 pandemic.

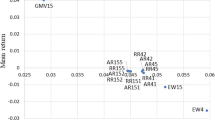

In order to show how our RBF boundary works in practice, we carry out a short numerical example, using the S &P100 market index as a benchmark and all its constituents, listed in Table 2 in Appendix C, as the universe of available risky securities. The daily returns for both index and stocks were calculated using one year of data covering two distinct periods: a pre-COVID period ranging from 2019-01-01 to 2019-12-31, and the period that goes from 2020-04-01 to 2021-03-31, which we define as the “post-COVID period”. The use of both periods is necessary to make a comparison because, as illustrated by Fig. 6, returns and volatility are generally higher during the “post-COVID” period.

Table 1 reports several statistics for some portfolios of interest, namely the benchmark (B), the minimum variance portfolio (Z) and the minimum VaR portfolio (M) on the RBF, and the Global Minimum Variance (C) and the Maximum Sharpe Ratio (Q) on the MVF. Figure 7 illustrates the MVF and the RBF boundaries for both periods. The plots on the left offer a global view; those on the right zoom in around the RBF minimum variance portfolio Z.

As can be noticed, all portfolios changed considerably from one analyzed period to another in terms of risks and return. The increased returns offered in the second period are accompanied by significant increases in the level of risks, excepting portfolios Q (decreased values for both return and risk), Z and M(less returns at a higher risk).

The efficiency loss also increased substantially. During the pandemic phase, the horizontal distance between B and the MVF is much greater, so the TEV cannot be kept under control without serious efficiency losses.

It is interested to note how the weights for the Z portfolio changed in post-COVID with respect to pre-COVID. The adjustments are perfectly coherent with the risk-return evolution of the three component portfolios B, C and Q. If in the pre-COVID period the benchmark portfolio was the second component in terms of weight, the situation is completely reversed in the second period due to the B’s significant increases in standard deviation and efficiency loss, with less significant increment in terms of return. Its position is taken by the portfolio Q, with zero efficiency loss.

Thus, the efficiency loss for the Z portfolio decreases in the COVID period, despite the drop in the portfolio return and the risk increase. It should also be noted that portfolio Z displays a much higher TEV in the COVID period and that this may have led managers to reduce the VaR.

The shift of the RBF towards riskier positions is mirrored by the adjustment of the \(x_i({\varvec{\omega _{}}} )\) weights for the Z and M portfolios, and especially by the increase in \(x_2({\varvec{\omega _{}}} )\) (see Eq. (8)). Therefore, there is a shift in favor of portfolio Q, whose TEV is much higher in the pre-COVID period. On the other hand, the shift of the MVF and RBF due to the instability caused by the pandemic has increased the distance between the upper branches of the two curves: the efficiency loss for an aggressive portfolio, which is minimal in the pre-COVID period, becomes quite substantial afterwards.

Regardless of context (economic turmoil or not) the properties of the new frontier RBF come to the support of investors, asset managers and the relationship between them.

Portfolios’ management is often delegated by investors to asset managers (agents) and the financial literature emphasizes that a suitable tool to measure agents’ performance and compensation is the benchmarking. Both delegated investments and benchmarked compensation could generate agency problems if there are misalignments between investor’s and agent’s objectives. In practice, when agent’s compensation depends on benchmark outperforming, the probability of unexpected divergent behavior of asset managers arises if the risk level chosen by her is not compatible with the investor’s wishes (see for example, Starks 1987). In other words, as long as agent’s risk objectives refer exclusively to relative risk, her behavior could not meet the total risk level mentioned in the IPS.

The RBF is obtained by setting both relative and total risk constraints, therefore the level of portfolio’s tracking error volatility can be limited and aligned with investor’s risk tolerance. These constraints narrow the set of optimal portfolios to those that meet the investor’s risk requirements while still maximizing returns. The RBF, in fact, contains portfolios for which the absolute risk is minimized for each level of relative risk.

Specifically, our new frontier contains portfolios with higher returns allowing to control two types of risk. This helps improve client’s satisfaction, and minimize benchmarked compensation issues.

4 Summary, Conclusions and Future Extensions

In this paper, we develop a novel tool to consider situations when asset managers must jointly satisfy the restrictions imposed by investors on two risk measures: the tracking error volatility (TEV) and the Value-at-Risk (VaR). This framework creates a trade-off possibility between the two constraints: when the TEV and the VaR restrictions hold at the same time, the more stringent is one, the less binding is the other.

The tool we propose to analyze this situation is the Risk Balancing Frontier (RBF), a portfolio boundary in the risk-return space that identifies all portfolios with minimum VaR given a preset TEV level. We prove that the RBF can be expressed as a combination of three basic portfolios, namely the benchmark, the ‘Maximum Sharpe Ratio’ and the ‘Global Minimum Variance’ portfolios; we also study the boundary’s main geometric properties, and provide operational details about the computational issues involved. In order to exemplify the practical usage of the RBF for analyzing actual market scenarios, we provide an analysis of the SP100 index before and after the COVID pandemic.

Our approach could be further developed in several directions. For example, introducing management fees or transaction costs would certainly make the analysis more realistic. Other possibilities to consider are to introduce a risk free asset and disallow short selling that corresponds to a severe restriction that often characterizes different fund policies or contracts between managers and investors, but it comes at the cost of making the algebra and the computational aspects much more complex. Finally, the hypothesis of normally distributed returns could be dropped in favor of more general alternatives: this possibility would enrich our analysis by generalizing for skewed and/or leptokurtic distributions of returns but, on the other hand, would require a substantial and complex revision of all the portfolio frontiers that our proposed approach is based on.

Availability of data, materials and code

Notes

Figure 8 in the appendix contains graphical representation of all these objects.

In order to avoid excessively burdensome notation, we use the notation \({\varvec{\omega _{}}} ^*\) instead of \({\varvec{\omega _{}}} ^*(T_0)\).

We use the customary definition of efficiency loss as the horizontal distance in the (\(\sigma _P,\mu _P\)) space between a portfolio and the Markowitz frontier MVF.

The situation of a benchmark located in the inefficient branch would have no practical relevance.

In principle, this may not be strictly true, as it is conceivable that one could reach portfolios with a higher return than \(\mu _B\) for very large values of the TEV. However, we consider this scenario as extremely unrealistic.

References

Adrian, T., & Brunnermeier, M. K. (2016). Covar. American Economic Review, 106(7), 1705–1741. https://doi.org/10.1257/aer.20120555

Alexander, G., & Baptista, A. (2008). Active portfolio management with benchmarking: Adding a value-at-risk constraint. Journal of Economic Dynamics and Control, 32(3), 779–820. https://doi.org/10.1016/j.jedc.2007.03.005

Alexander, G., & Baptista, A. (2010). Active portfolio management with benchmarking: A Frontier based on alpha. Journal of Banking & Finance, 34, 2185–2197. https://doi.org/10.1016/j.jbankfin.2010.02.005

Ammann, M., & Zimmermann, H. (2001). Tracking error and tactical asset allocation. Financial Analysts Journal, 57(2), 32–43. https://doi.org/10.2469/faj.v57.n2.2431

Bajeux-Besnainou, I., Belhaj, R., Maillard, D., et al. (2011). Portfolio optimization under tracking error and weights constraints. The Journal of Financial Research, 34(2), 295–330. https://doi.org/10.1111/j.1475-6803.2011.01292.x

Bertrand, P. (2010). Another look at portfolio optimization under tracking-error constraints. Financial Analysts Journal, 2, 78–90. https://doi.org/10.2469/faj.v66.n3.2

Best, M. J., & Grauer, R. R. (1990). The efficient set mathematics when mean-variance problems are subject to general linear constraints. Journal of Economics and Business, 42, 105–120. https://doi.org/10.1016/0148-6195(90)90027-A

Broyden, C. G. (1970). The convergence of a class of double-rank minimization algorithms. Journal of the Institute of Mathematics and Its Applications, 6, 76–90. https://doi.org/10.1093/imamat/6.1.76

Chow, G. (1995). Portfolio selection based on return, risk, and relative performance. Financial Analysts Journal, 51, 54–60. https://doi.org/10.2469/faj.v51.n2.1881

Daly, M. H., & Van Vuuren, G. W. (2020). Portfolio performance under tracking error and asset weight constraints. Journal of Economic and Financial Sciences, 13(1), 1–9. https://doi.org/10.4102/jef.v13i1.566

Du Sart, C. F., & Van Vuuren, G. W. (2021). Comparing the performance and composition of tracking error constrained and unconstrained portfolios. The Quarterly Review of Economics and Finance, 81, 276–287. https://doi.org/10.1016/j.qref.2021.06.019

El-Hassan, N., & Kofman, P. (2003). Tracking error and active portfolio management. Australian Journal of Management, 28(2), 183–207. https://doi.org/10.1177/0312896203028002

Fletcher, R. (1970). A new approach to variable metric algorithms. Computer Journal, 13(3), 317–322. https://doi.org/10.1093/comjnl/13.3.317

Goldfarb, D. (1970). A family of variable metric updates derived by variational means. Mathematics of Computation, 24(109), 23–26. https://doi.org/10.1090/S0025-5718-1970-0258249-6

Jorion, P. (2003). Portfolio optimization with constraints on tracking error. Financial Analysts Journal, 59(5), 70–82. https://doi.org/10.2469/faj.v59.n5.2565

Lee, W. (2000). Advanced theory and methodology of tactical asset allocation. Wiley. ISBN:978-1-883-24972-4.

Markowitz, H. M. (1952). Portfolio selection. The Journal of Finance, 7, 77–91. https://doi.org/10.1111/j.1540-6261.1952.tb01525.x

Maxwell, M., & Van Vuuren, G. W. (2019). Active investment strategies under tracking error constraints. International Advances in Economic Research, 25(2), 309–322. https://doi.org/10.1007/s11294-019-09746-3

Maxwell, M., Daly, M., Thomson, D., et al. (2018). Optimising tracking error-constrained portfolios. Applied Economics, 50(54), 5846–5858. https://doi.org/10.1080/00036846.2018.1488069

Merton, R. (1972). An analytic derivation of the efficient portfolio frontier. Journal of Financial and Quantitative Analysis, 7, 1851–1872. https://doi.org/10.2307/2329621

Palomba, G., & Riccetti, L. (2012). Portfolio frontiers with restrictions to tracking error volatility and value at risk. Journal of Banking and Finance, 36(9), 2604–2615. https://doi.org/10.1016/j.jbankfin.2012.05.014

Palomba, G., & Riccetti, L. (2019). Asset management with TEV and VaR constraints: The constrained efficient frontiers. Studies in Economics and Finance, 36(3), 492–516. https://doi.org/10.1108/SEF-09-2017-0255

Roll, R. (1992). A mean/variance analysis of tracking error. The Journal of Portfolio Management, 18(4), 13–22. https://doi.org/10.3905/jpm.1992.701922

Shanno, D. F. (1970). Conditioning of quasi-Newton methods for function minimization. Mathematics of Computation, 24(111), 647–656. https://doi.org/10.1090/S0025-5718-1970-0274029-X

Starks, L. T. (1987). Performance incentive fees: An agency theoretic approach. The Journal of Financial and Quantitative Analysis, 22(1), 17–32. https://doi.org/10.2307/2330867

Stowe, D. L. (2019). Portfolio mathematics with general linear and quadratic constraints. Journal of Mathematical Finance, 9, 675–690. https://doi.org/10.4236/jmf.2019.94034

Stucchi, P. (2015). A unified approach to portfolio selection in a tracking error framework with additional constraints on risk. The Quarterly Review of Economics and Finance, 56, 165–174. https://doi.org/10.1016/j.qref.2014.09.008

Acknowledgements

We would like to thank Jiri Kukacka and all participants of the 7th International Workshop on “Financial Markets and Nonlinear Dynamics” (FMND) held in Paris (France), 1–2 June 2023 for their helpful comments and suggestions.

Funding

Open access funding provided by Università Politecnica delle Marche within the CRUI-CARE Agreement. The authors declare that no funds, grants, or other support were received during the preparation of this manuscript.

Author information

Authors and Affiliations

Contributions

Riccardo Lucchetti: conceptualization, methodology, software, data collection and analysis, review and editing; Mihaela Nicolau: investigation, writing literature review and financial analysis, review and editing; Giulio Palomba: methodology, software, data collection and analysis, investigation, writing original draft; Luca Riccetti: writing literature review and financial analysis, review and editing. All authors have read and agreed to the published version of the manuscript.

Corresponding authors

Ethics declarations

Conflict of interest/Conflict of interest

The authors declare no Conflict of interest.

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: The portfolio variance along the RBF

Equation (8) can be re-expressed as

where \({\varvec{W}}=\begin{bmatrix}{\varvec{\omega _{B}}}&{\varvec{\omega _{Q}}}&{\varvec{\omega _{C}}} \end{bmatrix}\) is a \(n\times 3\) matrix and \( {\varvec{x}}({\varvec{\omega _{}}} ^*)' = \begin{bmatrix} x_1({\varvec{\omega _{}}} ^*)&x_2({\varvec{\omega _{}}} ^*)&x_3({\varvec{\omega _{}}} ^*) \end{bmatrix}\).

The variance of each portfolio lying on the RBF is

where the matrix \({\varvec{\Omega }}\) can be obtained as the quadratic form

In order to find the variance-minimizing portfolio along the RBF we need to solve the following problem

where

The problem (A2) consists of minimizing the portfolio variance in a trivariate system where the portfolio weights are restricted to be those obtained in Eq. (9). In this context, the restriction is nonlinear but it always guaranteed that such weights sum up to unity. The Lagrangian is

therefore

where \({\varvec{G}}'[{\varvec{x}}(\hat{{\varvec{\omega _{}}} })]\) is the \(3\times 3\) Jacobian matrix. Since we have

where \({\varvec{\omega _{}}} ={\varvec{W}}{\varvec{x}}({\varvec{\omega _{}}} )\) and \({\varvec{W}}'{\varvec{\mu }}=\begin{bmatrix}\mu _B&\mu _Q&\mu _C\end{bmatrix}'\), we get

where \(\phi =\displaystyle \frac{(\mu ^*-\mu _B)}{\mathrm {D({\varvec{\omega _{}}} ,\theta )}^2}\frac{r({\varvec{\omega _{}}} ,\theta )}{\sigma ^{2}}\) is a scalar and \({\varvec{I_3}}\) is the \(3\times 3\) identity matrix.

Assuming that the matrix \({\varvec{\Omega }}\) is non-singular, from Eq. (A3) the solution is

and therefore, after substituting \({\varvec{G}}[{\varvec{x}}(\hat{{\varvec{\omega _{}}} })]\) into the constraint, we get

Since by assumption \({\varvec{\Omega }}\) is positive definite, the existence of the solution (A4) guarantees that the RBF admits a portfolio in which the overall risk is minimized.

Appendix B: Points and Portfolio Weights on the RBF

For each \(n\times 1\) vector \({\varvec{\omega _{P}}} \) containing the portfolio weights, there exists a corresponding point P on the (\(\sigma _P,\mu _P\)) space. Clearly, given \({\varvec{\omega _{P}}} \), the n-dimensional column vector of expected returns \({\varvec{\mu }}\) and their covariance matrix \({\varvec{\Sigma }}\), the coordinates of P can be easily determined by the usual equations

As for the inverse problem, namely finding the portfolio weights given the couple \([\sigma _P\quad \mu _P]'\), one would have to solve a system of 2 equations in n variables, that obviously has infinitely many solutions. In this Appendix, we describe how to determine the vector of portfolio weights \({\varvec{\omega _{K}}} \) corresponding to any point K that lies on the Risk Balancing Frontier.

All portfolios belonging to the RBF share two main characteristics: on the one hand, they are characterized by the minimum VaR that can be reach for each TEV level and, on the other, they are the tangency points between the linear CVF and the “oval” CTF. The minimum VaR value \(V_0\) can be calculated via the algorithm we introduced at the end of section 2.1; in this context, information is needed on the benchmark portfolio weights \({\varvec{\omega _{B}}} \) and on \(T_0\) restriction imposed to the TEV. The tangency condition in the (\(\sigma _P,\mu _P\)) space implies that there is a single point K associated to both measures of risk \(T_0\) and \(V_0\), and the vector of portfolio weights \({\varvec{\omega _{K}}} \) corresponds to the solution for the two optimization problems from which the CTF and CVF are defined. In other words, assuming the vector \({\varvec{\omega _{J}}} \) as a portfolio lying on the oval boundary and the vector \({\varvec{\omega _{AB}}} \) as a portfolio on the linear boundary, K is the only point where the equality \({\varvec{\omega _{J}}} ={\varvec{\omega _{AB}}} \) holds.

From the technical point of view, it is sufficient to apply the following results in order to determine the portfolios lying on the RBF:

-

1.

A portfolio belonging to the CTF (and therefore, to the arc

) has equation $$\begin{aligned} {\varvec{\omega _{J}}} ={\varvec{\omega _{B}}} -\frac{1}{\lambda _2}{\varvec{\Sigma }}^{-1}({\varvec{\mu }}+\lambda _1{\varvec{\iota }}+\lambda _3{\varvec{\Sigma }}{\varvec{\omega _{B}}} ), \end{aligned}$$(B1)

) has equation $$\begin{aligned} {\varvec{\omega _{J}}} ={\varvec{\omega _{B}}} -\frac{1}{\lambda _2}{\varvec{\Sigma }}^{-1}({\varvec{\mu }}+\lambda _1{\varvec{\iota }}+\lambda _3{\varvec{\Sigma }}{\varvec{\omega _{B}}} ), \end{aligned}$$(B1)where

$$\begin{aligned} \lambda _1=-\frac{\lambda _3+b}{a},\quad \ \lambda _2=-2\sqrt{\frac{d\delta _B}{4T_0\Delta _2-y^2}},\quad \hbox {and}\quad \lambda _3=-\frac{1}{\Delta _2}\left( \Delta _1+\frac{y}{2}\lambda _2\right) ; \end{aligned}$$the parameters a, d, \(\Delta _1\), \(\Delta _2\), \(\delta _B\) are defined in section 2, while \(y=\sigma _J^2-\sigma _B^2-T_0\) is computed via Eq. (14). (See Appendix C in Jorion 2003, for the complete proof)

-

2.

A portfolio that lies on the CVF (the straight line \(\mu _P=z_{\theta }\sigma _P^2-V_0\) in the (\(\sigma _P,\mu _P\)) space) is defined by the linear combination

$$\begin{aligned} {\varvec{\omega _{AB}}} =X\,{\varvec{\omega _{C}}} +Y\,{\varvec{\omega _{Q}}} +Z\,{\varvec{\omega _{B}}} , \end{aligned}$$(B2)where

$$\begin{aligned} X=\frac{-k_4+\sqrt{k_4^2-4k_3k_5}}{2k_3},\quad Y=\frac{(k_7-k_6X)}{k_6+ad},\quad \hbox {and}\quad Z=1-X-Y. \end{aligned}$$The parameters are

$$\begin{aligned} k_3= & {} \frac{k_6^2\sigma _Q^2+(ad)^2\sigma _B^2+2adk_6\mu _B/b}{(k_6+ad)^2}-\sigma _C^2,\\ k_4= & {} 2\left[ \sigma _C^2+\frac{-k_6k_7\sigma _Q^2+adk_8\sigma _B^2+(k_6k_8-adk_7)\mu _B/b}{(k_6+ad)^2}\right] ,\\ k_5= & {} \frac{k_7^2\sigma _Q^2+k_8^2\sigma _B^2-(2/b)k_7k_8\mu _B}{(k_6+ad)^2}-\left( \displaystyle \frac{V_0+\mu _{AB}}{z_{\theta }} \right) ^2,\\ k_6= & {} b(b-a\mu _B),\\ k_7= & {} ab(\mu _{AB}-\mu _B),\\ k_8= & {} a(b\mu _{AB}-c), \end{aligned}$$where a, b, c and d are the scalars already defined in section 2, \(\mu _B\) is the benchmark return, and \(\sigma _B^2\), \(\sigma _Q^2=c/b^2\) and \(\sigma _C^2=1/a\) are the variances of portfolios B, Q, and C. (See Appendix D in Alexander and Baptista 2008, for the proof).

For any given \({\varvec{\mu }}\), \({\varvec{\Sigma }}\), \({\varvec{\omega _{B}}} \) and \(T_0\), each point \(K\in \hbox {RBF}\) has the property that the vectors in Eqs. (B1) and (B2) coincide (the corresponding Value-at-Risk \(V_0\) is a result of the optimization described in subsection 2.1).

A special situation arises for portfolio M, which lies on the Mean-Variance Frontier. In this case the Mutual Fund Separation Theorem (Merton, 1972) establishes that, for any portfolio P lying on the MVF, the portfolio weights can be conveniently obtained via the linear combination

where \(\psi =\displaystyle \frac{\mu _P-\mu _C}{\mu _Q-\mu _C}\) and \(\mu _Q=c/b\) and \(\mu _C=b/a\) are the returns of portfolios Q and C. Equation (B3) requires \({\varvec{\omega _{Q}}} \) and \({\varvec{\omega _{C}}} \) already defined before Eq. (8) and does not depend of any portfolio variance. For its computation in portfolio M it sufficient to set the target return \(\mu _P=\mu _M\).

Appendix C: Stock returns of the S &P 100

See Table 2.

Appendix D: The Constrained Mean-TEV Frontier and the Fixed VaR-TEV Frontier

This Appendix contains a brief geometric illustration of the scenarios for the Constrained Mean-TEV Frontier (CMTF) by Alexander and Baptista (2008) and the FVTF by Palomba and Riccetti (2012) arising from different VaR restrictions. The Constrained Mean-TEV Frontier (CMTF) is a portfolio boundary satisfying the VaR constraint, while the TEV is kept at its minimum value (Roll, 1992). The FVTF considers the CTF as well.

In general, based on different VaR bounds, the CMTF could be

-

(a)

an empty set if the CVF lies to the left of the MVF, i.e. in the set of inadmissible portfolios;

-

(b)

a single admissible portfolio when the CVF is tangent to the MVF;

-

(c)

a segment, if the CVF crosses the MVF but not the MTF (but may be tangent to the MTF);

-

(d)

an arc, consecutive to two segments, if the CVF crosses both the MVF and the MTF.

Assigning a VaR bound to each scenario, the FVTF could be

-

An empty set

in three cases:

-

in case (a) above;

-

in case (b) above, when the tangency between the CVF and the MVF does not satisfy the TEV restriction;

-

in case (c) above, when the CVF crosses the MVF only.

-

A single portfolio when the CVF is tangent to the CTF (portfolio K, where \(\text {TEV}=T_0\) and \(\text {VaR}=V_0\)).

A closed and bounded set in several cases:

-

when the CVF crosses the CTF given by the segment and the left arc identified by the two intersections;

-

when the CVF crosses all the other frontiers. This boundary have a horseshoe-like shape: the linear frontier crosses both the CTF and the MTF thus defining two arcs on the left whose endpoints are joined by two segments;

-

same as above, but the straight line passes through (at least) one intersection between the oval and the hyperbolic boundaries;

-

where the set is given by the two left arcs defined by the two intersections between the CTF and the MTF. In this case the VaR rvlimit is not binding.

Clearly, an empty FVTF indicates that no admissible portfolio can satisfy the joint limits on risk indicators, so these limits are incompatible. Otherwise, inside this frontier, the asset manager has to face a trade-off: she can try to reduce the VaR via a riskier active strategy that enlarges the TEV or try to reduce the relative risk, but this implies a higher VaR near to that of the selected benchmark. Figure 8 shows the various scenarios in the (\(\sigma _P,\mu _P\)) space.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Lucchetti, R., Nicolau, M., Palomba, G. et al. Reconciling Tracking Error Volatility and Value-at-Risk in Active Portfolio Management: A New Frontier. Comput Econ (2024). https://doi.org/10.1007/s10614-024-10684-4

Accepted:

Published:

DOI: https://doi.org/10.1007/s10614-024-10684-4

) has equation

) has equation