Abstract

The particular situation of the youngest and oldest individuals on the labour market motivates age-specific labour market analysis. One topical case is employment protection for older workers. The effect of employment protection on the total number of jobs is ambiguous. The positive effect of lower job destruction is counteracted by the negative effect of lower job creation. This ambiguity carries over to the more specific case of age-related employment protection. Numerical analysis can be illuminating when countervailing effects produce an ambiguity. In this paper, I present a numerical model based on the theoretical set-up of Chéron et al. (Econ J 121:1477–1504, 2011). Simulations performed with the model highlight age-specific effects of general employment protection measures and effects of measures targeted at particular age-groups on workers outside the target group. Firing taxes and hiring subsidies have age-specific consequences because employment and unemployment rates vary over the lifecycle. Positive effects of employment protection for the target group can be outweighed by negative effects for other workers.

Similar content being viewed by others

Notes

This model is further discussed and extended in CHL (2012).

Extended versions of the model with additional dimensions are used in Euwals et al. (2013): (1) a tenure dimension that splits each age-productivity cell of employed or unemployed individuals into sub-cells corresponding to the number of periods over which the current status has lasted and (2) a sector dimension that allows us to compare different technological or institutional settings in the same model. These dimensions have been eliminated from the following model description in order to improve readability.

The general form of the transition equations includes the two cases of worker- and match-specific productivities. If t and \(t^{0}\) are uniform, this does not make a difference. However, if productivity is persistent, we must answer the question of whether productivity persistence applies to the unemployed as well.

These state values need not be zero (e.g., pension income), as long as they are constant across labour market states. The important aspect is that in the last active period, \(T-1\), the future is irrelevant for hiring and firing decisions.

At a technical level, the model is formulated as a mixed complementarity problem in GAMS (Rutherford 1999).

The case of a uniform firing tax is covered in CHL (2011) as well. However, their analysis remains confined to the effect on reservation productivities and transition rates.

Observe that for the oldest workers, immediately before retirement, the reservation productivity is equal to the value of leisure. For younger workers it is substantially lower.

This makes the effects comparable in terms of shifts in the reservation productivity. A welfare analysis, which is beyond the scope of this paper, would need to take into account that a subsidy needs to be financed whereas a tax raises revenue.

The indirect effect runs via the worker. Firms can pay higher wages to new workers because of the subsidy. Hence, it becomes more attractive for the worker to leave an existing job, even if this means a period of unemployment.

Observe, however, that this does not imply a welfare assessment. Given that the reservation productivity of workers results from their outside option, it is not evident that a situation with higher employment increases their welfare.

In the setting with variable bin boundaries, one complication arises when implementing “unchanged productivity”. Bin boundaries change from one period to the next. As a consequence, one cannot simply define “unchanged productivity” as “remaining in the same productivity bin”. A plausible adjustment is asked for.

\(jc_{i}\) depends on \(R_{i+1}^{0}\), but \(jd_{i}\) on \(R_{i}\). This is slightly anomalous and requires care in the numerical implementation.

In the original paper the index runs from 1 to \(T-1\). This is incorrect.

The unemployed of age \(T-1\) can be matched with a vacancy, but they add no value, therefore the sum runs only up to \(T-2\).

The effect is not exactly zero, because one variable in the model, vacancies, does adjust continuously.

References

Addison, J. T., & Teixeira, P. (2003). The economics of employment protection. Journal of Labor Research, 24, 85–129.

Aubert, P., Caroli, E., & Roger, M. (2006). New technologies, organisation and age: Firm-level evidence. Economic Journal, 116, 73–93.

Bertola, G. (1992). Labor turnover costs and average labor demand. Journal of Labor Economics, 10, 389–411.

Bettendorf, L., & Broer, P. (2005). Lifetime labor supply in a search model of unemployment. Tinbergen Institute Discussion Paper 1679.

Blanchard, O., & Tirole, J. (2008). The optimal design of unemployment insurance and employment protection: A first pass. Journal of the European Economic Association, 6, 45–77.

Borghans, L., & ter Weel, B. (2002). Do older workers have more trouble using computers than younger workers? Research in Labour Economics, 21, 139–173.

Börsch-Supan, A., & Weiss, M. (2013). Productivity and age: Evidence from work teams at the assembly line. MEA Discussion Paper 148-2007 (Revised version).

Burdett, K., & Mortensen, D. (1998). Wage differentials, employer size, and unemployment. International Economic Review, 39, 257–273.

Chéron, A., Hairault, J.-O., & Langot, F. (2011). Age-dependent employment protection. Economic Journal, 121, 1477–1504.

Chéron, A., Hairault, J.-O., & Langot, F. (2012). Life-cycle equilibrium unemployment. Working Paper, University of Maine and Paris School of Economics (revised version of IZA DP 3396).

Corden, W. M. (1981). Taxation, real wage rigidity and employment. Economic Journal, 91, 309–330.

Euwals, R., Boeters, S., Bosch, N., Deelen, A., & ter Weel, B. (2013). Arbeidsmarkt ouderen en duurzame inzetbaarheit. CPB Achtergronddocument.

Friedberg, L. (2003). The impact of technological change on older workers: Evidence from data on computer use. Industrial and Labour Relations Review, 56, 511–529.

Fujimoto, J. (2013). A note on the life-cycle search and matching model with segmented labor markets. Economics Letters, 121, 48–52.

Garibaldi, P., & Violante, G. L. (2005). The employment effects of severance payments with wage rigidities. Economic Journal, 115, 799–832.

Hashimoto, M. (1981). Firm-specific human capital as a shared investment. American Economic Review, 71, 475–482.

Holden, S., & Wulfsberg, F. (2009). How strong is the macroeconomic case for downward real wage rigidity? Journal of Monetary Economics, 56, 605–615.

Hosios, A. J. (1990). On the efficiency of matching and related models of search and unemployment. Review of Economic Studies, 57, 279–298.

Kotlikoff, L. J., & Gokhale, J. (1992). Estimating a firm’s age-productivity profile using the present value of workers’ earnings. Quarterly Journal of Economics, 107, 1215–1242.

Lazear, E. P. (1979). Why is there mandatory retirement. Journal of Political Economy, 87, 1261–1284.

Lazear, E. P. (1990). Job security provisions and employment. Quarterly Journal of Economics, 105, 699–726.

Michau, J.-B. (2009). Optimal labor market policy with search frictions and risk-averse workers. Discussion paper 09/05. London School of Economics, Centre for Structural Econometrics.

Mortensen, D. T., & Pissarides, C. A. (1994). Job creation and job destruction in the theory of unemployment. Review of Economic Studies, 61, 397–415.

Mortensen, D. T., & Pissarides, C. A. (2003). Taxes, subsidies and equilibrium labor market outcomes. In E. Phelps (Ed.), Designing inclusion: Tools to raise low-end pay and employment in private enterprise. Cambridge: Cambridge University Press.

Moscarini, G. (2005). Job matching and the wage distribution. Econometrica, 73, 481–516.

OECD. (2006). Live longer, work longer. Paris: Ageing and Eemployment Policies.

Rutherford, T. F. (1999). Extensions of GAMS for complementarity problems in economics. Working Paper, University of Colorado.

Saint-Paul, G. (2009). Does the welfare state make older workers unemployable? IZA Discussion Paper 4440.

Acknowledgments

I thank Björn Brügemann, Rob Euwals, Egbert Jongen, Daniel van Vuuren, Bas ter Weel and an anonymous reviewer of this journal for their helpful comments on earlier versions of this paper.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: The Model of Chéron et al. (2011)

In contrast to the numerical model of this paper, the original model of CHL (2011) works with a continuous distribution of productivities. Crucial for the working mechanism are reservation productivities \(R_{i}\) (for ongoing jobs) and \(R_{i}^{0}\) (for new jobs), which generate transitions according to the productivity distribution function G.

The model has T age classes, indexed by \(i\in \left\{ 1,\ldots ,T\right\} \). At age \(i=1\), workers enter the labour market and are unemployed with certainty (\(u_{1}=1\)), age \(i=T-1\) is the last period when workers are active on the labour market, in period T, they retire with certainty.

The probability of an unemployed worker of age i to be employed at age \(i+1\) is

where p is the matching rate generated by the matching function for unemployed workers, u, and vacancies, v:

The job destruction rate for employed workers is given byFootnote 15

The resulting labour market flows generate the following age-profile of unemployment:

forFootnote 16 \(\forall i\in (1,T-2)\) and the initial condition \(u_{1}=1\). Adding up gives the overall level of unemployment:

Note that the unemployed of period \(T-1\) are part of the unemployment pool and can be matched with a vacancy, even if the do not start working because they are about to reach the retirement age.

The expected value of a vacant position isFootnote 17

which, using the zero-profit condition \(V=0\), can be written as

Bellman equations for the values of the different labour market states are formulated in the usual, recursive manner. This gives

for the value of a filled new job (with outsider wage \(w_{i}^{0}(\epsilon )\)) for \(\forall i\in (1,T-1)\),

for the value of a filled continued job (with insider wage \(w_{i}^{0}(\epsilon )\)) and

for the values of insiders, outsiders and unemployed workers, respectively. The final conditions are \({\mathcal {W}}_{T}={\mathcal {U}}_{T}\) (exogenous).

Wages are determined by Nash bargaining with bargaining power \(\gamma \) of the worker

Appendix 2: Pitfalls of Pre-determined Productivity Bin Boundaries

In a straightforward numerical implementation of the CHL set-up we can discretise the productivity space into bins of equal size and calculate the value functions for each of these bins. An earlier version of this paper was actually based on this straightforward implementation (with 30 equal-distant bins). However, the discretisation produces non-continuous reactions that make the results difficult to interpret. This appendix illustrates the pitfalls and motivates the approach with endogenous bin boundaries used in the main text (Sect. 3.4).

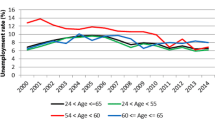

Figure 9 shows the employment effects of a uniform firing tax in the model with pre-determined bin boundaries. In contrast to the main text, the level of the tax is chosen particularly low (0.01, i.e. 1 % of the maximum production per worker and period) in order to highlight the resulting interpretation problems. The no-policy situation (solid line) is rather close to the model with endogenous bin boundaries (Fig. 1). The employment rate is first increasing, reaches a steady-state value of slightly higher than 70 % after the age of 30 and finally declines because of the end-game effect.

As in the main text, a uniform firing tax (dashed line in Fig. 9) has an employment-increasing effect in general. However, the age-specific pattern that emerges is irritating. For age groups between 25 and 50, employment increases considerably, significantly more that what one might have expected as a reaction to the small policy impulse. For workers above age 50, in contrast, the employment effect is hardly noticeable.

This strange age-pattern in the employment effect is an artefact of the productivity discretisation. With discrete productivity (in roughly 3 %-points steps when there are 30 bins), any policy will either have a negligible effectFootnote 18 (if the reservation productivity does not shift by at least one productivity bin) or a significant effect (if it does). This is highlighted in Fig. 10, which shows the pattern of the reservation productivity with and without the firing tax.

The solid line depicts the reservation productivity in the “no policy” case (where the lines for hiring and firing coincide). It is constant until age 55 and then sharply increasing. In the case with the firing tax, the reservation productivity for hiring remains unchanged. This outcome is not unexpected; however, because of general equilibrium feedback, it is not obvious either. The changes take place in the reservation productivity for firing, which in general declines. The changes are in line with the discrete structure of the productivity bins. For the age groups below 50 and above 60, the reservation productivity declines by exactly one bin width (3 %-points), for the age groups in-between, it does not change at all.

Patters of this sort are, even if qualitatively enlightening, quantitatively unconvincing. They produce spurious jumps in the age-specific effects of a uniform policy, depending solely on the coincidental closeness of the reservation productivities to the bin boundaries. Therefore, the model in the main text has been modified to include endogenously adjusting bin boundaries.

Figure 11 shows the age-specific employment effects of a small firing tax (0.01) in this modified model. In both respects that were unsatisfactory in the model with fixed bin boundaries, the situation is improved:

-

The employment effects are small and in the order of magnitude of the policy shock analysed.

-

The age-pattern of employment effects is smooth, as one would expect with a policy that is not targeted to specific age groups.

-

The pattern of reservation productivities (Fig. 12) is smooth as well. In both the no-policy and the firing-tax scenario the end-game effect sets in gradually, not abruptly as in Fig. 10.

Rights and permissions

About this article

Cite this article

Boeters, S. Age-Specific Labour Market Effects of Employment Protection: A Numerical Approach. Comput Econ 48, 281–305 (2016). https://doi.org/10.1007/s10614-015-9519-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-015-9519-2

Keywords

- Age-specific labour markets

- Matching model of unemployment

- Lifecycle effects

- Retirement

- Older workers

- End-game effect