Turn green or lose ‘licence to operate’—Deutsche Bank CEO Christian Sewing (Olaf Storbeck, “Turn green or lose ‘licence to operate’, says Deutsche Bank chief,” Financial Times, May 20, 2021).

Abstract

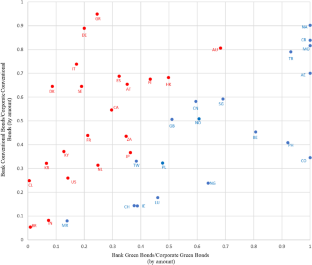

Banks are expected to play a key role in assisting the real economy with the green transition process. One of the tools used for this purpose is the issuance of green bonds. We analyze the characteristics of banks that issue green bonds to understand: (i) which banks are more likely to resort to these funding instruments, and (ii) if the issuance of green bonds leads to an improvement in a bank’s environmental footprint. We find that large banks and banks that had already publicly expressed their support for a green transition are more likely to issue green bonds. Conditional on being a green bond issuer, smaller banks tend to resort to green bonds in a more persistent manner and for relatively larger amounts, while larger banks issue green bonds on a more occasional basis and for smaller amounts. This heterogeneity is also reflected in our findings that only banks that issue green bonds more intensively improve their emissions and reduce lending to polluting sectors, thus contributing to the decarbonization of the financial sector.

Similar content being viewed by others

Notes

Authors’ calculations based on Bloomberg data.

The banking sector accounted for 43% of all corporate bonds issued globally in 2020. Authors’ calculations based on Bloomberg data.

The number of green bond issuers reported in Table 3 (120) is smaller than the one reported in Table 2 (177), since Table 3 only refers to banks that have financial data available at year-end 2012, while Table 2 includes all green bond issuers that have financial data available at any point during the sample period.

The correlation between bank size and presence of an ESG rating is equal to 48% in our sample.

Statement available at: https://www.unepfi.org/about/unep-fi-statement/.

Our specifications in Columns III–VI do not include country fixed effects since the multinomial logit models suffer from the curse of dimensionality issue when dealing with a large number of fixed effects for these sample sizes, and fail to converge to a solution. This is also the reason why we are unable to include bank fixed effects or country-year fixed effects in our specifications, which could otherwise have served as effective controls for any time-varying environmental policies in different countries. However, the inclusion of country EPI and NDC already contains key information on the countries’ environmental and regulatory specificities.

In an unreported robustness check, we replaced country EPI with country fixed effects, and the results are essentially unchanged.

We exclude from the pool of potential control banks those that never issue green bonds but belong to the same banking group of the treated banks and, as such, share the same environmental measures. Those banks would otherwise be classified as non-issuers even though they could potentially benefit, at a group level, from the green bond issuance of other institutions in the group.

Guidance on how to measure and disclose emissions from lending and investment activities has been detailed in the Global GHG Accounting and Reporting Standard for the Financial Industry only in November 2020. In February 2021, the European Banking Authority proposed the disclosure of banks’ green asset ratio, that is the share of a credit institution’s environmentally sustainable balance sheet exposures versus its total eligible exposures.

Some sample banks report the proportion of loans granted to green companies in their sustainability reports. We decide against using this information mainly because information on green lending has been provided for a sufficient number of years only by very few sample banks. Additionally, sustainability reports are a key input used by rating agencies to derive ESG ratings, hence any information on green lending included in sustainability reports is most likely embedded in the environmental measures used in the “Does Green Bond Issuance Improve Environmental Performance?” section.

We use bank fixed effects instead of country fixed effects to better control for any bank specific feature that may have not been captured by the matching.

For brevity, we proxy the intensity of green bond issuance only with this measure, given that all measures are positively and significantly (at 1% level) correlated and, as shown in Table 5, share the same explanatory factors.

See the Climate Bonds Standard and Certification Scheme at the Climate Bonds Initiative: https://www.climatebonds.net/certification. The list of green bonds that have obtained CBI certification is retrieved from https://www.climatebonds.net/certification/certified-bonds.

References

Baker, M., Bergstresser, D., Serafeim, G., & Wurgler, J. (2022). The pricing and ownership of U.S. green bonds. Annual Review of Financial Economics, 14(415), 437.

Bauckloh, T., Schaltegger, S., Utz, S., Zeile, S., & Zwergel, B. (2021). Active first movers vs late free-riders? An empirical analysis of UN PRI signatories’ commitment. Journal of Business Ethics, 1, 35.

Berg, F., Fabisik, K., & Sautner, Z. (2020). Is history repeating itself? The (un)predictable past of ESG ratings. ECGI Finance Working Paper No. 708–2020.

Berg, F., Kölbel, J. F., & Rigobon, R. (2022). Aggregate confusion: The divergence of ESG ratings. Review of Finance, 26(6), 1315–1344.

Bloomberg (2020). Guide to green bonds on the terminal. New York, USA: Bloomberg L.P.

Bolton, P., & Kacperczyk, M. (2021). Firm commitments. Working Paper.

Chen, I. J., Hasan, I., Lin, C.-Y., & Nguyen, T. (2021). Do banks value borrowers’ environmental record? Evidence from financial contracts. Journal of Business Ethics, 174, 687–713.

Choi, D., Gao, Z., & Jiang, W. (2020). Attention to global warming. Review of Financial Studies, 33, 1112–1145.

Daubanes, J.X., Mitali, S.F., & Rochet, J.-C. (2022). Why do firms issue green bonds? Swiss Finance Institute Research Paper No. 21–97.

Degryse H., Roukny T., & Tielens J. (2020). Banking barriers to the green economy. Working paper.

Degryse H., Goncharenko R., Theunisz C., & Vadasz, T. (2021). When green meets green. Working paper.

Delis, M., de Greiff, K., Iosifidi, M., & Ongena, S. (2021). Being stranded with fossil fuel reserves? Climate policy risk and the pricing of bank loans. Swiss Finance Institute Research Paper Series No 18–10.

Dyck, A., Lins, K. V., Roth, L., & Wagner, H. F. (2019). Do institutional investors drive corporate social responsibility? International evidence. Journal of Financial Economics, 131, 693–714.

Ehlers, T., Packer, F., & de Greiff, K. (2021). The pricing of carbon risk in syndicated loans: Which risks are priced and why? Journal of Banking and Finance, 136, 106180.

Emerson, J. W., Hsu, A., Levy, M. A., de Sherbinin, A., Mara, V., Esty, D. C., & Jaiteh, M. (2012). 2012 Environmental Performance Index and Pilot Trend Environmental Performance Index. Yale Center for Environmental Law & Policy.

European Banking Authority (2021). Advice to the Commission on KPIs and methodology for disclosure by credit institutions and investment firms under the NFRD on how and to what extent their activities qualify as environmentally sustainable according to the EU taxonomy regulation. EBA/Rep/2021/03.

European Central Bank (2019). Financial Stability Review: Climate risk-related disclosures of banks and insurers and their market impact. November.

Fatica, S., Panzica, R., & Rancan, M. (2021). The pricing of green bonds: Are financial institutions special? Journal of Financial Stability, 54, 100873.

Flammer, C. (2021). Corporate green bonds. Journal of Financial Economics, 12, 499–516.

Gianfrate, G., & Peri, M. (2019). The green advantage: Exploring the convenience of issuing green bonds. Journal of Cleaner Production, 219, 127–135.

Hachenberg, B., & Schiereck, D. (2018). Are green bonds priced differently from conventional bonds? Journal of Asset Management, 19, 371–383.

Hsu, A., Emerson, J. W., Levy, M. A., de Sherbinin, A., Johnson, L., Malik, O. A., Schwartz, J. D., & Jaiteh, M. (2014). 2014 Environmental Performance Index. Yale Center for Environmental Law & Policy.

Hsu, A., Esty, D. C., de Sherbinin, A., & Levy, M. A. (2016). 2016 Environmental Performance Index: Global Metrics for the Environment. Yale Center for Environmental Law & Policy.

Iovino, L., Martin, T., & Sauvagnat, J. (2021) Corporate taxation and carbon emissions. Working paper.

Krey, V., Masera, O., Blanford, G., Bruckner, T., Cooke, R., Fisher-Vanden, K., Haberl, H., Hertwich, E., Kriegler, E., Mueller, D., Paltsev, S., Price, L., Schlömer, S., Ürge-Vorsatz, D., van Vuuren, D., & Zwickel, T. (2014). Annex II: Metrics & methodology. In O. Edenhofer, R. Pichs-Madruga, Y. Sokona, E. Farahani, S. Kadner, K. Seyboth, A. Adler, I. Baum, S. Brunner, P. Eickemeier, B. Kriemann, J. Savolainen, S. Schlömer, C. von Stechow, T. Zwickel, & J. C. Minx (Eds.), Climate change 2014: Mitigation of climate change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press.

Kothari, S. P., & Warner, J. B. (2007). Econometrics of event studies. In E. Eckbo (Ed.), Handbook of corporate finance (pp. 3–36). Elsevier.

Krüger, P., Sautner, Z., & Starks, L. T. (2020). The importance of climate risks for institutional investors. Review of Financial Studies, 33, 1067–1111.

Mésonnier, J.-S. (2022). Banks’ climate commitments and credit to carbon-intensive industries: New evidence for France. Climate Policy, 22, 389–400.

Müller, I. and Sfrappini, E. (2021) Climate change-related regulatory risks and bank lending. Working paper.

Panetta, F. (2021). A global accord for sustainable finance. The ECB Blog, Frankfurt am Main, 11 May 2021.

Reghezza, A., Altunbas, Y., Marques-Ibanez, D., Rodriguez d’Acri, C., & Spaggiari, M. (2022). Do banks fuel climate change? Journal of Financial Stability, 62, 101049.

Sangiorgi, I., & Schopohl, L. (2021). Explaining green bond issuance using survey evidence: Beyond the greenium. British Accounting Review. https://doi.org/10.1016/j.bar.2021.101071

Spence, M. (1973). Job market signaling. Quarterly Journal of Economics, 87, 355–374.

Tang, D. Y., & Zhang, Y. (2020). Do shareholders benefit from green bonds? Journal of Corporate Finance, 61, 101427.

Wendling, Z. A., Emerson, J. W., Esty, D. C., Levy, M. A., & de Sherbinin, A. (2018). 2018 Environmental performance index. Yale Center for Environmental Law & Policy.

Wendling, Z. A., Emerson, J. W., de Sherbinin, A., & Esty, D. C. (2020). 2020 Environmental performance index. Yale Center for Environmental Law & Policy.

Zerbib, O. D. (2019). The effect of pro-environmental preferences on bond prices: Evidence from green bonds. Journal of Banking and Finance, 98, 39–60.

Zerbini, F. (2017). CSR initiatives as market signals: A review and research agenda. Journal of Business Ethics, 146, 1–23.

Acknowledgements

We are grateful to the editor, two anonymous reviewers, Özlem Dursun-de Neef and seminar participants at the University of Zurich, WHU Otto Beisheim School of Management, the Free University of Bozen-Bolzano, and conference attendants at the CGRM Conference in Rome, the FEBS Conference in Portsmouth, and the FMA European Conference in Lyon, for their helpful comments and useful suggestions. We thank Letizia Ricchiardi for excellent research assistance.

Funding

This study is funded by a CRC2021 Sustainability Grant from the Free University of Bozen-Bolzano.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors certify that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Event study around green bond announcements

In this appendix we perform an event study to test the stock price reaction of green bond issuers around the announcement of the issuance of green bonds. Our sample covers all green bonds issued by publicly listed banks worldwide between January 1, 2013 and October 31, 2020. The announcement dates of green bond issuances as well as the issuers’ daily stock prices are retrieved from Bloomberg. We use a one-factor market model to estimate the “normal” relation between stock and market returns since previous literature has shown that short-horizon event studies are not sensitive to the benchmark specification (Kothari and Warner, 2007):

where \({R}_{it}\) is the daily return on the common share of bank i on day t and \({R}_{mt}\) is the daily return on the MSCI World total return index on the same day. In line with Tang and Zhang (2020), the market model is estimated from 300 calendar days to 50 calendar days prior to the event date \(t=0\), which coincides with the announcement date. We derive daily abnormal stock returns \({AR}_{it}\) as the difference between raw returns and returns estimated from the market model:

As in Tang and Zhang (2020) and Flammer (2021), we then compute cumulative abnormal returns \({CAR}_{i}\) for bank i around each event date by aggregating \({AR}_{it}\) from 5 days before to 10 days after (5 days before to 5 days after) the announcement date. The table reports the average CARs computed across the two event windows separately for first-time issues and subsequent issues, with t-statistics in parenthesis. Consistently with the findings from previous studies on corporate green bonds in general, we document, also in banks: (i) a positive stock price response following the announcement of the first green bond issuance; (ii) no stock price response following the announcement of subsequent green bond issuances. This is in line with the signaling argument, as the market learns about the bank’s commitment to green lending with the first-time issue, while the information content of subsequent issues is likely to resemble that of conventional bond issues (see the discussion in Tang and Zhang, 2020, and Flammer, 2021).

First-time issues | Subsequent issues | |||

|---|---|---|---|---|

[−5, 5] | [−5, 10] | [−5, 5] | [−5, 10] | |

I | II | III | IV | |

CAR | 1.276** | 1.506* | −0.622 | −0.986 |

(1.982) | (1.952) | (−1.089) | (−1.412) | |

Observations | 78 | 78 | 89 | 87 |

Appendix 2: Variable definitions

Variable | Definition | Source |

|---|---|---|

Brown lending | The proportion of a bank’s credit exposure to carbon-intensive sectors | Carbon-intensive industries are classified by the Inter-governmental Panel on Climate Change (IPCC). Information on lending to such industries is obtained from annual reports and Pillar 3 reports |

Buildings | Dummy variable taking the value 1 (0) if green bond proceeds were (not) used for green buildings | Documentation provided on the banks’ websites |

Capital ratio | Ratio of equity over total assets | Moody’s analytics bankfocus |

CBI Certified GBI | Dummy variable taking the value 1 (0) if an issuer who obtained a third-party certification of compliance with the Climate Bonds Standards of the Climate Bonds Initiative has (has not) already issued a green bond by the current year | Climate bonds initiative |

∆CO2 emissions: scope 1 & 2 | Yearly log change in reported Scope 1 and 2 emissions | Thomson reuter’s refinitiv |

∆CO2 emissions: scope 3 | Yearly log change in reported Scope 3 emissions | Thomson reuter’s refinitiv |

∆CO2 emissions: total scope | Yearly log change in the sum of reported Scope 1, 2 and 3 emissions | Thomson reuter’s refinitiv |

Customer deposit ratio | Ratio of total customer deposits over total assets | Moody’s analytics bankfocus |

Emissions score | The bank’s emissions score | Thomson reuter’s refinitiv |

Energy | Dummy variable taking the value 1 (0) if green bond proceeds were (not) used for renewable energy purposes | Documentation provided on the banks’ websites |

Environmental score | The bank’s environmental score | Thomson reuter’s refinitiv |

EPI country score | The Environmental Performance Index score of the country where the bank is headquartered | The EPI is computed by Yale University and available at: https://epi.yale.edu/ |

Government controlled | Dummy variable taking the value 1 (0) if the bank’s global ultimate owner is (is not) a public authority, state, or government | Moody’s analytics bankfocus |

Green bond issuer (GBI) | Dummy variable taking the value 1 (0) if a bank has (has not) issued a green bond during the sample period | Bloomberg |

GBI post issuance | Dummy variable taking the value 1 (0) if a GBI has (has not) already issued a green bond by the current year | Bloomberg |

G-SIB | Dummy variable taking the value 1 (0) if the bank is (is not) a global systemically important bank | The yearly lists of G-SIBs are obtained from the website of the Financial Stability Board: https://www.fsb.org |

Has ESG rating | Dummy variable taking the value 1 (0) if the bank has (has not) an ESG rating | Thomson reuter’s refinitiv |

Institutional ownership | Percentage of total institutional ownership of the bank | Bloomberg |

Intense GBI | Dummy variable taking the value 1 (0) if a bank has issued in the sample period a proportion of green bonds over total bonds higher (lower) than the median | Bloomberg |

Intense GBI post issuance | Dummy variable taking the value 1 (0) if an Intense GBI by number of bonds has (has not) already issued a green bond by the current year | Bloomberg |

Listed | Dummy variable taking the value 1 (0) if a bank is (is not) publicly listed | Moody’s analytics bankfocus |

Ln(Assets) | Natural log of total assets in million USD | Moody’s analytics bankfocus |

Loan ratio | Ratio of gross loans over total assets | Moody’s analytics bankfocus |

Long-term funding ratio | Ratio of long-term funding over total assets | Moody’s analytics bankfocus |

NDC | Dummy variable taking the value 1 (0) for each year a country in which a bank is headquartered has (has not) a Nationally Determined Contribution in place | |

Other | Dummy variable taking the value 1 (0) if green bond proceeds were (not) used for land, water, or pollution prevention and waste management | Documentation provided on the banks’ websites |

ROA | Ratio of net income over total assets | Moody’s analytics bankfocus |

Transport | Dummy variable taking the value 1 (0) if green bond proceeds were (not) used for green transport projects | Documentation provided on the banks’ websites |

UNEP FI | Dummy variable taking the value 1 (0) if the bank is (is not) a member of the United Nations Environment Programme Finance Initiative | Member lists obtained from: https://www.unepfi.org/members |

Appendix 3: t-tests on treated and control samples

Treated | Control | ||||

|---|---|---|---|---|---|

Mean | St. dev. | Mean | St. dev. | t-stat. | |

Environmental score | 65.19 | 25.53 | 64.59 | 24.82 | − 0.14 |

Ln(Assets) | 19.09 | 1.58 | 18.63 | 1.27 | − 1.90 |

Capital ratio | 0.11 | 0.17 | 0.11 | 0.11 | − 0.08 |

ROA | 0.01 | 0.01 | 0.01 | 0.03 | 0.87 |

Loan ratio | 0.50 | 0.21 | 0.49 | 0.23 | − 0.25 |

EPI country score | 70.48 | 13.92 | 70.09 | 13.73 | − 0.17 |

Observations | 69 | 69 | |||

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Bedendo, M., Nocera, G. & Siming, L. Greening the Financial Sector: Evidence from Bank Green Bonds. J Bus Ethics 188, 259–279 (2023). https://doi.org/10.1007/s10551-022-05305-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-022-05305-9