Abstract

This paper studies the role of income inequality in the importing country as a determinant of export unit value and product quality estimated employing information on market shares and prices. Using detailed firm-level data, we find that higher inequality in the destination market is associated with lower unit value and product quality. Noticeably, the negative effect of inequality is stronger in richer destinations. Firm-level heterogeneous responses to market conditions explain changes in unit value and quality. Incumbent exporting firms report lower unit value when income inequality increases, while entrants supply products of lower quality. All in all, our findings show that income inequality is a determinant of import demand which ultimately induces quality and unit value differentials across markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In a world of rising earning disparities within and across countries, income inequality can be an important determinant of trade patterns.Footnote 1 So far, the literature has mainly focused on the effect of international trade on inequality.Footnote 2 Nonetheless, Mitra and Trindade (2005), and Fajgelbaum et al. (2011) assess the relevance of the effect working in the opposite direction: income disparities within countries influence trade flows.Footnote 3 Evidence shows that rich countries import more high-quality goods (Hallak 2006; Hummels and Lugovskyy 2009). Indeed, since quality demand increases with household income (Bils and Klenow 2001), firms export their most expensive products to destinations with high income per capita.Footnote 4 Although several studies investigated how income per capita affects trade flows, the role of the income distribution remained overlooked. Within this context, assessing how income inequality affects import demand is crucial for the optimal pricing strategy of the firm and for policy makers, whose actions affecting inequality might influence international trade patterns.

This study employs detailed firm-level data to determine if income inequality in the destination country influences the quality and the unit value of imported products.Footnote 5 The unit value is widely considered a reliable proxy for quality (Schott 2004; Feenstra and Romalis 2014), although it might be affected by variations in manufacturing costs or markups. Khandelwal (2010) relaxes the quality equals unit value assumption assigning higher quality to products with higher market shares, conditional on price.Footnote 6

This paper contributes to the literature investigating whether unit value and product quality are similarly affected by variations in income inequality, once accounting for other country-level determinants of import demand. Among these, we focus on the role of income per capita and on its interaction with inequality. Detailed data enables us to consider factors affecting the pricing strategy of the firm, such as market power and different product characteristics. In order to shed light on firm-level heterogeneous responses to market conditions, we assess whether incumbent exporters in the destination market respond differently to income inequality with respect to entrant firms.Footnote 7

This empirical analysis relies on data from Bulgarian firms exporting manufactured products in the period 2001–2006. Bulgaria in the years under observation was further liberalizing its trade regime in view of becoming a member of the European Union in January 2007. During this period, the transition economy experienced fast economic growth accompanied by a relevant increase in the exports of manufactured products (Gorodnichenko et al. 2014).Footnote 8 Evidence shows that both the extensive and the intensive margin of trade for firms in transition economies were affected by the EU accession process (Benkovskis and Rimgailaite 2011). This gives us the possibility to observe the trade performance of new and incumbent exporters from a European transition economy undergoing economic liberalization.

Empirical results, accounting for firm and product level determinants varying over time, show that income inequality in the importing country is negatively associated with the unit value and the quality of products exported by Bulgarian firms. A standard deviation increase in our proxy for income inequality, the interdecile ratio, is associated with 0.85% lower unit value and 0.97% lower product quality. These effects are economically relevant and comparable in magnitude to variations in unit value and quality due to other, previously considered, determinants of import demand.

Moreover, we find that exporting firms ship high-quality products to richer destinations: income per capita in the importing country is positively correlated with the two dependent variables.Footnote 9 Interestingly, we observe that the correlation between inequality and unit value is negative, significant, and larger in magnitude for richer importing countries.

Empirical results discussed in the present study are largely consistent with theoretical predictions obtained from frameworks based on hierarchical preferences (Bekkers et al. 2012) and demand systems allowing consumers in all parts of the income distribution to consume differentiated products (Simonovska 2015).Footnote 10 According to these frameworks, when exporting firms maximize profits not only serving high-income consumers but selling positive amounts to both rich and poor consumers, a higher income inequality in the importing country can be associated with lower prices and quality.

The importance to distinguish between unit value and product quality becomes apparent when considering firm-level heterogeneity in market presence (Rodrigue and Tan 2019). We find that incumbent firms react to higher inequality lowering unit values without changing the quality of exported products, while firms entering the same market for the first-time supply goods of lower quality, independently of income inequality.

Our main finding is robust to alternative specifications. First, we attempt to address the possible endogeneity of our explanatory variable employing two novel instruments measuring the availability of foreign and domestic newspapers in the importing country 10 years before each trade flow occurs (Buehlmann et al. 2011). Both instruments are strongly and negatively associated with our proxy for income inequality while not being affected by the quality and the price of products imported 10 years after. Estimates confirm that inequality impacts negatively both dependent variables. Second, we observe that income inequality is negatively correlated with unit value and quality when considering exports of consumer goods, while unit values of intermediate products are not significantly correlated with inequality. This result confirms that demand factors rather than supply-side determinants (e.g. FDI) mainly explain our findings. Third, the main result is confirmed using a different measure of income inequality, the Gini index. We then introduce several proxies for firm market power in a product-destination pair to consider within-firm adjustments in markups. Our finding holds when controlling for market shares (Amiti et al. 2014) and for product-level demand elasticities in the importing country (Broda et al. 2006). Finally, the alternative proxy for product quality proposed in Khandelwal et al. (2013) reports, as well, a negative correlation with income inequality.

Theoretical channels. The role of income inequality as a determinant of demand can be investigated relying on different theoretical frameworks. Fajgelbaum et al. (2011) suggest that the fraction of domestic consumers buying products of higher quality increases with income, thus raising the average willingness to pay for high-quality products.Footnote 11 According to their framework, inequality within a country determines trade patterns and the pricing of traded goods. Variations in income inequality might decrease or increase prices and quality, depending on how demand changes in the different income groups. Discrete-choice models, starting from Flam and Helpman (1987), assume that individuals consume a homogeneous good in every desirable quantity and a vertically differentiated good whose consumption is fixed at unity. Nevertheless, the consumer can choose the quality of the differentiated good. Richer individuals consume more units of the homogeneous good and a higher quality of the differentiated good. If we assume income heterogeneity in the population under analysis, when the increase in income inequality leads to an income of the median consumer significantly lower than the average income, we obtain a negative relationship between income inequality and import quality. Indeed, the increase in income inequality increases demand for goods of lower quality.

Bekkers et al. (2012) empirically validate the hierarchical demand model which predicts a negative relationship between import prices and income inequality. According to this framework, an increase in income inequality extends the budget set of high-income consumers which start demanding new varieties and consuming more units of the same product. For a given average income, higher income inequality as measured by the Atkinson index leads to higher price elasticity and lower import prices. This channel overturns increases in prices due to the increase in the weight of high-income consumers in total demand caused by higher inequality.

Frameworks proposed by Flach and Janeba (2017) and Latzer and Mayneris (2018) predict a non-linear relationship between prices and income inequality. According to both models, prices increase with income inequality in economies characterized by low income per capita, while this relationship is reversed in economies with high income per capita. Therefore, rich economies demand more goods of lower quality when income inequality increases. Our results confirm the negative correlation between inequality and unit value when firms export to rich destinations, thus supporting the existence of an inverted u-shaped relation between income per capita in the importing country and the effect of inequality on quality. Moreover, since we observe firms exporting to the same destination for different time intervals, we can assess whether incumbent exporters respond differently than new exporters to variations in income inequality.

This study also adds to the literature investigating how the size of the importing market influences the price of imported products. Hummels and Lugovskyy (2009) find that declining marginal utility of new varieties results in lower prices in larger markets and higher prices in richer destinations. Desmet and Parente (2010) show that firms operating in large markets obtain lower markups because of tougher competition. We focus on the role of income inequality as a demand determinant, and study how it affects the firm’s pricing strategy considering different market characteristics.

The rest of the paper unfolds as follows. Section 2 describes the firm-level data at our disposal. Section 3 discusses the results. Section 4 reports the robustness checks. Section 5 concludes.

2 Data

The empirical investigation carried out in the following sections is based on data from the Exporter Dynamics Database (EDD) compiled by the World Bank (Fernandes et al. 2016). We employ data from Bulgarian exporting firms for the entire period in which these trade flows are recorded by the EDD: 2001–2006.Footnote 12

Bulgaria represents an interesting case to address our research question. Since the beginning of the 2000s, Bulgarian firms have been increasingly involved in the international trade of goods and services. Exports of goods and service as a percentage of GDP grew from 35% in 2001 to 47% in 2006.Footnote 13 Both exports and imports as a percentage of GDP grew steadily at more than 10% per annum from 2001 to 2006. Moreover, firms export a wide set of manufactured products to a large group of destinations.Footnote 14 Indeed, the geographical position of the country gives to its exporting firms chances to enter markets with different demand features.

The EDD reports yearly observations on the identification code of exporting firms, HS 6-digit product codes, export destinations, total value, and quantity of trade flows at the firm-product-destination level. The monetary value of export flows is measured in Free on Board (f.o.b.) US dollars (USD), therefore it does not include any cost associated with shipping and freights. Export quantities are only measured in kilograms by the EDD.Footnote 15 This detailed firm-level database enables us to observe the entirety of firm-level export flows as recorded by customs.Footnote 16

We focus on data from firms exporting manufactured products by relying on trade flows belonging to HS 2-digits chapters 28 to 98. We make sure that firms in our sample export only products belonging to these sectors. Data on transactions reporting unit values above the 95th percentile and below the 5th percentile are discarded, this amounts to dropping almost 10% of observations in the sample. We consider only trade flows in differentiated manufactured products according to the Rauch (1999) conservative classification.

2.1 Unit values and product quality

The main objective of this study is to determine the sign of the correlation between inequality and two dependent variables: unit value and product quality. The unit value is the ratio between export value, v, and export quantity, q. This variable is available at the firm, j, HS 6-digit product, p, destination, z, and year, t, level: \(uv_{{_{j,\,p,\,z,\,t} }}\).

The procedure proposed by Khandelwal (2010) is a valid alternative to using unit value as a proxy for quality. Following Berry (1994), quality estimates are obtained from a nested-logit demand system which allows horizontal and vertical product differentiation. Product quality represents then the valuation of consumers in the importing country for the vertical attributes of a specific variety. To obtain quality estimates we rely on data on import quantity and unit value and assign higher quality to varieties attaining a higher market share in the importing market, conditional on price. Estimations are ran at the sectoral (HS-4) level and enable us to obtain quality measures at the firm-product level for each destination market. The following specification is estimated:

where \(s_{j,p,z,t} = \frac{{x_{j,p,z,t} }}{{MKT_{z,t} }}\) is the market’s share of a HS 6-digit product p supplied by firm j to the importing country z in year t; \(x_{j,\,p,\,z,\,t}\) represents the quantity of product exported in country z at time t by firm j, and \(MKT_{z,\,t} = \sum\nolimits_{p} {\tfrac{{x_{j,\,p,\,z,\,t} }}{{1 - s_{0t} }}} ,\) is a measure of market size. The term \(s_{0t}\) represents the market share in country z of non-Bulgarian competitors supplying the same HS 6-digit product, p.Footnote 17 This term is set equal to 1 minus import penetration of Bulgarian varieties in each sector-destination pair.

The price at which firm j sells product p in z is represented by \(uv_{j,p,z,t}\). Footnote 18 The nest share, \(ns_{j,p,z,t} \frac{{x_{j,p,z,t} }}{{\sum\nolimits_{p} {x_{p,t} } }},\) is the ratio between the imported quantity of product p supplied by j, and total import quantity of varieties in country z within the HS 6-digit product category. We introduce a quality component varying over time within the importing country z, \(\lambda_{z,\,t} .\) This fixed-effect enables us to account for time-varying factors affecting market-shares in the importing country, such as income or the exchange rate between the domestic currency and the Bulgarian Lev. Sectors are defined at the HS 4-digit classification.

We estimate specification (2.1), for each of the 1019 HS 4-digit categories.Footnote 19In order to take into account the endogeneity of \(uv_{j,p,z,t}\) and \(ns_{p,z,t} ,\) due to omitted variable and reverse causality (2.1) is estimated using a 2SLS procedure. Indeed, if the price is higher due to higher unobserved quality, and quality is positively associated with market shares, the omitted variable bias leads to underestimate the negative impact of prices on demand. Following Bernini and Tomasi (2015), \(uv_{j,p,z,t}\) is instrumented by the average unit value of Bulgarian exporters computed for each product, destination, and year, while \(ns_{p,\,z,\,t}\) is instrumented by the number of Bulgarian exporters in a specific destination for a given HS 6-digit product category. As expected, the median of the instrumented coefficient for price, \(\hat{\beta }_{1}\) is negative and equal to − 0.307, while \(\hat{\beta }_{2}\) reports a positive median coefficient, equal to 0.764. The median OLS coefficient for price is − 0.209, confirming the unobservable variable bias.

Product quality is defined as the sum of the time-varying quality component within the importing country z, \(\lambda_{z,t}\), and the residuals obtained from (2.1), \(\lambda_{j,\,p,\,z,\,t}\): qj,p,z,t=\(\hat\lambda_{z,t} + \hat\lambda_{j,z,p,t}\). We discard quality estimates below the 1st percentile and the 99th percentile of the quality distribution. We then standardize this measure by subtracting the mean and dividing by the standard deviation at the 6-digit product-destination level to obtain a consistent ranking of quality measures across destinations and products.

2.2 Control variables

Income inequality in the importing country. The main proxy for income inequality employed in this study is the interdecile ratio, obtained as the ratio between the income share earned by the top 10% of the income distribution and the income share earned by the bottom 10%. The Gini index is the alternative proxy for inequality employed in the robustness checks. We obtain these measures of income inequality in the importing market from the UN-WIDER database. When available, data on inequality based on disposable income are preferred.

Other features of the importing country. Data on per capita PPP gross national income, total population, the share of population enrolled in secondary education are available from the World Bank WDI database. Variables on the participation to the GATT agreement and other regional trade agreements for each importing country are obtained from the CEPII dataset.Footnote 20

Bilateral controls. Information on distance from Bulgaria and a dummy for common legal origin between the importing market and Bulgaria are also accessible from the CEPII gravity database.Footnote 21

Descriptive statistics. Panel (a) of Table 1 reports descriptive statistics for the variables of interest in the period 2001–2006. Focusing on the characteristics of importing countries in this sample, the mean of the interdecile ratio is higher than 11, spanning from 2.82 in Azerbaijan to 755 in Venezuela. The mean Gini index is 32.38, varying from 21.9 to 67.4. The mean income per capita is equal 18,265 PPP dollars per year, ranging from a minimum of 75 dollars in Burundi to a maximum of 60,304 dollars in Luxembourg. The average distance between Bulgaria and its trading partners is 2043 km, while the mean and median of population in the importing countries are equal to 44 and 11 million, respectively. Statistics reported in Panel (b) of this table confirm that firm heterogeneity in market presence is an important feature of the data. Each year, 56% of trade flows at the firm-product-destination level are due to firms that entered a specific product-destination pair during the current or in the previous year (Entrant, t−1), while 23% of trade flows are due to firms entering a product-destination market for only one year (Entrant, t). It is important to stress that entrant firms are either firms appearing in the database for the first time or firms that were present in a destination but start shipping a new product to that destination.Footnote 22 On average, 19 Bulgarian exporters supply a specific product to an importing country, while the average number of products supplied to each destination is 42.

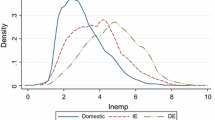

As shown in Figs. 1 and 2, the sample of countries importing manufactured products from Bulgarian firms is rather heterogeneous in terms of inequality, measured either using the Gini index or the interdecile ratio, and income per capita. Importing countries with income higher than the mean are present both among the less unequal and the more unequal in the sample. At the same time, countries with income per capita below the mean turn out over the entire range of the two proxies for inequality.

These figures provide graphical evidence on cross-sectional variation of the proxies for inequality in the estimation sample. Table 2 reports between and within standard deviations for our outcome and explanatory variables. In the first two columns of this table, we report standard deviations at the firm-product level across destinations and years, while we show deviations at the firm-product-destination level across years in the last two columns. It is important to stress that our measures of income inequality report sufficient variation not only across importing countries but also across years, both between and within. The same holds for the two outcome variables: unit value and quality.

3 Empirical analysis

3.1 Main specification

In this section, we investigate the relation between inequality and our dependent variables relying on the following empirical specification:

\(Y_{j,\,z,\,p,\,t} ,\) represents either the logarithm of the unit value, \(\ln (uv)_{{_{j,\,z,\,p,\,t} }} ;\) or the proxy for product quality, \(q_{j,\,z,\,p,\,t} ,\) as obtained in (2.1), of a HS 6-digit product, p, imported by country z from firm j in year t. The term \(\alpha_{j,\,t}\) is a firm-year fixed effect, introduced to consider firm-level characteristics varying over time, such as firm productivity or total revenues across products and destinations. The product-year fixed effect, \(\gamma_{p,\,t} ,\) allows to control for unknowns varying over time at the product-level. Indeed, common shocks affecting the production or total demand for a specific product might influence unit values and product quality. This fixed-effect strategy enables us to employ variation across products and destinations while considering unobservable factors affecting products and firms.

The term \(\omega_{z,\,t} ,\) represents income inequality proxied by the interdecile ratio. If, following findings in Bekkers et al. (2012), inequality is negatively associated with unit value and product quality, we should obtain a negative \(\hat{\mu }\). The vector \(X_{z,\,t}\) includes several importing country characteristics, such as the logarithm of population and the logarithm of income per capita. We also consider the share of students enrolled in secondary education, and two dummies for the participation of the importing country to the GATT agreement or to other regional trade-agreements.

Following predictions from the literature on unit values and country characteristics, population, our proxy for market size, should be negatively associated with both dependent variables, while income per capita should report a positive coefficient.Footnote 23 The two dummies representing the participation of the importing country to a regional trade agreement or to the GATT can be considered as proxies for trade costs not related to distance. The share of students enrolled in secondary education, a proxy for education in the importing country, could report either a positive or a negative coefficient. A higher human capital in the importing country might lead Bulgarian firms to increase the quality of exported products. Alternatively, a higher degree of cost competition, due to the technological level of domestic firms in the importing country, which is positively associated with human capital, could lead Bulgarian firms to reduce the unit value of exported products. It is important to introduce variables accounting for education in the importing country since our proxy for income inequality might capture changes in unit value and quality due to variations in human capital.\(B_{{^{z,d} }}\) is a vector of bilateral variables including the logarithm of geodesic distance between Bulgaria and the trade partner, as well as a dummy equal to one if Bulgaria and the importing country have a common legal origin. These variables are introduced to control for trade costs between country pairs. In all of the following regressions, standard errors are clustered at the importer-year level.

3.2 Results

Table 3 reports results obtained estimating specification (3.1). In column (1), we regress the logarithm of unit value on the proxy for income inequality: the interdecile ratio. In this specification, and in the following three, we consider time-varying firm-level determinants affecting unit value and quality employing firm-year fixed effects. In addition, we introduce product-year fixed effects to control for factors varying over time within HS 6-digit products. In column (2), we insert the dummy for countries being part of the Gatt agreement, the one for regional trade agreements, and the one for countries sharing the same legal origin. Specifications (3) and (4) employ the same set of controls as (1) and (2), respectively, to explain variation in the second dependent variable: product quality.

Estimated coefficients show that income inequality in the importing market is negatively and significantly associated with the unit value and the quality of products shipped to that market by Bulgarian firms. Coefficients, reported in columns (2) and (4), show that a standard deviation increase in the interdecile ratio is associated with a 0.85% reduction in unit value and a 0.97% reduction in product quality.Footnote 24

In order to assess the economic significance of this effect, we focus on the example of a Bulgarian firm exporting to the Czech Republic, which reports an interdecile ratio slightly larger than 6 in 2005. According to our estimates, this firm charges 0.77% higher unit value and produces 0.88% higher quality than if it would export to Latvia, which reports an interdecile ratio equal to 17 in the same year. Compare now this variation with the change in our dependent variables due to distance, a widely acknowledged determinant of export price and quality.Footnote 25

According to the distance elasticities estimated in columns (2) and (4), firms already exporting to the Czech Republic should increase unit value by 3.79% and quality by 3.12% when exporting to Latvia.Footnote 26 Variation in inequality between the two countries accounts then for more than one-fifth of the change in unit value and quality due to the distance differential.

Specifications (5) to (8) employ an alternative set of fixed effects. We now introduce firm-product-year fixed effects to consider factors influencing unit values and quality varying within firm-product-year. It is important to stress that, in this case, a larger number of singletons is dropped when running regressions. This is mainly due to the presence in our data-set of several firms exporting a product to a single destination in a given year (Bernard et al. 2007).

Results confirm that the interdecile ratio is negatively associated with both the unit value and the quality of imported products. Estimates are significant at the 1% in those specifications employing unit value as a dependent variable, while column (8) reports a, non-significant, negative estimate. The fact that this coefficient becomes not significant can be explained by the presence firms exporting a product to a specific destination for just a few years. According to the heterogeneous-firms literature, these exporters are recent entrants in the market which are more likely to enter a destination with a low-quality product, as found by Rodrigue and Tan (2019). Incumbent firms, on the contrary, should vary the price of products rather than change quality after a variation in market conditions. We will investigate on this result in the following section.

Findings reported in Table 3 confirm that income per capita in the importing country is positively and significantly associated with both the unit value and the quality of imported products as in Hummels and Lugovskyy (2009) and Simonovska (2015). Population enters with a negative, significant, coefficient those regressions employing unit value as a dependent variable.Footnote 27 Distance between Bulgaria and the importing market enters specifications from (1) to (6) with a positive significant coefficient. The more distant is an importing country, the higher are the unit value and the quality of products exported to that destination. Only Bulgarian firms producing high-quality goods can profitably export to distant markets, confirming the Alchian-Allen effect (1964), as in Mayneris and Martin (2015), and Flach and Janeba (2017).

The following Table investigates which channels are responsible for the negative relation between import quality and income inequality. Estimates reported in column (1) of Table 4 determine whether low-quality exporters report higher market share in markets with greater inequality. To identify low-quality exporters in a given destination-product pair, we compute the median of the quality measure estimated following Khandelwal (2010) in each product-destination-year. Firms supplying to a specific destination a product whose quality is below the median product quality in that market are identified with the dummy variable, “Below Median Destination Quality”. The dependent variable measures the market’s share of a HS 6-digit product p supplied by firm j in the importing country z in year t. Results show that firms supplying products below the median quality in a given destination report lower market shares. However, when these exporters reach destinations characterized by higher inequality their market share increases. In column (2) we assess whether low-quality varieties within a firm export mix get higher market shares in destinations with higher inequality. To identify low-quality varieties in a firm export mix, we compute the median quality of each HS 6-digit product exported by a firm during the whole period under observation, and then classify as low-quality varieties those product-destinations pairs reporting a quality below the median firm-quality. In this specification, we rely on firm-product-year fixed effects to exploit variation across importing markets. Results show that varieties of lower quality within the firm do not report higher market shares in destinations characterized by higher inequality. Specifications reported in columns (3) and (4) investigate whether firms substitute for lower-quality varieties when exporting to markets with higher inequality. The dummy variable employed in the previous regressions and measuring whether a variety reports a quality below the median of varieties in the firm portfolio is here employed as a dependent variable. We estimate a linear probability model and include firm-year and product-year fixed effects (3) as well as firm-product-year fixed effects (4). Findings show that products of lower quality in the firm product-portfolio are indeed shipped to markets with higher income inequality

Overall, results suggest that the negative relation between income inequality and import quality is mostly determined by low-quality firms obtaining higher market shares in destinations with higher income inequality. Firms tend to supply goods of lower quality in their product-portfolio to more unequal destinations. Nevertheless, low-quality varieties within the firm do not attain significantly higher market shares in destinations characterized by higher inequality. Overall, variation in average quality determined by income inequality across markets is mostly due to compositional effects across firms than due to within-firm adjustments in quality. In this context, quality tailoring within the firm across markets seems to play a minor role with respect to what assumed in recent theoretical frameworks (Feenstra and Romalis 2014).

Evidence discussed in this section show that income inequality is negatively associated with the unit value, and the quality of imported products. We now focus on assessing whether the effect of inequality varies according to income per capita in the importing country.

Interactions: average income. Average income and income inequality may jointly affect import product quality and unit values. Indeed, the interaction between the two variables can be considered as an approximation for the size of total expenditure on vertically differentiated goods. To address this point, in columns (1a–4a) of Table 5, we interact the logarithm of income per capita in the importing country with the interdecile ratio and the Gini index to explain variation in unit value. Estimates show that the negative correlation between income inequality and unit value increases in magnitude in rich destinations.

As shown in Fig. 3, the higher is income per capita, the larger is the negative correlation between the interdecile ratio and unit value. The estimated interaction effect becomes negative and significant when income per capita in the importing country is higher than 2980 USD per year. Estimates confirm that income inequality has a negative effect on import unit value in countries with high income per capita, while the effect is positive for countries with a low income per capita. The price of imports falls with income inequality in the importing country if the country’s income per capita is high, while poor importing countries with an equal income distribution demand goods of lower price than unequal poor economies.

Source: Computations on estimates obtained in column (3a) of Table 5

To further investigate on this finding, in Panels (b) and (c) of Table 5, we split the sample in two groups according to income per capita in the importing country. We rely on the income threshold employed by the World Bank to define high-income countries. In 2001, the first year under analysis, this threshold was set at 9250 USD per year. Estimates reported in Panels (b) and (c) strongly support findings reported in Fig. 3. The negative correlation between income inequality and the two variables of interest holds for exports to rich destinations, while this result is not confirmed for trade flows to destinations reporting an average income lower than 9250 USD per year. When employing the Gini index as a proxy for inequality, we find a positive correlation between income inequality and unit value for importing countries with an average income below 9250 USD per year, thus supporting results presented in Flach and Janeba (2017).

Nevertheless, quality estimates are not significantly correlated with inequality for the group of non-rich importing countries. These results suggest that income inequality acts as a determinant of total expenditure when income per capita in the destination market is relatively high (Bekkers et al. 2012; Simonovska 2015). On the contrary, higher inequality seems to increase the willingness to pay for high-quality products in poor and middle-income economies, as found by Flach and Janeba (2017).

3.3 Incumbent and entrant firms

Empirical results described in the previous section show that inequality is negatively associated with unit value and product quality. This effect tends to be larger in richer destinations. Nevertheless, the fact that a firm has been exporting to a specific market for several years might lead it to respond differently to a change in income inequality with respect to a firm starting to export a product when this feature of the market is changing.Footnote 28 The dataset at hand gives us the possibility to study how firm-level trade dynamics in the destination market are related to firm’s choices regarding product quality and unit value. More precisely, we can determine if the negative effect of income inequality is mainly due to incumbent firms or to new exporters.

Bulgarian exporters represent an interesting case to address this specific question. Economic reforms implemented to foster the EU accession process coincided with a higher integration of this emerging economy in the international exchanges of goods and services. Indeed, both exports and imports as a percentage of GDP grew steadily at more than 10% per annum from 2001 to 2006. We are then able to observe a significant share of new exporting firms within each product-destination pair. We estimate the following econometric model where the dummy for firms that just entered a product-destination pair (Entrant, t) and the one for firms that entered the market (product-destination pair) in the current or the previous year (Entrant, t−1) are, alternatively, interacted with income inequality.

The dependent variable, \(Y_{j,z,p,t}\) represents either the logarithm of the unit value of a HS 6-digit product, p, imported by country z from firm j at year t, \(\ln (uv)_{j,\,p,\,z,\,t} ,\) or the quality of this product, estimated in (2.1), \(q_{j,\,p,\,z,\,t} .\) The term \(\alpha_{j,\,t}\) is a firm-year fixed effect, introduced to consider how firm-level characteristics varying over time, such as labor productivity and total export revenues, affect the dependent variable. The product-year fixed effect, \(\gamma_{p,\,t} ,\) gives instead the possibility to consider how product-level time-varying determinants affect the dependent variable. In the last four specifications of this Table, we control for firm-product-year fixed effects,\(\alpha_{j,\,p,\,t}\), to consider factors affecting unit value and quality that vary within firm-product pairs over time. In all regressions reported in Panel (a) of Table 6, standard errors are two-way clustered at the firm-importer and at the importer-year level.

Specifications (1a) and (2a) show that the negative correlation between unit value, quality, and income inequality is confirmed when introducing the dummy variable for firms entering the market in the current year (Entrant, t). Yet, the interpretation of the coefficient for the interdecile ratio is now different: it shows that the quality and the unit value of incumbent firms in a product-destination pair are negatively correlated with income inequality. The coefficient for entrant firms is negative, as well, suggesting that firms entering the market supply goods of lower quality at a lower unit value. In columns (5a) and (6a), we estimate the same model with firm-product-year fixed effects in order to exploit only variation across importing markets. Coefficients estimated in (5a) confirm the negative relation between the interdecile ratio and the unit value for incumbent firms. Yet, the negative coefficient for the entrant dummy is obtained only when quality is the dependent variable suggesting that firms entering a destination market in a specific year supply goods of lower quality while the unit value of their products does not vary according to inequality. When focusing on mean and median quality for entrant and incumbent firms in the sample under analysis, we observe that the former supply products of lower quality, this is confirmed when running specification (3.2) without including the interaction term.

We further investigate on this, considering as entrant firms in a specific product-destination pair those firms that entered either in the current or in the previous year (Entrant, t−1), in order not to wrongly identify as incumbent those firms exporting to a specific destination for only 2 years. Findings reported in (3a) and (4a), confirm the negative correlation between inequality and unit value for incumbent firms, while a negative coefficient is found for entrants when using quality as a dependent variable. Specifications (7a) and (8a), relying on variation across destinations within firm-product-year, confirm that the interdecile ratio is negatively associated with the unit value charged by incumbent firms while entrants supply goods of lower quality. Controlling for time-varying factors at the firm-product level and exploiting variation across destinations, we find that the quality of imported products is significantly lower for entrants.

To sum up, estimates suggest that the effect of income inequality on unit value and product quality depends on the relative stance of a firm in each destination market. Indeed, incumbent firms react to a change in market conditions due to income inequality decreasing unit values, while entrants tend to supply goods of lower quality.

Large and small exporters. Starting from Bernard et al. (2007, 2011), large attention has been devoted to the relationship between heterogeneity in firm-size and trade outcomes. In order to partially address this point, we distinguish firms with respect to their total export revenues. We obtain total export revenues across destinations for each firm, and rank firms with respect to their quintile in the yearly frequency distribution of export revenues. Firms reporting revenues in the first, second, and the third quintile are labelled as “Small Exporters”, while “Large Exporters” are those firms belonging to the fourth or the fifth quintile of the distribution. We estimate specification (3.2) for the two groups of firms employing firm-year and product-year fixed effects in the first four regressions, while firm-product-year fixed effects are introduced in the last four. Results in Panel (b) of Table 6 show that our findings are mainly driven by large exporters. A higher income inequality in the importing country is associated with lower unit value for products supplied by large incumbents. Moreover, large exporters supply goods of lower quality when entering a new destination.

On the contrary, the unit value and quality of products supplied by small exporting firms is not significantly correlated with income inequality in the destination market.

4 Robustness checks

The robustness of the main finding is here assessed on various alternative specifications. First, we propose a strategy to address the possible endogeneity of our explicative variable. Estimates confirm that inequality affects negatively both dependent variables. Second, as in Flach and Janeba (2017), we consider several proxies for firm market-power in a product-destination pair (Brambilla et al. 2012; Martin 2012; Flach 2016; Simonovska 2015). The main result holds when controlling for different measures of market shares (Amiti et al. 2014) and for product-level demand elasticities in the importing country (Broda et al. 2006). Third, findings hold when considering a different proxy for income inequality, the Gini index. Fourth, we show that only the unit value and the quality of consumer and capital goods is negatively associated with income inequality in the importing market. Estimates also confirm that rich markets (e.g. EU and OECD) import goods of lower quality and unit value when inequality increases. Lastly, findings are confirmed when relying on the alternative procedure to estimate product quality proposed by Khandelwal et al. (2013).

Endogeneity. The fixed-effects strategy employed in our analysis controls for several unobservable factors varying at the firm and product level. Nevertheless, estimates might still be affected by the endogeneity of income inequality due to reverse causality and omitted variables. Imports of high-quality products might be associated with technological upgrading in the destination country and affect income inequality (Fieler et al. 2017). If a higher quality of imported products increases income inequality, estimates reported in Table 3 are upward biased. The bias is also positive if other variables positively (negatively) correlated with both the dependent variable and the proxy for income inequality are omitted from the econometric specification. We attempt to address these concerns estimating a 2SLS model.

This specification relies on two novel instrumental variables for income inequality:

-

the import value of newspapers, journals, and periodicals as a percentage of GDP in current US dollars,

-

the number of (paid and free) daily newspapers per 1 million inhabitants in each importing country.

Both variables are measured 10 years before trade flows occur and are standardized in relation to the best and the worst observation.Footnote 29 According to the Political Economy literature, information availability can have a sizeable effect on income inequality which is ultimately shaped by government policies on public expenditure and taxation, technological progress, and trade openness (Petrova 2008). A wider offer of information media is associated with a higher awareness of the public opinion regarding the decision process on policies affecting income inequality.Footnote 30 Besley and Burgess (2002) as well as Reinikka and Svensson (2005) find that the availability of alternative sources of information significantly determines policy outcomes.

Given that we exploit variation across importing countries within firm-year, our identification strategy clearly assumes that income inequality is persistent within countries across time. The two instruments plausibly affect the dependent variable only through their impact on income inequality. Indeed, demand-side factors are taken into account by controlling for average income, population size, and our proxy for human capital in the importing country which account for relevant contemporaneous determinants correlated with our instruments and affecting unit value and quality. Moreover, it is unlikely that firm-level export unit value and quality are directly affected by information availability in the importing country measured 10 years before firm-level trade flows are recorded. In Figs. 4 and 5 we provide descriptive evidence on the correlation between our instruments and the proxy for income inequality.Footnote 31 Figure 4 plots the average interdecile ratio in the period 2001–2006 against average imports of newspapers as a share of GDP measured 10 years before. It shows a negative slope of − 0.98 (t = − 5.90).

Similarly, Fig. 5 displays a strong, negative, correlation between average interdecile ratio and average number of newspapers per 1 million inhabitants. Therefore, consistent with our expectations, more unequal countries in the period 2001–2006 reported lower media availability ten years before. This is confirmed by the first-stage estimations reported in columns (3a–3b), and of Table 7. Both instrumental variables are strongly negatively associated with the interdecile ratio. Estimates in Panel (a) report second-stage coefficients obtained employing firm-year and product-year fixed effects, while Panel (b) displays estimates with firm-product-year fixed effects.

Results displayed in Table 7 are, at least, reassuring regarding the direction of the effect of income inequality on the unit value and the quality of imported products. Estimated coefficients are negative, and larger in magnitude than those reported in Table 3, suggesting that endogeneity leads us to obtain upward biased OLS estimates. As shown in columns (4b) and (5b), the negative impact of income inequality on unit value and quality is confirmed when employing firm-product-year fixed effects. It is possible to observe that the effect of income inequality on quality is larger in magnitude than the one on unit-value, as found in the OLS specifications reported in Table 3. It follows that income inequality not only affects import prices but also the market shares of Bulgarian products in each destination, which then determine our quality estimates. The Kleibergeen-Paap Wald F-statistic of the first stage is higher than 10, while the LM statistic is larger than the Stock-Yogo weak-ID 10% critical value. The Hansen J-statistic on overidentifying restrictions reports, for all specifications, a p value preventing us from rejecting the null-hypothesis that instruments are uncorrelated with the error term, and that the excluded instruments are correctly excluded from the estimated equation. Coefficients for other covariates are similar in magnitude and sign to those shown in Table 3.

As stated above, the identification strategy for 2SLS estimations reported in Table 7 assumes that the effect of the two instruments representing information availability affect the quality and prices of imported products only through their effect on income inequality. Instruments shall not be correlated with other variables, omitted from our specifications, and which may account for the mechanism implied by the instruments. We further investigate the validity of this assumption introducing additional control variables which may be correlated with the instruments and determine our outcome variables. For instance, government policies affecting income inequality can be determined by whether importing countries under analysis are democracies. Indeed, governments whose actions are subject to electoral scrutiny might be more likely to pursue policies against rising inequality. In this case, if information availability is correlated with being a democracy, the effect of our instruments on income inequality may simply account for the form of government in the importing country. Another factor which might be highly correlated with the two instruments and determine income inequality is the economic growth recorded in the importing country in the period preceding the trade flow. While specifications discussed until now control for the logarithm of income per capita, the two instruments might be correlated with economic growth in the importing country, which then affects income inequality. Given this, specifications reported in Table 8 consider three additional control variables, a dummy variable equal to one if the importing country allowed freedom of assembly in the years between 1991 and 1996 according to the democracy barometer, a dummy variable for importing countries considered as established democracies by the democracy barometer during the period 1991–1996, and the growth rate of GDP in the importing country measured 5 years before the trade flow occurs. Estimates confirm that the relationship between our instrumented variable and the two outcome variables is negative and significant, the magnitude of the estimated coefficients is comparable to those reported in Table 7. Interestingly, GDP growth is positively correlated with the quality of imported products, yet, this coefficient is not significantly different from zero when employing firm-product-year fixed effects and does not affect the significant, negative, impact of income inequality on import quality and unit value. The same holds for the two variables accounting for the democratic status of the importing country.

Market shares and demand elasticities. Following Flach and Janeba (2017), we now focus on unit values and consider the role of several proxies for firm’s market power in the destination market. The aim here is to control for markups when estimating the effect of inequality on unit value. We consider the market share a sufficient statistic for markups. Evidently, it would not be sensible to introduce product quality as a dependent variable in these regressions since that proxy is itself obtained using market shares in the destination market when estimating (2.1). We compute the firm’s market share in each product-destination pair with respect to other Bulgarian firms exporting the same product to the same destination, Share Firm over Other Bulg., Same Prod/Dest. We also compute the firm’s total market share in each destination with respect to other Bulgarian firms exporting to the same destination, Share Firm over Other Bulg., Same Dest. We then obtain the ratio between firm revenues in all destinations different from the one to which the observed unit value refers, and total firm revenues across destinations so to obtain a proxy for the relative importance of other importing destinations for each Bulgarian firm, M. Share Other Dest. Taking the ratio between a firm’s total revenue in a specific product-destination and total imports for that product in the same destination-year, available from the BACI-CEPII dataset, it is possible to obtain the variable Share Bulg. F. over Tot. Imports, Prod. In addition, we proxy competition faced by Bulgarian firms in each importing market with the total number of firms exporting from Bulgaria to that destination each year, Number of Exporters. We then merge to this database estimates of Import Demand Elasticities at the HS 3-digit product-level for 73 importing countries, reported in Broda et al. (2006). By controlling for demand elasticity in the importing country, we consider the role of average markups at the country-sector level in determining unit values.

Panel (a) of Table 9, showing estimates obtained employing firm-year and product-year fixed effects, confirms the negative relation between the interdecile ratio and unit value when controlling for the different measures of market shares in the importing market.Footnote 32 Importantly, the size of the estimated coefficient is slightly smaller than the one reported in Table 3 for a less conservative specification. The interdecile ratio reports, in almost all regressions, a coefficient equal to − 0.0004, significant at the 1%. Income per capita and distance to the importing country enter all estimations with a positive significant coefficient. Furthermore, we find that firms controlling a large share of the market, with respect to other Bulgarian firms exporting the same product to the same destination, report a higher unit value. On the contrary, firms accounting for a large share of Bulgarian exports to a specific destination report lower unit values, the same holds for the ratio between firm’s revenues in all other destinations and total export revenues. The less important is a specific importing market with respect to other destinations for a firm (i.e. the higher this index) the lower the unit value of products supplied to that market.

Comparing these results with those obtained in Table 3, we can then claim that controlling for market power in the importing market attenuates the magnitude of the negative correlation between inequality and unit value, thus confirming the role of markups in shaping the effect of inequality on prices (Bekkers et al. 2012).

Gini index, market shares and demand elasticities. Panel (b) of the same table reports estimates obtained when employing the Gini index as a proxy for income inequality. In all of the following regressions, we rely on variation across destinations and time by employing firm-year and product-year fixed effects. In columns (1b) and (2b), we report estimates for the main specification employing quality and unit value as dependent variables. Estimates in these two regressions show that a higher Gini index is associated with a lower unit value and a lower product quality. Interestingly, the magnitude of the estimated coefficients is larger than the one obtained when employing the interdecile ratio. From regression (3b) onwards, we control for the various proxies of market power described in the previous paragraph. The Gini index enters all specifications with a negative significant coefficient. Other control variables report estimates comparable to those obtained when considering the interdecile ratio as a proxy for income inequality, the only exception being the share of Bulgarian firms in the imports of a specific product to a specific destination, which enters column (6b) with a negative coefficient, significant at the 1%. The larger is the relative share of imports from Bulgaria in each destination the more stringent is competition leading firms to reduce the unit value of goods supplied to that market.

Overall, it is possible to conclude that considering different proxies for market power in the importing country to account for the role of markups does not significantly affect results discussed in the previous section. The estimated coefficient for the effect of inequality on unit values is smaller in magnitude, yet always negative and significant, suggesting that this effect cannot is not entirely explained by market power.

Different products. We now rely on the UNCTAD-SpO product classification to determine whether results discussed in this empirical analysis are driven by trade flows in final products, or by trade in intermediates, and raw materials. The UNCTAD-SpO database classifies HS92 products into four categories: capital goods, consumer goods, intermediate goods, and raw materials. Using a concordance table from the HS92 to the EDD product classification, we then classify products in this dataset with respect to the four categories. This classification gives the possibility to verify whether findings obtained in the main specification are mainly due to trade flows in final goods. We find that the coefficient for the interdecile ratio is negative and significant when data on consumer goods are employed, thus confirming predictions from theories stressing the role of inequality as a determinant of consumer demand. This result is obtained using our two different sets of fixed effects (2a) and (2b). On the contrary, income inequality does not play any role to explain variation in unit value for intermediate products (3a)–(3b). This result highlights that demand factors rather than supply-side determinants mainly explain our findings.

Different groups of importing countries. The correlation between inequality and unit value might crucially depend on the destinations to which Bulgarian exporters are shipping their goods. Importing countries belonging to the European Union (EU) or to the OECD account for the majority of trade flows from Bulgarian exporting firms in the period 2001–2006. To determine whether results are mainly due to exports directed to EU countries, we estimate Eq. (3.1) relying on export flows to EU members (1c)–(1d), while in (2c)–(2d) we restrict the sample to trading partners not belonging to the EU. We repeat the same exercise using data on exports to OECD members and countries not part of the OECD, in columns (3c)–(3d) and (4c)–(4d), respectively. In Panel (c), we rely on firm-year and product-year fixed effects, while in Panel (d) we employ firm-product-year fixed effects. Estimates show that income inequality reports a negative, significant, coefficient when considering trade flows to richer countries in the sample, thus confirming that the negative correlation between inequality and unit value is larger in richer destinations, as found in Panel (a) of Table 4. Interestingly, the effect of inequality becomes larger in magnitude when exports to OECD destinations are taken into consideration. The remarkable increases in inequality experienced by several OECD members during the last decades seem to have influenced the pricing strategy of Bulgarian exporters.Footnote 33

Khandelwal et al. (2013) quality measure. Estimates for product quality introduced in the previous regressions are obtained relying on an instrumental variable approach. In particular, the instrument for unit value employed in specification (2.1) is the average unit value of Bulgarian exporters in the same destination. Even if the procedure employed to standardize our quality estimates should reduce concerns, coefficients obtained following this methodology might still be affected by endogeneity when few Bulgarian firms export a specific product to the same destination. In order to address this issue, we employ the alternative proxy for quality proposed by Khandelwal et al. (2013). This measure does not rely on instrumental variable estimation while, being based on a CES framework, assumes constant demand elasticity at the product-level within destination.

The following econometric model is estimated:

Here \(q_{{_{j,\,z,\,p,\,t} }}\) and \(uv_{j,\,p,\,z,\,t}\) represent the quantity and the price of a 6-digit HS product p, sold by firm j in destination z, in year t. The term \(\sigma_{z,\,p - 3digit}\) represents the elasticity of substitution at the 3-digit HS level, estimated for product-importer dyads by Broda et al. (2006). The product-level fixed effect, \(\alpha_{p} ,\) and the destination-time fixed effect \(\beta_{z,\,t}\) capture variation within products and destination-specific demand factors varying over time. We obtain the log of quality for each HS 6-digit product p, sold by firm j, in destination z, using the following equation:

Panel (a) of Table 11 reports coefficients obtained when employing this new proxy for quality (Quality KSW) as a dependent variable in specification (3.1). The interdecile ratio enters all regressions with a negative and significant coefficient. The magnitude of this effect is larger than the one reported in Table 3, ranging from − 0.0017 to − 0.0023. The negative correlation between income inequality and quality is confirmed, as well, when employing firm-product-year fixed effects, as shown by the estimates reported in columns (3a) and (4a). Following results displayed in Table 10, Panel (b) shows coefficients obtained using the sub-sample of trade flows in capital and consumer goods. Findings show that the correlation between the interdecile ratio and product quality is also negative for these groups of goods. In Panel (c) we assess the correlation between our proxy for income inequality and product quality for trade flows directed to EU destinations and non-EU destinations. Estimates confirm what found for unit values in Table 10: product quality to EU destinations is negatively and significantly correlated with inequality in those countries, while the unit value and product quality of goods shipped to non-EU destinations are not significantly associated with inequality. Findings reported in Panel (b) and (c) hold when using different sets of fixed effects.

To conclude, results discussed in this paragraph confirm that increases in income inequality are associated with reductions in product quality also when we rely on this alternative approach to quality estimation.

5 Conclusion

We investigated whether the quality and the unit value of products exported by firms in a transition economy vary according to a crucial determinant of import demand: income inequality. Results accounting for time-varying firm-product characteristics show that income inequality in the importing country is negatively correlated with the unit value and the quality of exported products. A standard deviation increase in the interdecile ratio is associated with 0.85% lower unit value and 0.97% lower product quality. By influencing the unit value and the quality of demanded products, this feature of the income distribution determines the characteristics of products exported to different markets and, possibly, technological developments in the Bulgarian manufacturing sector. Findings obtained relying on instrumental variable estimation show that OLS estimates tend to be upward biased. Moreover, the effect of income inequality on unit value is negative for rich destinations in the sample.

We disentangled the correlation between income inequality and firm-level outcomes focusing on a period characterized by economic reforms pursued to foster the EU accession process. This period saw a significant increase in export flows from Bulgaria, giving us the possibility to observe incumbent exporters and new exporting firms to several destination markets. Bulgarian firms respond heterogeneously to a change in the income distribution given their stance in the importing market. Results show that higher inequality reduces the unit value of products exported by incumbent firms, while entrants supply goods of lower quality.

Overall, our findings confirm the role of inequality as a determinant of import demand which ultimately induces quality and unit value differentials across markets. Firm-level heterogeneous adjustments in product quality to changes in the income distribution might then explain a significant share of variation in firm revenues across the different destination markets.

Notes

See Attanasio et al. (2004), Yeaple (2005), Verhoogen (2008), Jaimovich and Merella (2012), among others. Refer to Goldberg and Pavcnik (2007, 2016) for a survey of the literature focusing on this topic. A recent strand of the literature investigates effects of trade shocks on real income inequality using consumer expenditure data. Faber (2014) finds that cheaper access to US imports reduces the relative price of higher quality products in Mexican cities. Faber and Fally (2017) find that larger, more productive, firms serve wealthier households and this gives rise to asymmetric effects on household price indices. Borusyak and Jaravel (2018) observe that a uniform trade cost reduction generates welfare gains that are larger for college graduates which consume goods of higher quality. Ardelean and Lugovskyy (2019) show that changes in U.S. tariffs decrease the cost-of-living for the rich households relative to that of the poor.

The unit value is obtained as a ratio between export value and shipped quantity. The terms “unit value” and “price” are used interchangeably in this manuscript.

We refer to the proxy obtained following Khandelwal (2010) as “product quality”.

Bernard et al. (2011) find that incumbent exporters react differently than entrants to variations in important features of the destination market.

Hallak (2006) finds a positive relationship between income per capita in the importing country and the unit value of imported products. Manova and Zhang (2012) observe that, across destinations within a firm-product pair, Chinese exporters set higher prices in richer markets. This result is confirmed by Fieler (2012), and by Feenstra and Romalis (2014). Simonovska (2015), using data from a large apparel manufacturer, finds that doubling a destination's average income results in a 18% higher price for identical items.

Bils and Klenow (2001) claim that an increase in total consumption can cause a reduction in the quality upgrading component of price as new consumers with a low preference for the good enter the market.

Schott (2004), Hummels and Klenow (2005), Hallak and Schott (2011) show that export prices increase with income per capita in the exporting country. This result, first proposed by Linder (1961), is confirmed at the sector-level by Hallak (2010). Choi et al. (2009) find that countries with higher average income report higher mean import prices. Moreover, country pairs with similar income distributions have similar import price distributions.

It is important to underline that we are using information on the only East European transition economy for which firm-product-destination level data on both export revenue and quantity is available from the EDD.

Data obtained from World Bank's World Integrated Trade Solution (WITS) Database.

We employ product-level fixed effects in our econometric analysis to take into account measurement issues for products with different physical characteristics.

Firm-level trade flows recorded in the EDD account for more than 98% of Bulgarian product-level exports recorded in the WITS database (World Integrated Trade Solution) during the same period.

Product level data on imports from other countries are obtained from the CEPII-BACI database, refer to Gaulier and Zignago (2010).

The f.o.b. unit value is used as a proxy for a variety's export price. Constructing an equivalent proxy for the consumer import price would require information on distribution costs in each importing country.

As a consequence, variation across different HS 6-digit products, p, within different HS 4-digits categories is employed when estimating this specification.

Refer to Gaulier and Zignago (2010).

Geodesic distances are computed by CEPII employing the great circle formula based on latitudes and longitudes of the most important cities/agglomerations in the trading partners.

These numbers are partially consistent with what reported by Bernard et al. (2007) for US exporters in 2000: they show that 40% of firms export a specific product to a single destination. Granularity is indeed an important feature of detailed trade data.

As reported in Table 1, the standard deviation of the interdecile ratio in countries importing from Bulgaria is equal to 12.21 during the period under analysis.

The geodesic distance between Bulgaria and the Czech Republic is 1083 km, while the distance between Bulgaria and Latvia is 1574 km, we then consider the effect of a 50% increase in distance.

Results do not change if we consider GDP as a proxy for market size instead of population. Results are available upon request.

Rodrigue and Tan (2019) find that new exporters charge relatively low prices and produce low quality goods upon initial entry into export markets.

Data available from “The democracy barometer” website. Refer to Buehlmann et al. (2011).

Bartels (2005) finds that most people with low and middle incomes supported the estate tax repeal in the US even if it was not in their interest. Their support for the estate tax repeal was negatively associated with their access to information.

This finding is confirmed using firm-product-year fixed effects in order to rely on variation across destinations. Results are available upon request.

Mexico, United States, Israel, and Japan were the OECD members experiencing the largest increases in income inequality during the period 1985–2010 (OECD 2011).

References

Alchian, A. A., & Allen, W. R. (1964). University economics. Belmont: Wadsworth Publishing Company.

Amiti, M., Itskhoki, O., & Konings, J. (2014). Importers, exporters, and exchange rate disconnect. American Economic Review, 104(7), 1942–1978.

Ardelean, A., & Lugovskyy, V. (2019). Tariffs, product quality and the relative prices of durables: Evidence from 1989 to 2009 US microdata. European Economic Review, 114, 54–75.

Attanasio, O., Goldberg, P. K., & Pavcnik, N. (2004). Trade reforms and wage inequality in Colombia. Journal of Development Economics, 74(2), 331–366.

Bartels, L. (2005). Homer gets a tax cut: inequality and public policy in the American mind. Perspectives on Politics, 3(1), 15–31.

Bekkers, E., Francois, J., & Manchin, M. (2012). Import prices, income and inequality. European Economic Review, 56(4), 848–869.

Benkovskis, K., & Rimgailaite, R. (2011). The quality and variety of exports from the new EU member states. Economics of Transition, 19(4), 723–747.

Bernard, A. B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2007). Firms in international trade. Journal of Economic Perspectives, 21(3), 105–130.

Bernard, A. B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2011). The empirics of firm heterogeneity and international trade. Annual Review of Economics, 4, 283–313.

Bernini, M., & Tomasi, C. (2015). Exchange rate pass-through and product heterogeneity: Does quality matter on the import side? European Economic Review, 77, 117–138.

Berry, S. (1994). Estimating discrete-choice models of product differentiation. The Rand Journal of Economics, 25, 242–262.

Besley, T., & Burgess, R. (2002). The political economy of government responsiveness: Theory and evidence from India. The Quarterly Journal of Economics, 117(4), 1415–1451.

Bils, M., & Klenow, P. J. (2001). Quantifying quality growth. American Economic Review, 91(4), 1006–1030.

Borusyak, K., & Jaraviel, X. (2018). The distributional effects of trade: Theory and evidence from the United States. Mimeo.

Brambilla, I., Lederman, D., & Porto, G. (2012). Exports, export destinations, and skills. American Economic Review, 102(7), 3406–3438.

Broda, C., Greenfield, J.,& Weinstein, D. (2006). From groundnuts to globalization: A structural estimate of trade and growth (NBER Working Paper No. 12512).

Buehlmann, M., Merkel, W., Mueller, L., & Wessels, B. (2011). The democracy barometer: A new instrument to measure the quality of democracy and its potential for comparative research. European Political Science, Symposium, 11(4), 1–18.

Chen, S., & Ravallion, M. (2007). Absolute poverty measures for the developing world, 1981–2004 (Working Paper No. 4211). World Bank Policy Research.

Choi, Y. C., Hummels, D., & Xiang, C. (2009). Explaining import variety and quality: The role of the income distribution. Journal of International Economics, 77, 265–276.

Crinò, R., & Epifani, P. (2012). Productivity, quality and export behavior. The Economic Journal, 122(565), 1206–1243.

Dalgin, M., Mitra, D., & Trindade, V. (2008). Inequality, nonhomothetic preferences, and trade: A gravity approach. Southern Economic Journal, 74(3), 747–774.

Desmet, K., & Parente, S. (2010). Bigger is better: Market size, demand elasticity and innovation. Internationl Economic Review, 51, 319–333.

Dingel, J. (2017). The determinants of quality specialization. Review of Economic Studies, 84(4), 1551–1582.

Faber, B. (2014). Trade liberalization, the price of quality, and inequality: Evidence from Mexican store prices. Mimeo.

Faber, B. & Fally, T. (2017). Firm heterogeneity in consumption baskets: Evidence from home and store scanner data (NBER Working Paper 23101).

Fajgelbaum, P., Grossman, G., & Helpman, E. (2011). Income distribution, product quality, and international trade. Journal of Political Economy, 119(4), 721–765.

Feenstra, R. C., & Romalis, J. (2014). International prices and endogenous quality. The Quarterly Journal of Economics, 129(2), 477–527.

Fernandes, A., Freund, C., & Pierola, M. (2016). Exporter behavior, country size and stage of development: Evidence from the exporter dynamics database. Journal of Development Economics, 119, 121–137.

Fieler, A. C. (2012). Quality differentiation in international trade: Theory and evidence (Working Paper). Department of Economics, University of Pennsylvania.

Fieler, A. C., Eslava, M., & Xu, D. Y. (2017). Trade, Quality Upgrading, and Input Linkages: A Theory with Evidence from Colombia. American Economic Review, 108(1), 109–146.

Flach, L. (2016). Quality upgrading and price heterogeneity: Evidence from Brazilian exporters. Journal of International Economics, 102, 282–290.

Flach, L., & Janeba, E. (2017). Income inequality and export prices across countries. Canadian Journal of Economics, 50(1), 162–200.

Flam, H., & Helpman, E. (1987). Vertical product differentiation and North-South trade. American Economic Review, 77(5), 810–822.

Francois, J., & Kaplan, S. (1996). Aggregate demand shifts, income distribution, and the linder hypothesis. Review of Economics and Statistics, 78(2), 244–250.

Gaulier, G., & Zignago, S. (2010). BACI: International Trade database at the product-level. The 1994–2007 Version (CEPII Working Paper 2010-23).

Goldberg, P. K., & Pavcnik, N. (2007). Distributional effects of globalization in developing countries. Journal of Economic Literature, 45(1), 39–82.

Goldberg, P. K., & Pavcnik, N. (2016). The effects of trade policy (NBER Working Paper No. 21957).

Gorodnichenko, Y., Svejnear, J., & Terrel, K. (2014). When does FDI have positive spillovers? Evidence from 17 emerging market economies. Journal of Comparative Economics, 42, 954–969.

Hallak, J. C. (2006). Product quality and the direction of trade. Journal of International Economics, 68(1), 238–265.

Hallak, J. C. (2010). A product-quality view of the Linder hypothesis. The Review of Economics and Statistics, 92(3), 453–466.

Hallak, J. C., & Schott, P. K. (2011). Estimating cross-country differences in product quality. The Quarterly Journal of Economics, 126(1), 417–474.

Hummels, D., & Klenow, P. J. (2005). The variety and quality of a nation’s exports. American Economic Review, 95(3), 704–723.

Hummels, D., & Lugovskyy, V. (2009). International pricing in a generalized model of ideal variety. Journal of Money, Credit and Banking, 41(1), 3–33.

Hummels, D., & Skiba, A. (2004). Shipping the good apples out? An empirical confirmation of the Alchian-Allen conjecture. Journal of Political Economy, 112(6), 1384–1402.

IMF (2015). Causes and consequences of income inequality: A global perspective. by Dabla-Norris, E., Kochhar, K., Ricka F., Suphaphiphat N., & Tsounta, E. Strategy, Policy, and Review Department - IMF Discussion Note.

Jaimovich, E., & Merella, V. (2012). Quality ladders in a Ricardian model of trade with nonhomothetic preferences. Journal of the European Economic Association, 10, 908–937.

Khandelwal, A. (2010). The long and short (of) quality ladders. Review of Economic Studies, 77(4), 1450–1476.

Khandelwal, A., Schott, P., & Wei, S. (2013). Trade liberalization and embedded institutional reform: evidence from Chinese exporters. American Economic Review, 103(6), 2169–2195.

Latzer, H. & Mayneris, F. (2018). Average income, income inequality and export unit values. Documents de travail du Centre d’Economie de la Sorbonne 18031, Université Panthéon-Sorbonne (Paris 1), Centre d’Economie de la Sorbonne.

Linder, S. (1961). An Essay on Trade and Transformation. Stockholm: Almqvist & Wiksell.

Manova, K., & Zhang, Z. (2012). Export prices across firms and destinations. The Quarterly Journal of Economics, 127, 379–436.

Martin, J. (2012). Markups, quality, and transport costs. European Economic Review, 56, 777–791.

Mayneris, F., & Martin, J. (2015). High-end variety exporters defying gravity: Micro facts and aggregate implications. Journal of International Economics, 96(1), 55–71.

Mitra, D., & Trindade, V. (2005). Inequality and trade. Canadian Journal of Economics, 38(4), 1695–1725.

Petrova, M. (2008). Inequality and media capture. Journal of Public Economics, 92(1--2), 183–212.

Rauch, J. E. (1999). Networks versus markets in international trade. Journal of International Economics, 48(1), 7–35.

Reinikka, R., & Svensson, J. (2005). Fighting corruption to improve schooling: Evidence from a newspaper campaign in Uganda. Journal of the European Economic Association, 3, 259–267.

Rodrigue, J., & Tan, Y. (2019). Price, product quality, and exporter dynamics: Evidence from China. International Economic Review, 60, 1911–1955.

Schott, P. K. (2004). Across-product versus within-product specialization in international trade. The Quarterly Journal of Economics, 119(2), 646–677.

Simonovska, I. (2015). Income differences and prices of tradables. Review of Economic Studies, 82(4), 1612–1656.

Various Authors. (2003). Trade policy review on Bulgaria. Report by the Secretariat, WTO WT/TPS/S/121.

Various Authors. (2007). Economic review 1/2007. Bulgarian National Bank.

Various Authors. (2011). Divided we stand: Why inequality keeps rising. OECD.

Verhoogen, E. (2008). Trade, quality upgrading and wage inequality in the Mexican manufacturing sector. The Quarterly Journal of Economics, 123(2), 489–530.