Abstract

This work provides evidence of the positive impact of Information and Communication Technology (ICT) on the labour productivity growth of 24 countries, members of the OECD, from 1995 to 2019. Using a non-parametric production‐frontier approach, we decompose labour productivity growth into components attributable to technological change (shifts in the world production frontier), efficiency change (movements toward or away from the frontier), physical (non-ICT) capital change and ICT capital change (movements along the frontier). We find that, on average, the most significant improvement in worldwide labour productivity is attributable to technological change, non-ICT, and ICT capital change over 1995–2019. In addition, we confirm the role of ICT as a general-purpose technology that needs to implement complementary changes in business organisations to exploit its growth opportunities fully. Finally, we conclude that ICT capital contributes to convergence.

Similar content being viewed by others

1 Introduction and literature review

The remarkable development of digitalisation and Information and Communication Technologies (ICT), especially since the 1990s, has been studied in various ways in economics and equated, in terms of magnitude and impact on development and productivity, to the most significant revolutions of modern economics (Roztocki et al., 2019; Watanabe et al., 2018). Although ICT technologies have significantly influenced business companies and, more generally, how people work and communicate within organisations, it has been a very challenging task to quantitatively establish a link between ICT and economic performance (Vu et al., 2020).

The most motivating challenge during the last decades has been to find one or more answers to Solow’s well-known production paradox: “You can see the computer age everywhere but in the productivity statistics” (Solow, 1987).

In other words, this means that Information and Communication technology has continued to advance since the early 2000s, but measured productivity growth has slowed dramatically (Byrne & Corrado, 2017). This phenomenon has been called the Information Technology (IT) productivity paradox and exists in developing (low and middle-income) as well as advanced (high-income) countries; see, for instance, the analysis of Lin and Chiang (2011). Then, it is evident that there is a discrepancy between investments in Information Technology (or ICT capital) and productivity growth, so it is natural to ask why the new ICT technologies (and the computer age) have not led to massive improvements in productivity.

Many arguments have been put forward to explain this paradox; Brynjolfsson and Hitt (2000) and Garicano and Heaton (2010) have documented that the adoption of IT requires complementary changes in the organisation of the firm, as it leads to higher productivity gains in better-managed companies. According to Cardona et al. (2013) and Liao et al. (2016), ICT holds most of the features of general purpose technology: an enabling technology that generates innovation in other economic sectors. In particular, given the nature of general purpose technology, ICT needs technical improvements and innovative complementarities to increase returns to scale phenomenon that may determine the rate of technological progress (Bresnahan & Trajtenberg, 1995). Similarly, Chou et al. (2014) recognise IT as a platform that can facilitate product and service development innovations and promote creative ideas and business process improvement, bringing about significant economic impacts. However, these spill-overs and the resulting technological improvement, can be slow. Then, the decline in productivity growth lies in the difficulty of effectively absorbing new technologies from those classified as ICT-intensive compared to less ICT-intensive users (Van Ark, 2016). In particular, a more robust empirical analysis is necessary because there is no evidence of the relationship between a time lag between ICT investments and technological change (Liao et al., 2016).

The lack of complementary investments and organisational change may determine a negative, short-run relationship between ICT investments and efficiency. Some studies point out that industries/firms can experience the benefits of ICT investments only if the organisational context (new business processes, new managerial skills, new organisational design and industry structure) for the total absorption of new ICT technologies has been outlined and prepared (Basu et al., 2003; Liao et al., 2016). For this reason, it needs to measure the changes in efficiency and their potential relationship with ICT investments. In this regard, traditional growth accounting based on Solow’s residual cannot provide an answer because total efficiency is assumed. Vice versa, if such changes are not implemented, (in)efficiency changes, which represent the catch-up towards the maximum production potential, may occur (Liao et al., 2016).

In this regard, Corrado et al. (2017) analysed the market sector of 10 major European countries from 1998–2007 to understand which intangible capital investments impact productivity growth. In contrast, Van Ark and O’Mahony (2016) classify intangible capital into three broad categories: computer information, innovative property and economic capabilities, and human resource training and organisational improvements. They find that the US has a much higher investment intensity than Europe in all three types of assets. However, the literature analysing the causes of this paradox is so broad and rich that it is challenging to stay abreast of the evidence. According to the researchers’ findings, survey papers propose different classifications of the existing literature. Among all, the survey by Cardona et al. (2013) is a structured overview that quantifies the impact of ICT on productivity growth and evaluates the general purpose technology hypothesis by classifying the existing literature into three different categories:

-

(i)

Method;

-

(ii)

Aggregation level;

-

(iii)

ICT product/measure.

The first category distinguishes articles according to the method used (parametric or non-parametric approach), the second according to the context considered (whether the results presented in the articles concern a country, an industry or a firm), and the third, finally, according to the technologies involved (hardware, software, telecommunications equipment, etc.). Regardless of the three categories, most of the 150 articles examined by the authors confirm the positive impact of ICT on economic growth.

However, the principal methodology presented in the survey by Cardona et al. (2013) is the growth-accounting (GA), which is based on Solow’s article on technical change and the aggregate production function (Solow, 1957), also discussed in Barro (1999) and Aghion and Howitt (2007). GA is a well-established methodology that aims to investigate how much the growth of various factors can explain the productive growth of a country. However, it needs to fully integrate the ICT effect, as the share of growth due to technological progress (residual) is incorrectly attributed to capital growth (Ceccobelli et al., 2012). Moreover, using some simulations, Giraleas et al. (2012) show that frontier-based approaches produce productivity change estimates that are more accurate than the traditional GA approach.

In a more recent survey, Vu et al. (2020) classify 208 articles published during the period 1991–2018 based on the (i) methodology used (e.g. regression analysis, growth accounting, production frontier, etc.); (ii) geographical area (e.g. single country, group of countries, regions or firms), (iii) effect of ICT on growth and (iv) main transmission channels between ICT and growth.

However, the articles reviewed by Vu et al. (2020) describe the positive effects of ICT capital on the growth of a Country, Industry, Firm or a combination of them. Therefore, it might be helpful to group the articles belonging to the different dimensions according to the level of aggregation of the data collected and the results obtained.

The work of Martínez et al. (2010) divides capital inputs into six types of capital: three are related to ICT assets (hardware, software and communications) and the others to non-ICT assets (constructions, machinery and transport). This work is based in the US only from 1980 to 2004. From this classification, it can be concluded that the contribution of non-ICT capital to productivity growth is small, while ICT capital is responsible for technological change.

Other significant works relating to ICT capital’s contribution to the US economic growth are those of Oliner and Sichel (2000) and Jorgenson et al. (2008). Oliner and Sichel (2000) demonstrate that ICT capital (computer hardware, software, and network infrastructure) has increasingly contributed to growth. Jorgenson et al. (2008) discuss that ICT is a substantial source of US productivity growth even after 2000, accounting for one-third of it. Hong (2017) examines the relationship between R&D investment in the ICT industry and economic growth in Korea, finding a bidirectional Granger-causality.

Other research questions are related to how gains from ICT capital differ from non-ICT capital and whether there are significant differences between developed and developing economies. The analysis of Dewan and Kraemer (2000) provides evidence of these issues by estimating a production function that includes IT and non-IT inputs for 36 countries from 1985 to 1993. They find that the estimated returns to IT investment are positive and significant for developed countries, while the returns from non-IT investments are inconsistent with relative factor shares.

For emerging countries, there are substantial returns from non-IT capital, but no significant impact is found from IT capital. Following Kumar and Russell (2002), Ceccobelli et al. (2012) applied a non-parametric framework based on Data Envelopment Analysis (DEA) and the Malmquist index to decompose the labour productivity growth into components attributable to (i) technological change (shift in the world production frontier), (ii) efficiency change (movements toward or away from the frontier), (iii) capital change (movements along the frontier). Their work investigates the relationship between ICT capital and labour productivity growth for 14 OECD countries from 1995 to 2005, using the bootstrap procedure to make inferences on some parameters. However, the need for direct measurement of the contribution of ICT capital to labour productivity growth limits their study. The current work aims to fill this gap by introducing a quadripartite decomposition.

According to Antonopoulos and Sakellaris (2009), investments in ICT capital are the main reasons for Greece’s economic recovery. Using a neoclassical growth accounting model, they show that the positive impact of ICT has increased over the period 1988–2003 and is more pronounced in the service sector.

Another contribution is the study by Vu (2013), which demonstrates, using econometric examination and growth accounting decomposition, that ICT capital was a significant source of economic growth in Singapore during 1990–2008. He also discusses strategic insights for developed and developing countries that seek to boost and embrace the impact of ICT on economic growth.

Niebel (2018) confirms the positive relationship between ICT and GDP growth, studying a panel of 59 countries from 1995 to 2010. In particular, the regression analysis shows that developing and emerging economies have similar returns on investing in ICT compared to developed economies.

Dimelis and Papaioannou (2011) use industry-level data for the US and the EU for the period 1980–2000 and a panel data methodology to assess the impact of ICT on growth. Their estimates suggest a significant ICT effect on growth in the early 1990s for the EU and in the late 1990s for the US and corroborate that the benefits are concentrated in ICT-producing and ICT-using industries. Shao and Lin (2016) evaluated the productivity performance of IT industries in 12 OECD countries from 2000 to 2011. They decompose the Malmquist productivity index into technological change and efficiency change. Their results show that changes in technology mainly drive productivity growth, while changes in efficiency have only a limited effect.

The work of Arvanitis and Loukis (2009) uses regression models and data collected in 2005 to assess the positive effect physical, ICT, and human capital have on the labour productivity growth of Swiss and Greek companies. Swiss firms can maximise the exploitation of ICTs more than Greek firms.

We present the most relevant studies of our extensive literature review in Table 1. Our literature review points to six classifications that may have influenced the empirical results: (1) level of aggregations, (2) geographic focus, (3) time period, (4) research method, (5) outcome variable and (6) main results of ICT contribution.

Other significant results in the existing literature concern the analysis of productivity convergence. Using a non-parametric approach, Arcelus and Arocena (2000) examine 14 OECD countries from 1970 to 990, also considering manufacturing and services sectors. They find evidence of convergence at different speeds according to the analysed sectors.

Kumar and Russell (2002) find that capital accumulation has been the main contributor to economic growth and bipolar international divergence. Partially contradicting Kumar and Russell’s conclusion, Henderson et al. (2005) argue that efficiency gains from physical and human capital accumulation can explain the shift of the productivity distribution from unimodal to bimodal. Again Ceccobelli et al. (2012) find out, utilising non-parametric tests, that ICT can be one of the factors contributing to the formation of convergence clusters in labour productivity development. Badunenko et al. (2013) confirm the main results of Henderson and Russell (2005), finding that efficiency shifts are solely responsible for bimodal labour productivity polarisation.

Starting from previous literature results, the present study wants to provide evidence, using a production frontier approach, of the positive effect ICT and digital technologies have had on the labour productivity growth of 24 OECD countries from 1995 to 2019. This study decomposes capital accumulation into non-ICT capital change (KACC) and ICT capital change (DACC). Hence, the tripartite decomposition, carried out by Kumar and Russell (2002), becomes a quadripartite decomposition, with the explicit contribution of ICT capital change. Our data covers an extended period (24 years) in which various economic and cultural events have developed and influenced the countries’ productive growth.

Finally, the decomposition of labour productivity growth is accompanied by a convergence analysis, and the latter allows us to examine the factors responsible for movements in the counterfactual distributions.

The structure of the paper is as follows. Section 2 describes the applied methodology and shows how to decompose labour productivity growth into four components. Data and empirical results are presented in Sects. 3 and 4. Finally, Sect. 5 concludes.

2 Research methodology

This work uses Data Envelopment Analysis (DEA) to evaluate the impact of ICT and non-ICT capital, efficiency, and technological change on economic growth. DEA is a non-parametric data-driven technique that allows estimating a frontier of production function from a sample of observations (Chen & Yu, 2014; Fried et al., 2008; Gutiérrez and Lozano, 2020; Kerstens et al., 2022). This means it identifies best practice units without imposing any parametric functional form (such as Cobb–Douglas, Translog or CES) of the production function.

We assume that countries produce output Y using three inputs: labour L, ICT capital D, and non-ICT capital K. According to production theory, this production process is operated on a production set \(\tau\):

The production set \(\tau\) includes all input–output combinations that are feasibly achievable, considering the current production technology. The boundary of the production set constitutes the frontier. Production set \(\tau\) is assumed to be monotone, convex and satisfy constant returns to scale (Chen & Yu, 2014; Fare et al., 1994; Kerstens et al., 2022; Kumar & Russell, 2002). Let t = 1, 2, …, T and j = 1, 2, …, J represent T observation on these variables for each of the J countries. It is adopted a construction of production set such as technology degradation is not allowed. This is implemented to avoid the implosion of the frontier (Henderson & Russell, 2005; Walheer, 2018). In particular, the production set is estimated as

The Farrel (1957) output efficiency measurement for country j at time t is defined by:

Equation (3) is a measure of technical efficiency, and it represents how much output can be expanded while holding inputs fixed: it is equal to or less than 1. It takes the value equal to 1 only if the country j at time t is on the frontier; a smaller value of \(E_{jt} \left( {Y_{jt} ,L_{jt} ,K_{jt} ,D_{jt} } \right)\) indicates more significant inefficiency. The Farrel output efficiency index is obtained by solving the following linear program (Fare et al., 1994; Fried et al., 2008):

The linear program (4) is computed for each observation, and the resulting value of \(\theta\) is the efficiency score.

We aim to identify the primary sources of labour productivity growth: in particular, we decompose economic growth into components attributable to (i) efficiency change (EFF), (ii) technological change (TECH), (iii) non-ICT capital change (KACC), and (iv) ICT capital change (DACC). The first three terms have been discussed by Kumar and Russell (2002), while the last term is introduced here to isolate the contribution of ICT to labour productivity growth.

Following Kumar and Russell (2002) and assuming constant returns to scale,Footnote 1 the production set can be reduced to a three-dimensional space, defining labour productivity with \(\widehat{{y_{t} }} = \frac{{Y_{t} }}{{L_{t} }}\), non-ICT capital per unit of labour with \(\widehat{{k_{t} }} = \frac{{K_{t} }}{{L_{t} }}\) and ICT capital per unit of labour \(\widehat{{d_{t} }} = \frac{{D_{t} }}{{L_{t} }}\). Considering the labour productivity change between the base period b and the current period c, the efficiency indexes in these periods are \(e_{b} = E_{b} \left( {Y_{b} ,L_{b} ,K_{b} ,D_{b} } \right)\) and \(e_{c} = E_{c} \left( {Y_{c} ,L_{c} ,K_{c} ,D_{c} } \right)\) respectively. Thus, the potential output per efficiency unit of labour in the base period is defined by \(\overline{{y_{b} }} \left( {\widehat{{k_{b} }},\widehat{{d_{b} }}} \right) = \frac{{Y_{b} }}{{e_{b} }}\) and that of the current period is \(\overline{{y_{c} }} \left( {\widehat{{k_{c} }},\widehat{{d_{c} }}} \right) = \frac{{Y_{c} }}{{e_{c} }}\), where the subscript b or c on \(\overline{y}\) indicates the year of technology. The ratio of labour productivity between the current period and the base period is

We define \(\overline{{y_{b} }} \left( {\widehat{{k_{c} }},\widehat{{d_{c} }}} \right)\) as counterfactual output per efficiency unit of labour at current-period non-ICT and ICT capital change while using the technology related to the base period. Similarly, \(\overline{{y_{c} }} \left( {\widehat{{k_{b} }},\widehat{{d_{b} }}} \right)\) is the counterfactual output per efficiency unit of labour at base-period non-ICT and ICT capital intensity using the current-period technology.Footnote 2 In order to include also the effect of ICT and non-ICT capital change, we define \(\overline{{y_{b} }} \left( {\widehat{{k_{c} }},\widehat{{d_{b} }}} \right)\) as counterfactual output per efficiency unit of labour at base-period ICT capital intensity using the technology related to the base-period, based on the assumption that non-ICT capital intensity was equal to its current-period level. Similarly, \(\overline{{y_{c} }} \left( {\widehat{{k_{b} }},\widehat{{d_{c} }}} \right)\) is the counterfactual output per efficiency unit of labour at the current period ICT capital intensity using the current-period technology based on the assumption that non-ICT capital intensity was equal to its base-period level.Footnote 3

Multiplying Eq. (4) by \(\frac{{\overline{{y_{b} }} \left( {\widehat{{k_{c} }},\widehat{{d_{b} }}} \right)}}{{\overline{{y_{b} }} \left( {\widehat{{k_{c} }},\widehat{{d_{b} }}} \right)}}\frac{{\overline{{y_{b} }} \left( {\widehat{{k_{c} }},\widehat{{d_{c} }}} \right) }}{{\overline{{y_{b} }} \left( {\widehat{{k_{c} }},\widehat{{d_{c} }}} \right)}}\), we obtain:

The terms in relation (6) measure: efficiency change (EFF), technological change (\(TECH^{b}\)), non-ICT capital change (\(KACC^{c}\)) and ICT capital change (\(DACC^{c}\)). In each term, the variable of interest changes from the denominator to the numerator: technological change is the shift in the frontier at the base period capital-labour ratio; non-ICT capital change (\(KACC^{c} )\) and ICT capital change (\(DACC^{c}\)) are measured along the current period frontier. Then labour productivity growth is decomposed into four components, isolating the effects of ICT and non-ICT capital change.

In Eq. (5), we consider the technology to the current period for measuring the effect of ICT and non-ICT capital change. Considering the base period technology instead, we can multiply Eq. (4) by \(\frac{{\overline{{y_{b} }} \left( {\widehat{{k_{c} }},\widehat{{d_{b} }}} \right)}}{{\overline{{y_{b} }} \left( {\widehat{{k_{c} }},\widehat{{d_{b} }}} \right)}}\frac{{\overline{{y_{b} }} \left( {\widehat{{k_{c} }},\widehat{{d_{c} }}} \right) }}{{\overline{{y_{b} }} \left( {\widehat{{k_{c} }},\widehat{{d_{c} }}} \right)}}\), obtaining:

Equation (7) also decomposes the labour productivity growth into four components attributable to efficiency change (EFF), technological change (\(TECH^{b}\)), ICT capital change (\(DACC^{c}\)) and non-ICT capital change (\(KACC^{c}\)). However, it is considered the technology of the base period. Thus, the choice between (6) and (7) is arbitrary, and the results will be different unless the technological change is Hicks neutral (Kumar & Russell, 2002). To overcome this ambiguity, following Fare et al. (1994) and Kumar and Russell (2002), we adopt the ‘Fisher Ideal’ decomposition, taking the geometric averages of the two measures, yielding:

where \(PROD = EFF \times TECH\) is the total factor productivity index as discussed by Fare et al. (1994). The Eq. (8) extends the decomposition of labour productivity growth introduced by Kumar and Russell (2002), including ICT capital change (DACC).

3 Data

The OECD databaseFootnote 4 is used for the data on output (Y), labour (L), non-ICT capital stock (K) and the construction of ICT capital stock (D). GDP measures output. The OECD database provides a more detailed differentiation of the contribution of various capital assets to growth. Precisely, growth contributions are calculated separately for ICT capital and non-ICT capital. According to the recent literature (Corrado et al., 2017; Haskel & Westlake, 2018) that emphasises the role of intangible assets (such as software and databases, R&D and other innovative property products), our measure of ICT capital includes Computer Hardware, Telecommunication Equipment, and Computer Software and Database while non-ICT capital is obtained as the difference between the net fixed assets and ICT capital.

Output and capital are measured in millions of the current national currency and labour in total hours worked by the employees. Output and capital are corrected by inflation and purchasing power parity (PPP), choosing 2015 as the reference year. The other variables do not need correction.

The most prominent sample possible is selected, and it consists of 24 countries: Australia, Austria, Belgium, Canada, Czech Republic, Estonia, Finland, France, Germany, Greece, Hungary, Italy, Japan, Latvia, Lithuania, Netherlands, Poland, Portugal, Slovak Republic, Slovenia, Spain, Sweden, United Kingdom and the United States. The period is 1995–2019. Table 2 shows the descriptive statistics of the variables.

We compute the median growth of each variable between 1995 and 2019. Firstly, output grows more than labour. Next, ICT capital growth differs significantly between countries, with positive and negative variations. This evidence can be the consequence of the ‘New Digital Economy’, characterised by two related phenomena: the reduction of ICT investment, especially computers and peripherals and communications equipment, as a percentage of nominal GDP and the decrease in prices of ICT assets. Thus, the countries characterised by higher ICT capital stocks in the first years of observation reduce their capital stock (at constant prices). In contrast, the countries that start with low ICT capital stock make investments to bridge the digital divide. Prices of digital assets (such as computers and peripherals, communications equipment, and software) have declined rapidly, allowing companies to operate at lower costs, increase efficiency, and provide products and services at lower prices (Van Ark, 2016).

4 Results

4.1 Results of the decomposition

The results of the decomposition of labour productivity growth (LABPROD CHG) from 1995 to 2019 are reported in Table 3. The single row shows for each country the contributions to labour productivity growth of the four components: efficiency change (EFF CHG), technological change (TECH CHG), physical (non-ICT) capital change (KACC CHG) and ICT capital change (DACC CHG).

The arithmetic and geometric averages indicate that the most significant improvement in worldwide labour productivity is similarly attributable to technological change, ICT and non-ICT capital change over the period 1995–2019.

Some further considerations are possible when ICT capital change is considered in analysing single country growth. Czech, Finland, Hungary, Latvia and Poland’s growth was driven primarily by ICT capital change, whereas Estonia derived primarily from physical capital change. The most considerable contribution to Lithuania, Slovak Republic and Slovenia’s growth appears to be mainly from efficiency improvements. There are no cases of collapse in labour productivity growth. However, some countries show a loss of efficiency (moving away from the frontier); the most relevant cases are Estonia, Greece, Italy, Japan, Latvia, and Spain.

The results obtained from the decomposition analysis were divided by years and by geographical area. Specifically, we divided the 24 available years into time intervals of 5 years, except for the last interval, which consisted of 4 years, and the 24 countries in Western Europe, Central-Eastern Europe, Northern America, and Asia-Australia. Table 4 shows the geometric averages of the four components of labour productivity growth for groups of countries, while “Appendix A” reports the detailed results.

Table 4 shows that the labour productivity growth in Western Europe and Northern America has slowed since the mid-2000s. Table 4 also sheds light on the contribution dynamics of ICT capital change to labour productivity growth. ICT capital change is mainly responsible for the growth of labour productivity in most countries during the period 1995–2010, but this turns into a lower coefficient after 2010. Then, the weak performance after 2010 is attributable to a low contribution of non-ICT and ICT capital change to labour productivity growth. Slower growth in ICT investment has been registered in the last decade. The ‘New Digital Economy’ is characterised by rapidly falling prices of ICT assets and by increased spending on ICT services rather than investment in ICT assets (Van Ark, 2016; Van Ark & O’Mahony, 2016; Watanabe et al., 2018).

However, the effects of digitalisation on growth were hidden in Europe more than in Northern America: in the last decade, the total contribution of ICT to labour productivity growth in European countries (Western and Central—Eastern Europe) is more downwards than that of Northern American countries (see “Appendix A” Tables 22–24). Furthermore, according to Van Ark (2016) and Remes et al. (2018), the primary source of the observed slowdown lies in the financial crisis in 2008 that has created weak demand, excess capacity, uncertainty, and unwillingness by firms to invest; for this reason, European and American countries have supported banks increasing public debt.

The global financial crisis also severely impacted the regular functioning of credit and capital markets in Japan and Australia. Although a weak economic recovery was already recorded in 2010, the results indicate a new slowdown between 2015 and 2019 (see Table 4). Nevertheless, our analysis shows that the investment effects from ICT in Northern America and Asia–Australia countries already slowed the 10 years before the 2008–2009 crisis and only declined moderately since 2008. Australia’s decline is due to a loss of efficiency, both to a lack of ICT capital accumulation and scarce technological progress. Japan’s decline is attributable to a loss of efficiency and a lack of physical and ICT capital accumulation. According to Flath (2022), Japan’s economic development is hampered by low population growth, substantial restrictions on foreign immigration, a high level of public debt and the central bank’s inability to implement expansive monetary policies.

The slowdown in labour productivity also affected the Central-Eastern European countries; our analysis provides evidence of its causes (see “Appendix A”). For some countries (Estonia, Hungary and Latvia), it can be attributable to efficiency losses: in this case, improving the government and managerial systems would be necessary. For other countries (the Slovak Republic and Slovenia), the leading cause of the productivity slowdown can be attributable to a lack of physical capital accumulation. In this latter case, increasing investments in physical capital is essential.

However, concerning previous studies, we can also observe the change between 2015 and 2019. In this last period, labour productivity growth in the Central-Eastern European countries increased weakly again. This is partly due to efficiency improvements, suggesting that some reforms have been implemented.

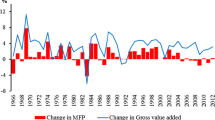

4.2 ICT as a new general purpose technology

Extensive literature has provided evidence of the “general purpose” nature of ICT. A general purpose technology is distinguished by its ability to fundamentally change production processes in industries that use a new invention (Basu et al., 2003). Benefiting from ICT requires unobserved additional co-invention and substantial corresponding investments in learning and reorganisation. The impact of ICT investments on technological progress is expected to be positive but “lagged” over time because of the potential mismatches between the organisation, the processes, the enabling systems and new technology (Liao et al., 2016). This transition period could be more or less long depending on countries’ ICT infrastructure and their ability to absorb newly developed technology. The productivity impact of ICT can only be materialised once it reaches a critical mass of diffusion and experience. Figure 1 shows the relationship between technological change (TECH) and ICT capital change (DACC) of the same period and between technological change (TECH) and ICT capital change occurred 5 years earlier (DACC_lag); in line with the time intervals of Sect. 4.1. We find that ICT capital change does not affect technological change in the short term (the estimated regression coefficient is β = − 0.003, p-value = 0.904); while there is a positive effect on technological progress in the next 5 years (β = 0.095, p-value < 0.001).

During the transition period, ICT investments can cause a productivity slowdown because it is necessary to reorganise working methods, integrate new technological tools in previous systems and routines, and re-skilling human capital (Liao et al., 2016). This failure to combine ICT investments with appropriate organisational changes explains the negative relationship between efficiency and ICT capital during the transition period (the estimated regression coefficient is β = − 0.449, p-value < 0.001); see Fig. 2. The findings related to Figs. 1 and 2 are confirmed considering a time interval of 4 years; see Appendix B.

4.3 Analysis of productivity distributions

To complete our work, we analyse multi-modality and distribution differences between the 1995 labour productivity distribution and counterfactual distributions obtained from adding the components EFF, TECH, KACC and DACC. Using the dip test of unimodality (Hartigan & Hartigan, 1985), we cannot reject unimodality in 1995 and 2019,Footnote 5 while we reject unimodality only for the counterfactual distributions with the capital-labour ratio.Footnote 6

Table 5 examines the statistical significance of differences between actual and counterfactual distributions. It applied the test proposed by Li et al. (2009) with 5,000 bootstrap replications. The results show that efficiency change and ICT capital change are only responsible for moving the 1995 distribution to 2019. This is also confirmed by the evidence that the test fails to reject the null hypothesis when one of these two components is included.

The graphical analysis of the counterfactual distributions of labour productivity growth can complement the distribution difference tests. Following Henderson and Russell’s (2005) approach, labour productivity in 1995 is multiplied by the components of the quadripartite decomposition. By introducing the single components of the decomposition separately, it is possible to explain the factors mainly responsible for the changes in labour productivity distribution between 1995 and 2019.

It is possible to evaluate several sequences of the components, and Fig. 3 reported only one of the possible outcomes; the other sequences are reported in “Appendix C”. In each panel, the solid curve is the actual 2019 output distribution per worker. In panel a, the dashed curve is the actual 1995 distribution of output per worker. The dashed curves in panels b, c and d are counterfactual distributions isolating, sequentially, the effects of non-ICT capital change, ICT capital change and efficiency change for the 1995 distribution of output per worker.

ICT capital change reduces the differences in distributions, and countries that have invested in ICT capital have achieved an increase in labour productivity. The rise in labour productivity can be generated by the growth of the ICT industry itself, by the improvement of all industrial sectors due to an increase in quality and a fall in the prices of ICT equipment and by the diffusion of internet services and the development of e-commerce, the so-called spill-over effect (Paunov and Rollo, 2016). Finally, panel d) shows that countries have improved their input–output configurations.

5 Conclusions

In this work, we have extended the tripartite decomposition that Kumar and Russell (2002) proposed to analyse economic growth and convergence across countries. Using a production frontier approach, we have carried out a quadripartite decomposition to assess the contribution of efficiency change, technological change, non-ICT capital and ICT capital to the labour productivity growth of 24 OECD countries from 1995 to 2019. Our findings confirm that technological change and non-ICT and ICT capital change are significant sources of economic growth, measured by labour productivity growth, and reject the hypothesis of any clubs among countries. In addition, the analysis of the results by year and by geographical area reveals the “general purpose” nature of ICT. We find evidence that the ICT contribution to technological progress is positive but “lagged”, as supposed by some previous studies, because it takes time for ICT usage to be efficiently assimilated and absorbed into the workforce of a country.

Finally, the initial (in)efficiency changes are due to the need for complementary organisational investment and intangible assets required for the new ICT capital to become effective and its gain to be realised. Further research should better investigate the factors contributing to increasing and decreasing the length of the transition period for each country.

6 Appendix A

See Table 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24 and 25.

Notes

The Malmquist productivity index is defined concerning constant returns to scale (Fare et al., 1994). However, this assumption can be relaxed, allowing a further decomposition that includes also scale effects.

They are computed obtaining the efficiency indexes, respectively, as \(E_{b} \left( {Y_{c} ,L_{c} ,K_{c} ,D_{c} } \right)\) and \(E_{c} \left( {Y_{b} ,L_{b} ,K_{b} ,D_{b} } \right)\)

\(\overline{{y_{b} }} \left( {\widehat{{k_{c} }},\widehat{{d_{b} }}} \right)\) is obtained using the efficiency indexes computed from \(E_{b} \left( {Y_{b} ,L_{b} ,K_{c} ,D_{b} } \right)\). In contrast, \(\overline{{y_{c} }} \left( {\widehat{{k_{b} }},\widehat{{d_{c} }}} \right)\) is obtained from \(E_{c} \left( {Y_{c} ,L_{c} ,K_{b} ,D_{c} } \right).\)

We cannot reject unimodality at the 5% level; the p-values of the tests for 1995 and 2019 are 0.241 and 0.325, respectively.

P-value equal to 0.021.

References

Aghion, P., & Howitt, P. (2007). Capital, innovation, and growth accounting. Oxford Review of Economic Policy, 23(1), 79–93.

Antonopoulos, C., & Sakellaris, P. (2009). The contribution of information and communication technology investments to Greek economic growth: An analytical growth accounting framework. Information Economics and Policy, 21(3), 171–191.

Arcelus, F. J., & Arocena, P. (2000). Convergence and productive efficiency in fourteen OECD countries: A non-parametric frontier approach. International Journal of Production Economics, 66(2), 105–117.

Arvanitis, S., & Loukis, E. N. (2009). Information and communication technologies, human capital, workplace organisation and labour productivity: A comparative study based on firm-level data for Greece and Switzerland. Information Economics and Policy, 21(1), 43–61.

Basu, S., Fernald, J.G., Outlton, N., & Srinivasan, S. (2003). The case of the missing productivity growth. In: Gertler, M., Rogoff, K. (Eds.), NBER macroeconomics annual. National Bureau of Economic Research, pp. 9–63.

Badunenko, O., Henderson, D. J., & Russell, R. R. (2013). Polarisation of the worldwide distribution of productivity. Journal of Productivity Analysis, 40(2), 153–171.

Barro, R. J. (1999). Notes on growth accounting. Journal of Economic Growth, 4(2), 119–137.

Bresnahan, T. F., & Trajtenberg, M. (1995). General purpose technologies ‘Engines of growth’? Journal of Econometrics, 65(1), 83–108.

Brynjolfsson, E., & Hitt, L. M. (2000). Beyond computation: Information technology, organisational transformation and business performance. Journal of Economic Perspectives, 14(4), 23–48.

Byrne, D. M., & Corrado, C. A. (2017). ICT services and their prices: What do they tell us about productivity and technology?. Finance and Economics Discussion Series, 2017–015.

Cardona, M., Kretschmer, T., & Strobel, T. (2013). ICT and productivity: Conclusions from the empirical literature. Information Economics and Policy, 25(3), 109–125.

Ceccobelli, M., Gitto, S., & Mancuso, P. (2012). ICT capital and labour productivity growth: A non-parametric analysis of 14 OECD countries. Telecommunications Policy, 36(4), 282–292.

Chen, P. C., & Yu, M. M. (2014). Total factor productivity growth and directions of technical change bias: Evidence from 99 OECD and non-OECD countries. Annals of Operations Research, 214(1), 143–165.

Chou, Y. C., Chuang, H. H. C., & Shao, B. (2014). The impacts of information technology on total factor productivity: A look at externalities and innovations. International Journal of Production Economics, 158, 290–299.

Corrado, C., Haskel, J., & Jona-Lasinio, C. (2017). Knowledge spill-overs, ICT and productivity growth. Oxford Bulletin of Economics and Statistics, 79(4), 592–618.

Dewan, S., & Kraemer, K. L. (2000). Information technology and productivity: Evidence from country-level data. Management Science, 46(4), 548–562.

Dimelis, S. P., & Papaioannou, S. K. (2011). ICT growth effects at the industry level: A comparison between the US and the EU. Information Economics and Policy, 23(1), 37–50.

Fare, R., Grosskopf, S., Norris, M., & Zhang, Z. (1994). Productivity growth, technical progress, and efficiency change in industrialised countries. American Economic Review, 84(1), 66–83.

Farrell, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society Series A: Statistics in Society, 120(3), 253–281.

Flath, D. (2022). The Japanese economy. Oxford University Press.

Fried, H. O., Lovell, C. K., Schmidt, S. S., & Schmidt, S. S. (Eds.). (2008). The measurement of productive efficiency and productivity growth. Oxford University Press.

Garicano, L., & Heaton, P. (2010). Information technology, organisation, and productivity in the public sector: Evidence from police departments. Journal of Labor Economics, 28(1), 167–201.

Giraleas, D., Emrouznejad, A., & Thanassoulis, E. (2012). Productivity change using growth accounting and frontier-based approaches–Evidence from a Monte Carlo analysis. European Journal of Operational Research, 222(3), 673–683.

Gutiérrez, E., & Lozano, S. (2020). Cross-country comparison of the efficiency of the European forest sector and second stage DEA approach. Annals of Operations Research, 314(2), 471–496.

Hartigan, J. A., & Hartigan, P. M. (1985). The dip test of unimodality. The Annals of STATISTICS, 13(1), 70–84.

Haskel, J., & Westlake, S. (2018). Productivity and secular stagnation in the intangible economy. VoxEU. org, 31.

Henderson, D. J., & Russell, R. R. (2005). Human capital and convergence: A production-frontier approach. International Economic Review, 46(4), 1167–1205.

Hong, J. P. (2017). Causal relationship between ICT R&D investment and economic growth in Korea. Technological Forecasting and Social Change, 116, 70–75.

Jorgenson, D. W., Ho, M. S., & Stiroh, K. J. (2008). A retrospective look at the US productivity growth resurgence. Journal of Economic Perspectives, 22(1), 3–24.

Kerstens, K., Sadeghi, J., Van de Woestyne, I., & Zhang, L. (2022). Malmquist productivity indices and plant capacity utilisation: new proposals and empirical application. Annals of Operations Research, 315(1), 221–250.

Kumar, S., & Russell, R. R. (2002). Technological change, technological catch-up, and capital deepening: Relative contributions to growth and convergence. American Economic Review, 92(3), 527–548.

Liao, H., Wang, B., Li, B., & Weyman-Jones, T. (2016). ICT as a general-purpose technology: The productivity of ICT in the United States revisited. Information Economics and Policy, 36, 10–25.

Li, J., Tai, B. C., & Nott, D. J. (2009). Confidence interval for the bootstrap P-value and sample size calculation of the bootstrap test. Journal of Nonparametric Statistics, 21(5), 649–661.

Lin, W. T., & Chiang, C. Y. (2011). The impacts of country characteristics upon the value of information technology as measured by productive efficiency. International Journal of Production Economics, 132(1), 13–33.

Martínez, D., Rodríguez, J., & Torres, J. L. (2010). ICT-specific technological change and productivity growth in the US: 1980–2004. Information Economics and Policy, 22(2), 121–129.

Niebel, T. (2018). ICT and economic growth–Comparing developing, emerging and developed countries. World Development, 104, 197–211.

Oliner, S. D., & Sichel, D. E. (2000). The resurgence of growth in the late 1990s: Is information technology the story? Journal of Economic Perspectives, 14(4), 3–22.

Paunov, C., & Rollo, V. (2016). Has the internet fostered inclusive innovation in the developing world? World Development, 78, 587–609.

Remes, J., Manyika, J., Bughin, J., Woetzel, J., Mischke, J., & Krishnan M. (2018). Solving the productivity puzzle: The role of demand and the promise of digitization. McKinsey Global Institute. https://www.mckinsey.com/~/media/mckinsey/featured%-20insights/meeting%20societys%20expectations/solving%20the%20productivity%20puzzle/mg-solving-the-productivity-puzzle--report-february-2018.pdf.

Roztocki, N., Soja, P., & Weistroffer, H. R. (2019). The role of information and communication technologies in socioeconomic development: Towards a multi-dimensional framework. Information Technology for Development, 25(2), 171–183.

Shao, B. B., & Lin, W. T. (2016). Assessing output performance of information technology service industries: Productivity, innovation and catch-up. International Journal of Production Economics, 172, 43–53.

Solow, R. M. (1957). Technical change and the aggregate production function. Review of Economics and Statistics, 39(3), 312–320.

Solow, R. M. (1987). We’d better watch out (p. 36). New York Times Book Review.

Van Ark, B. (2016). The productivity paradox of the new digital economy. International Productivity Monitor, 31(3), 3–18.

Van Ark, B., & O’Mahony, M. (2016). Productivity growth in Europe before and since the 2008/2009 economic and financial crisis. In D. Jorgenson, K. Fukao, & M. Timmer (Eds.), The world economy: Growth or stagnation? (pp. 111–152). Cambridge University Press.

Vu, K. M. (2013). Information and communication technology (ICT) and Singapore’s economic growth. Information Economics and Policy, 25(4), 284–300.

Vu, K., Hanafizadeh, P., & Bohlin, E. (2020). ICT as a driver of economic growth: A survey of the literature and directions for future research. Telecommunications Policy, 44(2), 101922.

Walheer, B. (2018). Labour productivity growth and energy in Europe: A production-frontier approach. Energy, 152, 129–143.

Watanabe, C., Naveed, K., Tou, Y., & Neittaanmäki, P. (2018). Measuring GDP in the digital economy: Increasing dependence on uncaptured GDP. Technological Forecasting and Social Change, 137, 226–240.

Funding

Open access funding provided by Università degli Studi di Siena within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Fulgenzi, R., Gitto, S. & Mancuso, P. Information and communication technology and labour productivity growth: a production‐frontier approach. Ann Oper Res 333, 123–156 (2024). https://doi.org/10.1007/s10479-024-05818-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-024-05818-8