Abstract

This study explores the underlying drivers of US public pension funds’ tendency to tilt their portfolios towards companies with stronger corporate social responsibility (CSR). Studying the equity holdings of large, internally managed US state pension funds, we find evidence that the political leaning of their beneficiaries and political pressures by state politicians affect funds’ investment decisions. State pension funds from states with Democratic-leaning beneficiaries tilt their portfolios more strongly towards companies that perform well on CSR issues, and this tendency is intensified when the state government is dominated by Democratic state politicians. Moreover, we find that funds which tilt their portfolios towards companies with superior CSR scores generate a slightly higher return compared with their counterparts. Overall, our findings indicate that funds align their investment choices with the financial and non-financial interests of their beneficiaries when deciding whether to incorporate CSR into their equity allocations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

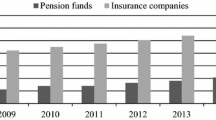

With holdings of USD 1.1 trillion in corporate stocks and an average ownership share of 7–8% of the total US equity market over the last decades,Footnote 1 US state pension funds are a major market force in the US and global financial markets (Tonello and Rabimov 2010). Their market power is highly concentrated in the largest state pension plans, providing these funds with enormous influence through their holdings of equity positions in large publicly traded companies.Footnote 2 And these funds increasingly use their power to promote positive change in the corporate governance and corporate social responsibility (CSR) performance of their holding companies, including the encouragement of desirable corporate behaviour such as environmental protection and better employment practices, as well as the avoidance of corporate behaviour which their beneficiaries may consider unethical.Footnote 3 In particular, several studies document a positive link between the ownership share of US state pension funds and the CSR performance of their portfolio companies (Johnson and Greening 1999; Neubaum and Zahra 2006; Di Giuli and Kostovetsky 2014). Furthermore, by 2013 nine state and local government pension plans had signed the United Nations-supported Principles for Responsible Investment (PRI) and thereby committed to incorporate aspects of CSR into investment practices, while since 2014 six additional state and local plans joined the PRI.Footnote 4

Relatively little is known about the determinants of state pension funds’ preferences for companies with stronger CSR performance, and the research that exists mainly regards public pension funds as one homogeneous investor class with respect to their motivation and propensity for incorporating CSR factors into their investment decisions.Footnote 5 However, only few public pension funds have developed an interest in CSR and have taken up leadership roles in promoting responsible investment practices. Hence, the question arises what motivates some US public pension funds to consider their investment targets’ CSR when making investment decisions. Following Aguilera et al.’s (2007) conceptual framework, institutional investors may consider CSR due to instrumental reasons, such as improving the financial performance of their portfolios, due to relational reasons based on claims by their stakeholders to account for CSR factors, or due to moral motives as they are guided by their own—or their beneficiaries’—norms and values. While much of the existing CSR literature is concerned with analysing the financial impact of CSR, both on the corporate level as well as for responsible investment strategies,Footnote 6 and hence focuses on instrumental motives, surprisingly little is known about the relational and moral drivers of institutional investors’ CSR preferences and the question whose morals should be guiding institutional investors’ investment processes. Our study aims to fill this gap by analysing whether US public pension funds’ propensity for incorporating CSR into their investment decisions is driven by instrumental, relational or moral motives. To do so, we focus on a sub-group of these funds that due to their strong beneficiary focus and relative independence in decision-making should be most prone and able to incorporate ethics in general and CSR in particular into investment processes (Ryan and Schneider 2002; Cox and Wicks 2011): large, internally managed public pension funds.Footnote 7

From the perspective of business ethics, these so far unexplored relational and moral drivers of public pension funds’ investment decisions are particularly relevant when analysing the role of morals in financial markets and the extent to which the incorporation of CSR into investment practices can foster the ethicalisation of investment processes, as argued in Cox and Wicks (2011), and may help to align funds’ investment practices with the interests and norms of their beneficiaries. In other words, if not even US public pension funds had a propensity to incorporate ethical considerations into their investment decision-making, then shareholder ethics, at least with regard to large institutional investors, may be considered a contradiction. If US public pension funds, however, are considering ethical aspects in their investment decision-making, then they may be a part or even an engine of the conceptual business revolution “to a more responsible capitalism” observed by Freeman (2017, p. 462) since the 2008 global financial crisis.

Based on Aguilera et al.’s (2007) conceptual framework and a review of the existing literature, we develop three channels that could explain the differences in public pension funds’ investment choices. First, drawing on the literature on the impact of political values (Hong and Kostovetsky 2012; Di Giuli and Kostovetsky 2014) and social norms (Cahan et al. 2017) on investment decision-making, public pension funds may be guided by their beneficiaries’ attitudes towards CSR, in line with Aguilera et al.’s relational and moral motives for CSR preferences. Hence, they may incorporate CSR criteria into their investment decisions if these are aligned with their beneficiaries’ attitudes towards CSR, as measured by beneficiaries’ political leaning. We call this the “beneficiaries’ interests” channel. Alternatively, state politicians may use the funds’ investments as an extended political campaigning tool or policy apparatus to extract personal benefits, as suggested by the literature on political connections and pressures in public pension funds (Romano 1993, 1995; Wang and Mao 2015; Bradley et al. 2016; Andonov et al. 2018). In this regard, public pension funds may be pressured by state politicians to promote CSR, irrespective of whether its social and environmental objectives align with their beneficiaries’ interests. In this case, public pension funds are driven by relational motives, but instead of prioritising beneficiaries’ interests, they cater to another of their stakeholders, state politicians. We term this the “political pressures” channel. Finally, public pension funds’ propensity to tilt their portfolios towards CSR might be unrelated to any relational or moral factors. Instead, the funds might consider the incorporation of CSR factors as a pure investment strategy to improve funds’ portfolio performance in line with findings in the literature that institutional investors and pension funds in particular predominantly focus on the financial impact and the ‘business case’ of responsible investment (e.g., Petersen and Vredenburg 2009; Himick and Audousset-Coulier 2016). This channel is based on instrumental motives and is termed the “pure financial motives” channel. In other words, we ask: Are state pension funds reflecting social movements in terms of shifting norms and values among their beneficiaries (Arjaliès 2010; Peattie and Samuels 2018)? Or are they merely playing politics (Wang and Mao 2015; Bradley et al. 2016; Andonov et al. 2018) or optimising financial returns without much ethical reflection?

These three channels have different implications for the drivers of the relation between funds’ portfolio allocation decisions and firms’ CSR scores, and for the link between funds’ portfolio performance and the aggregate CSR score of their portfolio. These different implications allow us to empirically test which of these channels drives funds’ incorporation of CSR into investment decisions. Looking at the public equity holdings of 31 large, internally managed US state pension funds, we find that funds with Democratic-leaning beneficiaries tilt their portfolios more strongly towards companies with high CSR scores than their counterparts with predominantly Republican-leaning beneficiaries. Additionally, we show that funds with a Democratic-leaning beneficiary base show a stronger CSR preference if the state government is predominantly affiliated with the Democratic Party. Finally, we document a weakly positive association between the funds’ portfolio performance and the portfolio’s CSR score. This finding suggests that public pension funds’ CSR preferences do not harm fund performance and thus are not detrimental to beneficiaries’ financial interests. We interpret these results as indicative that state pension funds incorporate their beneficiaries’ political values and attitudes towards CSR into investment choices, consistent with the “beneficiaries’ interests” channel.

Our study makes three distinct contributions to the CSR and responsible investment literature. First, while several previous studies have shown a positive link between public pension funds’ ownership share and the CSR performance of their investment targets (e.g., Johnson and Greening 1999; Neubaum and Zahra 2006; Di Giuli and Kostovetsky 2014) and attributed this link to social norms and values that these funds are subjected to (Cox and Wicks 2011; Cahan et al. 2017), these studies do not further investigate how such norms and values might govern pension funds’ investment decisions and whose norms and values are considered. We extend this literature by showing that it is funds’ beneficiaries’ values which determine their responsible investment practices and we provide a channel through which beneficiaries’ values and norms can transfer from individuals to the governing body and portfolio management of pension funds, namely via funds’ positive screening towards CSR. While the importance of political values in investment decisions has previously been documented for individual mutual fund and hedge fund managers (Hong and Kostovetsky 2012) and in corporate finance for CEOs, and founders and directors (Di Giuli and Kostovetsky 2014), we are the first to analyse how political values and norms play a role in US public pension funds whose institutional characteristics differ considerably from the previously investigated actors. As such our study contributes to a growing body of research in business ethics on the role of morals in markets and the foundations of the ethicalisation of investment practices through responsible investment strategies (see Cox and Wicks 2011; Hoepner and Schopohl 2018) by analysing one channel through which beneficiaries’ moral values can affect public pension funds’ investment decisions.

Second, we extend the literature on the drivers of state pension funds’ investment preferences towards CSR. To the best of our knowledge, only one other study by Wang and Mao (2015) tries to explain the dynamic changes of US public pension funds’ investment behaviour in relation to CSR. The authors link public pension funds’ probability to submit CSR-related shareholder proposals to the degree of political self-dealing by state politicians on funds’ board of trustees, and find that funds act against their beneficiaries’ interests. Our study provides a counter point to Wang and Mao (2015). We show that public pension funds’ tendency to positively screen for investment targets with stronger CSR is based on moral considerations, reflects their beneficiaries’ values and norms, and therefore is aligned with their beneficiaries’ interests.

Finally, our study contributes to the debate on the alignment of responsible investment with the fiduciary duties of institutional investors (e.g., Rounds 2005; Freshfields Bruckhaus Deringer 2005; Sethi 2005; Richardson 2007, 2011; Sandberg 2011; Hawley et al. 2014), by providing empirical evidence that US public pension funds can incorporate their beneficiaries’ moral and political values into their responsible investment practice without jeopardising beneficiaries’ financial interests. Hence, our findings support arguments by Sethi (2005) that public pension funds’ responsible investment practices are aligned with their fiduciary duty, while they do not back concerns expressed by opponents of responsible investment that “social investing subverts a fiduciary’s common-law duty of undivided loyalty” and serves as a “vehicle for political mischief at the expense of the interests of taxpayers” (Rounds 2005, p. 76). As such, we contribute to a discussion in the business ethics literature that argues for a broadening of the interpretation of fiduciary duties and an expansion of the understanding of beneficiaries’ interests beyond purely financial ones to entail beneficiaries’ values and norms (see Richardson 2007, 2009, 2011; Jansson et al. 2014; Hoepner and Schopohl 2018).

The rest of the paper is organised as follows. Section "Literature Review and Hypotheses Development" provides an overview of the existing literature and derives testable hypotheses. Section "Methods" describes the methodological design of our study and the data. In Section "Findings and Discussion of Results", we present the results of our empirical analyses. We test the robustness of our findings in Section Robustness Tests. In Section "Conclusions", we draw conclusions and discuss the implications of our findings for fiduciary asset management.

Literature Review and Hypotheses Development

To motivate our empirical analyses, we first review the investment processes in US public pension funds and argue that several institutional features of these funds make them particularly prone to consider CSR in their portfolio allocation, before we discuss the existing empirical evidence on the link between public pension fund equity ownership and firms’ CSR performance. We then derive testable hypotheses regarding the drivers of public pension funds’ preferences for firms with stronger CSR performance, inspired by the conceptual framework of the drivers of CSR preferences developed in Aguilera et al. (2007).

Investment Processes in US Public Pension Funds

Public pension funds differ significantly from other institutional investors regarding their investment processes and objectives. First, public pension funds are particularly well placed to consider the CSR performance of their portfolio companies due to their long-term investment horizon and their holdings of a significant share in the entire equity market (Ryan and Schneider 2002; Cox and Wicks 2011). The interplay of these two factors makes them especially susceptible to risks that materialise in the long term and that are the result of externalities affecting the whole market. Since CSR factors represent good indicators of such long-term externalities, public pension funds may consider the CSR performance of their portfolio companies as a way to manage their exposure to these long-term externalities.Footnote 8

Second, public pension funds are governed by a board of trustees which sets funds’ investment policies and is responsible for the appointment of investment managers (Andonov et al. 2018). Through these channels, the board can directly influence the degree to which the fund incorporates responsible investment practices into its investment process (Wang and Mao 2015). Due to the representation of state officials and politicians on public pension funds’ boards, funds’ investment policies may be subject to political influences, more so than corporate pension funds’ policies (Romano 1993; Andonov et al. 2018).

Third, while several of the smaller public pension funds appoint external investment managers for the day-to-day management of their funds, the largest US public pension funds tend to conduct a considerable share of their investment management internally via their own in-house asset managers (Ryan and Schneider 2002; Cox and Wicks 2011). In-house management fundamentally differs from contracted-out, external management. In-house fund managers are salaried employees, their remuneration is usually not closely tied to short-term performance targets, and their sole responsibility and duties lie with their employer. These factors make in-house managers more likely to adopt longer-term and more stable investment approaches such as those associated with CSR (Neubaum and Zahra 2006; Cox et al. 2008) and can ensure that their investment philosophy is aligned with the long-term culture and values of the pension plan and its members (Cox and Wicks 2011).

Finally, US public pension funds are not subject to the same strict fiduciary standards of ERISA as private US pension funds, which—according to the traditional interpretation of ERISA—require funds to purely focus on financial factors and disregard social and environmental concerns from their investment choices (Lydenberg 2007). In comparison, fiduciary standards for US public pension funds are typically based on state regulation and less strictly interpreted (Wang and Mao 2015), potentially offering them greater discretion towards responsible investment.

While these factors suggest that US public pension funds should have greater leeway and be more prone to consider the CSR performance of firms in their investment decisions, the issue whether they indeed tilt their portfolios towards companies with stronger CSR performance remains an empirical question.

Public Pension Funds’ Equity Investments and Their Preferences for CSR

The first study documenting differences among institutional investor classes in their preferences for firms’ CSR performance is by Johnson and Greening (1999). Analysing the link between the equity ownership of different investors and the investment target’s CSR performance as measured by KLD (now MSCI ESG) ratings, the authors find a positive relation between the percentage of a firm’s equity owned by US public pension funds and the firm’s CSR performance, while the ownership share by mutual funds and investment banks shows no significant link to firms’ CSR factors. Since then, findings presented in Neubaum and Zahra (2006) and Di Giuli and Kostovetsky (2014) have confirmed the positive link suggesting that firms that do well on CSR dimensions are significantly more likely to be owned by public pension funds.

However, several studies cast doubt on the unequivocal preference of US public pension funds for firms with good CSR performance. For instance, Barnea and Rubin (2010), using the same data sources as Johnson and Greening (1999), document a negative relation between public pension fund ownership and a firm’s CSR performance as measured by a firm’s net CSR score, i.e., its CSR strengths over its CSR weaknesses. In addition, Cox and Schneider (2010) analyse the equity holdings of US state pension funds in UK public companies and find no significant relationship between the ownership by US state pension funds and a firm’s CSR performance. The authors, therefore, conclude that the overseas investments of US state pension funds are predominantly driven by financial considerations and less by firms’ CSR credentials. Finally, results presented in Cox and Wicks (2011) point towards the importance of internal versus external investment management in affecting funds’ propensity towards CSR factors. The authors find that CSR plays a primary role in the share selection decisions for internally managed public pension funds, while for externally managed funds CSR considerations carry less weight.

Overall, the review of the literature provides mixed results regarding the link between public pension funds’ equity holdings and firms’ CSR performance and raises the question whether US public pension funds might differ in the extent to which they incorporate CSR factors into investment decisions. In the next section, we suggest three alternative explanations why some pension funds might show a propensity for CSR factors, and we derive hypotheses to empirically test which of these channels may explain CSR-related equity allocations of a sample of large, internally managed US state pension funds.

Hypotheses Development

Beneficiaries’ Interests Channel

Aguilera et al. (2007) suggest that CSR interests at the institutional level can be driven by relational and moral motives as institutional actors aim to act according to their stewardship duties and aim to reflect the higher-order values and norms of their stakeholders and society. In terms of institutional investors, Cahan et al. (2017) argue that such moral drivers are behind the positive CSR screening practices of certain norm-constrained investors, such as public pension funds. However, the authors do not empirically analyse how such norms affect investors’ portfolio allocations and whose norms are considered by these institutions.

For the case of public pension funds, their fiduciary duty defines whose interests should be given priority to as it obliges these funds to make investment decisions in the best interests of their beneficiaries. Hence, Barber (2007) argues that if public pension funds are to incorporate companies’ CSR performance into their investment choices, they should align their investment allocations with the moral norms and political values of their beneficiaries, but should not forgo beneficiaries’ financial objectives.Footnote 9 In other words, if public pension funds were to oblige by their beneficiaries’ interests and values, they should only incorporate CSR considerations into their portfolio allocations if they are in the interests of their beneficiaries, i.e., in line with beneficiaries’ norms and values and not detrimental to funds’ portfolio performance. We call this the “beneficiaries’ interests” channel.

Attempting to measure attitudes towards CSR, several studies have shown that the political leaning of individuals is significantly linked to their propensity for incorporating environmental and social factors into investment decisions. For instance, Di Giuli and Kostovetsky (2014) show that firms with Democratic-leaning CEOs, founders and directors spend more on CSR activities and have a higher CSR rating than companies with no affiliations to the Democratic Party. In addition, Hong and Kostovetsky (2012) analyse the portfolio holdings of Democratic-leaning mutual fund and hedge fund managers and show that Democratic-leaning fund managers invest less in industries that are not in line with the Democratic political agenda such as tobacco, natural resources, and guns and defence, whereas they tilt towards environmentally friendly firms and firms that score well on matters of diversity, community and employee relations.Footnote 10 Taken together, the results of these two studies suggest that people’s political leaning is closely linked to their attitudes towards CSR. Applying these insights to the case of public pension funds, we argue that beneficiaries’ norms and values towards CSR can be approximated by their political leaning, which results in the following two hypotheses for funds’ portfolio allocation and portfolio performance for the “beneficiaries’ interests” channel:

H1a

A pension fund holds a larger share of its portfolio in companies with strong CSR performance if its beneficiaries have a preference for CSR as captured by their political leaning.

H1b

A pension fund’s portfolio-weighted CSR score is not negatively related to the fund’s portfolio performance.

Political Pressures Channel

An alternative mechanism that may explain the propensity of some public pension funds to incorporate CSR considerations into investment decisions is through political pressures exerted on the funds by state politicians. This argument is based on the existing literature on political self-dealing in public pension funds (Romano 1993, 1995; Wang and Mao 2015; Bradley et al. 2016; Andonov et al. 2018). This body of work suggests that state politicians may influence funds’ investment decisions either directly through their representation on the board of trustees, or indirectly through their representative power in the state government and by occupying political offices with considerable influence over state pension funds. For instance, Wang and Mao (2015), studying the shareholder proposals submitted by US public pension funds, show that the number of proposals on environmental and social issues increases significantly as more politically affiliated trustees run for office and conclude that “public pension fund board members employ shareholder proposals to enhance their political capital”.Footnote 11 In addition, they find that the market reacts more negatively to proposals submitted while trustees run for office which suggests that these proposals do not serve beneficiaries’ financial interests. These findings are in line with the wider literature which documents a negative link between the strength of the political influence over public pension funds and funds’ financial performance (e.g., Romano 1993, 1995; Bradley et al. 2016; Andonov et al. 2018).

Hence, a second channel to explain why some funds tilt their portfolios towards firms with superior CSR is through their relational ties to another of their main stakeholders—state politicians—who exert pressures on public pension funds to adopt responsible investment policies. In particular, state politicians affiliated with the Democratic party may pressure funds to implement a CSR-focused investment policy aligned with the Democratic agenda to use the investments of public pension funds as an extended campaigning tool at the potential detriment of beneficiaries’ interests (Wang and Mao 2015). We call this the “political pressures” channel and based on Aguilera et al.’s (2007) framework, it reflects relational motives for CSR through public pension funds’ link to state politicians. The “political pressures” channel comprises the following two predictions:

H2a

A pension fund holds a larger share of its portfolio in companies with strong CSR performance if it is subject to stronger political pressures by Democratic state politicians.

H2b

A pension fund’s portfolio-weighted CSR score is negatively related to the fund’s portfolio performance.

Pure Financial Motives Channel

Finally, the link between funds’ propensity to invest in companies with stronger CSR performance could be unrelated to any political pressures or moral considerations. Instead, pension funds might take CSR factors into account as they believe that incorporating a firm’s environmental and social performance into investment decisions can improve their funds’ portfolio performance.Footnote 12 As such, public pension funds’ responsible investment practices would be purely instrumentally driven as funds considered positive CSR screens as a means to realise superior investment outcomes (Aguilera et al. 2007). For instance, Himick and Audousset-Coulier (2016) analysed the statements of investment policies of 60 Canadian public pension funds and show that the financial frame of responsible investment dominates the social frame in funds’ investment policies as funds’ primary motive for engaging in responsible investment seems to relate to financial considerations, such as improving returns or managing risks. Petersen and Vredenburg (2009) obtain similar results based on a survey of Canadian institutional investors in oil and gas companies which state financial objectives and their belief in a positive link between CSR and corporate financial performance as a motivating force to invest in companies with higher environmental and social performance.

A vast body of research has attempted to empirically test the link between CSR performance and financial performance, both by evaluating the performance of responsible investment portfolios, including SRI mutual funds, and by assessing the link between measures of firms’ CSR performance and corporate financial performance. However, the findings in the literature remain ambiguous, with some studies suggesting a positive link (e.g., Derwall et al. 2005; Kempf and Osthoff 2007; Statman and Glushkov 2009; Edmans 2011),Footnote 13 some documenting a negative link (e.g., Geczy et al. 2005; Adler and Kritzman 2008; De Haan et al. 2012),Footnote 14 and others finding no (consistent) significant relation between CSR and financial performance (e.g., Bauer et al. 2005; Bello 2005; Galema et al. 2008; Renneboog et al. 2008, 2011; Gil-Bazo et al. 2010)Footnote 15. Due to the size of this literature which covers more than 2200 individual studies (Friede et al. 2015), a comprehensive review goes beyond the scope of our study. However, we can turn to the findings of several meta-analyses which aim to determine the dominant relation between CSR and financial performance across this vast body of literature, (e.g., Orlitzky et al. 2003; Margolis et al. 2009; Rathner 2013; Friede et al. 2015). Covering around 2200 individual studies, Friede et al. (2015) conclude that around 90% of studies provide empirical evidence for a non-negative link between CSR and financial performance, while the majority of studies suggest a positive relation between both constructs. For studies on the investment performance of responsible portfolios, including mutual funds, the majority of evidence hints at a neutral, non-negative relation between CSR and investment performance, implying that responsible investors are at least not financially hurt by adopting a responsible investment approach. Similar results are obtained by Margolis et al. (2009) and Orlitzky et al. (2003) who find, on balance, only a small but positive link between CSR and financial performance and stress that this finding depends on several moderating factors including studies’ methodological approach, the sample choice and the choice of the measures for CSR and financial performance (see also Rathner 2013, for a more formal analysis of the impact of primary study characteristics on the likelihood of finding a performance differential between responsible investment portfolios and conventional portfolios).

Hence, the existing literature provides some support that public pension funds may turn to environmental and social factors purely as a way of generating improved portfolio returns, irrespective of any wider ethical considerations and political pressures. We call this the “pure financial motives” channel and it comprises the following two predictions.

H3a

A pension fund’s propensity for incorporating CSR factors into their share selection is not related to any political or social factors of the fund or the state.

H3b

A pension fund’s portfolio-weighted CSR score is positively related to the fund’s portfolio performance.

Methods

Next, we outline the methodological design of our analyses to test these sets of hypotheses.

Sample

Based on the above discussion of the literature, our sample of public pension funds comprises large, internally managed US state pension plans as this sub-group is well suited to incorporate CSR considerations into their investment decisions. Focusing our analysis on internally managed holdings also enables us to rule out that our results are affected by investment processes and incentive effects of the external management company that are unrelated to state plan-specific investment incentives.

We obtain data on the public equity holdings of these large internally managed US state pension funds from the Thomson Ownership Holdings Database. This database mainly relies on the holdings reported to the Security Exchange Commission (SEC) but further supplements this information with holdings data gathered from international filings and shareholder reports. The externally managed holdings of public pension funds are filed under the name of the external management company, so they are automatically screened out from the stated holdings in the Thomson Ownership database.

We manually searched the database and identified 31 state pension funds located in 23 different states. Compared to previous studies that rely on US state pension funds’ equity holdings, our sample is comparable in size and even larger than the sample usually employed in the literature (e.g., Woidtke 2002; Cremers and Nair 2005; Dittmar and Mahrt-Smith 2007; Barnea and Rubin 2010; Brown et al. 2015; Bradley et al. 2016).Footnote 16 Table 1 lists the 31 pension funds and their state, together with additional summary statistics at the pension-fund level. Our sample period runs from 1997Q1 to 2013Q4. In the majority of our analyses, we restrict our sample to funds’ holdings in S&P500 companies as our CSR measure is only available for S&P500 companies during our entire sample period and we want to avoid any time bias in our results (see Hong and Kostovetsky 2012). However, in Section "Robustness Tests", we test the robustness of our results to including companies for which CSR scores are not consistently available over the entire sample period. We do not have holdings data for all 31 funds over the entire sample period as some funds only report their holdings for sub-periods of the sample. The average (median) number of quarters per fund is 43 (55). For 14 of the 31 funds, we are able to obtain holdings data over the entire sample period.Footnote 17 The average number of funds per quarter is 19, with a minimum of 15 pension funds per quarter for 1997Q1 and a maximum of 26 pension funds per quarter for 2013Q4. Finally, most funds are invested in the vast majority of companies that are part of the S&P500 index, with the average sample fund holding 392 out of 500 companies in every quarter of the sample. However, several funds do only invest in a small sub-set of the S&P500 with one fund only holding eleven S&P500 companies.Footnote 18

Dependent Variables

To test our first set of predictions regarding the determinants of funds’ portfolio allocations, our main dependent variable is a company’s weight in the fund’s portfolio. We call this variable portfolio weight (\(w_{\text{ijt}}\)). While some earlier studies have documented a link between the CSR performance of firms and their ownership share by state pension funds (e.g., Johnson and Greening 1999; Di Giuli and Kostovetsky 2014), we focus on the fund portfolio level by directly employing funds’ portfolio weights as our dependent variable. The reason for our choice of dependent variable is that holdings, and hence portfolio weights, are more indicative of funds’ investment preferences (Fich et al. 2015), because they directly reflect funds’ portfolio allocation decisions. In contrast, the percentage of shares held by a fund compared to the firm’s total number of shares outstanding is not necessarily reflective of the relative importance of a particular firm in the fund’s portfolio as it is highly dependent on the fund’s total assets under management.

Following Grinblatt et al. (1995), we calculate portfolio weights (\(w_{\text{ijt}}\)) in the following way:

where \({\text{val}}_{\text{ijt}}\) is the value of the holding in company i held by pension fund j at the end of quarter t and \(\sum\nolimits_{i}^{N} {{\text{val}}_{\text{ijt}} }\) Sis the total portfolio value held by pension fund j at the end of quarter t in all S&P500 companies.

To test our second set of predictions, we calculate the quarterly portfolio returns on a fund’s S&P500 holdings (\(\left( {r_{{{\text{jt}}}} } \right)\)) by weighting the return of each holding i \(\left( {{r_{it}}} \right)\) by its weight in fund j’s portfolio at the end of the previous quarter \(\left( {w_{{{\text{ijt}} - 1}} } \right)\)

where \(\left( {r_{{{\text{jt}}}} } \right)\) is the quarterly portfolio-weighted return of fund j over quarter t.

We re-balance the portfolio every quarter based on the new portfolio weights.

Main Independent Variables

CSR Scores

The company-specific CSR scores are obtained from Kinder, Lydenberg, Domini and Co. which has been acquired by Riskmetrics and is now owned by MSCI (MSCI ESG). MSCI ESG ratings are a commonly used measure of a company’s CSR performance in the literature and have been employed in prior studies of the link between public pension funds’ equity ownership and firms’ CSR performance in the US market (Johnson and Greening 1999; Neubaum and Zahra 2006; Barnea and Rubin 2010; see also Hong and Kostovetksy 2012; Di Giuli and Kostovetsky 2014, for examples from the political values literature). Despite being widely used, MSCI ESG ratings are not without critics.Footnote 19 As an alternative, recent studies such as Ferrell et al. (2016) use MSCI’s latest CSR measure, Intangible Value Assessment (IVA). The reason why we rely on the standard MSCI ESG scores in our main analysis is because of its longer history of available ratings for a considerable share of the US equity market which ensures maximum coverage of our sample period. Alternative CSR measures tend to have a significantly more limited data availability. However, in Section “Alternative CSR Measure”, we replace the MSCI ESG scores with the more recent IVA/EcoValue21 rating to ensure that our results are not an artefact of using MSCI ESG scores.

MSCI ESG assesses companies on seven CSR-specific categories on a point-by-point basis and awards each company a separate score of strengths and concerns for each sub-category. These categories comprise: community activities, diversity, employees’ relations, environmental record, product quality, human rights, and corporate governance. For our analysis, we calculate a single CSR score (CSRa) that best captures the overall CSR performance of a company. The main argument behind this approach is that public pension funds look at the entirety of a firm’s CSR profile when deciding whether, and how much, they want to invest in a particular company. In other words, public pension funds cannot invest in a sub-set of a firm’s CSR performance (e.g., only the strength or concern components), which is why we focus on overall CSR scores. In addition, netting the strength and concern scores is a common approach in empirical finance studies and has been extensively used in related work (Barnea and Rubin 2010; Hong and Kostovetsky 2012; Di Giuli and Kostovetsky 2014).

To construct our CSR scores (csrit), we first deduct the number of strengths from the number of concerns for each of the seven MSCI ESG sub-categories. Kotchen and Moon (2012) point out that some of the asssessed items in the sub-categories have been added or removed over the years. Thus, the aggregate scores might lack comparability over time. We follow Kotchen and Moon (2012) and Hong and Liskovich (2015) and standardise net sub-category scores per year, so that each year the net sub-category score is scaled to a mean of zero and a standard deviation of one. The standardisation by year ensures that our results are not affected by increases in the number of assessed items over the sample period.Footnote 20 We aggregate the standardised sub-category scores to create an overall CSR score, ensuring that each sub-category is given equal weight in the overall score. Finally, we scale the CSR score to have an overall minimum of zero and a maximum of one to facilitate the interpretation of the coefficient estimates.

To test our second set of predictions regarding the portfolio performance of funds, we calculate the quarterly portfolio-weighted CSR score of each fund (\({\text{CSR}}_{{{\text{jt}}}}^{{{\text{pfw}}}}\)). We take the previously calculated CSR score of each firm (\(\left( {{\text{CSR}}_{{{\text{it}}}} } \right)\) and weigh it by its weight in fund j’s portfolio at the end of the previous quarter (\(w_{{{\text{ijt}} - 1}}\)). We then aggregate the weighted CSR scores for each fund to arrive at our measure of the overall portfolio-weighted CSR score per fund (\({\text{CSR}}_{{{\text{jt}}}}^{{{\text{pfw}}}}\)).

Proxies for Political Leaning and Political Pressures

Next, we turn to the proxies for the political leaning of the funds’ beneficiaries. As state pension funds do not have detailed information on the political affiliations of their members, the closest proxy for their beneficiaries’ political leaning is the political leaning of the state they are located in. We judge this as a viable proxy for the beneficiaries’ political values as members of state pension funds represent a considerable share of the state’s population and state pension funds indirectly account responsible to all taxpayers of a state. As the responsibility for funding the defined benefit funds of state pension plans ultimately lies with the sponsoring government, even taxpayers that are not employed in the public sector have a stake in how these pension funds are managed (Coronado et al. 2003; Brown et al. 2015). Note that we do not require that all members of funds located in states concentrated by Democrats (Republicans) be Democrat (Republican). Rather, we only assume that individuals in states concentrated by Democrats (Republicans) are more likely to subscribe to the Democratic (Republican) political ideologies, so that the political leaning of the state serves as an indicator for public pension funds regarding the predominant political tendencies of their beneficiaries’ base.Footnote 21 To capture whether a state’s population is Democratic-leaning, we rely on the percentage of a state’s votes received by the Democratic Party in the latest presidential elections, which we obtain from Dave Leip’s Atlas of US Presidential Elections.Footnote 22 This source is widely used in empirical studies in finance to proxy for the political environment of a state (e.g., Pe’er and Gottschalg 2011; Di Giuli and Kostovetsky 2014). We construct two proxies for beneficiaries’ political leaning: (a) the percentage of a state’s votes received by the Democratic Party in the latest presidential elections (% of Votes for Democratic Party), and (b) a dummy variable that takes the value of one if the percentage of a state’s votes received by the Democratic Party is larger than the percentage of the state’s votes received by the Republican Party, and zero otherwise (Democrat-Dummy).

Our proxy for political pressures by state politicians is based on the composition of the state government. We follow Di Giuli and Kostovetksy (2014) and define the proportion of a state’s government that is affiliated with the Democratic Party (% of Dem. State Gov.) as:

where Dem. Governor is a dummy variable equal to one if the state governor is a Democrat, and zero otherwise, and Dem. Lower Chamber and Dem. Upper Chamber are the proportions of the Lower and Upper Chamber of the state government, respectively, that are affiliated with the Democratic Party. We also construct a dummy variable (Dem. State Gov.-Dummy) that captures whether the majority of the state government are Democrats. In particular, Dem. State Gov.-Dummy equals one if % of Dem. State Gov. > 50%, and zero otherwise. The data on the composition of the Lower and Upper Chamber are taken from the US Census Bureau’s National Data Book. Information on State Governors is obtained from the National Governors’ Association.Footnote 23

To test the conditional effects of beneficiaries’ political leaning and political pressures, we construct four additional proxies: (a) Dem. Leaning and Dem. State Gov. − Dummy equals one if the funds’ beneficiaries are Democratic-leaning and the majority of the state government are Democrats (i.e., Democrat-Dummy = 1 and Dem. State Gov.-Dummy = 1), and zero otherwise; (b) Dem. Leaning and Rep. State Gov.-Dummy takes the value of one if the funds’ beneficiaries are Democratic-leaning and the majority of the state government is not affiliated with the Democratic Party (i.e., Democrat-Dummy = 1 and Dem. State Gov.-Dummy = 0), and zero otherwise; (c) Rep. Leaning and Dem. State Gov.-Dummy equals one if the funds’ beneficiaries are Republican-leaning and the majority of the state government are Democrats (i.e., Democrat-Dummy = 0 and Dem. State Gov.-Dummy = 1), and zero otherwise; and (d) Rep. Leaning and Rep. State Gov.-Dummy takes the value of one if the funds’ beneficiaries are Republican and the majority of the state government is not affiliated with the Democratic Party (i.e., Democrat-Dummy = 0 and Dem. State Gov.-Dummy = 0), and zero otherwise.

Control Variables

Since portfolio allocation decisions and portfolio performance depend on a variety of company, fund and state-specific factors, we employ several controls that are linked to fund’s investment decisions at the portfolio company level, pension fund level and state level. We rely on the CRSP database for stock price data and the Compustat database for financial accounting data to control for company-specific characteristics of the portfolio companies. We obtain data on state pension fund characteristics from the Public Plans Database provided by the Centre for Retirement Research at Boston College which we supplement with manually collected data from state pension funds’ Comprehensive Annual Financial Reports. Our state level data is obtained from a variety of publicly available sources.

Firm-Level Controls

The characteristics of the portfolio companies, i.e., the investment targets, may influence the public pension funds’ decision with respect to the proportion of their portfolio that they want to invest in the stocks of that company. For instance, many public pension funds benchmark their equity performance against a market-weighted equity index and hence, are likely to invest a larger share of their assets in firms of larger size as measured by firms’ stock market capitalisation (Del Guercio and Tkac 2002). To control for this positive relation between funds’ portfolio weights and the portfolio firms’ size, we include the log-transformed market capitalisation of the portfolio company, calculated as the product of the price per share and the number of shares outstanding, as a control variable. In addition, public pension funds may have preferences for value or growth stocks and tilt their portfolio towards companies with high book-to-market ratio and/or away from firms with low book-to-market ratio. Thus, we include as a control variable the natural logarithm of the portfolio firm’s book value of the equity over the market value of equity, measured at the end of the previous quarter. We are agnostic about the sign of the relationship between funds’ portfolio weights and a portfolio firm’s book-to-market ratio. Moreover, some funds might have policies in place that restrict them from investing in non-dividend paying firms or firms with large dividend cuts, as argued in Parrino et al. (2003). Consequently, their portfolio allocation decisions might be sensitive to a firm’s dividend pay-out policy. We account for this feature by including the firms’ dividend yield, i.e., the ratio of dividends per share over the price per share, measured at the end of the previous quarter, as an additional portfolio firm control.

The degree of a company’s debt ratio computed as the portfolio firm’s total debt over total assets serves as a measure of firm distress and indebtedness which might also affect funds’ portfolio allocations as portfolio firms with higher leverage are considered to be riskier investments (Cox et al. 2008; Di Giuli and Kostovetsky 2014). As a measure of a portfolio firm’s exposure to systematic market risk, we further include its stock market beta. A higher beta implies a greater exposure to systematic risk factors and hence a riskier investment (Cox et al. 2008). We construct beta coefficients based on rolling regressions of a stock’s monthly excess return on the market risk premium (i.e., the S&P500 return in excess of the risk-free rate) and an intercept, over a 36-month window.

Finally, funds’ portfolio allocation choices may be subject to the prior financial performance of that holding company. Hence, we control for a portfolio firm’s return on assets as an accounting-based performance measure and a company’s quarterly stock return to measure market-based performance. Return on assets is defined as the income before extraordinary items divided by a firm’s total assets (Cox et al. 2008; Di Giuli and Kostovetsky 2014) and a firm’s quarterly stock return is calculated as the stock’s continuously compounded previous-quarter return. The latter measure also accounts for potential momentum trading by funds which involves the conditioning of portfolio allocations on a stock’s past performance.

Fund-Level Controls

Several characteristics at the level of the public pension fund are argued to affect both the fund’s portfolio allocation choices and its portfolio performance. First, we include the natural logarithm of public pension funds’ actuarial assets under GASB standards to control for fund size. Fund size can influence portfolio allocation decisions and performance through various channels. First, it can be assumed that the larger the pension fund, the more professional its asset management and the more resources are allocated to investment research, including more investment staff and wider access to CSR information. Second, as larger funds are more likely to hold a larger ownership stake in a company they are considered more influential and may get access to superior information. Third, Coronado et al. (2003) provide evidence of a positive relation between fund size and the incentive for political intervention as politicians seek to maximise their relatively short-term political interests. Finally, Sievaenen et al. (2013) show that larger funds are more likely to engage in responsible investing.

Furthermore, pension fund’s security selection decisions might differ depending on the proportion of their assets invested in equities. For example, Coronado et al. (2003) show that the fraction of the portfolio invested in equities affects state pension funds’ total rate of return. Thus, we expect that funds, which show a higher allocation to equity and whose overall performance depends more strongly on the performance of their equity holdings, dedicate more resources to analysing and managing these holdings. The percentage of a pension fund’s assets invested in public equities is supposed to control for these effects. Moreover, we employ the proportion of shares outstanding held by a pension fund in a particular company. It is defined as the ratio of the number of shares held by the pension fund over a company’s total number of shares outstanding. As pointed out in Parrino et al. (2003) and Fich et al. (2015), the larger the ownership share of a fund in a company the more likely this fund is to have access to board members, senior managers, suppliers and customers of the company and thus to gain superior information. Moreover, the larger the fund’s ownership, the more attention and resources is the fund expected to allocate to that particular company.

Additionally, several studies show that the funding situation of a pension fund significantly affects its portfolio allocation and risk-taking behaviour as well as the degree of political pressures on the fund (Novy-Marx and Rauh 2011; Andonov et al. 2017; Mohan and Zhang 2014). We control for these effects using pension funds’ funded ratio under the GASB standards, defined as the ratio of actuarial assets over actuarial liabilities, updated at the end of the year (Hochberg and Rauh 2013). We also add the inflation assumption that the fund uses for its actuarial valuations to our set of pension fund controls. This variable accounts for the fund’s expectation of future price developments and inflationary tendencies which can affect its allocation towards equities.

We include the fund’s age, measured as the natural logarithm of the difference between the current year and the fund’s year of inception, since an older fund may have more investment experience and a different membership structure. To further address differences in the membership structure of funds, we include the fund’s ratio of active members to beneficiaries. Regarding a fund’s portfolio allocation decisions, the membership structure can affect a fund’s liquidity preferences, and its objective to generate high returns to ensure satisfying all future benefit payments. Finally, we account for the pension fund’s overall performance by including the total fund return as reported in the fund’s annual report to our set of fund controls.

State-Level Controls

The portfolio allocation choices of a fund and the degree of outside pressures it experiences may depend on the economic and social characteristics of its state. To account for these state-specific effects, we include several controls. First, we include the state’s real gross domestic product (GDP) per capita and the state’s corporate net income taxes over total tax revenues as proxies for local economic growth (Bradley et al. 2016). These measures are retrieved from the Bureau of Economic Analysis and the US Census, respectively. We also control for a state’s level of political corruption which is defined as the number of federal, state and local public officials convicted of a corruption-related crime, divided by the state’s population. Several previous studies have established that this measure is related to US state pension funds’ investment and funding decisions (Hochberg and Rauh 2013; Bradley et al. 2016). The data on political corruption convictions is retrieved from the US Department of Justice’s Report to Congress on the Activities and Operations of the Public Integrity Section. Finally, we employ the proportion of government employees who are union members to capture the influence of unions in public pension fund decision-making and investment processes. We retrieve the data from Barry Hirsch’s Union Membership and Coverage Database which is described in Hirsch and Macpherson (2003). It can be argued that unions’ objectives and agendas more closely align with the Democratic political beliefs and hence a stronger influence of unions in certain states can affect the state pension funds’ preferences for certain CSR policies, such as employee-friendly practices and policies.

Estimation Techniques

Portfolio Allocation Model

To test our first set of predictions relating to public pension funds’ portfolio allocation decisions, we estimate a series of fixed effect panel regressions with the portfolio weight \(\left( {w_{\text{ijt}} } \right)\) as the dependent variable.Footnote 24 The main independent variables are the company’s lagged CSR score \(\left( {{\text{CSR}}_{{{\text{it}} - 1}} } \right)\) and the lagged CSR score interacted with one of the political proxies \(\left( {{\text{CSR}}_{{{\text{it}} - 1}} \times {\text{political proxy}}_{{{\text{jt}}}} } \right)\). As MSCI ESG updates its ratings at the end of each year and publishes the ratings in January, we use lagged CSR scores to avoid any look-ahead bias. We also include the set of control variables described in the previous section. Employing fixed effects at the fund-security level, the regression model can be expressed as follows:

where \({\text{political proxy}}_{{{\text{jt}}}}\) is one of the political proxies described in Section "Main Independent Variables"; \({\text{firm controls}}_{{{\text{it}} - 1}}\), \({\text{fund controls}}_{{{\text{jt}}}}\)and \({\text{state controls}}_{{{\text{jt}}}}\) are column vectors of the seven company-specific, eight fund-specific and four state-specific controls; \(v_{{{\text{ij}}}}\) are fund-security fixed effects and \(u_{\text{ijt}}\) is an idiosyncratic disturbance term.

The unit of measurement is the fund-security-quarter level. As we employ a fixed effects panel model we only focus on the within-variation. That means we study the variation in portfolio weights per fund-security combination over time but not across funds and securities. Effects that are particular to the fund-security combination are captured in the fixed effects (\(\left( {v_{{{\text{ij}}}} } \right)\). Since funds are expected to hold similar portfolio weights in a particular S&P500 company over consecutive quarters, we correct standard errors by clustering at the fund-security level to reflect this clustered sampling. Our benchmark portfolio allocation model comprises around 530,000 observations and more than 20,000 fund-security fixed effects.

Financial Performance Model

To test our second set of predictions regarding funds’ portfolio performance, we follow Bradley et al. (2016) and estimate a portfolio performance model at the fund level in a multivariate panel setting. The model can be expressed as follows:

where \({r_{jt}}\) is the quarterly portfolio-weighted return of fund j over quarter t, \(CSR_{{jt - 1}}^{{pfw}}\) is the portfolio-weighted CSR score of fund j at quarter t-1, \(political prox{y_{jt}}\) is one of the political proxies described in Section "Main Independent Variables", \(fund control{s_{jt}}\) and \(state control{s_{jt}}\) are column vectors including seven fund-specific and four state-specific effects. We include pension fund fixed effects (\({v_j}\)) to absorb time invariant characteristics within a fund. For all model specifications, standard errors are clustered at the fund-level to correct for serial correlation in residuals. As we only have a very limited number of quarterly holdings for some of the funds, we restrict the sample for this empirical analysis to those funds with at least 25 quarters of holdings data which reduces our sample to 18 funds.Footnote 25 The fund performance model includes 1080 observations.

Findings and Discussion of Results

Summary Statistics

The discussion of results begins by presenting descriptive statistics for the sample data. Table 2 provides summary statistics (Panel A) and a correlation matrix (Panel B) for the main variables employed in the empirical analyses. The mean (median) portfolio weight held by a pension fund in one of the S&P500 companies is 0.23% (0.09%). These values correspond closely to the respective values for the weight of the companies in the S&P500 index—the mean (median) weight of a firm in the S&P500 index during our sample period is 0.20% (0.09%)—indicating that our funds tend to follow the S&P500 closely. The difference between the mean portfolio weight of our sample funds and the mean weight of a company in the S&P500 relates to few pension funds holding only a small subset of S&P500 firms and/or allocating a large proportion of their portfolio to single companies.Footnote 26

Looking at the dependent variable of the financial performance model, the fund portfolio return, we find a considerable degree of variation regarding funds’ quarterly performance on their S&P500 holdings.Footnote 27 The average (median) quarterly return on funds’ portfolio is 0.7% (2.2%) which suggests that funds only marginally generate a positive quarterly return on their S&P500 holdings; but the standard deviation of 9.2% as well as the minimum of -32.1% and the maximum of 16.6% show that these averages mask the level of variability in fund performance across the sample. Turning to the CSR performance measures, the CSR score at the fund-security level and the portfolio-weighted CSR score at the fund level have comparable mean and median values of 0.49 with a standard deviation of 0.11 and 0.012, respectively. While it has been noted in the previous literature that CSR measures can be relatively stable over time, we still find a reasonable level of variability in our sample. Regarding the political leaning of the funds’ members, the state population of the sample funds votes, on average, 50% for the Democratic Party, though the range of values from 25 to 63% indicates some strongly Democratic-leaning and strongly Republican-leaning states in our sample. The mean value of 0.64 for the Democrat-Dummy implies that the members of the average pension fund are likely to be predominantly Democratic-leaning. Additionally, we find that the pension funds in our sample tend to be located in states with a non-Democratic state government, as indicated by the mean values of the variables % of Dem. State Gov. (0.42) and Dem. State Gov.-Dummy (0.32) which clearly lie below 50%. This provides first evidence that the political leaning of the state population and the dominant party in the state government are not necessarily in line, and that our political proxies pick up different effects.Footnote 28

Turning to the correlations between our control variables (Panel B, Table 2), the highest (absolute) correlations are between our measure of a state’s political leaning (% of Votes for Democratic Party) and the size of the fund as well as the state’s degree of union membership by public employees and real GDP, which reinforces the importance to control for the demographic and economic characteristics of the state. As % of Votes for Democratic Party is included as an interaction term with the CSR score, we conclude that concerns of multicollinearity are not an issue in our data.

Portfolio Allocation Model

Table 3 reports results from our portfolio allocation model, expressed in Eq. (4), which allows us to test the first set of hypotheses relating to the drivers of funds’ portfolio allocation decisions towards firms’ CSR score. In each specification, we interact the CSR score with a different political proxy.

Turning to the results of the model, for all five model specifications, we obtain negative and statistically significant regression coefficients on the CSR score indicating that the higher the company’s CSR score the less weight does this company generally constitute in a fund’s portfolio. These results are in line with Barnea and Rubin’s (2010) finding of a negative relation between a firm’s CSR performance and its equity ownership by US public pension funds, although, unlike Barnea and Rubin (2010), our model explains funds’ portfolio weights and not the percentage of ownership in a firm. One possible explanation for the negative relation between portfolio weights and CSR scores may relate to funds’ tendency to follow index weights (Parrino et al. 2003). In unreported results, we find a negative association between a firm’s weight in the S&P500 index and its CSR score, so if state pension funds followed S&P500 index weights, we expect to find a negative coefficient on the standalone CSR score. However, in this case the identified negative relation does not reflect funds’ preferences toward CSR but rather their tendency to follow the S&P500 index. To ensure that our results are not purely driven by funds’ tendency to follow the index, we substitute the portfolio weights with deviations from S&P500 weights in Section "Deviations from Benchmark Weights", and find that the negative coefficient on the CSR standalone score loses its statistical significance.

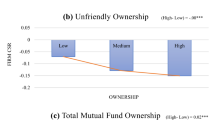

To assess whether the direction of the relation changes based on the different political drivers, we need to look at the values of the interaction term of the CSR score with the political proxies. Specifications (1) and (2) test the implications of the “beneficiaries’ interests” channel expressed in hypothesis H1a by interacting the CSR score with % of Votes for Democratic Party and the Democrat-Dummy, respectively. Both variables serve as indicators whether the members of the pension fund are predominantly Democratic-leaning. We find a positive and highly significant regression coefficient on both interaction terms, suggesting that funds with predominantly Democratic-leaning beneficiaries hold a higher portfolio weight in companies that perform well on CSR, compared to funds with predominantly Republican-leaning members. This finding provides first evidence consistent with the portfolio allocation implications of the “beneficiaries’ interests” channel.

In specifications (3) and (4), we test whether conditioning on political pressures by state politicians affects funds’ propensity to tilt their portfolio towards firms with better CSR performance. We interact the CSR score with % of Dem. State Gov. and the Dem. State Gov.-Dummy, respectively. We find a positive relation between the portfolio weight and the company’s CSR score for funds from states where the majority of the state government is affiliated with the Democratic Party as indicated by the positive and significant coefficient estimates on both interaction terms. Thus, public pension funds tilt their portfolios more strongly towards companies with higher CSR scores if they face greater pressures by state politicians, consistent with the prediction of hypothesis H2a of the “political pressures” channel. However, when comparing the magnitude of the coefficients on the interaction terms of specifications (1) and (2) with those of specifications (3) and (4), respectively, the effect of political pressures by Democratic state politicians seems to be considerably lower in economic magnitude than the effect arising from the political leaning of funds’ beneficiaries.

To evaluate the relative importance of the “beneficiaries’ interests” channel and the “political pressures” channel, we interact the CSR score with the proxies that condition on both political dimensions. The omitted group are funds with Democratic-leaning members and a predominantly Republican state government (Dem. Leaning & Rep. State Gov. -Dummy). Thus, the coefficients on the interaction terms have to be interpreted as deviations from this category. Turning to the results presented in specification (5), the coefficient on the interaction term for the Dem. Leaning & Dem. State Gov.-Dummy is significantly positive, implying that public pension funds with Democratic-leaning members show an even stronger CSR preference if the state government is dominated by the Democratic Party, which suggests that state politicians might exercise a reinforcing effect on funds’ portfolio allocations. In comparison, we find a negative coefficient on the interaction terms for the Rep. Leaning & Dem. State Gov.-Dummy and the Rep. Leaning & Rep. State Gov.-Dummy. These findings indicate that funds with Republican members tilt away from companies with strong CSR performance, irrespective of whether these funds might be subject to higher pressures by Democratic state politicians. One way of interpreting these findings is that the political leaning of funds’ members is the dominant force behind funds’ preferences for CSR, in line with hypothesis H1a of the “beneficiaries’ interests” channel. In comparison, political pressures from Democratic state politicians seem to merely have a moderating effect on funds’ CSR tilts, providing only limited support for the implications of the “political pressures” channel expressed in H2a. The significant coefficients on the interaction terms of the CSR score with the different political proxies are not consistent with H3a of the “pure financial motives” channel, which predicts an insignificant effect of such proxies on the portfolio allocation of public pension funds.

Turning to the estimated coefficients on the control variables, we find that public pension funds tend to invest more in larger companies, in line with a tendency of funds to follow the market weights (Del Guercio and Tkac 2002). Portfolio weights are also higher for companies with lower book-to-market ratios, lower debt ratios and lower market risk exposure. In line with Parrino et al.’s (2003) argument that funds’ portfolio allocations are sensitive to firm’s dividend policies, we find that funds allocate a higher portfolio weight to companies paying higher dividends. A potential explanation for this effect relates to the liquidity implications of dividend payments in relation to funds’ obligations of benefit payments. Surprisingly, our sample funds also seem to increase their allocation to companies that had a lower return in the previous quarter, suggesting that funds follow a contrarian investment strategy. Additionally, controlling for fund and state characteristics seems to be important as indicated by the statistically significant coefficients on all fund and state controls. While the results on most of these variables are difficult to interpret in this regression setting, the positive coefficient on the percentage of shares outstanding suggests that pension funds tilt their portfolio towards companies over which they can exercise greater control. This finding is in line with the reasoning in Fich et al. (2015).

Portfolio Performance Model

Next, we turn to the results of the portfolio performance model expressed in Eq. (5) and presented in Table 4. Specifications (1)–(2) show results for all funds, while specifications (3)–(6) and specifications (7)–(10) condition on the fund beneficiaries’ political leaning and the political pressures by state politicians, respectively. We run each specification with fund fixed effects and test the robustness of our findings to controlling for time-specific performance trends by including quarter fixed effects in specifications (2), (4), (6), (8), and (10).

As can be seen in Table 4, eight out of ten specifications suggest a positive and significant relation between funds’ portfolio-weighted CSR score and their quarterly portfolio return, implying that funds with a stronger CSR performance of their holdings generate higher returns. However, this association weakens in statistical significance once we control for quarter fixed effects and becomes statistically insignificant in specifications (6) and (8).

Dividing the funds in sub-samples based on our political proxies allows us to test whether the CSR-performance link is restricted to specific subsets of sample funds or applies to all funds irrespective of the leaning of their beneficiaries (specifications (3)-(6)) and political pressures by state politicians (specifications (7)-(10)). Interestingly, we find that the strongest statistical effect of the funds’ portfolio-weighted CSR score on fund returns is observed for funds with predominantly Democratic-leaning members (specifications (3)-(4)) and, to a lesser extent, for funds in states where the state government is not dominated by the Democratic Party (specifications (9)-(10)). In both sub-samples, the positive effect prevails even after controlling for time effects though its statistical significance weakens, while in the other two sub-samples the statistical significance of the coefficient estimates vanishes once adding quarter fixed effects.

To conclude, our findings are broadly in line with the empirical literature on the link between CSR and financial performance as the majority of these studies finds a non-negative, neutral link between portfolios’ CSR and financial performance, while some studies document a weakly positive relation. However, while much of the literature on which these findings are derived focuses on portfolios of SRI mutual funds, to the best of our knowledge, our study is the first to show weakly positive performance effects of CSR tilts for US state pension funds. In the light of the implications of these findings for fiduciary asset management, it is particularly noteworthy that funds with predominantly Democratic-leaning members show the most consistent positive performance effect of tilting their portfolios towards companies with better CSR scores, suggesting that the CSR tilts we documented in the previous section are not to the financial disadvantage of fund beneficiaries. As such and in contrast to Wang and Mao’s (2015) findings, we provide empirical evidence that US public pension funds’ responsible investment approach can be beneficial to their beneficiaries’ interests and is not unidirectionally linked to self-serving motives of state politicians. Overall, our results are consistent with the predictions of H1b and H3b but inconsistent with those of H2b.

Turning to the coefficient estimates on the control variables, we do not find many consistent associations between portfolio performance on the one hand and fund-specific and state-specific characteristics on the other hand, which are robust to the inclusion of time fixed effects. Hence, we are cautious when drawing conclusions from these results. We find some evidence in line with Bauer et al. (2010) suggesting that larger funds tend to generate lower returns than their smaller counterparts. Attempting to explain this negative association between fund size and portfolio performance, Bauer et al. (2010) name liquidity limitations associated with larger fund size which can restrict public pension funds’ portfolio allocation choices and lower their performance. This argument is in line with the negative coefficient estimate we find on the proportion of a fund’s portfolio invested in equities, as funds which have a higher share of their portfolio invested in equities might have more limited investment options and are more restricted when aiming to adjust their portfolio holdings. However, this effect is statistically weak. Additionally, our results provide limited support that some older funds and funds with stronger total returns tend to generate higher returns on their equity portfolio. But again, these effects are subject to the choice of sub-sample and sensitive to controlling for time-specific effects. Overall, our results lead us to conclude that the majority of fund-specific and state-specific factors do not have a systematic and consistent impact on the performance of funds’ equity portfolio throughout our sample period.

Robustness Tests

In this section, we test the robustness of our results to three alternative specifications.

Alternative CSR Measure

First, we test that our results are not an artefact of the specific CSR measure we use by replacing the CSR score of MSCI ESG with an alternative CSR rating, the IVA/EcoValue21 rating used in Ferrell et al. (2016).Footnote 29 The IVA/EcoValue21 rating is provided by MSCI and it rates companies on their environmental risk and opportunities assigning a rating of AAA to CCC for each company. We follow Ferrell et al. (2016) and transform the letter-based rating into a numerical score that ranges from 0 (for CCC, the lowest rating category) to 6 (for AAA, the highest category). Hence, a higher score is associated with a better CSR performance. We substitute the lagged CSR score with the firm’s EcoValue21 rating at the end of the previous quarter. IVA/EcoValue21 ratings are only consistently available for a smaller subset of US companies and for a considerably shorter time period, which reduces the number of observations to around 192,000.Footnote 30 The results are presented in Table 5. Overall, we find statistically positive coefficients on the interaction terms with our proxies for beneficiaries’ political leaning and, slightly weaker, positive coefficients on the proxies for political pressures. However, the coefficient estimate on the standalone CSR score is now mostly positive and statistically significant, providing additional support for our conjecture that the negative coefficient on the MSCI ESG-based CSR score may be linked to effects unrelated to funds’ investment preferences, such as their tendency to follow index weights. We control for this more explicitly in Section "Deviations from Benchmark Weights".

Extended Company Coverage

In our main analysis, we restrict the company coverage to S&P500 companies to avoid a time bias caused by the significant increase in companies covered by the MSCI ESG in the early 2000s. To test that our results are not limited to S&P500 companies, we include all companies to our sample once an MSCI ESG rating is available. We re-calculate portfolio weights to account for this extended company coverage by dividing a fund’s portfolio holding in a company by the total value of its holdings in all companies with available MSCI ESG scores. The results of this analysis are presented in Table 6. While the number of observations increases significantly to more than 1,200,000, the coefficient estimates on our main variables of interest remain qualitatively unchanged. In particular, the coefficient estimate on the standalone CSR score is negative and statistically significant and the interaction terms of the CSR scores with the political proxies remain statistically significant and positive for specifications (1) to (4) and show the same signs and statistical significance for specification (5), in line with our baseline results presented in Table 3.

Deviations from Benchmark Weights