Abstract

Italy is severely affected by floods, yet the government has still to develop a flood risk management strategy that is able to adequately protect the population from the huge financial, human and welfare losses they cause. In this respect, a major obstacle is the limited understanding of risk at the national level. To date, there are no analyses in the literature that estimate the flood losses for the whole Italian territory at the small area level. This is particularly due to the lack of uniformity in the collection of data by the river basin authorities, which are primarily responsible for collecting information on floods in the country. In this work, we combine different sources of flood data and propose a model for flood loss estimation that allows us to predict expected losses per square meter, per municipality, and per structural typology. We identify the areas that are critical to risk management either because of high inhabited density or because of the structural fragility of the assets. Flood expected losses are then compared with those generated by earthquakes, which constitute the natural hazard of main concern in Italy. We find that, in contrast with earthquakes, floods affect only some municipalities. Nevertheless, floods might generate losses per square meter even higher than earthquakes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Natural risks pose a broad range of social, financial, and economic issues, with potentially long-lasting effects (Chai & Wu, 2023; Gardin & Kerckhoven, 2023; Khan et al., 2023). Historically, governments have mostly addressed the financial effects of natural events on an ad-hoc basis, but, since the 1970s, the United Nations (UN) has started raising awareness among the national authorities about the importance of disaster risk planning.Footnote 1 According to the UN, governments should guide citizens toward recovery in the aftermath of an event, but they should also prepare them and strengthen the resilience of society. To this aim, the OECD/G20 (2012) and the World Bank (2014) encourage countries to adopt a comprehensive disaster risk management strategy, which should be articulated in a series of coherent and coordinated actions over time aimed at addressing each phase of a disaster. In particular, the strategy must include risk assessment, risk reduction, preparedness, emergency response, and recovery.

Several risk management tools for governors exist: investment in risk mitigation (Petkov, 2022) (e.g., urban planning and structural safety measures such as artificial dams), risk retention (Emrich et al., 2022) (e.g., disaster funds), and risk financing (Perazzini et al., 2022) (e.g., public insurance, insurance-linked securities). All these tools address different aspects of risk and come with a cost, and the best solution depends on the characteristics of the society and territory. Therefore, the effectiveness of risk management depends on the ability to identify and assess the risks (UNISDR, 2017). Both the Hyogo and the Sendai Frameworks have underlined the importance of risk understanding and, in turn, of data collection and risk assessment. Since then, substantial progress has been made but major gaps still affect many countries (UNISDR, 2017). In theory, a well-established collection of data on risks, exposures, vulnerabilities, and expected losses is desirable (Kunreuther, 2003), but this is often hard to achieve as important challenges concern data collection (UNDRR, 2019). Indeed, an enormous amount of high-quality data is necessary to study natural risks. A long time of observation is necessary to get sufficient information for risk analysis. Moreover, natural risks evolve quickly: any change in society, landscapes, or technology might completely reshape the area’s risk profile. As a consequence, past events might not be representative of the current risk in the area.

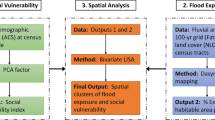

To overcome these issues, an alternative approach to risk assessment, called “catastrophe modeling”, has been developed. Catastrophe modeling is based on the idea that risk is determined by a combination of hazard, exposure, vulnerability, and loss. Therefore, the financial risk of natural events in an area can be quantified as the product of four components (Grossi et al., 2005):

where

-

Hazard (H) refers to a potentially damaging physical event.

-

Exposure (E) refers to the situation of people and tangible human assets located in hazard-prone areas.

-

Vulnerability (V) refers to the ability to cope with or avoid the consequences of a hazard.

-

Loss (L) converts physical damages into monetary losses.

In a catastrophe model, each component is defined based on a series of geophysical, engineering, or financial variables. Through a proper definition and combination of these components, the model describes the geological or environmental features of the peril under analysis and captures its impacts on the relevant assets.

In this paper, we analyze the Italian case study and propose a catastrophe model for flood risk assessmentFootnote 2. Italy is highly affected by floods, but, at the current moment, a few analyses have investigated their financial costs at the national level because of the lack of uniform data among the territory. A few studies concern small geographical areas (usually cities, sometimes sections of river basins) and focus on the estimation of damages in the immediate follow-up of an event (e.g., Carisi et al., 2018). Moreover, machine learning techniques for the construction of river basin hazard maps have been proposed (Degiorgis et al., 2012, 2013; Gnecco et al., 2017; Nguyen, 2023; Shikhteymour et al., 2023). However, for the definition of a national risk management strategy, flood losses are needed at both the national and local levels. In this work, we focus on residential buildings and estimate losses at both municipal and national levels. Moreover, we diversify the risk between three structural typologies, for which we provide expected losses per square meter. Indeed, this methodology allows for small-area estimation in the context of natural hazards. Since a set of hypotheses and parameters are needed in catastrophe risk modeling, the uncertainty of our estimates is also discussed.

We analyze the municipal expected losses obtained and investigate the high-risk areas. In particular, we identify the areas where the risk is strongly determined by the building’s structural fragility, the high inhabited density, or strong hazard intensity and frequency. Then, the expected flood losses are compared to the expected earthquake ones. Indeed, earthquakes constitute the hazard of main concern in Italy, and the comparison between the two perils helps in understanding the relevance of flood risk in the country. For earthquake loss prediction, we refer to the model by Asprone et al. (2013), which we extend by applying the most recent seismic risk maps by the Italian National Institute of Geophysics and Volcanology (INGV) for the hazard module and a more accurate representation of the exposure. We find that earthquakes in Italy generate annual expected losses approximately equal to 6234.67 million Euros, while flood expected losses amount to about 875.90 million Euros per year. Moreover, we observe that floods affect a limited number of municipalities, while the whole Italian territory is affected by earthquakes. Nevertheless, we find that flood losses per square meter often exceed the corresponding earthquake ones in municipalities that are affected by both perils. This indicates that floods might be even more concerning than earthquakes at the local level.

The work is organized as follows: Sect. 2 presents the database; Sects. 3 and 4 present the flood and earthquake models, respectively; Sect. 5 shows the results; Sect. 6 discusses the uncertainty of the estimation; Sect. 7 concludes the paper.

2 Data

To comprehensively capture the residential building stock of Italian municipalities, we employed two primary databases: the “Mappa dei Rischi dei Comuni Italiani” (MRCI) (https://www.istat.it/it/mappa-rischi) and the 2015 census conducted by the Italian National Institute of Statistics (ISTAT). The selection of these databases was motivated by their ability to provide the most accurate portrayal of the Italian building stock on a national scale, particularly in terms of characteristics relevant to the analyzed risk. Moreover, to ensure consistency, a little additional information was taken either from the sources used by ISTAT to construct MRCI or databases based on the same territorial units, mitigating potential issues related to inconsistencies arising from disparate sources.

The MRCI database, developed under the institutional project “Casa Italia” is purposefully crafted to provide a detailed depiction of major natural risks in Italy. It furnishes comprehensive data on Italian real estate, including the number of buildings categorized by the number of storeys, construction material, and year of construction for each municipality. This information plays a pivotal role in our analysis, as the number of storeys in a building is considered a significant determinant of the damage levels incurred during a flood, while the year and material of construction determine the building’s resistance to earthquakes. Consequently, it allows us to differentiate the territory not only by the number of units at risk but also by the fragility of its assets. At the same time, the 2015 census conducted by ISTAT offers essential insights into the average number of apartments per municipality. When combined with the average apartment size per region sourced from Agenzia delle Entrate (2015), this information enables us to achieve a precise representation of the exposed assets.

The flood hazard has been represented through flood frequency and depth, which have been fitted from historical records of flooding events. Data have been taken from the “Aree Vulnerate Italiane” (AVI) archive released by the Italian National Research Council (Guzzetti & Tonelli, 2004) (http://avi.gndci.cnr.it/), which currently provides the best representation of floods in the twentieth century in Italy. The database collects flooding events of different durations and extents and covers approximately 12000 locations and one century. Several variables are listed in the AVI archive, most of which have been gathered from local press and municipal archives. For this reason, unfortunately, many of them are incomplete, descriptive, and difficult to compare among the municipalities. To overcome these limitations, we restricted our attention to the events for which the variables we needed were available, i.e., 795 events for flood frequency and 475 events for depth. Some data pre-processing was necessary for flood depth. First, we excluded all the observations for which the hydrometric height was reported in place of the flood depth. Then, since records in AVI are largely gathered from local press or compensation claims, we assumed that the reported depth corresponds to the maximum reached in the area. Many flood events in the database are associated with multiple depth measures. In such a case, we selected the maximum value reported for each event. To improve the estimate, we combined information in the AVI archive with the most recent and accurate “Italian Flood Risk Maps” (EU Directive 2007/60/CE) indicating the perimeter of geographic areas that could be affected by floods according to three probability scenariosFootnote 3: extreme events with time to return 500 years (\(P_1\)); events with time to return of 100–200 years (\(P_2\)); events with time to return between 20 and 50 years (\(P_3\)). These data are also available at https://www.istat.it/it/mappa-rischi. Since the flood maps are not available for the Marche region and some parts of Sardinia, these areas have been excluded from the analysis. Overall, we have been able to estimate flood losses for 7772 municipalities.

Additional data have been used to estimate earthquake losses: information on the Peak Ground Acceleration (PGA) has been withdrawn from the most recent hazard maps released by INGV (Gruppo di Lavoro, 2004) and combined with the stratigraphic and topographic amplification factors reported in Colombi et al. (2010). Sardinia is not represented in the hazard maps because it is not affected by earthquakes, and the region has not been included in the analysis. Overall, we were able to estimate earthquake expected losses for 6404 over 7904 municipalities in Italy.

3 Flood risk assessment

We estimated flood losses per square meter, structural typology, and municipality as:

where f denotes “flood”, j refers to the structural typology, c represents the municipality, a denotes the reconstruction cost, \(\delta \) indicates the depth reached by the flood, \(g_j\) represents the depth-percent damage curve for the j-th structural typology and captures the vulnerability of the building, \(P_c(N_F \ge 1)\) is the probability of occurrence of at least one flood in 1 year in the c-th municipality, and \(f(\delta \vert N_F \ge 1)\) is the conditional probability density that a flood reaches a certain depth \(\delta \) (conditional to the flood occurrence).

We computed the municipal flood losses \(L_c^f\) by aggregation as

where \(E^f_{j,c}\) is the number of square meters covered by buildings of the j-th structural typology in the c-th municipality.

The model components are described in detail in the next subsections.

3.1 Hazard

We represented the hazard component by means of the flood frequency \(P_c(N_F)\) (where \(N_F\) is the number of floods affecting the c-th municipality in 1 year) and depth density \(f(\delta \vert N_F \ge 1)\).

To represent the flood frequency, we fitted the discrete probability density function of the number of floods \(N_F\) in a year, \(f_{N_F}(N_F)\). In doing so, we defined two groups (or clusters) of municipalities based on the hydrological hazard index \(P_2\) from the flood risk maps. Specifically, we considered \(0<P_2<0.5\) and \(P_2 \ge 0.5\) and referred to the two groups as \(A_1\) (120 floods) and \(A_2\) (620 floods) respectively. The flood frequencies in the two groups, \(f^{A_P}_{N_F}\), were analyzed. We found that the Negative Binomial distribution achieves the highest goodness of fit in both the groups and should hence be preferred to any other distributional form. Indeed, even the second best distributions—the Geometric and the Exponential—do not properly fit the data, while the Negative Binomial suits them almost perfectly, as shown in the top plot of Fig. 1. It could be noticed that the curves of the two groups appear very similar. However, they strongly differ in mean: the average number of floods per year is 11.95 in \(A_1\) and 42.58 in \(A_2\).

Top: Flood frequency discrete probability density. Observations (points) are divided into two groups—records from municipalities with \(0<P_2<0.5\) (group 1) and \(P_2 \ge 0.5\) (group 2)—and fitted with a Negative Binomial distribution. Down: Depth (meters) probability density. The dotted line is the empirical density \(f_{\delta \vert N_F}(\delta \vert N_F \ge 1)\), and colored lines show the fitting. (Color figure online)

We adjusted the frequency distribution of the two groups in such a way as to represent the flood frequency of the municipalities. First, since each flood affects a certain number of municipalities within a group, we computed the average number of municipalities affected by a flood, \(\bar{c}^{f}\). Given the number of municipalities in a group, \(N_c^{A_1}\) and \(N_c^{A_2}\), we obtained the probability that the c-th municipality will be flooded at least once in 1 year as \(f^{A_1}_{N_F} \cdot \frac{\bar{c}^f}{N^{A_1}_c}\) or \(f^{A_2}_{N_F} \cdot \frac{\bar{c}^f}{N^{A_2}_c}\). Then, we adjusted the flood probability by the \(P_3\) indexFootnote 4 (here denoted as \(x_{c,P_3}\)), which indicates the percentage of municipal surface flooded in a 20–50 years probabilistic scenario. Summing up, we computed the probability that a property will be hit by at least one flood in 1 year as:

As far as flood depth is concerned, no significant difference emerged among the municipalities. Therefore, we fitted the flood depth probability distribution on all the available observations in the AVI database. As shown in the bottom plot of Fig. 1, three distributions nicely approximate the curve: the Generalized Beta, the Generalized Gamma, and the Gamma. The first two achieved a similar sum of squared errors and sum of absolute errors, while both the errors are much higher for the Gamma (see Table 1). However, the likelihood ratio test suggests that the Gamma better fits the distribution. Given the mixed evidence, the Gamma has been chosen for computational advantages.

3.2 Exposure

Buildings’ structural fragility to floods is typically linked to the number of storeys. In this respect, we considered three structural typologies: buildings with 1, 2, and 3 or more storeys (see Table 2).

According to the prevailing literature, buildings with basement floors are likely to suffer higher levels of damage due to floods. Unfortunately, the information on the number of buildings with a basement is currently not available. For this reason, we took a precautionary assumption that half of the buildings have a basement.

We represented the flood exposure as

where \(B_{j,c}\) is the number of buildings with structural typology j within the municipality c, \(\bar{s}_c\) is the average apartments’ surface in c, and \(\bar{A}_c\) is the average number of apartments per building in c.

3.3 Vulnerability

The building’s vulnerability to floods is typically captured by the depth-damage curves, which represent the average damage that a building suffers during a flood that reaches a certain depth. A variety of these curves exist in the hydraulic literature, and the most widely adopted ones are the “depth-percent damage curves”, which quantify the damage as a percentage of the building value. These curves are not affected by monetary volatility and are more reliable than the ones expressing damages in absolute values (Appelbaum, 1985).

Depth-damage curves are typically constructed from historical data and reflect the characteristics of the area over which they have been estimated. Therefore, they tend to be inaccurate when applied to contexts whose urban and territorial features differ too much from the original site (Scorzini & Frank, 2015). To overcome this issue, we considered six depth-percent damage curves \(g_j(\delta )\) from the literature either defined or tested on Italian data (Appelbaum, 1985; Arrighi et al., 2013; Debo, 1982; Genovese, 2006; Luino et al., 2009; Oliveri & Santoro, 2000). The selected curves represent all or some of the considered structural typologies and are shown in Fig. 2. Curves have been averaged to guarantee higher reliability of the results at the national level and fitted by polynomial regression.

3.4 Loss

We transformed structural damages into monetary losses by means of the factor \(\frac{a}{100}\). A linear relationship between structural damages and monetary losses was assumed, in a similar way as in Asprone et al. (2013).Footnote 5 We assumed that the property value is equal to its reconstruction cost a (on average 1500 Euros per square meter, assumed to be constant among all the municipalities).

4 Earthquake risk assessment

For earthquake risk assessment we refer to Asprone et al. (2013) and extend its model by improving the accuracy of the estimates in two aspects: (i) we use the latest released data on hazard and fit the PGA probability distribution; (ii) for what concerns exposure, we apply the model to a more recent and detailed real-estate database on residential housing.

The earthquake model considers 5 building structural typologies j (i.e., reinforced concrete gravity-loaded, reinforced concrete seismic-loaded, masonry, other seismic-loaded, other gravity-loaded) and estimates losses per square meter, structural typology, and municipality as:

where s denotes “seismic”, j refers to the structural typology, c represents the municipality, \(\alpha \) is the PGA, \(F_c(\alpha ) = 1-\lambda _c(\alpha )\) is the cumulative distribution function of PGA for the c-th municipality, and \(\lambda _c(\alpha )\) is its exceedance probability. Please note that (Asprone et al., 2013) integrates the PGA on \(\left[ 0,2g\right] \) with g being the gravity acceleration unit, whereas we extended the domain to \(\left[ 0,+\infty \right) \) to include the rarest events in the analysis. Given a certain set of “limit states” (LS) representing subsequent levels of damage (usually from “no damage” to “collapse”), the probability that a building subject to an earthquake of a certain PGA will be damaged to a certain limit state is given by a “fragility curve” \(P \left( LS \vert \alpha \right) \). In more detail, denoting by X the random variable whole realization is the PGA, one defines

For each structural typology j, we considered a set of \(K_j\) fragility curves, each of which is indexed by k and is defined on a finite number \(N_{LS_k}\) of limit states. Details about the specific set of fragility curves are summarized in Asprone et al. (2013, Table 3). At last, \(a_k(LS)\) is a function that quantifies the monetary losses associated with a given LS.

Particular attention was dedicated to the PGA probability distribution. We referred to 9 seismic maps released by INGV, which represent different probabilities of exceedance in 50 years (Meletti & Montaldo, 2007) and report the corresponding PGA measures on a 0.05-degree georeferenced grid. The resulting 9 PGA measures available for each grid cell were used to extract information on the right tail of \(\lambda _c(\alpha )\), which is associated with rare and catastrophic events. This objective was achieved by regression, followed by extrapolation outside the range covered by such measures. An example is reported in Fig. 3. We found that the best fitting is obtained by the power law distribution (and not by the uniform distribution as assumed in Asprone et al., 2013). Then, the PGA values at the bedrock were multiplied by the stratigraphic \(S_S\) and topographic \(S_T\) amplification factors for the hazard curves to reflect the soil category at the building foundation. At last, we associated each grid cell with the corresponding municipality through reverse geocoding. Sometimes multiple grid cells refer to the same municipality. In this case, we represented the PGA of the municipality as the average PGA value of the grid cells in the municipality. The PGA of the municipalities for which no grid cell was available was approximated to the average value of the neighbors’ PGAs. Overall, we were able to capture 7685 municipalities.

Further details on the model components are presented in Appendix A, as the methodology does not consistently differ from the one used in Asprone et al. (2013).

The municipal losses per structural typology j in the municipality c were computed by multiplying the losses per square meter by the related exposure in the municipality \(E_{j,c}^{s}\), which is the number of the square meters covered by buildings of the j-th structural typology in the c-th municipality. Then, we summed the municipal losses per structural typology to obtain the total losses of the municipality c:

5 Results

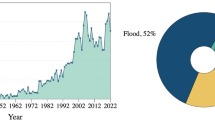

Flood and earthquake losses have been estimated per municipality, and per structural typology. Table 3 shows the results of the flood model, while results for earthquakes are shown in Table 4. We find that flood expected losses amount to about 875.90 million Euros per year, while earthquakes generate annual expected losses approximately equal to 6234.67 million Euros. It is interesting to note that, although earthquakes produce the highest expected losses at the national level, flood losses per square meter often exceed the corresponding earthquake ones. This finding is determined by the different extent of the areas exposed to the perils, as clearly shown in the maps in Fig. 4. As one can notice, almost the whole Italian territory is exposed to earthquakes, while floods affect a limited area.

Expected losses of floods (top) and earthquakes (bottom) residential risks. Left: expected loss per square meter for the most fragile structural typology (i.e., 1-storey buildings for floods and masonry buildings for earthquakes). Note that the minimum values are \(l^f_{j,c}=0\) and \(l^s_{j,c}=0.025\), whereas the maximum values are \(l^f_{j,c}=19.61\) and \(l^s_{j,c}=12.69\). Right: Expected annual loss per municipality. (Color figure online)

Comparing municipal losses and losses per square meter allows for capturing the different effects of hazard and exposure. As far as floods are concerned, Northern Italy is the most flood-prone area, and the highest expected losses per square meter are estimated around the Po River and correspond to municipalities in the Emilia-Romagna, Veneto, and Lombardy regions (see the top-left plot in Fig. 4). Most of these municipalities are densely inhabited and are therefore also associated with some of the highest municipal flood losses. In addition to this, the top-right plot in Fig. 4 shows that high municipal expected losses are also estimated on the northwest coast, in north Sardinia and Rome. Indeed, the probability that a natural phenomenon will hit these cities is quite low, but their high real estate value strongly affects their riskiness. As far as earthquakes are concerned, we find that the highest losses per square meter are associated with sparsely inhabited municipalities in the central area of the Apennines mountains, as reported in the bottom-left map in the figure. This result reflects the high probability of earthquake occurrence in the area. However, the bottom-right plot in the figure shows that the highest municipal expected losses correspond to densely populated cities on the coast. Comparing the right maps in the figure we can observe that northeast Italy is highly affected by both the two hazards, though the effects of floods remain consistently limited with respect to those of earthquakes.

6 Uncertainty

The estimates derived from the flood model are subject to uncertainty due to a set of underlying hypotheses and parameters. Traditional assessments of model prediction accuracy involve comparing estimates with historical losses, a practice often impractical for natural risk models (de Moel et al., 2015), as is the case here. Even in instances where historical records are available, such analyses allow the testing of all model components except the hazard.

Concerning the validation of our flood analysis, the report by ANIA (Association of Italian Insurers) (2011) estimates residential losses attributable to river flooding at approximately 230 million Euros annually. Our comprehensive analysis encompassing various flood types, detailed in Sect. 5, reveals an annual expected loss due to floods of approximately 876 million Euros. While a direct comparison between the results is precluded, the two values demonstrate compatibility. Additionally, ANIA found that expected losses from river floods constitute around 8% of the total annual expected loss from both river floods and earthquakes. Our findings, considering all flood types, indicate a comparable ratio of approximately 12%, aligning with the aforementioned report.

To assess the robustness of our results, we tested the sensitivity of the flood model to the chosen parameters, whose uncertainty can largely be traced back to the hazard component. The probability distributions for frequency and depth have been fitted on data from the AVI database that show great variability of flooding events in the observed years. The plots in Fig. 5 report the expected losses estimated excluding 1 year of observation at a time.Footnote 6 As one can notice, the selection of years of observed data does not strongly affect the results. However, it further reduces the low number of observations of depth. In particular, the right plot in Fig. 5 shows that the fewer observations are considered, the lower the overall loss estimates are. Nevertheless, estimates fluctuate around the mean value, showing quite limited variability.

The selection of distributions to represent the flood hazard component of the model adds a layer of uncertainty. In this analysis, we have selected distributions that exhibit optimal fitting to the observed data, characterized by heavy-tail densities. While no alternative distributions have emerged for the flood frequency distribution that match the fitting quality of the Negative Binomial, the Generalized Gamma distribution has demonstrated a satisfactory fit for the distribution of flood depth. Additionally, the Fréchet distribution, despite not aligning as well with the depth data as the Gammas, holds significance as a distribution rooted in Extreme Value Theory (EVT) (Longin, 2016). This distribution allows us to consider a scenario where extreme events carry a higher probability. The results presented in Table 5 illustrate the variation in expected losses resulting from representing depth with these alternative distributions, compared with the outcomes obtained using the Gamma distribution. Notably, these findings suggest that the model exhibits a limited sensitivity to variations in this particular assumption. In particular, we find that assuming a noticeable inflation in the right tail compared to the observed data would increase the total expected loss of 2.25%.

As far as flood frequency is concerned, we tested the sensitivity of the model to variations in the parameters of the Negative Binomial. Results of this piece of analysis are reported in Table 6, which overall shows the low sensitivity of the estimates.

Then, we explored diverse risk scenarios, providing valuable insights into the model’s response to variations in hazard and vulnerability components. The summarized results of this analysis are presented in Table 7. The initial row of the table outlines the outcomes of the base model, where flood depth follows the Gamma distribution, the probability \(P_c(N_F \ge 1)\) is modelled by the Negative Binomial, and the vulnerability function is denoted as \(g_j\). Subsequently, three distinct scenarios were considered: (i) an increase in the probability of floods, achieved by raising the probability \(P_c(N_F \ge 1)\) by 1% or 5%; (ii) an elevated probability of extreme flooding events, modelled using the Fréchet distribution for flood depth; (iii) an escalation in building fragility, assuming each level of flood depth results in a 1% higher building damage. Events (i)–(iii) are introduced individually or in combination to assess the impact of each variation on the model. For each risk scenario, the table presents the estimated maximum expected losses per square meter for each structural typology and the overall expected loss at the national level. The most substantial impacts on the model are observed as a result of a 5% increase in the probability of flooding. On the other hand, the other shocks considered do not markedly elevate losses. However, the combined effect of multiple shocks has much stronger consequences. Lastly, in the worst-case scenario considered - characterized by a 5% increase in flood frequency, depth distributed according to the Fréchet distribution, and a 1% increase in structural vulnerability - it results in a 12% increase in estimated losses.

To conclude, for the exposure, vulnerability, and loss of the earthquake model we refer to the analyses presented in Asprone et al. (2013), which suggest that the model has good predictive abilities. As previously discussed, we modified the earthquake hazard component of the model and estimated that the total annual expected loss due to earthquakes is approximately equal to 6235 million Euros. This result differs from the one provided in the former work, in which the total annual loss is estimated to be approximately equal to 11.1 billion Euros per year. For validation purposes, it is worth noticing that IVASS—the Italian insurance supervisory institute—estimated the average annual loss on residential buildings due to seismic events in Italy to be approximately equal to 4.7 billion Euros.Footnote 7 This value is quite close to our findings. For a detailed comparison of the estimates obtained by us and by Asprone et al. (2013), see Appendix B.

7 Conclusions

A natural risk assessment analysis for residential buildings has been presented. A model for flood risk assessment has been proposed and an earthquake model has been extended in order to improve the accuracy of the estimates. We have been able to estimate losses per square meter, at the municipal and national levels. The presented models might be of main relevance for governors, as they can be used to support decisions in risk management investment (for example, for cost-benefit analysis) or risk financing, especially for insurance activities.

We found that earthquakes produce higher expected losses at the national level and affect the whole country. On the other hand, we have found that floods severely affect a subset of municipalities in which they generate expected losses even higher than earthquakes. Moreover, our analysis allows identify the municipalities where the risk is mostly due to the high probability of an event and those where exposure is the main determinant of risk. These findings are particularly important for policymakers and can be useful for the definition of effective risk-reduction strategies (e.g., for the construction of short-notice flood evacuation plans, see Insania et al., 2022). Specifically, prioritizing flood risk management in the vulnerable northern regions, particularly along the Po River, emerges as a critical measure. Allocating resources and implementing resilience-enhancing measures in municipalities within the Emilia-Romagna, Veneto, and Lombardy regions is essential due to their exposure to the highest expected losses per square meter. Moreover, the consideration of regional real estate value is emphasized as a key factor influencing flood risk. Risk reduction strategies should not only consider the probability of natural phenomena but also address the economic impact on densely inhabited municipalities, such as those along the northwest coast, north Sardinia, and Rome. In these areas, strategies such as stricter building codes and incentives for retrofitting may be advisable. In earthquake-prone areas, specifically the central Apennines mountains, a focused earthquake preparedness strategy is recommended. The coexistence of flood and earthquake risks in northeast Italy highlights the need for a coordinated, cross-hazard risk mitigation approach. Policymakers can collaborate with regional authorities and develop comprehensive risk mitigation plans that address the unique challenges posed by the combined impact of these hazards.

In general, given the country’s overall susceptibility to floods and earthquakes, public awareness and education programs can play a pivotal role in building resilience at the community level. These programs should be tailored to inform residents in high-risk areas about the specific hazards they face. Additionally, the government should ensure and facilitate the development of adequate insurance coverage for both floods and earthquakes, especially in regions with high expected losses. In this regard, an application of the proposed models to home insurance has been presented in Perazzini et al. (2022). The work compares several natural hazard insurance policies and investigates public-private partnerships in natural risk insurance for the Italian case study, based on the risk assessment performed in the present article.Footnote 8 Similarly, the estimates can be used by the government for the construction and pricing of insurance-linked securities, such as catastrophe bonds.

For future works, the establishment of a framework for the periodic review and update of risk assessments should be carefully planned. This dynamic approach should consider changes in demographics, construction technologies, and climate conditions, ensuring that risk management strategies remain responsive to evolving conditions. To this aim, enhancing the collection of data on natural perils would greatly contribute to building resilience. Despite ISTAT’s commendable efforts in creating the MRCI database about natural risks, certain limitations persist. Notably, the MRCI database is static, last updated in 2018, while risks rapidly evolve due to phenomena such as urban development and climate change. Furthermore, a higher number of information on housing characteristics could facilitate further analyses, considering factors impacting natural risk-related losses such as the presence of basements for floods.

Moreover, a systematic collection of data about floods is lacking, resulting in a dearth of high-quality information on these events. While the AVI database proved valuable for insights into frequency and depth, it comes with inherent limitations. Being an archive of mostly press articles, AVI often provides incomplete and descriptive information about individual floods, making comparisons challenging across municipalities. Looking forward, a valuable addition would be a database specifically detailing losses caused by natural perils. Although challenging to gather, collaboration with the insurance sector, where available, could prove beneficial. Given the limited coverage of natural disaster insurance in Italy, investing in its expansion would be advantageous. In this respect, the collaboration between the public sector and private insurers could yield insights into flood losses and enhance our understanding of risk factors.

Data availability

Data sources used for the analysis were: the “Mappa dei Rischi dei Comuni Italiani” (MRCI) (https://www.istat.it/it/mappa-rischi); the 2015 census by the Italian National Institute of Statistics (ISTAT); the “Aree Vulnerate Italiane” (AVI) archive released by the Italian National Research Council (http://avi.gndci.cnr.it/); the most recent hazard maps released by the Italian National Institute of Geophysics and Volcanology (INGV) (Gruppo di Lavoro, 2004); the stratigraphic and topographic amplification factors reported in Colombi et al. (2010).

Notes

The UN dates the beginning of the global disaster risk reduction process to the International Expert Group Meeting in July 1979, but the first International Framework of Action—the International Decade for Disaster Reduction—began 10 years later, in January 1990. The framework has then been followed by the Yokohama Strategy in 1994, the Hyogo Framework for Action 2005–2015, the Sendai Framework, the 2030 Agenda, the Paris Agreement on climate change, the New Urban Agenda, the Addis Ababa Action Agenda, and the Agenda for Humanity.

The article extends thoroughly the book chapter (Perazzini et al., 2023) by more than doubling its content, particularly by presenting a deeper risk assessment analysis.

Legislative Decree, 23 February 2010, no. 4: “Attuazione della direttiva 2007/60/CE relativa alla valutazione e alla gestione dei rischi di alluvioni”.

Index \(P_3\) is not available for the entire Italian territory: data are missing for part of Marche and Emilia-Romagna Regions.

The reader is referred to that reference for a discussion about this linearity assumption, and about its possible extension to the nonlinear case.

Two years exhibit the strongest effect on the model and once excluded lead to the minimum and the maximum expected losses respectively: 1966 and 1998. However, there is no reason why they should be considered outliers, as no social event (e.g., wars) or change in technology and in the data collection method may have influenced the detection of floods during the 2 years.

See Cesari and D’Aurizio (2019, p. 35).

In Perazzini et al. (2022), the risk assessment is presented in much less technical details as in the present article, as the focus of that work is on the comparison of various insurance models.

Law no. 64, 2 February 1974 “Provvedimenti per le costruzioni con particolari prescrizioni per le zone sismiche”.

O.P.C.M. 3274 2003 “Primi elementi in materia di criteri generali per la classificazione sismica del territorio nazionale e di normative tecniche per le costruzioni in zona sismica”.

References

Agenzia delle Entrate. (2015). Gli immobili in Italia. Agenzia delle Entrate: Technical report.

ANIA & Carpenter, G. (2011). Danni da eventi sismici e alluvionali al patrimonio abitativo italiano. Technical report, ANIA—Associazione Nazionale fra le Imprese Assicuratrici.

Ahmad, N., Crowley, H., & Pinho, R. (2011). Analytical fragility functions for reinforced concrete and masonry buildings aggregates of Euro-Mediterranean regions—UPAV methodology. Internal report, Syner-GProject, 2009/2012.

Appelbaum, S. J. (1985). Determination of urban flood damage. Journal of Water Resources Planning and Management, 111(3), 269–283. https://doi.org/10.1061/(ASCE)0733-9496(1985)111:3(269)

Arrighi, C., Brugioni, M., Castelli, F., Franceschini, S., & Mazzanti, B. (2013). Urban micro-scale flood risk estimation with parsimonious hydraulic modelling and census data. Natural Hazards and Earth System Sciences, 13(5), 1375–1391. https://doi.org/10.5194/nhess-13-1375-2013

Asprone, D., Jalayer, F., Simonelli, S., Acconcia, A., Prota, A., & Manfredi, G. (2013). Seismic insurance model for the Italian residential building stock. Structural Safety, 44, 70–79. https://doi.org/10.1016/j.strusafe.2013.06.001

Borzi, B., Crowley, H., & Pinho, R. (2007). Un metodo meccanico per la definizione della vulnerabilitá basato su analisi pushover semplificate. In Proceedings of XII Convegno L’Ingegneria Sismica in Italia ANIDIS, Paper No. 160. Pisa, Italy.

Borzi, B., Crowley, H., & Pinho, R. (2008). The influence of infill panels on vulnerability curves for RC buildings. In Proceedings of the 14th World Conference on Earthquake Engineering. Beijing, China.

Carisi, F., Schröter, K., Domeneghetti, A., Kreibich, H., & Castellarin, A. (2018). Development and assessment of uni- and multivariable flood loss models for Emilia–Romagna (Italy). Natural Hazards and Earth System Sciences, 18, 2057–2079. https://doi.org/10.5194/nhess-18-2057-2018

Cesari, R., & D’Aurizio, L. (2019). Natural disasters and insurance cover: Risk assessment and policy options for Italy. IVASS Working Paper No. 12.

Chai, J., & Wu, H.-Z. (2023). Prevention/mitigation of natural disasters in urban areas. Smart Construction and Sustainable Cities, 1. https://doi.org/10.1007/s44268-023-00002-6.

Colombi, M., Crowley, H., Di Capua, G., Peppoloni, S., Borzi, B., Pinho, R., & Calvi, G. M. (2010). Mappe di rischio sismico a scala nazionale con dati aggiornati sulla pericolositá sismica di base e locale. Progettazione Sismica.

Crowley, H., Borzi, B., Pinho, R., Colombi, M., & Onida, M. (2008). Comparison of two mechanics-based methods for simplified structural analysis in vulnerability assessment. Advances in Civil Engineering, 2008, Article ID 438379. https://doi.org/10.1155/2008/438379.

de Moel, H., Jongman, B., Kreibich, H., Merz, B., Penning-Rowsell, E., & Ward, P. J. (2015). Flood risk assessments at different spatial scales. Mitigation and Adaptation Strategies for Global Change, 6(20), 865–890. https://doi.org/10.1007/s11027-015-9654-z

Debo, T. N. (1982). Urban flood damage estimation curves. Journal of the Hydraulics Division, 10(108), 1059–1069. https://doi.org/10.1061/JYCEAJ.0005906

Degiorgis, M., Gnecco, G., Gorni, S., Roth, G., Sanguineti, M., and Taramasso, A. C. (2012). Classifiers for the detection of flood prone areas from remote sensed elevation data. Journal of Hydrology, 470–471, 302–315. https://doi.org/10.1016/j.jhydrol.2012.09.006.

Degiorgis, M., Gnecco, G., Gorni, S., Roth, G., Sanguineti, M., & Taramasso, A. C. (2013). Flood hazard assessment via threshold binary classifiers: Case study of the Tanaro river basin. Irrigation and Drainage, 62, 1–10. https://doi.org/10.1002/ird.1806

Emrich, C. T., Aksha, S. K., & Zhou, Y. (2022). Assessing distributive inequities in FEMA’s disaster recovery assistance fund allocation. International Journal of Disaster Risk Reduction, 74. https://doi.org/10.1016/j.ijdrr.2022.102855.

Erberik, M. A. (2008). Generation of fragility curves for Turkish masonry buildings considering in plane failure modes. Earthquake Engineering and Structural Dynamics, 37, 387–405. https://doi.org/10.1002/eqe.760.

Gardin, F., & Kerckhoven, S. V. (2023). Managing environmental threats: Integrating nature-related risks into investment decisions and the financial system. In Handbook for Management of Threats (pp. 13–37). Springer. https://doi.org/10.1007/978-3-031-39542-0_2.

Genovese, E. (2006). A methodological approach to land use-based flood damage assessment in urban areas: Prague case study. JRC Report—EUR 22497.

Gnecco, G., Morisi, R., Roth, G., Sanguineti, M., & Taramasso, A. C. (2017). Supervised and semi-supervised classifiers for the detection of flood-prone areas. Soft Computing, 21, 3673–3685. https://doi.org/10.1007/s00500-015-1983-z.

Grossi, P., Kunreuther, H., & Windeler, D. (2005). An introduction to catastrophe models and insurance. In P. Grossi & H. Kunreuther (Eds.), Catastrophe modeling: A new approach to managing risk. Berlin: Springer.

Gruppo di Lavoro, M. P. S. (2004). Redazione della mappa di pericolositá sismica prevista dall’Ordinanza PCM 3274 del 20 marzo 2003. Rapporto Conclusivo per il Dipartimento della Protezione Civile.

Guzzetti, F., & Tonelli, G. (2004). Information system on hydrological and geomorphological catastrophes in Italy (SICI): A tool for managing landslide and flood hazards. Natural Hazards and Earth System Science, Copernicus Publications on Behalf of the European Geosciences Union, 4(2), 212–232. https://doi.org/10.5194/nhess-4-213-2004.

Insania, N., Akman, D., Taheri, S., & Hearne, J. (2022). Short-notice flood evacuation plan under dynamic demand in high populated areas. International Journal of Disaster Risk Reduction, 74, Paper no. 102844. https://doi.org/10.1016/j.ijdrr.2022.102844.

Kappos, A. J., Panagiotopoulos, C., Panagopoulos, G., & Papadopoulos, E. (2003). WP4: Reinforced concrete buildings (level I and II analysis). In RISK-UE project: An advanced approach to earthquake risk scenarios with applications to different European towns. Technical report. RISK-UE project deliverable, European Commission.

Kappos, A. J., Panagopoulos, G., Panagiotopoulos, C., & Penelis, G.: A hybrid method for the vulnerability assessment of R/C and URM buildings. Bulletin of Earthquake Engineering, 4, 391–413 (2006). https://doi.org/10.1007/s10518-006-9023-0.

Khan, M. T. I., Anwar, S., Sarkodie, S. A., Yaseen, M. R., & Nadeem, A. M. (2023). Do natural disasters affect economic growth? The role of human capital, foreign direct investment, and infrastructure dynamics. Heliyon, 9. https://doi.org/10.1016/j.heliyon.2023.e12911.

Kostov, M., Vaseva, E., Kaneva, A., Koleva, N., Varbanov, G., & Stefanov, D. (2006). WP13: Application to Sofia. RISK-UE project: An advanced approach to earthquake risk scenarios with applications to different European towns. Technical report. RISK-UE project deliverable, European Commission.

Kunreuther, H. (2003). Interdependent disaster risks: The need for public-private partnerships. In: Kreimer, A., Arnold, M., and Carlin., A. (eds.), Building safer cities: The future of disaster risk. Disaster risk management, series no. 3. Washington, D.C.: World Bank.

Kwon, O.-S., & Elnashai, A. (2006). The effect of material and ground motion uncertainty on the seismic vulnerability curves of RC structure. Engineering Structures, 28, 289–303. https://doi.org/10.1016/j.engstruct.2005.07.010.

Lagomarsino, S., & Giovinazzi, S. (2006). Macroseismic and mechanical models for the vulnerability and damage assessment of current buildings. Bulletin of Earthquake Engineering, 4, 415–443. https://doi.org/10.1007/s10518-006-9024-z.

Longin, F. (Ed.) (2016). Extreme events in finance: A handbook of extreme value theory and its applications. Wiley.

Luino, F., Cirio, C. G., Biddoccu, M., Agangi, A., Giulietto, W., Godone, F., & Nigrelli, G. (2009). Application of a model to the evaluation of flood damage. Geoinformatica, 13, 339–353. https://doi.org/10.1007/s10707-008-0070-3.

Meletti, C., & Montaldo, V. (2007). Stime di pericolositá sismica per diverse probabilitá di superamento in 50 anni: Valori di ag. Progetto DPC-INGV S1, Deliverable D2.

Nguyen, H. D. (2023). Spatial modeling of flood hazard using machine learning and GIS in Ha Tinh province, Vietnam. Journal of Water and Climate Change, 14 (1), 200–222. https://doi.org/10.2166/wcc.2022.257.

OECD. (2012). Disaster risk assessment and risk financing. A G20/OECD methodological framework. G20 meeting in Mexico City.

Oliveri, E., & Santoro, M. (2000). Estimation of urban structural flood damages: The case study of Palermo. Urban Water, 2, 223–234. https://doi.org/10.1016/S1462-0758(00)00062-5.

Ozmen, H., Inel, M., Meral, E., & Bucakli, M. (2010). Vulnerability of low and mid-rise reinforced concrete buildings in Turkey. In Proceedings of 14th European conference on earthquake engineering.

Perazzini, S., Gnecco, G., & Pammolli, F. (2022). A public-private insurance model for disaster risk management: An application to Italy. Italian Economic Journal. https://doi.org/10.1007/s40797-022-00210-6.

Perazzini, S., Gnecco, G., & Pammolli, F. (2023). Natural risk assessment of Italian municipalities for residential insurance. In Statistical modeling and risk analysis: ICRA 2022 (Series Springer Proceedings in Mathematics & Statistics) (vol. 430, pp. 131–142). Springer https://doi.org/10.1007/978-3-031-39864-3_11.

Petkov (2022). Public investment in hazard mitigation: Effectiveness and the role of community diversity. Economics of Disasters and Climate Change, 7, 33–92. https://doi.org/10.1007/s41885-022-00119-5.

Rota, M., Penna, A., & Magenes, G. (2010). A methodology for deriving analytical fragility curves for masonry buildings. Engineering Structures, 32, 1312–1323. https://doi.org/10.1016/j.engstruct.2010.01.009.

Rota, M., Penna, A., & Strobbia, C. (2008). Processing Italian damage data to derive typological fragility curve. Soil Dynamics and Earthquake Engineering, 28(10–11), 933–947. https://doi.org/10.1016/j.soildyn.2007.10.010.

Scorzini, A., & Frank, E. (2015). Flood damage curves: New insights from the 2010 flood in Veneto, Italy. Journal of Flood Risk Management, 10. https://doi.org/10.1111/jfr3.12163.

Shikhteymour, S. R., Borji, M., Bagheri-Gavkosh, M., Azimi, E., & Collins, T. W. (2023). A novel approach for assessing flood risk with machine learning and multi-criteria decision-making methods. Applied Geography, 158. https://doi.org/10.1016/j.apgeog.2023.103035.

Spence, R. (2007). Earthquake disaster scenario prediction and loss modelling for urban areas. In LESSLOSS Report 7. Pavia, Italy: IUSS Press.

Tsionis, G., Papailia, A., & Fardis, M. N. (2011). Analytical fragility functions for reinforced concrete and masonry buildings aggregates of Euro-Mediterranean regions—UPAT methodology. Internal report, Syner-G Project.

UNDRR. (2019). Global assessment report on disaster risk reduction 2019. United Nations, Geneva: United Nations Office for Disaster Risk Reduction .

UNISDR. (2017). National disaster risk assessment—Words into action guidelines: Governance system, methodologies, and use of results. Geneva: The United Nations Office for Disaster Risk Reduction.

World Bank. (2014). Financial protection against natural disaster: An operational framework for disaster risk financing and insurance. World Bank Group.

Acknowledgements

Giorgio Gnecco dedicates his contribution to the paper to the memory of his mother Rosanna Merlini.

Funding

Open access funding provided by Scuola IMT Alti Studi Lucca within the CRUI-CARE Agreement. The authors were partially supported by the PRIN 2022 Project “MAHATMA” (CUP: D53D23008790006), funded by the European Union Next Generation EU program.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no Conflict of interest or Competing interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Earthquake model

Here we present a detailed discussion of the components of the earthquake model that have not been presented in Sect. 4.

1.1 A.1 Exposure

As far as earthquake exposure is concerned, we referred to the relevant structural typologies identified in Asprone et al. (2013), which are based on three construction materials: reinforced concrete, masonry, and others. To identify the buildings that were built in compliance with modern anti-seismic requirements, we compared the construction year in the MRCI database to the series of regulations that led to the progressive re-classification of risk-prone areas from 1974Footnote 9 to 2003.Footnote 10 We defined a reinforced concrete or other structure as seismic-loaded if built after the laws entered into force in the municipality, and gravity-loaded otherwise. Since the database only specifies the number of buildings constructed in a time interval of approximately 10 years, we equally distributed the buildings among the years of the respective interval. According to Asprone et al. (2013), we assumed masonry was seismic-loaded only. Summing up, we have 5 structural typologies (see Table 8): gravity- or seismic-loaded reinforced concrete, masonry, gravity- or seismic-loaded other-type structures.

We computed the seismic exposure \(E^s_{j,c}\) as

where \(B_{j,c}\) is the number of buildings of type j in the c-th municipality, \(\bar{s}_c\) is the average apartments’ surface in c, and \(\bar{A}_c\) is the average number of apartments per building in c.

1.2 A.2 Vulnerability

The seismic vulnerability was captured using fragility curves, which provide the probability of exceeding a certain LS given a certain PGA. We applied the selection of fragility curves considered in Asprone et al. (2013). This selection contains 11 models for reinforced concrete structures (Ahmad et al., 2011; Borzi et al., 2007, 2008; Crowley et al., 2008; Kappos et al., 2003, 2006; Kostov et al., 2006; Kwon & Elnashai, 2006; Ozmen et al., 2010; Spence et al., 2007; Tsionis et al., 2011), 5 for masonry ones (Ahmad et al., 2011; Erberik, 2008; Lagomarsino & Giovinazzi, 2006; Rota et al., 2010, 2008), and 1 for the other typology (Kostov et al., 2006). Each model k is defined on a different set of \(N_{LS_k}\) limit states representing the building’s structural damage conditions (the last limit state always corresponds to collapse) and provides one fragility curve for each limit state. These fragility curves are log-normally shaped and require PGA as their unique input.

1.3 A.3 Loss

The loss component was represented by the function \(a_k(LS)\) which converts structural damages into monetary losses:

where each limit state is represented by a positive integer. We assumed that the property value is equal to its reconstruction cost a. Moreover, we set a equal to 1500 Euros per square meter and constant among all the municipalities.

Appendix B: Comparison of earthquake losses with the model by Asprone et al. (2013)

In this section we discuss the difference in earthquake expected losses estimated by Asprone et al. (2013) and those obtained by us and reported in Table 4.

Some differences emerge between the two analyses and there are a few elements that determine them. In general, the former work estimates higher losses for the territory. First of all, (i) estimates are highly sensitive to the probability distribution of hazard intensities, and while \(\lambda _c(\alpha )\) has been here fitted from INGV data, Asprone et al. (2013) relies on some distributional assumptions. In addition, (ii) with the aim of better modeling the right tail of the PGA distribution (which is associated with rare and catastrophic events), we assumed PGA values ranging in \([0,+\infty )\), while the previous analysis considers \(\left[ 0,2g\right] \) only. (iii) Different datasets have been used for the exposure. We refer to the MRCI dataset that collects the number of dwellings per structural typology at the municipal level, while Asprone et al. (2013) had information at the provincial level only. Moreover, MRCI refers to the 2011 population census, while the database used in the previous work refers to 2001. In particular, the differences in losses per square meter are mostly determined by arguments (i)–(ii) and therefore refer to the hazard. The differences in the aggregated losses are instead strongly determined by the different exposure databases and hence by argument (iii). The detailed information on buildings in the MRCI database allowed us to better capture the real estate assets. Rome is the most densely inhabited municipality in Italy, and we, therefore, found that its expected loss is extremely higher than the ones in the rest of the municipalities.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Perazzini, S., Gnecco, G. & Pammolli, F. A catastrophe model approach for flood risk assessment of Italian municipalities. Ann Oper Res (2024). https://doi.org/10.1007/s10479-024-06060-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-024-06060-y