Abstract

In recent years, there has been a bloom in the stock investors due to availability of various platforms that have provided an opportunity even for small scale investors to earn profits from the market. However, due to very high uncertainty, bad investments can lead to large financial losses and hence need for tools that can predict stock behaviour, arises. The main objective of this article is to provide a comparative empirical analysis of stochastic models with artificial neural networks in the prediction of stock indices across different markets. We consider three types of models, namely the time series models: autoregressive integrated moving average and autoregressive fractionally integrated moving average; jump diffusion models: Merton jump diffusion and Kou jump diffusion; the artificial neural network models: feed-forward network and the long short term memory. These models are used to forecast 10, 20 and 30 days ahead prices of major stock indices across different markets which include both developed and emerging economies. It is shown that the long short-term memory performs better than other considered models on most of the considered indices over all the time horizons. The results also indicate the forecasts provided by the LSTM model are significant from both statistical point of view and can possibly be used for profitable investments.

Similar content being viewed by others

Data availability

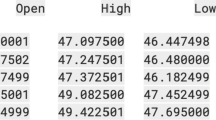

All the data used in the study is freely available on yahoo finance, see the link: https://finance.yahoo.com/. Data can also be accessed using the url: https://drive.google.com/drive/folders/1D-RSp9MmCvynUZNPhuGJ0amW0gN9WCFX?usp=sharing

Notes

https://finance.yahoo.com/. The data can also be accessed using the link: https://drive.google.com/drive/folders/1D-RSp9MmCvynUZNPhuGJ0amW0gN9WCFX?usp=sharing.

Abbreviations

- AR:

-

Autoregression

- MA:

-

Moving average

- ARMA:

-

Autoregressive moving average

- ARIMA:

-

Autoregressive integrated moving average

- ARFIMA:

-

Autoregressive fractionally integrated moving average

- LRD:

-

Long range dependent

- MJD:

-

Merton jump diffusion

- KJD:

-

Kou jump diffusion

- GBM:

-

Geometric Brownian motion

- ANN:

-

Artificial Neural Networks

- FNN:

-

Feedforward Neural Network

- LSTM:

-

Long short term memory

- DJIA:

-

Dow Jones Industrial Average

- Nikkei 225:

-

Nikkei 225 Stock Average

- NIFTY 50:

-

National Stock Exchange 50

- SENSEX:

-

Stock Exchange Sensitive Index

- ASX 300:

-

Australian Securities Exchange 300

- SP 500:

-

Standard’s and Poors 500

References

Alfaro, E., Garcia, N., Gámez, M., & Elizondo, D. (2008). Bankruptcy forecasting: An empirical comparison of adaboost and neural networks. Decision Support Systems, 45(1), 110–122. https://doi.org/10.1016/j.dss.2007.12.002

Alpaydin, E. (2014). Introduction to machine learning. Cambridge, MA: MIT Press.

Angelini, E., di Giacomo, T., & Roli, A. (2008). A neural network approach for credit risk evaluation. The Quarterly Review of Economics and Finance, 48(4), 733–755. https://doi.org/10.1016/j.qref.2007.04.001

Ariyo, A. A., Adewumi, A. O., & Ayo, C. K. (2014). Stock price prediction using the ARIMA model. In: 2014 UKSim-AMSS 16th international conference on computer modelling and simulation (pp. 106–112).

Bachelier, L. (1900). Théorie de la spéculation. Annales scientifiques de l’École Normale Supérieure, 3e série, 17, 21–86. https://doi.org/10.24033/asens.476

Bao, W., Yue, J., & Rao, Y. (2017). A deep learning framework for financial time series using stacked autoencoders and long-short term memory. PLOS ONE, 12(7), 1–24. https://doi.org/10.1371/journal.pone.0180944. 07.

Beran, J. (1994). Statistics for long-memory processes. Berlin: Springer.

Bhardwaj, G., & Swanson, N. R. (2006). An empirical investigation of the usefulness of ARFIMA models for predicting macroeconomic and financial time series. Journal of Econometrics, 131(1), 539–578. https://doi.org/10.1016/j.jeconom.2005.01.016

Bishop, C. M. (2007). Pattern recognition and machine learning (information science and statistics). New York: Springer.

Box, G., & Jenkins, G. M. (1976). Time series analysis: Forecasting and control. San Fransisco: Holden-Day.

Chatfield, C. (2004). The analysis of time series: An introduction. Florida: CRC Press.

Chen, A.-S., Leung, M. T., & Daouk, H. (2003). Application of neural networks to an emerging financial market: forecasting and trading the Taiwan Stock Index. Computers & Operations Research, 30(6), 901–923. https://doi.org/10.1016/S0305-0548(02)00037-0

Chen, K., Zhou, Y., & Dai, F. (2015). A LSTM-based method for stock returns prediction: A case study of China stock market. In: 2015 IEEE international conference on big data (big data) (pp. 2823–2824).

Chowdhary, K. (2020). Fundamentals of artificial intelligence. Berlin: Springer.

Cont, R., & Tankov, P. (2004). Financial modelling with jump processes. Boca Raton: Chapman and Hall.

Dash, R. K. , Nguyen, T. N. , Cengiz, K. & Sharma, A. (2021). Fine-tuned support vector regression model for stock predictions. Neural Computing and Applications 1–15.

Dufresne, D. (2005). Bessel processes and Asian options. Boston, MA: Springer.

Fischer, T., & Krauss, C. (2018). Deep learning with long short-term memory networks for financial market predictions. European Journal of Operational Research, 270(2), 654–669. https://doi.org/10.1016/j.ejor.2017.11.054

Forsyth, D. A., & Ponce, J. (2002). Computer vision: A modern approach. Prentice Hall professional technical reference.

Gajda, J., & Beghin, L. (2021). Prabhakar lévy processes. Statistics & Probability Letters, 178, 109–162. https://doi.org/10.1016/j.spl.2021.109162

Gugole, N. (2016). Merton jump diffusion model versus the black and Scholes approach for the log-returns and volatility smile fitting. International Journal of Pure and Applied Mathematics, 109(3), 719–736. https://doi.org/10.12732/ijpam.v109i3.19

Gupta, A. K., Kumar, A. & Pande, N.K. (2024). Machine learning assisted manufacturing. In: Industry 4.0 (pp. 77–108). CRC Press.

Hochreiter, S., & Schmidhuber, J. (1997). Long short-term memory. Neural Computation, 9, 1735–80. https://doi.org/10.1162/neco.1997.9.8.1735. 12.

Hornik, K., Stinchcombe, M., & White, H. (1989). Multilayer feedforward networks are universal approximators. Neural Networks, 2(5), 359–366. https://doi.org/10.1016/0893-6080(89)90020-8

HOSKING, J. R. M. (1981). Fractional differencing. Biometrika, 68(1), 165–176. https://doi.org/10.1093/biomet/68.1.165

Hossain, E., Hossain, M. S., Zander, P.-O., & Andersson, K. (2022). Machine learning with belief rule-based expert systems to predict stock price movements. Expert Systems with Applications, 206, 117706. https://doi.org/10.1016/j.eswa.2022.117706

Islam, M. R., & Nguyen, N. (2020). Comparison of financial models for stock price prediction. Journal of Risk and Financial Management, 13(8), 181. https://doi.org/10.3390/jrfm13080181

Karatzas, I., & Shreve, S. E. (2000). Brownian motion and stochastic calculus. Berlin: Springer.

Kohzadi, N., Boyd, M. S., Kermanshahi, B., & Kaastra, I. (1996). A comparison of artificial neural network and time series models for forecasting commodity prices. Neurocomputing, 10(2), 169–181. https://doi.org/10.1016/0925-2312(95)00020-8

Kou, S. G. (2002). A jump-diffusion model for option pricing. Management Science, 48(8), 1086–1101.

Leippold, M., Wang, Q., & Zhou, W. (2022). Machine learning in the Chinese stock market. Journal of Financial Economics, 145(2), 64–82. https://doi.org/10.1016/j.jfineco.2021.08.017

Leung, M. T., Daouk, H., & Chen, A.-S. (2000). Forecasting stock indices: A comparison of classification and level estimation models. International Journal of Forecasting, 16(2), 173–190. https://doi.org/10.1016/S0169-2070(99)00048-5

Mancini, C. (2009). Non-parametric threshold estimation for models with stochastic diffusion coefficient and jumps. Scandinavian Journal of Statistics, 36(2), 270–296.

Merton, R. C. (1976). Option pricing when underlying stock returns are discontinuous. Journal of Financial Economics, 3(1), 125–144. https://doi.org/10.1016/0304-405X(76)90022-2

Mitchell, T. M. (1997). Machine learning. New York: McGraw-Hill Education.

Qiu, J., Wang, B., & Zhou, C. (2020). Forecasting stock prices with long-short term memory neural network based on attention mechanism. PLOS ONE, 15(1), 1–15. https://doi.org/10.1371/journal.pone.0227222. , 01.

Revuz, D., & Yor, M. (1991). Continuous martingales and Brownian motion. Berlin: Springer.

Robinson, P. M. (Ed.). (2003). Time series with long memory. New York: Oxford University Press.

Roondiwala, M., Patel, H., & Varma, S. (2017). Predicting stock prices using LSTM. International Journal of Science and Research (IJSR), 6(4), 1754–1756.

Rostek, S. (2009). Option pricing in fractional Brownian markets. Berlin: Springer.

Sathe, A. M., Upadhye, N. S., & Wyłomańska, A. (2023). Forecasting of symmetric α-stable autoregressive models by time series approach supported by artificial neural networks. Journal of Computational and Applied Mathematics, 425, 115051. https://doi.org/10.1016/j.cam.2022.115051

Selvamuthu, D., Kumar, V., & Mishra, A. (2019). Indian stock market prediction using artificial neural networks on tick data. Financial Innovation, 51, 1–12.

Wilmott, P. (2007). Paul Wilmott introduces quantitative finance (2nd ed.). Hoboken: Wiley.

Wong, B., & Heyde, C. C. (2004). On the martingale property of stochastic exponentials. Journal of Applied Probability, 41(3), 654–664.

Yim, J. (2002). A comparison of neural networks with time series models for forecasting returns on a stock market index. In: Proceedings of the 15th international conference on industrial and engineering applications of artificial intelligence and expert systems: Developments in applied artificial intelligence (pp.25–35).

Acknowledgements

The first author would like to thank University Grants Commission, India for supporting his PhD research. This work was partially supported by the FIST program of the Department of Science and Technology, Government of India, Reference No. SR/FST/MS-I/2018/22(C). The authors would like to thank the reviewers for helpful comments and suggestions which have lead to the improvements in the paper.

Funding

The first author would like to thank University Grants Commission (UGC), India for the research funding.

Author information

Authors and Affiliations

Contributions

All the authors contributed equally to this work.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Pande, N.K., Kumar, A. & Gupta, A.K. Forecasting Stock Indices: Stochastic and Artificial Neural Network Models. Comput Econ (2024). https://doi.org/10.1007/s10614-024-10615-3

Accepted:

Published:

DOI: https://doi.org/10.1007/s10614-024-10615-3