Abstract

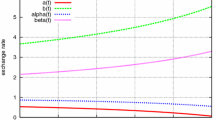

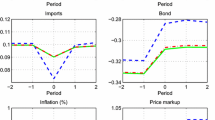

Stochastic control of exchange rates when a central bank employs anti-inflationary stochastic differential equation (SDE) monetary policy is the key topic of our paper. Despite low money growth SDE policy means exchange rates invariably violate the central bank’s targets. Monetary policy also incorporates interventions reflected by sudden money supply jumps that moderate deviations from targets. Controlling exchange rates involves minimizing target deviation and intervention costs. Restrictions on these costs ensure intervention vanishes under the optimal control, implying the central bank engineers freely floating exchange rates instead of managed floating or fixed exchange rates. Econometric evidence suggests discretionary interventions may be ineffective or generate excess volatility and speculation in currency markets. Our result demonstrates mathematically that such collateral damage discourages intervention.

Similar content being viewed by others

References

Abhyankar, A., Sarno, L., Valente, G.: Exchange rates and fundamentals: evidence on the economic value of predictability. J Int Econ 66, 325–348 (2005)

Cadenillas, A., Zapatero, F.: Optimal central bank intervention in the foreign exchange market. J Econ Theory 87, 218–242 (1999)

Cadenillas, A., Zapatero, F.: Classical and stochastic impulse control of the exchange rate using interest rates and reserves. Math Finance 10, 141–156 (2000)

Chang, Y., Taylor, S.: Intra-daily effects of foreign exchange intervention by the Bank of Japan. J Int Money Finance 17, 191–210 (1998)

Dembo, A., Zeitouni, O.: Large Deviations Theory and Applications. New York: Springer (2010)

Dominguez, K.: Central bank intervention and exchange rate volatility. J Int Money Finance 17, 161–190 (1998)

Engle, R., Ito, T., Lin, W.: Meteor showers or heat waves? Heteroskedastic intra-daily volatility in the foreign exchange market. Econometrica 58, 525–542 (1990)

El Karoui, N., Peng, S., Quenez, M.: Backward stochastic differential equations in finance. Math Finance 17, 1–71 (1997)

Elliott, R., Shen, J.: Dynamic optimal capital structure with regime switching. Ann Finance 11, 199–220 (2015)

Flood, R., Garber, P.: A model of stochastic process switching. Econometrica 51, 537–551 (1983)

Fatum, R., Hutchison, M.: Foreign exchange intervention and monetary policy in Japan 2003–2004. IEEP 2, 241–260 (2005)

Gagnon, G.: Stochastic impulse control of exchange rates with Freidlin–Wentzell perturbations. J Appl Probab 54, 23–41 (2017)

Gagnon, G.: Semimartingale property for a backward exchange rate process. Unpublished manuscript (2018)

Harrison, J.M., Taksar, M.: Impulse control of a Brownian motion. Math Oper Res 8, 439–453 (1983)

Hu, Y., Yong, J.: Forward–backward stochastic differential equations with non-smooth coefficients. Stoch Processes Appl 87, 93–106 (2000)

Ito, T.: Interventions and Japanese economic recovery. IEEP 2, 219–239 (2005)

Jeanblanc-Piqué, M.: Impulse control method and exchange rate. Math Finance 8, 161–177 (1993)

Kharroubi, I., Ma, J., Pham, H., Zhang, J.: Backward SDEs with constrained jumps and quasi-variational inequalities. Ann Probab 38, 794–840 (2010)

LeBaron, B.: Technical trading rule profitability and foreign exchange market intervention. J Int Econ 49, 125–143 (1999)

Mark, N.C., Sul, D.: Nominal exchange rates and monetary fundamentals: evidence from a small post-Bretton Woods sample. J Int Econ 53, 29–52 (2001)

MacDonald, R., Taylor, M.: The monetary approach to the exchange rate: rational expectations, long run equilibrium, and forecasting. IMF Staff Pap 40, 89–107 (1993)

MacDonald, R., Taylor, M.: The monetary model of the exchange rate: long run relationships, short run dynamics and how to beat a random walk. J Int Money Finance 13, 276–290 (1994)

Meese, R.A., Rogoff, K.: Empirical exchange rate models of the seventies: do they fit out of sample? J Int Econ 14, 3–24 (1983)

Mundaca, G., Øksendal, B.: Optimal stochastic intervention control with application to the exchange rate. J Math Econ 29, 225–243 (1998)

Peng, S., Shi, Y.: Infinite horizon forward–backward stochastic differential equations. Stoch Processes Appl 85, 75–92 (2000)

Protter, P.: Stochastic Integration and Differential Equations. New York: Springer (1990)

Rapach, D., Wohar, M.: Testing the monetary model of exchange rate determination: new evidence from a century of data. J Int Econ 58, 359–385 (2002)

Smith, G.: Exchange rate discounting. J Int Money Finance 14, 659–666 (1995)

Wang, P.: The Economics of Foreign Exchange and Global Finance. New York: Springer (2009)

Yong, J., Zhou, X.Y.: Stochastic Controls. New York: Springer (1999)

Acknowledgements

Many thanks to the referee whose comments significantly improved the paper. Thanks are also due to my parents, Linda Gagnon and Philip Gagnon, for their constant encouragement. Great thanks are due to Ruby Mack, recently retired Academic Councillor of UTM Economics, for her dedicated service over the years. The paper is dedicated to my departed feline friends Emerald, Athos, Sekhmet, Cicero Toodle, Scipio Toodle, Mycenae and Athena who helped make life worthwhile.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Lemma 4.1

To see that \(E|\int _0^{\tau _{1}}\exp (-\lambda s)\frac{\partial \phi }{\partial x}(s,x_s)\ dB_s|<\infty \) first observe that since the \(B(\cdot )\) signed measure of a singleton is zero we have \(\int _{{\{\tau _{1}\}}}\exp (-\lambda s)\frac{\partial \phi }{\partial x}(s,x_s) dB_s=0\). Recalling that \(y_s=x_s\) for all \(s<\tau _1\) it follows that almost surely we have

There exists a sequence \({\{\pi _n\}}_{n=1}^{\infty }\) where \(\pi _n={\{t_0^n,t_1^n,\ldots ,t^n_{m_{n}}\}}\) for each \(n\ge 1\) such that

-

(1)

\(t_i^n\) is a stopping time for all \(n\ge 1\) and all \(i=0,\ldots , m_n\) such that \(t_i^n\le \tau _1\).

-

(2)

for all \(\omega \in \Omega \) and \(n\ge 1\) the set \(\pi _n(\omega )={\{t_0^n(\omega ),t_1^n(\omega ),\ldots ,t^n_{m_{n}}(\omega )\}}\) is a partition of \([0,\tau _1(\omega )]\); specifically \(0=t_0^n(\omega )\le t_1^n(\omega )\le t_2^n(\omega )\le \cdots \le t_{m_{n}}^n(\omega )=\tau _1(\omega )\).

-

(3)

for all \(\omega \in \Omega \) we have \(|\pi _n(\omega )|\equiv \max _{1\le i\le m_{n}}(t_i^n(\omega )-t_{i-1}^n(\omega ))\rightarrow 0\) as \(n\rightarrow \infty \).

-

(4)

given any \(n\ge 1\) and \(\omega \in \Omega \) there exists an integer \(N(\omega )\ge 1\) with \(N(\omega )\le m_n\) such that \(t_{i-1}^n(\omega )<t^n_i(\omega )\) for all \(i\le N(\omega )\) then \(t_i^n(\omega )=\tau _1(\omega )\) when \(N(\omega )\le i\le m_n\).

Stopping times satisfying these conditions must exist since \(\tau _1\le h_1\) where \(h_1<\infty \) is a constant. We may take \(t_i^n=(\frac{i}{2^{n}})h_1\bigwedge \tau _1\) for \(i=0,\ldots , 2^n\) for each \(n\ge 1\), for instance.

Now since \((\exp (-\lambda s)\frac{\partial \phi }{\partial x}(s,y_s), s\in [0,\tau _1])\) is continuous \(\int _0^{\tau _{1}}\exp (-\lambda s)\frac{\partial \phi }{\partial x}(s,y_s)\ dB_s\) is a Riemann–Stieltjes integral and thus using \({\{\pi _n\}}_{n=1}^{\infty }\) almost surely

Hence, almost surely

Applying Fatou’s lemma yields

We will show that \(\sup _{n\ge 1}E|\sum _{i=1}^{m_{n}}\exp (-\lambda t_i^n)\frac{\partial \phi }{\partial x}(t_i^n,y_{t_{i}^{n}})(B_{t_{i}^{n}}-B_{t_{i-1}^{n}})|<\infty \) and employing (6.2) this will secure integrability of \(\int _0^{\tau _{1}}\exp (-\lambda s)\frac{\partial \phi }{\partial x}(s,x_s)\ dB_s\) since

Let \(|b|,|\frac{\partial \phi }{\partial x}|\le L\) for some constant \(L>0\). Theorem 3.1 implies there exists a constant \(C>0\) such that \(|B_{t_{i}^{n}}-B_{t_{i-1}^{n}}|\le C( |t_i^n-t^n_{i-1}|+|k_{t_{i}^{n}}-k_{t_{i-1}^{n}}|^2)\) for all \(i=1,\ldots , m_n\) and all \(n\ge 1\). Recall Theorem 3.1 can be applied to these oscillations of \((B_t,t\ge 0)\) since the points \(t_i^n\) satisfy \(0\le t_i^n\le \tau _1\le h_1\) for all \(i=0,\ldots , m_n\) and all \(n\ge 1\) where \(h_1>0\) is a fixed real number; in fact \(h_1\) generates C. Also let \(M_t=\int _0^t \sigma (s,k_s)\ dW_s\) and observe that \(|k_{t_{i}^{n}}-k_{t_{i-1}^{n}}|^2\le 2|\int _{t_{i-1}^{n}}^{t^{n}_{i}} b(s,k_s)\ ds|^2+2|M_{t^{n}_{i}}-M_{t_{i-1}^{n}}|^2\le 2L^2(t_i^n-t^n_{i-1})^2+2|M_{t^{n}_{i}}-M_{t_{i-1}^{n}}|^2\). Note that since \(t_0^n=0\) we have \(M_{t_{0}^{n}}=0\) for all \(n\ge 1\). Combining inequalities yields

Since \((M_t,t\ge 0)\) is a continuous martingale and \(t^n_i\) a bounded stopping time for all \(i=0,\ldots ,m_n\) and \(n\ge 1\), the optional sampling theorem implies that \((M_{t_{i}^{n}},\mathcal {F}_{t_{i}^{n}}, i=0,\ldots ,m_n)\) is a martingale where \(\mathcal {F}_{t_{i}^{n}}\) is the stopping time \(\sigma \)-field generated by \(t^{n}_{i}\). Moreover, by Doob’s maximal quadratic inequality \(E(M_{t_{i}^{n}})^2\le E\sup _{t\in [0,h_{1}]}|M_t|^2\le 4E|M_{h_{1}}|^2<\infty \) for all \(i=0,\ldots ,m_n\) and \(n\ge 1\). This implies that \(M_{t^{n}_{i}}\in L^2(\Omega ,\mathcal {F},P)\) for all \(i=0,\ldots ,m_n\) and \(n\ge 1\). Using the martingale property we have

By the Burkholder–Davis–Gundy inequality there is a constant \(J>0\) such that for every \(n\ge 1\), \(EM_{t^{n}_{m_{n}}}^2=E(\int _0^{t_{m_{n}}^{n}}\sigma (s,k_s)\ dW_s)^2\le JE\int _0^{\tau _{1}}\sigma ^2(s,k_s)\ ds\le JE\int _0^{h_{1}}\sigma ^2(s,k_s)\ ds<\infty \) since \(\sigma \) is bounded. Hence for every \(n\ge 1\) we have

implying \(\sup _{n\ge 1}E|\sum _{i=1}^{m_{n}}\exp (-\lambda t_i^n)\frac{\partial \phi }{\partial x}(t_i^n,y_{t_{i}^{n}})(B_{t_{i}^{n}}-B_{t_{i-1}^{n}})|<\infty \) as desired. \(\square \)

Rights and permissions

About this article

Cite this article

Gagnon, G. Vanishing central bank intervention in stochastic impulse control. Ann Finance 15, 125–153 (2019). https://doi.org/10.1007/s10436-018-0327-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-018-0327-2