Abstract

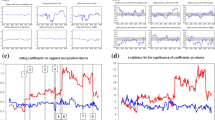

We examine the risk spillovers in the Chinese financial system by adopting a time-varying copula-CoVaR approach. We first identify the systemically important financial institutions for each industry group in China’s financial sector in a dynamic context. We then find strong evidence of upside and downside risk spillovers between these key institutions and the financial system, by quantifying value at risk (VaR), conditional VaR (CoVaR) and delta CoVaR (ΔCoVaR) through time-varying copulas. The empirical results further reveal asymmetric downside and upside risk spillover effects, indicating asymmetric hedging strategies for investors during market upturns and downturns.

Similar content being viewed by others

Notes

It should be mentioned that there are several alternative methods when estimating the time-varying parameters of the copula models. On the other hand, the regime switching copulas allow the changes of functional forms of couples over time. A detailed review can be found in Manner and Reznikova (2012). The detailed description of these approaches, however, is beyond the scope of this study.

We thank an anonymous reviewer for this comment.

The empirical analysis is based on the 5% VaR. When using the 1% VaR, our main findings remain robust. For brevity, the results using the 1% VaR are not reported here but can be provided upon request.

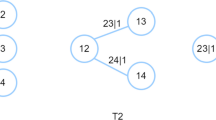

The SIFIs identified for each of the three industrial groups using the static copula-CoVaR approach are the same institutions as identified by the time-varying copula CoVaR approach, namely, SPDB, PS and PAI for banks, diversified financials and insurance, respectively. The estimation process is not shown here for brevity.

For brevity, the results of risk spillover and tests of asymmetric effects for diversified financials-PS and insurance-PAI are not reported here.

References

Abadie, A. (2002). Bootstrap tests for distributional treatment effects in instrumental variable models. Journal of the American Statistical Association, 97, 284–292.

Acharya, V., Engle, R., & Richardson, M. (2012). Capital shortfall: A new approach to ranking and regulating systemic risks. American Economic Review, 102, 59–64.

Acharya, V. V., Pedersen, L. H., Philippon, T., & Richardson, M. (2017). Measuring systemic risk. The Review of Financial Studies, 30, 2–47.

Adrian, T., & Brunnermeier, M. K. (2016). Covar. American Economic Review, 106, 1705–1741.

Banulescu, G.-D., & Dumitrescu, E.-I. (2015). Which are the sifis? A component expected shortfall approach to systemic risk. Journal of Banking and Finance, 50, 575–588.

BCBS. 2013. Global systemically important banks: updated assessment methodology and the higher loss absorbency requirement. https://www.bis.org/publ/bcbs255.pdf.

Bernal, O., Gnabo, J.-Y., & Guilmin, G. (2014). Assessing the contribution of banks, insurance and other financial services to systemic risk. Journal of Banking and Finance, 47, 270–287.

Bernanke, B., Gertler, M., & Gilchrist, S. (1996). The financial accelerator and the flight to quality. The Review of Economics and Statistics, 78, 1–15.

Bernardi, M., Durante, F., & Jaworski, P. (2017). Covar of families of copulas. Statistics and Probability Letters, 120, 8–17.

Betz, F., Hautsch, N., Peltonen, T. A., & Schienle, M. (2016). Systemic risk spillovers in the European banking and sovereign network. Journal of Financial Stability, 25, 206–224.

Billio, M., Getmansky, M., Lo, A. W., & Pelizzon, L. (2012). Econometric measures of connectedness and systemic risk in the finance and insurance sectors. Journal of Financial Economics, 104, 535–559.

Bollerslev, T., & Wooldridge, J. M. (1992). Quasi-maximum likelihood estimation and inference in dynamic models with time-varying covariances. Econometric Reviews, 11, 143–172.

Brownlees, C., & Engle, R. F. (2017). Srisk: A conditional capital shortfall measure of systemic risk. The Review of Financial Studies, 30, 48–79.

Dias, A., & Embrechts, P. (2009). Testing for structural changes in exchange rates’ dependence beyond linear correlation. The European Journal of Finance, 15, 619–637.

Diebold, F. X., & Yılmaz, K. (2014). On the Network topology of variance decompositions: Measuring the connectedness of financial firms. Journal of Econometrics, 182, 119–134.

ECB 2010. Financial networks and financial stability. Financial Stability Review, pp. 155–160.

Fan, X.-Q., Du, M.-D., & Long, W. (2017). Risk spillover effect of Chinese commercial banks: Based on indicator method and covar approach. Procedia Computer Science, 122, 932–940.

Fang, L., Sun, B., Li, H., & Yu, H. (2018). Systemic risk network of chinese financial institutions. Emerging Markets Review, 35, 190–206.

FSB. 2009. Guidance to assess the systemic importance of financial institutions, markets and instruments: initial considerations. Report to G20 finance ministers and governors.

FSB 2010. Reducing the moral hazard posed by systemically important financial institutions, FSB recommendations and time lines.

FSB 2016. 2016 List of global systemically important insurers (G-SIIs). http://www.fsb.org/wp-content/uploads/2016-list-of-global-systemically-important-insurers-G-SIIs.pdf.

FSB 2018. 2018 List of global systemically important banks (G-SIBs). http://www.fsb.org/wp-content/uploads/P161118-1.pdf.

Gang, J., & Qian, Z. (2015). China’s monetary policy and systemic risk. Emerging Markets Finance and Trade, 51, 701–713.

Ghulam, Y., & Doering, J. (2018). Spillover effects among financial institutions within Germany and the United Kingdom. Research in International Business and Finance, 44, 49–63.

Glasserman, P., & Young, H. P. (2015). How likely is contagion in financial networks? Journal of Banking and Finance, 50, 383–399.

Glick, R., & Hutchison, M. (2013). China’s financial linkages with Asia and the global financial crisis. Journal of International Money and Finance, 39, 186–206.

Hansen, B. E. 1994. Autoregressive conditional density estimation. International Economic Review, 705–730.

Härdle, W. K., Wang, W., & Yu, L. (2016). Tenet: Tail-event driven network risk. Journal of Econometrics, 192, 499–513.

Hautsch, N., Schaumburg, J., & Schienle, M. (2014). Financial network systemic risk contributions. Review of Finance, 19, 685–738.

Hmissi, B., Bejaoui, A., & Snoussi, W. (2017). On Identifying the domestic systemically important banks: The case of Tunisia. Research in International Business and Finance, 42, 1343–1354.

Huang, Q., De Haan, J., & Scholtens, B. (2017). Analysing systemic risk in the Chinese banking system. Pacific Economic Review. https://doi.org/10.1111/1468-0106.12212

Ji, Q., Bouri, E., Roubaud, D., & Shahzad, S. J. H. (2018). Risk spillover between energy and agricultural commodity markets: A dependence-switching Covar-Copula model. Energy Economics, 75, 14–27.

Ji, Q., Liu, B.-Y., & Fan, Y. (2019). Risk dependence of CoVaR and structural change between oil prices and exchange rates: A time-varying copula model. Energy Economics, 77, 80–92.

Jin, X. (2018). Downside and upside risk spillovers from China to Asian stock markets: A Covar-Copula approach. Finance Research Letters, 25, 202–212.

Joe, H. (1997). Multivariate Models and Multivariate Dependence Concepts. Chapman and Hall/CRC.

Kanno, M. (2015). Assessing systemic risk using interbank exposures in the global banking system. Journal of Financial Stability, 20, 105–130.

Liu, B.-Y., Ji, Q., & Fan, Y. (2017). Dynamic return-volatility dependence and risk measure of Covar in the oil market: A time-varying mixed Copula model. Energy Economics, 68, 53–65.

Low, R. K. Y. (2018). Vine Copulas: Modelling systemic risk and enhancing higher-moment portfolio optimisation. Accounting and Finance, 58, 423–463.

Mainik, G., & Schaanning, E. (2014). On dependence consistency of covar and some other systemic risk measures. Statistics and Risk Modeling, 31, 49–77.

Manner, H., & Reznikova, O. (2012). A survey on time-varying copulas: Specification, simulations, and application. Econometric Reviews, 31, 654–687.

Mensi, W., Hammoudeh, S., Shahzad, S. J. H., & Shahbaz, M. (2017). Modeling systemic risk and dependence structure between oil and stock markets using a variational mode decomposition-based copula method. Journal of Banking and Finance, 75, 258–279.

Nelsen, R. B. (2006). An Introduction to Copulas. Springer.

Patton, A. J. (2006). Modelling asymmetric exchange rate dependence. International Economic Review, 47, 527–556.

Patton, A. J. (2012). A review of Copula models for economic time series. Journal of Multivariate Analysis, 110, 4–18.

Philippas, D., & Siriopoulos, C. (2013). Putting the “C” into crisis: Contagion, correlations and copulas on EMU bond markets. Journal of International Financial Markets, Institutions and Money, 27, 161–176.

Pragidis, I. C., Aielli, G. P., Chionis, D., & Schizas, P. (2015). Contagion effects during financial crisis: Evidence from the Greek sovereign bonds market. Journal of Financial Stability, 18, 127–138.

Reboredo, J. C., Rivera-Castro, M. A., & Ugolini, A. (2016). Downside and upside risk spillovers between exchange rates and stock prices. Journal of Banking and Finance, 62, 76–96.

Reboredo, J. C., & Ugolini, A. (2015). Systemic risk in European sovereign debt markets: A Covar-Copula approach. Journal of International Money and Finance, 51, 214–244.

Sedunov, J. (2016). What Is the systemic risk exposure of financial institutions? Journal of Financial Stability, 24, 71–87.

Shahzad, S. J. H., Van Hoang, T. H., & Arreola-Hernandez, J. (2018). Risk spillovers between large banks and the financial sector: Asymmetric evidence from Europe. Finance Research Letters. https://doi.org/10.1016/j.frl.2018.04.008

Wang, G.-J., Jiang, Z.-Q., Lin, M., Xie, C., & Stanley, H. E. (2018a). Interconnectedness and systemic risk of China’s financial institutions. Emerging Markets Review, 35, 1–18.

Wang, G.-J., Xie, C., Zhao, L., & Jiang, Z.-Q. (2018b). Volatility connectedness in the Chinese banking system: Do state-owned commercial banks contribute more? Journal of International Financial Markets, Institutions and Money, 57, 205–230.

Wu, F. (2019). Sectoral contributions to systemic risk in the Chinese stock market. Finance Research Letters, 31, 386–390.

Wu, F., Zhang, D., & Zhang, Z. (2019). Connectedness and risk spillovers in China’s stock market: A sectoral analysis. Economic Systems, 43, 100718.

Xu, Q., Chen, L., Jiang, C., & Yuan, J. (2018). Measuring systemic risk of the banking industry in China: A Dcc-Midas-T approach. Pacific-Basin Finance Journal, 51, 13–31.

Yao, S. J., He, H. B., Chen, S., & Ou, J. H. (2018). Financial liberalization and cross-border market integration: Evidence from China’s stock market. International Review of Economics and Finance, 58, 220–245.

Zhang, D. (2017). Oil Shocks and Stock Markets Revisited: Measuring Connectedness from a Global Perspective. Energy Economics, 62, 323–333.

Zhang, D., & Fan, G. (2018). Regional spillover and rising connectedness in China’s urban housing prices. Regional Studies, 53, 1–13.

Zhang, D., Lei, L., Ji, Q., & Kutan, A. M. (2018). Economic policy uncertainty in the Us and China and their impact on the global markets. Economic Modelling, 79, 47–56.

Zhang, D., Liu, Z., Fan, G.-Z., & Horsewood, N. (2017). Price bubbles and policy interventions in the Chinese housing market. Journal of Housing and the Built Environment, 32, 133–155.

Zhang, Z. W., Zhang, D. Y., Wu, F., & Ji, Q. (2020). Systemic risk in the Chinese financial system: A copula-based network approach. International Journal of Finance and Economics. https://doi.org/10.1002/ijfe.1892

Acknowledgements

Supports from the National Natural Science Foundation of China under Grant Nos. 72022020, 71974159, 71974181 and the 111 Project (Grant No.: B16040) are acknowledged.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wu, F., Zhang, Z., Zhang, D. et al. Identifying systemically important financial institutions in China: new evidence from a dynamic copula-CoVaR approach. Ann Oper Res 330, 119–153 (2023). https://doi.org/10.1007/s10479-021-04176-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04176-z