Abstract

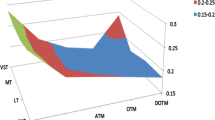

In this paper we present an option pricing model based on the assumption that the underlying asset price is an exponential Mixed Tempered Stable Lévy process. We also introduce a new R package called PricingMixedTS that allows the user to calibrate this model using procedures based on loss or likelihood functions.

Similar content being viewed by others

Notes

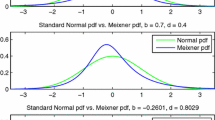

We refer the interested reader to Rroji and Mercuri (2015) for a more complete analysis on the shape of MixedTS distribution and on the behaviour of skewness and kurtosis for varying \(\alpha \) and different combinations of \(\lambda _+\) and \(\lambda _{-}\).

In the PricingMixedTS the dumping parameters can be selected by the user, the default value is 0.75.

Recall that APE and RMSE yield the same estimates as explained in Sect. 4.

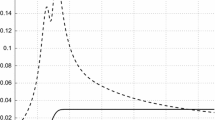

The uniform density has bounded support and the bounds depends on the model parameters. Consequently asymptotic results cannot be derived trivially (see Lehmann and Casella 1998, for more details).

References

Arnold, T., & Crack, T. F. (1999). A practical guide to GMM (with applications to option pricing). Available at SSRN, 268828.

Box, G. E. P., & Tiao, G. C. (1962). A further look at robustness via bayes’s theorem. Biometrika, 49(3/4), 419–432.

Carr, P., & Madan, D. (1999). Option valuation using the fast fourier transform. Journal of Computational Finance, 2(4), 61–73.

Carr, P., & Wu, L. (2004). Time-changed lévy processes and option pricing. Journal of Financial Economics, 71(1), 113–141.

Christoffersen, P., & Jacobs, K. (2004). The importance of the loss function in option valuation. Journal of Financial Economics, 72(2), 291–318.

Eberlein, E., & Madan, D. B. (2009). Sato processes and the valuation of structured products. Quantitative Finance, 9(1), 27–42.

Forbes, C. S., Martin, G. M., & Wright, J. (2007). Inference for a class of stochastic volatility models using option and spot prices: Application of a bivariate kalman filter. Econometric Reviews, 26(2–4), 387–418.

Gerber, H. U., Shiu, E. S., et al. (1994). Option pricing by esscher transforms. Transactions of the Society of Actuaries, 46(99), 140.

Hurn, A., Lindsay, K., & McClelland, A. (2015). Estimating the parameters of stochastic volatility models using option price data. Journal of Business & Economic Statistics, 33(4), 579–594.

Johnson, N. L., & Kotz, S. (1970). Distributions in statistics. New York, NY: Wiley. (in four volumes).

Lehmann, E. L., & Casella, G. (1998). Theory of point estimation (Springer texts in statistics) (2nd ed.). Berlin: Springer.

Li, H., Wells, M. T., & Cindy, L. Y. (2008). A bayesian analysis of return dynamics with lévy jumps. Review of Financial Studies, 21(5), 2345–2378.

Rroji, E., & Mercuri, L. (2015). Mixed tempered stable distribution. Quantitative Finance, 15(9), 1559–1569.

Sato, K. I. (1999). Lévy processes and infinitely divisible distributions. Cambridge: Cambridge University Press.

Schoutens, W. (2003). Lévy processes in finance: Pricing financial derivatives. New York: Wiley.

Schoutens, W., Simon, E., & Tistaert, J. (2004). A perfect calibration! Now what? Wilmott Magazine, 8, 66–78.

Subbotin, M. (1923). On the law of frequency of error. Mathematicheskii Sbornik, 31, 296–301.

Tankov, P. (2003). Financial modelling with jump processes (Vol. 2). Boca Raton, FL: CRC press.

Tiao, G. C., & Lund, D. R. (1970). The use of olumv estimators in inference robustness studies of the location parameter of a class of symmetric distributions. Journal of the American Statistical Association, 65(329), 370–386.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Mercuri, L., Rroji, E. Option pricing in an exponential MixedTS Lévy process. Ann Oper Res 260, 353–374 (2018). https://doi.org/10.1007/s10479-016-2180-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-016-2180-x