Abstract

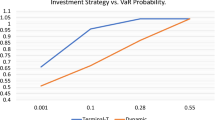

This paper sets out a basic framework for solving a stochastic portfolio problem using dynamic programming (DP). Dynamic portfolio decisions are concerned with simultaneous decisions on savings and asset allocation whereby asset returns, such as on equity and bonds, are stochastic as in Campbell and Viceira (Strategic asset allocation, portfolio choice for long-term investors, 2002). In contrast to CV (2002) we do not use a local approximation method to solve the stochastic model but rather use a global solution procedure such as DP. Whereas CV (2002) solve their model by assuming a constant consumption-wealth ratio and equity premium, we can allow both to be time varying. Different variances of equity and bond returns are explored in their impact on saving and asset allocation decisions and on the value function. The stochastic dynamic portfolio decision method proposed here allows for online decisions as data on asset returns are available in real time. The method is set up in a way such that it also helps to make fund decisions online for various types of investment opportunities.

Similar content being viewed by others

Notes

This is only a notation for:

$$\begin{aligned} X(t)=X(t_{0})+\int _{t_{0}}^{t}a(t,X(t))dt+\int _{t_{0}}^{t}b(t,X(t))dW(t) \end{aligned}$$Because it is numerical easier to maximize on a finite set.

Referring to Gruene (2008), pp. 102–103, modified to model (17).

Compare Algorithm in step 2.

See Mueller (2009).

For calculation: see Eq. (17).

Abbreviations

- \({\mathbb {R}}\) :

-

Real number

- x :

-

State

- u :

-

Control

- z :

-

Stochastic influence

- \(\beta \) :

-

Discount factor

- l :

-

Running costs in J

- \(J_{\infty }\) :

-

Objective function of stochastic control problem on infinite time horizon

- \(V_{\infty }\) :

-

Optimal value function on infinite time horizon

- h :

-

Increment

- \({\mathcal {W}}\) :

-

Function space

- \(\widetilde{V}_{\infty }\) :

-

Numerical approximation of \(V_{\infty }\)

- \(\pi \) :

-

Projection operator

- T(W):

-

Operator for right side of principle of optimality

- \(\Gamma \) :

-

Grid

- X(t):

-

State at the time of t

- u(t):

-

Control at the time of t

- z(t):

-

Stochastic influence at the time of t

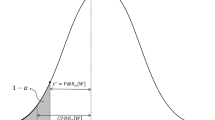

- \({\mathcal {N}}(\mu ,\sigma ^{2})\) :

-

Normal distribution with expected value \(\mu \) and standard deviation \(\sigma \), denoted with \((\mu ,\sigma ^{2})\)-normal-distributed

- \(\widetilde{W}(\cdot ,\omega )\) :

-

Approximated path of Wiener Process

References

Auckenthaler, C. (2001). Mathematische grundlagen des modernen portfolio-managements (3rd ed.). Bern: Publishing house Paul Haupt Bern Stuttgart Wien.

Campbell, J. Y., & Viceira, L. M. (2002). Strategic asset allocation, portfolio choice for long-term investors. Oxford: Oxford University Press.

Cochrane, J. (2006). Financial market and the real economy. Chicago: Website of John Cochrane, University of Chicago.

Danthine, J.-P., & Donaldson, J. B. (2005). Intermediate financial theory (2nd ed.). Toronto: Elsevier/Academic Press.

Di Giorgi, T. H., & Mayer, J. (2007). Computational aspects of prospect theory with asset pricing applications, computational economics. In W. Semmler (Ed.), Aadvances in asset pricing and dynamic portfolio decisions (pp. 233–265). Dordrecht: Springer.

Gruene, L. (2004). Numerische dynamik von kontrollsystemen. Bayreuth: University of Bayreuth.

Gruene, L. (2007). Stochastische dynamische optimierung. Bayreuth: University of Bayreuth.

Gruene, L. (2008). Numerische methoden fuer gewoehnliche differentialgleichungen (3rd ed.). Bayreuth: University of Bayreuth.

Gruene, L., Oehrlein, C., & Semmler, W. (2007). Dynamic consumption and portfolio decisions with time varying asset returns. Journal of Wealth Management, 12(3), 21–47.

Mueller, M. (2009). Stochastische dynamische portfolio-optimierung auf unendlichem zeithorizont, diploma thesis at faculty Mathematics and Physics, University of Bayreuth 2009, mentored by Professor Dr. Lars Gruene.

Munk, C., Soerensen, C., & Nygaard Vinther, T. (2004). Dynamic asset allocation under mean-reverting returns, stochastic interest rates, and inflation uncertainty: Are popular recommendations consistent with rational behavior? International Review of Economics and Finance, 13, 141–166.

Semmler, W. (2011). Asset prices, booms and recessions, financial economics from a dynamic perspective (3rd ed.). New York: Springer Publishing House.

Semmler, W., & Hsiao, C.-Y. (2011). Dynamic consumption and portfolio decisions with estimated low frequency movements of asset returns. Journal of Wealth Management, 14(2), 101–111.

Wachter, J. (2002). Portfolio and consumption decisions under mean-reverting returns: An exact solution for complete markets. The Journal of Financial and Quantitative Analysis, 37(1), 63–91.

Acknowledgments

The paper is inspired by joint work with Lars Gruene, University of Bayreuth, Germany. We would like to thank Lars Gruene for extensive communications

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Semmler, W., Mueller, M. A Stochastic Model of Dynamic Consumption and Portfolio Decisions. Comput Econ 48, 225–251 (2016). https://doi.org/10.1007/s10614-015-9517-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-015-9517-4