Abstract

Bitcoin enthusiasts argue that it is free from central banks decisions and it is a hedge against inflation. Using high-frequency monetary surprises associated with decisions made by the Fed and the ECB, I show that these claims are not supported by the data. Bitcoin systemically reacts to monetary and central bank information shocks. I find that these reactions vary over time: not only by changing the magnitude but sometimes sign of reaction. Fed’s disinflationary shocks increase Bitcoin price, while the ECB’s decrease, hence providing little support for it as an inflation hedge.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Monetary policy affects various asset classes: stocks, bonds, foreign exchange rates and others (see Jarociński and Karadi 2020; Paul 2020; Gilchrist et al. 2019; Gürkaynak et al. 2021). Surprisingly monetary policy affects cryptocurrencies prices even though these assets were meant to be free from any form of government influence. Take for instance the most popular cryptocurrency: Bitcoin is more volatile around monetary policy events and on average reacts to monetary policy shocks (Karau 2021). Has Bitcoin reacted to monetary policy from its inception? Or did it start to react once it became more wide-spread?

It is likely that the relationship between monetary policy decisions and Bitcoin has evolved as the ecosystem matured. The same applies to the relationship between Bitcoin and other financial assets: Fig. 1 shows that correlation of monthly returns with stock market indices varies from \(-\) 0.35 to 0.80. Tasca et al. (2018) document the evolution of the Bitcoin ecosystem and point to three phases: (1) early prototype stage, (2) growth stage dominated by illegal activities like gambling and black markets and, (3) mature stage dominated by legitimate entities like cryptocurrency exchanges.

Why specifically it is interesting to analyze Bitcoin responses following monetary policy decisions? First, many central banks work on introduction of Central Bank Digital Currencies (CBDC) which may compete with standard cryptocurrencies including Bitcoin (Cong and Mayer 2022; Laboure et al. 2021; Claeys et al. 2018). At some point central banks may need to know if and how they affect competitors of CBDCs. Second, many central banks are directly or indirectly tasked with keeping financial system stable. The Fed and the ECB assess that currently cryptocurrencies do not pose significant threats to financial stability, however if cryptocurrencies become more systemic they can become a source of significant vulnerability (Azar et al. 2022; Manaa et al. 2019). Third, impact of monetary policy decisions on Bitcoin uncovers its nature—whether it behaves as an inflation hedge following monetary tightening that eventually lowers inflation. It also allows to understand if monetary policy can drive its valuations among other factors (Halaburda et al. 2022).

For a few years after 2009—year in which Bitcoin was created by Satoshi Nakamoto—the concept of cryptocurrencies was not known in finance. Investing in Bitcoin was not easy due to technological constraints. However, its popularity grew so fast that nowadays both institutional and retail investors can easily access many cryptocurrencies. For instance, today institutional investors consider Bitcoin as a part of asset portfolios due to benefits of diversification (Platanakis and Urquhart 2019; Guesmi et al. 2019). According to Pew Research Center in 2021 16% of U.S. adults have invested in, traded or used a cryptocurrency (Faverio and Massarat 2022). While this falls short of 60% of U.S. adults participating in the stock market it is sufficiently high for prices of cryptocurrencies to matter for households wealth. Especially in those countries where cryptocurrencies are more popular (Feyen et al. 2022).

In this paper I investigate whether Bitcoin has ever been independent from the central bank influence and in particular how this relation changed over time. I find that Bitcoin systematically reacts to the Fed and the ECB decisions, but the patterns of these reactions change significantly and are hard to reconcile. For instance, until 2013 Bitcoin acted as an inflation hedge: its price decreased following disinflationary monetary shock by the Fed. It is surprising that this reaction was the strongest at Bitcoins inception, when it was still not known to general public. It is even more surprising that after 2013 Bitcoin price reversed its reaction to monetary shocks. At the same time its reaction to the ECB decisions was time-varying, but consistently negative.

My paper is related to the growing literature analyzing the relationship between Bitcoin and the traditional financial assets (Bouri et al. 2017; Ji et al. 2018; Park et al. 2021; Stavroyiannis and Babalos 2017; Pal and Mitra 2019). Bouri et al. (2017) use dynamic conditional correlation to establish that Bitcoin has a limited use as a hedge for major stock market indices. Ji et al. (2018) employ directed acyclic graph to find that Bitcoin is quite isolated from the main financial assets, however the relationship varies over time. Stavroyiannis and Babalos (2017) use time series models to conclude that Bitcoin is neither hedge nor diversifier and does not possess safe-haven properties with respect to S &P 500 index.

Methods I use in the paper draw from the literature focusing on the effects of high-frequency monetary policy surprises on asset prices (Gilchrist et al. 2019; Gürkaynak et al. 2021; Karau 2021; Kroencke et al. 2021; Paul 2020). I follow Jarociński and Karadi (2020) to deconstruct both the Fed and the ECB monetary policy surprises into two types of shocks: pure monetary shocks and central bank information shocks. Jarociński and Karadi (2020) show that the shock type matters as the direction of reaction of financial and macroeconomic variables depends on the shock type—it depends on the reason why interest rates were changed—not only on direction of changes. Karau (2021) finds that shock types matter also for Bitcoin. Closest to my study is Karau (2021) since he analyzes the responses of Bitcoin to monetary policy shocks using time-invariant vector autoregression (VAR) model. I extend his approach by using time-varying VAR, which allows to compare Bitcoin returns reaction to monetary policy at different points in time.

2 Data and method

2.1 Financial time series

Endogenous variables consist of financial time series obtained from Bloomberg. The list of time series is as follows.

-

Bitcoin price in US dollars (BTCUSD).Footnote 1

-

Euro to US dollar exchange rate (EURUSD).

-

Stock market indices in the US and the Euro Area (EA): S &P 500 and EURO STOXX 50.

-

Implied volatility of the US and the EA stock markets: VIX and VSTOXX.

-

2-year sovereign bond yield for the US and Germany.Footnote 2

Data are transformed before estimating the model. Bond yields are analyzed as first-differences of levels, while all other variables are taken as first-differences of their log-levels. Data are monthly and the sample starts on July 2010 and ends on June 2019. Sample ends in 2019 due to availability of monetary policy surprises taken from Gürkaynak et al. (2021). The detailed explanation of the surprises data follows in the next section.

In Fig. 6 (Appendix) I visualize relationships between each pair of financial variables. Apart from strong correlation in stock market indices and implied volatilities there are no clear patterns in the monthly returns. Especially not when it comes to Bitcoin returns.

2.2 Monetary policy surprises

Central banks monetary policy decisions are not endogenous as they reflect current and expected economic activity. If asset prices embody expectations, changes in asset prices in a narrow window around monetary policy meetings reflect the extent to what markets were surprised by a monetary policy decision. Jarociński and Karadi (2020) provide a method to identify exogenous monetary policy shocks using such surprises. I follow their approach and use surprises around the Fed and the ECB decisions.Footnote 3 Surprises data come from Altavilla et al. (2019) and Gürkaynak et al. (2021).

My measures of the interest surprise are US and German 2-year government bonds yield changes. I assume these yields are risk-free and capture innovations in forward guidance. I do not use central bank policy rates since they stayed near zero for extended periods of time and hence may not be informative (Karau 2021). My measures of stock market surprise are changes in S &P 500 and EURO STOXX 50 indexes.

Monetary policy tightening should decrease stock prices and lower bond yields. Stock prices should fall since the present value of dividends decreases: partly because future dividends are discounted by higher interest rate and partly because the future dividends decrease. The impact of monetary tightening on bond yields is obvious.

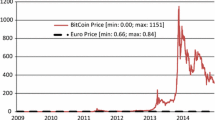

In reality this is not always the case. For instance Fig. 2 shows surprises after the ECB’s decisions. Two green-colored quadrants in this figure are in line with conventional wisdom: negative co-movement in changes in interest rates and changes in stock market index. More than one third of these changes does not match the conventional wisdom.

Jarociński and Karadi (2020) explain that wrong-signed surprises are associated with the decisions that are dominated by the release of private information possessed by a central bank—news about economic outlook. For instance, monetary easing is associated with stressing out significant risks to demand. Interest rates are lowered so one would expect higher stock prices. However, stocks react more to the pessimistic information than to the interest rate cut. In such cases monetary policy surprises are dominated by information shocks, not pure monetary shocks.

Pure monetary shocks and information shocks have different economic consequences despite the same direction of interest rate changes: output, inflation and stock prices react differently to these shocks (Jarociński and Karadi 2020). Karau (2021) shows that the same holds for Bitcoin. Paul (2020) shows that stock price and house price reactions vary substantially over the business cycle.

2.3 TVP-VAR Model

To analyze the effects of monetary policy on Bitcoin I estimate time-varying parameters vector autoregression (TVP-VAR) model that generates time-varying responses of endogenous variables to shocks. Reduced-form TVP-VAR of order p can be written as:

where \(Y_{t}\in \left[ X_{t},M_{t}\right] \) is a vector of endogenous financial variables \(X_{t}\) and high-frequency surprises \(M_{t}\) at time t, \(A_{k,t}\) is time-varying coefficient matrix related to k-th lag, \(C_{t}\) is time-varying vector of constant and \(\Xi _{t}\) is a vector of error terms.

Drawing on the literature I assume that TVP-VAR coefficients follow a random walk: it is a flexible and parsimonious proxy for different data-generating processes (Lubik and Matthes 2015). Hence, \(A_{t}\) follows:

where \(\nu _{t}\) is a vector of error terms. I assume that model error terms \(\Xi _{t}\) and \(\nu _{t}\) are jointly normally distributed with mean zero and the variance-covariance matrix to be block diagonal, which takes the form:

where \(\Sigma =\textrm{diag}\left( \left\{ \sigma _{i}^{2}\right\} \right) \). I estimate the model using Bayesian techniques. Bayesian methods have advantage in structural econometric modeling as they are particularly well-adapted to the treatment of time variation and they discipline the behavior of the model, especially when its dimension is high. They also easily handle sign restrictions that I use to identify the shocks.

The choice of priors is crucial in TVP-VAR estimation. I follow agnostic approach. For \(A_{t}\) I choose normal distribution and I set all prior means to 0 and prior precision of the coefficients to 1. Prior for variance-covariance matrix \(\Omega \) follows inverse Wishart distribution:

I set the scale \(\kappa _{\Omega }\) to 1 and the degrees of freedom \(df_{\Omega }\) equals number of variables in the model. In case of random walk variances in state equation (2) I choose inverse gamma distribution as a prior:

where I set the shape \(\alpha \) to 3 and the scale \(\beta \) to 0.01. The value of \(\sigma _{i}^{2}\) governs prior belief about the amount of time variation in \(A_{t}\) and I set its value to reduce the amount of time variation and obtain smoother changes over time. Another way to set the priors would be to estimate constant parameter VAR model and set priors according to estimation results. However, I choose not to follow this approach since the behavior of Bitcoin and its relation to monetary policy in the training sample may not be a good proxy for the rest of the sample (Tasca et al. 2018).

The simulation of the model is based on 10,000 iterations of the Gibbs sampler and the first 2,000 are discarded. I set the lag length \(p=3\) based on the Akaike’s Information Criterion. I check parameter convergence via trace plots and autocorrelation functions of the draws. Based on convergence checks I conclude that the posterior draws are produced efficiently.

2.4 Identification of structural shocks

I follow (Jarociński and Karadi 2020) and use two assumptions two uncover monetary shocks from the high-frequency surprises. Table 1 summarizes identification assumptions.

-

1.

Monetary policy surprises are driven only by two structural shocks: pure monetary shock and information shock. Other shocks do not affect monetary policy surprises.

-

2.

Pure monetary shocks occur when interest rate and stock market surprises co-move negatively. Information shocks occur when these surprises co-move positively. Shocks are independent.

The first assumption is justified given that monetary policy surprises are measured in a narrow window. During such a short time it is unlikely that surprises are also influenced by other shocks, for instance demand shocks or oil shocks. Bauer and Swanson (2022) show that this assumption holds when using high-frequency surprises to evaluate the responses of financial variables to monetary shocks. The second assumption allows to disentangle two surprise series into two structural shocks. Independence of structural shocks is standard econometric assumption.

I do not restrict behavior of other variables—their responses are driven by the data, and not by the structural assumptions on the model. Identification assumptions I use are standard in the literature on asset pricing and high-frequency surprises.

3 Results

Bitcoin was designed to be free from monetary policy decisions, but I provide evidence of the opposite. Bitcoin has never been independent from decisions made by the Fed and the ECB. Bitcoin dollar price reacts persistently to both monetary and central bank information shocks. While these reactions vary over time—changing not only size, but sometimes the sign—my findings do not support the concept of Bitcoin as being insulated from major central banks.

Figure 3 shows the cumulative response of Bitcoin to monetary policy shocks in the US and the EU. If one of the motives to invest in Bitcoin is to hedge against inflation, then the increase in interest rate should lead to the decline in price of Bitcoin. Disinflationary monetary shock eventually lowers inflation (Jarociński and Karadi 2020), hence it should decrease inflation-hedging-related demand for Bitcoin.

I find that up until 2013 the Fed monetary shocks indeed lowered Bitcoin price. Surprisingly this impact was stronger at the beginning of Bitcoin existence. Conventional wisdom suggests that at that time its price should not change after Fed’s decisions since Bitcoin was not well-known outside a tech niche. After 2013 Bitcoin price increases following contractionary monetary shocks in the US which suggests a change in how Bitcoin is treated. Contrary to the Fed monetary shocks, disinflationary ECB monetary shocks lower the price of Bitcoin, and its reaction is fairly stable over time. Hence, in case of the ECB’s decisions Bitcoin behaves as digital gold. Figures 7, 8, 9, and 10 in Appendix show impulse responses with posterior credibility intervals for selected periods.

Providing compelling evidence on the drivers of these changes is beyond the scope of this paper. While literature does not offer definitive answers, one possible avenue for future research is the maturity of Bitcoin market (Tasca et al. 2018). Urquhart (2018) shows that only starting from mid-2013 Bitcoin behaved randomly—its price did not exhibit any predictability and hence its market become more efficient. Halaburda et al. (2022) suggest that Bitcoin immature market might have reacted more excessively than more established markets. Another potential trigger for the change in reaction may be due to the first major theft of Bitcoins in June 2011 (Grobys et al. 2022), which could have changed the perception of Bitcoin. Note however that none of these possible explanations account for the different reactions to the Fed and the ECB. Though these differences may be due to the “hierarchy” of spillovers: the monetary policy of the Fed affects global financial markets more than the ECB (Ca’Zorzi et al. 2020; Miranda-Agrippino and Rey 2022).

Central bank information shocks affect macroeconomic and financial variables since they reveal how a central bank assesses economic outlook. Therefore, interest rate raise due to better economic activity increases prices of risky assets (Jarociński and Karadi 2020). I find that Bitcoin price reacts differently to information shocks in the US and EA as shown in Fig. 4. Bitcoin price declines following the Fed’s positive information shock, hence it does not react as a risky asset. The response is stronger and more persistent in the middle of the sample between 2014 and 2018. Before 2014 and after 2018 initial price response reverted back after a year. On the other hand, the ECB’s positive information shocks increase Bitcoin price with peak impact reaching maximum in early 2018. The only result shared by both information shocks is that at its inception Bitcoin was not significantly affected by economic outlook communicated by both central banks.

Figure 5 presents the main results in a different way—focusing on cumulative response of Bitcoin price to each shock after 6 and 18 months. In most cases effect of a shock after 6 and 18 months is the same, suggesting that price adjusts in the first few months. Since 2016 ECB shocks are more protracted— 18-month reactions are stronger that in the first six months.

Similar to monetary shocks there is no literature that would provide explanation why and how Bitcoin is expected to react to central bank information shocks. Stock market reacts to information shocks through the change in expected cash flows (dividends). However Bitcoin does not offer cash flows: it is a bubbly asset since it has no fundamental value associated with the present value of cash flows. Galí and Gambetti (2015) argue that in such cases contemporaneous impact of interest rate shock on bubbly asset is indeterminate. The long-term effect can be positive or negative depending on the persistence of shock response. I provide the evidence that on average short- and medium-term impacts do not change the sign, but their magnitude varies over time and there is no clear reason why it takes place.

One possible explanation of this discrepancy is the rebalancing and mentioned earlier the "hierarchy" of spillovers of the Fed and the ECB information shocks. These shocks increase stock market valuation, with the effect larger for the Fed. If Bitcoin is used to diversify a portfolio (Kajtazi and Moro 2019), and the stocks offer higher expected returns, then Bitcoin may be underweighted as investors expect higher return on stocks. This rebalancing may increase flows from Bitcoin to other standard risky assets.

4 Conclusions

Bitcoin was meant to be free from any form of government action, especially monetary policy. For many crypto-enthusiasts Bitcoin is a hedge against inflation (Halaburda et al. 2022). However, I find that these particular properties should be treated with caution. I find that Bitcoin price systematically reacts to decisions made by the Fed and the ECB and only some of these reactions are in line with inflation hedge logic. Moreover, I show that Bitcoin reactions vary substantially over time. One of the reasons why these reactions changed is the evolution of Bitcoin ecosystem (Tasca et al. 2018). Going forward, these reactions should be closely monitored, and their drivers should be explained. The need for that will increase as the Bitcoin becomes more integrated with financial system creating another vulnerability from the financial stability perspective. Central banks that plan or consider introducing CBDCs should better understand whether any why these reactions change over time as the competition between crypto assets and CBDCs intensify.

Notes

Conclusions do not change when Bitcoin is prices in euro.

Similar to other studies I use Germany sovereign bonds as a proxy for risk-free asset in the EA.

In case of the Fed it is a 30-min window around the decision announcement, in case of the ECB window starts 15 min before press statement to an hour after the start of the press conference.

References

Altavilla, C., Brugnolini, L., Gürkaynak, R.S., Motto, R., Ragusa, G.: Measuring euro area monetary policy. J Monet Econ 108, 162–179 (2019). https://doi.org/10.1016/j.jmoneco.2019.08.016

Azar, P.D. , Baughman, G., Carapella, F. , Gerszten, J., Lubis, A., Perez-Sangimino, J.P., Rappoport W, D.E.: The financial stability implications of digital assets. FRB of New York Staff Report, 1034 (2022)

Bauer, M., Swanson, E.: A Reassessment of monetary policy surprises and high-frequency identification. Tech Rep No w29939. Cambridge, MANational Bureau of Economic Research. (2022) http://www.nber.org/papers/w29939.pdfhttps://doi.org/10.3386/w29939

Bouri, E., Molnár, P., Azzi, G., Roubaud, D., Hagfors, L.I.: On the hedge and safe haven properties of Bitcoin: is it really more than a diversifier? Financ Res Lett 20, 192–198 (2017). https://doi.org/10.1016/j.frl.2016.09.025

Ca’Zorzi, M., Dedola, L., Georgiadis, G., Jarociński, M., Stracca, L., Strasser, G.: Monetary policy and its transmission in a globalised world. European Central Bank (2020)

Claeys, G., Demertzis, M., Efstathiou, K.: Cryptocurrencies and monetary policy Bruegel Policy Contribution No. 2018/10 (2018)

Cong, L.W. , Mayer, S.: The coming battle of digital currencies. In: The SC Johnson College of Business Applied Economics and Policy Working Paper Series (2022)

Faverio, M., Massarat, N.: 46% of Americans who have nvested in cryptocurrency say it’s done worse than expected. Washington, DC: Pew Research Center. (2022). https://www.pewresearch.org/fact-tank/2022/08/23/46-of-americans-who-have-invested-in-cryptocurrency-say-its-done-worse-than-expected

Feyen, E.H., Kawashima, Y., Mittal, R.: Crypto-assets activity around the world : Evolution and macro-financial drivers. In: Policy Research Working Paper Series. The World Bank (2022)

Galí, J., Gambetti, L.: The effects of monetary policy on stock market bubbles: some evidence. Am Econ J Macroecon 7(1), 233–257 (2015)

Gilchrist, S., Yue, V., Zakrajšek, E.: U.S. monetary policy and international bond markets. J Money Credit Bank 51(S1), 127–161 (2019). https://doi.org/10.1111/jmcb.12667

Grobys, K., Dufitinema, J., Sapkota, N., Kolari, J.W.: What’s the expected loss when bitcoin is under cyberattack? A fractal process analysis. J Int Financ Mark Inst Money 77, 101534 (2022). https://doi.org/10.1016/j.intfin.2022.101534

Guesmi, K., Saadi, S., Abid, I., Ftiti, Z.: Portfolio diversification with virtual currency: evidence from bitcoin. Int Rev Financ Anal 63, 431–437 (2019). https://doi.org/10.1016/j.irfa.2018.03.004

Gürkaynak, R.S., Kara, A.H., Kısacıkoğlu, B., Lee, S.S.: Monetary policy surprises and exchange rate behavior. J Int Econ 130, 103443 (2021). https://doi.org/10.1016/j.jinteco.2021.103443

Halaburda, H., Haeringer, G., Gans, J., Gandal, N.: The microeconomics of cryptocurrencies. J Econ Lit 603, 971–1013 (2022). https://doi.org/10.1257/jel.20201593

Jarociński, M., Karadi, P.: Deconstructing monetary policy surprises—the role of information shocks. Am Econ J Macroecon 122, 1–43 (2020). https://doi.org/10.1257/mac.20180090

Ji, Q., Bouri, E., Gupta, R., Roubaud, D.: Network causality structures among bitcoin and other financial assets: a directed acyclic graph approach. Q Rev Econ Financ 70, 203–213 (2018). https://doi.org/10.1016/j.qref.2018.05.016

Kajtazi, A., Moro, A.: The role of bitcoin in well diversified portfolios: a comparative global study. Int Rev Financ Anal 61, 143–157 (2019). https://doi.org/10.1016/j.irfa.2018.10.003

Karau, S.: Monetary policy and Bitcoin Discussion Papers No. 41/2021. Deutsche Bundesbank. (2021) https://ideas.repec.org/p/zbw/bubdps/412021.html

Kroencke, T.A., Schmeling, M., Schrimpf, A.: The FOMC risk shift. J Monet Econ 120, 21–39 (2021). https://doi.org/10.1016/j.jmoneco.2021.02.003

Laboure, M., Müller, H.-P.M., Heinz, G., Singh, S., Köhling, S.: Cryptocurrencies and CBDC: the route ahead. Global Policy 12(5), 663–676 (2021). https://doi.org/10.1111/1758-5899.13017

Lubik, T.A., Matthes, C.: Time-varying parameter vector autoregressions: specification, estimation, and an application. Econ Q 4Q, 323–352 (2015). https://doi.org/10.21144/eq1010403

Manaa, M., Chimienti, M.T., Adachi, M.M., Athanassiou, P., Balteanu, I., Calza, A., et al.: Crypto-assets: implications for financial stability, monetary policy, and payments and market infrastructures. In: ECB Occasional Paper Series 223 (2019)

Miranda-Agrippino, S., Rey, H.: The global financial cycle. In: Handbook of International Economics, vol. 6, pp. 1–43. Elsevier (2022)

Pal, D., Mitra, S.K.: Hedging bitcoin with other financial assets. Financ Res Lett 30, 30–36 (2019). https://doi.org/10.1016/j.frl.2019.03.034

Park, S., Jang, K., Yang, J.-S.: Information flow between bitcoin and other financial assets. Phys A Stat Mech Appl 566, 125604 (2021). https://doi.org/10.1016/j.physa.2020.125604

Paul, P.: The time-varying effect of monetary policy on asset prices. Rev Econ Stat 102(4), 690–704 (2020). https://doi.org/10.1162/rest_a_00840

Platanakis, E., Urquhart, A.: Portfolio management with cryptocurrencies: the role of estimation risk. Econ Lett 177, 76–80 (2019). https://doi.org/10.1016/j.econlet.2019.01.019

Stavroyiannis, S., Babalos, V.: Dynamic properties of the bitcoin and the US market. SSRN Electron J (2017). https://doi.org/10.2139/ssrn.2966998

Tasca, P., Hayes, A., Liu, S.: The evolution of the bitcoin economy: extracting and analyzing the network of payment relationships. J Risk Financ 19(2), 94–126 (2018)

Urquhart, A.: What causes the attention of bitcoin? Econ Lett 166, 40–44 (2018)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A: Additional figures

Appendix A: Additional figures

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Pietrzak, M. What can monetary policy tell us about Bitcoin?. Ann Finance 19, 545–559 (2023). https://doi.org/10.1007/s10436-023-00432-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-023-00432-3