Abstract

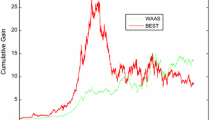

This paper proposes a novel online learning algorithm, named weak aggregating specialist algorithm (WASA), and presents its theoretical bound. This algorithm has a flexible feature, which is to allow abandoning some expert advice according to pre-set rules. Based on this algorithm, a new online portfolio strategy named weak aggregating specialized CRP (WASC) is designed, which only aggregates awake specialized expert advice. Firstly, a pool of special constant rebalanced portfolios \(\text {CRP}({\textbf{b}})\) strategies is employed to construct the index set of specialized experts. Secondly, a distance function is exploited to measure the distance between the current adjusted portfolio and each specialized expert advice, and the index set of awake specialized experts is constructed. Finally, the portfolio is updated by aggregating all awake specialized expert advice. Furthermore, theoretical and experimental analyses are established to illustrate the performance of the proposed strategy WASC. Theoretical results guarantee that WASC performs as well as the best specialized expert. Experimental results show that WASC outperforms some existing strategies in terms of the return and risk metrics, which illustrates its effectiveness in various real financial markets.

Similar content being viewed by others

References

Agarwal, A., Hazan, E., Kale, S., & Schapire, R. E. (2006). Algorithms for portfolio management based on the Newton method. In Proceedings of the international conference on machine learning (pp. 9–16).

Albeverio, S., Lao, L. J., & Zhao, X. L. (2001). On-line portfolio selection strategy with prediction in the presence of transaction costs. Mathematical Methods of Operations Research, 54(1), 133–161.

Blum, A., & Kalai, A. (1999). Universal portfolios with and without transaction costs. Machine Learning, 35, 193–205.

Borodin, A., El-Yaniv, R., & Gogan, V. (2004). Can we learn to beat the best stock. Journal of Artificial Intelligence Research, 21, 579–594.

Cai, X., & Ye, Z. K. (2019). Gaussian weighting reversion strategy for accurate online portfolio selection. IEEE Transactions Signal Processing, 67(21), 5558–5570.

Cover, T. M. (1991). Universal portfolios. Mathematical Finance, 1(1), 1–29.

Cover, T. M., & Ordentlich, E. (1996). Universal portfolio with side information. IEEE Transactions on Information Theory, 42(2), 348–363.

Cuchiero, C., Schachermayer, W., & Wong, T. K. L. (2019). Cover’s universal portfolio, stochastic portfolio theory, and the numéraire portfolio. Mathematical Finance, 29(3), 773–803.

Dai, H. L., Liang, C. X., & Dai, H. M. (2022). An online portfolio strategy based on trend promote price tracing ensemble learning algorithm. Knowledge-Based Systems, 239, 107957.

Das, P., & Banerjee, A. (2011). Meta optimization and its application to portfolio selection.

Fagiuoli, E., Stella, F., & Ventura, A. (2007). Constant rebalanced portfolios and side-information. Quantitative Finance, 7(2), 161–173.

Gaivoronski, A. A., & Stella, F. (2000). Stochastic nonstationary optimization for finding universal portfolios. Annals of Operations Research, 100(1–4), 165–188.

Györfi, L., Lugosi, G., & Udina, F. (2006). Nonparametric kernel-based sequential investment strategies. Mathematical Finance, 16(2), 337–357.

Györfi, L., Udina, F., & Walk, H. (2008). Nonparametric nearest neighbor based empirical portfolio selection strategies. Statistics & Decisions, 26(2), 145–157.

Guan, H., & An, Z. Y. (2019). A local adaptive learning system for online portfolio selection. Knowledge-Based Systems, 186, 104958.

Guasoni, P., & Weber, M. H. (2020). Nonlinear price impact and portfolio choice. Mathematical Finance, 30(2), 341–376.

Hazan, E., & Kale, S. (2015). An online portfolio selection algorithm with regret logarithmic in price variation. Mathematical Finance, 25(2), 288–310.

Ha, Y. M., & Zhang, H. (2020). Algorithmic trading for online portfolio selection under limited market liquidity. European Journal of Operational Research, 286(3), 1033–1051.

Helmbold, D. P., Schapire, R. E., Singer, Y., & Warmuth, M. K. (1998). On-line portfolio selection using multiplicative updates. Mathematical Finance, 8(4), 325–347.

Hoeffding, W. (1963). Probability inequalities for sums of bounded random variables. Journal of the American Statistical Association, 58, 13–30.

Huang, D. J., Yu, S. C., Li, B., Hoi, S. C. H., & Zhou, S. G. (2018). Combination forecasting reversion strategy for online portfolio selection. ACM Transactions on Intelligent Systems and Technology, 9(5), 58.

Huang, D. J., Yu, S. C., Li, B., Hoi, S. C. H., & Zhou, S. G. (2016). Robust median reversion strategy for on-line portfolio selection. IEEE Transactions on Knowledge and Data Engineering, 28, 2480–2493.

Kalai, A., & Vempala, S. (2002). Efficient algorithms for universal portfolios. Journal of Machine Learning Research, 3(3), 423–440.

Kalnishkan, Y., & Vyugin, M. V. (2008). The weak aggregating algorithm and weak mixability. The Journal of Computer and System Sciences, 74(8), 1228–1244.

Kelly, J., Jr. (1956). A new interpretation of information rate. Bell Systems Technical Journal, 2(3), 917–926.

Khedmati, M., & Azin, P. (2020). An online portfolio selection algorithm using clustering approaches and considering transaction costs. Expert Systems with Applications, 159, 113546.

Levina, T., Levin, Y., Mcgill, J., Nediak, M., & Vovk, V. (2010). Weak aggregating algorithm for the distribution-free perishable inventory problem. Operations Research Letters, 38(6), 516–521.

Lai, Z. R., Yang, P. Y., Fang, L. D., & Wu, X. T. (2020). Reweighted price relative tracking system for automatic portfolio optimization. IEEE Transactions on Systems, Man, and Cybernetics: Systems, 50(11), 4349–4361.

Li, B., Hoi, S. C. H., & Gopalkrishnan, V. (2011). CORN: Correlation-driven nonparametric learning approach for portfolio selection. ACM Transactions on Intelligent Systems and Technology, 2(3), 1–29.

Li, B., Zhao, P. L., Hoi, S. C. H., & Gopalkrishnan, V. (2012). PAMR: Passive aggressive mean reversion strategy for portfolio selection. Machine Learning, 87(2), 221–258.

Li, B., Hoi, S. C. H., Sahoo, D., & Liu, Z. Y. (2015). Moving average reversion strategy for on-line portfolio selection. Artificial Intelligence, 222, 104–123.

Li, B., Wang, J. L., Huang, D. J., & Hoi, S. C. H. (2018). Transaction cost optimization for online portfolio selection. Quantitative Finance, 18, 1411–1424.

Li, J. H., Zhang, Y., Yang, X. Y., & Chen, L. W. (2023). Online portfolio management via deep reinforcement learning with high-frequency data. Information Processing and Management, 60(3), 103247.

Li, Y. Y., Zheng, X. L., Chen, C. C., Wang, J. W., & Xu, S. (2022). Exponential gradient with momentum for online portfolio selection. Expert Systems with Applications, 187(3), 115889.

Markowitz, H. M. (1952). Portfolio selection. Journal of Finance, 7(1), 77–91.

Mohr, E., & Dochow, R. (2017). Risk management strategies for finding universal portfolios. Annals of Operations Research, 256(1), 129–147.

O’Sullivan, P., & Edelman, D. (2015). Adaptive universal portfolios. The European Journal of Finance, 21(4), 337–351.

Wang, X., Sun, T., & Liu, Z. (2020). Kernel-based aggregating learning system for online portfolio optimization (p. 6595329). Article: Mathematical Problems in Engineering.

Wesselhofft, N., & Hardle, W. K. (2020). Constrained Kelly portfolios under alpha-stable laws. Computational Economics, 55(3), 801–826.

Yang, X. Y., He, J. A., Lin, H., & Zhang, Y. (2020). Boosting exponential gradient strategy for online portfolio selection: an aggregating experts’ advice method. Computational Economics, 55(1), 231–251.

Zhang, W. G., Zhang, Y., Yang, X. Y., & Xu, W. J. (2012). A class of on-line portfolio selection algorithms based on linear learning. Applied Mathematics and Computation, 218, 11832–11841.

Zhang, Y., Yang, X. Y., Zhang, W. G., & Chen, W. W. (2020). Online ordering rules for the multi-period newsvendor problem with quantity discounts. Annals of Operations Research, 288(1), 495–524.

Zhang, Y., & Yang, X. Y. (2017). Online portfolio selection strategy based on combining experts’ advice. Computational Economics, 50(1), 141–159.

Zhang, Y., Lin, H., Yang, X. Y., & Long, W. R. (2021). Combining expert weights for online portfolio selection based on the gradient descent algorithm. Knowledge-Based Systems, 234, 107533.

Acknowledgements

This work was supported by the National Natural Science Foundation of China (No. 72274224) and the Humanities and Social Science Foundation of the Ministry of Education of China (No. 21YJA790044).

Author information

Authors and Affiliations

Corresponding authors

Ethics declarations

Conflict of interest

The authors declare that there are no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

He, J., Yin, S. & Peng, F. Weak aggregating specialist algorithm for online portfolio selection. Comput Econ (2023). https://doi.org/10.1007/s10614-023-10411-5

Accepted:

Published:

DOI: https://doi.org/10.1007/s10614-023-10411-5