Abstract

This paper analyzes bankruptcy problems from a strategic perspective using the parameterized TAL family of bankruptcy rules. We construct a strategic game where every player selects a parameter, and the rule from the TAL family that corresponds to the mean of the chosen parameters is used to divide the estate. We prove the existence of Nash equilibria for this strategic game. In particular, we provide the set of all Nash equilibria for two players, and for more players, we prove existence by constructing a Nash equilibrium of a particular form based on the notion of a pivotal player.

Similar content being viewed by others

1 Introduction

If an entity has a monetary estate that is insufficient to cover its monetary obligations to its claimants, all with justifiable claims, this leads to a so-called bankruptcy problem. A systematic procedure to solve every bankruptcy problem is called a bankruptcy rule, or, in short, rule. For every bankruptcy problem, a rule prescribes an allocation of the estate, such that no claimant receives more than his claim. The formal game-theoretic study of bankruptcy problems and rules began with O’Neill (1982). For an excellent survey, see Thomson (2019).

Several bankruptcy rules have been proposed in the literature, one of them being CEA (constrained equal awards). The CEA rule allocates the estate as equally as possible, under the condition that no claimant receives more than his claim. Similarly, the CEL (constrained equal losses) rule distributes the losses, i.e. the difference between the claim and the awards, as equal as possible such that no claimant receives a negative amount. Aumann and Maschler (1985) introduced the TAL (Talmud) rule, which is a combination of CEA and CEL, where claimants receive no more than half their claim if the sum of claims is greater than twice the estate, and no less than half their claim otherwise. In particular, TAL coincides with the nucleolus of the associated bankruptcy game, as introduced by O’Neill (1982). The TAL family of bankruptcy rules, first defined by Moreno-Ternero and Villar (2006), contains CEA, CEL, and TAL. Every rule in the TAL family is characterized by a parameter \(\theta \in [0,1]\), representing a measure of the distributive power of the rule. Moreno-Ternero and Villar (2006) studied the axiomatic foundations of the TAL family as a whole, in light of the standard properties of rules in the literature.

Besides the axiomatic approach to bankruptcy problems, there is the strategic approach (also called the Nash program, see Serrano, 2021). If the allocations of a bankruptcy rule correspond to the payoffs of a Nash equilibrium of an adequate strategic game for every bankruptcy problem, one can consider this to be a strategic justification of this rule. O’Neill (1982) proposed a strategic game in which the Nash equilibria correspond to the minimum overlap bankruptcy rule. Chun (1989) introduced a strategic game where each player is allowed to propose a solution concept. Dagan et al. (1997) capture a strategic dimension of the consistency property of bankruptcy rules. Furthermore, García-Jurado et al. (2006) provide a strategic game where each player declares how much he is willing to concede. Recently, Moreno-Ternero et al. (2022) have provided a strategic justification for each individual rule of the TAL family.

In this paper, we construct a strategic game, called the strategic TAL game, in which each player selects a parameter between 0 and 1, and the resulting payoffs are determined by the member of the TAL family corresponding to the mean of the selected parameters. The aim of this paper is to get insight into the Nash equilibria of this strategic TAL game. For two-player strategic TAL games, the payoff functions are monotone in their arguments, which enables us to characterize all Nash equilibria. Furthermore, we show that all Nash equilibrium payoffs are equal to the allocation of the Talmud rule, for every bankruptcy problem.

For strategic TAL games with three or more players, the situation is more complicated, as the payoff functions are in general not monotone for every player. We show that the existence of Nash equilibria does not readily follow from the Kakutani fixed point theorem. Instead, a constructive approach is used to prove the existence of Nash equilibria for every strategic TAL game. The Nash equilibrium we construct is based on a pivotal player, such that every player whose claim is lower than this player selects the parameter 1, and every player whose claim is higher selects the parameter 0. The idea of a pivotal player has been prevalent in the economic literature, see for example Gans and Smart (1996), Bergantiños and Moreno-Ternero (2021, 2023). The constructed Nash equilibrium reflects the intuition that players with large claims prefer CEL to CEA and vice versa.

Section 2 introduced the TAL family of bankruptcy rules, after which Sect. 3 formally defines the strategic TAL game and fully describes the set of Nash equilibria for every two-player TAL game. Lastly, in section 4 we construct a specific type of Nash equilibrium, based on pivotal players, for every strategic TAL game.

2 The TAL family of bankruptcy rules

Let N be a finite set of claimants or players. A bankruptcy problem with player set N is a tuple (E, c) where \(E \in {\mathbb {R}}_{+}\) denotes the estate and \(c\in {\mathbb {R}}_{+}^N\) a vector of claims, such that \(\sum _{j\in N} c_j \ge E\). Let \({\mathcal {B}}^N\) denote the class of all bankruptcy problems with a fixed player set N.

In this paper, we assume without loss of generality that \(N= \{1,\ldots ,n\}\) and

A bankruptcy rule is a map \(R: {\mathcal {B}}^{N} \rightarrow {\mathbb {R}}^{N}\) that assigns a vector of awards to every bankruptcy problem in such a way that, for every \((E,c)\in {\mathcal {B}}^N\),

-

\(0\le R_i(E,c) \le c_i\) for every \(i\in N\),

-

\(\sum _{i\in N} R_i(E,c) = E.\)

One way of allocating the estate is to award everyone as equally as possible, under the condition that no player receives more than his claim.

Definition

The constrained equal awards (CEA) rule is defined by

for every \((E,c)\in {\mathcal {B}}^N\) and \(i\in N\), where \(\lambda \in {\mathbb {R}}\) is such that \(\sum _{j\in N} \min \{c_j,\lambda \}=E\).

In the same way, one can distribute the losses (i.e. the difference between the claim and the awards of each player) as equally as possible under the condition that no player is allocated a negative amount.

Definition

The constrained equal losses (CEL) rule is defined by

for every \((E,c)\in {\mathcal {B}}^N\) and \(i\in N\), where \(\lambda \in {\mathbb {R}}\) is such that \(\sum _{j\in N} \max \{c_j-\lambda ,0\} = E\).

The Talmud rule is a combination of CEA and CEL. If the estate is insufficient to guarantee everyone half his claim, CEA is used as the allocation principle. If the estate is sufficient to cover all half-claims, every player gets half of his claim, and the remainder is allocated using CEL.

Definition

(Aumann & Maschler, 1985) The Talmud (TAL) rule is defined by

for every \((E,c)\in {\mathcal {B}}^N\).

Using the fact that CEA and CEL are dual rules, i.e. it holds for every \((E,c)\in {\mathcal {B}}^N\) that

we can also write

for every \((E,c)\in {\mathcal {B}}^N\).

Extending the Talmud rule, Moreno-Ternero and Villar (2006) introduced the TAL family. Each member of the TAL family is characterized by a parameter \(\theta \in [0,1]\), representing a degree of the distributive power of the bankruptcy rule.

Definition

(Moreno-Ternero & Villar, 2006) Let \(\theta \in [0,1]\). The rule \(TAL^\theta \) is defined by

for every \((E,c)\in {\mathcal {B}}^N\).

Using (2.1), one can also write

for every \((E,c)\in {\mathcal {B}}^N.\)

Clearly, \(TAL^0=CEL\), \(TAL^1=CEA\) and \(TAL^{\frac{1}{2}}= TAL.\) Furthermore, it is readily seen that \(TAL^\theta (E,c)\) is continuous in \(\theta \) for every \((E,c)\in {\mathcal {B}}^N\). In fact, we show that the function \(TAL_i^\theta (E,c)\) is piecewise linear in \(\theta \) for every \(i\in N\) and \((E,c)\in {\mathcal {B}}^N\). To this end, for every bankruptcy problem \((E,c)\in {\mathcal {B}}^N\), we define the points \(a_1(E,c),\ldots , a_n(E,c)\) and \(b_n(E,c),\ldots ,b_1(E,c)\), with

given by

for every \(k\in \{1,\ldots ,n\}\). Here, we use the notation \(C_k = \sum _{j=1}^k c_j\). Notice that not all the points in (2.4) need to be contained in the interval [0, 1]. We will often abbreviate \(a_k=a_k(E,c)\) and \(b_k=b_k(E,c)\) to ease notation.

Note that

and

for every \((E,c)\in {\mathcal {B}}^N\). Furthermore, if \((E,c)\in {\mathcal {B}}^N\) is such that \(c_i=c_j\) for some \(i,j\in N\), we have \(a_i(E,c) = a_j(E,c)\) and \(b_i(E,c)=b_j(E,c)\).

The points \(b_n(E,c),\ldots ,b_1(E,c)\) can be used to rewrite the function \(CEA_i(E,\theta c)\) for every \((E,c)\in {\mathcal {B}}^N\), \(i\in N\) and \(\theta \in [0,1]\).

Lemma 2.1

Let \((E,c)\in {\mathcal {B}}^N\), \(i\in N\) and \(\theta \in [0,1]\). Then,

Proof

Let \(\theta \le b_i\). Then \(\theta (C_i + (n-i)c_i) \le E\), and hence it is possible to allocate every player \(j\in \{1,\ldots ,i\}\) his claim \(\theta c_j\), and the remaining players \(k\in \{i+1,\ldots ,n\}\) are guaranteed at least \(\theta c_i\). Consequently,

Next, let \(\theta \in [b_{k+1}, b_k]\) and \(k\in \{1,\ldots ,i-1\}\). Then

Hence it is possible to allocate every player \(j\in \{1,\ldots , k\}\) his claim \(\theta c_k\), and the remaining players are allocated equally a value between \(\theta c_k\) and \(\theta c_{k+1}\). In other words,

Consequently, \(CEA_i(E,\theta c) = \frac{E-C_k}{n-k}.\)

Finally, let \(\theta \ge b_1\). Then \(\theta (nc_1) \ge E\), which means no player can be allocated his full claim. Therefore

for all \(j\in N\). Consequently, \(CEA_i(E,\theta c)=\frac{E}{n}\). \(\square \)

Using Lemma 2.1, and the points \(a_1(E,c),\ldots a_n(E,c)\) for the case where \(\theta \sum _{j\in N} c_j\le E\) in equation (2.2), we are now able to provide a full piecewise linear description of \(TAL_i^\theta (E,c)\) for every \((E,c)\in {\mathcal {B}}^N\), \(i\in N\) and \(\theta \in [0,1]\).

Proposition 2.2

Let \((E,c)\in {\mathcal {B}}^N\), \(i\in N \) and \(\theta \in [0,1]\). Then,

Proof

Note that, if \(\theta \ge b_n = \frac{E}{\sum _{j\in N} c_j}\), we have \(\theta \sum _{j\in N} c_j \ge E\), and due to Lemma 2.1

So, let \(\theta \sum _{j\in N} c_j \le E\) (i.e. \(\theta \le a_n=b_n\)). Then,

and, using Lemma 2.1, it follows that

where \({\tilde{b}}_k = b_k\left( \sum _{j\in N} c_j - E, c\right) \) for all \(k\in \{1,\ldots ,n\}\).

Now, note that for all \(k\in \{1,\ldots ,n\}\)

Consequently, with \(a_k=a_k(E,c)\) for every \(k\in \{1,\ldots ,n\}\), (2.8) and (2.9) imply

\(\square \)

Note that Proposition 2.2 implies that \(TAL^\theta _i(E,c)\) is strictly increasing on \([a_i,b_i]\cap [0,1]\), and \(TAL_i^\theta (E,c)\) is weakly decreasing on \([0,a_i]\) and \([b_i,1]\), for every \(i\in N\) and \((E,c)\in {\mathcal {B}}^N\).

We now illustrate the previous results by means of an example, and, in particular, we use a picture that turns out to be helpful in our further analysis.

Example 2.1

Consider the bankruptcy problem \((E,c)\in {\mathcal {B}}^N\), with \(N=\{1,2,3,4\}\), \(E=550\) and \(c=(150,200,250,350)\). First, note that

Using Proposition 2.2, we are able to calculate \(TAL_i^\theta (E,c)\), for every \(i\in N\), as a function of \(\theta \in [0,1]\). For example, we have

It follows from the above description that \(TAL_2^\theta (E,c)\) is weakly decreasing on \([0,a_2]\), then strictly increasing on \([a_2,b_2]\) and lastly weakly decreasing on \([b_2,1]\). In Fig. 1 the function \(TAL_i^\theta (E,c)\) is displayed in a graph for every player \(i\in N\).

Finally, note that \(TAL_1^\theta (E,c)\) is weakly increasing, and \(TAL_4^\theta (E,c)\) is weakly decreasing on [0, 1].\(\diamond \)

The final remark in Example 2.1 can be generalized. Using Proposition 2.2, we can write

and, similarly, for every \((E,c)\in {\mathcal {B}}^N\)

From this, one readily obtains the following result.

Proposition 2.3

\(TAL_1^\theta (E,c)\) is weakly increasing in \(\theta \) and \(TAL_n^\theta (E,c)\) is weakly decreasing in \(\theta \) for every \((E,c) \in {\mathcal {B}}^N\).

\(TAL^\theta (E,c)\) in Example 2.1

3 Strategic TAL games

The strategic approach we propose in this paper is the following. Given a bankruptcy problem, we let each player select a parameter between 0 and 1. The rule of the TAL family corresponding to the mean of the selected parameters is then used to allocate the estate.

Definition

For every bankruptcy problem \((E,c)\in {\mathcal {B}}^N\), we define the corresponding strategic TAL game \(G^{TAL}(E,c)\) by

where \(\Theta _i=[0,1]\) is player i’s strategy space, for every \(i\in N\), and

is player i’s payoff function, for every \(i\in N\).

The focus of this paper is to gain insight into the Nash equilibria (Nash, 1951) of strategic TAL games. A Nash equilibrium of a strategic TAL game \(G^{TAL}(E,c)=((\Theta _i,\pi _i))_{i\in N}\) is a strategy profile \((\theta _i)_{i\in N} \in \prod _{i\in N} \Theta _i\) such that for every \(i\in N\) and \(\theta '_i\in \Theta _i\) it holds that

That is, for every player \(i\in N\), the strategy \(\theta _i\in \Theta _i\) is a best reply to the strategies \(\theta _{-i}\) played by the other players.Footnote 1 For every player \(i\in N\) and \(\theta _{-i}\in \prod _{j\in N{\setminus }\{i\}}\Theta _j\), we write

as the set of best replies. Clearly, a Nash equilibrium is a strategy profile \((\theta _j)_{j\in N}\) such that \(\theta _i \in B_i(\theta _{-i})\) for every \(i\in N\). Denote by \({\mathcal {N}}\left( G^{TAL}(E,c)\right) \) the set of Nash equilibria of the game \(G^{TAL}(E,c)\).

Proposition 2.3, together with the fact that \(\pi _i((\theta _j)_{j\in N})=TAL_i^{\frac{1}{n}\sum _{j\in N}\theta _j}(E,c)\), for every \((E,c)\in {\mathcal {B}}^N\), implies

Next, we provide a full description of the set of Nash equilibria of two-player strategic TAL games. By construction, every two-player strategic TAL game is a constant-sum game. This implies that all Nash equilibria lead to the same payoff vector. Combining this with (3.1) we obtain the following result.

Proposition 3.1

Let \((E,c)\in {\mathcal {B}}^N\) with \(N=\{1,2\}\). Then, \((1,0)\in {\mathcal {N}}\left( G^{TAL}(E,c)\right) \). As a consequence, all Nash equilibria of \(G^{TAL}(E,c)\) lead to the payoff vector given by \(TAL^{\frac{1}{2}}(E,c) = TAL(E,c)\).

The following bankruptcy problem is an example where the corresponding two-player strategic TAL game has more than one Nash equilibrium.

Example 3.1

Consider \((E,c)\in {\mathcal {B}}^N\) with \(N=\{1,2\}\), \(E=450\) and \(c=(250,400)\). Clearly, we have

It follows from Proposition 2.2 that

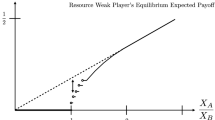

as depicted in Fig. 2. The set \(B_1(\theta _2)\) of all the best replies of Player 1 against \(\theta _2\) is given by

which is depicted in Fig. 3.

\(TAL^\theta (E,c)\) in Example 3.1 as a function of \(\theta \)

The best reply correspondence for Player 1 in Example 3.1

To see this, the following intuitive reasoning can be applied.

If \(\theta _2\le \frac{1}{5}\), then all replies \(\theta _1\in [0,1]\) lead to a mean below \(\frac{3}{5}\), and therefore all lead to a payoff to player 1 of 150.

If \(\frac{1}{5}<\theta _2 \le \frac{4}{5}\), then \(\theta _1=1\) leads to a mean between \(\frac{3}{5}\) and \(\frac{9}{10}\). Clearly, replies \(\theta _1\in [0,1)\) lead to a strictly lower mean, and therefore lead to a strictly lower payoff to player 1.

Finally, if \(\frac{4}{5}\le \theta _2 \le 1\), then exactly all replies \(\theta _1\in [\frac{9}{5} -\theta _2,1]\) lead to a mean of at least \(\frac{9}{10}\) and therefore to the highest possible payoff to player 1 of 225.

Similarly, the set \(B_2(\theta _1)\) of all best replies of Player 2 against \(\theta _1\) is given by

as depicted in Fig. 4.

The best reply correspondence for player 2 in Example 3.1

The set of Nash equilibria from Example 3.1, indicated by the dashed area

From Fig. 5, in which the intersection of two best reply correspondences is depicted, it can be concluded that

\(\diamond \)

The next theorem shows that the set of Nash equilibria of a strategic TAL game depends on the exact position of the estate with respect to the individual claims.

Theorem 3.2

Let \((E,c)\in {\mathcal {B}}^N\) with \(N=\{1,2\}\). Then,

Proof

Let \(G^{TAL}(E,c) = \left( ([0,1],\pi _1),([0,1],\pi _2)\right) \) be the strategic TAL game corresponding to the bankruptcy problem (E, c). Then,

and, since \(E = \pi _1(\theta _1,\theta _2)+\pi _2(\theta _1,\theta _2)\),

for all \(\theta _1,\theta _2\in [0,1]\).

If \(c_1=c_2\), then \({\mathcal {N}}\left( G^{TAL}(E,c)\right) =[0,1]\times [0,1]\), since in this case \(a_1=(a_2=b_2)=b_1\) and therefore

for all \(\theta _1,\theta _2\in [0,1]\).

Next, let \(c_1 <c_2 \le E\). Then, \(0\le \frac{E-c_2}{c_1}\le 1\). To prove that

it suffices to show that \(B_2(\theta _1)=[0,\frac{E-c_2}{c_1}]\) for all \(\theta _1\in [0,1]\), and that \(B_1(\theta _2)=[0,1] \text {for all } \theta _2\in [0,\frac{E-c_2}{c_1}]\).

Let \(\theta _1\in [0,1]\). Then every \(\theta _2 \in [0,\frac{E-c_2}{c_1}]\) leads to a mean less or equal to than \(a_1=1-\frac{c_1+c_2-E}{2c_1}\) and consequently to the same payoff to player 2. Moreover, every \(\theta _2\in (\frac{E-c_2}{c_1},1]\) leads to a mean strictly higher than \(a_1\), and therefore to a lower payoff to player 2. This implies \(B_2(\theta _1)=[0,\frac{E-c_2}{c_1}]\) for every \(\theta _1\in [0,1]\).

Next, let \(\theta _2\in [0,\frac{E-c_2}{c_1}]\). Then, for every \(\theta _1\in [0,1]\), the mean is smaller than \(a_1\). This means that the payoff to player 1 is constant. Therefore \(B_1(\theta _2)=[0,1]\) for every \(\theta _2\in [0,\frac{E-c_2}{c_1}]\).

We omit the proof of the case where \(E\le c_1 < c_2\), because it is analogous to the case where \(c_1 < c_2 \le E\).

Finally, let \(c_1<E<c_2\). Then \(a_1< \frac{1}{2} < b_1\). We will prove that

Proposition 3.1 guarantees that \((1,0)\in {\mathcal {N}}\left( G^{TAL}(E,c)\right) \). To see that this is the only Nash equilibrium, note that all equilibria must have the same payoff vector \(TAL^{\frac{1}{2}}(E,c)=(c_1/2,E-c_1/2)\). Since \(a_1< \frac{1}{2} < b_1\), we have that \(TAL_1^\theta (E,c)\) is strictly increasing in a neighborhood of \(\theta =\frac{1}{2}\). Similarly, \(TAL_2^\theta (E,c)\) is strictly decreasing in a neighborhood of \(\theta =\frac{1}{2}\). This, together with the fact that \(TAL_1^\theta (E,c)\) is weakly increasing and \(TAL_2^\theta (E,c)\) is weakly decreasing, implies that \(TAL^\theta (E,c) \ne TAL^{\frac{1}{2}}(E,c)\) for \(\theta \in [0,1]{\setminus }\{\frac{1}{2}\}\). Now, let \((\theta _1,\theta _2)\in {\mathcal {N}}\left( G^{TAL}(E,c)\right) \). The argument above implies

If \(\theta _1<1\), then player 1 can improve his payoff by selecting a parameter \(\theta _1'\) close to \(\theta _1\) with \(\theta _1'>\theta _1\), because \(TAL_1^\theta (E,c)\) is strictly increasing around \(\theta =\frac{1}{2}\). Therefore, \(\theta _1=1\). Similarly, if \(\theta _2>0\), player 2 can improve his payoff by selecting a parameter \(\theta _2'\) close to \(\theta _2\) with \(\theta _2'<\theta _2\). Hence, \(\theta _2=0\). \(\square \)

4 Constructing a Nash equilibrium in n-player TAL games

In this section, a specific type of Nash equilibrium is constructed for every strategic TAL game with three or more players. As a first illustration, we analyze a three-player strategic TAL game.

Example 4.1

x problem \((E,c)\in {\mathcal {B}}^N\) with \(N=\{1,2,3\}\), \(E=600\) and \((c_1,c_2,c_3)=(150,300,450)\).

By (3.1) we have that \(1\in B_1(\theta _2,\theta _3)\) and \(0\in B_3(\theta _1,\theta _2)\) for all \(\theta _1,\theta _2,\theta _3 \in [0,1]\). Therefore,

Note that the set in (4.1) is non-empty because \(\pi _2(1,\theta _2,0)\) is continuous in \(\theta _2\) and the maximum is taken over a compact interval.

Using Proposition 2.2,

as depicted in Fig. 6. For strategy combinations of the type \((1,\theta _2,0)\) the mean will be between \(\frac{1}{3}\) (when \(\theta _2=0)\) and \(\frac{2}{3}\) (when \(\theta _2=1\)). Since \(TAL_2^{\frac{1}{3}}(E,c)=TAL_2^{\frac{2}{3}}(E,c)=200\), it follows that

Hence, \(\left\{ (1,0,0),(1,1,0)\right\} \subseteq {\mathcal {N}}\left( G^{TAL}(E,c)\right) \). \(\diamond \)

\(TAL_2^\theta (E,c)\) in Example 4.1

In particular, Example 4.1 illustrates that the set of best replies need not be convex. This means that the Kakutani fixed point theorem, which is commonly used to prove the existence of Nash equilibria, cannot be applied in the conventional way.

In Example 4.1, the constructed equilibria are such that the players with a claim lower than player 2 select the strategy \(\theta =1\), and players with a claim higher than player 2 select the strategy \(\theta =0\). Here, player 2 acts as a ’pivotal player’. In Example 4.2 we construct a similar type of Nash equilibrium, using a pivotal player, for a strategic TAL game with four players, but as the example shows, a more subtle approach is needed.

Example 4.2

Consider the bankruptcy problem \((E,c)\in {\mathcal {B}}^N\) with \(N=\{1,2,3,4\}\), \(E=600\) and \(c=(100,200,350,500)\). We claim that

We show (4.3) by showing that all the strategies involved are mutual best replies.

From (3.1) it immediately follows that the strategy \(\theta = 1\) for player 1 and the strategy \(\theta = 0\) for player 4 are best replies.

For player 2, strategy combinations of the type \((1,\theta _2,\frac{2}{5},0)\) lead to a mean between \(\frac{7}{20}\) (when \(\theta _2=0\)) and \(\frac{12}{20}\) (when \(\theta _2=1\)). From Fig. 7 it can be seen that \(\theta _2=1\) is indeed a best reply.

\(TAL_2^\theta (E,c)\) in Example 4.2

Lastly, for player 3, strategy combinations of the type \((1,1,\theta _3,0)\) lead to a mean between \(\frac{1}{2}\) (if \(\theta _3=0)\) and \(\frac{3}{4}\) (if \(\theta _3=1)\). From Fig. 8 it can be seen that playing \(\theta _3 = \frac{2}{5}\) is indeed a best reply, leading to an average of \(b_3=\frac{3}{5}\).\(\diamond \)

\(TAL_3^\theta (E,c)\) in Example 4.2

Let \((E,c)\in {\mathcal {B}}^N\). In the remainder of this section, we will show the existence of a Nash equilibrium of \(G^{TAL}(E,c)\) of the formFootnote 2

with a pivotal player \(m=m(E,c) \in N\) and \(\theta _m^*\in [0,1]\). In particular, in Example 4.2 player 3 acts as the pivotal player.

The following lemma provides a starting point in the search for the pivotal player.

Lemma 4.1

Let \((E,c)\in {\mathcal {B}}^N\). Then, there exists a player \(k\in N\) such that

or such that

where, for notational convenience, we denote \(b_0 = \infty \).

Proof

Let

Clearly, if \(k\in U\cap V\), (4.5) is satisfied. Note that \(U\ne \emptyset \) because \(n\in U\) since \(b_n=\frac{E}{C_n} \le 1\).

Next, let \(U\cap V = \emptyset \). If \(1\not \in V\), then \(b_1< 0 < b_0 = \infty \), and (4.6) is satisfied for \(k=1\). So assume \(1 \in V\). Since \(n\in U\) and \(U\cap V = \emptyset \), we know that \(n\not \in V\), and therefore there must be a \(k\in N{\setminus } \{1\}\) such that \({k-1}\in V\) and \({k}\not \in V\). Because \(U\cap V=\emptyset \), this implies that \(k-1\not \in U\). Thus, (4.6) is satisfied for player k. \(\square \)

For \((E,c) \in {\mathcal {B}}^N\), define \(k(E,c)\in N\) as the player with the smallest index that satisfies (4.5) or (4.6).

In Example 4.2 it is seen that \(k(E,c)=3\), which is equal to the pivotal player in the constructed Nash equilibrium. However, this is not always the case, as the following example shows.

Example 4.3

Consider the bankruptcy problem \((E,c)\in {\mathcal {B}}^N\) with \(N=\{1,2,3,4\}\), \(E=400\) and \(c=(100,200,200,200)\). Proposition 2.2 implies

and for every \(j\in \{2,3,4\}\)

It is straightforward to check that \(k(E,c)=3\) (in this case \(\frac{1}{2} \le b_3 \le \frac{3}{4}\)). Since \(B_2(1,\theta _3,0)=\{0\}\) for every \(\theta _3\in [0,1]\), the profile \((1,1,\theta _3,0)\) cannot be a Nash equilibrium for any \(\theta _3\in [0,1]\). In this case, since \(TAL_1^\theta (E,c)\) is weakly increasing and \(TAL_j^\theta (E,c)\), for \(j\in \{2,3,4\}\), is weakly decreasing on [0, 1], the strategy profile (1, 0, 0, 0) is a Nash equilibrium of \(G^{TAL}(E,c)\).\(\diamond \)

Let \((E,c)\in {\mathcal {B}}^N\). We define

where \(B_i\) is the best reply correspondence of player i in the game \(G^{TAL}(E,c)\). Note that (3.1) implies that \(\ell (E,c)\) is well-defined. We have that in Example 4.2\(\ell (E,c)=4\) and in Example 4.3\(\ell (E,c)=2\).

For \(\ell =\ell (E,c)\) we have \(0\in B_{\ell }(1^{\ell -1},0^{n-\ell })\). In fact, the following lemma states that for every player j with an index higher than \(\ell \), the best reply structure exhibits the same feature: \(0\in B_j(1^{\ell -1},0^{n-\ell })\).

Lemma 4.2

Let \((E,c)\in {\mathcal {B}}^N\), with \(|N|\ge 3\). Let \(\ell = \ell (E,c) \in N\) be defined as in (4.7). For every \(j\in N\), let \(B_j\) be the best reply correspondence of player j for \(G^{TAL}(E,c)\). Then, for every \(j\in \{\ell ,\ldots ,n\}\)

Proof

Let \(j\in \{\ell ,\ldots ,n\}\). To ease notation, we write \(TAL_j^\theta =TAL_j^\theta (E,c)\). By assumption, \(0\in B_\ell (1^{\ell -1},0^{n-\ell })\), i.e.

If \(\ell =n\), there is nothing to prove.

Assume, for the sake of contradiction, that \(0\not \in B_j(1^{\ell -1},0^{n-\ell })\). In other words, suppose there is a strategy \(\theta '\in (0,1]\) for player j such that

Note that \(TAL_j^\theta \) is weakly decreasing for \(\theta \ge b_j\). Therefore, (4.9) implies that \(\frac{\ell -1}{n} < b_j\), and consequently, since \(b_j \le b_\ell \), we have \(\frac{\ell -1}{n}<b_\ell \). Then, as \(TAL_\ell ^\theta \) is strictly increasing on \([a_\ell ,b_\ell ]\cap [0,1]\), it follows from (4.9) that \(\frac{\ell -1}{n}<a_\ell \). Proposition 2.2 now implies that

and, since \(a_\ell \le a_j\),

Consequently,

Note that (4.9) implies that

because \(TAL_j^\theta \) is weakly decreasing for \(\theta \le a_j\).

We distinguish between two cases.

Case 1: \(\frac{\ell -1+\theta '}{n} \le b_j\).

In this case, (4.11) implies that \(\frac{\ell -1+\theta '}{n} \in [a_j,b_j]\), and therefore \(\frac{\ell -1+\theta '}{n}\in [a_\ell ,b_\ell ]\). Consequently, Proposition 2.2, together with (4.8), implies

and, together with (4.9), it follows that

Finally, using (4.10), the above inequalities imply

which is clearly a contradiction, since \(\frac{\ell -1+\theta '}{n}<1\) and \(c_\ell \le c_j\).

Case 2: \(\frac{\ell -1+\theta '}{n} > b_j\).

Since \(TAL_j^\theta \) is weakly decreasing for \(\theta \ge b_j\), Proposition 2.2 implies

Furthermore, \(a_\ell \le a_j \le b_j \le b_\ell \), and therefore \(b_j\in [a_\ell ,b_\ell ]\). Hence, Proposition 2.2 implies \(TAL_\ell ^{b_j}=b_j c_\ell \). Because \(b_j \in [\frac{\ell -1}{n},\frac{\ell }{n}]\), from (4.8) it follows that

Similar to the previous case, the above arguments imply that

which is a contradiction. \(\square \)

Now we have available all ingredients to formulate our constructive main equilibrium existence result based on a pivotal player.

Let \((E,c)\in {\mathcal {B}}^N\). We define the pivotal player \(m(E,c)\in N\) as

and we will show that the pivotal player m(E, c) is indeed the player m such that the proposed strategy profile in (4.4) is a Nash equilibrium for the game \(G^{TAL}(E,c)\).

Note that in Example 4.2\(m(E,c)=k(E,c)=3\), while in Example 4.3\(m(E,c)=\ell (E,c)=2\).

Theorem 4.3

Let \((E,c) \in {\mathcal {B}}^N\) with \(|N|\ge 3\) and let \(G^{TAL}(E,c)\) be the corresponding strategic TAL game. Let \(m(E,c)\in N\) be the pivotal player as defined in (4.12). Then, there is a \(\theta ^*_{m(E,c)}\in [0,1]\) such that

Proof

We write \(m = m(E,c)\), \(\ell =\ell (E,c)\), \(k=k(E,c)\) and \(TAL_j^\theta =TAL_j^\theta (E,c)\).

We first treat the case where \(m=1\). If \(m=k=1\), then \(b_1 <\frac{1}{n}\). This implies that \(0\in B_j(1,0^{n-2})\), for every \(j\in \{2,\ldots ,n\}\), since \(TAL_j^\theta \) is constant for \(\theta \ge b_1\). By (3.1), we have that \(1\in B_1(0^{n-1})\), and we can choose \(\theta ^*_1\), as \((1,0,\ldots ,0)\) is a Nash equilibrium.

If \(m=\ell =1\), then \(0\in B_1(0^{n-1})\). Lemma 4.2 now implies that \(0\in B_j(0^{n-1})\), for every \(j\in \{2,\ldots ,n\}\). Consequently, \((0,\ldots ,0)\) is a Nash equilibrium.

For the remainder of this proof, assume \(m\ge 2\). We distinguish two cases.

Case 1: \(k < \ell \).

In this case, \(m=k\). Note that \(m<\ell \) implies that player m satisfies (4.5) from Lemma 4.1, because the alternative (4.6) would imply \(0\in B_m(1^{m-1},0^{n-m})\) since \(TAL_m(E,c)\) is weakly decreasing for \(\theta \ge b_m\). So

Let \(\theta _m^*= nb_m - m +1\). Clearly, using (4.13), we have \(0\le \theta _m^* \le 1\). We claim that \((1^{m-1},\theta ^*_m,0^{n-m})\) is a Nash equilibrium of the game \(G^{TAL}(E,c)\). Note that the mean of the strategy profile \((1^{m-1},\theta ^*_m,0^{n-m})\) equals \(b_m\).

Claim 1a: \(1 \in B_j(1^{m-2},\theta ^*_m,0^{n-m})\) for every \(j\in \{1,\ldots ,m-1\}.\)

Clearly, (3.1) implies that \(1\in B_1(1^{m-2},\theta _m^*,0^{n-m})\). Next, suppose that for some \(j\in \{2,\ldots ,m-1\}\) we have that \(1 \not \in B_j(1^{m-2},\theta ^*_m,0^{n-m})\). Then, there is a \(\theta _j'\in [0,1)\) such that

It follows that \(\frac{m-2+\theta _j'+\theta _m^*}{n} < a_j\), since \(TAL_j^\theta \) is increasing on \([a_j,b_j]\cap [0,1]\). In particular, \(\frac{j-1}{n} \le \frac{m-2+\theta _j'+\theta _m^*}{n} < a_j\).

From (4.14) and the fact that \(TAL_j^\theta \) is decreasing for \(\theta \le a_j\), it follows that

Next, we show that for all \(\theta '\in [0,1]\)

which implies \(0\in B_j(1^{j-1},0^{n-j})\). This is a contradiction, since \(j<m\le \ell \).

Let \(\theta '\in [0,1]\). Then, \(\frac{j-1+\theta '}{n} \le \frac{m-1+\theta _m^*}{n}= b_m\). If \(\frac{j-1+\theta '}{n} \le a_j\), then \(TAL_j^{\frac{j-1}{n}} \ge TAL_j^{\frac{j-1+\theta '}{n}}\), since \(TAL_j^\theta \) is decreasing for \(\theta \le a_j\). If \(\frac{j-1+\theta '}{n} \in (a_j,b_m]\), then (4.15) implies

because \(TAL_j^\theta \) is increasing for \(\theta \in (a_j,b_m] \cap [0,1]\). This shows (4.16), a contradiction, and therefore \(1\in B_j(1^{m-2},\theta _m^*,0^{n-m})\).

Claim 1b: \(0 \in B_j\left( 1^{m-1},\theta ^*_m,0^{n-m-1}\right) \) for every \(j\in \{m+1,\ldots ,n\}\).

For every \(j\in \{m+1,\ldots ,n\}\) we have \(b_j\le b_m\). This implies that for every \(\theta _j' \in (0,1]\)

since \(TAL_j^\theta \) is decreasing for \(\theta \ge b_j\).

Claim 1c: \(\theta _m^* \in B_m\left( 1^{m-1},0^{n-m}\right) \).

It is clear that no deviation \(\theta '_m>\theta ^*_m\) can be profitable, because \(TAL_m^\theta \) is decreasing for \(\theta \ge b_m = \frac{m-1+\theta ^*_m}{n}\).

Next, suppose there is a \(\theta '_m < \theta ^*_m\) such that

This implies \(\frac{m-1+\theta '_m}{n} < a_m\), because \(TAL_m^\theta \) is increasing for \(\theta \in [a_m,b_m]\cap [0,1]\). In particular, \(\frac{m-1}{n} \le \frac{m-1+\theta '_m}{n} < a_m\). By (4.17), and the fact that \(TAL_m^\theta \) is decreasing for \(\theta \le a_m\), we have

Next, we show that for all \(\theta '\in [0,1]\)

which implies \(0\in B_m(1^{m-1},0^{n-m})\), a contradiction.

Let \(\theta '\in [0,1]\). If \(\frac{m-1+\theta '}{n} \le a_m\), we have

since \(TAL_m^\theta \) is decreasing for \(\theta \le a_m\). If \(\frac{m-1+\theta '}{n} > a_m\), then (4.18) implies

since \(TAL^\theta \) is increasing on \([a_m,b_m]\cap [0,1]\), and decreasing for \(\theta \ge b_m\). This proves (4.19), a contradiction, and therefore \(\theta _m^*\in B_m(1^{m-1},0^{n-m})\).

Case 2: \(k \ge \ell \).

In this case \(m=\ell \). We claim that in this case, the strategy profile \((1^{m-1},0^{n-m+1})\) is a Nash equilibrium.

For sure, Lemma 4.2 implies that \(0\in B_j(1^{m-1},0^{n-m})\), for every \(j\in \{m,\ldots ,n\}\). Next, let \(j\in \{1,\ldots , m-1\}\). First we show that

Clearly, since \(m = \ell \), we have \(0\not \in B_{m-1}(1^{m-2},0^{n-m+1})\). Therefore, \(\frac{m-2}{n} < b_{m-1}\), because \(TAL_{m-1}^\theta \) is weakly decreasing for \(\theta \ge b_{m-1}\). Since \(m-1< k\), the definition of k (and (4.5) in particular) implies that \(\frac{m-1}{n} < b_{m-1}\), and consequently \(\frac{m-1}{n} < b_j\).

Clearly, \(\frac{j}{n} \le \frac{m-1}{n}\). To show that (4.21) holds, it suffices to show that \(a_j < \frac{j}{n}\). Suppose \(a_j \ge \frac{j}{n}\). Then, for all \(\theta \in [0,1]\)

which follows from the fact that \(TAL_j^\theta \) is decreasing for \(\theta \le a_j\). However, this would imply that \(0\in B_j(1^{j-1},0^{n-j})\), contradicting the fact that \(j < m = \ell \).

Next, we will show that \(1 \in B_j(1^{m-2},0^{n-m+1})\). We proceed by contradiction. Let \(1 \not \in B_j(1^{m-2},0^{n-m+1})\). Then, there exists \(\theta _j'\in [0,1)\) such that

Since \(TAL_j^\theta \) is increasing for \(\theta \in [a_j,b_j]\cap [0,1]\), we have that (4.22) implies that \(\frac{m-2+\theta _j'}{n} < a_j\). Consequently,

since \(\frac{j-1}{n} \le \frac{m-2+\theta '_j}{n}<a_j\), and \(TAL_j^\theta \) is decreasing for \(\theta \le a_j\).

Finally, we show that for all \(\theta '\in [0,1]\)

which implies \(0\in B_j(1^{j-1},0^{n-j})\). Note that this is a contradiction since \(j < m = \ell \).

Let \(\theta '\in [0,1]\). If \(\frac{j-1+\theta '}{n}\le a_j\), then

because \(TAL_j^\theta \) is decreasing for \(\theta \le a_j\). Next, if \(\frac{j-1+\theta '}{n} > a_j\), then in particular \(a_j< \frac{j-1+\theta '}{n} \le \frac{m-1}{n} < b_j\). Consequently, (4.23) implies that

since \(TAL_j^\theta \) is increasing on \([a_j,b_j]\cap [0,1]\). This proves (4.24), a contradiction, and therefore \(1\in B_j(1^{m-2},0^{n-m+1})\). \(\square \)

It is worth mentioning that Example 4.2 aligns with Case 1 in the proof of Theorem 4.3, while Example 4.3 corresponds to Case 2.

The following example shows that there exist strategic TAL games with Nash equilibria that are different from the type of Nash equilibrium proposed in Theorem 4.3.

Example 4.4

Let \((E,c)\in {\mathcal {B}}^N\), with \(|N|=4\), \(E=400\), \(c = (400,500,600,700)\). Then,

is a Nash equilibrium of \(G^{TAL}(E,c)\). To see this, consider the following argument.

By (3.1) we have that \(1\in B_1(\theta ^*_{-1})\) and \(0\in B_4(\theta ^*_{-4})\). Next, note that for every \(\theta \in [0,1]\) the mean of \((1,\theta ,\frac{1}{2},0)\) is greater than \(b_1=\frac{1}{4}\), and hence \(\pi _2(1,\theta ,\frac{1}{2},0)\) is constant. Consequently, \(\frac{1}{2}\in B_2(\theta _{-2})\). The argument is analogous for player 3.

Note that, in this case, (1, 1, 1, 0) is also a Nash equilibrium, which leads to the same payoffs as \(\theta ^*\).\(\diamond \)

Theorem 4.3 shows that for strategic TAL games with four or more players there exists a Nash equilibrium similar to the one constructed in Example 4.1. However, the proof of Theorem 4.3 shows that constructing a Nash equilibrium for strategic TAL games with four or more players is notably more difficult than for games with only two or three players, as the construction of the pivotal player is quite intricate. It is well-known that CEA benefits players with lower claims, and CEL favors those with higher claims. Interestingly, this fact is reflected in the constructed Nash equilibrium, where the pivotal player neatly separates the two groups.

Notes

For a vector \(x\in {\mathbb {R}}^N\) and a subset of players \(S\subset N\), we denote by \(x_{-S}\) the restriction of x to \(N{\setminus } S\). Moreover, \(x_{-\{i\}}\) is abbreviated to \(x_{-i}\).

We write \(1^j\) and \(0^j\) for a repetition of j ones and j zeros respectively, where the case \(j=0\) corresponds to an empty repetition.

References

Aumann, R. J., & Maschler, M. (1985). Game theoretic analysis of a bankruptcy problem from the Talmud. Journal of Economic Theory, 36(2), 195–213.

Bergantiños, G., & Moreno-Ternero, J. D. (2021). Compromising to share the revenues from broadcasting sports leagues. Journal of Economic Behavior & Organization, 183, 57–74.

Bergantiños, G., & Moreno-Ternero, J. D. (2023). Decentralized revenue sharing from broadcasting sports. Public Choice, 194(1–2), 27–44.

Chun, Y. (1989). A noncooperative justification for egalitarian surplus sharing. Mathematical Social Sciences, 17(3), 245–261.

Dagan, N., Serrano, R., & Volij, O. (1997). A noncooperative view of consistent bankruptcy rules. Games and Economic Behavior, 18(1), 55–72.

Gans, J. S., & Smart, M. (1996). Majority voting with single-crossing preferences. Journal of public Economics, 59(2), 219–237.

García-Jurado, I., González-Díaz, J., & Villar, A. (2006). A non-cooperative approach to bankruptcy problems. Spanish Economic Review, 8, 189–197.

Moreno-Ternero, J. D., Tsay, M.-H., & Yeh, C.-H. (2022). Strategic justifications of the TAL family of rules for bankruptcy problems. International Journal of Economic Theory, 18(1), 92–102.

Moreno-Ternero, J. D., & Villar, A. (2006). The TAL-family of rules for bankruptcy problems. Social Choice and Welfare, 27, 231–249.

Nash, J. (1951). Non-cooperative games. Annals of Mathematics, 54(2), 286–295.

O’Neill, B. (1982). A problem of rights arbitration from the Talmud. Mathematical Social Sciences, 2(4), 345–371.

Serrano, R. (2021). Sixty-seven years of the Nash program: Time for retirement? SERIEs, 12(1), 35–48.

Thomson, W. (2019). How to divide when there isn’t enough: From Aristotle, the Talmud, and Maimonides to the axiomatics of resource allocation. Econometric Society Monographs. Cambridge University Press.

Funding

No external funding was provided to aid in the preparation of this manuscript.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no pertinent conflicts of interest to disclose regarding the content of this article.

Ethical standards

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bouwhuis, D., Borm, P. & Hendrickx, R. A strategic approach to bankruptcy problems based on the TAL family of rules. Ann Oper Res (2024). https://doi.org/10.1007/s10479-024-05906-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-024-05906-9