Abstract

We analyze the trade effects of a new unfolding transport infrastructure in connection with China’s Belt and Road Initiative. Using panel data for the years 1996–2018, featuring 27 exporting countries and 96 industries, we exploit variation in the timing and number of railway connections to estimate whether European countries benefit from increased export revenues and product variety of their shipments to China. We find that both increase and that also indirectly connected countries benefit. Using additional data on the mode of transport, we find that industries with intermediate time-sensitivity appear to increase their utilization of rail-freight to China the most and confirm that the overall increase in exports is also driven by these industries. We further show that mainly Central, Eastern and Southeast European regions are specialized in economic activities related to “railway adopting industries”, which makes likely to benefit the most from first-order gains of improved market access and export opportunities.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Trade infrastructure is a key determinant for both market access and trade volumes between countries. A well functioning infrastructure reduces frictions in the importing and exporting process as well as overall trade processing times. Both have been shown to explain differences in trade activity across countries (e.g. Djankov et al., 2010; Waugh, 2010).

In 2013, China’s President Xi Jinping announced the launch of the Belt and Road Initiative (BRI), a transcontinental infrastructure investment project aimed at reviving the historical Eurasian Silk Roads. The BRI consists of two main elements: the Silk Road Economic Belt, which focuses on the development of land-based connections between China and Europe; and the 21st Century Maritime Silk Road, which involves sea transport routes and maritime infrastructure connecting China’s East Coast to South Asia, Europe, and Africa. The former comprises the New Eurasia Land Bridge Economic Corridor, which consists of several intercontinental railway connections between China and Europe.

In this paper, we study the trade response to the development of this ‘Corridor’. More specifically, we analyze how the gradual expansion of the railway network connecting China and Europe promotes exports of the latter. In doing so, we use different metrics to measure the expansion of the network and consider a number of different outcome variables. Besides the value of shipments, we look at trade creating effects of the Corridor for European exporters by analyzing the extensive product margin over time. Moreover, we use data on the transportation mode of European shipments to China in order to investigate in which sectors exports appear to switch towards time-saving (compared to sea shipments) or cost-saving (compared to air-freight) railway transport.

We exploit a detailed panel data set of countries’ merchandise exports to China, spanning more than two decades up until 2018. Since 2011, and more broadly since 2014, we observe an increasing range of direct railway connections starting their operations on a regular schedule between China and Europe. Of the 23 European countries in our main sample (i.e. the EU25, minus Cyprus and Malta), about two-thirds experience the establishment of a direct connection, so that we can compare their export performance relative to (i) non directly connected European countries, as well as to (ii) other high-income but non-European exporters, such as Japan and South Korea or Canada and the US.

To identify whether a country is connected to China by rail, we compile a list of announced and initiated train connections, which specifies the main end or starting points in China and Europe and the month when operations started. We also take into consideration the intra-European rail network and consider countries that are indirectly connected through the BRI, depending on their geographic proximity to a particular connection point in another European country. Along these lines, including non-European countries (i.e. East Asian and North American) into our comparison group enables us to fully account for potential spillover effects of the corridor on Europe’s rail-connectivity and trade with China.

Moreover, we analyze how the share of European shipments to China realized via rail transport evolves as connections are being built. Our interest here focuses on the type of goods that show the strongest response, so that we can better understand which products or industries most likely benefit from these new connections. In terms of shipping times and costs, rail transport lies in between ocean container shipment (which has larger capacity, lower cost, and takes more time) and air-freight (which has lower capacity, higher cost and is faster). We, hence, expect a non-linear relationship between products’ time-sensitivity and their propensity to switch to rail freight.

Our findings suggest that BRI train connections increased exports from Europe to China by about 10 percent on average, according to our baseline specification. While we find a generally robust positive relationship across specification and estimators (i.e. log-linear regression vs. PPML), we find statistically and quantitatively stronger evidence for exports to China when using non-European control groups (e.g. North America, represented by Canada and the US, and East Asia, represented by Japan and South Korea). This suggests that not only directly connected countries in Europe benefit from the BRI. Moreover, the performance differences are most pronounced relative to East Asian exporters, which could suggest that the BRI diverted some of the trade between China and those countries (and thus limiting the actual trade creation effects for China).

Besides the direct effects, we also find positive spillovers on exports by countries that are neighbors or geographically proximate to locations where the China-European railways stop. This is in line with our observations that the Corridor initially had only a few European end points from and to which freight could be forwarded. As such transmissions complicate the evaluation and quantification of the relationship between the BRI and European exports, we turn to an alternative data set where we observe exports by transportation mode and HS2 sector. This allows us, in a first step, to identify responsive industries and, in a second step, include this new sector dimension into our analysis. Results obtained from this refined identification strategy suggest an increase of exports by about 4–6 percent on average, and a similar increase in the number of products exported to China.

Regarding the responsiveness of different industries, we find substantial heterogeneity. On average, about one third of the HS2 industry sectors in our sample reveal significant increases in rail-freight to China, compared to other transportation modes. Comparing them to estimates of sector-level time sensitivity (as defined in Hummels & Schaur, 2013; Ciani & Mau, 2021), we report suggestive evidence of a non-monotonous inverse u-shaped relationship in 5 out of 6 of our specifications. While the last specification suggests that the relative likeliness of switching to rail-freight is orthogonal to time-sensitivity, the remaining ones suggest that industries where timely delivery is of intermediate importance may benefit the most from the BRI railway corridor. We find support for a role of time-sensitivity also in our augmented baseline specifications, estimating the impact of BRI connections on export revenues and diversification. Moreover, we present suggestive evidence that the prospective first-order gains arising from new export opportunities might be primarily concentrated in Central, East and Southeast European regions, where manufacturing production is relatively more prevalent than in the service-sector based Western European economies.

Our paper makes several contributions to the empirical trade literature and in particular the literature that focuses on the importance of trade infrastructure. Several studies structurally estimate parameters of infrastructure-related trade costs to quantify its importance (Bougheas et al., 1999; Limão & Venables, 2001; Egger & Larch, 2017). Hummels (2007) reviews how advances in transport technologies since the 1950s contributed to increased trade volumes and changing modes of transport, comparing ocean and air freight. Prominent examples with an explicit reference to railway networks are Donaldson and Hornbeck (2016) and Donaldson (2018), who focus on quantifying the impact of improved market access on the value of land and on price convergence respectively. Our approach is methodologically different in that we abstain from structural estimation. While being consistent with the gravity equation of international trade, we adopt a difference-and-difference type strategy to evaluate the revealed quantitative changes in trade pattern after the initiation of BRI railway operations.

Our study makes also a clear topical contribution by focusing on a recent and unprecedented, large scale infrastructure project. The BRI increasingly attracts interest of researchers in economics, as it offers novel approaches to answering a wide range of research questions (Li & Schmerer, 2017; Ruta et al., 2020).Footnote 1 In this respect, our study is similar to Jackson and Shepotylo (2018) and Baniya et al. (2019), who employ a structural gravity model to estimate key parameters and quantify the potential effects of the BRI on trade with China. However, like most of the BRI related research to date, their studies are forward-looking in the sense that potential costs or benefits are discussed based on counterfactual exercises. The only ex-post analysis we are aware of is Li et al. (2018), who focus primarily on Chinese exports to Europe. We partly build on their modelling approach, but improve on it by controlling more systematically for spurious correlation and potential omitted variable bias, using fixed effects and control variables that are constistent with the gravity equation. Moreover, extending the period of analysis by at least three years adds significant value to our study, as many connections started their regular operations only in 2014 or after. Accordingly, our results differ from their findings which seemed to question any detectable impact of the BRI on Europe’s exports to China.

Finally, by documenting patterns of sectoral heterogeneity in the BRI effect on trade as well as highlighting different economic specialization patterns across Europe, we shed some light on potential distributional effects and conflicting interests in BRI participation which constitute promising avenues of future research on this topic.

Our paper is structured as follows. In Sect. 2 we present some background information about the BRI in general, and the new rail connections between China and Europe in particular. We also outline some theoretical channels through which we think the BRI might promote exports from Europe to China. In Sect. 3 we describe the data used in our analysis and explain our empirical methodology, as well as our measurement and identification strategies. Section 4 presents our empirical results, including robustness checks and alternative specifications. Section 5 discusses the implications of our research and concludes.

2 The ‘One Belt, One Road’ initiative

2.1 General background and scope

Announced in 2013, the ‘One Belt, One Road’ initiative (or Belt and Road Initiative; BRI) has been promoted as a project aimed at increasing connectivity between the European, Asian and African continents, and to strengthen their partnerships. Formally, there are five interdependent objectives:Footnote 2 (i) enhance policy coordination; (ii) improve infrastructure connectivity; (iii) reinforce trade and investment cooperation; (iv) promote financial integration; and (v) support people-to-people collaboration. According to McKinsey (2016), the BRI covers almost two-thirds of the world’s population, one-third of global GDP and at least a quarter of world trade. However, there exists no formal list of participants so that the BRI can be considered as an open agreement where everyone is welcome to participate (World Bank, 2017).

In fact, countries’ involvement is difficult to capture. Table 9 presents one specific view on the scope of the BRI, which uses data from the China Global Investment Tracker (CGIT).Footnote 3 It displays monthly BRI-related foreign investment and construction contracts for Chinese firms across the world, up until December 2019. China’s BRI activities reached out to 112 different countries on all continents. It is especially active in Africa and Asia, where almost all its investment and construction projects relate to the BRI. There is also a sizeable number of projects in the Americas, as well as a few transactions in South Korea and New Zealand. Japan, Australia, Canada and the US did not receive any BRI-related investment from China. In Europe, we observe 22 countries with BRI investments from China in 127 projects. These projects, however, account for a relatively small fraction of total investment inflows from China, i.e. between 20 and 30 percent of the total volume of Chinese investment in Europe. A closer look at the CGIT data further reveals that BRI investment concentrates primarily in Central, Eastern and Southeast European countries, while—with the exception of Italy—it is almost entirely absent in Western Europe (Fig. 6).

Another way is to consider the political level of involvement and to look at countries that signed a Memorandum of Understanding (MoU) with China concerning the mutual promotion of BRI related collaboration.Footnote 4 The list of European countries signing such MoUs since 2015 overlaps considerably with that reporting positive investment inflows from China in the CGIT data. However, their practical value for the purposes of our paper is questionable, given that they provide little to no information on the actual scope and state of relevant trade-promoting infrastructure projects between Europe and China. A similar concern applies to the way how de Soyres et al. (2019) identify BRI participating countries, as they focus primarily on planned projects (all outside Western Europe) in order to predict future trade volumes based on the assumed transport time and cost reductions once the connection is fully operational.Footnote 5 A similar, yet, broader approach is taken by the MERICS BRI Tracker, which collects, combines and documents information on BRI projects based from various publicly available sources (governments, industry associations, companies and media) and encompasses all projects that either officially state BRI involvement or are seen as contributing to the five BRI objectives, stated at the beginning of this section.

Source: International Road Transport Union (© IRU.org)

Six economic corridors constitute the Belt

Our approach follows Li et al. (2018) and focuses exclusively on the actual implementation and operation of regular commercial rail freight connections between China and Europe. To this end, we adopt the so-called the “geographic approach” to BRI participation (World Bank, 2017), by asking whether a particular rail transport corridor runs through (and stops in) a particular country or not. As we can observe in Fig. 1, there are six economic land corridors and a number of maritime corridors. While the land routes establish connections among countries in Asia and Europe, the maritime corridors complement those connections and involve additional countries mainly in the Middle East, North Africa, and the eastern coast of Sub-Saharan Africa. The New Eurasia Land Bridge Economic Corridor (henceforth: ‘the Corridor’) denotes one of two northern land routes and is the only one that establishes direct rail-freight connections between Western Europe and China. Detailed information about the European end points of the various train connection that started operating via the Corridor will constitute the basis for our measure of bilateral trade-infrastructure improvements.

2.2 ‘The corridor’: connecting China and Europe

The Corridor consists of a number of direct railway connections between Chinese and European cities. Our analysis defines a direct connection as a regularly operating rail-freight service to and from a specific Chinese city. For example, the connection YuXinOu operates between Chongqing and Duisburg (Germany). The train had initially no further scheduled stops inside the EU, except at the border from Poland to Belarus where rail gauges change. At this occasion it is possible to add or remove containers. Hence, Poland and Germany are treated as being directly connected with Chongqing. More recently, since 2018, another direct connection to Chongqing started operating from Mannheim (Germany). Since the train forwards freight to and from the same Chinese city (i.e. Chongqing) and the connection signs under the same name (i.e. YuXinOu), we do not consider this link as a new connection for Germany or any other country. Following this definition, we identify 15 different connections that have become operational by the end of 2019 and which we distinguish according to their respective start or end points in China. Most connections evolve over time, as further stops or departure points across Europe are added.Footnote 6

Table 10 gives a detailed overview of the direct railway connections for which we collected information from various sources. The average reported distance travelled by a train amounts to slightly more than 10,000 km and ranges between about 8000 and 13,000 km overall. Reported travel times for a rail connection vary between 11 and 26 days and average at 15 days. The much more eclectic information about the alternative maritime shipping times suggests about 40 days on average, more than 2.5 times as many days. This highlights the time advantage of rail transport over conventional sea shipment.Footnote 7

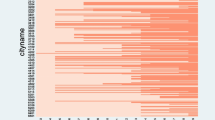

Evolution of the BRI Corridor, number of connections to China since 2011. Note Authors’ calculations based on data from various source (see Table 10). Chart depicts number of direct train connections with China across European countries at monthly frequency. Belgium (BE) includes also Luxembourg

In Fig. 2 we show how the number of direct railway connections to China evolved over time and across Europe; variation we will exploit in our empirical analysis. It shows that direct connections via the Corridor differ substantially. Some countries are involved in almost all connections (and numbers increase over time), while others participate only recently or in a few lines. We also note that several (mostly geographically peripheral) European economies have not been at all directly connected to China via the Corridor.Footnote 8 This does not necessarily mean that these countries are unable to take advantage of the Corridor. In fact, Europe itself has a tightly-knit rail infrastructure network and many of the connected destinations are located at major transport and logistics hubs, so we have to take into consideration the indirectly connected countries as well.

Despite these important identification challenges, Fig. 3 illustrates the main adjustments on which our analysis will focus. It shows how exports from directly connected EU countries to China evolved before and after the launch of their first BRI rail connection. In the years prior to their launch, they hover around fairly comparable levels. An aggregate trend is not observable. However, their exports pick up as soon as the new rail connections to China become operational. The confidence intervals suggest that the differences to the pre-BRI period are statistically significant, which lends support to an export stimulating effect of the railway connections.

Exports before and after launch of first direct BRI railway connection. Note Authors’ calculations. Figure shows average export values (and 95% confidence intervals) from 14 EU countries to China in the years before and after the launch of the first direct BRI connection. Individual start dates range from 2011 to 2018, so that sample size and composition varies across bars. Exports are normalized to 1 at time 0; the year before a BRI connection became operational

2.3 Theoretical channels

Before turning to the data description and empirical strategy, we briefly review the main theoretical mechanisms that should guide our subsequent analysis. The direct channels through which BRI railway connections may affect international trade are threefold. They all operate through the bilateral component \(\phi _{ni}\) of a standard gravity equation, which can be derived from most conventional trade models (Head & Mayer, 2014):

The left-hand side variable \(X_{ni}\) denotes the value of exports from country i to destination n, \(M_{n}\) denotes a general demand shifter and \(S_{i}\) denotes a general supply shifter. The bilateral term \(\phi _{ni}\) captures a wide set of exporter-importer specific trade determinants, such as geographic indicators (e.g. distance), cultural and historical indicators (e.g. language or colonial history), and bilateral contemporaneous political indicators (e.g. trade agreements).

We expect the BRI effects to operate through the distance-related channel. First, although the BRI does not change the geographic location of countries, it affects effectively travelled distances. We noticed earlier that they are reduced by about 50 percent compared to conventional ocean shipping routes between Europe and China. According to Chaney (2018), lower distances increase trade independently of trade policies and transport technology, as they affect the network structure of internationally operating firms. Second, shorter travel distances and faster transportation technology reduce the time it takes for a good to be shipped to a specific destination. Hummels and Schaur (2013) show that shorter delivery times have real trade effects as they enter the objective function of importers. Empirical evidence by Djankov et al. (2010) and Ciani and Mau (2021) supports this mechanism and also that travel times are of variable importance across industries. Finally, shipping routes, duration and transportation mode determine the charges that have to be paid. While per unit charges should be lower for shorter travels (Hummels & Skiba, 2004), they are likely to be higher in the case of capacity constraints for a specific mode of transport. Compared to ocean shipping, we expect charges and transportation costs to be higher for trade via the BRI, but still considerably lower than air-freight.Footnote 9

Altogether, the three different channels (distance, time, and transport charges) are likely to adjust in a way that trade barriers between China and the EU are reduced. To what extent this stimulates trade is an empirical question, but we expect to observe adjustments in both overall export revenues and at the extensive margin (i.e. the number of different types of goods exported). The latter will be the case if the new trade routes lower trade barriers for certain transport- and time-sensitive products in such a way that they start being exported to China. In fact, adjustments may differ across industries if they are differentially sensitive to timely delivery. As air-freight remains a faster but more expensive modal choice, trade in goods with intermediate levels of time-sensitivity might be most responsive to the new BRI railway connections.

3 Empirical model and data

3.1 Data and sample selection

To analyze the effect of newly established BRI connections on Europe’s exports to China, we use comprehensive information from the CEPII BACI database (Gaulier & Zignago, 2010). It reports annual bilateral trade flows between more than 200 countries at the 6-digit Harmonized System level (HS6), which distinguishes about 5000 different product categories. Using the most recently released version, we observe trade for the period 1996–2018. By counting the number of HS6 products a country exports to China in a given year, we attempt to capture the extensive product margin. In doing so, we assume that unreported trade flows in the data reflect negligible amounts of trade or true export zeros.

For the main part of our analysis, we aggregate the data to the 2-digit HS level (HS2) and obtain two outcome variables.Footnote 10 First, the revenues (measured in thousands of current US dollars) earned by country i from exporting goods of HS2 chapter k to China in year t, \(X_{ikt}\). Second, the number of HS6 goods within HS2 chapter k, shipped by country i to China in year t, \(N_{ikt}\). According to our discussion above, both variables should reveal a positive relationship with BRI railway connections.

Our baseline estimation sample considers exports by 23 EU member states (i.e. the EU25, minus Cyprus and Malta) and 4 non-European high-income countries (i.e. Canada, Japan, South Korea, and the US). The latter are included as an additional control group, which we believe is economically comparable to EU25 exporters but not connected to China via the BRI. This enables us to investigate potential spillover effects of the BRI connections within Europe. To detect those, we will report our main results for alternative compositions of sub-samples of exporters.

3.2 Empirical model

3.2.1 Baseline estimation equation

Export revenue equation We adopt the following empirical model (expressed in logs) to estimate the effect of BRI connections on exports to China:

where the dependent variable measures the (log) dollar value of export revenues from shipments to China and \(train_{it}\) indicates whether exporter i was connected to China via the BRI at time t. We include two types of multi-dimensional fixed effects to establish consistency with the gravity equation: \(\mu _{kt}\) captures China’s demand shifter and varies across industries and over time, independently of which country is exporting.Footnote 11\(\mu _{ik}\) captures time-invariant bilateral and industry-specific trade barriers between exporter i and China. Since exporter-year fixed effects would be perfectly collinear with our main variable of interest, \(train_{it}\), we proxy the supply shifter with control variables \({\mathbf {Z}}_{ikt}\). In our revenue equation, we will use i’s global exports in HS2 sector k and year t, which is defined as \(X^{W}_{ikt}\equiv \sum _{n}X_{nikt}\).

Export diversification equation Whenever we estimate the number of goods exported to China, we include two additional control variables. First, we include the equivalent to global export revenues by counting how many different HS6 products exporter i ships to any destination at time t, within HS2 chapter k (\(N_{ikt}\)). Second, to account for the fact that our count variable has an upper bound, we interact our main variable of interest with i’s degree of diversification in k at the beginning of our sample period (\(train_{it}\times [N_{ik}^{96}/N_{k}^{\max }]\)). The ratio \([N_{ik}^{96}/N_{k}^{\max }]\) is bound between zero and one and denotes the fraction of HS6 products within an HS2 chapter, i exported to China at \(t_{0}=1996\). We expect that initially high levels of diversification result in systematically lower rates of diversification after getting connected via the BRI, simply because no further diversification can be observed with our count measure.

Estimation methods Even with fairly aggregated data and a sample of frequently trading countries, export zeros result in missing (or even omitted) information when estimating a log-linear model like Eq. (2). Santos-Silva and Tenreyro (2006) formulate a more general critique on the use of log-linear estimation and suggest a Poisson-Pseudo-Maximum-Likelihood (PPML) estimator, which has since become widely applied in the empirical trade literature. The corresponding model to estimate export revenues takes the following form:

and simply represents the multiplicative version of the log-linear specification above. By avoiding any variable transformation that complicates the presence of zeros, the PPML estimator is able to exploit the full information of the data, including absence of trade (i.e. zeros). For our baseline findings we will report results obtained from both log-linear least squares and PPML estimation.

3.2.2 Measurement

Our trade data and estimation methods are widely used in the empirical trade literature. However, our measurement and identification strategies are novel, given that we are the first to estimate the effect of BRI connections on exports in a non-structural way. Hence, we have to be aware of the caveats associated with measurement and with potentially confounding effects or endogeneity. This is important, because our data does not allow us to observe the true amount of trade that is realized via a BRI rail connection. What we do observe is (i) whether and since when a particular country is connected to China via the BRI, (ii) where the connection starts or ends in China and (iii) how much a country exported to China before and after it became connected.

With this information at hand, we construct three different measures for our main variable of interest, \(train_{it}\). First, we define it as a simple binary indicator variable, which takes a value equal to one as soon as a direct connection has been launched (see Table 10).Footnote 12 Although this measure is fairly crude, it allows us to infer whether the pure existence of a direct rail connection reveals differential export performance compared to non-connected countries. Our second measure takes into account the number of different connections to China. As outlined in Sect. 2, rail-freight routes differ by their final destinations in China and we argue that this might be relevant, given its geographic size and internal distances. By counting the number of railway connections between exporter i and China, we no longer estimate the overall effect of a BRI connection, but rather the marginal effect of adding one additional connection. In a similar fashion, our third measure, which takes into account the time that has elapsed since the first connection has been launched, will inform us about the effect of being connected via the BRI for one additional year.

3.2.3 Identification

Despite using alternative measures and substantial variation in our data (see Fig. 2), we cannot rule out that our results will be biased due to unobserved contemporaneous factors. We are aware that also indirect connections might play a role and promote exports for countries that are neighbors of or proximately located to a directly connected country. Such indirect connections could result in a downward bias in our estimates, even though having non-European exporters in our control group might address part of this issue. In our robustness checks, we experiment with alternative definitions of being connected. Such evidence would also help to alleviate reverse causality concerns.Footnote 13 Although we will carry out some direct falsification tests, based on placebo regressions, we note that the existence of indirect effects would work in favor of an appropriate causal interpretation of our results, as it is intuitively difficult to argue that A and C establish a connection in order to facilitate trade between B and C.

Another potential caveat of identification is that we cannot observe the mode of transport. As long as this is not the case, we are unable to verify whether any change in export performance actually takes place via the BRI railway connections. To address this concern, we will report results from an alternative data set of (only) European exporters, which features information on the transport mode. We will exploit this information also to determine sectors that increasingly rely on rail transport when exporting to China, after getting connected, and to revisit our baseline findings by adding this sectoral dimension to estimate the BRI effect on EU exports.

A final threat to identification is that we do not observe the frequency and capacity of shipments via a particular train connection. It is possible, for instance, that a country gets connected at some point (resulting in \(train_{it}=1\)), but operations are discontinued due to low profitability. In that case, we would have to set \(train_{it}\) back to zero. Unfortunately, such detailed information is not available to us and prevents distinguishing these and other qualitative dimensions across different train connections and over time. This might result in an attenuation bias and lack of precision of our coefficient estimates. While we have no possibility to address this issue of measurement error directly, we will keep in mind that our reported findings reflect average estimated effects and that responses in trade activity for specific individual connections might differ substantially.

4 Empirical findings

4.1 Baseline results for export revenues and diversification

Export revenues. Table 1 reports our baseline results for the value of exports to China, showing point estimates obtained from 24 different specifications. Specifications differ in terms of their estimation method (i.e. log-linear least squares versus PPML), country samples and subsamples, and in terms of the variable that measures BRI connections (see Panels A through C). In most of these specifications, we observe a positive and statistically significant relationship between countries’ exports and a railway connection to China via the Corridor.

Looking at the full sample in Panel A, columns (1) and (5) report between 9 and 15 percent higher export revenues in China upon the initiation of a direct railway connection (relative to the non-connected countries in Europe, North America and East Asia). Panel B suggests that each additional direct connection from country i to China is associated with a 1–3 percent relative increase in exports. In Panel C we find that, on average, each additional year of direct rail freight operations are associated with 1.5–5 percent higher export revenues relative to non-connected economies. Comparing our log-linear specifications to the PPML estimates, we notice that the latter produces more conservative estimates throughout.

In several specifications the estimated differences reveal most strongly in samples where the control group is composed of Japan and South Korea, as indicated in columns (4) and (8). In contrast to this, relative exports among the European countries indicate only a minor advantage of having a direct connection, as shown in columns (2) and (6). This might suggest that the EU as a whole benefits from the BRI through increased exports to China. Moreover, the fact that the revealed relative export performance appears to depend partly on the control group might suggest that improved market access for Europe either displaced some of the East Asian countries’ exports to China, or that certain underlying regional trends have not appropriately been controlled for. These factors make identification more difficult and we will attempt to address them in the following subsection.

We nevertheless carry out some immediate robustness checks, in which we consider alternative sample lengths by (i) excluding the year 2018 to prevent confounding effects arising from the escalating US–China trade war; and by (ii) excluding the first decade of our data set (i.e. the years 1996 through 2005) to trace potential contamination of our estimates by underlying country-specific trends. The findings are summarized in sub-panels I and II of Table B1 (see online Appendix). While, our baseline results reveal to be qualitatively robust to these modifications, we see the latter concern justified in the case of our log-linear model. It reveals a systematic downward correction of the point estimates once we exclude early years from our sample. Point estimates of our PPML specifications are quantitatively robust, which we also illustrate graphically in Figure B1(a).

Next to an alternating sample length, we also carry out a falsification exercise. It consists of artificially anticipating the launch of BRI connections by several years and by removing all observations after 2010 to exclude years in which BRI connections were actually operational. If our baseline results truly reflect the effects of newly established BRI connectivity the estimates from this falsification test should be different (and possibly statistically insignificant) from our baseline. As can be seen in Table B1 and Figure B1(b), this test performs poorly in our log-linear model. However, the PPML estimator produces very different results and cannot reproduce the baseline findings in our placebo regression. Based on this evidence, we consider the PPML estimator as more reliable for estimating the causal impact of BRI railways on EU exports.

Market access and diversification Table 2 reports our findings for extensive margin effects, which we measure by counting the number of distinct HS6 products each country exports to China within their HS2-sector level exports. Moreover, as explained in the previous section, we account for the fact that our diversification variable has an upper bound, \(N_{k}^{\max }\), by construction. Hence, we include an interaction of our main variable of interest with exporter i’s initial stage of diversification in sector k. As expected, the interaction term produces a negative and statistically significant coefficient.Footnote 14

Regarding the estimated relationship between the BRI connections and export diversification, we find a positive and highly significant relationship. Overall, connected countries experienced a relative increase in their product range by almost 30 percent. Each additional connection and the longer these connections are operating, the larger is this advantage. As in our previous results for export revenues, we observe that most of this increase appears to materialize vis-à-vis the two East Asian exporters in our sample. However (and partly in contrast to the previous results), they do not fully drive the overall findings reported in columns (1) and (5). Improved market access opportunities appear to result also relative to the US and (to a smaller extent) also relative to not directly connected European countries.

4.2 Indirect connections and robustness

4.2.1 Regional trends and spillovers

Since our baseline specifications considered only the relationship between exports and direct BRI railway connections to China, we did not allow neighbors or very nearby countries to benefit. Such an approach might be too restrictive, given that the majority of BRI connections via the Corridor concentrates in two countries. This could explain the relatively smaller coefficient estimates obtained for the purely European samples. However, we also noticed that there are potentially unobserved regional effects that drive our results (and inflate coefficient estimates for the non-European control groups). Although we control for countries’ general export performance, there might be region-specific shocks that are correlated with exports to China and the gradual increase in the number of railway connections with Europe. To address the latter point we include a full set of region-year fixed effects into our model, where regions are the EU (i.e. the 23 European countries), East Asia (i.e. Japan and South Korea), and North America (i.e. Canada and the US).

In order to take into consideration also indirect access to the railway network we consider two modifications of our treatment group. First, we count countries as being connected to the BRI if they are either directly connected themselves or if a direct neighboring country gets connected. In our alternative modification, we use a wider criterion and include also countries that are less than 500 km away from a country that is directly connected. These modifications have a major impact on our treatment variable. For example, after the extension to direct neighbors, we count 11 instead of 2 countries (out of 23) with a connection since 2011.Footnote 15 While the maximum number of connections a country obtained was 10 with our standard measure, taking into account indirect connections via neighbors or proximate countries enables some countries to access all 15 connections we consider in this paper.

Results for export revenues In Table 3, we report our PPML results for export revenues (in Panel A) and for export diversification (in Panel B). Looking first at Panel A, we make two observations. First, whenever we keep our original specification without region-year fixed effects, increasing the scope of our treatment group also increases the magnitude of the estimated coefficient for our BRI connections. This can be seen by comparing columns (1), (3), and (5) of Panel A and suggests that countries might export more to China, even if they are only indirectly connected to the Corridor. Second, we observe in columns (2), (4) and (6) that including region-year fixed effects results in substantial downward corrections of the coefficients. This implies that the observed increases of exports to China by newly connected countries are highly correlated with EU-wide changes in exports. While the first observation suggests that our baseline model suffers from measurement error which induces an attenuation bias on our coefficient of interest, the second observation indicates an omitted variable bias in our baseline that operates into the opposite direction. Altogether, column (6) indicates that relative exports increased by about 11–12 percent following the connection to the BRI railway corridor.

Another observation can be made by comparing the coefficient estimates reported in the first row of columns (2), (4) and (6). They suggest that directly connected countries may have benefited less than indirectly connected countries from the new export opportunities via the Corridor—at least in relative terms. In fact, upon closer inspection, we note that directly connected countries exported larger values of goods to China than those with an indirect connection to begin with. In fact, comparing the pre-BRI period 2008–2010 with the end of our sample period (2016–2018), we observe a doubling of shipping volumes to China in both groups. Since absolute trade volumes between the two groups differed by a factor of five during the earlier years, the implied absolute increase in trade volumes actually reveals to be larger for the directly connected countries.Footnote 16

Results for export diversification Turning to Panel B of Table 3, we find a robust significantly positive relationship between railway connections and the range of products exported. Although region-year fixed effect induce downward corrections also here, we still find a relative increase in the number of products shipped by 20 percent on average. Every additional connection increases this range by about 3 percent and each additional year of operation corresponds to an about 5 percent increase in the product range.

Altogether, the results from this subsection support our hypothesis that the BRI has provided improved market access and new export opportunities for European countries. Countries with direct or indirect BRI connections appear to have about 10 percent higher export revenues from selling their goods to China. The fact that we cannot detect a robust relationship between export revenues and additional connections (or the time elapsed since their first setup) might be due to different factors we cannot observe in our data, such as differential frequency and capacity of utilization, potential time-lags, or network effects that prevent a clearer separation of connected and non-connected countries (or regions). We therefore attempt to augment our identification in the following subsection.

4.2.2 Network effects and other BRI related policies

The previous subsection has shown that a direct railway connection to China might not be a necessary condition to improve export volumes. The existence of an intra-European transport network could explain this observation. To follow up on this, we attempt to separate these effects empirically. Moreover, to acknowledge our initial discussion on the different identification criteria of countries’ BRI participation (Sect. 2) we include additional control variables to further mitigate concerns of omitted variable bias.

To test the European transport network hypothesis, we begin with a modification of our previous specification (Table 3, column(6)) and include both our baseline binary measure for a direct connection as well as the binary measure of BRI connectivity for proximately located EU countries into our model. The result is shown in column (1) of Table 4 and suggests a positive effect of both types of connectivity, although the direct link is statistically insignificant. This indicates that being part of the (narrower) network could be a sufficient condition for improved market access and exports to China. In the following columns, we include additional measures of countries’ BRI involvement. Columns (2)–(4) suggest that countries’ exports to China increased faster in countries that have signed a BRI-related bilateral MoU. FDI inflows from China, in turn, are not statistically related to EU countries’ exports to China. The reason could be that trade-effects of FDI depend on their sectoral focus and that they also take time to materialize. Contrarily, an MoU could have a positive signalling effect and encourage firms to invest into accessing the Chinese market based on the prospect of intensifying economic collaboration. Altogether, including further BRI-related control variables do not appear to invalidate or challenge the conclusions from our baseline specifications.

In the remaining columns (5)–(8), we further augment our model to explore alternative ways of capturing the European transport network. While we keep our baseline definition, which is based purely on countries’ geographic proximity to a directly connected location, the included alternative measures should divert explanatory power from this variable, if they better describe the network structure and, hence, suffer less from measurement error.

We experiment with four variants of a connectivity effect that could operate via the European rail network (RNE).Footnote 17 Based on the country coverage of nine European rail-freight corridors (RFCs) and their immediate or indirect connection with an individual stop of a China-European rail-freight connection (see Table 10), we test whether third countries benefit from a rail network effect. That is, we consider, for example, the location of Malaszewice/Terespol and Duisburg (i.e. the two early destinations of the YuXinOu connection launched in 2011) and treat third countries as “indirectly connected” to China, if they are connected to either Duisburg or Malaszewice/Terespol via a common or intersecting RFC.Footnote 18 The result is displayed in column (5) of Table 4. It shows the familiar result from the previous columns, with two differences. First, being directly connected now results in a marginally significant positive coefficient. Second, the peripheral countries becoming connected via European RFCs (but not based on their geographic proximity) appear to export relatively less than the otherwise connected European economies.

Assuming narrower definitions of connectivity via the European RFCs, we see the differential effect becoming quantitatively smaller and statistically less significant. Column (6) requires countries to be covered by the same RFC as a newly connected BRI stop. Columns (7) and (8) further impose that countries must also be geographically proximate.Footnote 19 Altogether, our alternative measures of connectivity do not add explanatory power to our model. In fact, focusing purely on a single transport mode seems to result in a too narrow conceptualization of the network, so that our ad-hoc geographic measure outperforms the seemingly more sophisticated approach based on RFCs.Footnote 20 We nevertheless conclude that BRI the seems to have facilitated an expansion of European exports to China via regular commercial railway connections. In the following we explore further related patterns to support this conclusion by considering the modal choice of trade and sectoral heterogeneity in these effects.

4.3 Transport mode and differential responses across sectors

Our main data set does not provide any information about the mode of transport chosen by exporters. This prevents us from verifying that the estimated changes in exports can actually be attributed to rail freight. Data from Eurostat, however, does provide such information for the years 2000–2019 for our set of European exporters. In this subsection, we leverage this information in order to further evaluate the contribution of the BRI to Europe’s export performance.

4.3.1 Rising importance of rail-freight?

Data and measurement. Before presenting results, we have to discuss some features of the data. We work with a balanced panel of reported exports to China by each of our 23 European countries. The data is disaggregated at the HS2 sector level and distinguishes 9 modes of transport. Table 5 depicts these modes along with their number of non-zero observations, the number of HS2 sectors where they are used, and the percentage of the total shipping value they account for.

Not surprisingly, sea transport accounts for the largest portion of shipments. It amounts to more than 60 percent of the total exported value and is used in all 97 HS2 sectors.Footnote 21 Air transport accounts for 30 percent of the value of shipments, while only 1.5 percent of exports used rail freight. This minor number could be explained by the recency of the BRI connections, as the data already starts in 2000. However, another transport mode is surprisingly prominent. According to our calculations, about three percent of exports to China use road transport in a wide range of observations and sectors.Footnote 22 Given this fairly unrealistic statistic, we consider the possibility that transport modes are not always accurately reported. The high number of observations with road transport might result from indirect shipments via export hubs in another country. Likewise, rail shipments might signify both, direct shipments to China or shipments to a seaport or other logistics hub.

Following this reasoning we consider changes in the transport mode structure for countries with a direct rail connection to China via the Corridor. To assess this, we use the varying indicators for a direct connection, namely: (i) a simple dummy for a connection; (ii) the number of different connections; and (iii) the years since the first direct connection was set up. As dependent variables, we use different measures for the prominence of rail transport. First, similar to Hummels and Schaur (2013) we use the log-ratios of exports via rail to non-rail transport modes. Since such a specification has the advantage that values have no upper or lower bound, a drawback in the context of our data is a relatively small number of observations, due to frequent zeros. Hence, we also estimate the fraction of rail exports in total shipments using PPML.

Results We show our results in Table 6, where all specifications include HS2 sector-year and HS2 sector-exporter fixed effects (as in previous specifications), as well as exporter-specific linear trends. Using the simple binary indicator for a direct connection does not produce any clear results (Panel A). The log-linear specifications report positive, yet statistically insignificant coefficients, regardless of how railway prominence is measured. Our PPML specification in column (6) even reports a negative and significant coefficient, which suggests that rail exports became less prominent. This is an implausible result and suggests that simply observing the pure existence of a rail connection is not sufficient to determine the use of rail transportation to China.

We obtain more consistent findings as we use finer measures for direct connections. In Panel B, we observe that each additional direct rail connection to China increases rail-freight relative to sea or air freight by about thirty percent. Similar magnitudes are reported for rail-freight relative to other non-rail (or overall) exports. The PPML estimator makes a downward correction of these coefficients to about 18 percent. Similarly, in Panel C, we observe that each additional year since the first launch of a direct rail connection to China is associated with higher utilization of this transport mode.

Overall, we find that direct BRI connections appear to be associated with the mode of transport European exporters choose. Not surprisingly, the age and number of these train connections matter for this decision, as we do not distinguish their quality, capacity and frequency of operations.

4.3.2 Heterogeneous responses across industries

Besides the general relationship assessed in the previous subsection, it is also of interest to understand which industries are more likely to switch to increased rail-freight. Given that products can be expected to differ in their propensity to use a particular transport mode, we can use such variation also to revisit our general results on the value and diversification of exports to China.

We therefore estimate once again our specifications from above, but this time individually for each HS2 sector. For example, the log-linear model from Table 6 column (5) now takes the following form:

where \(train^{\text {yrs}}_{it}\) measures the number of years elapsed since setup of the first direct connection and \(\sum _{i}\delta ^{k}_{i}({\mathbf {D}}_{i}\times year_{t})\) denotes exporter-specific linear trends to proxy general gradual preference shifts over time. Our interest focuses on the estimated \({\hat{\beta }}^{k}\), which indicates the relative probability of HS2 sector-k to shift towards rail freight, as direct connections to China via the Corridor are being launched.Footnote 23

To analyze our estimation results, we note that our specification is very similar to the one used by Hummels and Schaur (2013), who estimate sector-specific time-sensitivity parameters in a transport-mode choice model for air-freight versus container shipments. We can compare our results to see how the differential response across sectors in switching to increased rail-freight relates to their estimates of products’ time-sensitivity.Footnote 24 We expect that rail-transport is most likely to be adopted at intermediate levels of time-sensitivity, as it is faster than sea transport but still considerably slower than air-freight.

Our results are shown in Fig. 4, where we plot our HS2-specific estimates of \(\hat{\beta }^{k}\) (vertical axis) against the time-sensitivity measure of Hummels and Schaur (2013, horizontal axis).Footnote 25 Each panel corresponds to a different specification of Eq. (4) where we consider dependent variables as indicated in the corresponding subtitles. We removed extreme values of time-sensitivity and \(\hat{\beta }^{k}\).Footnote 26 Despite large confidence intervals, we find patterns that resemble a non-linear inversely u-shaped relationship with time sensitivity in most of our specifications. Only our PPML model seems to reject a clear non-monotonic relationship, and instead suggests that time sensitivity is orthogonal to the relative sectoral propensity of shifting towards rail-transport. Such lack of a clear relationship could point at additional factors being at play for the transport-mode choice of exporters. However, given the limited number of observations in this figure (as well as the underlying data samples), the presented patterns can be seen to be only of indicative nature.

Estimated increase in rail-transport due to BRI versus time-sensitivity, by HS2 sector. Note Figures depict estimated responses of exports from Europe to China via rail-freight (using different measures, see subtitles) and their relationship with a sectoral measure of time-sensitivity according to Hummels and Schaur (2013). All estimates, except the one displayed in panel (f), are based on a log-linear specification displayed in Eq. (4)

4.3.3 Revisiting the BRI effect on European exports

In this final subsection, we exploit the revealed industry heterogeneity to revisit our original evidence on the relationship between the BRI railways and European exports to China. We do so by estimating augmented panel data models to see whether railway-adopting or time-sensitive industries drive the documented expansion of exports to China.

Railway-adopting industries With six different sets of \(\beta ^{k}\) estimates (each based on a different specification, as presented above), we expect that exports increase more in rail-way adopting sectors, i.e. where \(\beta ^{k}>0\) and significant. Hence, using a significance threshold of 10 percent, we create an HS2-specific and time-invariant variable, which is equal to the estimated \(\hat{\beta }^{k}\), if the above requirement holds, while it takes a value of 0 in all other cases. When carrying out our estimation, we benefit from an additional sectoral dimension in our BRI measure, which allows us to control for exporter-specific aggregate supply shocks using a full set of exporter-year fixed effects. This is an improvement compared to our previous approach, where the lack of cross-sectoral variation allowed identification exclusively across countries and over time. Hence, Table 7 reports results only for the differential correlation between BRI connections and exports that is conditional on the responsiveness of HS2 sectors in their transport mode.

Panel A of Table 7 shows that we continue to obtain a positive and statistically significant relationship between export revenues and the existence of railway connections to China. As before, log-linear specifications seem to produce somewhat larger coefficients.Footnote 27 Nevertheless, we find that the implied percentage change in export revenues is fairly similar, ranging from 4.2 to 6.0 percent, depending on the specification.Footnote 28 While this is less than the estimated 11 percent increase in revenues we obtained earlier in Table 3 column (6), we conclude that BRI railway connections are likely to have increased EU export revenues in a range of different sectors.

In Panel B, we report our corresponding results for export diversification and find again that the number of goods exported to China increased in particular sectors and relative to non-connected countries by about 4 percent on average. Our PPML estimate in columns (6) reports a quantitatively small negative coefficient, which is marginally significant. While this may cast some doubts about the robustness of our results, we note that this sample also encompasses the largest number of sectors that are considered to shift towards rail transport. Over-estimating the number of responsive sectors here might explain weaker estimated responses in diversification, due to measurement error.

Time-sensitive industries We also investigate the existence of significantly differential effects of BRI connectivity on exports in time-sensitive industries. We do so by interacting the measure of Hummels and Schaur (2013) with our main variable of interest: countries’ direct and indirect BRI connectivity according to the proximity based measure. Acknowledging a potential non-linear relationship with time-sensitivity, we incorporate a second interaction of BRI connectivity with the squared time-sensitivity measure. Furthermore, we estimate alternative specifications that differ in terms of omitting and including exporter-year fixed effects.

The results are shown in Table 8. Panel A suggests that the estimated increase in export revenues following the launch of a BRI railway connection is indeed mainly driven by relatively time-sensitive industries and sectors. This finding is robust across all four specifications. Once we allow for a non-linear differential relationship with time-sensitivity, we further obtain suggestive evidence of a decreasing responsiveness after a certain threshold. This supports the notion that trade with China via rail-freight might offer a competitive alternative for goods with intermediate levels of time-sensitivity. Panel B leads to similar conclusions. However, the expansion of trade at the extensive product margin is not entirely driven by time sensitive industries and evidence for a non-linear relationship is less robust. Altogether, we find our previous results confirmed and can highlight that the trade-facilitating effects of commercial BRI railway connections between Europe and China appear differ across industries.

Implications of heterogeneous effects and regional industry specialization The findings from above have also implications for the regional distribution of first-order benefits that can be expected from improved market access through BRI railway connectivity.Footnote 29 Assuming that the European transport network is sufficiently efficient to facilitate equal access to a BRI rail hub from any European location, we can use our industry-specific estimates to infer which regions are likely to benefit, based on their observable industry structure.

To address this question, we turn again to our estimates of railway-adopting HS2-level industries (obtained from Eq. (4); i.e. \(\hat{\beta }^{k}\)) and count how many times we found each HS2 industry to increase the share of railway transport in our six different specifications. We map these frequencies to the NACE Rev.2 industry classification to relate them to industry-level statistics on economic activity provided by Eurostat at the NUTS2 regional level. We express the incidence of railway adoption at the NACE Rev.2 level as a fraction. A value of 1 denotes that all HS2 industries comprised in a NACE Rev.2 category have revealed a statistically significant increase in rail transport in all six specifications. A incidence rate of 0 implies that no HS2 industry comprised in a NACE Rev.2 activity has shown signs of increased railway use in any of the six specifications we estimated in Sect. 4.3.2. We report these numbers along with a description of the respective NACE Rev.2 codes in Appendix Table 11. Activities related to the manufacturing of electrical equipment, motor vehicles and other machinery and equipment appear to be the most responsive sectors. More fragile goods like food and beverages, or chemicals, indicate a relatively lower responsiveness. The same holds for heavy industry outputs, which are goods that are typically traded in large volumes and therefore less susceptible rail transport.

To evaluate which regions are most likely to benefit, we consider employment and firm population statistics from Eurostat and calculate the “exposure” of a NUTS2 region to new BRI export opportunities based on their relative specialization in railway-adopting industry activities. That is, we calculate the share of NACE Rev.2 industry K in region r’s total employment L (or firm population F) and divide this by the corresponding industry share for the entire sample. We obtain a measure that is conceptually similar to expressing a regions’ revealed comparative advantage (RCA) and label this measure accordingly:

We then multiply these RCA’s with K’s estimated prevalence of railway adoption (\(\text {RWA}_{K}\)) reported in Table 11 and aggregate over NACE Rev.2 industry activities:Footnote 30

BRI railway connections and regional specialization in railway-adopting industries. Note Authors’ calculations based on average industry-specific railway adoption estimates \(\hat{\beta }^{k}\) and NUTS2-level sectoral employment and firm population statistics from Eurostat. Colors distinguish regions’ locations in respective quartiles of the exposure distribution. Yellow indicates low specialization of RWA industries (i.e. low exposure to estimated BRI export opportunities). orange, light and dark red indicate correspondingly higher levels of specialization on RWA industries. Red dots indicate the location of a start or end point of observed BRI connections. Their relative size indicates difference in the number of commercial railway connections

The results are displayed in Fig. 5. Both panels indicate a relatively higher degree of specialization in RWA industries in Central and Eastern European regions, including Southeast Europe. Relatively brighter colors in Western Europe indicate that larger fractions of their working and firm populations are active in sectors where no statistically significant increase in railway use could be observed. The distribution of red dots, which indicate the location of a start or end point of our observed BRI connections, is concentrated in the center of the European map and suggests similar levels of connectivity for the respective peripheral regions.

The overall pattern that emerges from this simple representation of beneficial BRI exposure suggests that first-order benefits are not equally distributed across Europe. While this might be explained by the relative concentration manufacturing sector activity in many Central and Eastern European member states of the EU (Hanson & Robertson, 2010)—Western European economies are relatively more specialized in services industries—they might also indicate why countries have taken different standpoints and actions towards an active involvement in the BRI. However, second-order effects could shift the suggested regional distribution to some extent so that further and more dedicated analyses of these effects would be worthwhile.

5 Conclusion

Our paper studies patterns in merchandise trade data of European countries exporting to China, conditional on the existence of new transport routes via the BRI railway Corridor. We exploit detailed information on the starting date and number of such connections and leverage their variation across countries and over time to analyze changes in the value of shipments and the range of different products exported. Using alternative measures, estimation methods and model specifications, we find strong support for a positive relationship between BRI connections and export performance, which suggest that the new railway connections have contributed to lower trade barriers and improved market access opportunities.

Our baseline results suggest an about 10 percent increase in export revenues, which are realized not only by directly connected countries, but also by other proximately-located European exporters, while being distinct from Europe-wide changes in export activity with China. Using additional information on transport-mode choices, we further find that direct BRI connections are positively correlated with increased utilization of rail-freight for exports to China. Sectors (defined at the HS2 Chapter level) where rail-transport is estimated to increase the most appear to (i) be of intermediate time-sensitivity and (ii) drive at least half of the estimated increase in overall exports to China. While the former finding is in line with theoretical considerations that rail-freight has intermediate time-saving potential when compared to slow ocean cargo and very fast air-freight, the latter findings lend support to our measurement and identification strategy which faces the limitation of not directly observing a number of potential qualitative features of the individual BRI railway connections.

To this end, our study is the first to present empirical evidence on the efficiency of the BRI and its potential benefits for European exporters. These benefits appear to materialize in different dimensions, but are quantitatively still limited due to their only recent activation in many cases. Nevertheless, we cannot reject trade-creation effects through easier market access and find that our estimates are very similar to findings obtained by Baniya et al. (2019) from structural estimates. While their results are not directly comparable to ours (they focus on trade among all countries connected via the BRI, except Europe), their preferred estimate of a 4.2 percent increase corresponds to the lower bound reported in our findings. This might be plausible, given that trade effects of the BRI are determined also by other factors, such as the type of goods traded or complementary trade agreements.

To conclude, more detailed information about the differential characteristics of the railway connections (e.g. frequency, capacity utilization, etc.) will be useful for future analyses which will be able to exploit also additional years of data. With additional information at hand, it might also be possible to test through which of the different theoretical channels the BRI connections affect trade activity, as they may operate through changes in travelled distances, transit times, and transportation cost. A detailed characterization of the state and evolution of the European transport network would further be helpful in this context and enable a more accurate evaluation of the BRI’s impact on local economic growth and industry performance.

Notes

Besides trade, prominent questions relate to implications for maritime transport (e.g. Lee et al., 2018; Lau et al., 2018; Zhang et al., 2018; Chhetri et al., 2018), general logisitics and supply chains (Liu et al., 2018; Yang et al., 2018; Shao et al., 2018), or economic growth and development implications of the BRI (e.g. Enderwick, 2018; Cai, 2017). Questions naturally also go beyond economics and discuss also the important geopolitical role of the BRI, as The Economist highlights in a recent Special Report from February 2020: https://www.economist.com/special-report/2020/02/06/china-wants-to-put-itself-back-at-the-centre-of-the-world.

The CGIT is published and maintained by the American Enterprise Institute and the Heritage Foundation. The data can be accessed here: https://www.aei.org/china-global-investment-tracker/.

An overview of the date and content of these MoUs is available on the website www.beltroad-initiative.com. The following European countries have signed a BRI-related MoU with China: Bulgaria, Hungary, Poland, Romania, Slovakia, Serbia (all 2015); Latvia (2016); Albania, Bosnia and Herzegovina, Montenegro, Croatia (all 2017); Greece, Malta, Portugal (all 2018); Luxembourg (2019).

Such an approach is appropriate for their type of analysis, which is based on a structural model to evaluate potential future scenarios under alternative assumptions. Their main working assumption is that BRI railways enhance the travel speed of rail-freight from 50 to 75 kilometers per hour (km/h), while maritime transport travels at 25 km/h, so that optimal transport routes and travel times change.

Like YuXinOu, most connections can be identified by their name. While we can observe their stops for loading and unloading inside the European Union, we are unable to identify and account for them outside the EU. This means that trains running to Chongqing might stop in and establish direct connections to more Chinese cities (or other countries on the way) than we are able to observe.

Note that comparison of these numbers is complicated by that fact that shipping times within China (e.g. from the factory to the port and from port to final destination) are typically not quoted. Using data on bilateral sea distances from CERDI (Bertoli et al., 2016), maritime shipping between China and Europe bridges 14,200 to 22,400 km, with an average of 18,800 km.

Considering the EU-25, non-connected countries are: Cyprus, Denmark, Estonia, Greece, Ireland, Malta, Portugal, Slovenia, Sweden.

Anecdotal evidence from Li et al. (2018) suggests 80 percent lower shipping charges for rail transport compared to air-freight.

HS2 chapters range from 1 to 97 in our data. Chapter 77 is currently not used by the World Customs Organization (WCO), so that there are 96 sectors overall.

Since China is the only destination we observe, importer subscripts n are omitted here.

A value in between 0 and 1 is assigned in the year when the connection started to operate, whenever it started later than January. In that case, \(train_{it}=(13-month)/12\).

Reverse causality would imply that a train connection is established due to increasing exports to China. While this might be true for the decision to build any connection between China and Europe, the exact location within Europe (and the timing of launching their operations) is likely to be determined by logistical factors in a fashion that major transport hubs and geography are preferred over more remote locations. Along these lines, the way a handful of European sea ports dominate the EU’s maritime trade with the rest of the world, a few logistic hubs appear to dominate EU’s railway connections to and from China.

The ratio displayed in the table is equal to 1, whenever exporter i already exported all the HS6 products that fall into a respective HS2 sector at the beginning of our sample period (in 1996). It is zero if it did not export any HS6 product from that sector initially. The former case rules out any further diversification whereas the latter case makes it very likely to occur.

The extension to proximate countries adds one additional country to early treatment (i.e. the United Kingdom, which is 495 km away from Germany, according to the CEPII bilateral distances data set we used to construct our measure).

To come to this conclusion, we re-estimate the model from column (6), but control separately for the direct effect of the BRI connection. The results suggest that directly connected exporters experience a 4.42 percent increase, whereas indirectly connected economies obtain an estimate of 15.02 percent higher exports. Converted into absolute numbers (using average volumes from the pre-BRI years 2008–2010) this implies an average increase by about 2300 euros per HS2 chapter for indirectly connected exporters and a corresponding expansion by 3400 euros for directly connected countries. See Appendix Table B2 for details.

The RNE was formally established in 2004 and promoted the setup of initially 9 rail-freight corridors, which were subsequently described in the Regulation (EU) No 913/2010 of the European Parliament and of the Council of 22 September 2010 concerning a European rail network for competitive freight. Since then the network evolved continuously and Fig. 7 depicts structure of the network as of 2021. It currently comprises 11 RFCs, which establish timely and coordinated connectivity between a wide range of locations across Europe.

We follow this procedure for each stop that is listed in Table 10 and based on the RFC structure outlined in the original EU Regulation No 913/2010 and the most vintage version of the more detailed NRE map we could find (dating back to 2014).

Referring back to our previous example, the early YuXinOu connection from 2011 established an indirect connection for Italy, France, Spain, Lithuania, Czech Republic, Slovakia, Hungary and Slovenia, based on the broad measure considered in column (5). The narrow measure used in column (6) requires countries to share the same corridor, so that only Italy and Lithuania remain connected. Column (7) returns to the broad definition, but distant countries like Spain, Hungary or Slovenia are excluded. Column (8) removes the indirect connection to Italy, while the link to Lithuania remains.

Future research could provide a more detailed mapping and evaluation of the European transport network in the context of BRI connecivity. This would result in an approach that is more closely related to de Soyres et al. (2019).

While HS chapter number 77 is not currently defined by the World Customs Organization (WCO), which administers the HS nomenclature, Eurostat reports trade in a residual chapter 99 for goods not else where classified.

Another mode of transport worth explaining is “Self Propulsion”, shown in column (7). Such trade takes place essentially only in two sectors, which are “air planes” (HS chapter 88) and “ships” (HS chapter 89).

That is we estimate the below equation repeated times for each HS2 Chapter k and also for each of the six alternative measures of rail-way adoption as the dependent variable.

Time-sensitivity in their paper is defined as the ad-valorem tariff equivalent of importers’ willingness to pay for a one day earlier delivery of a product. Hence, a higher willingness to pay indicates higher time-sensitivity.

We obtain estimates of time-sensitivity from the replication files published by Hummels and Schaur (2013), which we adjusted to obtain HS2-specific (instead of their original NAICS-specific) estimates.

We define outliers as observations with a value residing outside the upper and lower quartile of the distribution by more than twice the inter-quartile range. While the number of outliers is small they are typically extreme and often resulted from a small number of observations in the original estimation sample. We removed them here mainly for the purposes of illustration, while they do not significantly affect our conclusions.

We use log-linear specifications here to remain consistent with the method from which we obtained our estimates of \(\hat{\beta }^{k,s}\)

We obtain implied changes by multiplying the estimated coefficient with the average value of \({\tilde{\beta }}^{k,s}\) in our sample, and multiplying with 100 to obtain percentage units.

We disregard potential second-order effects arising from supply chain transmission or spillovers, for example.

Note that the NACE Rev.2 classification distinguishes a total of 69 activities at the 2-digit level. Our 96 HS2 codes could be matched to only 26 NACE Rev.2 activities, implying that 43 NACE Rev.2 categories correspond to activities that do not predominantly produce tradeable physical goods. Such activities include mainly public and private services and we consider them as being non-responsive to the BRI in terms of their railway adoption probability. Accordingly, we assign them a value of \(\text {RWA}_{K}=0\).

References

Baniya, S., Rocha Gaffurri, N. P., & Ruta, M. (2019). Trade effects of the new silk road: A gravity analysis. Policy Research working paper 8694, World Bank Group.

Bertoli, S., Goujon, M., & Santoni, O. (2016). The CERDI-seadistance database. Working papers 201607, CERDI.

Bougheas, S., Demetriades, P. O., & Morgenroth, E. L. W. (1999). Infrastructure, transport costs and trade. Journal of International Economics, 47(1), 169–189.

Cai, P. (2017). Understanding China’s belt and road initiative. Lowy Institute for International Policy.

Chaney, T. (2018). The gravity equation in international trade: An explanation. Journal of Political Economy, 126(1), 150–177.