Abstract

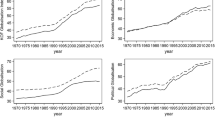

Using data for 113 countries covering the period 1980–2005 we show how international comparisons of income inequality and the way it changes over time are inherently sensitive to (i) the choice of multilateral price index formula used to convert per capita incomes into units of the same currency, (ii) the approach (if any) used for reconciling spatial benchmarks with national growth rates, and (iii) the way inequality is measured. We then consider how best to deal with these issues and highlight some distortions that can arise in such comparisons. Based on our preferred methods we observe convergence when countries are population weighted and divergence when they are not.

Similar content being viewed by others

Notes

The International Panel on Climate Change (IPCC), for example, has been heavily criticized for using market exchange rates in the construction of its projections for carbon dioxide emissions (see Castles and Henderson 2004). Assumptions about future rates of convergence also have a critical impact on these projections. PPP—exchange rates are used by the World Bank in its World Development Indicators and in comparisons of regional and global poverty, by the United Nations in its Human Development Index, by the World Health Organization (WHO) and United Nations Scientific and Cultural Organization (UNESCO) in international comparisons of health and education respectively (see Rao 2013), and by the International Monetary Fund (IMF) in its World Economic Outlook and for computing its special drawing rights (SDRs)—which determine budget contributions and voting power (see Silver 2010).

The newest version of PWT 8.0 provides two sets of results, one based on extrapolation of the latest benchmark and the other that uses all the benchmarks (see Feenstra et al. 2013).

Some other widely used measures such as the Atkinson index and generalized entropy indexes with \(\alpha \ne 2\) cannot be derived in this way.

A number of other decisions in addition to the choice of multilateral price index formula have to be made when calculating PPP exchange rates. These include the treatment of sectors of the economy where market prices may not be available (such as government services, health and education) and more generally how one constructs the basic heading prices and expenditures over which the price index is defined in the first place. See Deaton and Heston (2010) for a survey of some of these issues.

As noted in Sect. 1, the path dependency arises mainly from changes in methodology between benchmarks and differences in budget shares across countries.

Here we do not consider paths via third countries.

The reason for using market exchange rates for comparing incomes in (11) is that they are given exogenously. Replacing market exchange rates with endogenous PPP-exchange rates would very significantly complicate the model. The overall results are not invariant to the choice of base country j in (11). In the empirical comparisons, the US is used as the base. We experiment with some alternative base countries and found that the choice of base has only a marginal impact, and certainly does not affect the general thrust of our findings.

It is not straightforward to compare our benchmark averaging method empirically with the Rao et al. (2010) method since they only provide time-series results for a few specific countries and do not consider the impact of their method on global inequality.

The Atkinson index and generalized entropy index with \(\alpha \ne 2\) cannot be represented in this way.

It may be better in (19) to divide by \(K(K-1)\) rather than by \(K^2\) since by construction the K dissimilarity indexes on the lead diagonal equal zero. Given however that the Gini index is typically calculated by dividing by \(K^2\) we follow the same approach here.

It is straightforward to show that \(d^A\) and \(d^B\) satisfy all seven axioms. Regarding A6, the second derivatives of \(d^C\) and \(d^E\) equal zero. So these indexes satisfy concavity but not strict concavity. In this sense their violation of A6 is not as bad as that of \(d^D\). That \(d^E\) violates A7 can be demonstrated as follows: \(d^E(y_1/\bar{y},1) = (1/2)|y_1/\bar{y} - 1/\bar{y}|\). Similarly, \(d^E(y_2/\bar{y},1) = (1/2)|y_2/\bar{y} - 1/\bar{y}|\). Now assuming that \(y_1/\bar{y} = \bar{y}/y_2\), it follows that \(d^E(y_2/\bar{y},1) = (1/2)|\bar{y}/y_1 - 1/\bar{y}| \ne d^E(y_1/\bar{y},1)\) except in the special case where \(y_1 = y_2 = \bar{y}\). It can be shown in an analogous way that \(d^D\) also violates A7.

\(\delta ^C\) does, however, have an intuitive interpretation in that it measures the average per capita income differential across the set of countries. For example, a value of 7 implies that, on average, the richer of a pair of countries has a per capita income 7 times that of the poorer country.

This asymmetry in the treatment of higher and lower income countries by the Gini coefficient has been previously noted by Blackorby and Donaldson (1978), although from a different perspective that does not involve dissimilarity indexes.

Maddison’s data set can be downloaded from http://www.ggdc.net/maddison/. Updates and further extensions can be found at the Groningen Growth and Development Centre website: http://www.ggdc.net/Dseries/totecon.html.

The spatial benchmark data for 1980 and 1985 can be downloaded from http://pwt.econ.upenn.edu/Downloads/benchmark/benchmark.html.

The overall trend at the aggregate level can mask differing patterns within different market sectors (e.g., high and low tech industries). See for example Stehrer and Wörz (2003).

Our selection was determined by our focus on dispersion measures that can be derived from bilateral dissimilarity indexes.

We interpret this as evidence that \(\delta ^D\) is an erratic measure of dispersion. We return to this issue shortly.

This is true even in 1996 where the headings are much more aggregated (i.e., there are only 31), and hence the substitution effect should be less pronounced. Using Engel curves for food, Almås (2012) finds that Geary–Khamis PPP-exchange rate comparisons very significantly underestimate per capita income differences across countries. She attributes this finding to a combination of substitution bias and quality bias. The quality bias arises from the fact that superficially similar products tend to be of better quality in richer countries than in poorer countries, and that PPP-exchange rate methods fail to fully account for these quality differences. This quality bias should apply just as much to GEKS and ECLAC as to Geary–Khamis. Almås’s finding has interesting implications. First, it suggests that ECLAC might be preferable to Geary–Khamis and GEKS on the grounds that the substitution and quality biases in ECLAC partially offset each other. Second, it raises the possibility that it might be preferable to use market-exchange rates rather than PPP-exchange rates. This is an issue that clearly warrants further investigation.

References

Aizenman, J., & Jinjarak, Y. (2006). Globalization and developing countries—A shrinking tax base? (NBER Working Paper 11933).

Almås, I. (2012). International income inequality: Measuring PPP bias by estimating engel curves for food. American Economic Review, 102(2), 1093–1117.

Balassa, B. (1964). The purchasing power parity doctrine: A reappraisal. Journal of Political Economy, 72(6), 584–596.

Baumol, W. J., Blackman, S. A. B., & Wolff, E. N. (1989). Productivity and American leadership: The long view. Cambridge and London: MIT Press.

Bhagwati, J. N. (1984). Why are services cheaper in the poor countries? The Economic Journal, 94(374), 279–286.

Blackorby, C., & Donaldson, D. (1978). Measures of relative equality and their meaning in terms of social welfare. Journal of Economic Theory, 18(1), 59–80.

Castles, I., & Henderson, D. (2004). Economics, emissions scenarios and the work of the IPCC. Energy and Environment, 14(4), 415–435.

de la Fuentes, A. (1997). The empirics of growth and convergence, a selective review. Journal of Economic Dynamics and Control, 21(10), 23–73.

Deaton, A., & Heston, A. (2010). Understanding PPPs and PPP-based national accounts. American Economic Journal: Macroeconomics, 2(4), 1–35.

Diewert, W. E. (1976). Exact and superlative index numbers. Journal of Econometrics, 4(2), 115–145.

Diewert, W. E. (1999). Axiomatic and economic approaches to international comparisons. In A. Heston & R. E. Lipsey (Eds.), International and interarea comparisons of income (pp. 13–87). Chicago: Output and Prices, NBER, University of Chicago Press.

Diewert, W. E. (2002). Similarity and dissimilarity indexes: An axiomatic approach. (Discussion Paper 02-10). Vancouver, Canada: Department ofEconomics, University of British Columbia.

Diewert, W. E. (2009). Similarity indexes and criteria for spatial linking. In D. S. P. Rao (Ed.), Purchasing power parities of currencies: Recent advances in methods and applications, Chap 8 (pp. 183–216). Cheltenham: Edward Elgar.

Dowrick, S., & Akmal, M. (2005). Contradictory trends in global income inequality: A tale of two biases. Review of Income and Wealth, 51(2), 201–229.

ECLAC (Economic Commission for Latin America and the Caribbean) (1978). Series Históricas del Crecimento de AméricaLatina, Cuadernos Estadisticos de la CEPAL 3, Santiago de Chile.

Eltetö, O., & Köves, P. (1964). On a problem of index number computation relating to international comparison. Statisztikai Szemle, 42, 507–518.

Feenstra, R. C., Inklaar, R., & Timmer, M. (2013). The next generation of the Penn World Table. (NBER Working Paper 19255).

Firebaugh, G. (1999). Empirics of world income inequality. American Journal of Sociology, 104(6), 1597–1630.

Geary, R. G. (1958). A note on the comparison of exchange rates and PPPs between countries. Journal of the Royal Statistical Society, Series A, 121(1), 97–99.

Gerschenkron, A. (1951). A dollar index of soviet machinery output, 1927–28 to 1937. Santa Monica, CA: Rand Corporation.

Gini, C. (1931). On the circular test of index numbers. International Review of Statistics, 9(2), 3–25.

Grier, K., & Grier, R. (2007). Only incomes diverge: A neoclassical anomaly. Journal of Development Economics, 84(1), 25–45.

Heston, A., Summers, R., & Aten, B. (2009) Penn World TableVersion 6.3, Center for International Comparisons of Production, Income and Prices at the University of Pennsylvania.

Hill, R. J. (1997). A taxonomy of multilateral methods for making international comparisons of prices and quantities. Review of Income and Wealth, 43(1), 49–69.

Hill, R. J. (2000). Measuring substitution bias in international comparisons based on additive purchasing power parity methods. European Economic Review, 44(1), 145–162.

Hill, R. J. (2004). Constructing price indexes across space and time: The case of the European union. American Economic Review, 94(5), 1379–1410.

Hillebrand, E. (2008). The global distribution of income in 2050. World Development, 36(5), 727–740.

Johnson, S., Larson, W., Papageorgiou, C., & Subramanian, A. (2013). Is newer better? Penn World Table revisions and their impact on growth estimates. Journal of Monetary Economics, 60(2), 255–274.

Khamis, S. H. (1972). A new system of index numbers for national and international purposes. Journal of the Royal Statistical Society, Series A, 135(1), 96–121.

Kravis, I. B., & Lipsey, R. E. (1983). Toward an explanation of national price levels. Princeton studies in international finance, No. 52 Princeton: Princeton University Press.

Maddison, A. (1987). Growth and slowdown in advanced capitalist economies: Techniques of quantitative assessment. Journal of Economic Literature, 25(2), 649–698.

Maddison, A. (2001). The world economy: A millennial perspective. Paris: OECD.

Neary, J. P. (2004). Rationalizing the Penn World Table: True multilateral indices for international comparisons of real income. American Economic Review, 94(5), 1411–1428.

Neary, J. P., & Gleeson, B. (1997). Comparing the wealth of nations: Reference prices and multilateral real income indexes. Economic and Social Review, 28(4), 401–421.

Neumayer, E. (2003). Beyond income: Convergence in living standards, big time. Structural Change and Economic Dynamics, 14(3), 275–296.

Nuxoll, D. A. (1994). Differences in relative prices and international differences in growth rates. American Economic Review, 84(5), 1423–1436.

OECD (2002). Purchasing power parities and real expenditures: 1999 benchmark year. Paris: Organization for Economic Co-operation and Development.

Pritchett, L. (1997). Divergence: Big time. Journal of Economic Perspectives, 11(3), 3–17.

Rao, D.S.P. (2013). The framework of the international comparison program, Chap. 1. In Measuring the real size ofthe world economy: The framework, methodology and results of theinternational comparisons program (pp. 13–46). ICP Global Office, World Bank: Washington DC.

Rao, D. S. P., Rambaldi, A., & Doran, H. (2010). Extrapolation of purchasing power parities using multiple benchmarks and auxiliary information: A new approach. Review of Income and Wealth, 56(Special Issue 1), S59–S98.

Rogoff, K. (2009). Exchange rates in the modern floating era: What do we really know? Review of World Economics/Weltwirtschaftliches Archiv, 145(1), 1–12.

Sala-i-Martin, X. (2006). The world distribution of income: Falling poverty and ... convergence, period. Quarterly Journal of Economics, 121(2), 351–397.

Samuelson, P. A. (1964). Theoretical notes on trade problems. Review of Economics and Statistics, 46(2), 145–154.

Silver, M. (2010). IMF applications of purchasing power parity estimates. (IMF Working Paper WP/10/253). Washington, DC: International Monetary Fund.

Stehrer, R., & Wörz, J. (2003). Technological convergence and trade patterns. Review of World Economics/Weltwirtschaftliches Archiv, 139(2), 191–219.

Summers, R. (1973). International price comparisons based upon incomplete data. Review of Income and Wealth, 19(1), 1–16.

Summers, R., & Heston, A. (1988). A new set of international comparisons of real product and price level estimates for 130 countries, 1950–1985. Review of Income and Wealth, 34(1), 1–25.

Summers, R., & Heston, A. (1991). The Penn World Table (Mark 5): An expanded set of international comparisons, 1950–1988. Quarterly Journal of Economics, 106(2), 327–368.

Szulc, B. (1964). Indices for multiregional comparisons. Przeglad Statystyczny 3 Statistical Review, 3, 239–254.

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank Erwin Diewert, Alan Heston, and an anonymous referee for helpful comments, and the World Bank for providing our data. The views expressed here are those of the authors and do not necessarily represent those of the World Bank.

Appendices

Appendix 1: Weighted least squares estimation of our active benchmark averaging model

We assume for simplicity that we have complete data (i.e., that is all countries are present in all benchmarks and have complete temporal data). The extension to the case where there is incomplete data is immediate and just involves removing the relevant rows of the various vectors and matrices.

The full model can be written in matrix notation as follows:

where

Here \(\mathbf{\ln P_{jk|t}}\) is a column vector of spatial price indexes with country j as the base for benchmark t and \(\mathbf{\ln P_{k|st}} - \mathbf{\ln P_{j|st}}\) is a column vector of differences between the temporal price indexes of countries j and k from year s to t, again with j as the base. These price indexes are related to the spatial parameters of interest by the matrix \(\mathbf{X}\). The \(\mathbf{X}\) matrix is itself constructed from component \(\mathbf{D}\) matrices, each of which is a diagonal matrix of ones with dimension \(K \times K\) (where K is the number of countries in the benchmark). The first four rows in the \(\mathbf{X}\) matrix as written above relate to the spatial price index Eq. (9) for the four benchmarks, while the last three rows relate to the Eqs. (16)–(18) which measure the differences across countries in temporal price indexes calculated over the time interval between adjacent benchmarks.

Given this model we use the following weighted-least-squares estimator for the spatial parameter coefficients:

The error covariance matrix \(\hat{\varvec{\Sigma }}\) is diagonal with the terms on the lead diagonal obtained from the spatial and temporal variance Eqs. (11) and (12). We iterate between the estimation of (30) and using the regression residuals, conditional on the current value of \(\hat{{\alpha }}\), to model the variance function shown in Eqs. (11) and (12). The predictions from the variance model are inverted and used as weights in \(\hat{\varvec{\Sigma }}\). Convergence occurs when there is a suitably small change in \(\hat{{\alpha }}\).

Appendix 2: Derivation of the underlying dissimilarity indexes of dispersion measures A, D and E

The variance of log per capita income can be written as follows:

The implicit dissimilarity index underlying the standard deviation of log per capita income is therefore

As it stands, this dissimilarity index violates the symmetry axiom A4. However, taking the sum of \(d(y_{jt},y_{kt})\) and \(d(y_{kt},y_{jt})\) as defined in (31) we obtain the log quadratic dissimilarity index \(d^A\) defined in (21). It follows that

Hence \(\sigma _t = \sqrt{{\delta }^A_t/2}\). In other words, the standard deviation of log per capita income is an increasing monotonic function of \({\delta }^A\).

The square of the coefficient of variation of per capita income can likewise be rewritten as follows:

The implicit dissimilarity index underlying the coefficient of variation of per capita income therefore is

Taking the sum of \(d(y_{jt},y_{kt})\) and \(d(y_{kt},y_{jt})\) as defined in (32) we obtain the dissimilarity index \(d^D\) defined in (24). It follows that:

Hence \(\sigma _t/\mu _t = \sqrt{{\delta }^D_t/2}\). In other words, the coefficient of variation of per capita income is an increasing monotonic function of \({\delta }^D\). Similarly, given that GE(2) = \((\sigma /\mu )^2/2\) it follows that GE(2) = \(\delta _t^D/4\), where GE(2) is the generalized entropy index with \(\alpha =2\).

The Gini index can be written as follows:

Appendix 3

See Table 4.

About this article

Cite this article

Hill, R.J., Melser, D. Benchmark averaging and the measurement of changes in international income inequality. Rev World Econ 151, 767–801 (2015). https://doi.org/10.1007/s10290-015-0229-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-015-0229-6

Keywords

- Multilateral price index

- International comparisons program

- Penn World Table

- Substitution bias

- Spatiotemporal consistency

- Benchmark averaging

- Dissimilarity index