Abstract

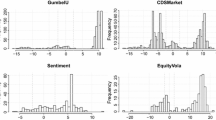

Most important financial models assume randomness is explained through a normal random variable because, in general, use of alternative models is obstructed by the difficulty of calibrating and simulating them. Here we empirically study credit default swap pricing models under a reduced-form framework assuming different dynamics for the default intensity process. We explore pricing performance and parameter stability during the highly volatile period from June 30, 2008 to December 31, 2010 for different classes of processes driven by Brownian motion, three non-Gaussian Lévy processes, and a Sato process. The models are analyzed from both a static and dynamic perspective.

Similar content being viewed by others

References

Amadei, L., Di Rocco, S., Gentile, M., Grasso, R., & Siciliano, G. (2011). Credit default swaps: Contract characteristics and interrelations with the bond market. Discussion Papers: Consob, n. 1.

Barndorff-Nielsen, O. E. (1997). Processes of normal inverse Gaussian type. Finance and Stochastics, 2(1), 41–68.

Barndorff-Nielsen, O. E., & Shephard, N. (2001). Non-Gaussian Ornstein–Uhlenbeck based models and some of their uses in financial economics. Journal of the Royal Statistical Society: Series B (Statistical Methodology), 63(2), 167–241.

Bhar, R. (2010). Stochastic filtering with applications in finance. Singapore: World Scientific.

Bianchi, M. L., Rachev, S. T., & Fabozzi, F. J. (2013). Tempered stable Ornstein-Uhlenbeck processes: A practical view. Working Paper, Bank of Italy, n. 912.

Bibby, B. M., & Sørensen, M. (2003). Hyperbolic processes in finance. In S. T. Rachev (Ed.), Handbook of heavy tailed distributions in finance (pp. 211–248). Amsterdam: Elsevier.

Brigo, D., & El-Bachir, N. (2010). An exact formula for default swaptions pricing in the SSRJD stochastic intensity model. Mathematical Finance, 20(3), 365–382.

Brigo, D., & Hanzon, B. (1998). On some filtering problems arising in mathematical finance. Insurance: Mathematics and Economics, 22(1), 53–64.

Brigo, D., & Mercurio, F. (2006). Interest rate models—Theory and practice: With smile, inflation, and credit. Berlin: Springer.

Candy, J. V. (2009). Bayesian signal processing: Classical, modern, and particle filtering methods. New York: Wiley.

Cariboni, J., & Schoutens, W. (2009). Jumps in intensity models: investigating the performance of Ornstein-Uhlenbeck processes in credit risk modeling. Metrika, 69(2), 173–198.

Carr, P., & Wu, L. (2010). Stock options and credit default swaps: A joint framework for valuation and estimation. Journal of Financial Econometrics, 8(4), 409–449.

Carr, P., Geman, H., Madan, D., & Yor, M. (2007). Self-decomposability and option pricing. Mathematical Finance, 17(1), 31–57.

Chen, R. R., Cheng, X., Fabozzi, F. J., & Liu, B. (2008). An explicit, multi-factor credit default swap pricing model with correlated factors. Journal of Financial and Quantitative Analysis, 43(1), 123–160.

Chen, R. R., Cheng, X., & Wu, L. (2013). Dynamic interactions between interest-rate and credit risk: Theory and evidence on the credit default swap term structure. Review of Finance, 17(1), 403–441.

Cont, R. (2001). Empirical properties of asset returns: Stylized facts and statistical issues. Quantitative Finance, 1(2), 223–236.

Cont, R. (2010). Credit default swaps and financial stability. In Financial Stability Review (Vol. 14, pp. 35–43). Paris: Banque de France.

Cont, R., & Kan, Y. (2011). Statistical modeling of credit default swap portfolios. Working Paper.

Cont, R., & Tankov, P. (2004). Financial modelling with jump processes. Boca Raton: CRC Press.

Cox, J. C., Ingersoll, J. E., & Ross, S. A. (1985). A theory of the term structure of interest rates. Econometrica, 35(2), 385–408.

Douc, R., & Cappé, O. (2005). Comparison of resampling schemes for particle filtering. In Proceedings of the 4th International Symposium on Image and Signal Processing and Analysis (pp. 64–69). IEEE.

Duan, J. C., & Simonato, J. G. (1999). Estimating and testing exponential affine term structure models by Kalman filter. Review of Quantitative Finance and Accounting, 13(2), 111–135.

Duffie, D., & Garleanu, N. (2001). Risk and valuation of collateralized debt obligations. Financial Analysts Journal, 57(1), 41–59.

Duffie, D., & Singleton, K. J. (1999). Modeling term structures of defaultable bonds. Review of Financial Studies, 12(4), 687–720.

Duffie, D., Filipović, D., & Schachermayer, W. (2003). Affine processes and applications in finance. Annals of Applied Probability, 13(3), 984–1053.

Dunbar, K. (2008). US corporate default swap valuation: the market liquidity hypothesis and autonomous credit risk. Quantitative Finance, 8(3), 321–334.

Fang, F., Jönsson, H., Oosterlee, K., & Schoutens, W. (2010). Fast valuation and calibration of credit default swaps under Lévy dynamics. Journal of Computational Finance, 14(2), 57–86.

Hull, J., Predescu, M., & White, A. (2004). The relationship between credit default swap spreads, bond yields, and credit rating announcements. Journal of Banking and Finance, 28(11), 2789–2811.

Jarrow, R. A., Li, H., & Ye, X. (2011). Exploring statistical arbitrage opportunities in the term structure of CDS spreads. Working Paper, National University of Singapore.

Kantas, N., Doucet, A., Singh, S. S., & Maciejowski, J. M. (2009). An overview of sequential Monte Carlo methods for parameter estimation in general state-space models. In Proceedings of the 15th IFAC Symposium on System Identification (SYSID). Saint-Malo, France.

Kokholm, T., & Nicolato, E. (2010). Sato processes in default modelling. Applied Mathematical Finance, 17(5), 377–397.

Lando, D. (2004). Credit risk modeling: Theory and applications. Princeton: Princeton University Press.

Li, J. (2011). Sequential Bayesian analysis of time-changed infinite activity derivatives pricing models. Journal of Business and Economic Statistics, 29(4), 468–480.

Lopes, H. F., & Tsay, R. S. (2011). Particle filters and Bayesian inference in financial econometrics. Journal of Forecasting, 30(1), 168–209.

Malik, S., & Pitt, M. K. (2011). Modelling stochastic volatility with leverage and jumps: A simulated maximum likelihood approach via particle filtering. Working Paper, Banque de France, n. 318.

Mandelbrot, B. (1963). The variation of certain speculative prices. Journal of Business, 36(4), 394–419.

Mayordomo, S., Peña, J. I., & Schwartz, E. S. (2013). Are all credit default swap databases equal? European Financial Management.

O’Kane, D., & Turnbull, S. (2003). Valuation of credit default swaps. Lehman Brothers: Fixed Income Quantitative Credit Research.

O’Sullivan, C. (2008). Parameter uncertainty in Kalman-Filter estimation of the CIR term structure model. In J. A. D. Appleby, D. C. Edelman, & J. H. Miller (Eds.), Numerical methods for finance. London: Chapman & Hall.

Pan, J., & Singleton, K. J. (2008). Default and recovery implicit in the term structure of sovereign CDS spreads. Journal of Finance, 63(5), 2345–2384.

Rachev, S. T., & Mittnik, S. (2000). Stable Paretian models in finance. New York: Wiley.

Rachev, S. T., Kim, Y. S., Bianchi, M. L., & Fabozzi, F. J. (2011). Financial models with Lévy processes and volatility clustering. Hoboken: Wiley.

Rebonato, R., McKay, K., & White, R. (2010). The SABR/LIBOR market model: Pricing, calibration and hedging for complex interest rate derivatives. Wiley.

Rosiński, J., & Sinclair, J. L. (2010). Generalized tempered stable processes. In Stability in Probability. Banach Center Publications.

Sato, K. I. (1991). Self-similar processes with independent increments. Probability Theory and Related Fields, 89(3), 285–300.

Sato, K. I. (1999). Lévy processes and infinitely divisible distributions. Cambridge: Cambridge University Press.

Schoutens, W. (2003). Lévy processes in finance. West Sussex: Wiley.

Schoutens, W., & Cariboni, J. (2009). Lévy processes in credit risk. Hoboken: Wiley.

van der Merwe, R., Doucet, A., De Freitas, N., & Wan, E. (2001). he unscented particle filter. Advances in neural information processing systems. Cambridge: MIT Press.

Zhang, S., & Zhang, X. (2008). Exact simulation of IG-OU processes. Methodology and Computing in Applied Probability, 10(3), 337–355.

Acknowledgments

Michele Leonardo Bianchi acknowledges that the views expressed in this article are those of this author and do not involve the responsibility of the Bank of Italy.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Stability Analysis of the Regularized Optimization Problem

The non-linear least square optimization problem defined in Eq. (16), that is

has neither a closed-form solution nor a global minimum. A numerical optimization routine is needed to find a relative minimum also because the gradient vector and the Hessian matrix related to the problem are difficult to express in closed-form: even if they can be computed, they have a messy expression. In this paper we follow the practical approach described in Fang et al. (2010); indeed we define the regularized problem

where \(\rho \) is a constant term and \(\omega \) is a vector defined to provide a comparable parameter sensitivity as the parameters may differ significantly in magnitude. The vector \(\omega \) is given by \((1/\varTheta _0^1, \dots , 1/\varTheta _0^N)\), where \(N\) is the length of \(\varTheta \) and with “\(\cdot \)” we indicate the inner products of vectors. The choice is aimed at achieving a satisfactory calibration error and parameter stability over time.

In this appendix we study how, by increasing the value of the parameter \(\rho \), the parameters, calibration errors and computational time vary. The selection of a proper \(\rho \) is itself an optimization problem which has to be solved to find a solution to the original least squares problem. As already observed in Sect. 5.1, \(\rho \) depends on the data at hand and on the level of error present in it. In Table 2 we report the results of the empirical study conducted over time and across all the 117 companies analyzed. More precisely, we show the lag-5 autocorrelation computed by considering the parameter time series of each company. Then we compute median and mean values across all companies. As expected, the parameter stability increases by increasing \(\rho \), even if some parameters are more volatile than others. Additionally, we report median and mean values of the RMSE, of the average relative percentage error (ARPE) and of the number of function evaluations into the optimization routine. The number of function evaluations is a proxy for the computational time. These values are computed both over time and across all the 117 companies analyzed. By increasing the value of \(\rho \), we find that the calibration error increases in the CIR and in the Gamma-OU cases, it remains quite stable in the Sato Gamma case, and in the IG-OU and in the VG-OU cases it reaches the minimum value when \(\rho {=}10\). The computational time decreases in the CIR case and, conversely, increases in the Sato-Gamma case. The value \(\rho {=}100\) shows a good balance between the calibration error and the parameter stability and for this reason we selected this value in the main text of the paper. In the empirical study we solve a large number of problems of the form of (22): for each model and across the 117 companies we consider 655 daily observations for a total of more than 380,000 daily calibration exercises. For this reason, even if the selected value of \(\rho \) may be not the optimal value, it is sufficient for our purposes as it provides us with an acceptable calibration error and parameter stability. As shown in Table 2, when \(\rho \) is equal to 100, the median values for the ARPE are just over 2 per cent (less than 1.5 per cent if we do not consider the Sato based model) and the median lag-5 autocorrelations are all above 0.9. Finally, we note that Table 2 confirms that the VG-OU model outperforms its competitor models while having a comparable degree of parameter stability over time and of computational complexity, not only when \(\rho \) is equal to \(100\), but also for all other selected values of \(\rho \).

Rights and permissions

About this article

Cite this article

Bianchi, M.L., Fabozzi, F.J. Investigating the Performance of Non-Gaussian Stochastic Intensity Models in the Calibration of Credit Default Swap Spreads. Comput Econ 46, 243–273 (2015). https://doi.org/10.1007/s10614-014-9457-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-014-9457-4

Keywords

- Credit default swap

- Cox-Ingersoll-Ross model

- Non-Gaussian Ornstein-Uhlenbeck processes

- Lévy processes

- Sato processes

- Filtering methods