Abstract

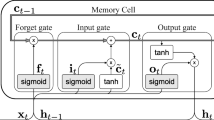

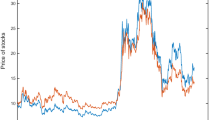

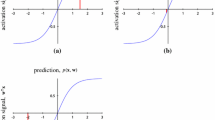

This paper introduces a comprehensive multidimensional pair trading strategy that integrates a multi-objective programming approach, cyclical insights, and neural networks to optimize trading performance. The strategy aims to exploit market inefficiencies by identifying statistical arbitrage opportunities in highly-correlated pairs of stocks. By incorporating multiple objectives, including maximizing returns and minimizing risk, the multi-objective programming framework enables the exploration of a diverse set of Pareto-optimal solutions. The inclusion of cyclical insights enhances the understanding of market dynamics, while the neural network methodology captures complex patterns and accurately predicts trading signals.

Similar content being viewed by others

Notes

The specific value of c is not clearly specified.

References

Alexander, C. O. (2001). Market models: A guide to financial data analysis. Wiley.

Alexander, C. O., & Dimitriu, A. (2002). The Cointegration alpha: Enhanced Index Tracking and long-short equity market neutral strategies. Discussion papers in Finance. ISMA Centre, University of Reading.

Alexander, C. O., & Dimitriu, A. (2005). Indexing and statistical Arbitrage: Tracking error or cointegration? Journal of Portfolio Management, 32, 50–63.

Andreou, P. C., Charalambous, C., & Martzoukos, S. H. (2008). Pricing and trading European options by combining artificial neural networks and parametric models with implied parameters. European Journal of Operational Research, 185(3), 1415–1433.

Bertoneche, M. L. (1979). Spectral analysis of stock market prices. Journal of Banking and Finance, 3(2), 201–208.

Burden, F., & Winkler, D. (2008). Bayesian regularization of neural networks. Methods in Molecular Biology, 458, 25–44.

Chen, H., Chen, S. J., Chen, Z., & Li, F. al. (2019). Investigation of an Equity Pairs Trading Strategy. Management Science, 65(1), 370-389.

Desai, J., Trivedi, A., & Joshi, N. (2012). The case of gold and silver: A new algorithm for Pairs trading. Ahmadabad: Shri Chimanbhai Patel Institutes.

Do, B., Faff, R., & Hamza, K. (2006). A New Approach to Modelling and Estimation for Pairs Trading. Monash University.

Do, B., & Faff, R. (2009). Does naïve pairs trading still work. Working Paper. Monash University.

Do, B., & Faff, R. (2012). Are Pairs trading profits robust to trading costs? Journal of Financial Research, 35(2), 261–287.

Dwyer, G. P. (2015). The Johansen Tests for Cointegration, White Paper.

Elliott, R. J., Van Der Hoek, J., & Malcolm, W. P. (2005). Pairs trading. Quantitative Finance, 5(3), 271–276.

Engle, R. F., & Granger, C. W. (1987). Cointegration and Error Correction: Representation, Estimation, and Testing. Econometrica: Journal of the Econometric Society, 251–276.

Engelberg, J., Gao, P., & Jagannathan, R. (2008). An anatomy of Pairs trading: The role of idiosyncratic news, Common Information and Liquidity. University Of Notre Dame.

Faber, M. T. (2007). A quantitative approach to tactical asset allocation. The Journal of Wealth Management. (2013).

Figuerola-Ferretti, I., Serrano, P., Tang, T., & Vaello, A. (2017). Supercointegrated, Working paper.

Fischer, T., & Krauss, C. (2018). Deep learning with long short-term memory networks for financial market predictions. European Journal of Operational Research, 270(2), 654–669.

Gatev, E., Goetzmann, W., & Rouwenhorst, K. G. (1999). Pairs Trading: Performance of a Relative Value Arbitrage Rule. Working papers. Yale School of Management.

Gatev, E., Goetzmann, W., & Rouwenhorst, K. (2006). Pairs trading: Performance of a relative-value arbitrage rule. Review of Financial Studies, 19(3), 797–827.

Gianola, D., Okut, H., Weigel, K. A., & Rosa, G. J. M. (2011). Predicting complex quantitative traits with Bayesian neural networks: A case study with Jersey cows and wheat. BMC Genetics, 12, 1–37.

Granger, C. W. J., & Morgenstern, O. (1963). Spectral Analysis of New Your Stock Market Prices. Kyklos.

Hagan, M. T., & Menhaj, M. B. (1994). Training feedforward networks with the Marquardt algorithm. IEEE Transactions on Neural Networks, 5, 989–993.

Hamilton, J. D. (1994). Time Series Analysis. Princeton University Press.

Herlemont, D. (2003). Pairs Trading. Convergence Trading, Cointegration, YATS Finances and Technology, 33, 1–31.

Hecht-Nielsen, R. (1992). Theory of the Backpropagation Neural Network. Neural Networks for Perception Computation, Learning, and Architectures (pp. 65–93).

Huafeng, C., Shaojun, C., & Feng, L. (2012). Empirical investigation of an equity Pairs trading strategy. Working paper.

Huck, N. (2009). Pairs selection and outranking: An application to the S &P 100 index. European Journal of Operational Research, 196(2), 819–825.

Huck, N. (2010). Pairs trading and outranking: The multi-step-ahead forecasting case. European Journal of Operational Research, 207(3), 1702–1716.

Huck, N. (2015). Pairs trading: does volatility timing matter?. Applied Economics (pp. 1–18).

Iacobucci, A. (2003). Spectral Analysis for Economic Time Series. Observatoire Francais des Conjonctures Economiques (OFCE).

Johansen, S. (1988). Statistical Analysis of Cointegration Vectors. Journal of Economic Dynamics and Control, 12, 231–254. North-Holland.

Johansen, S. (1991). Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models. Econometrica: Journal of the Econometric Society. 1551–1580.

Kayri, M. (2016). Predictive abilities of Bayesian regularization and Levenberg–Marquardt algorithms in artificial neural networks: A comparative empirical study on social data. Mathematical and Computational Applications, 21(2), 20.

Krauss, C., Do, X. A., & Huck, N. (2017). Deep neural networks, gradient-boosted trees, random forests: Statistical arbitrage on the S &P 500. European Journal of Operational Research, 259(2), 689–702.

Lin, Y., Mccrae, M., & Chandra, G. (2006). Loss protection in pairs trading through minimum profit bounds: A cointegration approach. Journal of Applied Mathematics and Decision Sciences, 1, 1.

Maciel, L. S., & Ballini, R. (2008). Design a neural network for time series financial forecasting: accuracy and robustness analysis. Anales do\(9^{\circ }\)Encontro Brasileiro de Finanças, Sao Pablo, Brazil.

Marwalla, T. (2007). Bayesian training of neural networks using genetic programming. Pattern Recognition Letters, 28, 1452–1458.

Moreno, M., & Platania, F. (2015). A cyclical square-root model for the term structure of interest rates. European Journal of Operational Research, 241(1), 109–121.

Moreno, M. , Novales, A., & Platania, F. (2019). Long-term swings and seasonality in energy markets. European Journal of Operational Research. https://doi.org/10.1016/j.ejor.2019.05.042

Nath, P. (2003). High Frequency Pairs Trading with U.S Treasury Securities: Risks and Rewards for Hedge Funds. Working paper. London Business School.

Pizzutilo, F. (2013). A note on the effectiveness of Pairs trading for individual investors. International Journal of Economics and Financial Issues, 3(3), 763–771. Bari, Italy.

Puspaningrum, H. (2012).Pairs trading using cointegration approach. University of Wollongong Thesis Collection 1954–2016.

Rampertshammer, S. (2007). An Ornstein–Uhlenbeck framework for Pairs trading. http://www.ms.unimelb.edu.au/publications/RampertshammerStefan.pdf.

Rojas, R. (1996). The Backpropagation Algorithm, Neural Networks. Springer.

Ross, S. A. (1976). The Arbitrage Theory of Capital Asset Pricing. Journal of Economic Theory, 13(3), 341–360.

Rumelhart, D. E., Hinton, G. E., & Williams, R. J. (1986). Learning representations by back-propagating errors. Nature Publishing Group.

Sermpinis, G., Theofilatos, K., Karathanasopoulos, A., Georgopoulos, E. F., & Dunis, C. (2013). Forecasting foreign exchange rates with adaptive neural networks using radial-basis functions and Particle Swarm Optimization. European Journal of Operational Research, 225(3), 528–540.

Sermpinis, G., Stasinakis, C., Theofilatos, K., & Karathanasopoulos, A. (2015). Modeling, forecasting and trading the EUR exchange rates with hybrid rolling genetic algorithms-Support vector regression forecast combinations. European Journal of Operational Research, 247(3), 831–846.

Specht, D. F. (1991). A General Regression Neural Network. IEEE Transactions on Neural Networks (Vol. 2).

Ticknor, J. L. (2013). A Bayesian regularized artificial neural network for stock market forecasting. Expert Systems with Applications, 14, 5501–5506.

Titterington, D. M. (2004). Bayesian methods for neural networks and related models. Statistical Science, 19, 128–139.

Vidyamurthy, G. (2004). Pairs Trading: Quantitative Methods and Analysis (Vol. 217). Wiley.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Platania, F., Appio, F., Toscano Hernandez, C. et al. A multi-objective pair trading strategy: integrating neural networks and cyclical insights for optimal trading performance. Ann Oper Res (2023). https://doi.org/10.1007/s10479-023-05754-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-023-05754-z