Abstract

Given the rapid growth and emerging trend of e-commerce have changed consumer preferences to buy online, this study analyzes the current Indian legal framework that protects online consumers’ interests. A thorough analysis of the two newly enacted laws, i.e., the Consumer Protection Act, 2019 and Consumer Protection (E-commerce) Rules, 2020 and literature review support analysis of 290 online consumers answering the research questions and achieving research objectives. The significant findings are that a secure and reliable system is essential for e-business firms to work successfully; cash on delivery is the priority option for online shopping; website information and effective customer care services build a customer's trust. The new regulations are arguably strong enough to protect and safeguard online consumers' rights and boost India’s e-commerce growth. Besides factors such as security, privacy, warranty, customer service, and website information, laws governing consumer rights protection in e-commerce influence customers’ trust. Growing e-commerce looks promising with a robust legal framework and consumer protection measures. The findings contribute to the body of knowledge on e-commerce and consumer rights protection by elucidating the key factors that affect customer trust and loyalty and offering an informative perspective on e-consumer protection in the Indian context with broader implications.

Similar content being viewed by others

Study Background

The study context, which discusses two key aspects, namely the rationale for consumer protection in e-commerce and its growth, is presented hereunder:

The Rationale for Consumer Protection in E-commerce

Consumer protection is a burning issue in e-commerce throughout the globe. E-Commerce refers to a mechanism that mediates transactions to sell goods and services through electronic exchange. E-commerce increases productivity and widens choice through cost savings, competitiveness and a better production process organisationFootnote 1 (Vancauteren et al., 2011). According to the guidelines-1999 of the Organisation for Economic Cooperation and Development (OECD), e-commerce is online business activities-both communications, including advertising and marketing, and transactions comprising ordering, invoicing and payments (OECD, 2000). OCED-1999 guidelines recognised, among others, three essential dimensions of consumer protection in e-commerce. All consumers need to have access to e-commerce. Second, to build consumer trust/confidence in e-commerce, the continued development of transparent and effective consumer protection mechanisms is required to check fraudulent, misleading, and unfair practices online. Third, all stakeholders-government, businesses, consumers, and their representatives- must pay close attention to creating effective redress systems. These guidelines are primarily for cross-border transactions (OECD, 2000).

Considering the technological advances, internet penetration, massive use of smartphones and social media penetration led e-commerce growth, the OECD revised its 1999 recommendations for consumer protection in 2016. The 2016-guidelines aim to address the growing challenges of e-consumers’ protection by stimulating innovation and competition, including non-monetary transactions, digital content products, consumers-to-consumers (C2C) transactions, mobile devices, privacy and security risks, payment protection and product safety. Furthermore, it emphasises the importance of consumer protection authorities in ensuring their ability to protect e-commerce consumers and cooperate in cross-border matters (OECD, 2016). The United Nations Conference on Trade and Development (UNCTAD), in its notes-2017, also recognises similar consumer protection challenges in e-commerce. The notes look into policy measures covering relevant laws and their enforcement, consumer education, fair business practices and international cooperation to build consumer trust (UNCTAD, 2017).

E-commerce takes either the domestic (intra-border) route or cross-border (International) transactions. Invariably, six e-commerce models, i.e. Business-to-Consumer (B2C), Business-to-Business (B2B), Consumer-to-Business (C2B), Consumer-to-Consumer (C2C), Business-to-Administration (B2A) and Consumer-to-Administration (C2A) operate across countries (UNESAP and ADB, 2019; Kumar & Chandrasekar, 2016). Irrespective of the model, the consumer is the King in the marketplace and needs to protect his interest. However, the focus of this paper is the major e-commerce activities covering B2B and B2C.

The OECD and UNCTAD are two global consumer protection agencies that promote healthy and competitive international trade. Founded in 1960, Consumer InternationalFootnote 2 (CI) is a group of around 250 consumer organisations in over 100 countries representing and defending consumer rights in international policy forums and the global marketplace. The other leading international agencies promoting healthy competition in national and international trade are European Consumer Cooperation Network, ECC-Net (European Consumer Center Network), APEC Electronic Consumer Directing Group (APECSG), Iberoamerikanische Forum der Konsumer Protection Agenturen (FIAGC), International Consumer Protection and Enforcement Agencies (Durovic, 2020).

ICPEN, in the new form, started functioning in 2002 and is now a global membership organisation of consumer protection authorities from 64 countries, including India joining in 2019 and six observing authorities (COMESA, EU, GPEN, FIAGC, OECD and UNCTAD). While it addresses coordination and cooperation on consumer protection enforcement issues, disseminates information on consumer protection trends and shares best practices on consumer protection laws, it does not regulate financial services or product safety. Through econsumer.govFootnote 3 enduring initiative, ICPEN, in association with the Federal Trade Commission (FTC), redresses international online fraud.Footnote 4 Econsumer.gov, a collaboration of consumer protection agencies from 41 countries around the world, investigates the following types of international online fraud:

-

Online shopping/internet services/computer equipment

-

Credit and debit

-

Telemarketing & spam

-

Jobs & making money

-

Imposters scam: family, friend, government, business or romance

-

Lottery or sweepstake or prize scams

-

Travel & vacations

-

Phones/mobile devices & phone services

-

Something else

Online criminals target personal and financial information. Online trading issues involve scammers targeting customers who buy/sell/trade online. Table 1 on online cross-border complaints of fraud reported by econsumer.gov reveals that international scams are rising. Total cross-border fraud during 2020 (till 30 June) was 33,968 with a reported loss of US$91.95 million as against 40,432 cases with a loss of US$ 151.3 million and 14,797 complaints with the loss of US$40.83 million 5 years back. Among others, these complaints included online shopping fraud, misrepresented products, products that did not arrive, and refund issues. Figure 1 shows that the United States ranked first among the ten countries where consumers lodged online fraud complaints based on consumer and business locations. India was the third country next to France for online fraud reporting in consumer locations, while it was the fifth nation for company location-based reporting. Besides the USA and India, Poland, Australia, the United Kingdom, Canada, Turkey, Spain, and Mexico reported many consumer complaints. Companies in China, the United Kingdom, France, Hong Kong, Spain, Canada, Poland and Turkey received the most complaints. The trend is a serious global concern, with a magnitude of reported loss of above 60%.

Source: Data compiled from https://public.tableau.com/profile/federal.trade.commission#!/vizhome/eConsumer/Infographic, Accessed 7 October 2020

Online shopping-top consumer locations and company locations.

The international scenario and views on consumer protection in e-commerce provide impetus to discuss consumer protection in e-business in a regional context-India. The reason for this is that India has become a leading country for online consumer fraud, putting a spotlight on electronic governance systems-which may have an impact on India's ease of doing business ranking. However, to check fraud and ensure consumer protection in e-commerce, the government has replaced the earlier Consumer Protection Act, 1986, with the new Act-2019 and E-Commerce Rule-2020 is in place now.

E-commerce Growth

E-commerce has been booming since the advent of the worldwide web (internet) in 1991, but its root is traced back to the Berlin Blockade for ordering and airlifting goods via telex between 24 June 1948 and 12 May 1949. Since then, new technological developments, improvements in internet connectivity, and widespread consumer and business adoption, e-commerce has helped countless companies grow. The first e-commerce transaction took place with the Boston Computer Exchange that launched its first e-commerce platform way back in 1982 (Azamat et al., 2011; Boateng et al., 2008). E-commerce growth potential is directly associated with internet penetration (Nielsen, 2018). The increase in the worldwide use of mobile devices/smartphones has primarily led to the growth of e-commerce. With mobile devices, individuals are more versatile and passive in buying and selling over the internet (Harrisson et al., 2017; Išoraitė & Miniotienė, 2018; Milan et al., (2020); Nielsen, 2018; Singh, 2019; UNCTAD, 2019a, 2019b). The growth of the millennial digital-savvy workforce, mobile ubiquity and continuous optimisation of e-commerce technology is pressing the hand and speed of the historically slow-moving B2B market. The nearly US$1 Billion B2B e-commerce industry is about to hit the perfect storm that is driving the growth of B2C businesses (Harrisson et al., 2017). Now, e-commerce has reshaped the global retail market (Nielsen, 2019). The observation is that e-commerce is vibrant and an ever-expanding business model; its future is even more competitive than ever, with the increasing purchasing power of global buyers, the proliferation of social media users, and the increasingly advancing infrastructure and technology (McKinsey Global Institute, 2019; UNCTAD, 2019a, 2019b).

The analysis of the growth trend in e-commerce, especially since 2015, explains that online consumers continue to place a premium on both flexibility and scope of shopping online. With the convenience of buying and returning items locally, online retailers will increase their footprint (Harrisson et al., 2017). Today, e-commerce is growing across countries with a compound annual growth rate (CAGR) of 15% between 2014 and 2020; it is likely to grow at 25% between 2020 and 2025. Further analysis of e-commerce business reveals that internet penetration will be nearly 60% of the population in 2020, and Smartphone penetration has reached almost 42%. Among the users, 31% are in the age group of 25–34 years old, followed by 24% among the 35–44 years bracket and 22% in 18–24 years. Such a vast infrastructure and networking have ensured over 70% of the global e-commerce activities in the Asia–Pacific region. While China alone accounts for US$740 billion, the USA accounts for over US$$560 billion (Kerick, 2019). A review of global shoppers making online purchases (Fig. 2) shows that consumers look beyond their borders-cross-border purchases in all regions. While 90% of consumers visited an online retail site by July 2020, 74% purchased a product online, and 52% used a mobile device.

Source: Data compiled from https://datareportal.com/global-dig ital-overview#: ~ :text = There%20are%205.15%20billion%20unique,of%202.4%20percent%20per%20 year and , Accessed 12 October 2020

Global e-commerce activities and overseas online purchase.

The e-commerce uprising in Asia and the Pacific presents vast economic potential. The region holds the largest share of the B2C e-commerce market (UNCTAD, 2017). The size of e-commerce relative to the gross domestic product was 4.5% in the region by 2015. E-commerce enables small and medium-sized enterprises to reach global markets and compete on an international scale. It has improved economic efficiency and created many new jobs in developing economies and least developed countries, offering them a chance to narrow development gaps and increase inclusiveness—whether demographic, economic, geographic, cultural, or linguistic. It also helps narrow the rural–urban divide.

Nevertheless, Asia’s e-commerce market remains highly heterogeneous. In terms of e-commerce readiness—based on the UNCTAD e-commerce index 2017, the Republic of Korea ranks fifth globally (score 95.5) while Afghanistan, with 17 points, ranks 132 (UNCTAD, 2017). According to a joint study (2018) by the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) and Asian Development Bank (ADB), Asia is the fastest-growing region in the global e-commerce marketplace. The region accounted for the largest share of the world’s business-to-consumer e-commerce market (UNESCAP and ADB, 2019). World Retail Congress (2019) brought out the Global E-Commerce Market Ranking 2019 assessing the top 30 ranking e-commerce markets on various parameters-USA, UK, China, Japan and Germany were the first top countries. India figured at 15 with a CAGR of 19.8% between 2018 and 2022. The report suggests that companies need to enhance every aspect of online buying, focusing on localised payment mode and duty-free return.Footnote 5 The observation of this trend implies online consumers’ safety and security.

Figure 3 explains that global cross-border e-commerce (B2C) shopping is growing significantly and is estimated to cross US$1 Trillion in 2020. Adobe Digital Economic Index Survey-2020Footnote 6 in March 2020 reported that a remarkable fact to note is about steadily accelerated growth in global e-commerce because of COVID-19. While virus protection-related goods increased by 807%, toilet paper spiked by 231%. Online consumers worldwide prefer the eWallet payment system. The survey also revealed an exciting constellation that COVID-19 is further pushing overall online inflation down.

Source: Authors’ compilation from https://www.invespcro.com/blog/cross-border-shopping/, Accessed on 15 October 2020

Global cross-border e-commerce (B2C) market. *Estimated to cross US$ 1 Trillion in 2020.

According to UNCTD’s B2C E-Commerce Index 2019 survey measuring an economy’s preparedness to support online shopping, India ranks 73rd with 57 index values, seven times better than the 80th rank index report 2018 (UNCTAD, 2019a, 2019b). The E-commerce industry has emerged as a front-runner in the Indian economy with an internet penetration rate of about 50% now, nearly 37% of smartphone internet users, launching the 4G network, internet content in the local language, and increasing consumer wealth. Massive infrastructure and policy support propelled the e-commerce industry to reach US$ 64 billion in 2020, up by 39% from 2017 and will touch US$ 200 by 2026 with a CAGR of 21%.Footnote 7 Now, India envisions a five trillion dollar economyFootnote 8 by 2024. It would be difficult with the present growth rate, but not impossible, pushing for robust e-governance and a digitally empowered society. The proliferation of smartphones, growing internet access and booming digital payments and policy reforms are accelerating the growth of the e-commerce sector vis-a-vis the economy.

Analysis of different studies on the growth of e-commerce in India shows that while retail spending has grown by a CAGR of 22.52% during 2015–2020, online buyers have climbed by a CAGR of 35.44% during the same period (Fig. 4). The government’s Digital India drive beginning 1 July 2015-surge using mobile wallets like Paytm, Ola Money, Mobiwik, BHIM etc., and the declaration of demonetisation on 9 November 2016 appears to be the prime reasons for such a vast growth in the country’s e-commerce industry. The Times of India (2020 October 12), a daily leading Indian newspaper, reported that India's increase in digital payments was at a CAGR of 55.1% from March 2016 to March 2020, jumping from US$ 73,90 million to 470.40, reflecting the country's positive policy environment and preparedness for the digital economy. The government's policy objective is to promote a safe, secure, sound and efficient payment system; hence, the Reserve Bank of India (RBI), the national financial and fiscal regulating authority, attempts to ensure security and increase customer trust in digital payments (RBI, 2020).

Source: Data compiled from https://www.ibef.org/news/vision-of-a-new-india-US$-5-trillion-economy, http://www.ficci.in/ficci-in-news-page.asp?nid=19630, https://www.pwc.in/research-insights/2018/propelling-india-towards-global-leadership-in-e-commerce.html, https://www.forrester.com/data/forecastview/reports#, Accessed 12 October 2020

E-Commerce growth in India during 2015–2020.

The massive growth of e-commerce in countries worldwide, especially in India, has prompted an examination of the legal structure regulating online consumer protection.

Literature Review and Research Gap

Theoretical Framework

Generally speaking, customers, as treated inferior to their contracting partners, need protection (Daniel, 2005). Therefore, due to low bargaining power, it is agreed that their interests need to be secured. The ‘inequality of negotiating power’ theory emphasises the consumer's economically weaker status than suppliers (Haupt, 2003; Liyang, 2019; Porter, 1979). The ‘inequality in bargaining power’ principle emphasises the customer's economically inferior position to suppliers (Haupt, 2003). The ‘exploitation theory’ also supports a similar view to the ‘weaker party’ argument. According to this theory, for two reasons, consumers need protection: first, consumers have little choice but to buy and contract on the terms set by increasingly large and powerful businesses; second, companies can manipulate significant discrepancies in knowledge and complexity in their favour (Cockshott & Dieterich, 2011). However, a researcher such as Ruhl (2011) believed that this conventional theoretical claim about defining the customer as the weaker party is no longer valid in modern times. The logic was that the exploitation theory did not take into account competition between firms. Through competition from other businesses, any negotiating power that companies have vis-a-vis clients is minimal. The study, therefore, considers that the ‘economic theory’ is the suitable theoretical rationale for consumer protection today.

The principle of ‘economic philosophy’ focuses primarily on promoting economic productivity and preserving wealth as a benefit (Siciliani et al., 2019). As such, the contract law had to change a great deal to deal with modern-age consumer transactions where there is no delay between agreement and outcomes (McCoubrey & White, 1999). Thus, the ‘economic theory’ justifies the flow of goods and services through electronic transactions since online markets' versatility and rewards are greater than those of face-to-face transactions. The further argument suggests that a robust consumer protection framework can provide an impetus for the growth of reliability and trust in electronic commerce. The ‘incentive theory’ works based on that argument to describe consumer protection in electronic transactions (McCoubrey & White, 1999).

Online shopping needs greater trust than purchasing offline (Nielsen, 2018). From the viewpoint of ‘behavioural economics, trust (faith/confidence) has long been considered a trigger for buyer–seller transactions that can provide high standards of fulfilling trade relationships for customers (Pavlou, 2003). Pavlou (2003) supports the logical reasoning of Lee and Turban (2001) that the role of trust is of fundamental importance in adequately capturing e-commerce customer behaviour. The study by O'Hara (2005) also suggests a relationship between law and trust (belief/faith), referred to as ‘safety net evaluation’, suggesting that law may play a role in building trust between two parties. However, with cross-border transactions, the constraint of establishing adequate online trust increases, especially if one of the parties to the transaction comes from another jurisdiction with a high incidence of counterfeits or a weak rule of law (Loannis et al., 2019). Thus, the law promotes the parties' ability to enter into a contractual obligation to the extent that it works to reduce a contractual relationship's insecurity. The present research uses the idea of trust (faith/belief/confidence) as another theoretical context in line with ‘behavioural economics’.

As a focal point in e-commerce, trust refers to a party's ability to be vulnerable to another party's actions; the trustor, with its involvement in networking, sees trust in the form of risk-taking activity (Mayer et al., 1995; Helge et al., 2020). Lack of confidence could result in weak contracts, expensive legal protections, sales loss and business failure. Therefore, trust plays a crucial role in serving customers transcend the perceived risk of doing business online and in helping them become susceptible, actual or imaginary, to those inherent e-business risks. While mutual benefit is usually the reason behind a dealing/transaction, trust is the insurance or chance that the customer can receive that profit (Cazier, 2007). The level of trust can be low or high. Low risk-taking behaviour leads to lower trustor engagement, whereas high risk-taking participation leads to higher trustor engagement (Helge et al., 2020). The theory of trust propounded by (Mayer et al., 1995) suggests that trust formation depends on three components, viz. ability, benevolence, and integrity (ABI model). From the analysis of the previous studies (Mayer et al., 1995; Cazier, 2007; Helge et al., 2020), the following dimensions of the ABI model emerge:

Dimensions | Description |

|---|---|

Ability | Competence and characteristics of vendors in influencing and approving a particular area or domain-level service to the consumer |

Elements: technological skills and solutions to provide the core service, as well as privacy, security, data protection, and preparedness | |

Benevolence | Concerns caring, and it's the muse for client loyalty |

Elements: attention, empathy, belief and acceptance | |

Integrity | Compliance with laws and transparent consistency and links to attitude and behaviour of sellers in running their business |

Elements: equality, satisfaction, allegiance, fairness, and reliability |

Precisely, ability, benevolence and integrity have a direct influence on the trust of e-commerce customers.

Gaining the trust of consumers and developing a relationship has become more challenging for e-businesses. The primary reasons are weak online security, lack of effectiveness of the electronic payment system, lack of effective marketing program, delay in delivery, low quality of goods and services, and ineffective return policy (Kamari & Kamari, 2012; Mangiaracina & Perego, 2009). These weaknesses adversely impact business operations profoundly later. Among the challenges that are the reasons for the distrust of customers and downsides of e-commerce is that the online payment mechanism is widely insecure. The lack of trust in electronic payment is the one that impacts negatively on the e-commerce industry, and this issue is still prevalent (Mangiaracina & Perego, 2009). The revelation of a recent study (Orendorff, 2019) and survey resultsFootnote 9 on trust-building, particularly about the method of payment, preferred language and data protection, is fascinating. The mode of payment is another matter of trust-building. Today’s customers wish to shop in their local currency seamlessly. In an online shoppers’ survey of 30,000 respondents in 2019, about 92% of customers preferred to purchase in their local currency, and 33% abandoned a buy if pricing was listed in US$ only (Orendorff, 2019). Airbnb, an online accommodation booking e-business that began operations in 2009, has expanded and spread its wings globally as of September 2020-over 220 countries and 100 k + cities serving 7 + billion customers (guests) with local currency payment options.Footnote 10

Common Sense Advisory SurveyFootnote 11-Nov. 2019-Feb. 2020 with 8709 online shoppers (B2C) in 29 countries, reported that 75% of them preferred to purchase products if the information was in their native language. About 60% confirmed that they rarely/never bought from an English-only website because they can’t read. Similarly, its survey of 956 business people (B2B) moved in a similar direction. Whether it is B2B or B2C customers, they wanted to go beyond Google translator-this is about language being a front-line issue making or breaking global sales. Leading Indian e-commerce companies like AmazonFootnote 12 and FlipkartFootnote 13 have started capturing the subsequent 100 million users by providing text and voice-based consumer support in vernacular languages. These observations suggest trust in information that the customers can rely upon for a successful transaction.

Data protection is probably the most severe risk of e-commerce. The marketplaces witness so many violations that it often seems that everyone gets hacked, which makes it a real challenge to guarantee that your store is safe and secure. For e-commerce firms, preserving the data is a considerable expense; it points a finger to maintaining the safety and security of the e-commerce consumers’ data privacy in compliance with General Data Protection Regulations (GDPR) across countries.Footnote 14

PwC’s Global Consumer Insight Survey 2020 reports that while customers’ buying habits would become more volatile post-COVID 19, consumers’ experience requires safety, accessibility, and digital engagement would be robust and diversified.Footnote 15 The report reveals that the COVID-19 outbreak pushed the popularity of mobile shopping. Online grocery shopping (including phone use) has increased by nearly 63% post-COVID than before social distancing execution and is likely to increase to 86% until its removal. Knowing the speed of market change will place companies in a position to handle the disruption-74% of the work is from home, at least for the time being. Again, the trend applies to consumers’ and businesses’ confidence/trust-building. The safety and security of customers or consumer protection are of paramount importance.

Given the rationale above, the doctrine of low bargaining power, exploitation theory and the economic approach provides the theoretical justification for consumer protection. Economic theory also justifies electronic transactions and e-commerce operations as instruments for optimising income. The trust theory based on behavioural economic conception also builds up the relationship between the law and customer trust and thus increases confidence in the online market. These premises form the basis for this research.

Need and Instruments for Online Consumer Protection

The law of the land guides people and the living society. Prevailing rules and regulations, when followed, provide peace of mind and security in all spheres, including business activities (Bolton et al., 2004). Previous research by Young & Wilkinson (1989) suggested that those who have more legally strict contracts face more legal problems in contrast to trust-related issues (Young & Wilkinson, 1989). Time has changed; people going for online transactions go with the legal framework and feel safe and secured (Bolton et al., 2004). An online agreement is a valid contract. Most UNCTAD member countries, including India, have adopted various laws concerning e-governance/e-business/e-society, such as e-transaction laws, consumer protection laws, cyber-crime laws, and data privacy and protection laws. The trend indicates that the law is vital in establishing trust in online transactions.

A review of literature on e-commerce and consumer protection suggests that over the years, consumer protection in e-commerce has received significant attention, particularly from the regulatory authorities-government agencies, trade associations and other associated actors (Belwal et al., 2020; Cortés, 2010; Dhanya, 2015; Emma et al., 2017; Ibidapo-Obe, 2011; ITU, 2018; Jaipuriar et al., 2020; Rothchild, 1999; Saif, 2018). The OECD (2016), UNCTAD (2017), and World Economic Forum (2019) guidelines on e-commerce have facilitated countries to have regulations/laws to provide online customers with data privacy, safe transaction and build trust. Table 2 explains policy guidelines on consumer protection based on a summary of online consumer challenges and possible remedies at different purchases stages.

Research Issue and Objective

The research gap identification involves reviewing the literature on various aspects of e-commerce and consumer rights protection issues spanning two decades. An objective review of 36 highly rated (Scopus/Web Services/ABDC Ranking or the like) e-commerce related publications from over 100 articles published in the last 20 years (2000–2020) suggests that the vast majority of earlier studies in this field have been conceptual/theoretical and generic. Regarding the legal framework of e-commerce and consumers’ rights protection, six current papers exclusively in the Indian context were available for analysis and review. The observations are that while the focus on consumer privacy and rights protection concerns is too general, the legal framework's scrutiny has limited its scope. A review of selected studies on trust and consumer rights protection in e-commerce, as shown in Table 3, reveals that application aspects, particularly legal issues, are lacking. Indian experience in e-commerce consumer rights protection through jurisprudence is nascent. Review studies show the research of a combination of management and law-related analysis in e-commerce and consumer rights protection is lacking. This scenario showed a gap in exploring a more comprehensive research opportunity in the Indian context.

While e-commerce and electronic transactions have evolved as a global trend, it is noteworthy that Indian customers are still reluctant to place complete confidence and trust in commercial online transactions. Compared to conventional offline customers, online customers face greater risk in cyberspace because they negotiate with unknown vendors and suppliers.Footnote 16 The common issuesFootnote 17 related to e-commerce are data privacy and security, product quality, uncertain delivery, no/low scope of replacement, the jurisdiction of filing complaints, and inconceivable terms and conditions (Lahiri, 2018). “Country of origin” of the product is a significant issue in e-commerce, particularly in cross-border transactions (Bhattacharya et al., 2020). The inadequacy of the Consumer Protection Act, 1986 and other associated laws has surged the insecurity and lack of trust among online customers. The significance of digital payments pursued by the Government of India's essential demonetisation policy-2016 has pushed for online transaction security and consumer protection in e-commerce activities. Therefore, the Consumer Protection Act, 2019Footnote 18 replaced the Consumer Protection Act 1986 and became effective with effect from 20 July 2020,Footnote 19 while on 7 July 2020, the Consumer Protection (E-commerce) Rules, 2020Footnote 20 came into force to address the e-commerce challenges. Nevertheless, it was evident that to attract additional investment and to engage with the global market, India, as an emerging country, had to gain the confidence of e-consumers.

These two legislations primarily govern domestic e-commerce businesses. Therefore, the research focuses on these two legal infrastructure strands-new laws enacted during 2019 and 2020 and discusses their implications for online consumer security to increase customers' interest and trust in India's electronic transactions. Like the ABI model, the study also examines the factors influencing e-commerce customers' confidence in the present research context.

Methodology

The research initially depended on the rigorous review of the consumer protection guidelines released from time to time by various bodies, such as the OECD and UNCATD, accompanied by an analysis of the Indian consumer protection legal structure. The Indian Consumer Protection Act, 2019 and the Consumer Protection (E-commerce) Rules, 2020 were the review and analysis subjects. The study used e-commerce driver data collected from secondary sources-published material; the survey reported e-commerce growth and trends and consumer protection and conducted an online survey of 432 online consumers during August and September 2020.

Analysing the arguments of Zikmund (2000), Bryman (2004), Saumure & Given (2008), Bill et al., (2010) and Bornstein et al. (2013) about the representative of convenience sampling and bias, we consider it is similar to that of the population, and there is no harm with due care. Regarding inherent bias in convenience sampling, data collection from different sources with different respondents’ inclusion provides more data variability and considerably reduces prejudice (Sousa et al., 2004; Edgar and Manz, 2017). Therefore, the respondents included in the research were students, professors, advocates, doctors, professionals, and homemakers, avoiding excluding family, relatives and friends to ensure bias-free. Their contact details sources were various channels, including public institution websites, social networking sites, and the authors’ email box. Assuming that more respondents feel fun filling out online questionnaires and providing truthful answers (Chen & Barnes, 2007; Saunders et al., 2007), the study used an online survey. Furthermore, because people in the digital age are more computer/smartphone savvy, they are more likely to follow a similar trend. Besides, such a technique was convenient during the COVID-19 pandemic condition because of its timeliness, inexpensive methods, ease of research, low cost (no support for this research), readily available, and fewer rules to follow. The respondents' contact details sources were various channels, including public institution websites, social networking sites, and the authors' email box.

The study used a structured questionnaire comprising seven questions with sub-questions except the 7th one being open-ended, consuming about 8–10 min, designed based on the insights gained from responding to customer surveys of different e-commerce companies last year. Pretesting the questionnaire with 17 responses from the target group supported modifying the final questionnaire partially. The first four questions were background questions-gender, age, respondent's attitude towards internet purchasing. Question number five with sub-questions, being the focused question, provided the answer to some trust-building factors found in the literature review. Following previous research (McKnight et al., 2002; Corbit et al., 2003; Pavlou, 2003) tested the Likert-scale, this question's solicited response relied on a five-point Likert-rating scale (1 = Not important at all, 2 = Less important, 3 = Somewhat important, 4 = Important, 5 = Very important). The query six asked was about the consumer protection issues in e-commerce/online transaction-scam/fraud and grievance settlement. The final question seven was open-ended for any remark the respondent wanted to make. The questionnaire was reliable on a reasonable basis with greater internal consistency on overall internal reliability (Cronbach's alpha = 0.829) at a 1% level of significance. The Zoho Survey technique was used to solicit required information. The response rate was 76% (327) of the total emails sent (432). The retained responses were 290, i.e. 88.69% of the replies received, completed in all respects and satisfying the research requirement. The research applied statistical instruments like percentage, weighted mean and multiple regression analysis using SPSS-26 for analysis and interpretation.

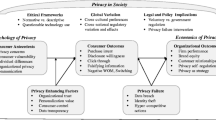

Figure 5 highlights the research framework and process.

Analysis

Deficiency in Act, 1986 and Key Feature of the New Act Governing E-Commerce Consumer Protection

The rapid development of e-commerce has led to new delivery systems for goods and services and has provided new opportunities for consumers. Simultaneously, this has also exposed the consumer vulnerable to new forms of unfair trade and unethical business. The old Act, 1986, has severe limitations regarding its applicability and adjudication processes in consumer rights protection in e-commerce. The new Act, 2020 brings fundamental changes regarding its scope of application, penalty and governance; and envisages CCPA and vests regulating and controlling powers. Table 4 explains the comparative picture between the old Act, 1986 and the new Act, 2019.

The Act, 2019 applies to buying or selling goods or services over the digital or electronic network, including digital products [s.2 (16)] and to a person who provides technologies enabling a product seller to engage in advertising/selling goods/services to a consumer. The Act also covers online market places or online auction sites [s.2 (17)].

Necessary definition/explanation connected to e-commerce provided by the Act are:

Consumer: Meaning

If a person buys any goods and hires or avails any service online through electronic means, the person would be a consumer of the Act [Explanation b to s.2 (7)].

Product Seller: Electronic Service Providers

The electronic service providers are the product sellers under the Act and have the same duties, responsibilities, and liabilities as a product seller [s.2 (37)].

Unfair Trade Practice: Disclosing Personal Information

Unfair trade practice under the Act [s.2 (47) (ix)] refers to electronic service providers disclosing to another person any personal information given in confidence by the consumer.

Authorities: Central Consumer Protection Authority (CCPA)

The Act, 2019 provides, in addition to the existing three-tier grievance redress structure, the establishment of the Central Consumer Protection Authority [CCPA] [s.10 & 18] to provide regulatory, investigative or adjudicatory services to protect consumers’ rights. The CCPA has the powers to regulate/inquire/investigate into consumer rights violations and/unfair trade practice suo motu or on a complaint received from an aggrieved consumer or on a directive from the government. The specific actions it can take include:

-

Execute inquiries into infringements of customer rights and initiate lawsuits.

-

Order for the recall of dangerous/hazardous/unsafe products and services.

-

Order the suspension of unethical commercial practises and false ads.

-

Impose fines on suppliers or endorsers or publishers of false advertising.

The power of CCPA is categorical regarding dangerous/hazardous/unsafe goods and false/misleading advertisements. The CCPA has the authority to impose a fine ranging from Rs 100 k to Rs 5 million and/imprisonment up to life term for the violators depending on the type of offences committed by them (Table 5).

Redress Mechanism

The provisions laid down in Sect. 28 through Sect. 73 deal with various aspects of the consumer dispute redress system. The new Act has changed the District Consumer Dispute Redressal Forum terminology to the District Consumer Dispute Redressal Commission. The pecuniary jurisdiction of filling complaints in the three-tier consumer courts at the District, State and National level has increased (Table 5). For better understanding, Fig. 6 shows a diagrammatic picture of the judicial system of dispute settlement.

Mediation

The Act, 2019 provides a dispute settlement mechanism through the mediation process in case of compromise at the acceptance point of the complaint or some future date on mutual consent (Sec 37). A mediation cell would operate in each city, state, national commission, and regional bench to expedite redress. Section 74 through 81 of the Act lays down the detailed procedure. Section 81(1) maintains that no appeal lies against the order passed by Mediation, implying that the redress process at the initial stage would be speedy, impacting both the consumers and service providers.

Consumer Protection (E-Commerce) Rules, 2020

The Consumer Protection (E-Commerce) Rules, 2020, notified under the Consumer Protection Act, 2019 on 23 July 2020, aims to prevent unfair trade practices and protect consumers' interests and rights in e-commerce.

Applicability (Rule 2)

The Rules apply to:

-

i.

Both products and services acquired or sold through automated or electronic networks;

-

ii.

All models of e-commerce retail;

-

iii.

All the e-commerce entities, whether they have inventory or market place model. The inventory-based model includes an inventory of goods and services owned by an e-commerce entity and directly sold to consumers [Rule 3(1) f]. In the marketplace model, an e-commerce entity has an information infrastructure platform on a digital and electronic network that facilitates the consumer and the seller. [Rule 3(1)g];

-

iv.

All aspects of unfair trading practise in all models of e-commerce; and

-

v.

An e-commerce entity is offering goods or services to consumers in India but not established in India.

General Duties of E-commerce Entities (Rule 4)

The duties of e-commerce entities are:

-

i.

An e-commerce entity must be a company incorporated under the Companies Act.

-

ii.

Entities must appoint a point of contact to ensure compliance with the Act.

-

iii.

They have to establish an adequate grievance redress mechanism; they would appoint a grievance officer for this purpose and display his name, contact details, and designation of their platform. He would acknowledge the complaint's receipt within 48 h and resolve the complaint within a month from receipt of the complaint.

-

iv.

If they are offering imported goods, the importers’ names and details from whom the imported goods are purchased, and the sellers’ names are to be mentioned on the platform.

-

v.

They cannot impose cancellation charges on consumers unless they bear similar costs.

-

vi.

They have to affect all payments towards accepted refund requests of the consumers within a reasonable period.

-

vii.

They cannot manipulate the goods' prices to gain unreasonable profit by imposing unjustified costs and discriminating against the same class of consumers.

Liabilities of Marketplace E-commerce Entities (Rule 5)

The liabilities of marketplace e-commerce entities include the following:

-

i.

The marketplace e-commerce entity would require sellers to ensure that information about goods on their platform is accurate and corresponds with the appearance, nature, quality, purpose of goods.

-

ii.

They would display the following information prominently to its users at the appropriate place on its platform:

-

•

Details about the sellers offering goods-principal geographic address of its headquarters and all branches and name and details of its website for effective dispute resolution.

-

•

Separate ticket/docket/complaint number for each complaint lodged through which the user can monitor the status of the complaint.

-

•

Information about return/refund/exchange, warranty and guarantee, delivery and shipment, payment modes and dispute/grievance redress mechanism.

-

•

Information on the methods of payment available, the protection of such forms of payment, any fees or charges payable by users.

-

iii.

They would make reasonable efforts to maintain a record of relevant information allowing for the identification of all sellers who have repeatedly offered goods that were previously removed under the Copyright Act/Trademarks Act/Information Technology Act.

Sellers’ Duties on the Marketplace (Rule 6)

The duties of sellers on the market encompass:

-

i.

The seller would not adopt any unfair trade practice while offering goods.

-

ii.

He should not falsely represent himself as a consumer and post-product review or misrepresent any products' essence or features.

-

iii.

He could not refuse to take back goods purchased or to refund consideration of goods or services that were defective/deficient/spurious.

-

iv.

He would have a prior written contract with the e-commerce entity to undertake sale.

-

v.

He would appoint a grievance officer for consumer grievance redressal.

-

vi.

He would ensure that the advertisements for the marketing of goods or services are consistent with the actual characteristics, access and usage conditions of goods.

-

vii.

He will provide the e-commerce company with its legal name, the primary geographic address of its headquarters and all subsidiaries/branches, the name and details of the website, e-mail address, customer contact details such as faxes, landlines and mobile numbers, etc.

Duties and Liabilities of Inventory E-commerce Entities (Rule 7)

As in the inventory-based model, inventory of goods and services is owned and sold directly to consumers by e-commerce entities, so inventory e-commerce entities have the same liabilities as marketplace e-commerce entities and the same duties as marketplace sellers.

The Act 2019 has several provisions for regulating e-commerce transactions with safety and trust. Since the Act is new, it would be premature to comment on its operational aspects and effectiveness. In a recent judgement in Consumer Complaint No 883 of 2020 (M/s Pyaridevi Chabiraj Steels Pvt. Ltd vs National Insurance Company Ltd, the NCDRCFootnote 21 has proved the Act's operational effectiveness by deciding the maintainability of a claim's jurisdiction based on the new Act's provisions. However, it is inevitable that "beware buyer" will be replaced by "beware seller/manufacturer"; the consumer will be the real king. The Rules 2020 strike a balance between the responsibilities of e-commerce business owners and on-the-platform vendors. Contravention, if any, of the new regulation/rules would invite the provisions of the Act 2019. The observation is that limited liability partnerships are missing from the e-commerce entities. However, with the Act and Rules' operational experience, the judiciary or legislature will address this issue sooner or later.

Nevertheless, the Rules 2020 provide a robust legal framework to build consumers' trust in e-commerce transactions and protect their rights and interests, thereby proving the notion, "consumer is the king". The COVID-19 impact has pushed the government to adopt and encourage online compliant filling procedures through the National Consumer Helpline. Using various APPs is likely to expedite the adjudication process and benefit the aggrieved consumer and build trust in the governance system.

Discussion

Reading the Rules, 2020, with the Act, 2019, the observation is that by making smartphones the primary target of the new legislation, the Act, 2019 is hailed as an all-inclusive regulatory regime that would raise customer interest investment in e-commerce. To safeguard consumers' rights in all modern-day retail commerce models, the Act, 2019 attempts to turn the jurisprudence pervading consumer protectionism from a caveat emptor to a caveat seller. In addition, the Act formally incorporated e-commerce within its limits and entered the realm of B2C e-commerce. One crucial takeaway benefit for consumers is simplifying the complaint filing process, enabling consumers to file complaints online and redress grievances.

E-commerce has become a gift to all customers in the COVID-19 pandemic's aftermath. The E-Commerce Rules, 2020 follow the stringent consumer protection regime under the new Act, 2019. In the raging pandemic, the timing of the E-Commerce Rules, 2020 is beneficial considering the current limitations on customers' freedom of travel and increased reliance on e-commerce. The grievances redress mechanism as provided in the Rules, 2020 is indubitably a calibrated step ensuring neutrality in the e-commerce market place, greater transparency, stringent penalties and a striking balance between the commitments of e-commerce firms and vendors in the marketplace. The mandatory provisions of appointing a consumer grievance redress officer and a nodal contact person or an alternative senior appointed official (resident in India) with contact details, acknowledging consumer complaints within 48 h of receipt with a ticket number, and resolving complaints within 1 month of receipt are unquestionably beneficial to consumers. Although each e-commerce company has its refund policy, all refund claims must have a timely settlement. However, anxiety abounds as daily online fraud and unethical trading practices have made consumers fearful of exposing themselves to unscrupulous vendors and service providers. Moreover, the regulations' effective enforcement would dissuade unethical retailers and service providers, thereby building consumer trust, which time will see.

Practical Contributions

The practical contributions of the paper emerge from survey findings. Concerning the primary survey, the male–female ratio is nearly 1:1, with an average age of 36 years in the age range of 20–65. As regards profession, 67% were working professionals, and 22% were students. While all of the respondents were computer/tablet/mobile-savvy, 96% had at least a five-time online shopping experience during the last 7 months between January–July 2020. The desktop with 61% response is still the preferred device for online shopping. The pricing with cash on delivery, shipping convenience, and quality reviews determined online shopping factors. About 57% of them agreed that COVID-19 impacted their online purchase habits and pushed for online transactions even though they feared insecurity about online shopping. The primary concerns were low-quality products at a high price, a refund for defective products, and a delay in settlement of wrong/excess payments. The top five leading e-commerce platforms reported were Amazon, Flipkart, Alibaba, Myntra, and IndiaMart. Netmeds was also a leading e-commerce business platform in the pharmaceutical sector. During the COVID-19 pandemic, JioMart was very popular for home-delivery food products, groceries and vegetables in the metro locality. The customer feedback system was found robust on Amazon.

The respondents' trust in online shopping reveals that a secure and reliable system was essential for 93% of the respondents. For nearly the same proportion, information about how e-business firms work provided security solutions was a priority factor. Choosing a payment option, 76% of the respondents prioritised “cash on delivery-online transfer at the doorstep. Regarding the privacy of personal information shared by online shoppers, 52% said that they cared about this aspect. Factors like warranty and guarantee (67%) and customer service (69%) were important factors of trust-building with the e-entities. Information on the websites (easy navigation/user friendly and reviews) was either important or very important, with 77% of the respondents’ confidence building to buy online. Information about the product features and its manufacturer/supplier was essential to 86% of the respondents for trust-building on the product and the supplier (manufacture) and e-commerce entity. Along with the ABI model discussed above, the presumption is that security, privacy, warranty/guarantee, customer service, and website information factors positively influence e-commerce customers' trust.

Multiple regression analysis suggests that as the P = value of every independent variable is below 0.05% level of significance, the independent variables security, privacy, warranty, customer service, and website information are all significant. Alternatively, the overall P value of 0.032 with R2 0.82 supports the presumption that security, privacy, warranty/guarantee, customer service, website information factors have a combined influence on e-commerce customers' trust.

Given this backdrop, Table 6 summarises the micro findings on respondents' online shopping behaviour, their trust and safety aspects, and understanding of the provisions of the new Act, 2019 and Rules, 2020. The higher mean value for a sub-factor implies higher importance attached to the factor by the respondents. P value at a 5% level of significance explains an individual element's contribution to trust-building behaviour for online buying.

Managerial Insights

The first observation from the data analysis is that, comparatively, the younger generation is prone to online shopping; it goes along with Xiaodong and Min (2020). Secondly, the respondents of all age groups have online buying experience even in a pandemic situation forced by COVID-19, compromising their safety and security concerns. The third observation is that factors like “cash on the delivery option (COD)”, adequate information on the e-commerce entity corporate website, and effective grievance/complaint redress mechanism are the three crucial factors that build consumers’ trust in e-commerce transactions. The reason probably is that this Act and Rules are new and significant dispute (s) could yet be reported seeking invoking the relevant provisions of the Act and Rules in an appropriate legal forum.

Further, the logical observation of the COD option being a perceived influential factor in trust-building emanates from the fact that protection and security are the essential elements that make customers hesitant toward utilizing other e-payment options. The studies by Mekovec and Hutinski (2012), Maqableh (2015) and Ponte et al.(2015); have similar views. However, post-demonetization (2016), India is growing with more digital payments. In this context, we value Harvard researchers Bandi et al. (2017) contention that customers who switch to digital payments maintain their purchasing recurrence but spend more and are less likely to restore their purchases. The firms in emerging markets may appreciate gains from customer interest, notwithstanding operational increases from payment digitalization. The coherent perception about the impact of website information on trust-building is in line with the findings of Brian et al. (2019) that the online information source creates a spill-over effect on satisfaction and trust toward the retailer. The implication of the need for an effective grievance redress mechanism is that trust-building would be a tricky proposition if the company cannot ensure dedicated and tailored customer service and support. Kamari and Kamari (2012) and Mangiaracina and Perego (2009) had comparative perspectives likewise.

The final observation is that the level of trust required to engage in online shopping/transaction varies among the respondents depending on their trust perception level. The younger generation, less than 35 years old, is more risk-taking when it comes to pre-purchase online payment, but women over 45 years old are a little hesitant and prefer to do their online shopping with payment at the time of placing an order. This is ostensibly because the younger generation is more tuned to network connectivity via smartphone/tablet, and they perceive online transactions as less dangerous. The present research findings on the influence of security, privacy, warranty/guarantee, customer service, and website information on e-commerce customers' confidence-building support the earlier discussed ABI model proposition (Mayer et al., 1995; Cazier, 2007; Helge et al., 2020). The R2-value of 0.82 implies that there are other factors beyond what is studied. The other probable factor (s) that might have influenced trust is the new Act and Rules' effectiveness in protecting online consumers' interests. The new regulations need a couple of years (at least 2 years) of operational experience for proper assessment. The Act 2019 appears robust to protect consumer rights and interests of e-commerce customers with specific regulations (i.e. Consumer Protection (E-Commerce) Rules, 2020) in force, helping the country's economic growth.

The study variably supports Nehf (2007) view that consumers make decisions about distributing their data in exchange for different benefits like, e.g., information on web sites and access to databases. Trust, credibility, privacy issues, security concerns, the nature of the information on the website, and the e-commerce firm's reputation directly influence consumers' internet trust (Kim et al., 2008). Trust is the focal point of online consumers' decision-making; the observation endorses Larose and Rifon (2007) creation of privacy alerts as part of consumer privacy self-regulation initiatives and the use of a social cognitive model to consider consumer privacy behaviours. Besides, data privacy and trust breaches adversely affect the firm's market value (Tripathi & Mukhopadhyay, 2020) also hold good in the present context. Figure 7 demonstrates a diagrammatic model of trust of the consumer on e-commerce transactions leading to his decision-making.

Limitations

Every research has more or less some limitations; this one has too. The main impediment was the non-availability of adequate literature defining the impact assessment of the legal framework of consumer protection measures in e-commerce. The probable reasoning is that the Acts/Laws governing e-commerce and online consumer rights protection under consideration are new; ethical dispute resolution and judicial interventions have only recently begun. Sample size limitation is also a hindering factor in the generalisation of the findings. The observations and managerial insights are likely to change with a few more years of implementation experience of the Acts.

Conclusions, Implications and Future Research

Conclusions

Lack of trust in goods and their suppliers/manufacturers was one of the primary reasons for people not buying online. The widespread internet penetration and the growing use of computer/tablets/smartphones have pushed e-commerce growth across countries, including India. The rapid e-commerce development has brought about new distribution methods. It has provided new opportunities for consumers, forcing consumers vulnerable to new forms of unfair trade and unethical business. Further, the government's measures to protect consumer rights, particularly online consumers, are inadequate. Hence, the government enacted the Consumer Protection Act, 2019 and the Consumer Protection (E-commerce) Rules, 2020 and made them effective from July 2020. The new Act and Rules have less than 6 months of operational experience, implying premature comment on its effectiveness in providing safety and security to online consumers. However, online consumers' positive responses suggest that people gain confidence in online shopping with safety and security. Because consumer rights protection is paramount in the growth of e-commerce, the new regulations strengthen the grievance redress mechanism of online consumers, ensuring their trust-building ability, safety, and security. The "Consumer is the King with power" now. The new reform, i.e., enactment of the two laws, aids in doing business too. Some legal complications may arise with more operational experience in the future. Still, with judiciary intervention and directives, the online consumer's safety and security will pave the growth of e-commerce in India.

Implications

Some stakeholders have apprehension about the new Act and Rules' effectiveness because of the slow judiciary process, inadequate infrastructure support, and corrupt practices. The findings provide some practical implications for consumer activists, policymakers, and research communities to explore how to strengthen trust-building among online consumers. Regarding theoretical implications, the research improves the scientific community's understanding of the existing body of knowledge about online trust and e-consumer protection. The article further contributes to the body of literature on e-commerce and consumer protection, understanding the crucial factors impacting customer trust and loyalty and provides an insightful perspective on e-consumer protection in the Indian context on the eve of the new legislation enacted in 2019–2020.

Future Research

Given the presumption that e-commerce and trust are areas of constant change, trust in e-commerce will change, and it will be more challenging to integrate e-commerce into people's lives. The scope for further research to test the effectiveness of the Act, 2019, and Rule, 2020 in redressing e-commerce consumers' grievances and protecting their rights is wider only after a couple of years of operational experience. The government's policy drive for accelerating online transactions also poses challenges considering the importance of trust-building and consumer rights protection in e-commerce. Future research would shed more light on these issues.

Notes

See The United Nations Economic Commission for Europe (UNECE) guidelines on e-commerce https://www.unece.org/fileadmin/DAM/stats/groups/wggna/GuideByChapters/Chapter_13.pdf, pp 249–263, Accessed 7 October 2020.

Consumer International is a champion in the sustainable consumer movement for the last 60 years. Its vision for the future of 2030 is to address three issues-sustainability, digitalization and inclusion. See for more details https://www.consumersinternational.org/who-we-are/.

econsumer.gov came into being in April 2001, addresses international scams and guides its members to combat fraud worldwide; see for details https://econsumer.gov/#crnt.

For more details, refer to https://icpen.org/consumer-protection-around-world.

For a detailed report, see https://www.worldretailcongress.com/__media/Global_ecommerce_Market_Ranking_2019_001.pdf, Accessed 10 October 2020.

Complete report available at https://business.adobe.com/resources/digital-economy-index.html, Accessed 10 October 2020.

https://www.ibef.org/news/vision-of-a-new-india-US$-5-trillion-economy, Accessed 7 October 2020.

Government of India’s press release, see https://pib.gov.in/PressReleseDetailm.aspx?PRID=1603982, Accessed 7 October 2020.

See CUTS International survey at https://cuts-citee.org/pdf/Discussion_Paper_E-Commerce_in_the_Context_of_Trade_Consumer_Protection_and_Competition_in_India.pdf, CSA Research at https://insights.csa-research.com/reportaction/305013126/Marketing, https://insights.csa-research.com/reportaction/305013125/Marketing, and UNTAD study at https://unctad.org/page/data-protection-and-privacy-legislation-worldwide, Accessed 12 December 2020.

https://innovationtactics.com/business-model-canvas-airbnb/, Accessed 12 December 2020.

Detailed findings at https://insights.csa-research.com/reportaction/305013125/Marketing, Accessed 19 October 2020.

Amazon India began testing a Hindi for its mobile website, marking its first foray into vernacular languages in August 2018.

Flipkart started voice assist in multiple languages-Hindi and English to make shopping easier in June 2020.

See cross-border shopping statistics and trends at https://www.invespcro.com/blog/cross-border-shopping/, Accessed 15 October 2020.

For global trend-access, explore, and personalized insights, see details at https://www.forrester.com/data/forecastview/reports#, Accessed 15 October 2020.

For defined common issues, see Government’s e-gazette at http://egazette.nic.in/WriteReadData/2020/220661.pdf, Accessed 15 October 2020.

https://consumeraffairs.nic.in/sites/default/files/Act%20into%20force.pdf, Accessed 30 October 2020.

See Government’s e-gazette notification http://egazette.nic.in/WriteReadData/2019/210422.pdf, Accessed 30 October 2020.

Government of India’s press release see https://pib.gov.in/Pressreleaseshare.aspx?PRID=1656161 and for detailed Rules see https://consumeraffairs.nic.in/theconsumerprotection/consumer-protection-e-commerce-rules-2020.

Full reported case details are available at https://indiankanoon.org/doc/49459460/, Accessed November 22, 2020.

References

Agag, G. (2019). E-commerce ethics and its impact on buyer repurchase intentions and loyalty: An empirical study of small and medium Egyptian businesses. Journal of Business Ethics, 154, 389–410. https://doi.org/10.1007/s10551-017-3452-3.

Agag, G., & El-Masry, A. (2016). Understanding consumer intention to participate in online travel community and effects on consumer intention to purchase travel online and WOM: An integration of innovation diffusion theory and TAM with trust. Computers in Human Behavior, 60, 97–111. https://doi.org/10.1016/j.chb.2016.02.038.

Ayilyath, M. (2020). Consumer protection in E-commerce transactions in India—need for reforms, SSRN. https://doi.org/10.2139/ssrn.3571069.

Azamat, N., Rashad, Y., Shahriar, M., Behrang, S., & Menon, M. (2011). The evolution and development of E-commerce market and E-cash. SSRN Electronic Journal. https://doi.org/10.1115/1.859858.

Bandi, C., Ngwe D., Moreno, A., & Xu Z. (2017). The effect of payment choices on online retail: Evidence from the 2016 Indian demonetization, https://www.hbs.edu/faculty/Publication%20Files/19-123_ea5e9c88-8207-4aef-acb5-b206333b70dc.pdf. Accessed 15 Oct 2020.

Belanche, D., Flavián, M., & Pérez-Rueda, A. (2020). Mobile apps use and WOM in the food delivery sector: The role of planned behavior, perceived security and customer lifestyle compatibility. Sustainability, 12(10), 4275. https://doi.org/10.3390/su12104275.

Belwal, R., Al Shibli, R., & Belwal, S. (2020). Consumer protection and electronic commerce in the Sultanate of Oman. Journal of Information, Communication and Ethics in Society. https://doi.org/10.1108/JICES-09-2019-0110.

Bhattacharya, S., Sanghvi, K., & Chaturvedi, A. (2020). India: E-Commerce Rules, https://www.mondaq.com/india/dodd-frank-consumer-protection-Act/976876/e-commerce-rules-2020#:~:text=The%20Rules%20restrict%20the%20sellers,that%20represent%20an%20inaccurate%20picture. Accessed 12 Oct 2020.

Bill, A., Tom T., & Donna, T. (2010). Chapter 2-Planning the study. In Beyond the Usability Lab, Conducting Large-scale Online User Experience Studies (pp. 17–47). ScienceDirect. https://doi.org/10.1016/B978-0-12-374892-8.00002-8

Boateng, R., Heeks, R., Molla, A., & Hinson, R. (2008). E-commerce and socio-economic development: Conceptualizing the link. Internet Research, 18, 562–594. https://doi.org/10.1108/10662240810912783.

Bolton, G., Katok, E., & Ockenfels, A. (2004). How effective are electronic reputation mechanisms? An experimental investigation. Management Science, 50(11), 1587–1602. http://www.jstor.org/stable/30047967. Accessed 10 Dec 2020.

Bornstein, M. H., Jager, J., & Putnick, D. L. (2013). Sampling in developmental science: Situations, shortcomings, solutions, and standards. Developmental Review, 33, 357–370. https://doi.org/10.1016/j.dr.2013.08.003.

Brian, I. S., O’Neill, B. S., & Terence, T. O. (2019). The upside of showrooming: How online information creates positive spill-over for the brick-and-mortar retailer. Journal of Organizational Computing and Electronic Commerce, 29(4), 294–315. https://doi.org/10.1080/10919392.2019.1671738.

Bryman, A. (2004). Social research methods. 2nd Edition, Oxford University Press, New York, 592.

Cazier, J. A. (2007). A framework and guide for understanding the creation of consumer trust, Journal of International Technology and Information Management, 16(2). https://scholarworks.lib.csusb.edu/jitim/vol16/iss2/4. Accessed 14 Oct 2020.

Chandni, G. (2017). Carving the map for a protected consumer: Establishing the need of a separate legislation for E-commerce, 6.1 NULJ, 123–138. SCC Online Web Edition. file:///E:/Downloads/Need%20for%20separate%20legislation.pdf. Accessed 22 Mar 2021.

Chen, Y-.H., & Barnes, S. (2007). Initial trust and online buyer behavior. Industrial Management and Data Systems, 107(1), 21–36. https://doi.org/10.1108/02635570710719034

Chia, T. S. (2014). E-Business; The New Strategies Ande-Business Ethics, that Leads Organizations to Success, Global Journal of Management and Business Research: A Administration and Management, 14(8), Version 1.0. https://globaljournals.org/GJMBR_Volume14/2-E-Business-The-New-Strategies.pdf. Accessed 15 Nov 2020.

Cockshott, P., & Dieterich, H. (2011). The contemporary relevance of exploitation theory. MARXISM 21(8), 206–236. https://doi.org/10.26587/marx.8.1.201102.009.

Corbitt, B., Thanasankit, T., & Yi, H. (2003). Trust and e-commerce: a study of consumer perceptions. Electronic Commerce Research and Applications, 2, 203–215. https://doi.org/10.1016/S1567-4223(03)00024-3

Cortés, P. (2010). Online dispute resolution for consumers in the European Union. In Routledge Research in IT and E-commerce Law, Routledge, London. https://www.econstor.eu/bitstream/10419/181972/1/391038.pdf.

Daniel, D.B. (2005). Inequality of bargaining power, 76 U. Colo. L. Rev. 139. https://digitalcommons.law.msu.edu/facpubs/107/. Accessed 17 Aug 2020.

Dhanya, K.A. (2015). Consumer protection in the E-commerce Era. International Journal of Legal Research, 3(4):1. https://ssrn.com/abstrAct=3489753. Accessed 6 July 2020.

Durovic, M. (2020). International consumer law: What is it all about? Journal of Consumer Policy, 43(125–143), 2020. https://doi.org/10.1007/s10603-019-09438-9.

Eastlick, M., Lotz, S.L., & Warrington, P. (2006). Understanding online B-to-C relationships: An integrated model of privacy concerns, trust, and commitment. Journal of Business Research, 59, 877–886. https://doi.org/10.1016/j.jbusres.2006.02.006.

Edgar, T. W., & Manz, D. O. (2017). Research Methods for Cyber Security. Elsevier. ISBN:9780128129302.

Elbeltagi, I., & Agag, G. (2016). E-retailing ethics and its impact on customer satisfaction and repurchase intention: A cultural and commitment-trust theory perspective. Internet Research, 26(1), 288–310. https://doi.org/10.1108/IntR-10-2014-0244.

Emma, P., Sara, F., Marta, S., & Ana, G. (2017). Exploratory study of consumer issues in online peer-to-peer platform markets. European Commission. file:///C:/Users/BASANT~1/AppData/Local/Temp/Annex5_Task5_ReportMay2017pdf.pdf. Accessed 6 July 2020.

Fang, Y., Chiu, C., & Wang, E. T. G. (2011). Understanding customers’ satisfaction and repurchase intentions: An integration of IS success model, trust, and justice. Internet Research, 21(4), 479–503. https://doi.org/10.1108/10662241111158335.

Freestone, O. & V. W. Mitchell. (2004) Generation Y attitudes towards E-ethics and Internet-related Misbehaviours. Journal of Business Ethics, 54, 121–128, http://www.jstor.org/stable/25123331. Accessed 27 Nov 2020.

Grabner-Kraeuter, S. (2002). The role of consumers’ trust in online-shopping. Journal of Business Ethics, 39, 43–50. https://doi.org/10.1023/A:1016323815802.

Harrigan, M., Feddema, K., Wang, S., Harrigan, P., & Diot, E. (2021). How trust leads to online purchase intention founded in perceived usefulness and peer communication. Journal of Consumer Behaviour: An International Research Review, 1-16. https://doi.org/10.1002/cb.1936.

Harrisson, B., Jean, P., & Dahl, B. (2017). 10 eCOMMERCE TRENDS FOR 2018. Project: Growth Strategies in an Omnichannel Retail Context. https://doi.org/10.13140/RG.2.2.34264.19205.

Haupt, S. (2003). An economic analysis of consumer protection in Con-trAct law. German Law Review, 4(11), 1137–1164. https://static1.squarespace.com/static/56330ad3e4b0733dcc0c8495/t/56b96e2f22482e110fab1f78/1454992944362/GLJ_Vol_04_No_11_Haupt.pdf. Accessed 6 Oct 2020.

Helge, S., Anne, H., & Guido, M. (2020). The function of ability, benevolence, and integrity-based trust in innovation networks. Industry and Innovation, 27(6), 585–604. https://doi.org/10.1080/13662716.2019.1632695.

Husted, B. W., & Allen, D. B. (2008). Toward a model of cross-cultural business ethics: The impact of individualism and collectivism on the ethical decision-making process. Journal of Business Ethics, 82(2), 293–305. https://doi.org/10.1007/s10551-008-9888-8.

Ibidapo-Obe, T. (2011). Online consumer protection in E-commerce transactions in Nigeria: An analysis. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2683927.

Išoraitė, M., & Miniotienė, N. (2018). Electronic commerce: Theory and practice. Integrated Journal of Business and Economics. https://doi.org/10.33019/ijbe.v2i2.78.

ITU. (2018). Big data, machine learning, consumer protection and privacy. https://www.itu.int/en/ITU-T/extcoop/figisymposium/2019/Documents/Presentations/Big%20data,%20Machine%20learning,%20Consumer%20protection%20and%20Privacy.pdf. Accessed 6 July 2020.

Jain, S., & Jain, S. (2018). E-commerce and competition law: Challenges and the way ahead. Indian Competition Law Review, 3, 7–32.

Jaipuriar, A., Khera, A., & Ganguly, S. (2020). Consumer protection (e-commerce) rules, 2020: A compliance framework in the digital market. https://www.mondaq.com/india/dodd-frank-consumer-protection-act/977768/consumer-protection-e-commerce-rules-2020-a-compliance-framework-in-the-digital-market. Accessed 22 Sept 2020.

Kamari, F., & Kamari, S. (2012). Trust in electronic commerce: A new model for building online trust in B2C. European Journal of Business and Management, 4(10), 126–133.

Kerick, F. (2019). The growth of ecommerce. https://medium.com/swlh/the-growth-of-ecommerce-2220cf2851f3. Accessed 4 July 2020.

Khandelwal, P. (2018). Ease of doing E-commerce business in India : The FDI policy relating to Ecommerce and its impact on the Indian economy. RGNUL Financial and Mercantile Law Review, 20–37. https://cf9d2836-9a17-4889-b084-bc78a1bb74ee.filesusr.com/ugd/0fa0b3_d7453802d99a4dd7a20ff4b3886b1d04.pdf. Accessed 12 Dec 2020.

Kim, D. J., Ferrin, D. L., & Rao, H. R. (2008). A trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decision Support Systems, 44(2), 544–564. https://doi.org/10.1016/j.dss.2007.07.001.

Kracher, B., Corritore, C. L., & Wiedenbeck, S. (2005). A foundation for understanding online trust in electronic commerce. Journal of Information, Communication and Ethics in Society, 3(3), 131–141. https://doi.org/10.1108/14779960580000267.

Kumar, P., & Chandrasekar, S. (2016). E-Commerce trends and future analytics tools. Indian Journal of Science and Technology. https://doi.org/10.17485/ijst/2016/v9i32/98653.

Lahiri, A. (2018). Consumer protection in E-commerce in India. https://amielegal.com/consumer-protection-in-e-commerce-in-india/. Accessed 12 Oct 2020.

Larose, R., & Rifon, Nora, J. (2007). Promoting i-safety: Effects of privacy warnings and privacy seals on risk assessment and online privacy behavior. Journal of Consumer Affairs. https://doi.org/10.1111/j.1745-6606.2006.00071.x.

Lăzăroiu, G., Neguriţă, O., Grecu, I., Grecu, G., & Mitran, P. C. (2020). Consumers’ decision-making process on social commerce platforms: Online trust, perceived risk, and purchase intentions. Frontiers in Psychology, 11, 890. https://doi.org/10.3389/fpsyg.2020.00890.

Lee, O. M. K., & Turban, E. (2001). A trust model for consumer internet shopping. International Journal of Electronic Commerce. https://doi.org/10.1080/10864415.2001.11044227.

Leonidou, L. C., Kvasova, O., Leonidou, C. N., & Chari, S. (2013). Business unethicality as an impediment to consumer trust: The moderating role of demographic and cultural characteristics. Journal of Business Ethics, 112(3), 397–415. https://doi.org/10.1007/s10551-012-1267-9.

Lin, C., & Lekhawipat, W. (2014). Factors affecting online repurchase intention. Industrial Management & Data Systems, 114(4), 597–611. https://doi.org/10.1108/IMDS-10-2013-0432.

Liyang, H. (2019). Superior bargaining power: The good, the bad and the ugly. Asia Pacific Law Review, 27(1), 39–61. https://doi.org/10.1080/10192557.2019.1661589.

Loannis, L., Despoina, M., Gracia, M. D., Amber, D., & d Azza R. (2019). The global governance of online consumer protection and E-commerce-building trust, http://www3.weforum.org/docs/WEF_consumer_protection.pdf. Accessed 9 Oct 2020.

Majithia, V. (2019). The changing landscape of intermediary liability for E-commerce platforms : Emergence of a new regime. International Journal of Law and Technology, 15, 470–493..

Mangiaracina, R., & Perego, A. (2009). Payment systems in the B2C eCommerce: Are they a barrier for the online customer? Journal of Internet Banking and Commerce, 14(3), 1–16..

MaqablehMasa’deh, M. R., Shannak, R., & Nahar, K. (2015). Perceived trust and payment methods: An empirical study of MarkaVIP company. International Journal of Communications Network and System Sciences, 8(11), 409–427. https://doi.org/10.4236/ijcns.2015.811038.

Mayer, R. C., Davis, J. H., & Schoorman, F. D. (1995). An integrative model of organizational trust. Academy of Management Review, 20, 709–734. http://www.makinggood.ac.nz/media/1270/mayeretal_1995_organizationaltrust.pdf. Accessed 14 Oct 2020.

McCoubrey, H., & White, N. D. (1999). Textbook on jurisprudence (3rd ed.). Blackstone Press Limited.

Mcknight, D., Choudhury, V., & Kacmar, C. (2002). The impact of initial consumer trust on intentions to transact with a web site: A trust building model. The Journal of Strategic Information Systems, 11, 297–323. https://doi.org/10.1016/S0963-8687(02)00020-3.

McKinsey global institute. (2019). Digital India: Technology to transform a connected nation, https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/McKinsey%20Digital/Our%20Insights/Digital%20India%20Technology%20to%20transform%20a%20connected%20nation/MGI-Digital-India-Report-April-2019.pdf. Accessed 10 Oct 2020.

Mekovec, R., & Hutinski, Ž. (2012). The role of perceived privacy and perceived security in online market. In: Proceedings of the 35th international convention MIPRO (pp. 1549–1554). Institute of Electrical and Electronics Engineers. https://ieeexplore.ieee.org/document/6240857. Accessed 25 Oct 2020.

Milan, J., Antonio, G., & Niklas, A. (2020). Exploring the growth challenge of mobile payment platforms: A business model perspective. Electronic Commerce Research and Applications. https://doi.org/10.1016/j.elerap.2019.100908.