Abstract

We use market data to reconstruct the volatility adjustment, a component of the Solvency II framework designed to mitigate the impact of market risk on insurance liabilities, of different countries on a monthly basis. Only partially in agreement with the regulation, we observe that the volatility adjustment, especially the proposed new mechanism, is not affected by credit quality, illiquidity of bonds, and investors’ risk appetite, but by turbulence in financial markets and equity market performance. We also show that the new mechanism proposed by EIOPA performs differently with respect to the one in force at the time of writing the current paper, yielding higher and smoother values and providing a relief to insurance companies on the Solvency II capital requirement front.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this paper, we investigate the functioning of the volatility adjustment (VA) mechanism. The VA is a component of the Solvency II framework designed to mitigate the impact of market risk on insurance liabilities, particularly for long-term products with guarantees. Under Solvency II, insurance companies are required to calculate the solvency capital requirement (SCR), which represents the amount of capital that they must hold to meet their obligations to policyholders. The VA is applied to the risk-free interest rates used in the calculation of the SCR. It adds an adjustment to the risk-free rates to neutralize the impact of exaggerations of corporate spreads (volatility not justified by fundamentals), having the purpose to strike a balance between the need for insurers to hold adequate capital for financial stability while also considering market exaggerations dealing with illiquid liabilities. We analyze the VA as it is in force at the time of writing the current paper, and according to the mechanism proposed by EIOPA (see European Insurance and Occupational Pensions Authority (2015) and European Insurance and Occupational Pensions Authority (2020c)), respectively. The goal is to describe its functioning, to investigate its capability to meet the expectations of the regulation and its effect on the Solvency II capital requirement of an insurance company.

The Solvency II framework builds on market consistent evaluation of assets and liabilities of insurance companies. In order to cope with the volatility of the best estimate of liabilities (BEL), insurance companies are allowed to correct the discounting interest rate curve by adding the VA. The VA aims to translate into the discounting risk free rate curve the component of the spread of bonds detained by insurance companies which is not associated with fundamentals and therefore with the credit quality of bonds. Recital 32 of the Omnibus II Directive (European Parliament 2014) states that in order to prevent pro-cyclical investment behavior, insurance and reinsurance undertakings should be allowed to adjust the relevant risk-free interest rate term structure for the calculation of the best estimate of technical provisions to mitigate the effect of exaggerations of bond spreads. Recently, Gatzert and Heidinger (2020) emphasized that European insurance companies using adjustment measures as the VA react differently to solvency and financial condition reports. For a theoretical analysis of liabilities valuation of insurance companies considering an illiquidity premium in the Solvency II framework, see Gambaro et al. (2018), Gambaro et al. (2019), Jørgensen (2018), Van den Broek (2014), Wuthrich (2011); for asset-liability management, see Duarte et al. (2017), Hainaut et al. (2018), Mezőfi et al. (2017). For market consistent evaluation of liabilities, see also Barigou et al. (2022), Delong et al. (2019).

Managing portfolios of assets and liabilities is an important action undertaken by an insurer in order to deal with potential losses. The risk management system shall cover the risks to be included in the calculation of the solvency capital requirement defined in the Solvency II framework, and the VA is a key measure to ensure the appropriate treatment of insurance products with long-term guarantees in this framework. We refer to Olivieri and Pitacco (2015, Chapter 2) and Pitacco (2020) for details on the risk factors that materialize in an insurance company. In this paper, we deal only with market risk but the framework can be directly extended to a context where longevity risk is included (see, for example, Olivieri and Pitacco (2003)).

The functioning of the VA has been discussed from many angles. In particular, the following issues have been pointed out (see European Insurance and Occupational Pensions Authority (2019b)): The impact of VA may over/under-shoot the effect of spread exaggerations on the asset side because of asset allocation, credit quality, duration mismatches of insurance companies; the application of VA does not take into account illiquidity of liabilities; cliff effect for the country-specific component impedes a smooth management of the solvency capital ratio; misestimation of risk correction of VA; VA is almost always positive, it is not symmetric and therefore does not provide resilience build up in good times; the relationship between the assumptions underlying the VA and the goals pursued by the regulation is not made explicit. In our analysis we shed some light on these topics that are key issues to manage capital according to Solvency II regulation.

The functioning of the VA went under scrutiny along with the revision of Solvency II regulation. The European Commission asked EIOPA for a technical advice on the review of the Solvency II directive (see European Commission (2019)). EIOPA sent out a consultation document on October 15th, 2019 (see European Insurance and Occupational Pensions Authority (2019b)), and published its proposal of revision of Solvency II in 2020 with a proposal for the VA (see European Insurance and Occupational Pensions Authority (2020b), European Insurance and Occupational Pensions Authority (2020c)).

In this paper, we reconstruct the monthly VA time series for eighteen countries. We provide descriptive statistics and we analyze the functioning of the in force VA and of the one proposed by EIOPA. To investigate the capability of the VA mechanism to meet the expectations of the regulation, we analyze the relationship between the VA and some economic and financial variables; to evaluate the effects of the VA on the Solvency II capital position we simulate the effect of the VA on BEL and Own Funds (OF) of a representative insurance company through an asset-liability exercise.

We compare the new proposal of the VA to the one currently in force performing a backward analysis. The new mechanism is smoother (less erratic and less reactive to crisis periods) but its magnitude on average is higher. The variability of the VA for the two countries that went under pressure during the Euro crisis (Italy and Greece) is much higher with the new mechanism than with the one currently in force.

As far as the variables affecting the VA are concerned, we show mixed results. First of all, in agreement with the regulation, there is no evidence that the VA is affected by the default risk of a country. Moreover, it turns out that both formulations of the VA are positively affected by the level of turbulence in financial markets, and not by changes of risk aversion (risk appetite). On the other hand, at odds with the regulation, we observe that the proposed VA is not affected by the illiquidity of government bond markets, while the in force mechanism is negatively affected by it. Moreover, both VA types are negatively affected by the equity market performance, which can be considered as a proxy of fundamentals. From a practical point of view, identifying the factors affecting the VA, this analysis provides a hint for risk managers of insurance companies to perform hedge accounting on the VA contribution.

As far as the effect of the VA on the BEL and OF is concerned, we observe that the effect associated with the proposed VA is larger than the one associated with the VA in force in all countries, i.e., the difference in one and five years between asset values and BEL turns to be higher (almost equal for Czech Republic, Poland, Spain, and UK) and less variable. We can conclude that the new mechanism represents an improvement for insurance companies on the Solvency II capital requirement front as it provides on average a higher discounting factor for BEL (and capital surplus). However, variability of the balance sheet for weak countries under the proposed mechanism is higher than under the actual one. The effect of the VA mechanism on the capital front is weakly related to maturity mismatch between assets and liabilities showing weak evidence of over/under-shooting of the mechanism (in particular for the proposed VA).

The paper is organized as follows. In Sect. 2, we describe the functioning of the VA as it is currently in force and according to the proposal by EIOPA. We also outline the methodology to compute the main components of the VA and provide a descriptive analysis. In Sect. 3 we investigate the determinants of the VA. A simulation of the effect of the VA on the present value of liabilities and OF is presented in Sect. 4.

2 The volatility adjustment mechanism

In what follows, we describe how the VA mechanism works according to the regulation in force and to the proposal of reform put forward by EIOPA.Footnote 1

The VA is a long-term guarantees (LTG) measure. LTG measures were introduced in the Solvency II Directive 1 through the Omnibus II Directive 2 to ensure an appropriate treatment of insurance products that include long-term guarantees.

The VA should reflect “exaggerations of bond spreads.” Exaggerations are interpreted as changes of bond prices that are not associated with default changes, and therefore they mostly refer to market movements attributable to liquidity changes in the market. Thanks to the VA mechanism, the OF of an insurance company should not be affected by nonfundamental/temporary changes of bond prices: by adding the portion of the spread observed in bond prices not related to fundamental risks (risk-corrected spread) to the liability discount rate, the anomalous market movements on the asset side should be reflected in the computation of the BEL and, therefore, OF movements should not reflect exaggerations of bond prices. The rationale of this measure is that being the liabilities illiquid, their evaluation should not incorporate temporary market movements on the asset side.

The VA as it is in force was introduced in European Insurance and Occupational Pensions Authority (2015). It is provided by the combination of two components: a component related to the currency and one related to the country, currency and country VA, respectively. In both cases, the VA is based on the spread of a representative portfolio corrected for risk (SRC). In order to avoid tailor-made capital requirements, the SRC refers to portfolios representative of undertakings holding obligations denominated in a specific currency (reference portfolio for that currency) or sold in a country and denominated in the currency of the country (reference portfolio for that country) and not to specific undertakings’ portfolios. Both SRCs are given by the spread of the portfolio at currency/country level corrected for a risk correction which depends on the long-term average of the spread for government bonds and on a combination of the long-term average spread, the probability of default and the expected loss due to a downgrade for corporate bonds. These quantities aim to capture fundamental risks of bonds. The country VA component is activated if the SRC at country level is above a threshold and is larger than the double of the SRC for the currency area. In 2019, the European Parliament approved a change on the threshold for the country-specific component of the VA (from the original one, i.e., 100 basis points, to 85 basis points), the new threshold became effective in January 2020.

The functioning of the VA went under scrutiny along with the revision of Solvency II regulation. The European Commission asked EIOPA for a technical advice on the review of the Solvency II directive (see European Commission (2019)). The advice concerned two main features of the VA: the application of an adjustment that takes into account the illiquidity features and/or the duration of insurers’ liabilities (different application ratios maintaining the representative portfolios approach); the application of an adjustment that takes into account the weights of own assets holdings of each insurer. In addition, EIOPA was asked to review the functioning of the increased VA per country and suggest amendments to the measure where necessary.

EIOPA sent out a consultation document on October 15, 2019, with the goal of addressing the main issues (see European Insurance and Occupational Pensions Authority (2019b)). EIOPA identified the following main objectives that can be attributed to the VA: prevent procyclical investment behavior; mitigate the impact of exaggerations of bond spreads on OF; recognize illiquidity characteristics of liabilities in the valuation of technical provisions. In 2020, EIOPA published its proposal of revision of Solvency II with a proposal for the VA (see European Insurance and Occupational Pensions Authority (2020b), European Insurance and Occupational Pensions Authority (2020c)). The new mechanism modifies the previous one on several aspects maintaining the reference to a representative portfolio rather than to insurance companies’ portfolios. The main novelties are the following: a) a smooth activation mechanism for the country component is introduced; b) duration/illiquidity mismatches are taken into account; c) risk correction is made dependent on the actual spread value.

In what follows, we technically introduce the currently in force and the proposed VA. The Matlab code to compute both VAs is available in the supplementary materials.

2.1 The mechanism currently in force

For each country, the current VA is made up of two components: the currency VA (\(\textrm{VA}_\textrm{cu}\)) and the country VA (\(\textrm{VA}_\textrm{co}\)). The first component is defined as

where \(\textrm{SRC}_\textrm{cu}\) is the risk-corrected currency spread which is defined as

\(S_\textrm{cu}\) is the currency spread and \(\textrm{RC}_\textrm{cu}\) is the risk correction computed according to the reference portfolio associated with that currency. The \(65\%\) ratio comes from regulation with no sound technical motivation.

The \(\textrm{VA}_\textrm{co}\) is computed as

where the risk-corrected country spread \(\textrm{SRC}_\textrm{co}\) is defined as in the currency case for a country-specific reference portfolio.

The current VA is computed as

Hence, the VA is equal to \(\textrm{VA}_\textrm{cu}\) if \(\textrm{SRC}_\textrm{co}\le S^L\) and \(\textrm{VA}_\textrm{cu}+\textrm{VA}_\textrm{co}\) otherwise. Notice that, as already said, the activation threshold changed in 2020 from \(S^L=1\%\) to \(S^L=0.85\%\).

The VA relies on the computation of the SRC. The risk-corrected spread is calculated as the difference between the spread of the representative portfolio and the risk correction. The risk correction is described in the Omnibus II Directive as the portion of the spread that is attributable to a realistic assessment of expected losses, unexpected credit risk or any other risk, of the assets in the reference portfolio. The risk correction aims to capture fundamental risk and, therefore, the risk corrected spread should represent the component associated with exaggerations. In case of \(\textrm{SRC}_\textrm{cu}\), the two quantities are defined as follows

where \(S_\textrm{cu}^{\cdot +}\equiv \max \{S_\textrm{cu}^{\cdot }, 0\}\) and \(\textrm{RC}_\textrm{cu}^{\cdot +}\equiv \max \{\textrm{RC}_\textrm{cu}^{\cdot }, 0\}\), and

-

\(w_\textrm{cu}^\textrm{gov}\) is the weight of the value of government bonds, loans and securitizations included in the reference portfolio for that currency;

-

\(w_\textrm{cu}^\textrm{corp}\) is the weight of the value of bonds other than government bonds, loans and securitizations included in the reference portfolio for that currency;

-

\(S_\textrm{cu}^\textrm{gov}\) is the average spread on government bonds, loans and securitizations included in the reference portfolio for that currency;

-

\(S_\textrm{cu}^\textrm{corp}\) is the average spread on bonds other than government bonds, loans and securitizations included in the reference portfolio for that currency;

-

\(\textrm{RC}_\textrm{cu}^\textrm{gov}\) is the risk correction corresponding to the \(S_\textrm{cu}^\textrm{gov}\) component that is attributable to a realistic assessment of the expected losses, unexpected credit risk or any other risk;

-

\(\textrm{RC}_\textrm{cu}^\textrm{corp}\) is the risk correction corresponding to the \(S_\textrm{cu}^\textrm{corp}\) component.

The reference portfolio for a currency shall be representative for the bonds denominated in that currency that are detained by undertakings to cover the BEL for insurance and reinsurance obligations denominated in that currency. The weights of the reference portfolios are defined by EIOPA. During the sample, they have been changed five times: on September 2016, March 2018, March 2019, March 2020, and March 2021. As detailed in Appendix A, the calculations for \(S_\textrm{cu}^\textrm{gov}\), \(S_\textrm{cu}^\textrm{corp}\), \(\textrm{RC}_\textrm{cu}^\textrm{gov}\), and \(\textrm{RC}_\textrm{cu}^\textrm{corp}\) are based on the discrepancies in internal rate of returns (IRRs) of a portfolio of zero coupon bonds (zcbs), with each bond corresponding to an element of the representative portfolio. To be more specific, the spread (S) is evaluated as the difference between the IRR computed using zcb prices obtained exploiting the market interest rate curve, and the IRR related to zcb prices calculated through the risk-free curve. In the context of risk correction (RC), the risk-free curve is substituted with the risk-corrected curve, i.e., the market curve minus the risk correction (see Appendix A for details). The risk correction for each government bond belonging to the reference portfolio is given by 30% of the LTAS, if the bond issuer belongs to the EURO area, and 35% otherwise, while for each corporate bond it is defined as

where:

-

LTAS is the long-term (30 years) average of the spread over the risk-free interest rate of assets of the same duration, credit quality and asset class;

-

PD is the credit spread corresponding to the probability of default of the assets;

-

CoD is the credit spread corresponding to the expected loss resulting from downgrading of the assets.

PD and CoD spreads are calculated by projecting defaults and credit downgrades over time using a transition matrix with fixed assumptions for the recovery rate of bonds on default, and scaling factors used to calculate the cost of downgrades. The transition matrix is based on data obtained from Standard & Poor’s from 1987 onward and is hence a long-term average that is updated annually. LTAS, PD and CoD are all provided by EIOPA.

At country level, the country spreads (\(S_\textrm{co}, \,S_\textrm{co}^\textrm{gov}, \,S_\textrm{co}^\textrm{corp}\)), risk corrections (\(\textrm{RC}_\textrm{co}, \,\textrm{RC}_\textrm{co}^\textrm{gov},\) \(\textrm{RC}_\textrm{co}^\textrm{corp}\)) and risk-corrected spreads (\(\textrm{SRC}_\textrm{co}\)) are computed in a similar way with respect to a country reference portfolio which is representative of the assets detained by undertakings to cover the BEL associated with products sold in the insurance market of that country and denominated in the currency of that country.

Note that \(\textrm{SRC}_\textrm{cu}\) and \(\textrm{SRC}_\textrm{co}\) are two different quantities: The first one refers to assets detained by insurance companies to cover obligations denominated in that currency, the latter to assets detained by insurance companies to cover obligations sold in the insurance market of that country and denominated in the currency of that country. For a non-Euro country (e.g., UK), the difference is given by the possibility that insurance companies doing business in another country hold obligations in the currency of that country. The difference is particularly relevant for Euro area countries because the representative portfolio for the Euro (which is common to all countries belonging to the Euro area) mirrors investment of insurance companies toward liabilities denominated in Euro, and therefore, companies from all the countries in the Euro area are considered, instead the representative portfolio of a specific country belonging to the Euro (e.g., Belgium) only considers the assets held to cover obligations denominated in Euro associated with business activity in that country. For these countries, the country-specific add on to the risk corrected spread (multiplied for 65%) for the Euro area reflects turbulence of that specific country. The activation is driven by two barriers: the country risk corrected spread is more than 100 basis points and is higher than twice the risk corrected spread at currency level. The rationale being that the nonfundamental risk component at country level should be high both in absolute term and in relative term with respect to the nonfundamental risk component at currency level. The two barriers generate an erratic activation of country-specific component rendering very difficult to manage the capital position of an insurance company. This is one of the main reason for the revision of the mechanism.

Notice that the VA only applies to risk-free interest rates of the term structure that are not derived through the extrapolation technique. The VA shall not be applied with respect to insurance obligations where the relevant risk-free interest rate term structure to calculate the BEL for those obligations includes a matching adjustment.

2.2 The proposal

The proposed VA consists of a permanent VA that can be increased by a macroeconomic VA which provides a country specific increase triggered whenever the country risk-corrected spread is higher than both an absolute and a relative threshold. We introduce the proposed mechanism (see European Insurance and Occupational Pensions Authority (2020b), European Insurance and Occupational Pensions Authority (2020c)), adopting the notation of the above subsection only when a variable is defined in the same way.

The main novelties are: new definition of currency VA, which becomes the permanent VA (\(\textrm{VA}_\textrm{perm}\) in what follows); new definition of risk correction; gradual activation of the country-specific VA (\(\textrm{VA}_\textrm{macro}\) in what follows); introduction of company-specific parameters to cope with duration mismatches and illiquidity characteristics of liabilities.

The permanent VA is computed as follows

where

-

GAR is the general application ratio which is set at \(85\%\) instead of \(65\%\) as in the currently in force mechanism;

-

AR\(_4\) denotes the application ratio 4;

-

AR\(_5\) denotes the application ratio 5;

-

Scale\(_\textrm{cu}=\frac{1}{w^\textrm{gov}_\textrm{cu}+w^\textrm{corp}_\textrm{cu}}\);

-

RC\(_\textrm{Scu}\) denotes the risk-corrected spread of the representative portfolio for currency cu (\(\textrm{SRC}_\textrm{cu}\) in (2) according to the current formulation).

Note that Scale\(_\textrm{cu}\) allows for a full normalization of the portfolio while the in force formulation does not take care of the fact that \(w^\textrm{gov}_{\cdot }\) and \(w^\textrm{corp}_{\cdot }\) don’t sum up to 1. The reference portfolio for a specific currency is defined as for the mechanism actually in force. AR\(_4\) and AR\(_5\) are company specific parameters that account for mismatches in the fixed income asset and insurance liabilities in respect of duration and volume and for the illiquidity characteristics of liabilities in the valuation of technical provisions, respectively. The two ratios have been introduced to address the requests of revision by the European Commission about illiquidity of reserves and maturity mismatches.

As in the mechanism currently in force, \(\textrm{RC}_\textrm{Scu}\) is defined as

where \(S_\textrm{cu}\) and \(\textrm{RC}_\textrm{cu}\) are defined as in (5) and (6), and therefore are all computed as differences of internal rate of returns of a portfolio of zero coupon bonds (see Appendix A). The novelty is provided by the computation of the risk-corrected interest rate curve, necessary to obtain \(\textrm{RC}_\textrm{cu}^\textrm{gov}\) and \(\textrm{RC}_\textrm{cu}^\textrm{corp}\), where, for each government bond in the European Economic Area (EEA) of the representative portfolio, the risk correction becomes

while for government bonds not in the EEA and corporate bonds it is

where S is the spread, i.e., the difference between the market interest rate and the risk-free curves associated to the considered asset of the representative portfolio, computed in its duration. As above, LTAS is the long-term (30 years) average of the spread over the risk-free interest rate of assets of the same duration, credit quality and asset class.

Comparing (7) with (11), we notice that the two main novelties in the computation of the risk correction with respect to the in force VA mechanism are that the probability of default and the cost of downgrade do not appear anymore in the risk correction of the interest rate curve and that the risk correction directly depends on the spread.

Regarding the country-specific component (\(\textrm{VA}_\textrm{macro}\)), the proposed approach follows European Insurance and Occupational Pensions Authority (2019b, pages 146-147, section 2.481):

where Scale\(_\textrm{co}=\frac{1}{w^\textrm{gov}_\textrm{co}+w^\textrm{corp}_\textrm{co}}\), \(R=1.3\) and w being defined as

\(S^L=0.6\%\), and \(S^H=0.9\%\). RC\(_\textrm{Sco}\) is defined as in (9) and risk corrections as in (10) and (11) referring to the country portfolio.

Notice that two conditions should be verified for the activation of the macro-(country-specific) component: The risk correction at country level is higher than 60 basis points and not 85 or 100 as in the mechanism in force, the risk correction for the country representative portfolio is higher than 1.3 the risk correction for the currency representative portfolio instead of 2 as in the mechanism in force. Therefore, conditions for the activation of the macro/country-specific component are milder than for the mechanism in force. The weight w is designed to have a smooth activation. In the mechanism in force we have a strong nonlinearity (cliff effect) due to the absolute and relative hurdle, the proposed mechanism foresees a linear activation when the 60 basis point threshold is triggered with full activation when the risk correction triggers 90 basis points.

The formula of the VA to be compared to (4) becomes

where \(\textrm{VA}_\textrm{perm}\) and \(\textrm{VA}_\textrm{macro}\) are defined respectively in (8) and (12).

2.3 Descriptive analysis

We reconstruct the VA of eighteen countries according to the two methodologies described above: \(\textrm{VA}_\textrm{cur}\) and \(\textrm{VA}_\textrm{prop}\) as in (4) and (13), respectively. We deal with twelve countries with Euro as currency: Austria (AT), Belgium (BE), Germany (DE), Finland (FI), France (FR), Greece (GR), Ireland (IE), Italy (IT), Netherlands (NL), Portugal (PT), Slovakia (SK), and Spain (ES).Footnote 2 We also consider some non-Euro countries: Bulgaria (BG), Czech Republic (CZ), Hungary (HU), Poland (PL), Sweden (SE), and UK. The sample is made up of monthly observations for the time span November 30th, 2015–December 31st, 2021 (74 observations).Footnote 3 On the effects of the VA on the Solvency II capital requirement ratio at market level, see European Insurance and Occupational Pensions Authority (2016), European Insurance and Occupational Pensions Authority (2017), European Insurance and Occupational Pensions Authority (2018), European Insurance and Occupational Pensions Authority (2019a), European Insurance and Occupational Pensions Authority (2019b), European Insurance and Occupational Pensions Authority (2020a).

We consider the VA as it is in force with a \(S^L=1\%\) threshold (see (4)) and with a \(0.85\%\) threshold for \(\textrm{SRC}_\textrm{co}\). We also consider the VA as defined in (13), setting AR\(_4=1\), and AR\(_5\) according to European Insurance and Occupational Pensions Authority (2020c, Figure Illiquidity application ratios per jurisdiction, page 856).Footnote 4 We recall that AR\(_4\) is a company-specific parameter accounting for mismatches in the fixed income assets and insurance liabilities in respect of duration and volume. We set it equal to 1, i.e., its maximum value, for lack of data on company specific information (durations and volumes of assets and liabilities, and future discretionary benefits, e.g., company loss-absorbing capacity of technical provisions).

In Table 1, we report the countries (number of months) for which \(\textrm{VA}_\textrm{co} >0\), and \(\textrm{VA}_\textrm{co}\) (1% and 0.85% threshold) or \(\textrm{VA}_\textrm{macro}\) were activated (\(\textrm{VA}_\textrm{cur}\ne \textrm{VA}_\textrm{cu}\), or \(\textrm{VA}_\textrm{prop}\ne \textrm{VA}_\textrm{perm}\)), i.e., countries for which the country specific VA component was activated. For all the other countries not shown in Table 1, \(\textrm{VA}_\textrm{co}\) and \(\textrm{VA}_\textrm{macro}\) were always equal to zero.

Concentrating on the current mechanism, we observe that the number of months with activation of \(\textrm{VA}_\textrm{co}\) decreases as the threshold on \(\textrm{SRC}_\textrm{co}\) increases (from 0 to \(0.85\%\) and then \(1\%\)), as expected. However, the backward simulation shows that moving from the 1% to the 0.85% threshold does not significantly impact the activation of the country-specific component. In both cases, Greece and Italy are the only countries with a positive impact of the \(\textrm{VA}_\textrm{co}\) on the \(\textrm{VA}_\textrm{cur}\).

We remark that the set of (country-month) observations such that \(\textrm{VA}_\textrm{co}>0\) and \(\textrm{SRC}_\textrm{co} > 0.85\%\), i.e., both the conditions necessary for the activation of the country-specific component, corresponds to the set of (country-month) observations showing \(\textrm{SRC}_\textrm{co} > 0.85\%\), i.e., the trigger on the activation of the country component of the in force VA is the threshold on \(\textrm{SRC}_\textrm{co}\) and not the positiveness of \(\textrm{VA}_\textrm{co}\) (risk corrected spread at country level greater than twice the risk corrected spread at currency level). The same holds true for the 1% threshold.

We observe that \(\textrm{VA}_\textrm{macro}\) in (12) is positive in 73 (country-month) observations, and therefore in these cases the country-specific component affects the total \(\textrm{VA}_\textrm{prop}\). On the other hand, the 100 basis points threshold significantly reduces the observations in which the country component is activated in the current VA (from 162 cases to 11 observations). This evidence shows that the country-specific component \(\textrm{VA}_\textrm{macro}\) in (12) is activated more frequently than the current mechanism \(\textrm{VA}_\textrm{co}\) in (3).

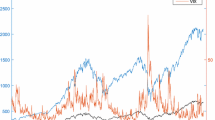

In Fig. 1, we provide a state-by-state comparison between the in force VA (\(\textrm{VA}_\textrm{cur}\)) and the VA from the EIOPA’s proposal (\(\textrm{VA}_\textrm{prop}\)), while in Table 2 we report the mean values and the variances of \(\textrm{VA}_\textrm{cur}\) and \(\textrm{VA}_\textrm{prop}\) obtained by computing them for the time span November 30, 2015, to December 31, 2021. The proposed VA provides higher mean values with respect to the one in force in seventeen countries and smaller variances in fourteen countries (out of eighteen). Notice that the variability of the VA for the two countries that went under pressure during the Euro crisis (Italy and Greece) is much higher with the new mechanism than with the mechanism currently in force.

To investigate the statistical significance of mean and variance differences according to the two mechanisms, we use the paired t-test and the Levene’s test, respectively. The latter, compared to other tests, is not highly sensitive to deviations from the normality assumption of the data (see Brown and Forsythe (1974)).Footnote 5 From Table 3, we observe that we fail to reject the null hypothesis of equal means in seven countries while we fail to reject the null hypothesis of equal variances in thirteen out of the eighteen countries at a significance level of \(5\%\). In the last two columns of Table 3 we also present the correlation between \(\textrm{VA}_\textrm{cur}\) and \(\textrm{VA}_\textrm{prop}\) and the p-value of the test with the null hypothesis of zero correlation between the two measures.Footnote 6 The evidence shows a statistically significant high correlation for the two measures computed state by state, except for Hungary, Italy and Portugal. Similar results are obtained replacing the correlation between the VA levels obtained for the two mechanisms with the correlation of their monthly variations.

From this descriptive analysis we can conclude that the new mechanism is smoother but its magnitude is higher in most of the countries. Therefore, the new mechanism represents an improvement for insurance companies on the Solvency II capital requirement front as it provides on average a higher and less variable discounting factor for BEL allowing to meet capital requirements in a smoother way.

3 Time series analysis

In what follows, we conduct a time series analysis to investigate whether the VA is effective in capturing exaggerations of bond spreads that are not associated with the credit quality of bonds. We concentrate our analysis on \(\textrm{VA}_\textrm{cur}\) and \(\textrm{VA}_\textrm{prop}\) on a monthly basis considering the eighteen countries in Sect. 2. We consider the VA as dependent variable (Y) in the following dynamic panel:

where \(\epsilon _t \sim N(0,1)\). \(X_t\) is a vector of exogenous variables that include both country specific and global factors.Footnote 7

As country-specific factors, we consider:

-

equity: equity market index monthly return;

-

vol30: 30 days implied volatility of the equity market index (interpolated 30 days annualized implied volatility of the underlying index using index option prices);

-

yield10y: yield of 10 years government bonds;

-

yield10y_1y: difference of 10 years and 1 year yield of government bonds (term premium);

-

cds5: 5 years credit default spread of government bonds;

-

Bid_ask10y: bid-ask spread of 10 years government bonds;

-

Ec_sent: indicator of economic sentiment.

As global factors we include:

-

VIX: implied volatility index;

-

BAA_AAA spread: yield difference between BAA and AAA rated bonds in the US market;

-

Eurostoxx: 30 days historical volatility of the EUROSTOXX 50 Index;

-

Iboxx: 30 days historical volatility of the the IBOXX Euro Corporates Index. This index represents investment grade fixed-income bonds issued by public or private corporations.

According to Dornbush et al. (2000), there are fundamentals-based and investor behavior-based determinants of yield bonds. Looking at exaggerations in bond markets we have to look inside the second class of factors, in fact regulation suggests that exaggerations should refer to components of the yield rate that are not related to credit quality. Among them, the most relevant one is market illiquidity. The standard measure of market illiquidity is provided by the bid-ask spread. Unfortunately, this measure is available only for government bonds (Bid_ask10y) and not for corporate bonds at market level. Note that there is large evidence that this variable is positively associated to bond-yield spreads (see Afonso et al. (2015), Afonso and Jalles (2019), Beber et al. (2009), De Santis (2012), Favero (2013), Favero et al. (2010), Giordano et al. (2013)); we want to ascertain whether the bid-ask spread of government bonds also positively affects the risk corrected spread and the VA as the regulation requires.

To capture investor behavior determinants, we consider the economic sentiment of the country (Ec_sent) (see Galariotis et al. (2016), Georgoutsos and Migiakis (2013), Gomez-Puig et al. (2014)). This variable reflects people perceptions of economic growth rather than fundamentals. The literature has shown that this variable amplifies economic and public finance fundamentals mostly in peripheral countries of the Euro area and in crisis periods, therefore, we expect this variable to positively affect the VA, according to the regulation.

As an indicator of risk in global financial markets (not related to fundamentals of a specific country), we consider the VIX, which has been widely employed in the literature on the determinants of credit spreads of government bonds in particular after the financial crisis (see Afonso et al. (2015), Afonso and Jalles (2019), Arghyrou and Kontonikas (2012), Beirne and Fratzscher (2013), De Santis (2012), Favero et al. (2010), Galariotis et al. (2016), Gerlach et al. (2010), Giordano et al. (2013), Gomez-Puig et al. (2014)). A positive and statistically significant effect has been detected in the literature. As this variable is built on the implied volatility of the S &P 500, it provides a forward measure and a good proxy of global turbulence in financial markets. As alternative measures of risk at the global level, we consider the historical volatility of the Eurostoxx (Eurostoxx) and of the IBOXX Euro Corporates Index (Iboxx). As a local measure of risk at country level, we consider the implied volatility of the stock market (vol30). Georgoutsos and Migiakis (2013), Gomez-Puig et al. (2014) show that stock volatility positively affects bond spreads. Being volatility indicators not strictly related to fundamentals, we expect both local and global measure of risk to positively affect the VA.

As in Favero (2013), Georgoutsos and Migiakis (2013), Gomez-Puig et al. (2014), we capture the general investors’ risk aversion through the difference between the yield of BAA corporate bonds and AAA corporate bonds in the United States (BAA_AAA spread). This variable doesn’t capture a fundamentals-based determinant, it rather captures investors’ preferences, its interpretation according to the regulation is not obvious as we can interpret it as a changes of preferences or as an increase in risk aversion due to extreme events. As a consequence, we make no guess about its effect on VA, in case it should be positive.

Turning to fundamentals-based variables, according to the regulatory design, the VA should be orthogonal to the yield component related to credit quality of bonds, i.e., the probability of default and the expected loss. As shown in Beber et al. (2009), Longstaff et al. (2005), Monfort and Renne (2014), Schwarz (2019), a good proxy of the default risk is provided by the credit default spread. This information is only available for government bonds (cds5) and only partially for corporate bonds at market level, making difficult to compute it for each country’s corporate bonds representative portfolio. As we include this variable, we omit to consider the credit rating as explanatory variable. In our analysis, we do not include variables reflecting public finance fundamentals (public debt/GDP) and real economy performance (GDP, industrial production growth rate), or expectations on them, because they are not available on a monthly basis. The performance of the economy is considered including the equity return of the national stock exchange (equity). Georgoutsos and Migiakis (2013) show that there is a negative relationship between equity returns and spread movements, Gerlach et al. (2010) provide mixed evidence. We can interpret this variable as a market indicator of fundamentals of the economy, but we can not exclude that financial markets over/under-react to the performance of the economy. Therefore, market return should not affect the VA but we may not completely rule out this possibility in case of inefficient markets.

We control for the level of interest rate (yield10y) and the term premium (yield 10y_1y). The term premium is usually associated with inflation expectations; however, in the Euro area it has also been affected by the rebalancing of portfolios with significant outflows from weak countries and by the Asset Purchase Programme of the European Central Bank which mostly affected the short-term portion of the curve. Therefore, a steep curve can also be interpreted as evidence of flight to quality and tensions (exaggerations) in the market (see Altavilla et al. (2014), Blattner and Joyce (2016), Cœuré (2018)).

In Table 4, we report the regressions of the monthly VA (\(\textrm{VA}_\textrm{cur}\) and \(\textrm{VA}_\textrm{prop}\)) on its lagged value and one of the above variables. We evaluate model specification through the Arellano and Bond (ar2p) test (Arellano and Bond 1991) for residual autocorrelation and focus on its p-value (the null hypothesis is that there is no autocorrelation in the residuals). The results show that both the current and the proposed VA are affected by the above variables. Notice that the models including cds5 in both cases and including the VIX for \(\textrm{VA}_\textrm{cur}\) are not well specified as residuals are autocorrelated (ar2p is below 0.1).

In Tables 5 and 6, we provide a multivariate regression on \(\textrm{VA}_\textrm{cur}\) and \(\textrm{VA}_\textrm{prop}\). We have selected the variables evaluating them according to the Arellano and Bond test for residual autocorrelation. Notice that any model having the credit default swap rate of government bonds (cds5) as exogenous variable does not pass the test (ar2p is below 0.1). This evidence does not contrast with the regulation which requires the VA not to reflect risk factors/credit quality of assets.

Notice that the illiquidity measure (Bid_ask10y) negatively affects the \(\textrm{VA}_\textrm{cur}\) (with a statistically significant coefficient) and is not statistically significant for \(\textrm{VA}_\textrm{prop}\). To meet the tasks of the regulation we should observe a positive statistically significant coefficient for this variable while the evidence shows the opposite. It seems that the illiquidity component of bond spreads is captured by the risk correction factor rendering VA not sensitive to this feature. As far as country-specific factors are concerned, we observe that the volatility of the equity market and the equity market return are statistically significant in all the regressions with a positive and a negative coefficient, respectively. The first result is aligned with the tasks identified by the regulation, instead the latter is against them unless we trust the market inefficiency hypothesis.

Considering global factors, we observe that the VA is not sensitive (when volatility is inserted) to changes in risk aversion (BAA_AAA) and is positively related to a forward global measure of risk (VIX) in some specifications of the model. Notice that VIX is a global turbulence indicator, i.e., it is based on the US stock market, and therefore it is not strictly related to economic fundamentals of European countries. This result suggests that VA is sensitive to global financial risk which has been shown to drive bond spreads in crisis periods and therefore this evidence can be positively interpreted in light of the regulation.

As far as yield rate variables are concerned, it turns out that \(\textrm{VA}_\textrm{prop}\) is positively affected both by the long-term yield rate (yield10y) and by the term premium (yield10y_1y). Instead, \(\textrm{VA}_\textrm{cur}\) is positively affected by the yield rate and no effect is associated with the term premium. It is difficult to interpret these results in light of the regulation. An interpretation in agreement with the regulation is that a surge of the long-term bond rate or of the steepness of the curve in weak countries is due to market tensions and to the fly to quality phenomenon. Some evidence in this direction is available for European countries also with respect to asset purchase programmes by Central Banks (see Beber et al. (2009), Cœuré (2018)).

The last two specifications include the economic sentiment. The variable enters with a positive coefficient but the models don’t pass the residual autocorrelation test, and therefore, results are not worthwhile of comments.

4 Asset-liability simulations

In what follows, we provide a simulation analysis of the effect of \(\textrm{VA}_\textrm{cur}\) and \(\textrm{VA}_\textrm{prop}\) on the balance sheet of a country-representative insurance company.

For each country, we consider a representative insurance company facing liabilities and investing in a portfolio of bonds. As reference date we choose December 31st, 2021. We assume that the company faces liabilities having a bell-shape mimicking the liabilities of an insurance company (see Biffis 2014, for example) with discounted value, computed according to the EIOPA national risk-free curve (without VA), equal to 100 million Euros (see Fig. 2 for an example). The duration of the liabilities is that of a representative company of the country as reported in European Insurance and Occupational Pensions Authority (2019c) (see Table 7). More precisely, for each country the bell shape is modeled assuming that the outflows as a function of maturity can be described through the function

where t is the maturity (in years), \(\alpha _0\) is a positive parameter set to match the 100 million Euros present value, while \(\alpha _1,\alpha _2\) are positive parameters chosen to match the required duration, maintaining the desired bell-shape.

As far as the asset side is concerned, we assume that the company holds a portfolio with market value equal to 100 million Euros. The weights and durations of the components of the portfolio for a given country are those of the VA country representative portfolio provided by EIOPA, considering both government and corporate bonds. The durations of these representative portfolios are reported in Table 8.

The goal is to analyze the effect of the VA on the balance sheet of the company after one and five years starting from an equilibrium condition (assets and liabilities having a discounted value of 100 million Euros). To this end, we have to deal with the following quantities for each country: government and corporate bonds to calibrate and then simulate the values of the asset portfolio; risk-free bonds, \(\textrm{SRC}_\textrm{co}\), and \(\textrm{SRC}_\textrm{cu}\) (RC\(_\textrm{Sco}\) and \(\textrm{RC}_\textrm{Scu}\) for the proposal), to calibrate and then simulate the quantities related to liabilities’ discounting. The risk-free rate curve is provided by EIOPA, from which we compute zero coupon risk-free bond prices. As far as risk-free, government and corporate bonds are concerned, we calibrate Vasicek models from bonds prices. For \(\textrm{SRC}_\textrm{co}\) and \(\textrm{SRC}_\textrm{cu}\) we provide a maximum likelihood estimation of Vasicek models from time series. Notice that insurance companies of a country hold government bonds of many countries and therefore for each country we calibrate as many Vasicek models for government bonds spot rates as the number of countries that populate the portfolios of insurance companies. As far as corporate bonds is concerned, we calibrate a Vasicek model for financial and nonfinancial corporations depending on the credit quality.Footnote 8 The reason to estimate/calibrate a Vasicek model is that it is well suited to capture the dynamics of interest rates allowing for mean reversion and negative rates and is manageable enough to obtain closed form solutions for bond prices, an important step to calibrate the parameters from market data.

More precisely, the Vasicek model for the process x(t) is

We observe that the process is a mean reverting model: \(\lambda \) is the speed of mean reversion, \(\mu \) is the long-term mean, and \(\sigma \) is the volatility, \((W(t))_{t\ge 0}\) denotes a Wiener process. First of all, we exploit the Vasicek model with x(t) describing the \(\textrm{SRC}_\textrm{co}\) and \(\textrm{SRC}_\textrm{cu}\) (\(\textrm{RC}_\textrm{Sco}\) and RC\(_\textrm{Scu}\) for the proposal) for each country; we estimate the Vasicek parameters via a maximum likelihood procedure, using the available monthly data. As an example, dealing with \(x(t)=\textrm{SRC}_\textrm{co}(t)\), given the time series of the risk-corrected spread \(\textrm{SRC}_\textrm{co}(t_0)\), i.e., November 2015, \(\ldots \), \(\textrm{SRC}_\textrm{co}(t_N)\), i.e., December 2021, we define the log-likelihood function as

f being the conditional probability density of an observation at time \(t_i\) given the previous observation at time \(t_{i-1}\) with a monthly time-step. To estimate the Vasicek model, we identify the parameters \(\mu ,\,\lambda ,\,\sigma \) that maximize the log-likelihood function. Given that the conditional probability density for the Vasicek model is normal, there exist analytical formulas that allow to calibrate the parameters (see Fergusson and Platen (2015)).

We also exploit the Vasicek model to describe rate dynamics, that is x(t) in Equation (14) corresponds to the risk-free spot rates, and to spot rates of government and corporate bonds; in this case, for the calibration, we exploit the analytical formula to price zero coupon bonds in the Vasicek model, see Proposition 21.4 in Björk (2019), matching model to market prices on the reference date, that is, December 31st, 2021, that is, we minimize the function

\(P_\textrm{mkt}(t_i)\) (\(P_\textrm{mod}(t_i)\)) being the market (model) price of a zero coupon bond with maturity \(t_i\), for different maturities \(t_1,\cdots ,t_L\). We highlight the fact that x(0) is an output of the calibration, as we only observe the market bond prices at different maturities, but not the spot rate \(x(t),\, t\ge 0\). The setting is different from the previous case in which the Vasicek model is used, for example, to simulate \(\textrm{SRC}_\textrm{co}\). As a matter of fact, in that case x(0), i.e., the value of \(\textrm{SRC}_\textrm{co}\) at the reference date, is known.

We compute the correlations from historical values of \(\textrm{SRC}_\textrm{co}\), and \(\textrm{SRC}_\textrm{cu}\), as well as from historical values of zero coupon bonds of all the risk-free, government and corporate bonds, with time to maturity equal to the duration of the corresponding government/corporate bonds held in the representative portfolio of the insurance company. As far as the risk-free curve is concerned, we consider the duration of the whole asset portfolio.

Given the estimated correlation matrix, we exploit Cholesky decomposition to simulate correlated Wiener processes, and therefore correlated Vasicek models,Footnote 9 to analyze the expected value and the variance of the difference between assets (bonds portfolio) and discounted value of liabilities (in millions), with and without the VA. More precisely, once all the Vasicek models are simulated, we are able to compute for each simulation the value of the bonds portfolio, as well as the risk-free curve and the VA (computed through the simulated risk-corrected spreads) to discount liabilities. We would like to stress that VA only enters in discounting liabilities. Notice that the estimation procedure, as well as the evaluation of assets, is under the risk-neutral probability measure.

In Tables 9 and 10, we report the expected values and the variances of the difference between the asset values and the discounted values of the liabilities after one and five years. Along the path of simulated spot rates, asset values are computed using no arbitrage pricing formulas. In Table 11 we show the probability that the country (macro) component will enter into the definition of the VA with a positive contribution. These quantities are computed empirically using simulated values for bond spot rates and for risk corrected spreads.

We observe that the adoption of the VA leads to an increase, with respect to the no VA case, in the expected value of the difference between assets and discounted value of liabilities in all countries. The only exception is Bulgaria. Notice that Bulgaria is the only country with a negative value for the \(\textrm{VA}_\textrm{cur}\) for 32 months over 74 observations, see Fig. 1, negative values of the VA are also observed in our simulations driving the negative gain. The proposed VA has an effect larger than the VA in force in most of the cases, with the exception of Czech Republic, Poland, Spain and UK, for which we obtain similar results. Analyzing the data presented in Table 9, when calculating the mean difference between the values derived from the utilization of \(\textrm{VA}_\textrm{prop}\) and those from \(\textrm{VA}_\textrm{cur}\) across all countries, it turns out that the proposed approach yields an average effect of 0.59 (millions) in the context of the one-year scenario and 0.62 in the five-year scenario, when compared to the existing mechanism in place. These results are in line with Fig. 1 which shows that the proposed VA is usually higher than the VA in force for most of the countries with the above-cited exceptions.

Asset-liabilities duration mismatch and VA benefit (the expected difference for simulations at 2026 between assets and discounted liabilities considering the VA—in force and proposal—as in Table 9 minus the expected difference without the VA): VA in force (left-hand side) and proposed VA (right-hand side)

One of the main concerns with the VA mechanism is that its benefit may depend on the business model rewarding companies holding liabilities with a long duration compared to the assets. If this is the case, the VA mechanism would overshoot the target. To investigate this issue, in Fig. 3 we report two pictures on the expected asset-liability gain associated with the VA in force and the proposed one toward the duration mismatch. The duration mismatch is provided by the duration of liabilities minus the one of the assets, and the gain associated with VA is given by the expected difference for simulations at 2026 (2025 for UK) between assets and discounted liabilities considering the VA (in force and proposal) as in Table 9 minus the expected difference without the VA. As an example, for Austria the benefit associated with the VA proposal is given by 2.32\(-\)(\(-\) 0.30)=2.62. We also report the line obtained by performing a cross-section linear regression with 18 observations: the slope coefficient is positive both for \(\textrm{VA}_\textrm{cur}\) (0.070) and \(\textrm{VA}_\textrm{prop}\) (0.090) even if the significativity is low as the R-square of the regression is 0.161 (0.169) for the in force (proposed) VA and the p-value for the slope coefficient is 0.099 (0.090). These pictures show that there is a positive correlation between the mean value of the difference between assets and discounted liabilities and the maturity mismatch between assets and liabilities as reported in Tables 7 and 8. The positive relationship provides evidence that insurance companies benefit from the VA mechanism in case the liabilities have a larger duration than the assets (maturity mismatch). A positive duration gap is inherent to the insurance business, in particular to life business, but the VA mechanism may provide incentives for insurance companies to sell products with a long duration (over-shooting effect). However, the evidence seems to be rather limited.

In Table 10, we observe that both VA mechanisms usually increase the variance of the difference between assets and discounted liabilities with respect to the no VA case for Euro countries, especially for the proposed one where the macrocomponent is not null in a large number of simulations of some countries, i.e., Greece, Italy, Portugal (see Table 11). This result shows that although the VA in force causes excess volatility because of cliff effects associated with the activation of the country-specific component, the proposed VA mechanism leads to a higher variability in the balance sheet.

Finally, in line with the results presented in Table 1, from Table 11 we observe that the (risk-neutral) probability that the country-specific component will enter into the definition of the proposed VA is much higher than in the current VA mechanism; however, it is nonnegligible only for Greece, Italy, Portugal and Spain.

These results suggest that the VA (in particular the proposed one) improves the capital requirement positions of insurance companies with a positive delta in the difference between assets and discounted liabilities with respect to the case without VA. Variability of the asset-liability position (and therefore of the capital requirement position) increases, especially in case of the activation of the country-specific component (weak countries).

5 Conclusions

In this paper, we have analyzed the VA currently in force and the VA proposed by EIOPA from different perspectives.

As far as the capability of the VA mechanism to accomplish the requests of the regulation capturing exaggerations in financial markets is concerned, we show mixed results. It turns out that both formulations of the VA are positively affected by the level of turbulence in financial markets that is not strictly related to fundamentals and not by changes of investors’ risk appetite. On the other hand, at odds with the regulation, we observe that the proposed VA is not affected by the illiquidity of government bond markets, while the in force mechanism is negatively affected by it and that both are affected by the equity market return which can be considered as a proxy of fundamentals. From a practical point of view, identifying the factors that affect the VA, the analysis opens to the possibility to perform a hedge accounting on the VA contribution.

The proposed VA provides higher mean values with respect to the current mechanism in seventeen countries over eighteen and a smaller variance in most of the countries. The new mechanism is smoother (less reactive in crisis periods) and its magnitude on average is higher. As far as the effect of the VA on the BEL and OF is concerned, we observe that the proposed VA mechanism has an effect larger than the one obtained with the current VA in all countries (almost equal in four countries), i.e., the difference between asset values and BEL turns to be higher, providing a relief to insurance companies on the capital requirement front. The average effect over all countries is approximately 0.6% of the discounted value of liabilities both on the one and five years of scenarios. However, variability of the balance sheet for weak countries under the proposed mechanism is higher than under the actual one. The effect of the VA mechanism on the capital front is weakly related to maturity mismatch between assets and liabilities showing weak evidence of over/under-shooting of the mechanism. Summarizing, the new mechanism, providing higher values, should help insurance companies to meet their capital requirements, instead the evidence on its capability to render a smoother constraint makes it less erratic, but also less reactive to crisis periods.

Notes

Article 77d of the Solvency II Directive specifies the calculation of the VA. This specification is further detailed the Delegated Regulation, specifically in Article 49-51.

We did not consider Cyprus, Estonia, Latvia, Lithuania, Malta, Slovenia for missing values on the bond market.

The methodology employed to compute the VA mechanism currently in force is validated performing a backtesting on a monthly basis with respect to the data reported by EIOPA. We did not use data referring to the period before November 2015 as in that time frame EIOPA considered a different specification of the country representative portfolio with weights of the currency component being equal to those of the country component.

We report the AR\(_5\) values considered in the analysis: AT 0.74, BE 0.71, CZ 0.48, DE 0.76, ES 0.46, FI 0.91, FR 0.73, GR 0.78, HU 0.61, IE 0.58, IT 0.69, NL 0.72, PL 0.57, PT 0.83, SE 0.79, SK 0.49, UK 0.54. For Bulgaria, we set AR\(_5=0.6\).

The test statistic for the paired samples t-test is \(t={{\bar{y}}_\textrm{diff}}/{\left( \frac{s_\textrm{diff}}{\sqrt{n}}\right) }\) where \({\bar{y}}_\textrm{diff}\) and \(s_\textrm{diff}\) are respectively the sample mean and the sample standard deviation of the differences. If the computed t-value is greater than a critical value (obtained as a quantile of a Student-t distribution with \(n-1\) degrees of freedom) for a chosen level of significance \(\alpha \) we reject the null hypothesis of equal means. This two-sided test is implemented in the Matlab function ttest. The Levene’s test statistic W is defined as \({ W={\frac{(n-k)}{(k-1)}} {\frac{\sum _{i=1}^{k}n_{i}(Z_{i\cdot }-Z_{\cdot \cdot })^{2}}{\sum _{i=1}^{k}\sum _{j=1}^{n_{i}}(Z_{ij}-Z_{i\cdot })^{2}}},}\) where k denotes the number of different groups, \(n_{i}\) is the number of cases in the i-th group, n is the total number of observations, \(Y_{{ij}}\) is the j-th case from the i-th group, \( Z_{ij}=|Y_{ij}-{{\bar{Y}}}_{i\cdot }|,\) where \({{\bar{Y}}}_{i\cdot }\) is the mean of the i-th group, \(Z_{i\cdot }=\frac{1}{n_i}\sum _{j=1}^{n_{i}}Z_{ij}\) is the mean of the \(Z_{ij}\) for group i \(Z_{\cdot \cdot }=\frac{1}{n}\sum _{i=1}^{k}\sum _{j=1}^{n_{i}}Z_{ij}\) is the mean of all \(Z_{ij}\). W is tested against a quantile of the F-distribution with \(k-1\) and \(N-k\) degrees of freedom for a the chosen level of significance. This two-sided test is implemented in the Matlab function vartestn.

The test statistic considered is \(t={\rho }/{\sqrt{\frac{1-\rho ^2}{n-2}}}\), where \(\rho \) is the correlation coefficient. The computed statistics should be compared with the critical value obtained as a quantile of a \(\chi ^2_{n-2}\) distribution once fixed a level of confidence \(\alpha \). The p-value of the two-sided test can be easily obtained as an output of the Matlab function corrcoef.

All the data are obtained from Refinitiv. We used the R package pdynmc introduced in Fritsch et al. (2021) under R version 4.0.3.

We simplify the analysis excluding bonds with weights smaller or equal to 1%, and we do not consider corporate bonds with rating equal or worse than BB, due to the lack of market data for calibration. As an illustrative example, for Germany we have (a) 10 government bonds, e.g., AT with weight 5% and duration 13.5, and BE with weight 9% and duration 17; (b) 8 corporate bonds - class AAA, AA, A and BBB from the financial industry, class AAA, AA, A and BBB from the nonfinancial industry, e.g., class AAA bonds from the financial industry with weight \(40\%\) and duration 8.6. The VA UK representative portfolio is not defined from March 31st, 2021. Therefore for UK, we consider as reference date December 31st, 2020.

For Germany, we have 10 government bonds, 8 corporate bonds, as well as the \(\textrm{SRC}_\textrm{co}\) and the \(\textrm{SRC}_\textrm{cu}\) and the risk-free rate; therefore, the correlation matrix is a 21\(\times \)21 matrix.

References

Afonso, A., Arghyrou, M.G., Kontonikas, A.: The determinants of sovereign bond yield spreads in the EMU, European Central Bank working paper, No. 1781 (2015)

Afonso, A., Jalles, J.T.: Quantitative easing and sovereign yield spreads: euro-area time-varying evidence. J. Int. Financ. Mark. Inst. Money 58, 208–224 (2019)

Altavilla, C., Giannone, D., Lenza, M.: The financial and macroeconomic effects of OMT announcements, European Central Bank working paper, No. 1707 (2014)

Arellano, M., Bond, S.: Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 58(2), 277–297 (1991)

Arghyrou, M.G., Kontonikas, A.: The EMU sovereign-debt crisis: fundamentals, expectations and contagion. J. Int. Financ. Mark. Inst. Money 22, 658–677 (2012)

Barigou, K., Bignozzi, V., Tsanakas, A.: Insurance valuation: a two-step generalised regression approach. ASTIN Bull. 52(1), 211–245 (2022)

Beber, A., Brandt, M., Kavajecz, K.: Flight-to-quality or flight-to-liquidity? Evidence from the Euro-area bond market. Rev. Financ. Stud. 22, 925–957 (2009)

Beirne, J., Fratzscher, M.: The pricing of sovereign risk and contagion during the European sovereign debt crisis. J. Int. Money Financ. 34, 60–82 (2013)

Biffis, E.: Pricing of life insurance liabilities. In: Balakrishnan, N., Colton, T., Everitt, B., Piegorsch, W., Ruggeri, F., Teugels, J.L. (eds.) Wiley StatsRef: Statistics Reference Online (2014)

Blattner, T., Joyce, M.: Net debt supply shocks in the Euro area and the implications for QE, European Central Bank working paper, No. 1957 (2016)

Björk, T.: Arbitrage Theory in Continuous Time. Oxford University Press, Oxford (2019)

Brown, M.B., Forsythe, A.B.: Robust tests for the equality of variances. J. Am. Stat. Assoc. 69(346), 364–367 (1974)

Cœuré, B.: Speech at the Financial Times European Financial Forum. Building a New Future for International Financial Services, Dublin (2018)

Delong, Ł, Dhaene, J., Barigou, K.: Fair valuation of insurance liability cash-flow streams in continuous time: applications. ASTIN Bull. 49(2), 299–333 (2019)

De Santis, R.A.: The Euro Area sovereign debt crisis: safe haven, credit rating agencies and the spread of the fever from Greece, Ireland and Portugal, ECB Working Paper, No. 1419 (2012)

Dornbush, R., Park, Y.C., Claessens, S.: Contagion: understanding how it spreads. World Bank Res. Obs. 15, 177–198 (2000)

Duarte, T.B., Valladão, D.M., Veiga, Á.: Asset liability management for open pension schemes using multistage stochastic programming under Solvency-II-based regulatory constraints. Insur. Math. Econ. 77, 177–188 (2017)

European Commission: Request to EIOPA for technical advice on the review of the Solvency II directive, Directive 2009/138/EC (2019)

European Parliament: Directive 2014/51/EU (2014)

European Insurance and Occupational Pensions Authority: Technical documentation of the methodology to derive EIOPA’s risk-free interest rate term structures (2015)

European Insurance and Occupational Pensions Authority: Report on long-term guarantees measures and measures of equity risk 2016 (2016)

European Insurance and Occupational Pensions Authority: Report on long-term guarantees measures and measures of equity risk 2017 (2017)

European Insurance and Occupational Pensions Authority: Report on long-term guarantees measures and measures of equity risk 2018 (2018)

European Insurance and Occupational Pensions Authority: Report on long-term guarantees measures and measures of equity risk 2019 (2019a)

European Insurance and Occupational Pensions Authority: Consultation paper on the Opinion on the 2020 review of Solvency II (2019b)

European Insurance and Occupational Pensions Authority: Report on insurers’ asset and liability management in relation to the illiquidity of their liabilities (2019c)

European Insurance and Occupational Pensions Authority: Report on long-term guarantees measures and measures of equity risk 2020 (2020a)

European Insurance and Occupational Pensions Authority: Opinion on the 2020 review of Solvency II (2020b)

European Insurance and Occupational Pensions Authority: Background document on the opinion on the 2020 review of Solvency II (2020c)

Favero, C.A.: Modelling and forecasting government bond spreads in the Euro area: a GVAR model. J. Econom. 177, 343–356 (2013)

Favero, C.A., Pagano, M., von Thadden, E.-L.: How does liquidity affect government bond yields? J. Financ. Quant. Anal. 45, 107–134 (2010)

Fergusson, K., Platen, E.: Application of maximum likelihood estimation to stochastic short rate models. Ann. Financ. Econ. 10(2), 1550009 (2015)

Fritsch, M., Pua, A., Schnurbus, J.: pdynmc: a package for estimating linear dynamic panel data models based on nonlinear moment conditions. R J. 13(1), 218–231 (2021)

Galariotis, E., Makrichoriti, P., Spyrou, S.: Sovereign CDS spread determinants and spill-over effects during financial crisis: a panel VAR approach. J. Financ. Stab. 26, 62–77 (2016)

Gambaro, A.M., Casalini, R., Fusai, G., Ghilarducci, A.: Quantitative assessment of common practice procedures in the fair evaluation of insurance contracts. Insur. Math. Econ. 81, 117–129 (2018)

Gambaro, A.M., Casalini, R., Fusai, G., Ghilarducci, A.: A market consistent framework for the fair evaluation of insurance contracts under Solvency II. Decis. Econ. Finan. 42, 157–187 (2019)

Gatzert, N., Heidinger, D.: An empirical analysis of market reactions to the first Solvency and financial condition reports in the European insurance industry. J. Risk Insur. 87(2), 407–436 (2020)

Georgoutsos, D.A., Migiakis, P.M.: Heterogeneity of the determinants of Euro-area sovereign bond spreads; What does it tell us about financial stability? J. Bank. Finance 37, 4650–4664 (2013)

Gerlach, S., Schulz, A., Wolff, G.B.: Banking and sovereign risk in the Euro area, CEPR Discussion Paper, No. 7833 (2010)

Giordano, R., Pericoli, M., Tomassino, P.: Pure or wake-up-call contagion? Another look at the EMU Sovereign debt crisis. Int. Finance 16, 131–160 (2013)

Gomez-Puig, M., Sosvilla-Rivero, S., del Carmen Ramos-Herrera, M.: An update on EMU sovereign yield spread drivers in times of crisis: a panel data analysis. N. Am. J. Econom. Finance 30, 133–153 (2014)

Hainaut, D., Devolder, P., Pelsser, A.: Robust evaluation of SCR for participating life insurances under Solvency II. Insur. Math. Econ. 79, 107–123 (2018)

Jørgensen, P.L.: An analysis of the Solvency II regulatory framework’s Smith-Wilson model for the term structure of risk-free interest rates. J. Bank. Finance 97, 219–237 (2018)

Longstaff, F., Mithal, S., Neis, E.: Corporate yield spreads: default risk or liquidity? New evidence from the credit default swap market. J. Finance 60(5), 2213–2253 (2005)

Mezőfi, B., Niedermayer, A., Niedermayer, D., Süli, B.M.: Solvency II reporting: how to interpret funds’ aggregate solvency capital requirement figures. Insur. Math. Econ. 76, 164–171 (2017)

Monfort, A., Renne, J.-P.: Decomposing Euro-area sovereign spreads: credit and liquidity risks. Rev. Finance 18(6), 2103–2151 (2014)

Olivieri, A., Pitacco, E.: Solvency requirements for pension annuities. J. Pension Econ. Finance 2(2), 127–157 (2003)

Olivieri, A., Pitacco, E.: Introduction to Insurance Mathematics: Technical and Financial Features of Risk Transfers, 2nd edn. Springer, Berlin, Heidelberg (2015)

Pitacco, E.: ERM and QRM in Life Insurance. Springer International Publishing, Cham (2020)

Schwarz, K.: Mind the gap: disentangling credit and liquidity in risk Spreads. Rev. Finance 23(3), 557–597 (2019)

Van den Broek, K.: Long-term insurance products and volatility under Solvency II framework. Eur. Actuar. J. 4, 315–334 (2014)

Wuthrich, M.V.: An academic view on the illiquidity premium and market-consistent valuation in insurance. Eur. Actuar. J. 1, 93–105 (2011)

Funding

Open access funding provided by Politecnico di Milano within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

The computation of the volatility adjustment

The computation of the volatility adjustment

The computation of the VA deeply relies on the computation of the risk-corrected spreads, SRC in the in force VA, RC\(_S\) in the proposal. The risk-corrected spread is calculated as the difference between the spread of the representative portfolio and the risk correction. The risk correction is described in the Omnibus II Directive as the portion of the spread that is attributable to a realistic assessment of expected losses, unexpected credit risk or any other risk, of the assets in the reference portfolio. \(S_\textrm{cu}^\textrm{gov}\), \(S_\textrm{cu}^\textrm{corp}\), \(\textrm{RC}_\textrm{cu}^\textrm{gov}\), and \(\textrm{RC}_\textrm{cu}^\textrm{corp}\) and \(S_\textrm{co}^\textrm{gov}\), \(S_\textrm{co}^\textrm{corp}\), \(\textrm{RC}_\textrm{co}^\textrm{gov}\), and \(\textrm{RC}_\textrm{co}^\textrm{corp}\) in Equation (5) - and the corresponding equation for corporate bonds - are all computed as internal rates of returns (IRRs).

Let us consider first the in force mechanism for the gov components, EIOPA provides the composition of the representative portfolio of central government and central banks bonds for each country/currency as well as the corresponding durations. Given a country/currency, for each bond issuer belonging to the reference portfolio, the procedure works as follows:

-

Construct the market interest rate curve, according to the EIOPA documentation (for example, if the bond issuer is Italy, we consider the Italian zero coupon rates), interpolating the curve (exploiting a linear interpolation, as stated in European Insurance and Occupational Pensions Authority (2015)) in the corresponding duration and therefore obtaining the market yield before risk correction;

-

Consider the risk-free curve, provided by EIOPA, interpolating the curve in the corresponding duration;

-

Compute the risk correction, defined according to EIOPA documentation and sketched below;

-

Subtracting the risk correction from the market interest rate curve, obtain the risk-corrected curve, and interpolate this curve in the corresponding duration, obtaining the risk-corrected market yield.

Therefore, for each bond issuer belonging to the country/currency reference portfolio, we have a zero coupon bond with maturity given by the corresponding duration and with three different prices, according to the considered yield (market, risk-free, risk-corrected). Investing in these bonds a quantity given by the weights of the representative portfolio of central government and central banks bonds, we obtain three portfolios, and therefore three cashflows. We thus compute the IRRs of these cashflows:

-

IRR1 for the market yield before risk correction portfolio;

-

IRR2 for the basic risk free rate portfolio;

-

IRR3 for the risk-corrected market yield portfolio.

The spreads S and the risk corrections RC are defined as the differences of two internal rates of returns (IRRs), that is

\(S^\textrm{gov}_\textrm{cu}\) (\(S^\textrm{gov}_\textrm{co}\)) and RC\(^\textrm{gov}_\textrm{cu}\) (RC\(^\textrm{gov}_\textrm{co}\)) are computed as above, dealing with the currency (country) representative portfolio, assuming a risk correction for each government bond belonging to the reference portfolio given by 30% of the LTAS, the long-term (30 years) average of the spread over the risk-free interest rate of assets of the same duration, credit quality and asset class provided by EIOPA, if the bond issuer belongs to the European Economic Area (EEA), and 35% otherwise.

For the corp components (\(S^\textrm{corp}_\textrm{cu}\), RC\(^\textrm{corp}_\textrm{cu}\), \(S^\textrm{corp}_\textrm{co}\) and RC\(^\textrm{corp}_\textrm{co}\)), the procedure is the same as above, substituting the bond issuers with asset classes provided by EIOPA. In fact the composition of the currency/country representative portfolio of assets other than central government and central banks bonds is given partitioning the assets in financial and nonfinancial and then dividing both classes according to the investment grade. Another difference is that the risk correction is given by Equation (7).

For the proposal, the procedure is similar to the one defined above, with the three IRRs, the difference being provided by the computation of the risk-corrected interest rate curve, necessary to obtain \(\textrm{RC}_\textrm{cu}^\textrm{gov}\) and \(\textrm{RC}_\textrm{cu}^\textrm{corp}\), where, for each asset of the representative portfolio, the risk correction is given by Eqs. (10) and (11).

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Barucci, E., Marazzina, D. & Rroji, E. An investigation of the Volatility Adjustment. Decisions Econ Finan (2023). https://doi.org/10.1007/s10203-023-00416-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10203-023-00416-y