Abstract

This paper analyzes for a panel of Romanian manufacturing firms whether the quality of foreign firms, measured by their productivity level, affects their potential as a source of indirect productivity effects on domestic firms. We find that only sufficiently productive foreign firms generate positive productivity effects on domestic supplier firms. The most productive foreign firms are the main source of productivity effects. Domestic firms with higher productivity levels also enjoy larger total positive productivity effects. When supplying foreign firms that are less productive than themselves, domestic firms experience zero to negative effects.

Similar content being viewed by others

Notes

Our dataset of Romanian firms is taken from the Amadeus database and has been used in several papers in the literature and is known for its extensive coverage and high quality reporting of basic firm-level information (cf. infra).

Furthermore, Damijan et al. (2013) indicate that foreign affiliates in Eastern Europe (we consider Romania) are mainly engaged in end-user consumer goods.

We follow Amiti and Konings (2007) and compute investment from our data as the change in real capital corrected for a depreciation rate taken from the Penn World Table.

Downstream foreign entry could increase demand for intermediate products which may result in scale economies. To separate this effect, the regression includes demand for intermediates following Javorcik (2004) calculated as:

$$\begin{aligned} demand_{jt} = \sum \limits _{k} a_{jk} * Y_{kt} \end{aligned}$$where \(\alpha _{jk}\) is the IO-matrix coefficient which indicates that in order to produce one unit of good k, \(\alpha _{jk}\) units of good j are needed. \(Y_{kt}\) is the output of industry k deflated by an industry-specific deflator.

We use multiple issues (published on DVDs) of the database because a single issue is only a snapshot of the ownership information and firms that exit are dropped from the next issue released. In order to get a full overview of ownership and financials through time, multiple issues are required. See Merlevede et al. (2014).

If the ‘outlier’ is due to the first or last observation for a specific firm and other data points are normal, the other firm-year data are kept. If this is not the case, all observations for the firm are dropped from the data.

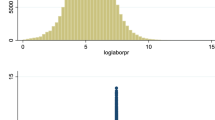

The larger the spread of the distribution of foreign and domestic firms and the smaller the gap between both, the larger the variation across firms in values for the foreign presence variables within an industry.

Averaged over domestic firms within an industry, in 2005 up to 51% (22%) of foreign firms within the industry are foreign firms with a productivity level more than two standard deviations higher (lower) than the focal domestic firm. The average across industries is 10% (5%). Between 1 and 37% (1 and 32%) of foreign firms have a productivity level between one and two standard deviations higher (lower). The average across industries is 19% (12%). Foreign firms with a productivity level up to one standard deviation higher account for between 10 and 41% of foreign firms within an industry (30% averaged over industries), those with a productivity level up to one standard deviation lower account for between 5 and 39% of foreign firms within the industry (24% averaged).

Figures showing only the contribution of statistically significant backward effects are very similar.

This would be observationally equivalent to a situation where foreign firms with higher productivity levels identify industries with more potential for ‘actively and successfully assisting and developing local suppliers’ at low cost. If high quality foreign firms are able to predict productivity evolutions in supplier industries, it is also highly likely that they will be able to discern such possibilities as well.

Geishecker et al. (2009) confirm empirically that firms with affiliates abroad are more productive than those without affiliates.

References

Ackerberg, D., Caves, K., & Frazer, G. (2008). Structural identification of production functions. New York: Mimeo.

Altomonte, C., & Colantone, I. (2008). Firm heterogeneity and endogenous regional disparities. Journal of Economic Geography, 8(6), 779–810.

Amiti, M., & Konings, J. (2007). Trade liberalization, intermediate inputs, and productivity: Evidence from Indonesia. American Economic Review, 97(5), 1611–1638.

Antràs, P., & Helpman, E. (2004). Global sourcing. Journal of Political Economy, 112(3), 552–580.

Arnold, J. M., & Javorcik, B. S. (2009). Gifted kids or pushy parents? Foreign direct investment and plant productivity in Indonesia. Journal of International Economics, 79(1), 42–53.

Barrios, S., Görg, H., & Strobl, E. (2011). Spillovers through backward linkages from multinationals: Measurement matters!. European Economic Review, 55(6), 862–875.

Bloom, N., Schankerman, M., & van Reenen, J. (2013). Identifying technology spillovers and market share rivalry. Econometrica, 81(4), 1347–1393.

Borensztein, E., De Gregorio, J., & Lee, J.-W. (1998). How does foreign direct investment affect economic growth? Journal of International Economics, 45, 115–135.

Bureau van Dijk. (2011). Amadeus database. http://www.bvdinfo.com/Products/Company-Information/International/Amadeus.aspx.

Caves, R. E. (1974). Multinational firms, competition and productivity in host-country markets. Economica, 41(162), 176–193.

Crespo, N., & Fontoura, M. P. (2007). Determinant factors of fdi spillovers—What do we really know? World Development, 35(3), 410–425.

Damijan, J. P., Rojec, M., Majcen, B., & Knell, M. (2013). Impact of firm heterogeneity on direct and spillover effects of FDI: Micro-evidence from ten transition countries. Journal of Comparative Economics, 41, 895–922.

Geishecker, I., Görg, H., & Taglioni, D. (2009). Characterising Euro area multinationals. The World Economy, 32(1), 49–76.

Girma, S. (2005). Absorptive capacity and productivity spillovers from FDI: A threshold regression analysis. Oxford Bulletin of Economics and Statistics, 67(3), 281–306.

Girma, S., Gong, Y., Görg, H., & Lacheros, S. (2015). Estimating direct and indirect effects of foreign direct investment on firm productivity in teh presence of interactions between firms. Journal of International Economics, 95(1), 157–169.

Girma, S., & Görg, H. (2007). The role of the efficiency gap for spillovers from FDI: Evidence from the UK electronics and engineering sectors. Open Economies Review, 18(2), 215–232.

Görg, H., & Greenaway, D. (2004). Much ado about nothing? Do domestic firms really benefit from foreign direct investment? World Bank Research Observer, 19, 171–197.

Gorodnichenko, Y., Svejnar, J., & Terrell, K. (2014). When does fdi have positive spillovers? Evidence from 17 transition market economies. Journal of Comparative Economics, 42(4), 954–969.

Griliches, Z., & Mairesse, J. (1995). Production functions: The search for identification. In NBER Working Papers No. 5067.

Guadalupe, M., Kuzmina, O., & Thomas, C. (2012). Innovation and foreign ownership. American Economic Review, 102(7), 3594–3627.

Harding, T., & Javorcik, B. S. (2011). Roll out the red carpet and they will come: Investment promotion and FDI inlows. The Economic Journal, 121, 1445–1476.

Havranek, T., & Irsova, Z. (2011). Estimating vertical spillovers from FDI: Why results vary and what the true effect is. Journal of International Economics, 85(2), 234–244.

Helpman, E., Melitz, M. J., & Yeaple, S. R. (2004). Exports versus FDI with heterogenous firms. American Economic Review, 94(1), 300–316.

Iacovone, L., Javorcik, B., Keller, W., & Tybout, J. (2015). Supplier responses to Walmart’s invasion of mexico. Journal of International Economics, 95(1), 1–15.

Irsova, Z., & Havranek, T. (2013). Determinants of horizontal spillovers from FDI: Evidence from a large meta-analysis. World Development, 42(C), 1–15.

Javorcik, B. S. (2004). Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. American Economic Review, 94(3), 605–627.

Javorcik, B. S., & Spatareanu, M. (2008). To share or not to share: Does local participation matter for spillovers from foreign direct investment? Journal of Development Economics, 85(1–2), 194–217.

Javorcik, B. S., & Spatareanu, M. (2011). Does it matter where you come from? Vertical spillovers from foreign direct investment and the origin of investors. Journal of Development Economics, 96, 126–138.

Katayama, H., Lu, S., & Tybout, J. (2003). Why plant-level productivity studies are often misleading, and an alternative approach to interference. In Working Paper 9617, NBER.

Keller, W. (1996). Absorptive capacity: On the creation and acquisition of technology in development. Journal of Development Economics, 49(1), 199–227.

Keller, W. (2010). International trade, foreign direct investment, and technology spillovers. Handbook of the Economics of Innovation, 2, 793–829.

Keller, W., & Yeaple, S. R. (2009). Multinational enterprises, international trade, and productivity growth: Firm-level evidence from the United States. Review of Economics and Statistics, 91(4), 821–831.

Kokko, A. (1996). Productivity spillovers from competition between local firms and foreign affiliates. Journal of International Development, 8(4), 517–530.

Lenaerts, K., & Merlevede, B. (2016). Supply chain fragmentation, input-output-tables and spillovers from foreign direct investment. Economic Systems Research, 28(3), 315–332.

Levinsohn, J., & Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. Review of Economic Studies, 70(2), 317–341.

Marin, A., & Bell, M. (2006). Technology spillovers from foreign direct investment (FDI): The active role of MNC subsidiaries in Argentina in the 1990s. The Journal of Development Studies, 42(4), 678–697.

Marin, A., & Sasidharan, S. (2010). Heterogeneous MNC subsidiaries and technological spillovers: Explaining positive and negative effects in India. Research Policy, 39(9), 1227–1241.

Markusen, J. R. (1995). The boundaries of multinational enterprises and the theory of international trade. Journal of Economic Perspectives, 9(2), 169–189.

Merlevede, B., Schoors, K., & Spatareanu, M. (2014). FDI spillovers and time since foreign entry. World Development, 56, 108–126.

Meyer, K. E., & Sinani, E. (2009). When and where does foreign direct investment generate positive spillovers? Journal of International Business Studies, 40(7), 1075–1094.

Moulton, B. R. (1990). An illustration of a pitfall in estimating the effects of aggregate variables on micro units. Review of Economics and Statistics, 72(2), 334–338.

Olley, S. G., & Pakes, A. (1996). Dynamics of productivity in the telecommunications equipment industry. Econometrica, 64(6), 1263–1297.

Pauwels, S., & Ionita, L. (2008). FDI in Romania: From low-wage competition to higher value-added sectors. ECFIN Country Focus, 5(3), 1–6.

RSO. (2005). Statistical Yearbook, Bucharest, Romania. Technical report, Romanian Statistical Office

Sjöholm, F. (1999). Technology gap, competition and spillovers from direct foreign investment: Evidence from establishment data. The Journal of Development Studies, 36(1), 53–73.

UNCTAD. (2003). World investment directory. Technical report, United Nations Conference on Trade and Development.

WIIW. (2007). Industrial Database Eastern Europe, Vienna, Austria. Technical report, Vienna Institute for International Economic Studies

Acknowledgements

The authors acknowledge financial support of the Research Foundation - Flanders (FWO-Vlaanderen).

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

About this article

Cite this article

Lenaerts, K., Merlevede, B. Indirect productivity effects from foreign direct investment and multinational firm heterogeneity. Rev World Econ 154, 377–400 (2018). https://doi.org/10.1007/s10290-017-0298-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-017-0298-9