Abstract

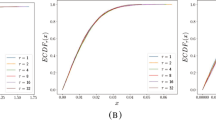

This paper concerns an investigation on the multifractal features of liquidity in China's stock markets based on multifractal detrended fluctuation analysis, and an analysis on multifractal features of market liquidity and fractal degree by determining the generalized Hurst exponent. Also involved in this paper are the identification of the trended fluctuations by tendency entropy dimension and a study on the validity of the correct rate of identification by stochastic correct rate. The results show that the multifractal features of liquidity are obvious in China's stock markets and that the multifractal liquidity degree of the large-cap stock is lower than those of the medium and small-cap stocks. The trend entropy dimension can be used to identify the trend of liquidity effectively, serving as an effective method to identify the fluctuation trend of fractal market.

Similar content being viewed by others

References

Adam, K., Marcet, A., & Nicolini, J. P. (2016). Stock market volatility and learning. The Journal of Finance, 71, 33–82.

Amihud, Y. (2002). Illiquidity and stock returns: Cross-section and time-series effects. Finance Mark, 5, 31–56.

Amihud, Y., & Mendelson, H. (1986). Asset pricing and the bid-ask spread. Financial Economics, 17, 223–249.

Amihud, Y., Mendelson, H., & Pedersen, L. H. (2006). Liquidity and asset prices. Foundations and Trends in Finance, 1, 269–364.

Asness, C., Moskowitz, T., & Pedersen, L. H. (2013). Value and momentum everywhere. The Journal of Finance, 68, 929–985.

Avramov, D., Chordia, T., & Goyal, A. (2006). Liquidity and autocorrelations in individual stock returns. The Journal of Finance, 61, 365–2394.

Bernstein, R. (1993). The earning expectation life cycle. Financial Analysts Journal, 49, 90–93.

Cheridito, P. (2003). Arbitrage in fractional Brownian motion models. Finance and Stochastics, 7(4), 533–553.

Chordia, T., Roll, R., & Subrahmanyam, A. (2000). Commonality in liquidity. Journal of Financial Economics, 56, 3–28.

Chordia, T., Roll, R., & Subrahmanyam, A. (2008). Liquidity and market efficiency. Journal of Financial Economics, 87, 249–268.

Chordia, T., Sarkar, A., & Subrahmanyam, A. (2011). Liquidity dynamics and cross-autocorrelations. Journal of Financial and Quantitative Analysis, 46, 709–736.

Chung, D., & Hrazdil, K. (2010). Liquidity and market efficiency: A large sample study. Journal of Banking and Finance, 34, 2346–2357.

DeBondt, W. F. M., & Thaler, R. (1985). Does the stock market overreact? The Journal of Finance, 40, 793–805.

Eghdami, I., Panahi, H., & Movahed, S. M. S. (2018). Multifractal analysis of pulsar timing residuals: Assessment of gravitational wave detection. The Astrophysical Journal, 864, 162.

Falconer, K. (2003). Fractal geometry. John Wiley & Sons Inc.

Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. Journal of Finance, 25, 383–417.

Galariotis, E. C. (2014). Contrarian and momentum trading: A review of the literature. Review of Behavioral Finance, 6, 63–82.

Griffin, J. M., Ji, X., & Martin, J. S. (2003). Momentum investing and business cycle risk: Evidence from pole to pole. J. Finance, 58, 2515–2547.

Gu, R., Xiong, W., & Li, X. (2015). Does the singular value decomposition entropy have predictive power for stock market? —Evidence from the Shenzhen stock market. Physica a: Statistical Mechanics and Its Applications, 439, 103–113.

Hasbrouck, J. (2003). Intraday price formation in U.S. equity index markets. Journal of Finance, 58, 2375–2400.

He, X. Z., & Li, K. (2015). Profitability of time series momentum. Journal of Banking & Finance, 53, 140–157.

Huang, F., & Yang, C. J. (2007). Liquidity risk and stock pricing: Empirical evidence from China’s stock market. Management World, 5, 30–39.

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: Implications for stock market efficiency. The Journal of Finance, 48, 65–91.

Jegadeesh, N., & Titman, S. (2001). Profitability of momentum strategies: An evaluation of alternative explanations. The Journal of Finance, 56, 699–720.

Jotikasthira, P., Lundblad, C. T., & Ramadorai, T. (2012). Asset fire sales and purchases and the international transmission of funding shocks. The Journal of Finance, 67, 2015–2050.

Kaniel, R. O. N., Liu, S., Saar, G., & Titman, S. (2012). Individual investor trading and return patterns around earnings announcements. The Journal of Finance, 67, 639–680.

Kantelhardt, J. W., Zschiegner, S. A., Eva, K. B., Havlin, S., Bunde, A., & Stanley, H. E. (2002). Multifractal detrended fluctuation analysis of nonstationary time series. Physica a: Statistical Mechanics and Its Applications, 316, 87–114.

Kelly, B., & Jiang, H. (2014). Tail risk and asset prices. Review of Financial Studies, 27, 2841–2871.

Khan, M. S. R., & Rabbani, N. (2017). Momentum in stock returns: Evidence from an emerging stock market. Macroeconomics and Finance in Emerging Market Economies, 10, 191–204.

Korajczyk, R. A., & Sadka, R. (2004). Are momentum profits robust to trading costs? The Journal of Finance, 59, 1039–1082.

Lee, C. M. C., & Swaminathan, B. (2000). Price momentum and trading volume. J. Finance, 55, 2017–2069.

Lim, B. Y., Wang, J. G., & Yao, Y. (2018). Time-series momentum in nearly 100 years of stock returns. Journal of Banking & Finance, 97, 283–296.

Mandelbrot, B. B., & Ness, V. (1968). Fractional Brownian motions, fractional noises and applications. SIAM Review, 10(4), 422–437.

Mantegna, R. N., Palagyi, Z., & Stanley, H. E. (1999). Applications of statistical mechanics to finance. Physica a: Statistical Mechanics and Its Applications, 274, 216–221.

Mantegna, R. N., & Stanley, H. E. (1996). Turbulence and financial markets. Nature, 383, 587–588.

Moskowitz, T. J., Ooi, Y. H., & Pedersen, L. H. (2012). Time series momentum. Journal of Financial Economics, 104, 228–250.

Münnix, M., Shimada, T., & Schäfer, R. (2012). Identifying states of a financial market. Science and Reports, 2, 644–647.

Nnadi, M., & Tanna, S. (2017). Accounting analyses of momentum and contrarian strategies in emerging markets. Asia-Pacific Journal of Accounting & Economics, 24, 1–21.

Pablo, S. G., & David, G. U. (2014). Multifractality and long memory of a financial index. Physica a: Statistical Mechanics and Its Applications, 394, 226–234.

Peng, C. K., Buldyrev, S. V., Havlin, S., & Goldberger, A. (1994). Mosaic organization of DNA nucleotides. Physical Review E, 49, 1685–1689.

Peters, E. E. (1991). Chaos and order in the capital markets. John Wiley & Sons Inc.

Schwartz, R. A. (1988). Equity markets: Structure, trading, and performance. Harper & Row Inc.

Wang, Y., Liu, L., & Gu, R. (2009). Analysis of efficiency for Shenzhen stock market based on multifractal detrended fluctuation analysis. International Review of Financial Analysis, 18, 271–276.

Wei, Y., Wang, Y., & Huang, D. (2011). A Copula-multifractal volatility hedging model for CSI 300 index futures. Physica a: Statistical Mechanics and Its Applications, 390, 4260–4272.

Wu, X., Chun, W. D., Lin, Y., & Li, Y. Z. (2018). Identification of momentum life cycle stage of stock price. Nonlinear Dynamics, 94, 249–260.

Yan, R. Z., & Wu, X. (2017). The stages identification of momentum life cycle of stock market based on tendency entropy dimension. Systems Engineering, 35, 36–44.

Zhou, W. X. (2009). The Components of empirical multifractality in financial returns. Europhysics Letters, 88, 28004.

Zhou, W., Dang, Y., & Gu, R. (2013). Efficiency and multifractality analysis of CSI 300 based on multifractal detrending moving average algorithm. Physica a: Statistical Mechanics and Its Applications, 392, 1429–1438.

Acknowledgements

The authors would like to acknowledge financial support by the National Natural Science Foundation of China (Grant Nos. 71501018, 71903017).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Yan, R., Yue, D., Wu, X. et al. Multiscale Multifractal Detrended Fluctuation Analysis and Trend Identification of Liquidity in the China's Stock Markets. Comput Econ 61, 487–511 (2023). https://doi.org/10.1007/s10614-021-10215-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-021-10215-5