Abstract

In this paper, we argue that the system of student debt functions as one of the most egregious and yet poorly understood mechanisms by which structural racism is reproduced in the U.S. today. We present evidence that student debt is unevenly distributed across race and gender, show that this pattern arises from policy choices made over time, and demonstrate that these disparities play a significant role in maintaining and exacerbating racial and gender wealth gaps. Our paper contends that the student debt crisis not only erodes the core principles of higher education but also perpetuates a cycle of racial and gender inequality and given the crucial role played by business corporations, urges scholars of business ethics to pay attention to this issue.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In May 2020, the murder of George Floyd at the hands of the police spurred a rebellion that took to the streets. The Movement for Black Lives (M4BL) brought millions of people across the country together under its slogan Black Lives Matter (BLM) in a series of protests against the spate of police violence on Black people. The re-emergence of M4BL in public consciousness and the set of demands codified in its manifesto (The Movement for Black Lives, 2023) has led to a wide-ranging conversation about structural racism in the U.S., resulting in a series of promises by major corporations to tackle racial inequities (Gelles, 2020; Hsu, 2020), universities to decolonize their curricula (Prieto & Phipps, 2021), and academic journals to pay greater attention to issues of racial justice (Abdallah et al., 2021; Harper et al., 2021).

In this paper, we respond to the call of the M4BL by examining the system of student debt, which functions as one of the most egregious mechanisms through which structural racism is reproduced in the United States today. We present evidence that student debt is distributed unevenly across race and gender, and show that these disparities contribute to the exacerbation of racial and gender wealth gaps. Our analysis highlights how the student debt crisis undermines the core principles of higher education and perpetuates a cycle of inequality and shows that corporations have played a major role in generating this crisis. We explain the mechanisms behind the perpetuation of this inequality by describing the emergence of a student loan financial complex, a network comprised of the federal and state governments, major business corporations, and universities. This intricate system results in the further concentration of wealth, and in unprecedented levels of structural inequality reminiscent of the era preceding the civil rights movement. Within this system, millions of young Black individuals, particularly Black women, find themselves trapped in a cycle of what can only be described as debt servitude (Jackson & Williams, 2022). Given the magnitude of this problem, it is no surprise that the demand for free higher education features so prominently in the manifesto released by the M4BL, and that the elimination of student debt is presented by the movement as a significant form of reparations for African Americans (The Movement for Black Lives, 2023).

The M4BL’s demand is rooted in the belief that Black student debt today must be understood as a mechanism by which historical racial inequalities are perpetuated across generations (see also Mir & Toor, 2023; Mustaffa & Dawson, 2021; Seamster & Charron-Chénier, 2017). Drawing upon the scholarship of Black radical scholars (Cox, 1959; Harris, 2021; Kelley, 2000; Robinson, 1983; Williams, 1944) and the insights of the recent work of race historians (Baptist, 2014; Johnson, 2017; Rosenthal, 2018; Schermerhorn, 2015) as well as data on student debt from a variety of sources, we argue that the current crisis was manufactured by the shaping of public policy in ways that profited private corporations and steered the wealth-poor, especially Black students, into debt traps.

We argue that the racialized and gendered pattern of student loan debt is the product of a specific set of decisions about funding higher education made over time and propose that this phenomenon can best be understood through the framework of “racial capitalism” (Kelley, 2016; Robinson, 1983). Furthermore, we suggest that the disproportionate impact of student debt on Black women requires a broadening of this concept to incorporate the intricate interplay between race, gender, and capitalism. We contend that while student debt is one of the biggest ethical issues facing us as a society, Black student debt demands our particular moral outrage, given its deeply troubling resonance with the racialized form of debt servitude experienced by African Americans in the wake of Emancipation (Du Bois, 1935).

The Theory of Racial Capitalism

One of the enduring slogans of the 2020 protests led by the M4BL and emblazoned on signs carried by the protestors was: “There is no capitalism without racism.” This statement captured the essence of the concept of “racial capitalism.” The theory of racial capitalism has a long history in the tradition of Black radical thought, even if the term ‘racial capitalism’ was ultimately popularized via Cedric Robinson through his book Black Marxism: The Making of the Black Radical Tradition (1983). Its basic—and powerful—insight is that racism is not incidental to capitalism, but constitutive of it (Kelley, 2016). As Harris (2021) puts it, “[r]acial subjugation is not a special application of capitalist processes, but rather central to how capitalism operates.” Race has played a crucial role in the extraction, expropriation, dispossession, exploitation, and wealth accumulation that has characterized capitalism from its very inception. Kelley (2000, pp. xii–xiii) argues that capitalist expansion has always been coterminous with the process of racialization and racism; capitalism and racism “did not break from the old order but rather evolved from it to produce a modern world system of racial capitalism dependent on slavery, violence, imperialism, and genocide.” As Robinson (1983) and others argue, capitalist systems across the world have built their wealth through imperialism, slavery, colonization, and the subordination of certain—typically racialized—sections of their population (see Kelley, 2021). Further, racial capitalism did not disappear with the end of chattel slavery in the U.S. or globally with the formal end of the era of modern colonialism.

The work of contemporary scholars of racial capitalism draws upon the legacy of early Black intellectuals, especially W.E.B. Du Bois whose masterpiece Black Reconstruction studied the role of slavery in the development of capitalism in the United States and detailed how Black slave labor in the sugar, rice, tobacco, and cotton fields laid the foundations of capitalism:

The giant forces of water and of steam were harnessed to do the world’s work, and the black workers of America bent at the bottom of a growing pyramid of commerce and industry…. Black labor became the foundation stone not only of the Southern social structure, but of Northern manufacture and commerce, of the English factory system, of European commerce, of buying and selling on a world-wide scale (Du Bois, 1935, p. 5).

For Du Bois, the plantations of the American South, the financial houses of Manhattan, and the mills of England were part of the same system of capitalism, which relied on the engine of slavery. As Johnson (2018) points out, Du Bois demonstrated that “the history of capitalism makes no sense separate from the history of the slave trade and its aftermath. There was no such thing as capitalism without slavery: the history of Manchester never happened without the history of Mississippi.”

Building on Du Bois, Black scholars such as Eric Williams (1944), Oliver Cromwell Cox (1959), and Cedric Robinson (1983) focused on the historical relationship between capitalism and slavery. Robinson’s book refuted Marx’s reading that “bourgeois society would rationalize social relations and demystify social consciousness” and sought to show that the “development, organization, and expansion of capitalist society pursued essentially racial directions” and that rather than being a “revolutionary negation of feudalism,” capitalism generated a world system in which accumulation was fundamentally based on systems of slavery, colonialism, and imperialism (Robinson, 1983, p. 2). In a similar vein, other Black scholars insist that race is built into the very structure of the capitalist system and that the colonization of African Americans has continued till today in one guise or another (Kelley, 2000).

A steady stream of work by Black scholars has used the insights of the theory of racial capitalism to link capitalist development in the contemporary period to the histories of slavery, colonialism, empire, enclosure, containment, incarceration, ghettoization, underdevelopment, and indebtedness among Black communities (see for instance Gilmore, 2022; Kelley, 2000; Taylor, 2019; Wilkerson, 2020). Recent historical research (Baptist, 2014; Beckert, 2014; Johnson, 2017; Rosenthal, 2018; Schermerhorn, 2015) has demonstrated the crucial role played by the institution of chattel slavery in the establishment and growth of American capitalism. In this article, we bring the crucial insights from this scholarship on racial capitalism to bear on our analysis of how and why student debt exhibits such an intensely racialized pattern. In order to do so, we relate the history of the processes through which the crisis of student debt was manufactured and describe how business interests drove key changes in public policy that drove up the profits of private corporations at the expense of student borrowers. That these policy changes were not race neutral in their effects is evident from the fact that the greatest burden of this crisis has come to be borne by Black students and their families. Our analysis illustrates how these policy changes resulted in gendered and racial consequences once they were implemented within the existing patterns of disenfranchisement in the U.S.

African Americans and Higher Education

Before we address the issue of student debt today, we need to take stock of the relationship between race and higher education in the U.S. After Emancipation, African American reformers saw education as a major driver of social mobility. W.E.B. Du Bois argued that democratic citizenship entailed “at least a basic education and the economic wherewithal to live a relatively comfortable life free from unearned debt” (quoted in Balfour, 2003, p. 36). Higher education was a vitally important asset not just for the acquisition of skills but as a major source of what Bourdieu (1984) refers to as “cultural capital.” Du Bois was clear that this racial privilege had to be challenged in order to prevent African Americans from being treated as “material resources” and “future dividends” for white America.

African Americans, however, had few educational opportunities at this time. Alexander Twilight, the first African American to get a college degree, graduated from Middlebury College in Vermont in 1823 but it was not until 1835 that the first collegiate institution—Oberlin College—admitted African American (male) students (Oberlin also has the distinction of being the first to graduate an African American female student—Mary Patterson—in 1862). The first of what came to be called Historically Black Colleges and Universities (HBCUs) were established in the mid-nineteenth century but were owned and administered by whites motivated primarily by a civilizing mission, which was reflected in their curriculum (Harper et al., 2009, p. 394). As Roebuck and Murty (1993, p. 27) point out, the creation of the HBCUs—with their limited funding, poorly trained faculty, and substandard facilities—served certain aims: “[t]o get millions of dollars in federal funds for the development of white land-grant universities, to limit African American education to vocational training, and to prevent African Americans from attending white land-grant colleges.” Despite the 1896 ruling of Plessy v. Ferguson, which in theory was supposed to lead to separate, but equal accommodations, state appropriations received by white land-grant institutions were 26 times more than those given to Black colleges (Harper et al., 2009).

African Americans continued to be educated overwhelmingly at HBCUs until the Supreme Court overturned segregation through the 1954 Brown v. Topeka Board of Education ruling. As Davis et al. (2020, p. 18) point out, prior to this ruling “less than one percent of entering freshmen at PWIs [Predominantly White Institutions] were Black.” Despite Brown, desegregation of education did not begin to take place in any real fashion till activists took up the fight and forced the passage of the Civil Rights Act of 1964, which included the provision (under Title VI) that federal funding was to be withheld from segregated institutions.

The Brown ruling, and the Civil Rights Act produced a racist backlash, with white communities across the country resisting desegregation in two significant ways. First, white flight to suburbs ensured that residential communities and therefore schools could continue to be segregated by default, while the policy decision to use property taxes to fund public schools ensured what Jonathan Kozol (1991) evocatively calls “savage inequalities.” Steinbaum (2017) notes that desegregation by legislative decree coincided with the emergence of subsidized mortgages in white communities, ensuring “that even as one political movement integrated the economy and society, another resegregated it.” Second, it became clear that there would be no Brown for higher education. In 1960, the state of California had unveiled its Master Plan for Higher Education, which offered the blueprint for a system of higher education funding, where needs-blind admission coupled with the state’s financial support offered educational opportunity for all regardless of family background or economic status, resulting in a system that was egalitarian (Douglass, 2010; McPherson and Schapiro, 1998). However, instead of following the California model, the federal government chose a different path, one which ensured stratification by race and class, leading us to the current crisis of racialized student debt (Leslie & Johnson, 1974; Steinbaum, 2017).

The Manufactured Crisis of Racialized Student Debt

Student debt, which has been exploding over time, now exceeds $1.7 trillion (see Student Borrower Protection Center, 2023). Over 45 million borrowers currently hold student debt; annual student borrowing in the U.S. has increased five-fold over the last 30 years; and 71% of students who graduate from 4-year colleges are indebted (see Chamber of Commerce, 2019; Debt Collective, 2020; Student Borrower Protection Center, 2023). Given the huge profits that can be made from penalties and fees, student debt servicing and debt collection industries, owned by private for-profit companies, have a financial incentive to steer students toward default. In January 2022, Attorneys Generals from 39 states announced a $1.85 billion settlement with Navient (formerly Sally Mae), one of the largest student loan servicers in the country “to resolve allegations of widespread unfair and deceptive student loan servicing practices and abuses in originating predatory student loans” (Navient Multi-State Settlement, 2022). It is no surprise then that millions of borrowers have been defaulting on their student loans each year. According to the Student Borrower Protection Center (2018), over 13 million borrowers defaulted on a federal student loan in 2018 alone. According to the Department of Education (2021), the rate of default of the FY 2018 national cohort was 7.3%.

The mainstream discourse takes the existence of this system of student debt and its attendant fallouts for granted; this manner of paying for college has by now been naturalized. However, this is not the case in other comparable parts of the world. The U.S. has the highest average tuition among OECD member countries; the tuition charged in most others is substantially lower and college is free in a third of these countries (OECD, 2022).

The astronomical size of the debt and the inability of people to pay it off—hence the crisis of student loan repayment—is seen as a failure of ‘individual responsibility.’ However, as we outline here, the crisis was manufactured primarily via public policy. As recently as 50 years ago, students graduated from college with hardly any loans. Public colleges were supported by both the federal and state governments based on the belief that education was a public good and that a well-educated citizenry contributed to a stronger nation. Along with the Civil Rights Act, the President Lyndon Johnson’s Great Society initiative included legislation such as the Higher Education Facilities Act of 1963, which expanded college aid dramatically, and the Higher Education Act (HEA) of 1965, which created scholarships, increased federal funds for universities, and established low-interest student loans (under the Federal Guaranteed Student Loan program). Both these legislations spurred an increase in college enrollment and graduation; tuition was low, and grants covered much of the expense of going to college.

However, even though the 1965 HEA made college accessible to students from modest backgrounds, the decision to fund individual students—instead of funding institutions directly—through grants and federally guaranteed loans issued via private lending institutions also started the system off on the road toward the student debt crisis. Steinbaum (2017) observes that “Title IV of the Higher Education Act of 1965 led the way” when it came to the “new ideology of economic individualism…[that] came to dominate federal and state policymaking.”

That policymaking was not race neutral in its effect. As Davis et al., (2020, p. 19) note, “the public good of higher education—defined as open access and fully funded for students—shifted to more of a focus on student loans at the same time Black students and other racially minoritized communities gained access to college.” The passage of the “Education Amendments of 1972” (which also included the well-known Title IX that prohibits discrimination in higher education on the basis of sex) included a provision that allocated financial aid funds directly to the students, signaling the shift toward a market-based approach to higher education (see Leslie & Johnson, 1974).

As the U.S. economy began undergoing a major restructuring, with unionized manufacturing jobs being outsourced and replaced with less well-paid service sector ones (Bluestone & Harrison, 1984), high school diplomas were no longer enough to secure a job that could provide the standard of living an earlier generation had access to, since the wages of those without college degrees had dropped significantly (Congressional Research Service Report, 2020). By the late 1970s, the college wage premium—the amount college graduates make over those with high school diplomas—had gone up by a robust 40% (Lowrey, 2013). This created enormous incentives for high school graduates to seek further education.

Economic orthodoxy of this period began to preach a theory of human capital (see Becker, 1964), which helped shape public policy regarding the labor markets and allowed a particular narrative to take hold. This theory posited that individuals and societies could enhance their productivity and economic potential through investments in people, primarily through education and training. The message conveyed to the workers was that they would need to undergo retraining to acquire additional skills if they wished to boost their income. The debt accrued during this process was depicted as an investment destined to yield returns. What followed was a growth in “credential inflation” with several employers asking for a college degree for jobs that did not need a college education (Steinbaum, 2017). That trend has continued. A 2012 analysis of job advertisements from more than 20,000 online sources ranging from major job boards to small and midsize employer sites showed that a far larger number of occupations asked for a college diploma in 2012 than they had 5 years earlier (Rampell, 2012). As a Harvard Business School report notes, “(d)egree inflation—rising demand for a 4-year college degree for jobs that previously did not require one—is a substantive and widespread phenomenon” (Fuller & Raman, 2017, p. 2). The college degree appears to have become the new high school diploma; it is “the new minimum requirement, albeit an expensive one, for getting even the lowest-level job” (Rampell, 2013). The Federal Reserve Bank of New York (2021) estimates that the underemployment rate in March 2021, defined as the percentage of graduates working in jobs that typically do not require a college degree, was 33.5%.

Steinbaum (2017) points out that since a college diploma was seen as an investment, states could cut funding for higher education under the assumption that this debt-financed asset would eventually pay off. Universities raised tuitions to cover the deficit and to fund new buildings, student centers, gyms, parking garages, and dining facilities to woo their student “customers.” Tuitions started to rise at rates that were three times that of the consumer price index at the very time that students started enrolling in colleges in greater numbers (Akers & Chingos, 2016; Taibbi, 2013). In their book “The Financial Aid Game,” McPherson and Schapiro (1998) seek to explain how financial aid, once a medium for ensuring that students with financial need could attend college, became part of the universities’ strategic toolbox for enhancing revenue generation. Intense competition for students and dollars turned public universities into partners in a system that channeled students toward college, and therefore education debt, in increasing numbers. The need to boost tuition revenues in order to compensate for declining state support, combined with the pressure to manage the institution more “efficiently,” increasingly led to universities adopting administrative structures resembling those of the business world, a phenomenon that has come to be known as “the corporatization of the university” (Mills, 2012).

The transformation of student lending during this period is exemplified by the story of its most prominent player. Established by the U.S. government in 1972 to support the provisions of the 1965 HEA, Sallie Mae’s purpose was to act as a warehouse and create a secondary market for federally insured student loans, thus enhancing liquidity in student loan markets. As a government sponsored enterprise, Sallie Mae was exempt from most state and local taxes (despite being a private corporation), could operate with a low capital base, and received a fee for the services it provided. Over time, Congress granted Sallie Mae greater control over student loans. By 1981, it had started dealing with non-insured loans, and by 1983, its non-voting stock was listed on the New York Stock Exchange. Sallie Mae steadily expanded its ownership of student loans, and by 1990, it held almost half of the student loans that were guaranteed by the federal government. It was also an extremely profitable enterprise growing its asset base from $100,000 in 1972 to $53 billion in 1994 (Department of Treasury, 2006). When Congress started a direct lending program to students in 1992, Sallie Mae’s stakeholders successfully lobbied for its privatization and the organization, now released from its GSE constraints, grew rapidly in scope, size, revenue, profits, lobbying capacity, and power (Collinge, 2009).

During this period, a series of amendments to the Higher Education Act steadily undermined consumer protections for student loans and made the entire chain of operations in the student lending business immensely lucrative. The HEA of 1980 had established the Parent Loan for Undergraduate Students (PLUS) program, which allowed parents to borrow money on behalf of their children once the Stafford Loan program borrowing limit had been reached. In its 1992 version, the HEA set up an unsubsidized loan program under which federal loans were made available to all students regardless of their financial circumstances (the loans were “unsubsidized” in the sense that they begin to accumulate interest from the beginning of the loan period). The 1992 HEA eliminated loan limits for PLUS borrowers, allowing students (or rather, their parents) to potentially go deep into debt to fund their education. In addition, this Act authorized lenders to collect fees and penalties on defaulted loans. The 1998 HEA amendments were particularly severe on student borrowers. Among other things, they ended the possibility of discharging student loans through bankruptcy except under conditions of undue hardship (a vague standard that has been near impossible to meet), prevented students from refinancing their consolidated loans, removed the statute of limitations on student loans, exempted student loans from usury laws, and allowed guarantors to ignore the Fair Debt Collection Practices Act. Under the new system, defaulted loans would incur an immediate penalty of 24%, while steep collection fees could be levied by the collection agencies on outstanding loans. The impact of this last piece of legislation can be seen in the fact that Sallie Mae’s fee income went up from $280 million to $920 million between 2000 and 2005, an increase of 228% even though its loan portfolio only increased by 82% (Collinge, 2009). In 2005, the PLUS program was opened up directly to graduate students. These Grad PLUS Loans did not have a set limit on the amount a student could borrow. Instead, students could borrow up to the cost of attendance including tuition, fees, room and board, textbooks, and other educational expenses.

As fees and penalties on defaulted loans became a significant source of revenue, lending turned into a very lucrative business. Student loans were almost risk-free since, with few exceptions, the loans could never be written off or discharged through bankruptcy, and collection agencies were given unprecedented powers to collect loans through means such as the garnishing of wages, social security income, and disability payments without a court order. During the period of time when legislation benefiting the lending industry was being enacted, Sallie Mae and other lenders spent millions of dollars lobbying Congress (Center for Responsive Politics, 2016), while dealing with charges of deceptive lending practices, racial redlining, bribing financial aid administrators to coax students toward their products, submitting false claims, and worst of all, steering students toward default through a variety of fraudulent means including the use of misinformation (Consumer Financial Protection Bureau, 2017; Office of Inspector General, 2001).

The 2008 financial crisis made the student debt situation far worse, specifically via the explosion of for-profit educational institutions. As millions of individuals faced unemployment, they pursued college education either to acquire new skills or to utilize their time productively, learning potentially marketable skills, while weathering a challenging job market. Ordinarily, community colleges would accommodate this surge of new students. However, due to budget cuts, these institutions found themselves underfunded, limiting their capacity to expand and cater to the increased demand. The resulting void was filled by for-profit private colleges, many of which entered the scene to capitalize on the situation. Students who attend these colleges tend to have a higher dropout rate are more likely to be un(der)employed after graduation and make a far lower wage on average than those who graduate from public or non-profit private universities (the median annual salary for 2010 graduates of for-profit colleges was $22,000, see Cellini & Turner, 2016; Dynarski, 2015). The so-called “diploma mills”—typically unaccredited institutions that provide substandard education—generate their revenue mostly through student loans, a fact underscored by the existence of the Congress-enacted “90/10 rule,” which limits the share of revenue a for-profit institution can receive from federal aid to 90% (Lee & Looney, 2019). Further, as a report by the Student Borrower Protection Center (2021) titled “Mapping Exploitation” shows, for-profit colleges engage in aggressive race-targeted recruiting, which results in a disproportionate number of their students being Black.

The Racialized and Gendered Burden of Student Debt

Activists have long been aware that student debt was racialized. Preliminary research had highlighted the deeply troubling fact that Black students were taking on more debt than white students and were more likely to default on their loans (Goldrick-Rab et al., 2014; Huelsman, 2015; Vaghul & Steinbaum, 2016). In the absence of official data, however, this research had to rely on proxy variables (such as zip codes) and non-official data sources.

Nevertheless, study after study confirmed the racial differences in borrowing, delinquency, and default. A 2016 Brookings Institution report offered evidence that Black graduates were defaulting on their loans at five times the rate as white graduates, and that strikingly, the default rate of Black graduates was greater than that of white dropouts (Scott-Clayton & Li, 2016). Further, the report pointed out that the Black-White debt gap for the 2008 cohort, which was around $7,400 at the time of graduation, had tripled in size within 4 years. A subsequent report by the Dēmos Foundation (Hiltonsmith, 2017) showed that 52.6% of Black borrowers were either in default or delinquency on their loans, that the default rate for Black borrowers (19.4%) was substantially greater than that of white ones (12.3%), and that 33.2% of Black borrowers had loans that were delinquent when compared to 24.3% of white borrowers. A report by the Center for American Progress (Miller, 2017) showed that of the 2003–2004 cohort, 78% of Black students had borrowed money for college compared to 57% of white students. What was more startling was that 12 years after starting college, African American borrowers owed 113% of the original loan amount while their white peers owed 47% of their loans. The long-term distress of Black borrowers can be gauged from the fact that the median Black student from the 1996/2001 cohort had borrowed $19,500 for college education while the median white student had borrowed a not too dissimilar $16,300; however, 20 years later, Black students still owed $18,500 (nearly 95% of the original amount) while white students had paid down most of the debt and owed around $1,000 (see Mustaffa & Dawson, 2021).

Despite this accumulating evidence revealing serious racial disparities in student loan repayment, and in the face of growing evidence of the disproportionate harm to borrowers of color caused by “abusive practices of collection agencies,” the Department of Education did not respond to the demands of advocacy groups such as the ACLU to track, collect, or release student debt data broken down by race for a long time (see Letter to the Secretary of Education, National Consumer Law Center, 2016). In fact, it was not until October 2017 that these groups were successful in getting the Department to publish a report which, for the first time, offered a look at the impact of student debt on borrowers broken down by race and ethnicity (National Center for Educational Statistics, 2017). This report confirmed the patterns that researchers and advocates had long been noting and highlighting. The Department has since added tranches of data into a repository that now runs into over 8,000 tables presenting a variety of information about education across the US. The National Center for Educational Statistics (NCES) also offers an online tool, which allows users to select from a series of variables and perform statistical analyses (Datalab, 2023), examine the data on student debt and student loan default rates, and disaggregate it by race and gender.

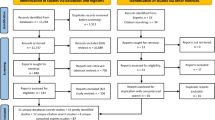

The data in the table and the figures that follow were taken from multiple sources such as the Beginning Postsecondary Students Longitudinal Study of the NCES (which surveys two separate cohorts of new students—those who entered college in 1995–1996 and those who entered in 2003–2004), the U.S. Census Bureau, the Integrated Postsecondary Education Data System, the Digest of Education Statistics, the Bureau of Labor Statistics, and the Survey of Income and Program Participation. When pieced together, it produces a coherent narrative that tells the story of racialized student debt outlined in Table 1 and Figs. 1, 2, 3, 4, 5, 6, 7, 8, 9, 10.

As the figures illustrate, high college wage premiums (Figs. 1 and 2) encourage an increasing number of Black students to attend college (Fig. 3). However, tuition and other costs continue to rise (Figs. 4 and 5) primarily due to the reduction in state funding for higher education (Fig. 6). Black students, often hailing from less affluent families, find themselves compelled to borrow more often and in larger sums compared to their white counterparts (Fig. 7). Upon graduation, African Americans face labor market discrimination, resulting in elevated rates of unemployment and diminished wages (Fig. 8). This leads to increased challenges in loan repayment (Fig. 9) and a higher default rate compared to white students. Defaults trigger significant penalties and collection fees, thereby substantially augmenting the size of the outstanding loan while concurrently reducing the likelihood of the borrowers being able to repay it. This entraps borrowers in a cycle of debt, and plays a significant role in perpetuating the vast Black-white racial wealth gap (Fig. 10).

In sum, the system, while ostensibly set up to provide students with the financial wherewithal to pay for college and to reap the benefits of a college education through promising career opportunities, ends up producing a multitude of indebted citizens. A disproportionate number of these indebted citizens are Black, who struggle—and often fail—to pay off their student loans. Given the vital importance of education in social mobility, burdening young people of color with crippling student debt is nothing less than a means of colonizing their future (Marez, 2014, p. 265).

While these figures underscore the racialized nature of student debt, recent work shows that women in general and Black women in particular are especially disadvantaged (see American Association of University Women, 2021; Zaw et al., 2017). As per these reports, women hold nearly two-thirds of all student loan debt; graduate with an average of $31,276 in debt (significantly more than the $29,270 owed by men on the average); and earn an average of $35,338 after graduation. A Pew Research study shows that in 2022, women with bachelor’s degrees earned 79% as much as their male counterparts (Kochhar, 2023). Women also experience higher rates of unemployment and were laid off in greater numbers than men during lean times (see Bateman & Ross, 2020 for a report on how this dynamic unfolded during the Covid pandemic). The discriminatory job and wage market they encounter exacerbates the income and wealth gap between men and women and makes it difficult for women to pay off their loans, which subsequently balloon due to the accumulation of interest and penalties.

Black women find it even more difficult to address this debt burden. As per the data available through Datalab and the NCES’ Baccalaureate and Beyond Longitudinal Study, the average cumulative debt on undergraduate loans, including principal and interest, 1 year after graduation, was around $34,000 for white women and $42,000 for Black women. These figures were markedly higher for individuals who pursued graduate studies. Approximately 1 year after completing their graduate programs, the average total debt, including principal and interest, was about $56,000 for white women and $75,000 for Black women. Black women encounter discrimination in numerous forms, including in the labor market, a reality that has direct bearing on their ability to repay student loans and avoid spiraling into the debt trap. A Goldman Sachs study demonstrates that Black women earn 15% less when compared to white women and 35% less when compared to white men and that this wage gap only widens with the passage of time (Struyven et al., 2021). The same report also documents that Black women are the least likely of all groups to inherit wealth (p. 19) or to own a home (p. 16); that they are most likely to live in unhealthy and unsafe spaces (p. 21), face health issues (p. 22); and that they have the lowest levels of wealth (p. 6). Clearly, these factors individually and collectively contribute to their distinct challenges in repaying student loans and preventing the catastrophe of default.

Gendering Race, Racializing Gender: Accounting for Black Women

In this paper, we have delineated how the student debt crisis is racialized. Furthermore, as we have shown, Black women experience the most detrimental outcomes. However, care must be exercised while seeking to explain the differential impact of the student debt crisis on African American women. This cannot be understood simply by adding the ‘race effect’ to the ‘gender effect.’ Black women intellectuals have long been pointing out that the experiences of Black women were sui generis, lying at the nexus of multiple systems of oppression which worked together in complex ways. While Kimberlé Crenshaw (1989) coined the term ‘intersectionality’ to capture this uniqueness, Taylor (2017) points out earlier formulations of the concept of intersectionality by Black women intellectuals such as Anna Julia Cooper writing in 1892, Frances Beal in the 1960s, and the Combahee River Collective (CRC) in 1977 (see also Collins, 2019; Nash, 2019). These scholars argued that the condition of Black women in the U.S. embodies and reflects the deeply gendered history of white supremacy—Beal speaks of “the specificity of their compounded oppressions,” the CRC about “interlocking forms of oppression” which create “new categories of suffering,” while Crenshaw argues that “the intersectional experience is greater than the sum of racism and sexism.” A study by Cosic (2019) compares wages across race and gender and concludes that “[t]he wage penalty for black women is not equal to the sum of penalties estimated for women and blacks separately.” Black feminist writer Moya Bailey recently coined the term ‘misogynoir’ to underscore the unique form of misogyny faced by Black women: a combination of gendered racism and racialized sexism (see Bailey & Trudy, 2018).

We have posited that the observed racial pattern in student debt is a product of the specific interplay between race and socioeconomic status in the U.S., a legacy of slavery and subsequent racial projects. We further assert that the manner in which Black women are enmeshed in the system of student debt needs to be understood within the context of their unique positioning within the framework of racial capitalism in the U.S. The current socioeconomic status of Black women is largely a result of a gendered and racialized occupational segregation, originating from their unique experience under slavery. Following Emancipation, Black women were slotted into occupations which reflected the type of work they had performed as enslaved workers—namely, agricultural labor and domestic service. These were the two forms of work which were also excluded from the legal protections provided to workers under the provisions of the National Labor Relations Act of 1935 and the Fair Labor Standards Act of 1938, due to pressure from Southern politicians (Perea, 2011). These exclusions continued to be enshrined under later legislation. In this respect, the historical experiences of Black women workers have differed from their male counterparts. Although freed Black men in the South also performed agricultural labor, Black male workers in the North did not face this type of occupational segregation in paid employment (even though they faced severe discrimination themselves). By contrast, Black women without higher education found domestic work to be the one of few employment opportunities open to them in northern cities following the Great Migration (Jones, 1985).

Black women with higher education were an integral part of the project of racial uplift following Emancipation and played a vital role as teachers, both because of their commitment to this project and because teaching was the primary occupation open to educated Black women for a long time. Perkins (2015, p. 133) notes that “[e]ncouraging black female college students…to think beyond becoming a public or private school teacher from the 1920s to the 1940s was ambitious, given that the other professional fields open to them were basically nursing, social work, and library science.” In The Philadelphia Negro, Du Bois himself had reported that an overwhelming number of Black women in the Seventh Ward in Philadelphia worked as domestic help (Du Bois, 1899). Private domestic service continued to be the predominant form of employment available to Black women until the 1970s (Hartman, 2019).

In the early twentieth century, the lack of educational opportunities in the South—where most of the Black population was concentrated—along with this gendered and racialized occupational segregation prevented Black women from taking advantage of the opportunities that opened up for women in clerical work in the early twentieth century. Black women were able to seize the opportunities generated by the needs of the war economy in the 1940s, but against the backdrop of the racism of employers and white women workers. While the end of WWII dealt a blow to all the women workers who had been able to enter non-traditional fields during the war, it hit Black women workers particularly hard. Racial discrimination compounded the sexism of the post-war era and saw most of them return to domestic service and restaurant work (Field, 1980). Even when career and job opportunities for women expanded once again in the 1970s, Black women remained disproportionately clustered in low-wage service jobs (Banks, 2019).

The high college wage premium for Black women today is less a reflection of higher education's ability to help them secure well-paying jobs, and more indicative of the fact that without such education, they often find themselves relegated to low-wage occupations. This is reflected in the wage gap between Black and white women with similar levels of education. In 1979, this gap was negligible (Wilson and Rogers, 2016); however, by 2022, it had grown to 13% (Kochhar, 2023). This must be read against the fact that 80% of Black mothers serve as primary earners in contrast to 50% of white mothers (Struyven et al., 2021).

Where racial capitalism’s exponents focus on the centrality of race to capitalism, Marxist and socialist feminists (Davis, 1983; Federici, 2004; Mies, 1986; Vogel, 2013) have shown the centrality of gender to the emergence and continuation of capitalism, specifically with regard to social reproduction. At least within the U.S., the waged portion of social reproduction work has been disproportionately performed by Black, and now also Brown, women, a direct legacy of slavery. The pandemic laid bare the forms of gendered and racialized labor, which lies at the heart of capitalism, and the centrality of Black women’s paid and unpaid work. Neither ‘social reproduction theory’ nor ‘racial capitalism’ fully capture Black women’s experiences within capitalism—either historically or in the contemporary moment. A theoretical framework which can explain capitalism in its fullness has to be one which can account for its fundamentally gendered and racialized nature as reflected in the experience of Black women.

Student Debt and the Racial Wealth Gap

Despite the fact that an increasing number of Black students have been gaining admission into and graduating from institutions of higher education over the few decades, the racial income gap and the racial wealth gap have not narrowed. As we have seen, Black students have to borrow more to go to college compared to white students and therefore graduate with greater debt. Black graduates face discrimination in the labor market and end up with poorer paid jobs than their white peers. They are the first to get laid off and find it difficult to advance in their careers. Since their financial status is rather precarious, they lack the ability to tide over bad times. Due to their lack of wealth, Black borrowers simply do not have the wherewithal to weather adverse financial events and end up defaulting on their loans, which triggers huge penalties that trap them in debt further.

Given the importance conferred upon education in Black communities, Black families “tend to be more supportive of children’s education (through direct financial support) than white families in similar households and socioeconomic positions” (Darity et al., 2018). As a result, Black parent borrowers are disproportionately represented in the PLUS loans, an unsubsidized and relatively precarious form of student loan that allows parents to borrow as much as they need for the cost of their child’s education. According to a report by the Government Accountability Office (2016) that examined data over a 10-year period, the number of seniors living below the poverty line and whose social security benefits were garnished rose from 8,300 to 67,300. In 2015 alone, a total of $171 million in Social Security payments was seized by the government from elderly individuals who had defaulted on their student loans. A report by another federal agency (Consumer Finance Protection Bureau, 2017) showed that the number of student loan borrowers over 60 had quadrupled between 2005 and 2015, and that “in 2014, 73 percent of student loan borrowers aged 60 and older report that their student debt is for a child’s and/or a grandchild’s education.” While the data on senior student loan indebtedness is not broken down by race, it stands to reason that Black co-signers are overrepresented in this group. Anecdotal evidence reported by activists in the field suggests that Black grandmothers who co-sign their grandchild’s loan application find out all too often that the terms of the loan allow the lenders to garnish their social security checks (Schirmer, 2022).

What makes the nature of racialized debt so deeply unethical is that the very system that should serve as a means of social equality has instead led to the reinforcement—indeed, the expansion—of racial and gender wealth gaps. The Federal Reserve Bank of St. Louis shows that despite making significant progress in educational attainment, young Black adults do not have the wealth profile to match, a direct result of the burden of student debt (Addo, 2018). As Darity et al. (2018) show, access to higher education does not lower the racial wealth gap; as a matter of fact, a Black family headed by a college degree holder has lesser wealth than a white family headed by a high school dropout. In an article “Is College Still Worth it?” published by the Federal Reserve Bank of St. Louis, Emmons et al. (2019) show that the income advantage of Black graduates has been declining as has been their wealth-building advantage. According to their study, among “all racial and ethnic groups born in the 1980s, only the wealth premium for White 4-year college graduates remains statistically significant” (Emmons et al., 2019, p. 297).

The data on the wealth of Black female college graduates paint a particularly bleak picture. A report from Duke University (Zaw et al., 2017) shows that the median single Black woman with a college degree has less than one-seventh the wealth of the median single white woman with a college degree. Single Black women college graduates with children have no wealth at all. This lack of wealth is a direct result of the fact that Black women bear the greatest burden of student debt and have the hardest time paying it off. The report shows that “between 2009 and 2012, white women who graduated in the 2007–08 school year paid off an average of 33 percent of their student debt, while black women in that group managed to pay off less than 10 percent of their student debt. As a result, black women are less able to build wealth by saving for retirement or purchasing a home.” According to Mishory et al. (2019) the fact that Black women with college degrees have less wealth than white high school dropouts “is a striking sign that the debt-financed higher education system may actually be contributing to the racial wealth gap” (emphasis ours).

Each new economic crisis—from the Great Recession to the pandemic—has exacerbated these issues. Corporate profits bounce back but the recovery does not reach the working or middle classes, ensuring that wealth is distributed upwards, further widening existing racial wealth gaps. The restructuring which follows each crisis yields jobs that often pay less than the ones that were lost. Meanwhile, credentialing continues to be presented as the only hope for increasingly precarious generations of young people even as students find the promised well-paying jobs to be a fantasy once they graduate (Cellini & Turner, 2016; Dynarski, 2015). The outcome is a vicious cycle of debt entrapment for many, particularly individuals from wealth-poor families who are disproportionately Black, with many of these families headed by Black women. Racialized student debt hinders wealth accumulation among African Americans, while their lack of wealth limits their ability to escape the debt trap. The racialized student debt and the racial wealth gap reinforce each other. The gender and racial wage gaps that exist today are not the unfortunate outcomes of systems of racism and sexism that exist independently of capitalism, but a reflection of their imbrication within the history of racial capitalism. We therefore contend that it is crucial that the concept of racial capitalism must be expanded to center the unique experience of Black women because, as the Combahee River Collective (1986, p. 15) powerfully argued, “If Black women were free, it would mean that everyone else would have to be free since our freedom would necessitate the destruction of all the systems of oppression.”

Student Debt, Racial Justice, and Business Ethics

In the wake of the murder of George Floyd and the demonstrations that followed, corporate America expressed its support for racial equality in largely symbolic ways: by using black squares in place of profile images on their Instagram accounts, using BLM hashtags in social media posts, issuing statements against structural racism, and making multimillion-dollar pledges toward programs to promote diversity and fight racial discrimination. Despite this apparent show of support for BLM, the words of these corporations rang hollow given corporate America’s track record on racial (in)equality, with prominent African Americans calling these gestures “meaningless” and “performative” (Gelles, 2020). In a recent piece in Business Ethics Quarterly by Reeves and Sinnicks (2021, p. 512) address “the frustratingly cyclical nature of business ethics,” wherein “periods of recurrent scandal are followed by periods in which all involved earnestly resolve never to let such failings occur again, before they inevitably do” (see also, Abend, 2013; Brenkert, 2019). They argue that this cycle is the result of the mismatch between the demands of the capitalist system and managers’ self-understanding as ethical beings.

The fact of the matter—as illustrated by the story we have laid out here—is that corporate America has long profited from racism and continues to do so. In his book How Capitalism Underdeveloped Black America, Manning Marable (1983) shows how the legacy of racist violence against African Americans, aided and guided by business corporations, undermined the economic and political development of African Americans in the twentieth century leading to high rates of unemployment, poverty, lack of education opportunities, and the collapse of entrepreneurship. In her book Race for Profit: How Banks and the Real Estate Industry Undermined Black Homeownership, Keeanga-Yamahtta Taylor (2019) details how the Housing and Urban Development Act in 1968, while supposedly designed to incentivize the real-estate industry to treat Black buyers fairly, was written to ensure that the practice of racist exclusion was replaced by one of “predatory inclusion,” resulting in the impoverishment of the Black community and enormous profits for bankers, investors, and real-estate interests, and the impoverishment of Black communities (Taylor, 2019). By predatory inclusion, Taylor is referring to the process by which historically excluded groups are granted access to a service or opportunity but on specific and highly risky conditions, which often results in them being stripped of the benefit of this access, and frequently extract an additional price from them (see Seamster & Charron-Chénier, 2017). The 2008 financial crisis, which was largely characterized by race-targeted lending of subprime loans, another example of predatory inclusion (see Lardner, 2008), facilitated one of the greatest transfer of wealth from Black to white communities (see Pfeffer et al., 2013). This racist history of business corporations is encoded in the Black–White wealth gap we see today.

In this paper, we have argued that the profit interests of private business corporations have helped shape the system of public higher education in ways that undermine its very purpose. We have demonstrated that the system exploits the most vulnerable of groups, especially African Americans, and funnels them into debt traps. We have shown how the Higher Education Act was repeatedly amended in a manner that profited large businesses who made usurious profits from student loans, especially by steering students toward defaults that trigger huge penalties and collection fees (see Cowley & Silver-Greenberg, 2017; Taibbi, 2013). The bald nature of these unethical practices is illustrated by a lawsuit filed on July 8, 2021, in the 3rd Circuit Court of the District of New Jersey. Manetta et al. vs. Navient Corporation et al. charges Navient—Sally Mae’s current avatar—with developing “a repayment system intended, by design, to maximize a borrower’s indebtedness through a scheme that inflates interest and thwarts repayment of principal to increase their own interest income.”

An entire ecosystem of business corporations has developed to feed off the enormous student loan industrial complex: debt servicers, private lenders, refinance lenders, debt collectors, for-profit universities, and Wall Street investors including huge institutions such as Morgan Stanley, Bank of America, and Wells Fargo, who trade in complicated financial instruments derived from student loan asset-backed securities (SLABS), the value of which is estimated to be in the hundreds of billions of dollars. To get a sense of the money involved, according to the Federal Procurement Data system, the Department of Education pays out an annual fee of around $600 million to debt servicing companies and approximately $1 billion to debt collectors (Lorin, 2015). Student loan derivates are considered to be secure because repayment is literally guaranteed by the federal government whose powers to extract money far exceed that of any private organization.

Among its objectives, the call for papers of this special issue lists the desire to highlight structural racism and theorize racial justice (Harper et al., 2021). The timing of the special issue is certainly no coincidence. It is an explicit response to the M4BL that erupted on the streets in 2020 and its very purpose is to demand that scholars of business ethics pay serious attention to racial justice and structural racism. The discipline of business ethics, charged in the pages of the JBE with “speaking platitudes to power” (Marens, 2010), has engaged with race and racism rather reluctantly and obliquely, through depoliticized concepts such as “diversity” and “multiculturalism.” The paucity of articles dealing with racism, let alone structural racism, in journals of business ethics is indicative of the discipline’s determined evasion of this topic, even if there have been a few recent efforts to discuss race in newer contexts such as the racialized roots of the corporation (Logan, 2019), the nature of caste discrimination (Bapuji & Chrispal, 2020), and the self-representation of marginalized groups (Chowdhury, 2021).

We hope that this special issue, and our paper, encourage further conversation around issues of structural racism in the discipline of business ethics. We specifically hope that it spurs business ethicists to use their positions within universities to talk about how business corporations use the most unethical of means at their disposal to profit from poor and Black students through the mechanism of student debt, and to oppose policies that subvert the very intent of higher education. The “color line” that Du Bois (1903) spoke about is still with us, and the fact that there is no place where it is more in evidence than in the field of education, which is supposed to be ‘the great equalizer,’ should be offensive to us all as educators.

Conclusion

In the summer of 2016, the M4BL had released a manifesto containing a spectrum of demands. These ranged from calls for economic justice to the advocacy for community control over laws, institutions, and policies that affect African Americans. One of the most important demands was that of reparations. Tellingly, access to free higher education was defined as a crucial form which these reparations should take, along with the retroactive forgiveness of student loans. In June 2023, the U.S. Supreme Court, in a 6–3 decision, turned down a federal student loan forgiveness initiative, which had proposed that the Department of Education cancel $20,000 in student debt for Pell Grant recipients and up to $10,000 for non-Pell Grant recipients. The court ruled that under federal law, the Department of Education does not have the legal authority to forgive student debt. This decision was a disappointment for millions of federal loan borrowers who were expecting their student debts to be reduced or eliminated. Unless alternative routes to debt relief can be devised, a significant number of borrowers will continue grappling with their financial burdens.

The pressing issue of student debt had first been brought into public consciousness by the youth activists of the Occupy Wall Street (OWS) movement, which emerged in 2011 as a response to the devastating impact of economic policies on the quality of life of working people, the so-called 99%. OWS was the catalyst that brought the pressing issue of student debt, which had reached crisis levels, to the forefront of public awareness. While OWS understood the student debt crisis as part of the neoliberal regime of debt which had overwhelmingly come to define life under unregulated capitalism (see Debt Collective, 2020), and while it addressed issues of race and gender, it did so without an understanding of the ways in which these structure capitalism itself.

The M4BL manifesto can be seen, among other things, a corrective to this. It argues that every issue raised by the OWS—the loss of wealth, the lack of economic opportunities, the increasing levels of all forms of consumer debt, especially student debt—has a racial dimension. Like Strike Debt, the activist organization which emerged from OWS, the M4BL makes two major demands with regard to higher education: the writing-off of all student loans and free public education for all. The story we tell here explains why these demands are not just possible solutions to a complicated problem—they are a moral imperative. The current student debt regime is unethical and must be dismantled in the interests of racial justice.

References

Abdallah, C., Dar, S., Kalemba, J., McCluney, C., & Mir, A. (2021). Anti-Blackness in management and organization studies. Call for papers, Organization. https://journals.sagepub.com/page/org/call-for-papers

Abend, G. (2013). The origins of business ethics in American universities, 1902–1936. Business Ethics Quarterly, 32(2), 171–205.

Addo, F. (2018). Parents’ wealth helps explain racial disparities in student loan debt. Federal Reserve Bank of St. Louis. https://www.stlouisfed.org/publications/in-the-balance/2018/parents-wealth-helps-explain-racial-disparities-in-student-loan-debt

Akers, B., & Chingos, M. (2016). Game of loans: The rhetoric and reality of student debt. Princeton University Press.

American Association of University Women. (2021). Deeper in debt, 2021 update. https://www.aauw.org/app/uploads/2021/05/Deeper_In_Debt_2021.pdf

Bailey, M., & Trudy. (2018). On misogynoir: citation, erasure, and plagiarism. Feminist Media Studies, 18(4), 762–768.

Balfour, L. (2003). W.E.B. Du Bois and the case for reparations. American Political Science Review, 97(1), 33–44.

Banks, N. (2019). Black women’s labor market history reveals deep-seated race and gender discrimination. Economic Policy Institute. https://www.epi.org/blog/black-womens-labor-market-history-reveals-deep-seated-race-and-gender-discrimination/

Baptist, E. E. (2014). The half has never been told: Slavery and the making of American capitalism. Basic Books.

Bapuji, H., & Chrispal, S. (2020). Understanding economic inequality through the lens of caste. Journal of Business Ethics, 162(3), 533–551.

Bateman, N., & Ross, M. (2020). Why has COVID-19 been especially harmful for working women? The Brookings Institution. https://www.brookings.edu/essay/why-has-covid-19-been-especially-harmful-for-working-women/

Becker, G. S. (1964). Human capital: A theoretical and empirical analysis, with special reference to education. Columbia University Press.

Beckert, S. (2014). Empire of cotton: A global history. Penguin Books.

Bluestone, B., & Harrison, B. (1984). The deindustrialization of America. Basic Books.

Bourdieu, P. (1984). Distinction: A social critique of the judgement of taste. Harvard University Press.

Brenkert, G. G. (2019). Mind the gap! The challenges and limits of (global) business ethics. Journal of Business Ethics, 155(4), 917–930.

Cellini, S., & Turner, N. (2016). Gainfully employed? Assessing the employment and earnings of for-profit college students using administrative data. National Bureau of Economic Research. https://www.nber.org/papers/w22287

Center for Responsive Politics. (2016). Annual lobbying by SLM Corporation. Retrieved April 14, 2016, from http://www.opensecrets.org/lobby/clientsum.php?id=D000022253&year=2015

Chamber of Commerce. (2019). Student loan statistics. https://www.chamberofcommerce.org/student-loan-statistics/

Chowdhury, R. (2021). Self-representation of marginalized groups: A new way of thinking through W.E.B. Du Bois. Business Ethics Quarterly, 31(4), 524–548.

Collinge, A. (2009). The student loan scam: The most oppressive debt in US history – and how we can fight back. Beacon Press.

Collins, P. H. (2019). Intersectionality as critical social theory. Duke University Press.

Combahee River Collective. (1986). The Combahee River Collective statement: Black feminist organizing in the seventies and eighties. Kitchen Table: Women of Color Press.

Congressional Research Service Report. (2020). Real wage trends, 1979 to 2019. Congressional Research Service. https://sgp.fas.org/crs/misc/R45090.pdf

Consumer Financial Protection Bureau. (2017). Snapshot of older consumers and student loan debt. https://www.consumerfinance.gov/data-research/research-reports/snapshot-older-consumers-and-student-loan-debt/

Cosic, D. (2019, March). College premium and its impact on racial and gender differentials in earnings and future old-age income. Working paper, Urban Institute.

Cowley, S., & Silver-Greenberg, J. (2017). Student loan collector cheated millions, lawsuits say. https://www.nytimes.com/2017/01/18/business/dealbook/student-loans-navient-lawsuit.html

Cox, C. (1959). The foundations of capitalism. Philosophical Library.

Crenshaw, K. (1989). Demarginalizing the intersection of race and sex: A Black feminist critique of antidiscrimination doctrine, feminist theory and antiracist Policies. University of Chicago Legal Forum, 1989(1), 139–167.

Darity, W., Jr., Hamilton, D., Paul, M., Aja, A., Price, A., Moore, A., & Chiopris, C. (2018). What we get wrong about closing the racial wealth gap. Samuel DuBois Cook Center on Social Equity. https://socialequity.duke.edu/wp-content/uploads/2020/01/what-we-get-wrong.pdf

Datalab. (2023). Power stats. National Center for Education Statistics. https://nces.ed.gov/datalab/start

Davis, A. (1983). Women, race and class. Vintage Books.

Davis, C. H. F., III, Mustaffa, J. B., King, K., & Jama, A. (2020). Legislation, policy, black student debt crisis. National Association for the Advancement of Colored People.

Debt Collective. (2020). Can’t pay won’t pay: The case for economic disobedience and debt abolition. Haymarket Books.

Department of Education. (2021). Official cohort default rates for schools. https://www2.ed.gov/offices/OSFAP/defaultmanagement/cdr.html

Department of Treasury. (2006). Lessons learned from the privatization of Sallie Mae. https://www.treasury.gov/about/organizational-structure/offices/Documents/SallieMaePrivatizationReport.pdf.

Douglass, J. A. (2010). From chaos to order to back? A revisionist reflection on the California Master Plan for Higher Education@50 and thoughts about its future. UC Berkeley: Center for Studies in Higher Education. https://escholarship.org/uc/item/6q49t0hj

Du Bois, W. E. B. (1899). The Philadelphia Negro: A social study. University of Pennsylvania.

Du Bois, W. E. B. (1903). The souls of Black folk. A. C. McClurg & Co.

Du Bois, W. E. B. (1935). Black reconstruction. Quinn & Boden Company Inc.

Dynarski, S. (2015, September 10). New data gives cleaner picture of student debt. The New York Times. http://www.nytimes.com/2015/09/11/upshot/new-data-gives-clearer-picture-of-student-debt.html

Emmons, W., Kent, A., & Ricketts, L. (2019). Is college still worth it? The new calculus of falling returns. . Federal Reserve Bank of St. Louis Review, Fourth Quarter 2019, 101(4), 297–329. https://doi.org/10.20955/r.101.297-329

Federal Reserve of Bank of New York. (2021). The labor market for recent college graduates. https://www.newyorkfed.org/research/college-labor-market/college-labor-market_underemployment_rates.html

Federici, S. (2004). Caliban and the witch. Autonomedia.

Field, C. (1980). The Life and Times of Rosie the Riveter [Film]. Clarity Films.

Fuller, J., & Raman, M. (2017). Dismissed by degrees. Accenture, Grads of Life, Harvard Business School. https://www.hbs.edu/managing-the-future-of-work/Documents/dismissed-by-degrees.pdf

Gelles, D. (2020, June 6). Corporate America has failed Black America. The New York Times. https://www.nytimes.com/2020/06/06/business/corporate-america-has-failed-black-america.html

Gilmore, R. W. (2022). Change everything: Racial capitalism and the case for abolition. Haymarket Books.

Goldrick-Rab, S., Kelchen, R., & Houle, J. (2014). The color of student debt: Implications of federal loan program reforms for Black students and historically black colleges and universities. Wisconsin Hope Lab discussion paper. https://news.education.wisc.edu/docs/WebDispenser/news-connections-pdf/thecolorofstudentdebt-draft.pdf

Government Accountability Office. (2016). Social Security offsets: Improvements to program design could better assist older student loan borrowers with obtaining permitted relief. https://www.gao.gov/products/gao-17-45

Harper, P., Derry, R., & Fairchild, G. (2021). Call for papers—Racial justice and business Ethics. Journal of Business Ethics Special Issue. https://www.springer.com/journal/10551/updates/18290364

Harper, S. R., Patton, L. D., & Wooden, O. S. (2009). Access and equity for African American students in higher education: A critical race historical analysis of policy efforts. The Journal of Higher Education, 80(4), 389–414.

Harris, A. (2021). Racial capitalism and law. In D. Jenkins & J. Leroy (Eds.), Histories of racial capitalism (pp. vii–xx). Columbia University Press.

Hartman, S. (2019). Wayward lives, beautiful experiments: intimate histories of riotous black girls, troublesome women, and queer radicals. W. W. Norton.

Hiltonsmith, R. (2017). Small loans, big risks: Major consequences for student debtors. Demos. http://www.demos.org/publication/small-loans-big-risks-major-consequences-student-debtors

Hsu, T. (2020, May 31). Corporate voices get behind ‘Black Lives Matter’ cause. The New York Times. https://www.nytimes.com/2020/05/31/business/media/companies-marketing-black-lives-matter-george-floyd.html

Huelsman, M. (2015). The Debt divide: The racial and class bias behind the “new normal” of student borrowing. Demos. https://www.demos.org/research/debt-divide-racial-and-class-bias-behind-new-normal-student-borrowing

Jackson, V., & Williams, B. (2022). How Black women experience student debt. The Education Trust. https://edtrust.org/resource/how-black-women-experience-student-debt/

Johnson, W. (2017). River of dark dreams: Slavery and empire in the cotton kingdom. Belknap Press.

Johnson, W. (2018). To remake the world: Slavery, racial capitalism, and justice. Boston Review. https://www.bostonreview.net/forum/walter-johnson-to-remake-the-world/

Jones, J. (1985). Labor of love, labor of sorrow: Black women, work and the family from slavery to the present. Basic Books.

Kelley, R. D. G. (2000). Foreword. In C. Robinson’s (Ed.), Black Marxism: The making of the black radical tradition (pp. xi–xxvi). University of North Carolina Press.

Kelley, R. D. G. (2016). Revisiting Black Marxism in the wake of Black Lives Matter. https://www.youtube.com/watch?v=xxRuTQZAT2Y

Kelley, R. D. G. (2021, February 1). Why Black Marxism, why now? Boston Review. https://www.bostonreview.net/articles/why-black-marxism-why-now/

Kochhar, R. (2023, March 1). The enduring grip of the gender pay gap. Pew Research. https://www.pewresearch.org/social-trends/2023/03/01/the-enduring-grip-of-the-gender-pay-gap

Kozol, J. (1991). Savage inequalities. Harper Perennial.

Lardner, J. (2008). Beyond the mortgage meltdown: Addressing the current crisis, avoiding a future catastrophe. Demos Report. London: Demos. https://www.demos.org/research/beyond-mortgage-meltdown-addressing-currentcrisis-avoiding-future-catastrophe

Lee, V., & Looney, A. (2019). Understanding the 90/10 Rule: How reliant are public, private, and for-profit institutions on federal aid? The Brookings Institution. https://www.brookings.edu/wp-content/uploads/2019/01/ES_20190116_Looney-90-10.pdf

Leslie, L. L., & Johnson, G. P. (1974). The market model and higher education. The Journal of Higher Education, 45(1), 1–20.

Logan, N. (2019). Corporate personhood and the corporate responsibility to race. Journal of Business Ethics, 154(4), 977–988.

Lorin, J. (2015, December 11). Who’s profiting from $1.2 trillion of federal student loans? Bloomberg. https://www.bloomberg.com/news/articles/2015-12-11/a-144-000-student-default-shows-who-profits-at-taxpayer-expense

Lowrey, A. (2013, June 7). The premium from a college degree. The New York Times. http://economix.blogs.nytimes.com/2013/06/07/the-premium-from-a-college-degree/

Marable, M. (1983). How capitalism underdeveloped Black America: Problems in race, political economy and society. South End Press.

Marens, R. (2010). Speaking platitudes to power: Observing American business ethics in an age of declining hegemony. Journal of Business Ethics, 94, 239–253.

Marez, C. (2014). Seeing in the red: Looking at student debt. American Quarterly, 66(2), 261–281.

McPherson, M. S., & Schapiro, M. O. (1998). The student aid game: Meeting need and rewarding talent in American higher education. Princeton University Press.

Mies, M. (1986). Patriarchy and accumulation on a world scale: Women in the international division of labor. Zed Books.

Miller, B. (2017). New federal data show a student loan crisis for African American borrowers. https://www.americanprogress.org/issues/education-postsecondary/news/2017/10/16/440711/new-federal-data-show-student-loan-crisis-african-american-borrowers/

Mills, N. (2012). The corporatization of higher education. Dissent Magazine. https://www.dissentmagazine.org/article/the-corporatization-of-higher-education

Mir, A., & Toor, S. (2023). Racial capitalism and student debt in the U.S. Organization, 30(4), 754–765. https://doi.org/10.1177/1350508421995762

Mishory, J., Huelsman, M., & Kahn, S. (2019). How student debt and the racial wealth gap reinforce each other. The Century Foundation. https://tcf.org/content/report/bridging-progressive-policy-debates-student-debt-racial-wealth-gap-reinforce/

Mustaffa, J. B., & Dawson, C. (2021). Racial capitalism and the Black student loan debt crisis. Teachers College Record, 123(6), 1–28.

Nash, J. C. (2019). Black feminism reimagined: After intersectionality. Duke University Press.

National Center for Educational Statistics. (2017). Repayment of student loans as of 2015 among 1995–96 and 2003–04 first-time beginning students. https://nces.ed.gov/pubsearch/pubsinfo.asp?pubid=2018410

National Consumer Law Center. (2016). A letter to the Honorable John B. King Jr., Secretary of Education. https://www.studentloanborrowerassistance.org/wp-content/uploads/2013/05/ltr-sec-king-race-student-debt.pdf

Navient Multi-State Settlement. (2022). 39 State Attorneys General Announce $1.85 Billion Settlement with Student Loan Servicer Navient. https://navientagsettlement.com

OECD. (2022). Education at a glance 2022. OECD Publishing. https://doi.org/10.1787/3197152b-en

Office of Inspector General. (2001). Sallie Mae pays $3.4 million to settle civil false Claims Act allegations. http://www2.ed.gov/about/offices/list/oig/invtreports/ma12001.html

Perea, J. F. (2011). The echoes of slavery: Recognizing the racist origins of the agricultural and domestic worker exclusion from the National Labor Relations Act, 72 OHIO ST. L.J. l 95.

Perkins, L. (2015). ‘Bound to them by a common sorrow’: African American women, higher education and collective advancement. Journal of African American History, 100(4), 721–747.

Pfeffer, F. T., Danziger, S., & Schoeni, R. F. (2013). Wealth Disparities before and after the Great Recession. The Annals of the American Academy of Political and Social Science, 650(1), 98–123. https://doi.org/10.1177/0002716213497452

Prieto, L., & Phipps, S. (2021). Why business schools need to address Black history. Harvard Business Publishing Education. https://hbsp.harvard.edu/inspiring-minds/why-business-schools-need-to-address-black-history

Rampell, C. (2012, December 4). Degree inflation? Jobs that newly require B.A.’s. The New York Times. https://archive.nytimes.com/economix.blogs.nytimes.com/2012/12/04/degree-inflation-jobs-that-newly-require-b-a-s/

Rampell, C. (2013, February 20). It takes a B.A. to find a job as a file clerk. The New York Times. http://www.nytimes.com/2013/02/20/business/college-degree-required-by-increasing-number-of-companies.html.

Reeves, C., & Sinnicks, M. (2021). Business ethics from the standpoint of redemption: Adorno on the possibility of good work. Business Ethics Quarterly, 31(4), 500–523.

Robinson, C. (1983). Black Marxism: The making of the Black radical tradition. University of North Carolina Press.

Roebuck, J. B., & Murty, K. (1993). Historically black colleges and universities: Their place in American higher education. Praeger.

Rosenthal, C. (2018). Accounting for slavery: Masters and management. Harvard University Press.

Schermerhorn, C. (2015). The business of slavery and the rise of American capitalism, 1815–1860. Yale University Press.

Schirmer, E. (2022, July 27). The aging student debtors of America. The New Yorker. https://www.newyorker.com/news/us-journal/the-aging-student-debtors-of-america

Scott-Clayton, J., & Li, J. (2016). Black-white disparity in student loan debt more than triples after graduation. Evidence Speaks Reports (Vol. 2, #3), Economic Studies at Brookings.

Seamster, L., & Charron-Chénier, R. (2017). Predatory inclusion and education debt: Rethinking the racial wealth gap. Social Currents, 4(3), 199–207.

Steinbaum, M. (2017, September 1). A Brown v. Board for higher ed. Boston Review. https://bostonreview.net/education-opportunity-class-inequality/marshall-steinbaum-brown-v-board-higher-ed

Struyven, D., George-Joseph, G., & Milo, D. (2021). Black womenomics: Investing in the underinvested. Report by Goldman Sachs Global Investment Research. https://www.goldmansachs.com/insights/pages/black-womenomics-f/black-womenomics-report.pdf

Student Borrower Protection Center. (2018). A year without action: An analysis of borrower complaints. https://protectborrowers.org/wp-content/uploads/2018/12/SBPC-A-Year-Without-Action_2018.pdf

Student Borrower Protection Center. (2021). Mapping exploitation: Examining for-profit colleges as financial predators in communities of color. https://protectborrowers.org/wp-content/uploads/2021/07/SBPC-Mapping-Exploitation-Report.pdf

Student Borrower Protection Center. (2023). About us. https://protectborrowers.org/who-we-are

Taibbi, M. (2013). Ripping off young America: The college-loan scandal. http://www.rollingstone.com/politics/news/ripping-off-young-america-the-college-loan-scandal-20130815

Taylor, K.-Y. (2017). Introduction. In K.-Y. Taylor (Ed.), How we get free: Black feminism and the Combahee River Collective. Haymarket Books.

Taylor, K.-Y. (2019). Race for profit: How banks and the real estate industry undermined Black homeownership. University of North Carolina Press.

The Movement for Black Lives. (2023). Reparations. https://m4bl.org/policy-platforms/reparations/

Vaghul, K., & Steinbaum, M. (2016). How the student debt crisis affects African Americans and Latinos. Washington Center for Equitable Growth.

Vogel, L. (2013). Marxism and the oppression of women: Toward a unitary theory. Brill. (Original work published 1983)

Wilkerson, I. (2020). Caste: The origins of our discontents. Random House.

Williams, E. (1944). Capitalism and slavery. University of North Carolina Press.