Abstract

This article analyzes the effect of endogenous valuations-based capital requirements on risk-shifting in a closed economy DSGE Model. It adds to the existing literature by including concentration risk into the portfolio allocation of the commercial banks. It finds that capital requirements move procyclically, which amplifies the expansionary effect of monetary easing. The movement of the capital requirements is asymmetric, which creates a risk-shifting impulse. Sticky bank capital rents can strengthen this risk-shift.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

After the financial crisis, the old dogma of the neutrality of monetary policy was questioned. After all, why had the period of accommodative monetary policy before the crisis coincided with a seemingly ever increasing risk-appetite of the financial sector? If there was a link between risk-taking behavior and monetary policy, this could explain why banks risk-appetite rose.

This potentially perilous effect of monetary policy has received increased scrutiny after the financial crisis. Empirical studies, such as Jimenez et al. (2014) find evidence for an increase of the risk held in the portfolio of commercial banks in response to accommodative monetary policy. They show that a greater share of loans is extended to borrowers with a troubled credit history during a period of monetary easing. Reflecting a decline in lending standards.

Borio and Zhu (2008) highlight several potential avenues, through which monetary policy could influence risk-taking. A key point of their argumentation is the observation that monetary policy has a positive effect on cash-flow and the valuation of assets and collateral, which would reduce the perceived risk associated with a borrower. Microprudential risk provisions, such as risk-weighted capital requirements, are also based on the valuation of a borrower’s financial position. Implying that they could shift procyclically with the change in valuations.

The impact of monetary policy on valuations is not necessarily uniform. A borrower’s ex ante financial position, risk profile, sector and location influence the impact a change in valuations has on their access to funding. A borrower who could not have received a loan under previous lending standards naturally profits significantly more then one who would have been eligible either way. This asymmetrical effect could be a key driver for the risk-shifting effect of monetary easing.

The main contribution of this paper is the exploration of the effects of concentration risk provisions and risk-based capital requirements on the transmission of monetary policy. Thereby highlighting the importance of borrower heterogeneity for the impact of monetary policy on financial stability. A secondary contribution is the development of a simple and expendable model, which implements concentration risk provisions and limited borrower heterogeneity into the endogenous optimal portfolio choice of commercial banks.

I construct a calibrated closed-economy DSGE model with commercial banks, two types of borrowers and risk-weighted capital requirements. The borrowers are differentiated by their probability of default. The basis for our model stems from the financing through money creation (FMC) concept by Benes et al. (2014). Valuations-based capital requirements are implemented into the model based on the BASEL Internal-Ratings-Based Approach for Credit Risk (IRB, Basel Committee on Banking Supervision (2017)). The existence of two types of borrowers results in two types of loan contracts in the model. A safer loan and a riskier loan. The banks maximize their profits by choosing the optimal allocation of their portfolio into the two loans. I calibrate our model to Euro-zone data. Our model allows us to explore the effects of a decline in the policy rate on the risk profile of the financial sector, when borrowers are heterogeneous. In a subsequent iteration I also look at the effect of sticky target rates of returns on the risk-shifting response of the banks. An alternative to the use of concentration risk would be the implementation of binding borrowing constraints, as in Gerali et al. (2010). The results of the simulation of an alternative model with borrowing constraints are similar to the results presented in this paper.

The results can be summarized as follows:

-

1.

The valuations effect of a policy rate decline is distributed asymmetrically across borrowers. The effect on the riskier borrowers is relatively stronger. The decrease of the exposure price is stronger for the riskier loans when there are no capital requirements.

-

2.

The impact of monetary policy’s valuations effect is amplified by a procyclical decline in capital requirements. The change in capital requirements leads to an overall higher expansion of lending. Financial stability also declines more then it would in the absence of capital requirements. This is caused by the asymmetric effect of the valuations change on borrowers. High-risk borrowers profit more from the combined change in valuations and capital requirements.

-

3.

Sticky rate of return targets enhance the shift of the banks’ portfolio. The widening gap between market interest rates and banks’ capital costs leads to a smaller expansion of lending. This smaller expansion entails a steeper decline in capital requirements and a stronger risk-shift.

This paper is closely related to the recent literature examining the relationship between policy interest rates and the stability of the financial sector. It explores two of the avenues described by Borio and Zhu (2008), the valuations and the expected rate of return avenue, through the lens of borrower heterogeneity. It has close methodological similarities with Gambacorta and Karmakar (2018) and de Groot (2014), but differs from them in its focus. Another example would be Angelini et al. (2014). The first paper examines the relationship between interest rates and banks monitoring efforts, whereas the second examines the liabilities side of the banks’ balance sheet. This paper focuses on the asset side of the balance sheet. I choose this focus to replicate the observations documented in an array of different empirical studies, most notably (Jimenez et al. 2014) and Bonfim and Soares (2018). These studies link declining interest rates causally to an increase of risks on the asset side of the banks’ balances (See also Altunbas et al. (2014); Maddaloni and Peydró (2011) and Memmel et al. (2016)). Another set of papers that inspired this paper and to which it is thematically related are two papers by Agénor et al., Agénor and Pereira da Silva (2017) and Agénor et al. (2018), which introduce a model approach with two different types of loans for the bank, comparable to the present paper. A similar approach is also used by Collard et al. (2017), where banks can hide a portion of their risky loans from regulators. I add to the models of these papers by constructing the choice between the different loans not as an exogenous regulatory mandate, but as the result of an endogenous optimization. The approach presented in this paper benefited from the exploration of the incentives for the portfolio choice of a bank in a binary scenario put forward by Acosta-Smith (2018). A different approach to the question of risk-shifting is taken by Gete (2018) who implements only one type of loan contract into their model. Gete (2018) models risk-shifting through the changes of banks’ lending standards, where lower standards lead to a riskier bank portfolio.

The remainder of this paper is structured as follows. The next paragraphs elaborate on the framework for the banks’ portfolio optimization, Section (3) describes the agents of the model. Section (4) presents the parameter calibration and the steady-state used for the numerical solution of the model. The final section discusses the results of the simulation, limitations and policy implications.

2 Portfolio choice and concentration risks

Lending is subject to risk. Borrowers may default on their loans. These defaults can be triggered by idiosyncratic or systemic risk factors. Idiosyncratic risk are risks unique to the individual borrower, whereas systemic risks arise from economy wide factors (business cycle, etc.). In a perfectly granular portfolio, the idiosyncratic risks can be diversified away. The systemic risk on the other hand is part of all lending and therefore undiversifiable Basel Committee on Banking Supervision (2005). A core reason for the implementation of capital requirements is the inability or unwillingness of banks to completely cover all the potential costs for systemic and rare tail risks through the pricing of their lending. Banks shoulder some of these costs themselves and are therefore compelled to accumulate appropriate capital reserves Basel Committee on Banking Supervision (2005). The insufficient pricing of the potential costs is also what provides risk-weighted capital requirements the capacity to steer bank lending. A risk-neutral bank would be indifferent to the potential losses associated with a loan if it can push the entirety of the cost for the potential losses onto the borrower.

The portfolio is no longer perfectly granular, when a single exposure constitutes a significant share of the portfolio. A part of the idiosyncratic risk of that exposure is then no longer diversified away. Because of this, some jurisdictions have imposed limits on the share of the lenders portfolio, that can be lend to a single exposure. The EC Capital Requirements Directive for example prescribes hard limits for the maximum exposure to a single entity.

Deviations from perfect granularity are not necessarily the result of a single large exposure. They can also arise from the exposure to significant share of correlated exposures. Applied economy wide this is the systemic risk factor. On a smaller scale, this is a concentration risk. It describes the possibility of a correlation between parts of the idiosyncratic risk factor of a subset of exposures. Exposures can be linked, because they are for example situated in the same sector or location. Research Task Force Concentration Risk Group (2006) gives the example of concentration risks arising from exposures that share specific business sector, a geographic area, are situated along a supply chain or are of a specific asset class. The widespread devaluation of mortgage-backed securities during the financial crisis would be an example for a correlated risk factor within an asset class. In this case the risk of a loss of market confidence in the specific asset class. A bank, that is heavily involved in the real estate market may not have a large exposure to any single entity, but a downturn on the housing market will put pressure on all of the bank’s lending to this sector Research Task Force Concentration Risk Group (2006).

Regulation mandates banks to assess and monitor possible concentration risks and to implement appropriate risk mitigation methods. For example, article 81 of the Capital Requirements Directive of the EC. Methods of risk mitigation include the establishment of concentration limits and the allocation of additional capital The Joint Forum (2008).

The accumulation of additional capital is a function of the concentration of the portfolio. The higher the concentration becomes, the higher the additional capital. This increase of the concentration risk is non-linear, which implies that the accumulation of additional capital must also follow a non-linear function. I assume that the accumulation of additional capital can be captured by an exponential function. If it is assumed, that not all costs for the concentration risks are reflected in the loan interest rate, the possible profit earned from allocating a share of the portfolio to a group of correlated loans is implied to be concave. The maximum of this concave function is the optimal share of the portfolio for this group of correlated loans. All further investment would decrease the overall profit. Figure 1 presents two sample concave profit functions. It shows that the optimal portfolio allocation is to extend the amount a of the A-type loan and the amount b of the B-type loan. Extending more than the amount a of the A-type loan would decrease overall profit from this loan, even though it is still superior to the B-type loan between A and x (\(\Pi ^2 > \Pi ^1\)).

With this setup there is no need to assume scarce or preset bank capital, the limiting factor for the issuance of loans comes from the exponential nature of exposure prices. Unlike in a model approach with preset capital, all loan types can expand simultaneously in response to an expansionary monetary policy shock. The portfolio composition reacts endogenously to economic shifts—the portfolio allocation is price-based and cyclical. Figure 2 illustrates the effects of a policy rate decline on a concave profit function. If only the loan interest rate declines, then the profit function would shift left and the new optimal investment in the loan would be A’. But if the valuation of collateral increases sufficiently as a result of the policy rate decline, then the profit function shifts to the right. The new optimal investment would then be A”. The valuations effect of a policy rate decline is not homogeneous across all borrowers, which means that the right-push of the profit function varies between the different loan functions. Whether the portfolio shifts, and in what direction, is then a question of the relative strength of the rightward movement of the optimum for each type of loan. In relation to our sample functions, a shift towards the A-type loan after a policy rate decline would be observed if \(A''/(A''+B'')\) was larger than \(A/(A+B)\).

3 The model

This section presents a FMC-type DSGE model derived from the model introduced in Benes et al. (2014) and Jakab and Kumhof (2015). Its is constructed with the aim to provide a relatively simple basis for the exploration of the effect a negative shock on the policy rate (monetary easing) has on the portfolio allocation of commercial banks. The models real economy is relatively standard. Key aspects of the BASEL guidelines on capital requirements (parts of the IRB framework) and the leverage ratio framework are incorporated into the construction of the banks. We base these mainly on Basel Committee on Banking Supervision (2017, 2014) and Basel Committee on Banking Supervision (2005).

The model is a closed economy with a financial sector, entrepreneurs, final goods producers and patient households. The entrepreneurs are separated into two distinct groups by their probability of default. The financial sector is made up of a continuum of competitive commercial banks. There are two different types of loans that banks can extend to entrepreneurs, high risk loans and low risk loans, matching the existence of high risk and low risk entrepreneurs. The probability of default for the high risk entrepreneurs is based on the C ratings grade provided by Standard and Poors (S &P) and the probability of default for the low risk entrepreneurs is based on the B S &P ratings grade. The probability of default is 3.89% and 25% p.a. respectively for the B and C grade entrepreneurs. In the FMC-setup banks are not intermediaries that channel loanable funds, they create a corresponding deposit on their balance sheet when they extend a new loan. The balance sheet of a bank can be increased or decreased without the need for a change of saving desires by the households. Limitations for the extension of credit by the bank arise from the bank capital cost associated with the extension of credit Jakab and Kumhof (2018).

The economy is populated by a continuum of infinitely lived households. These utility maximizing households consume the final good and are equipped with a differentiated labor skill. They create investment capital and lend bank capital to the commercial banks. They are faced with proportional transaction costs for their consumption and investment purchases, build according to the framework introduced by Schmitt-Grohé and Uribe Schmitt-Grohé and Uribe (2002). These transaction costs decrease with the amount of deposits held by the household. This gives households an incentive to hold deposits without the necessity of a desire to save Jakab and Kumhof (2015). Households are also subject to habit formation concerning their consumption.

There are two more entities in the economy, the retail good producer and the monetary authority. The retail good producer and the real economy production chain is relatively standard. Entrepreneurs exchange their deposits for investment capital with the households. This investment capital is then combined with their retained depreciated capital (the capital stock) from the previous quarter to create input capital. Intermediate goods firms owned by the entrepreneurs use the input capital and labor to create differentiated intermediate goods. The intermediate good produced by each individual firm is then aggregated into two composite goods, in accordance with the existence of two types of entrepreneurs. These composite goods are then used by the retail good producers to create a differentiated retail good, which is then aggregated into the final good. The final good less the costs for price rigidities is then consumed by the households and used for investments. The monetary authority is implemented into the model by a policy rate smoothing Taylor-rule taken from Christoffel et al. (2008).

Wages and prices for the intermediate and retail good are modeled as subject to quadratic price adjustment costs following Ireland (2001).

3.1 Commercial bank

The risk neutral commercial banks are situated on the interval \(j \in [0,1]\). They are infinitely lived and they maximize their lifetime profits. They achieve profit maximization by choosing the optimal allocation of their loan-portfolio between the two types of one-period loans present in the model. The bank’s optimization is subject to the loan interest rate, the capital cost of regulatory capital requirements and the additional capital for concentration risks. I assume that competition between banks forces them to use a similar technology for the formulation of loan interest rates. Regulatory mandates obligate the bank to hold capital reserves to provision against unexpected losses and to fulfill the minimum capital requirement(MCQ). Table(1) shows the static balance sheet of a commercial bank. It issues a deposit of the same amount for every loan that it extends and holds other assets, such as reserves with the central bank which earn the risk free interest rate. The bank distributes its earnings every period to its owners and rents bank capital from the households. For simplicity I will in the following use the i as a catch all for both types of loans(\( i = [b,c]\)).

3.1.1 Default risk and portfolio diversification

I introduce the risk that individual entrepreneurs default on their loans in a relatively simple manner. This approach is inspired by Benes et al. (2014). The return on input-capital received by entrepreneurs is subject to a random shock, the default shock. It occurs with the unconditional probability \( \rho ^i \). Following Gordy (2002), the unconditional probability is the expected probability that the default shock will occur given all information available at the beginning of a quarter. This unconditional probability is known to the banks when they make their lending decisions. I define \( \rho ^i \) as the average default probability of an i-rated entrepreneur. If a shock occurs, the entrepreneur defaults on the loan and exits the market. The actual realization of the default shock at the end of the quarter is unique to each entrepreneur, it can differ from \( \rho ^i\).

3.1.2 Loan interest rate technology

For the moment I exclude bank capital, other assets and reserves. Freixas and Rochet (1997) provide a relatively straightforward starting point for the construction of loan interest rates. In the case where the bank cannot collect anything if the loan defaults, the interest rate of the loan must not only be equal to the risk free interest rate, but also include an additional compensation to cover the expected default risk. The interest rate on the loan is then the risk free rate plus the unconditional probability of default. This assures that the expected value of the return on the loan is equal to the return on an investment in a risk free asset (central bank reserves/ government bonds). If \( F^i_t \) is a loan of the ratings grade i extended in period \( t \), then the following equation holds

where \( R_t \) is the risk free interest rate and \( R^{i}_t \) is the interest rate for an i-rated loan. The marginal loan interest rate is then \( R_t^i = R_t / (1 - \rho ^i) \). By virtue of pushing the costs of default onto the borrower, the bank becomes indifferent between investing in the risky or the safe loan or a risk free asset.

The interest rate technology changes, when banks can reclaim some of the loan in the case of a default, or if there is a collateral that can be sized by the bank in the case of borrower default. The interest on the loan is then also dependent on the expected value of the reclaimable portion of the loan/the pledged collateral. I assume for our model that the expected portion of a loan that can be reclaimed by the bank is dependent on the leverage of the borrower. Banks therefore use the relation between the entrepreneur’s capital stock and the value of the total input capital employed by the entrepreneur as a measure for entrepreneur leverage and the expected value of the collateral at the end of the quarter. The marginal loan interest rate is then determined according to the following technology

The term \( \frac{N^i_{t}}{K^i_t}\) represents the marginal earnings given default. The absolute earnings given default are \( \frac{N^i_{t}}{K^i_t} F^i_t \). Where \( N^i_{t} \) is the capital stock held by the entrepreneur with access to i-rated loans and \( K^i_t \) is the total capital employed by the entrepreneur in the quarter \( t \).

The profits realized by the bank j at the end of the quarter are no longer only the payments from the non-defaulted loans if there is a collateral. The value of the collateral sized at the end of the quarter adds to the overall profits. The equation is given below, where \( \Pi ^j_t \) are the profits of the bank j, \(D^j_t\) are deposits and \(R^d_t \) is the interest payed on the deposits.

3.1.3 Capital requirements and quadratic exposure price

Adopting the definitions put forward by the BASEL regulations, I assume that there are two types of losses that a bank can incur on its loans, expected losses and unexpected losses. Expected losses are the losses that are predicted by the unconditional probability of default assumed by the bank (In this model this is the expected value of the default shock). BASEL states that these losses are to be provisioned for by the normal operations of the bank. BASEL sets no mandate to maintain a specific capital base for these expected losses. This is also the main type of losses that banks in our model take into account when calculating the loan interest rates—the expected costs of default are borne completely by the borrowers.

The second type of losses are unexpected losses. Banks are aware that these losses can occur, but they can not know their severity in advance. The potential costs arising from these losses cannot be incorporated fully into the interest rate technology. Competition prevents sufficient prices to account for all unexpected losses Basel Committee on Banking Supervision (2005). Accordingly, banks have to absorb these losses. This creates a need to accumulate capital not to only to fulfill regulatory demands but also to assure the bank’s survival. BASEL mandates banks to hold an adequate stock of capital to provision for these unexpected losses. BASEL also provides a formula to calculate the marginal capital requirements associated with each individual loan. The formula is derived from the expected probability of default for a given type of loans, the correlation of the default risks for that type of loans and the potential loss given default in percent. The correlation between the risk associated with each type of loans taken from BASEL (the calculation given for corporate and bank exposures) that I use is calculated as follows, where \( \sigma ^i \) is the correlation between the systematic risk associated with different i-rated loans Basel Committee on Banking Supervision (2017).

Following BASEL, the marginal capital requirement is then calculated according to the following formula, where \( \left( 1 - \frac{N^i_t}{K^i_t}\right) \) is the marginal loss given default, \( \mathscr {N} \) is a cumulative distribution for a standard normal variable with mean zero and variance of one and \( \mathscr {N}^{-1} \) denotes the inverse cumulative distribution function for a standard normal variable. \( j^i_t \) is the marginal capital requirement for an i-rated loan.

This capital requirement is, according to BASEL, ratings based and portfolio invariant Basel Committee on Banking Supervision (2005). It is also linear in regards to the volume lend. For the model approach this means, that as long as the return on a loan minus the cost for the capital requirement is above that of an alternative loan, the bank has every incentive to invest solely in the loan with a higher expected return. The only limiting factor would be the availability of bank capital.

This paper transforms this binary choice by including an exponential (quadratic) price for the exposure of the loan-portfolio to the concentration risk form a type of loans. The basis for this exposure price is derived from Gordy and Lütkebohmert (2013). They provide a formula to adjust the capital provisions of a bank to a lack of granularity in its portfolio. It is based on the assumption that a higher concentration in a certain asset class entails that a part of the idiosyncratic risk associated with that asset class is no longer diversified away. I borrow their formulation of the granularity adjustment in this paper to construct the exposure price Gordy and Lütkebohmert (2013). The equation for the exposure price factor is given below, where \( \phi ^g \) is a recovery risk parameter and \( g^i_t \) is the exposure price factor for an i-rated loan.

The capital requirement and the exposure price are used to formulate the following concave function for the total profit on the i-rated loans, absent bank capital, reserves and equity.

3.1.4 Finalization of the commercial bank

With the introduction of the capital requirement and the exposure price the banks are no longer indifferent between the two loans, as they can not fully push these costs upon the borrower. The marginal and the total expected profits from the loans are different. As in Acosta-Smith (2018), I augment the loan interest rate technology with the constant premium \(\mu ^i\), which represents the costs associated with the extensions of an i-rated loan. The premium assures that the marginal steady state interest rates are higher than the marginal steady-state capital cost. \(\mu ^i\) is set so that the inequalities \( \bar{r}^i \ge \frac{\bar{r} + (\bar{r}^f - \bar{r})(1/\eth + \bar{j}^i) - \rho ^i (\bar{n}^i/\bar{k}^i)}{1 - \rho ^i}\) hold in the steady-state (\(\bar{r}^f \) is the steady-state value of the bank capital rent). The updated technology is then given by

The end of quarter profit maximization problem of the j’th bank is then described by the following equation.

where \(H^{j}_t\) is the raised bank capital and \(B^j_t\) are the risk free assets held by the bank and \(R^f_t\) is the bank capital rent. The maximization is subject to Eq. 10 given below, where \(\eth \) is the minimum capital quota (MCQ) (This requirement is the BASEL III mandatory minimum non risk-weighted capital requirement of at least 3% of the bank’s loan portfolio (Basel Committee on Banking Supervision 2014)).

This equation establishes the amount of bank capital \(H^{j}_t\) which the bank has to raise to amass enough equity to fulfill the MCQ plus the required provisions for the capital charge and the exposure price. Equity and bank capital are always equal and the bank will raise exactly the amount of bank capital necessary to fulfill Eq. 10. In addition to the MCQ imposed upon the bank, it also is subject to the minimum reserves quota \(\Upsilon \). The total amount of risk free assets held by the Bank is the sum of the minimum reserves quota and its equity.

Assets and liabilities of the bank have to be equal. This can be used to replace bank capital, deposits and reserves in the banks profit maximization problem. The interest on deposits is set equal to the policy interest rate. \( H_t^{j} + D^j_t = \displaystyle \sum _{i=b}^c (F^{j,i}) + B^j_t\) and \(D_t^j\) is accordingly equal to \((\displaystyle \sum _{i=b}^c F_t^{j,i})/(1 - \Upsilon )\). I then arrive at the following function, which is concave if \( R^f_t > R_t \).

The first order condition that solves the banks optimization problem is given below. In the symmetric equilibrium all superscripts are dropped.

3.2 Household

Households in the model derive utility from consuming the final good and leisure. They exchange investment capital for deposits with the entrepreneurs and rent differentiated bank capital to the commercial banks. Each household is equipped with a differentiated labor skill for which they are monopolistically competitive. They are price setters for wages, investment capital and the bank capital and take demand for these as given. Consumption and investment purchases of the households are subject to proportional transaction costs \( s^c_t \) and \(s^i_t\), whose severity depends on the household’s deposit to consumption ratio and deposit to investment ratio. Lower transaction costs provide household with additional liquidity, which gives them an incentive to acquire deposits. The households consumption is subject to habit formation. The equation below displays the utility function of the h’th household, where \( \mathbb {E}_t \) is an expectation operator and \( \beta \) is the discount factor. \( \chi \) is a parameter for the importance of the habit stock, which is the consumption in the preceding quarter. \( L^{h,\nabla }_t \) is the demand for the differentiated labor skill provided by the h’th household. \( \phi ^\ell \) is the weight of the disutility incurred from exchanging units of leisure for units of labor and \( \ell \) is the inverse Frisch elasticity for hours worked.

The real one period budget constraint for the individual household is stated below.

Where \( P_t \) is the price index and \( \frac{H^{h,\nabla }_t}{P_t} \) is the real demand for the differentiated bank capital provided by the h’th household. \( \frac{D^h_t}{P_t} \) are the deposits held by the h’th household in exchange for the investment capital they provided to the entrepreneurs. \( R^d_t \) is the nominal interest payed on deposits. \( \frac{W^h_t}{P_t} \) is the real wage received by the h’th household for their differentiated labor skill and \( R^{h,f}_t \) is the nominal rent for the household’s differentiated bank capital. \(I_t^h \) is the investment supplied by the household and \(K^h_{t-1}\) is the investment capital sold to the entrepreneurs in period t. \(P^k_t\) is the investment capital price. Investment is equal to the investment capital created in period t, so that \(I^h_t = K^h_t\). \(\frac{\tau ^h}{P_t}\) are the profits received from commercial banks and retail goods producers.

The differentiated labor skill \( L^h_t \) provided by the h’th household is situated on the interval \( h \in [0,1] \). The skills are aggregated into the labor composite by the technology given below

where \( \theta ^w \) is the elasticity of substitution between the differentiated labor skills. The demand function for the labor skill \( L^h_t \) is then

\( W_t \) is the composite wage related to the wage of the differentiated labor skill by \( W_t \equiv \left[ \int _0^1 (W^h_t)^{1 - \theta ^w} dh \right] ^{\frac{1}{1 - \theta ^w}} \)

The differentiated capital \(H^h_t \) situated on the interval \( h \in [0,1] \) is aggregated into the composite bank capital used by the banks in a way similar to the labor skill. The aggregation technology is given by

where \( \theta ^f \) is the elasticity of substitution for the differentiated bank capital. The demand function for bank capital is then

\( R^f_t \) is the composite bank capital rent related to the rent of the differentiated bank capital by \( R^f_t \equiv \left[ \int _0^1 (R^{h,f}_t)^{1 - \theta ^f} dh \right] ^{\frac{1}{1 - \theta ^f}} \)

Wages are modeled as rigid. Quadratic adjustment costs provide a threshold for wage adjustments that delay the reaction to shocks (Adjustment costs are derived from Ireland (2001)). The equations for the quadratic adjustment costs are shown below, where \( \Omega ^w \) is the average wage adjustment cost and \( \bar{\pi }^w \) is the steady-state wage inflation.

I assume that changes to the level of investment supplied by the household are subject to quadratic adjustment costs. The costs are captured by the following equation, where \(\Omega ^i \) is the average investment adjustment cost.

Following Schmitt-Grohe and Uribe, the transaction cost technology for \(s^c_t\) and \(s^i_t\) is specified as follows, where \(\gamma _t\) is either \(C_t/D_t\) or \(I_t/D_t\). \( \theta ^s\) and \( \phi ^s\) are parameters of the transaction cost function Schmitt-Grohé and Uribe (2002).

The following Lagrangian gives the maximization of utility for the h’th household conditional on the real budget constraint and the demand schedule for labor and bank capital. \( \Lambda ^h_t \) is the Lagrange multiplier for the households maximization and \(K^h_{t-1}\) is replaced with \(I_{t-1}^h\).

The first order conditions that solve the households optimization problem in the symmetric equilibrium where all superscripts are dropped are given below, where the real wage is defined by \( w_t \equiv \frac{W_t}{P_t} \) and wage inflation is defined by the equation \( \frac{\pi ^w_t}{\pi _t} \equiv \frac{w_t}{w_{t-1}} \). \( \pi _t \) is the price inflation tied to the price index by \( \pi _t = \frac{P_t}{P_{t-1}} \). The real investment capital price \( Q^k_t \) is defined by \( Q^k_t \equiv \frac{P^k_t}{P_t}\) and \(\pi ^k_t\) is then the investment price inflation defined by the equation \( \frac{Q^k_t}{Q^k_{t-1}} \equiv \frac{\pi ^k_t}{\pi _t}\). I use Eq. 25 to replace \(\Lambda _t\) in Eq. 28.

3.3 Entrepreneur (B and C)

There are two types of infinitely lived entrepreneurs, who are the owners/managers of intermediate good firms. The z’th i-rated entrepreneur is situated on the interval \( z \in [0,1] \). The intermediate good firms use capital and labor to produce differentiated intermediate goods. Entrepreneurs are risk neutral and profit maximizing. Their accumulation of capital is subject to the default shock. They maximize their lifetime profits by setting the price for their differentiated intermediate good. Demand for their differentiated good is taken as given.Footnote 1 The two types of entrepreneurs are monopolistically competitive within their type. The differentiated intermediate goods produced are aggregated into a composite good for each type of entrepreneurs.

The capital used in the production process, is created by the entrepreneurs. They combine their preset capital stock with investment capital. Investment capital is provided by households in exchange for deposits. Accordingly the investment capital purchased by the entrepreneur \(P^k_t K^{z,i}_{t-1}\) is equal to the deposits \( (1 - \Upsilon )D^{z}_t\) that they obtained by entering into a loan contract \(F^{z,i}_t\). So that \( P_t^k K^{z}_{t-1} =(1 - \Upsilon )D^z_t\) holds, which can be rewritten as \(P^k_t K^z_{t-1} = F^{z,i}_t\). Conceptually capital is then rented by the entrepreneur to their firm. The capital rent is equal to the marginal productivity of capital.

The creation process for the capital of the z’th i-rated entrepreneur for use in quarter \( t \) is given below, where we replace the investment capital according to the equality given above

The end of quarter capital stock held by the entrepreneur evolves according to the path given below, where \( \delta \) is the depreciation rate and \( \mathscr {H}^z_t \) is the default shock.Footnote 2

If \( \mathscr {H}^z_t \) takes the value zero, the entrepreneur defaults and exits the market. I use the average probability of default to simplify the path of the capital stock. We assume that the realization of the shock at the end of the quarter for each entrepreneur of a class and the expected probability are equal. I make this simplification with the assumption, that the topic of this paper can be explored without the need for random default shock deviations. I am interested in the potential for systematic and undiverisified shocks, not their actual occurrence. The path for the capital stock is then given by

Capital and labor then are transformed into the differentiated intermediate good through a standard Cobb-Douglas production technology, where \( Y^{z,i}_t \) is the differentiated intermediate good produced by the z’th entrepreneur, \(\alpha ^i \) is the production share of capital, \( L^{z,i}_t\) is the amount of labor employed by the j’th entrepreneur and \( A^i_t \) is the technology augmenting component for the production technology of the i-class of entrepreneurs.

The technology augmenting component follows an AR(1) process given by the following equation, where \( \varphi ^i \) is a persistence parameter and \( \bar{A}^i \) is the steady state technology component. \( \sigma ^i \) is the standard deviation of the component and \( \epsilon ^i \) is an exogenous technology shock.

The marginal cost \( V^{z,i}_t \) for the j’th entrepreneur’s intermediate good is then given by the formula below, where \( \tilde{\alpha ^i} \) is a parameter formed according to \( \tilde{\alpha ^i} = (\alpha ^i)^{-\alpha ^i} (1 - \alpha ^i)^{\alpha ^i-1} \)

Cost minimizing then leads to the following joint cost function for capital and labor

Taking demand for their differentiated good as given, the entrepreneur then maximizes lifetime profits according to the following equation, where \( Y^{z,i,\nabla }_t \) is the demand for the entrepreneur’s good and \( P^{z,i}_t \) is the nominal price for the z’th entrepreneur’s good. \( \bar{\pi }^i \) is the steady-state price inflation for the i-class composite good.

The last term in the maximization are the quadratic adjustment costs for the price of the intermediate good, where \( \Omega ^i \) are average adjustment costs and \( \bar{\pi }^i \) is the steady-state class-i good price inflation.

The differentiated intermediate good \(Y^{z,i}_t \) produced by the z’th i-rated entrepreneur is aggregated to a composite good \(Y^i_t \). The differentiated intermediate goods within a type are situated on the interval \( z \in [0,1]\) and the aggregation technology for the i-rated composite good is given by

where \( \theta ^i \) is the elasticity of substitution between the intermediate goods of the i-rated entrepreneurs. From this the demand function for the z’th entrepreneurs intermediate good is

where \(P^i_t\) is the price for the composite good related to the price of the z’th intermediate good by \(P^i_t \equiv \left[ \int ^1_0 (P_t^{z,i})^{1 - \theta ^i} dz \right] ^{\frac{1}{1 - \theta ^i}}\).

Solving for the nominal intermediate good price we obtain the following first order condition in the symmetric equilibrium. Where we use the demand function for z’th entrepreneurs good to replace the demand with the composite good. And substitute the nominal for the real price according to \( P^{z,i}_t / P_t = Q^{z,i}_t \).

The inflation of the price for the composite good is related to the real price for the good by

3.4 Retail good producer

A continuum of retail good producers exists in the model economy along the interval \( u \in [0,1] \). They combine the composite goods to create their differentiated retail goods. These retail goods are then aggregated in the final good, which is either consumed or used in investment. The retail good producers are monopolistically competitive for their retail good. They set the price for their good and take demand as given.

The retail good is produced using a standard Cobb-Douglas production function, with the technology augmenting component \( \Xi \), which is an AR(1) process analogous to \( A^i_t \). \(\xi \) is the share of the b-type composite good \( Y^b_t \) used in the production of the retail good and \(Y^c_t\) is the c-type composite good. The differentiated retail good of the u’th producer is then produced according to the following technology

The real marginal costs for the retail good produced by the u’th producer are then given by, where \(Q^b\) is the real price for the b-type composite good and \(Q^c\) is the real price for the c-type composite good.

where \( V^u_t \) are the marginal cost and and \(\tilde{\xi }\) is a parameter formed according to \( \tilde{\xi } = (\xi )^{-\xi } (1 - \xi )^{\xi -1}\).

Cost minimizing then leads to the following joint cost function for the b and c-type composite good

The producers optimization problem is the maximization of their lifetime earnings. The maximization problem is given in the equation below. Where \( P^u_t \) is the price for the u’th retail good and \( Y^{u,\nabla }_t \) is the demand for the u’th retail good.

The differentiated retail good \( Y_t^u \) provided by the u’th producer is aggregated into the final good \(Y_t\), which is then consumed by the households. The differentiated retail goods are situated on the interval \( u \in [0,1]\) and the aggregation technology for the final good is given by

where \( \theta ^y\) is the elasticity of substitution between retail goods. From this the demand function for the u’th retail good is

The price index \(P_t\) is related to the price of the u’th retail good by \( P_t \equiv \left[ \int _0^1 (P^u_t)^{1 - \theta ^y}du\right] ^{\frac{1}{1 - \theta ^y}}\).

The price for the retail good is subject to quadratic price adjustment costs. The equation for the costs is given below, \( \Omega ^y\) are the average adjustment costs and \( \bar{\pi } \) is steady-state inflation.

I take the partial derivative of the producer’s maximization problem for the retail good price to calculate the first order condition. I use the demand function for the differentiated retail good to replace the demand. In the symmetric equilibrium all superscripts are dropped and \( P^u_t \) becomes \( P_t \), meaning that the real price for the final good is unity.

3.5 Monetary authority

The only government agency included in the model is the monetary authority. The authority engages in inflation targeting and uses the policy rate as its instrument to implement policy. I use a slightly adapted version of the interest rate rule proposed by Christoffel et al. (2008). Where \( \hat{\pi _t} \) is the logarithmic deviation of inflation from a target rate, which is set to be equal to the steady-state. Similarly \( \hat{y_t} \) is the logarithmic deviation of output from the steady-state. \( \xi ^r \), \(\xi ^\pi \) and \( \xi ^y \) are target weights. \( \xi ^{\Delta \pi } \) is a weight for the change in inflation from quarter to quarter and \( \xi ^{\Delta y} \) is a weight for the change in output. \( \epsilon _t^r \) is an AR(1) process analogous to \( A^i_t \). The shock term in the rule is used to introduce the policy rate shock into the simulation of the model.

3.6 Equilibrium conditions

An equilibrium in the model economy is reached when, taking every price but the price for its own retail good as given, the price and resource allocations for each individual entrepreneur and retail producer solves its profit maximization problem. The wage and the allocations for each individual household solves the utility maximizing problems, when all prices and wages but its own are taken as given. When the portfolio allocation of the banks solves their maximization problem. Additionally the markets for all goods, loans and deposits clear. I also introduce the variable \(GDP_t\) into the model, which is the sum of investment and consumption in quarter t.

4 Calibration

For the numerical solution of the model, values are attributed first to the constant parameters. I calibrate the parameters with the aim to represent an aggregate of the Euro-zone countries. The primary source for the calibration is the revised version of the New Area Wide Model(NAWM) described in Coenen et al. (2018). I use the averages of the posterior distribution of their Bayesian Calibration for an array of parameters. The weights in the interest rate rule are taken from the NAWM as well as the values for the inverse Frisch elasticity and the elasticities of demand for the different differentiated goods and labor skills. Accordingly \( \xi ^r \) is set to 0.93, \( \xi ^\pi \) is set to 2.74, \(\xi ^y \) is set to 0.03, \( \xi ^{\Delta \pi } \) is set to 0.04 and \( \xi ^{\Delta y} \) is set to 0.1. In line with NAWM we set all elasticities to 10. \( \xi \) is set to 0.36. The inverse Frisch elasticity is 2.

The NAWM also provides values for the discount factor, depreciation and the standard deviation of the interest rate shock. I set the discount factor to 0.998, depreciation to 0.025 and \( \sigma ^r \) to 0.11.

The values for \( \theta ^s \) and \( \phi ^s \) are taken from Schmitt-Grohé and Uribe (2002), \( \theta ^s \) is set to 0.0111 and \( \phi ^s \) to 0.075424.

Surveys on the frequency of wage and price changes conducted by the ECB are used to calculate the average adjustment costs for the different price rigidities. Wages are assumed to change on average every 15-17 month, the price for the retail goods every 10 months, the prices for the intermediate goods every 6 months. The values are then, 220 for \( \Omega ^w \), 70 for \( \Omega ^y \), 18 for \( \Omega ^i \). The habit persistence parameter is set to 0.62, in line with the calibrations in NAWM.

I use the data from Standard and Poors on average defaults for different ratings grades of loans to implement the average probability of default for B and C grade loans. \( \rho ^b \) is set to 0.0097 and \( \rho ^c \) is set to 0.0625 (The yearly probability of default are 3.89% and 25% respectively, I divide by four to determine the quarterly default probabilities). Gordy and Lütkebohmert propose a value of 0.25 for \( \phi ^g \). The minimum requirement \(\eth \) is set 0.03, in line with the BASEL mandate for the non risk-weighted minimum core capital requirement Basel Committee on Banking Supervision (2014). The persistence parameter of the interest rate shock \( \varrho ^r \) is set to 0.1.

4.1 Steady-state

The second step in the numerical solution of our model is the calculation of an initial steady-state, without exogenous processes or wage and price adjustment costs. I solve the steady state with a fairly small set of preset variables. The steady-state policy rate is set at 1.02 and the technology augmenting components are set to one. I further set the steady-state loss given default to 40% for both loans. This loss given default implies that investment is 26% of GDP in the steady-state, which is in line with Eurozone data, if net exports and government spending are excluded (The direction of the impulse response functions is robust to different levels of loss given default, if the same loss given default is attributed to both loans). I set the steady state value of the bank’s loan portfolio to one (\(\displaystyle \sum _{i=b}^c \bar{f}^i = 1\)), of which 90% is allocated in the safer loan. I use the steady-state distribution of loans to calibrate the constant premium, which is calculated using the following formula

With these presets I arrive at a numerical solution of the steady-state.

5 Simulation results and conclusion

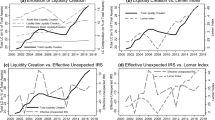

In this section I discuss the results of the simulation of the model, when it is subjected to transitory negative policy rate shock. I discuss the technical reasons for the shape of the impulse responses and give an economic interpretation for the results. Figure 3 shows the impulse response functions of key variables of our model. I use the default probability of the bank’s entire portfolio \( \rho _t \) as a measure for the effect of the expansionary shock on financial stability. \(\rho _t \) is the weighted sum of the probability of default of the b and c rated loans. It is derived by the following equation

The IRF show, that the negative policy rate shock has an expansionary effect on the model economy. Output, inflation and total lending all increase in response to the decline of the policy rate. I also observe a decline of the interest rates on loans and bank capital. Financial stability drops due to an increase in the default probability of the bank’s portfolio.

The increase in lending indicates a shift of the maximum of the loan profit functions to the right. The volume of both loans increases as a result of the negative policy rate shock. The increase in \(\rho _t\) also indicates that the growth of the riskier loan outpaces that of the safer loan. Why does this happen? The equation governing the volume of a loan, Eq. 13, can be rewritten as follows, if \(R^i_t \) is replaced with Eq. 8.

A look at this equation shows, that there are three avenues through which the policy rate decline can increase the volume of a loan in the bank’s portfolio.

-

1.

Through the difference between bank capital rents and the policy rate

-

2.

Through changes to the capital requirements

-

3.

Through changes of the exposure prices

We can discard the difference between bank capital rents and the policy rate as a possible origin. Equation 27 simplifies to \( \hat{r}^f_t = \hat{r}_t \) in the log-linear model, so that the difference between the log-linear deviations is zero over the entire simulation. Which leaves the capital requirements and the exposure prices as the origin of the risk-shift. I derive the log-linear version of Eq. 56 and use the equality given above to construct the following log-linear equation

Which can be further simplified as the term \(\left[ \frac{1}{2 \bar{g}^i \bar{f}^i}\left( \mu ^i \frac{\bar{r}}{\bar{r}^f - \bar{r}} - \eth - \bar{j}^i\right) - 1\right] \) sums to zero. The shift of the portfolio depends accordingly on changes in the capital requirements \(\hat{j}^i_t\) and changes of the exposure price factor \(\hat{g}^i_t\). The capital requirements can be turned into constants by setting \(\hat{j}^i_t = 0\). Simulation of the model in this configuration shows a small shift of the portfolio towards the riskier loan. This shift is most likely the result of the stronger decline of the exposure price for the riskier loan. The exposure price of the riskier loan declines more due to the more pronounced reduction of the c-rated entrepreneurs leverage. The slightly steeper decline of the riskier entrepreneurs leverage is caused by the stronger impact of interest rate changes on the c-rated capital stock. This interpretation is in line with the observation that the risk-shift reverses after the initial quarter, when \(\hat{g}^c_{t=2}> \hat{g}^b_{t=2}\). The direction of the initial risk-shift is robust in regards to the steady-state distribution of the loans in the bank’s portfolio (I tested the results with steady-state distributions ranging from 99% of the portfolio allocated in the safe loan to 1% allocated in the safe loan). As the risk-shift is bound to the reduction in the exposure price factor, it is very limited in its scope due to the dynamic relationship between the exposure price factor and entrepreneur leverage. An increase in the riskier loan increases entrepreneur leverage, which in turn diminishes the value of the collateral. And a lower collateral leads to a higher exposure price factor.

This leverage based risk-shift conforms to the argumentation of Borio and Zhu (2008). The policy rate decline leads to an increase of the value of the collateral, reducing the loss given default. Which has a stronger impact on the perceived and actual risk associated with the riskier entrepreneur. The impact of the valuations increase is more pronounced for the riskier borrower, similar to Ottonello and Winberry (2018). (The higher impact is caused by an effect similar to the financial accelerator described by Bernanke (1995)). Accordingly the share of the riskier loan in the portfolio increases, leading to a decline in financial stability.

As visible in the IRF graph Fig. (3), there is also a shift in the model when capital requirements are endogenous. Depending on the initial steady-state presets for \(\bar{f}^b\) and \(\bar{f}^c\), this shift can be a stronger pivot towards the riskier loan or a shift towards the safer loan. Equation 57 establishes that the changes in the capital requirements are multiplied by the term \( \frac{\bar{j}^i}{2 \bar{g}^i \bar{f}^i} \), which approaches infinity if \(\bar{f}^i\) approaches zero. It follows that the lower the steady-state share of a loan is, the higher its multiplier becomes (The actual value of the multiplier is also dependent on the steady-state exposure price factor and capital requirements. Which links the multiplier to the expected default probability and the steady-state loss given default of a loan. A higher probability of default leads to a smaller multiplier. Which explains why an equal steady-state distribution of the loans leads to a negative risk-shift). So that a decline in capital requirements has a relatively stronger impact on the loan with the higher multiplier. If the multiplier is set to 1, a limited risk-shift similar to the risk-shift without capital requirements occurs.

I set the initial steady-state distribution of the loan to a portfolio share of 10% for the riskier loan. With this configuration a decline in capital requirements has a pronounced effect on the risk-shift of the portfolio. This proportionally stronger growth of the riskier loan is paralleled by a relatively lower decline in the capital requirement and exposure price factor of the riskier loan. Which is the moderating effect of the dynamic relationship between the volume of a loan, entrepreneur leverage, capital requirements and exposure price factor. It also shows that the scope for the risk-shift caused by the reduction in the capital requirements is larger than the possible risk-shift caused by a decline in the exposure price factor alone.

In the model a decline in the policy rate boosts collateral values, as borrower leverage declines. This effect, which is also described by Borio and Zhu (2008), reduces the loss given default. The perceived risk associated with a loan declines, which leads to lower capital requirements, loan demand and a lower exposure price factor. A decline that is independent of the average default probability of the loan \(\rho ^i\), which remains constant. The movement of the capital requirements has a procyclical effect. Their decline leads to an expansion of total lending significantly above the increase in a scenario with constant capital requirements. The capital requirements amplify the stronger impact of the interest rate decline on the riskier borrowers, leading to a stronger risk-shift.

The increased portfolio share of the riskier loan is a logical step in the model. The riskier loans actually have become less risky and have become relatively more attractive than before the policy rate decline. But the probability of default of the entire portfolio still increases, reducing financial stability. The banks are insured against the expected probability of default through the interest rate technology. But they are also exposing themselves to larger tail risks stemming from the unexpected losses associated with the riskier loans.

Empirical studies, for example, (Jimenez et al. 2014) show a similar movement towards more portfolio risk due to a reduction in perceived risk as a response to a policy rate decline. They also found that this increase in riskier lending is not necessarily a problem during a period of monetary easing/ economic expansion itself. As the riskier borrowers actually become less risky during the expansionary episode. This development is problematic because of the accumulation of riskier loans that will become troublesome when the economic expansion slows down/ when the episode of monetary easing ends. Borrowers that were able to service their debt during the economic expansion may become unable to do so in the event of a slow down of the expansion. In the model the monetary tightening following the initial expansion is not a problem for the banks, as changes in the monetary stance occur with the same frequency as the maturity of loans, quarter-by-quarter. Which means that the banks do not carry over loans extended in a period of monetary expansion into a period of tightening. When lending is longer term though, a problem arises. Banks will accumulate a legacy of loans from less credit worthy borrowers, whose ability to service their debt/ avoid default will drop once the economic expansion slows down. And the risk provisions for these loans will react procyclically, which implies that banks may lack sufficient capital to provision for the reevaluated risk associated with their portfolio. Or that their profitability will be impacted as they have to accumulate more capital for a reevaluated loan without the ability to increase the interest on that loan.

5.1 Sticky target rates of return

Borio and Zhu (2008) note that the expected rate of return can be slow to adapt to economic developments. Which leads to a deviation of the expected rates from the market rates. I explore this avenue for a risk-taking effect of a policy rate decline by implementing sticky bank capital rents. These sticky rents represent the delay in the adjustment of shareholder return expectations to the development of market rates. This creates a search-for-yield motive, which pushes the banks to allocate their portfolios in a riskier way.

To implement sticky bank capital rents, quadratic adjustment costs for the bank capital rent are indroduced, build following Ireland (2001). The following term is added to the expenditure side of the households budget constraint, where \(\Omega ^f\) are the average adjustment costs. These costs are set to 70, representing an average rent adjustment period of two quarters (Simulations with different values for \(\Omega ^f\) show, that the direction of the IRF is indifferent as long as \(\hat{r}^f_t \ne \hat{r}_t \) holds).

With the addition of adjustment costs, \(\hat{r}^f_t \) is no longer equal to \(\hat{r}_t\). Now the difference between bank capital rents and the policy rate widens as a response to the policy rate shock. This increases the relative bank capital price of capital requirement, exposure price factor and the minimum capital quota (MCQ). Figure 4 shows the impulse responses of key variables to a policy rate decline when bank capital rents are sticky. The IRF show that the expansionary effect of the decline on total lending and the real economy persists. But the higher bank capital price diminishes the overall expansion of lending compared to a simulation without sticky bank capital rent. Financial stability declines more severely. The direction of the shift in the portfolio distribution is also indifferent to the steady-state presets for \(\bar{f}^a\) and \(\bar{f}^b\).

Why does the widening of the gap between bank capital rents and the policy rate lead to a higher share of the riskier loan in the portfolio? Referring to Eq. 56, I derive the following log-linear expression

Which shows that there are now four avenues through which a policy rate shock can influence the volume of a loan. Through the first term on the right hand side the volume of loans is positively correlated with the policy rate. Ceterum paribus a declining policy rate leads to a lower volume of loans. Since \(\bar{r}\hat{r}_t > \bar{r}^f \hat{r}^f_t\), the second term also implies a decline in the volume of a loan. The expansionary effect of a decline in the bank capital rent is superseded by the widening of the gap between bank capital rent and the policy rate. Accordingly lending contracts in response to a policy rate decline, if capital requirements are constant. The portfolio also shifts towards the safer loan. Through the multipliers (steady-state values and the probability of default) the decline in the policy rate has a relatively stronger effect on the riskier loan (If the steady-state distribution of the portfolio is reversed, the portfolio shifts towards the riskier loan).

Why do sticky bank capital rents then increase the risk-shift, when capital requirements are endogenous? And why is the direction of the shift indifferent to the steady-state portfolio distribution? The answer to the second question is that the multipliers in the first three terms of Eq. 59 all approach infinity if \(\bar{f}^i \) approaches zero, and vice versa. Which means that the increase in the multiplier \(\bar{j}^i/(2\bar{g}^i\bar{f}^i)\) is matched by an increase in the multipliers in the first two terms. Which eliminates the effects of the steady-state portfolio distribution in regards to the direction of the risk-shift. The answer to the first question is more complex. Borrower leverage declines more than in the absence of sticky bank capital rents. This is a result of the lower overall expansion of credit. Capital requirements accordingly drop more severely. The drop is steeper for the safer loan, due to the dynamic relationship between the volume of a loan and the capital requirements. But the size of the gap between the decline of the safer loan’s and the riskier loan’s capital requirements is much smaller than in the absence of sticky bank capital rents. Steady-state exposure price and capital requirements are higher for the riskier loan, which means that a decline in capital requirements has a relatively stronger impact on the volume of the riskier loan. And this in turn leads to a higher risk-shift.

Sticky bank capital rents accordingly have two effects on the reaction of the banks to a policy rate decline. The first effect is that they reduce the overall expansion of credit, because of the relatively higher funding costs for the bank. And the second effect is that they lead to a relatively higher shift of the portfolio towards riskier loans. This can be seen as a search-for-yield effect.

5.2 Concluding remarks

In this paper, I investigate the link between financial stability, borrower heterogeneity and loose monetary policy. I explore in particular the effects of a transitory shock on the policy interest rate on financial stability. For this purpose I construct a relatively simple closed-economy DSGE model and calibrate it with Euro-zone data. I implement heterogeneous borrowers and an optimization of the banks’ loan-portfolio, which is derived from an endogenous optimization. The model implements the BASEL IRB capital requirement and leverage ratio framework.

The simulation of the model shows that monetary policy can affect the stability of the financial system through its impact on valuations and interest rates. The heterogeneous response of borrowers’ leverage/ valuations plays a crucial role in this.

Lower interest rates change valuations in two important ways: They increase the value of the collateral and borrowers’ assets and they decrease the perceived default risk. These effects are not homogeneous. Borrowers with a higher probability of default and ex ante higher risk premiums on their loans profit proportionally more from an increase in the valuation of their collateral/ assets. This has not only an effect on the risk premium, but it also affects the IRB capital requirements and the exposure prices. Capital requirements react procyclically, which amplifies the valuations effect of the interest rate decline. The higher impact on the riskier borrowers leads to a relative increase of the risky lending. The policy rate decline accordingly not only causes an overall expansion of credit, but also a risk-shift of the banks’ portfolio.

The simulation also shows that sticky rate of return targets have a negative impact on financial stability when the policy rate declines. If the return expectations of bank shareholders/ owners adapt at a slower pace than market rates, then this creates a search-for-yield push. This push leads to an amplification of the risk-shifting impulse generated by the policy rate decline.

This oberservation has an important implication for policy makers: Macroprudential policy and monetary policy are inextricably linked. Monetary policy must consider its effect on financial stability when policy decisions are made, otherwise monetary policy might increase market risks. This effect could be mitigated by a gradual approach to monetary policy, which allows market expectations and bank protfolios to adjust gradually. This is most important at the end of a phase of monetary easing, when the amount of risky borrowers in bank portfolios is high.

References

Acosta-Smith J (2018) lnterest rates, capital and bank risk-taking. Bank Engl Staff Working Pap 774

Agénor J-P, Gambacorta L, Kharroubi E, Pereira da Silva LA (2018) The effects of prudential regulation, financial development and financial openness on economic growth. BIS Working Pap 752

Agénor J-P, Pereira da Silva LA (2017) Capital requirements, risk-taking and welfare in a growing economy. IDB Working Pap Ser 771

Altunbas Y, Gambacorta L, Marques-Ibanez D (2014) Does monetary policy affect bank risk. Int J Cent Bank 10(1)

Angelini P, Neri S, Panetta F (2014) The Interaction between capital requirements and monetary policy. J Money Credit Bank 46(6)

Basel Committee on Banking Supervision (2005) An explanatory note on the basel II IRB risk weight functions. Basel Comm Banking Superv Publ

Basel Committee on Banking Supervision (2014) Basel III leverage ratio framework and disclosure requirements. Basel Comm Banking Superv Publ

Basel Committee on Banking Supervision (2017) BASEL III : finalising post-crisis reforms. Basel Comm Banking Superv Publ

Benes J, Kumhof M, Laxton D (2014) Financial crises in DSGE models: a prototype model. IMF Working Pap 57

Bernanke BS (1995) Inside the black box: the credit channel of monetary policy transmission. NBER Working Pap Ser 5146

Bonfim D, Soares C (2018) The risk-taking channel of monetary policy: exploring all avenues. J Money Credit Bank 50(7)

Borio C, Zhu H (2008) Capital regulation, risk taking and monetary policy: a missing link in the transmission mechanism? BIS Working Pap 268

Christoffel K, Coenen G, Warne A (2008) The new area-wide model of the euro area. ECB Working Pap Ser 944

Coenen G, Karadi P, Schmidt S, Warne A (2018) The new area-wide model II: an extended version fo the ECB’s micro-founded model for forcasting and policy analysis with a financial sector. ECB Working Pap Ser 2200

Collard F, Dellas H, Diba B, Loisel O (2017) Optimal monetary and prudential policies. Am Econ J Macroecon 9(1)

de Groot O (2014) The risk channel of monetary policy. Int J Cent Bank 10(2)

Dib A (2010) Banks, credit market frictions, and business cycles. Bank of Canada Working Paper 24

Freixas X, Rochet J-C (1997) Microeconomics of banking. MIT Press

Gambacorta L, Karmakar S (2018) Leverage and risk-weighted capital requirements. Int J Cent Bank 14(5)

Gerali A, Neri S, Sessa L, Signoretti FM (2010) Credit and banking in a DSGE model of the euro area. J Money Credit Bank 42(6)

Gete P (2018) Lending standards and macroeconomic dynamics. ECB Working Pap Ser 2207

Gordy M (2002) A risk-factor model foundation for ratings-based bank capital rules. (FEDS) Federal Reserve 55

Gordy MB, Lütkebohmert E (2013) Granularity adjustment for regulatory capital assessment. Int J Cent Bank 9(3)

Ireland PN (2001) Sticky-price models of the business cycle: specification and stability. J Monet Econ 47

Jakab Z, Kumhof M (2015) Banks are not intermediaries of loanable funds – and why this matters. Bank England Work Pap 529

Jakab Z, Kumhof M (2018) Banks are not intermediaries of loanable funds – facts, theory and evidence. Bank England Staff Work Pap 761

Jimenez G, Ongena S, Peydró J-L, Saurina J (2014) Hazardous times for monetary policy: what do twenty-three million bank loans say about the effects of monetary policy on credit risk-taking. Econometrica, 82(4)

Maddaloni A, Peydró J-L (2011) Bank risk-taking, securitization, supervision, and low interest rates: evidence from Euro-area and the U.S. lending standards. Rev Financ Stud 24(6)

Memmel C, Seymen A, Teichert M (2016) Bank’s interest rate risk and search for yield: a theoretical rationale and some empirical evidence. Deutsche Bundesbank Discus Pap 22

Ottonello P, Winberry T (2018) Financial heterogeneity and the investment channel of monetary policy. Working Paper 24221, National Bureau of Economic Research. http://www.nber.org/papers/w24221

Research Task Force Concentration Risk Group (2006) Studies on credit risk concentration. BIS Work Pap 15

Schmitt-Grohé S, Uribe M (2002) Optimal fiscal and monetary policy under sticky prices. NBER Working Paper 9220

The Joint Forum (2008) Corss-sectional review of group-wide identificatiion and management of risk concentrations. Basel Comm Bank Superv Publ

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Fittje, J. Risk-shifting, concentration risk, and heterogeneous borrowers. Int Econ Econ Policy 20, 509–536 (2023). https://doi.org/10.1007/s10368-023-00570-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10368-023-00570-z